LIC has launched Life insurance plan called Jeevan Sugam which offers triple benefit of insurance, investment & tax-saving ,an irresistible combination,that too at one time payment only. In our article Checklist for buying Life Insurance Policy we had covered the questions that one need to ask one self before buying a life-insurance policy, understanding the policy, terms and conditions. Using the checklist let’s evaluate whether one should buy LIC Jeevan Sugam policy or not?

Understanding LIC Jeevan Sugam

Plan Type: Market Linked or Traditional : It is not a market linked i.e not a ULIP but a traditional endowment plan.

Premium Mode: It is single premium plan available for limited period only.

Tenure or Term : 10 year

Premium paying Term : As it is single premium policy one needs to pay premium only once.

Benefits

- On death within 5 years from the date of commencement of policy: Sum assured i.e. 10 times the single premium (net of service tax) excluding any extra premium charged would be payable

- On death after 5 years from the date of commencement of policy: Sum assured i.e. 10 times the single premium (net of service tax) excluding any extra premium charged + loyalty additions (if any) would be payable

- Maturity Benefit: Maturity sum assured along with loyalty additions (if any) would be payable on maturity of 10 years.

- Loyalty additions would be purely based on LIC’s claim experience.

Let us take one example. Mr. Shyam who is 30 yrs old want to invest in this policy.

- He wants to opt for Maturity Sum Assured(guaranteed amount he receive from this policy) of Rs 60,000.

- The amount he needs to invest i.e premium is Rs 33,759 (excluding service tax).

- During the first 5 years of policy if his death occurs then his nominee will receive 10 times the premium i.e Rs 3,37,590.

- But if his death occurs after 5th yr and within 10th year then his nominee will receive this Rs 3,37,590+ Loyalty Additions (LA,which is unknown as of now and will be provided as per the rates available at that time).

- If he survives till maturity then he will receive the Additional Maturity Sum Assured (MSA) which is Nil (zero) as MSA is 60,000 below 1.5 lakh. So on maturity he will receive 60,000 + Loyalty Addition.

- Additional MSA is 0% for MSA below 1,50,000

- Additional MSA is 3.5% of MSA if Maturity Sum Assured (MSA) is between 1,50,001 to 3,99,999

- Additional MSA is 4.5% of MSA is Maturity Sum Assured (MSA) is above 4,00,000.

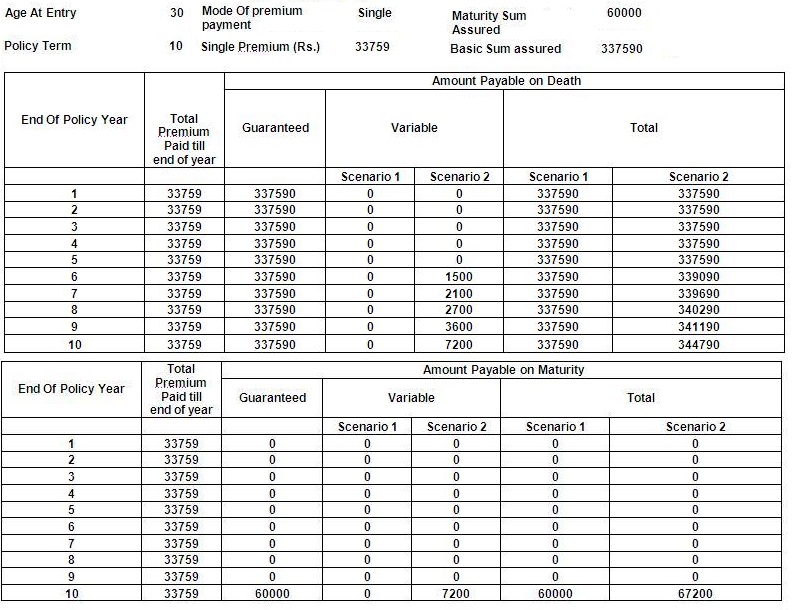

Benefit Illustration

From LIC webpage Benefit Illustration of Jeevan Sugam is given below. It’s the same example as explained above.

Surrender Value

The policy can be surrendered for cash at any time during the policy term. The minimum Guaranteed Surrender Value allowable is as under:

- First year: 70% of the Single premium (net of service tax) excluding all extra premiums, if any.

- Thereafter: 90% of the Single premium (net of service tax) excluding all extra premiums, if any.

Loan

Loan can be availed under this plan any time during the policy term. Loan shall be equal to 60% of the surrender value as on the date of sanction of loan.

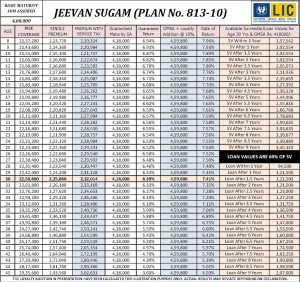

Premiums at various ages from mylicindia JeevanSugum are shown in picture below (Click to enlarge)

Exclusions

From LIC webpage on Jeevan Sugam

The policy shall be void if the Life Assured (whether sane or insane at the time) commits suicide at any time within one year from the date of commencement of risk and the Corporation will not entertain any claim under this policy except to the extent of a maximum of

- 90% of the single premium paid excluding any extra premium paid or

- third party’s bonafide beneficial interest acquired in the policy for valuable consideration (but limited to applicable death benefit of this policy) of which notice has been given in writing to the branch where the policy is being presently serviced (where the policy records are kept) at least one calendar month prior to death.

Tax Benefits

You can avail the tax benefit under Sec 80C during the period of investment. For insurance policies issued on or after April 01 2012, deduction is allowed for only so much of the premium payable as does not exceed 10% of the actual capital sum assured. That means, if your premium is Rs 50,000 and the sum assured Rs 1 lakh, only Rs 10,000(10% of 1,00,000) will be allowed as deduction. But first check how much tax do you need to save? Usually salaried employee have EPF in which employee contribution qualifies for 80C or principal of home-loan also qualifies for 80C. Our article Choosing Tax Saving options : 80C and Others explains how to choose tax saving investments.

Also you can avail the tax benefit under Sec 10(10D) post maturity also under current income tax laws . For insurance policies issued on or after April 01 2012, exemption would be available for policies where the premium payable for any of the years during the term of the policy does not exceed 10% of the actual capital sum assured. But advertisement of LIC Jeevan Sugam (click on the image to enlarge) does not mention tax benefit under Section 10(D). MoneyLife’s Why is LIC suppressing the tax benefit feature under Section 10(10D) suggests reasons as to why LIC has not mentioned it. Quoting from it

Let’s take example of person aged 30 years with premium of Rs33759 + 3.09% service tax. The death benefit will be Rs3,37,590, but maturity sum assured is only Rs60,000.

If you are not healthy, your premium will be loaded and you may not even meet the requirement of death benefit of 10 times the premium; 10(10D) will not be applicable. E.g. class one extra for age 30 years in above example will be Rs846. Total premium payable = Rs33,759 + 846 + service tax.

LIC Jeevan Sugam does have death benefit as 10 times of the premium, but it is excluding the service tax. Could this be an issue as the total premium with service tax will be more than 10% of the death benefit? It is unlikely. E.g. Premium with service tax = Rs33,759 + Rs1,043.15 = Rs34,802.15.

The maturity sum assured in the product is different than death sum assured. While the death sum assured is 10 times the premium, the maturity sum assured is low. The wordings in the rules specify about premium up to 10% of the actual capital sum assured. Some interpret actual capital sum assured as maturity sum assured, which makes Jeevan Sugam ineligible for tax benefits. More likely, death benefit will be the capital sum assured and stamp duty of the policy is payable on it and not maturity sum assured. It may be a non-issue, but see comment section below for another interpretation.

The advertisement of LIC Jeevan Sugum is given below (See only 80C deductions mentioned, nothing about tax benefits under section 10(10D)). Click on image to enlarge

Age Factor

The premium for LIC Jeevan Sugam is dependent on age of the insured. So for the maturity assured amount of Rs. 1.75 lakhs,

- a 8 year old has to pay Rs. 96 thousand

- a 30 year old has to pay Rs. 1.01 Lakhs,

- a 45 year has to pay Rs. 1.32 Lakhs as premium.

So if you want to invest in this plan premium amount suggests it is better to invest in your spouse or kid name to benefit from the age factor. But does your child or spouse need protection? Our article Checklist for buying Life Insurance Policy talks in detail about who should get insured and why?

Return from the policy

How much will you earn from the policy?

Let us take one example. Mr. Ghansu who is 25 yrs old and wants to invest in this policy.

- He wants to opt for Maturity Sum Assured(guaranteed amount he receive from this policy) of Rs 5,00,000 ( 5 lakh).

- The amount he needs to invest i.e premium is Rs 2,86,539 (including service tax) or 2,77,950 (excluding the service tax).

- During the first 5 years of policy if his death occurs then his nominee will receive 10 times the premium i.e Rs 27,79,500

- But if his death occurs after 5th yr and within 10th year then his nominee will receive this Rs 27,79,500

+ Loyalty Additions (LA,which is unknown as of now and will be provided as per the rates available at that time). - If he survives till maturity then he will receive the Additional Maturity Sum Assured (MSA) which is 4.5% of MSA as MSA is above 4 lakh. So on maturity he will receive 5,00,000+Rs.22,500 (Additional MSA at 4.5% of MSA)+LA. Assuming loyalty addition at 10% of MSA on maturity he will receive 52,250. Totally after 10 years he receives 5,74,750 (5,00,000+Rs.22,500+52,250)

So on investing Rs 2,86,539 he gets 5,74,750 after 10 years. Using our calculator Calculate Returns on Investments we find that his CAGR is 7.21%.

If he takes into account 80C benefits then if his income is in 20% income slab and he invests entire 1 lakh limit in 80C in buying LIC Jeevan Sugam he would save tax at the rate of 20.6% i.e 20,600. So his initial investment comes down to 2,86,539 – 20,600 = 2,65,939. Assuming his maturity value to be 5,74,750 his return now is 8.01%.

For 30% income slab his effective return will be around 8.44% and for 10% it would be around 7.60%.

An alternative with similar return

Currently Tax-free bonds with the tenures of 10-15 years with yield of 7.5% return are available. LIC Jeevan Sugam is a combination of debt investment, insurance, tax saving and hence the comparable investments are Fixed Deposits, NSC or PPF in combination with term insurance.

Should you go for it?

The plan provides cover only for 10 years. So it cannot be used as a basic insurance plan in 20s-40s.You need other insurance policies to provide protection.

If you have sufficient investments to cover section 80C exemptions, this plan may not benefit you as returns are just okay-okay.

You would mostly lose money in case you surrender this plan before maturity. (Unless it is in the Free look period)

There is no clarity on tax benefits under Section 10(D). If returns are taxable then returns will be lesser.

References : BasuNivesh’s LIC’s Jeevan Sugam-Review , ApnaPlan’s LIC Jeevan Sugam – Review, myinvestmentideas LIC Jeevan Sugam Insurance Plan – Review

Related Articles :

- Checklist for buying Life Insurance Policy

- Understanding Returns: Absolute return, CAGR, IRR etc

- Mixing Insurance with Investment

- Tax saving options : 80C,80CCC,80CCD,80D,80U,80E,24

- Insurance : Surrender or Make policy paid up or Continue

You should have a close look of these insurance products, especially in months of January to March, when people are in hurry to save tax as they have to submit the tax saving proof to their offices. Would you choose to invest in LIC Jeevan Sugam or have you invested in LIC Jeevan Sugam and if yes why? How did you buy life insurance?

Hello, I have been reading your post for quite a while, though I do not understand the depth of ur explanations in many cases, I enjoy it and grasp many useful points… If this plan’s return is Okay-Okay I wonder if there are any better plans. Plz reply coz I was about to take this plan and after reading ur post i decided not to, thanks for the last minute help..

Ajeeth a request when you find something which you can’t understand please ask. It will help you, us and other readers too. We believe in “Questions are never stupid answers are”

“Investing is a plan not a product or a procedure”. So what is your investing plan, your risk profile, your age, your liabilities, your other investments One shoe does not fit all.

To look for alternative let’s start by answering a simple question .

Why did you want to take the plan?

Thank you I would love to ask questions that are burning in my head, alright my idea for buying a plan

1. is not for tax deductions.

2. I need a plan that can provide some reasonable amount of money to my family if something happens to me(death or illness etc).

3. If I’m alive after 10 years I would need a considerable amount to start my own business or at least use it for investing in land or gold or house (coz being in IT sector I don’t believe I can be in this field for more than 10 years from now)

4. Or after 20 years I would need a considerable amount for my kids education(coz im having my first kid in a week or two)

I am not greedy to have one plan that would satisfy all my needs, These are my ideas if there is one/two/many policies that has to be taken to satisfy this I’m ready to do so.

Age:27

Liabilities: 1.5 lakh gold loan

Investments: 2400 sq feet land, Second hand car, Kotak Assured Income Plan, Term insurance

Risk profile : If it means willingness to take risks I am ready for it.

Best of luck on having your first kid.

When I had my first kid (a daughter who has just finished her IX class exams) the fact of having responsibility of another human being totally dependent on me really hit me hard.

Okay coming back to your question.

You seem to be doing good for 27 years.

Are you salaried ? (Want to know if you have EPF).

Why have you not invested in PPF?

Why have you not invested in Mutual Funds?

Why gold loan?

Hello, I have been reading your post for quite a while, though I do not understand the depth of ur explanations in many cases, I enjoy it and grasp many useful points… If this plan’s return is Okay-Okay I wonder if there are any better plans. Plz reply coz I was about to take this plan and after reading ur post i decided not to, thanks for the last minute help..

Ajeeth a request when you find something which you can’t understand please ask. It will help you, us and other readers too. We believe in “Questions are never stupid answers are”

“Investing is a plan not a product or a procedure”. So what is your investing plan, your risk profile, your age, your liabilities, your other investments One shoe does not fit all.

To look for alternative let’s start by answering a simple question .

Why did you want to take the plan?

Thank you I would love to ask questions that are burning in my head, alright my idea for buying a plan

1. is not for tax deductions.

2. I need a plan that can provide some reasonable amount of money to my family if something happens to me(death or illness etc).

3. If I’m alive after 10 years I would need a considerable amount to start my own business or at least use it for investing in land or gold or house (coz being in IT sector I don’t believe I can be in this field for more than 10 years from now)

4. Or after 20 years I would need a considerable amount for my kids education(coz im having my first kid in a week or two)

I am not greedy to have one plan that would satisfy all my needs, These are my ideas if there is one/two/many policies that has to be taken to satisfy this I’m ready to do so.

Age:27

Liabilities: 1.5 lakh gold loan

Investments: 2400 sq feet land, Second hand car, Kotak Assured Income Plan, Term insurance

Risk profile : If it means willingness to take risks I am ready for it.

Best of luck on having your first kid.

When I had my first kid (a daughter who has just finished her IX class exams) the fact of having responsibility of another human being totally dependent on me really hit me hard.

Okay coming back to your question.

You seem to be doing good for 27 years.

Are you salaried ? (Want to know if you have EPF).

Why have you not invested in PPF?

Why have you not invested in Mutual Funds?

Why gold loan?