Union Budget 2012 delivered a staggering blow by hiking the service tax and excise duty from 10% to 12%. Our expenses are bound to go up too as the service tax net has been widened to include almost all services. Only 17 items, such as essential education, public transport and services meant for agriculture, are exempt from this tax. But what is Service tax? Since when are we paying Service tax? At what tax rate? On what services are we paying tax? Who pays the tax? How does service provider pay the tax? How much revenue is government collecting through service tax. This article will try to explain the basics about the service tax.

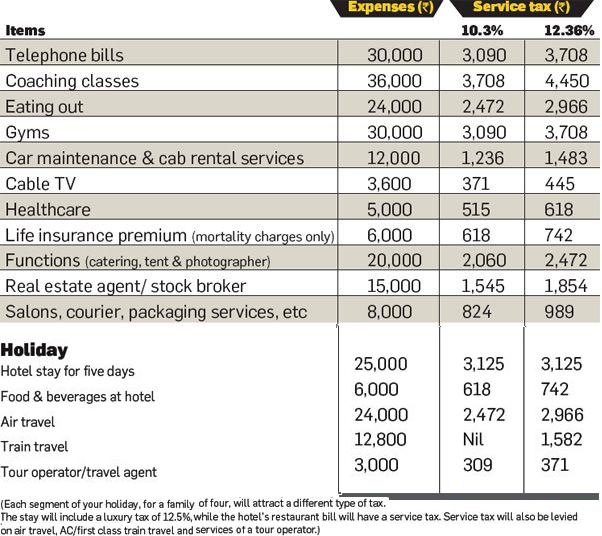

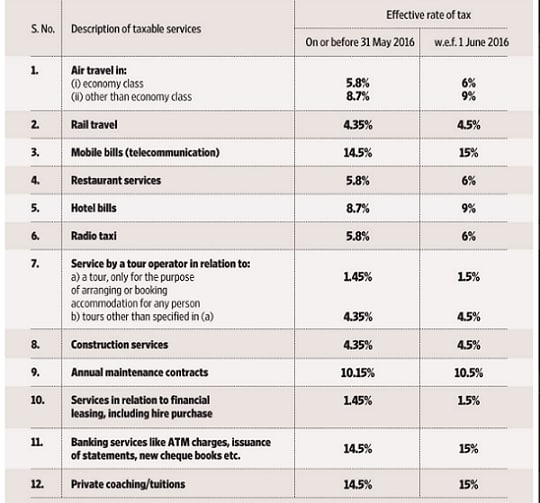

Latest Service Tax Rates are shown in image below

First let’s see how the change in tax will impact our expense bill. From EconomicTimes:How the hike in service tax from 10.3% to 12.36% will affect your family budget(Mar 2012)

Change in Service Tax

Table of Contents

What is Service Tax?

As the name suggests Service tax is a tax on Services. It is a tax levied on the transaction of certain services specified by the Central Government under the Finance Act, 1994. Service requires two parties. One cannot give service to himself. Service tax cannot be levied on value of goods. Service tax and Value Added Tax(VAT) are mutually exclusive.

It is an indirect tax (like Excise Duty or Sales Tax) which means that normally, the service provider pays the tax and recovers the amount from the recipient of taxable service.

Example: Suppose the value of taxable service is Rs.100. Service tax @12% will be Rs.12 and Education Cess @2% of the Service Tax will be Rs.0.24 and Secondary & Higher Education Cess @1% of the service tax will be 0.12. So Now the total tax would be = 12 + 0.24 + 0.12 = 12.36 and we would be required to pay 112.36 Rs

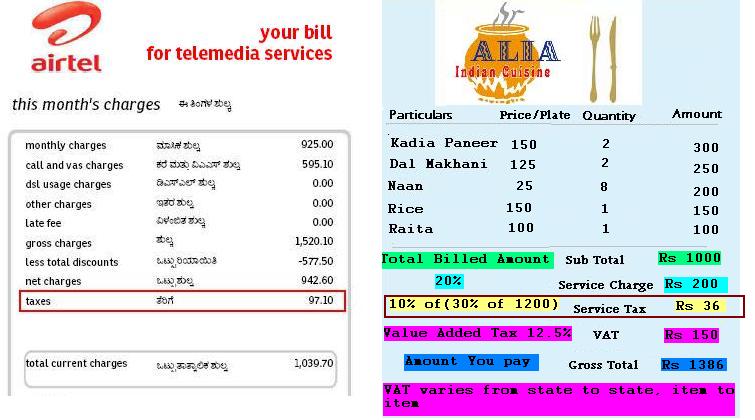

Some bills which show service tax are given below.

Bill with service tax

Service Tax Rates

Service tax was imposed for first time on 3 services with effect from 1-7-1994 and its scope is increasing every year. As on 1st May, 2011, 119 services are taxable services in India. From 1st April 2012 only 17 items, such as essential education, public transport and services meant for agriculture, are exempt from this tax. List of items excluded are on servicetax.gov.in:Notification on list of services excluded.

- While presenting the Budget 2015, the FM had increased the Service Tax Rate from 12.36% to 14%. This new rate of Service Tax @ 14% was applicable from 1st June 2015. From 15th Nov 2015, Swachh Bharat Cess @ 0.5% also got applicable. Therefore the effective rate of Service Tax is currently at 14.5% with effect from 15th Nov 2015. From 1 Jun 2016, Krishi Kalyan Cess, at

- From 15th Nov 2015, Swachh Bharat Cess @ 0.5% also got applicable. Therefore the effective rate of Service Tax became 14.5% with effect from 15th Nov 2015. From 1 Jun 2016, Krishi Kalyan Cess, at

- From 1 Jun 2016, Krishi Kalyan Cess, at rate of 0.5% was levied on all taxable services. The new effective service tax is now 15%. It seems, the rate is slowly being increased to bring service tax closer to the expected goods and services tax (GST) rate of 17-18%.

Education Cess and Secondary & Higher Education Cess(SHEC) are levied on Service Tax and not value of good. For ex: from 1st Apr 2012 Education Cess is 2% of 12% i.e .24% and SHEC is 1% of 12% which is .12% hence total service tax is 12% + .24% + .12% = 12.36%

| Period | Service Tax Rate | Education Cess Rate | SHEC | Effective levy |

| 1st Jul 1994 to 13th May 2003 | 5% | NIL | NIL | 5% |

| 14th May 2003 to 9th Sep 2004 | 8% | NIL | NIL | 8% |

| 10th Sep 2004 to 17th Apr 2006 | 10% | 2% | NIL | 10.20% |

| 18th Apr 2006 to 10th May 2007 | 12% | 2% | NIL | 12.24% |

| 11th May 2007 to 23rd Feb, 2009 | 12% | 2% | 1% | 12.36% |

| 24th Feb 2009 to 31 Mar 2012 | 10% | 2% | 1% | 10.30% |

| 1st Apr 2012 onwards | 12% | 2% | 1% | 12.36% |

Who is liable to pay service tax?

Normally, Service tax is payable by service provider i.e by the person who provides the taxable service on receipt of service charges is responsible for paying the Service Tax to the Government under Sec.68 (1) of the 1994 Act. In few cases, tax is payable by service receiver, under reverse charge method under Section 68(2) of 1994 Act.The Table below shows the services which are taxable with link to details on servicetax.gov.in website

| Advertising Agency Service | Advertisement- sale of space or time services | Air travel agent’s services | Auction Service |

| Architect’s Services | Asset Management Services By Individuals | ATM operation, maintenance or management services | Auction Service |

| Authorised Service Stations for motor vehicles servicing or repairs | Banking and other financial services | Beauty treatment Services | Brand Promotion Services |

| Broadcasting Services | Business Auxiliary Service | Business Exhibition Service | Business Support Service |

| Cable Operator’s services | Cargo handling Services | Chartered Accountant’s (practising) services | Cleaning Services |

| Clearing and forwarding agent’s services | Clearing & processing house services | Club’s or Association’s membership services | Commercial training or coaching services |

| Commercial use or exploitation of any event service | Commodity exchange service | Company secretary’s (practising) services | Construction of residential complex service |

| Construction or renovation of commercial / industrial buildings / pipelines / conduits services | Construction Services – Preferential Location and Development | Consulting engineer’s service | Convention services |

| Copyright Services | Cosmetic or Plastic Surgery Service | Cost accountant’s (practising) services | Courier Services |

| Credit card, debit card, charge card or other payment cards related services | Credit rating agency’s services | Custom house agent’s services | Design services |

| Development & supply of content for telecommunication, advertising and on-line information services | Dredging services | Dry cleaning services | Electricity Exchange services |

| Erection, commissioning or installation service | Event management Service | Fashion Designer Service | Foreign Exchange broking services |

| Forward Contract Service | Franchise Services | Health club and fitness centre services | Health Services |

| Information Technology software services | Insurance auxiliary services concerning general insurance business | Insurance auxiliary services concerning Life Insurance business | Insurance business services (General Insurance) |

| Insurance business services (Life Insurance) | Intellectual property services | Interior decorator’s services | Internet café’s services |

| Internet telecommunication services | Investment management service under ULIP | Legal consultancy services | Lottery and other Games of Chance Services |

| Mailing list compilation and mailing services | Management or business consultant’s services | Management, maintenance or repair services for goods, equipments or properties | Mandap keeper’s services |

| Manpower recruitment or supply agency’s services | Market research agency’s services | Medical records maintenance service | Mining service |

| On-line information and database access and/or retrieval services | Opinion poll service | Outdoor caterer | Packaging services |

| Pandal or shamiana services | Photography services | Port services by major ports | Port services by other ports (minor ports) |

| Programme (T. V. or Radio) services | Public Relation Service | Rail travel agent’s services | Real estate agent’s services |

| Recovery agent’s services | Registrar to an issue services | Rent-a-cab services | Renting of immovable property services |

| Scientific or Technical Consultancy Services | Security agency’s services | Share transfer agent service | Ship management services |

| Site formation and clearance, excavation and earthmoving and demolition services | Sound recording services | Sponsorship service | Steamer agent’s services |

| Stock broking services | Stock exchange service | Storage and warehousing services | Supply of tangible goods services |

| Survey and exploration of mineral services | Survey and map making services | Technical inspection and certification services | Technical testing and analysis services |

| Telecommunication services | Tour operator’s services | Transport of coastal goods and transport of goods through national water way/inland water service | Transport of goods by air services |

| Transport of goods by road | Transport of goods by rail service | Transport of goods through pipeline / conduit services | Travel agent’s (other than air or rail) services |

| Travel by air services | Travel by cruise ship service | Travel by cruise ship service | Video tape production services |

| Works contract Services | Hotel, Inn, Club and Guest House Service | Restaurant service |

Exemptions

Taxable services provided by the small scale service provider are exempted from service tax if the taxable value is within a limit. From no exemption limit before 1st April 2005 the current limit is Rs 10 lakh.The exemptions limits are given in table below.

| Period | Exemption Limit |

| Before 01-04-2005 | No Limit |

| 01-04-2005 to 31-03-2007 | Rs 4 lakh |

| 01-04-2007 to 31-03-2008 | Rs 6 lakh |

| 01-04-2008 onwards | Rs 10 lakh |

Payment of Service Tax

Registration: In case a service recipient is liable to pay service tax he has to obtain registration. For registration he has to make an application to the concerned Superintendent of Central Excise in Form ST-1 within a period of thirty days from the date on which the service tax under section 66 of the Finance Act, 1994(32 of 1994) is levied. Along with the form one needs to enclose photocopy of PAN card, proof of address to be registered and copy of constitution /partner ship deed etc. of the firm, if any.

Invoice: Every person providing taxable service is required to issue (within 14 days of completion of service or receipt of payment towards value of service, whichever is earlier) an invoice, a bill or challan signed by him or a person authorized by him. Such invoice, bill or challan should be serially numbered and should contain following information:

- Name, address and registration number of such person

- The name and address of the person receiving services

- Description, classification and value of taxable service provided, and

- Service tax payable thereon.

Dates for Payment of Service Tax: In case of Individuals or Proprietary Concerns and Partnership Firm, service tax is to be paid on a quarterly basis. The due date for payment of service tax is the 5th of the month immediately following the respective quarter ( in case of e-payment, by 6th of the month immediately following the respective quarter). For this purpose, quarters are: April to June, July to September, October to December and January to March. However, payment for the last quarter i.e. January to March is required to be made by 31st of March itself.

The assessee is required to deposit the amount of service tax in the designated banks through GAR-7 challan. While depositing the service tax, the appropriate ‘account head’ pertaining to the particular service category should be mentioned on the challan.

E-Payment:The facility of e-payment of service tax has been introduced with effect from 11.05.2005. From 1st April, 2010 e-payment of service tax has been made mandatory for the assessees who have paid service tax of Rs.10 Lakhs (cash+ cenvat) and above during the last financial year or who have paid service tax of Rs.10 Lakhs (cash + cenvat) and above during the current financial year. The e-payment shall be made only in designated banks by 6th day of the following month.

Service Tax Collection

The Service Tax collections have shown a steady rise since its inception in 1994. The tax collections have grown manifolds since 1994-95 i.e from Rs. 410 crores in 1994-95 to Rs.71174.58 crores in 2010-11.The target for the year 2010-11 was Rs.69400 Crores and the actual realisation was Rs.71174.58 Crores, showing increase of Rs.1774.58 Crores (2.56%). There is a substantial growth in the assessee base from 3943 numbers in 1994-95. The revenue and assessee statistics from the year 1994-95 onwards onwards is given in the below. Reference:servicetax.gov.in Analysis of Service Tax Revenue

| FinancialYear | RevenueRs. Crores | % Growth over PY | No. of Services | No. of Assessees | % Growth over PY |

| 1994-95 | 410 | Base Year | 3 | 3943 | Base Year |

| 1995-96 | 846 | 106 | 6 | 4866 | 23.41 |

| 1996-97 | 1022 | 21 | 6 | 13982 | 187.34 |

| 1997-98 | 1515 | 48 | 18 | 45991 | 228.93 |

| 1998-99 | 1787 | 18 | 26 | 107479 | 133.70 |

| 1999-00 | 2072 | 16 | 26 | 115495 | 7.45 |

| 2000-01 | 2612 | 23 | 26 | 122326 | 5.91 |

| 2001-02 | 3305 | 26 | 41 | 187577 | 53.34 |

| 2002-03 | 4125 | 25 | 52 | 232048 | 23.71 |

| 2003-04 | 7890 | 91 | 62 | 403856 | 74.04 |

| 2004-05 | 14196 | 80 | 75 | 774988 | 91.89 |

| 2005-06 | 23053 | 62 | 84 | 846155 | 9.18 |

| 2006-07 | 37482 | 63 | 99 | 940641 | 11.17 |

| 2007-08 | 51133 | 36 | 100 | 1073075 | 14.08 |

| 2008-09 | 60702 | 19 | 106 | 1204570 | 8.78 |

| 2009-10 | 58319 | -3.93 | 117 | 1307286 | 8.53 |

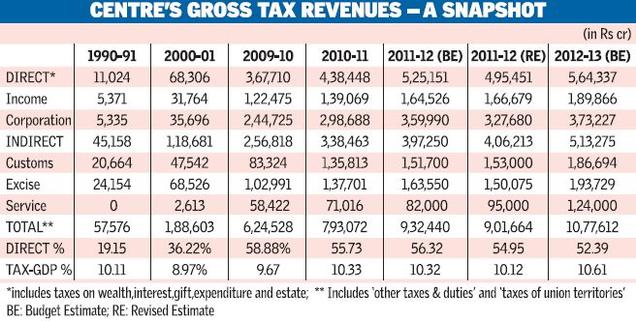

Quoting from HinduBusinessLine:Pranab shifts focus to indirect taxes to bolster revenues(Mar 2012)

Government is shifting focus from garnering additional revenues from indirect taxes rather than direct taxes.The contribution of direct taxes had grown from less than a fifth in 1990-91 to almost 59 per cent in 2010-11. Since then there has been steady decline and in 2012-13, this share is budgeted at 52.39 per cent of total revenues. Government expects the indirect tax proposals to result in a net revenue gain of Rs 45,940 crore during next financial year.

The increased reliance on indirect taxes is seen as regressive as taxes on goods are paid by the rich and poor alike while taxes on income and corporate profits are viewed as more egalitarian.

With services accounting for about 55 per cent of India’s GDP, there is now a concerted attempt by policymakers to “shift gears and accelerate ahead” in terms of mopping up service tax revenues.

For the first time ever, the Centre is looking to mobilise over Rs 1 lakh crore from service tax with the Budget estimate for 2012-13 pegged at Rs 1,24,000 crore.

Everything about Service Tax can be found at Government’s website servicetax.gov.in

Hope this article helped in explaining the service tax. Our expenses are bound to go up since the service tax net has been widened to include almost all services that comprise a huge chunk of the household consumption basket. While politicians were quick to demand roll back of raised railway fares which forms a small percentage of Aam Aadmi budget, raising the service tax didn’t get anyone’s support. Why did not anyone raise the voice against increase in service tax? Is it because of ignorance on service tax or because we cannot do anything about it. Is Service tax regressive as taxes on goods are paid by the rich and poor alike?

Please see if the answer to my previous questions lies in point 13 at the following link:

http://www.servicetax.gov.in/faq-29sept11.pdf

Thanks for yet another thoroughly written article! After reading your posts I’m getting smarter day by day.

I was wondering if you know whether service tax is applicable on export of analytic services? I’ve been working with firms in the USA and doing analytics for them (they email me the data, I prepare reports and email them back), for which they send me payment in foreign currency (USD) to my Indian bank account. These US companies don’t have any offices in India, I work directly with them. The place of consumption of the services I provide is entirely in the US.

My Google searches lead me to mixed opinions, with frequent mentioning of clause 105 of section 65:

http://www.servicetax.gov.in/exp-service-rule.htm

http://www.caclubindia.com/notice_circulars/-exempts-the-taxable-service-of-outdoor-catering-referred-to-in-sub-clause-zzt-of-clause-105-of-section-65-of-the-finance-act-under-the-centrally-assisted-mid-day-meal-scheme-3670.asp

http://www.lawyersclubindia.com/forum/service-tax-liability-for-export-of-services-10878.asp

Thanks Pratham. We checked up your links(thanks for them) and discussed with our team. We feel that analysis service is a grey area and our hands are tied as we have no information on the amount of services you bill etc. We feel Googling is a great place to find answers but only for getting an idea. For specific cases it is best to get professional advice. We would recommend you to contact a tax consultant for it should not be a case of penny wise and pound foolish.

Totally agree with your advice. I surely will be following up with a Service Tax consultant.

Thanks Pratham in matters of tax we feel that one should consult the professional. Please do let us know what Service consultant said it would help others.

Didn’t realize we pay so much through service tax.The explanation is simple. Thanks