Tax implications on selling a property. Like most other earnings when you sell your house, you are liable to pay tax. As explained in our article Basics of Capital Gains, Gains which arise from the transfer of capital assets,such as Debt Mutual Fund, Gold, are subject to tax under the Income-tax Act. As Real estate is regarded as an asset, so the profit from its sale is also assessed under the head ‘Capital gains’ . This article covers Computation of capital gains, Computation of capital gains for Real Estate or Property, What is Long Term Capital Gain, how to calculate it with example. It expands on tax benefits, When can tax benefits taken on prinicipal repayment and interest payment be reversed, how can one claim exemption on tax by investing in another property under section 54, 54F, 54EC of income tax or by putting in Capital Gain Account Scheme (CGAS). How to determine Holding Period of property?

Table of Contents

Computation of Capital Gains

Computation of capital gains depends upon following things:

- The nature of capital asset that is transferred ex: Mutual Fund, Stocks, Property, Gold

- Time for which asset was owned based on the type of asset. Ex: If Shares, Equity Mutual Funds are for which Securities Transaction Tax(STT) has been paid, are transferred after being held for an year it class as Long Term Capital Gain. If Period of holding is less than 1 year it classifies as Short Term Capital Gain.

- Cost of acquisition, Cost of improvements, Expenditure incurred exclusively in connection with the transfer.

- Exemptions allowed under the income Tax Act.

Capital Gains for Real Estate or Property

For Real Estate the computation of capital gains are as follows:

- If a property is sold within three years of buying it, it is treated as a short-term capital gain. This is added to the total income and taxed according to the slab rate.

- If a property is sold after three years from the date of purchase, the profit is treated as a long-term capital gain and is taxed at 20% after indexation .

While you can avail of various tax exemptions in case of long-term capital gains, no such benefit is provided for short-term ones.

Long Term Capital Gain and Indexation

Advantage associated with long-term capital gains is factoring of inflation while determining the profit by what is called as indexation . Since inflation reduces the value of an asset over time, it is essential to increase the initial cost of the house to calculate its current value. The concept of indexed cost allows the taxpayer to factor in the impact of inflation on cost. Consequently, a lower amount of capital gains gets to be taxed than if historical cost had been considered in the computations. Indexation is a method through which the seller is able to inflate the value of his assets. This is done by multiplying the original cost price with a factor that is issued by the Central Board of Direct Taxes. This factor tracks the increase in the general price level, or inflation, and is known as the cost inflation index (CII). It is notified by the central government for every financial year. The Income Tax Act considers 1981-82 as the base year with a cost inflation index of 100. So, the CII for 1982-83 is 109, and so on.

The indexed price is calculated as = Purchase price x (CII for year of sale / CII for year of purchase).

LTCG = Sale proceeds – (Indexed cost of acquiring + indexed cost of making improvements + selling expenses).

The indexation of purchase price helps to reduce the net capital gain, thereby slashing the tax burden for the seller. Our article Cost Inflation Index from Financial Year 1981-82 to Financial Year 2011-12 covers Cost Inflation index in detail.

Example

Amit bought a residential property in June 2008 and sold it in Nov 2010. The details are as follows

- Purchase Price: 14 lakh (14,00,000)

- Expenses on improvement : Rs 4.50 lakh (4,50,000) in Aug 2010

- Selling Price : Rs 48 lakh (48,00,000)

- Selling Expenses : Rs 1.5 lakh (1,50,000)

As Holding period is Nov 2010 – June 2008 which is less than 3 years or 36 months, hence profits made on sale will qualify as Short Term Capital Gain(STCG). He will be taxed as per his individual tax rate. Education cess at 3% of STCG will also be charged.

If he had sold property any time after Jun 2011, his gains would have qualified as Long Term Capital Gain (LTCG). Formula to calculate Long Term Capital Gain is as follows:

LTCG = Sale proceeds – (Indexed cost of acquiring + indexed cost of making improvements + selling expenses).

CII of the Purchase Year: 2008 is 582,

CII of the Improvement Year: 2010 is 711,

CII of the Sale Year: 2011 : 785

Indexed Cost of Acquisition = (CII of FY 2011-2012/CII of 2008-2009) * Purchase Price

= (785/582) * 14,00,000

= 18,88,316.15

Indexed Cost of Improvement = (CII of FY 2010-2011/CII of 2008-2009) * Purchase Price

= (785/711) * 4,50,000

= 4,96,835.44

LTCG = Sale proceeds – (Indexed cost of acquiring + indexed cost of making improvements + selling expenses).

= 48,00,000 – ( 18,88,316.15 + 4,96,835.44 + 1,50,000)

= 22,64,848.56

You can use Capital Gain Calculator to calculate Capital Gains.

Selling Price: The sale proceeds are calculated on the basis of the valuation adopted by the state’s Stamp Duty and Registration Authority and will not be the amount mentioned in the deed of conveyance/sale deed. This is intended to cover the cases where a portion of the sale price is received by the seller as unaccounted for cash.

Holding Period: What is the purchase date ? Details are discussed later but in summary

- For a flat that is under construction Date of agreement/Date of allotment letter would be the purchase date.

- For a constructed flat the date of taking possession of the flat is the purchase date.

Reversal of Tax Benefits

Under the Income Tax Act, if you sell a house within three years of buying it, the tax benefits on the principal repayment and interest paid on the home loan are reversed . These are then included in your income when you file your tax return. Also, if a house is sold within five years of the end of the financial year in which it was purchased, all the deductions claimed under Section 80C with respect to the property are added to the taxable income in the year of sale.

Exemption : Reduce your tax burden

You can claim tax exemption under Section 54 on the long-term capital gain on the sale of a house. To avail of this exemption, you must

- Use the entire profit to either buy another house within two years or

- Construct one in three years.

- If you had already bought a second house within a year before selling the first one, you could still avail of the tax exemption,

You can also utilise Section 54F to avail of exemption on the long term capital gain made from the sale of any asset other than a house. Again, the sale proceeds should be invested only in a residential property , not a commercial property or a vacant plot of land. However, to avail of this benefit, you should not own more than one house.

But what if you don’t want to buy a property at all with the LTCG amount? You can still get tax exemption. The long-term capital gain tax can also be saved under Section 54EC if the capital gain is invested for three years in bonds of the National Highways Authority of India and Rural Electrification Corporation Limited within six months of selling the house. However, you can invest only up to 50 lakh in a financial year. More on it is given below.

You can get an exemption for an amount equal to the cost of a new house, or the amount of capital gains, whichever is lower. So let’s say, you sold your house for Rs. 80 lakh, made LTCG of Rs. 40 lakh, and bought a new house worth Rs. 20 lakh. On the remaining Rs. 20 lakh amount, you will have to pay LTCG tax at 20%, that comes to Rs. 4 lakh.

Capital Gain Account Scheme (CGAS)

It’s possible that you are not able to make the required investment to avail of the exemption on capital gains before the due date for filing your tax return. In such a situation, the amount of capital gain or net consideration , as the case may be, has to be deposited in a separate account in a nationalised bank under the Capital Gains Account Scheme (CGAS) before the last date of filing your return for the relevant year. There are two types of such accounts:

- Type A is a savings deposit

- Type B is a term deposit.

The interest rates for these are the same as those for regular savings and term bank deposits. The proof of the deposit can be attached along with the tax return in order to claim exemption. But treat CGAS as a parking place, where you can deposit money until you find a house that suits you, but of course within a time limit.The amount has to be parked in CGAS with the intention to use the funds to buy a new house within two years or to construct one within three years.

- You can deposit the capital gains amount in a CGAS before the due date of filing tax returns (July 31) to save LTCG tax.

- If you fail to buy or construct a new house within the stipulated period, the entire amount is treated as LTCG and you will have to pay tax on it.

Example:

Let’s say, you sold a property in April 2010. The capital gain made should be used to either buy a house by April 2012 or construct a house by 2013. Until then, you can deposit the money in a CGAS account before the date of filing returns, which in this case was be July 31 2011, to save tax.

If you do not acquire the new property till April 2013, the LTCG would be taxable in the fiscal year 2013-14.

You can open a CGAS account at an authorised government-owned bank. It’s important to remember that

- The amount you withdraw from CGAS should be used to purchase a house within two months from the date you’ve withdrawn these funds.

- In case you buy a new house, ensure that you do not sell the new house within three years or you stand to lose the exemption. In such a case, you will have to pay LTCG tax in the year you sell the new house

Vijaya Banks CGAS , SimpleTaxIndia’s Capital Gains Account Statement explains the same.

Investing in 54EC bonds

But what if you don’t want to buy a property at all with the LTCG amount? You can still get tax exemption, but you will have to invest the amount in specific bonds that fall under section 54EC of the Income-tax Act. These bonds are issued only by the National Highways Authority of India and Rural Electric Corporation Ltd.

- You can invest a minimum of Rs. 10,000 and a maximum of Rs. 50 lakh. The face value is Rs. 10,000 per bond and you can buy up to 500 bonds.

- They come with a coupon rate of 6%, payable annually.

- The bond is available for three years and can be redeemed only after three years.

- Capital gains have to be invested in the bonds and the benefit is allowed to the extent of the amount invested. For example if you’ve made LTCG of 30 lakh and invested 30 lakh in these bonds, the amount will be exempt from tax. But if you invest only a part, say10 lakh, you will get an exemption only on that part i.e 10 lakh and will have to pay LTCG tax on the remaining i.e 20 lakh.

- To get the tax benefit, you have to hold these bonds for at least three years. If for some reason, you are unable to keep the bond for three years, your tax exemption will be withdrawn and you will have to pay LTCG tax in the subsequent year. Also, if you avail a loan against such bonds within three years, you will have to let go of the exemption.

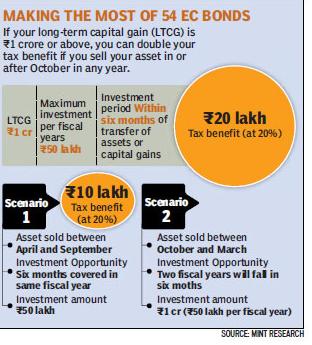

- To avail the exemption, you need to invest the whole or part of the capital gains in these bonds within a period of six months after the date of such transfer. If you could time the sale of your house property that this period of six months actually falls between two fiscal years then you can claim 50 lakh per fiscal. So, if you sell the house between October and March, you come in the six months limit between two fiscal years. In that case, you can invest Rs. 1 crore in total over two financial years and get the tax benefit as shown in picture below from HindustanTimes : Home Truths :

-

54 EC Bonds

Holding Period

There is a difference between a flat which is still under construction and the possession has not been given to you by the builder and a flat which is ready and the possession has been taken by you. As technically both are capital assets, in the first case the asset is not the flat (as it is not yet complete and, therefore, not in existence) but the right to acquire a flat, while in the second case the asset is the flat itself. You, therefore, need to determine what is it that you are selling—the right to acquire the flat or the flat itself—to be able to determine the date of acquisition.

Under Construction Flat

From Livemint Selling under-construction flat before possession saves tax and taxguru Sale of Under Construction Property – Taxability, Nature of Gain, Date of Indexation, Benefit U/s. 54 or 54EC

Normally, when one books a flat to be constructed, one pays a token amount as booking charges, a letter of allotment is issued when the layout is finalized and, thereafter, an agreement to purchase is executed and registered. If you have merely booked a flat in the building to be constructed with no particular flat having been allotted to you, you cannot be said to have acquired the right to purchase a specific flat. It is only when the letter of allotment is issued that such a right can be said to have come into existence. The purchase agreement just codifies the rights between the parties, which have already come into existence after the issue of the letter of allotment. However, a safer view is that the date of signing of the agreement to purchase is the date of acquisition of such right. Subsequent registration of the purchase agreement merely grants better legal protection to such right and, therefore, it is the date of agreement and not the date of registration that would be the date of acquisition of such right. The dates of payments made for such a purchase are irrelevant for this purpose.

When you take possession of the flat which you have agreed to purchase, the right to purchase the flat gets converted into the flat itself. You continue to hold the capital asset. Only its form changes on getting actual possession of the property. Therefore, it cannot be said that period of holding would be counted only from the date of getting the possession. Accordingly, the earlier period is also to be counted for the purpose of determination of nature of the capital gain, whether short term or long term.

Generally, in cases of sale of flats under construction, a tripartite agreement is entered into between the seller (who had originally booked the flat), the purchaser and the builder. Under this agreement, the seller assigns his rights to the under-construction flat to the purchaser with the consent of the builder, the purchaser agrees to pay the balance of the original purchase price payable to the builder and the builder agrees to give possession of the ready flat to the purchaser directly. The agreement assigns the right to acquire a particular flat. As mentioned Right came into existence on getting allotment letter.

Example :

Taxguru Sale of Under Construction Property – Taxability, Nature of Gain, Date of Indexation, Benefit U/s. 54 or 54EC explained through example:

- The Assessee is a individual who has booked a flat with a Builder in Malad (W) on 21.06.2007 and Builder has given the Allotment letter on the same date.

- Total Agreement Value of the Flat is Rs. 42,16,000/- which Assessee has paid in Ten Installments spread over financial Year 2007-08 and Financial Year 2008-2009.

- In addition to above Assessee has incurred the following expenditures in respect of Purchase of above property:-

-

Date Nature of Payment Rupees 31.12.2009 Stamp Duty 2,02,650/- 01.02.2010 Registration Fees 31,500/- 24.03.2011 Society Deposit 1,60,000/- Total 3,94,150/- - Assessee’s Agreement for Purchase of this Property got registered on 01.02.2011.

- Assessee Receives possession of the Flat on 25.03.2011.

- Assessee Sold the Flat on 07th July 2011 for Rs. 1,00,80,000/-.

Answers:

- Right to own the Property is a Capital Asset – Yes.

- Holding Period: An asset which is held for 36 months is a long term asset. So in this case as right to own property was more than 3 years (from 21.06.2007 to 07.07.2011) it is long term asset.

- If the Gain is long term how the indexed cost will be calculated? So in our case we will take the index of the year in which Assessee receives allotment letter of the Flat i.e. 2007-08. In respect of Stamp Duty, Registration Charges, Society Deposits we will take index of the year of payment. If Assessee has incurred any other expenses in respect of Purchase of property in addition to these in respect of those expense also we take index of the year of expense for calculation of Long Term Capital Gain

- Is there a way Assessee can save tax on Gain on Sale of Flat? The Provisions of Income Tax Allows the assessee to save capital gains tax on sale of a property, namely flat in our case. This benefit is provided under Sections 54 and Section 54EC of the Income Tax Act, 1961.

Related Articles:

- Basics of Capital Gains

- Cost Inflation Index from Financial Year 1981-82 to Financial Year 2011-12

- Capital Gain Calculator

This article covers tax implications on selling a house, Computation of capital gains for Real Estate or Property, Long and Short Term Capital Gains, how to calculate it with example. How to use the selling proceeds by investing under section 54 of Income Tax.

I bought a flat in a co-operative society in 1992 costing 10 lakhs and sold it for 80 lakhs in 2017. I had furnished the flat with white goods cooking Range and other improvements such as Air conditioners washing machine fans and lights , cots and beds etc

The flat was sold in 2017 for 80 lakhs.

Would ilke to know the tax implications ad how much moneythas to be invested under section 54 EC to save tax.

Did selling price also included cost of white goods or there was a separate bill for it?

Please refer to case Deductibility of Cost of Furniture in Computation of Capital Gain on Property Sale for more details.

Your indexed cost (assuiming your sold it before 31 Mar 1992. i.e for FY 1991-1992) is 565327(10,00,000 * 1125/199)

So Capital gain is 234673.

Long term capital gain tax is 20% of 234673 which is Rs 46934.6 only.

You can use it if your new residential house is constructed within 3 years, or purchased 1 year before or 2 years after the date of transfer

Or you can buy bonds issued by National Bank for Agricultural & Rural Development or by National Highway Authority of India or by Rural Electrification Corporation within 6 months from the date of transfer, then exemption would be available as computed in Sec. 54F.

My aunty is having one bungalow since 1966. It may accuire by uncle for about 4 to 5 lac. In that time. Now suppose aunty sell it for 80 lac ( it’s JANTY IS ABOUT 63 lac ). What will be our LONG TERM CAP. GAIN.?????

I want to ask following questions

1) whether loan processing fee and house insurance premium can be added to purchase price and indexed?

2) whether indexation to be applied to purchase price components like service tax, registration fee?

Dear Sir,

I am planning to sell one residential plot in Lucknow which was purchased in Year 1997. I am also planning to purchase a resale property from a seller ‘X’. This is a society flat in under-construction position in Noida for which seller ‘X’ yet did not receive the possession letter. Seller purchased that property on year 2012. So presently he will just transfer his ownership. Possession will be in around next 2.0 Yrs.

1) Is resale property considered to get the exemption on the long term capital gain?

2) Residential plot (to sell) is in mother’s name and so I will be purchasing resale flat on mother’s name only. But if I become co-applicant with mother in new buying property (to avail the home loan and to pay home loan myself), will it affect anyhow in property gain tax exemption?

3) Residential plot to sell is actually 2 plots but in single registry. Can i sell one plot and invest in one property and another sell to another property and exempted by property gain tax?

Thanks,

Would just like to add one more thing that in case the Property has been sold at a price lower than the Stamp Duty Value of the Property, the Sale Price for the purpose of computation of Capital Gains would be the Stamp Duty Value.

And in case the Sale price is more than the stamp duty value, the actual sale price would be considered while computing the capital gains.

Thanks for input Karan.

Where can I find IRS income tax tables for 2010?? I have recently moved to US and am trying to understand about paying taxes here. Is there any beginners guide or some tool or tutorial that I can use to understand how to file my taxes? Are there any professional services available that can do this for me? Any guidance from you will be very much appreciated. Thanks and Regards.

You can IRS tax tables at efile: tax table

You can start with IRS website