Soham, a 35 year old marketing manager led a content life with his wife and two kids, till disaster struck. While driving to work last year, his car collided with a rash truck driver. Though his life was saved, the injuries he sustained meant that he would take some time to get back to normal life. His main worry (when he realised he won’t be able to work for another year) was – how will he and his family (housewife and 2 children) manage monthly expenses for the next year. And hence, at a time when he had to take care of his health completely, he was left worrying about his family. Although he had an accident cover, it only covered the hospital bills and that too partially. He had put off the decision to buy a life cover, as he had an accident cover, and now it had failed to cover his situation. With some savings and help, he barely managed to make ends meet that year.

With Indian roads accounting for the highest fatalities in the world (400 road deaths per day in India in 2015); this can be a similar fate of many in India. While we all feel we are safe now and can wait another day to get a life insurance or term cover; a better judgment would mean getting a good cover as soon as we can. In Soham’s case after a year due to high medical bills; plus taking at least 6 months more to find a good job again – not only have all of his savings been completely wiped out, he has been left with a huge amount of debt which can take him at least 3 more years to pay off. For Soham, a second was all it took to have his future planning seemed to have come apart.

Several insurers offer pure term insurance policies online; which also offer critical illness and disability cover. Online policies are offered at very reasonable rates as the agent’s commission gets cut out; yet most of us hesitate as we feel we already have an accident or medical insurance policy and can wait some more time. Very often applying for a life insurance cover like a term plan is similar to going to the dentist or filing your returns- it needs to be done but you don’t want to do it today. But in all these cases the delay can cost you your hard earned money.

Here is how the longer you delay getting life insurance the more costly it can become for you :

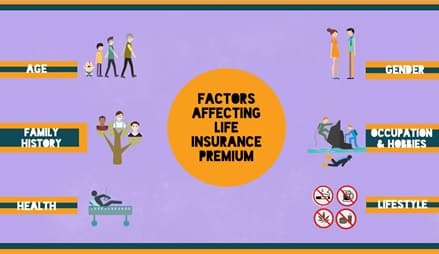

- The premium amount goes up with age This is maybe one of the least costly of all the other costs caused due to a delay; but still worth mentioning. The older you are the more costly is the life insurance premium. So if you are 34 years of age and end up delaying taking a term insurance for another 1-2 years; though the amount per month will not differ that much, but it can add up over the term of life insurance policy. For instance in case the difference adds up to Rs. 2400 pa., then you would end up paying an extra Rs. 48,000 for a 20 year term life insurance While not a lot of money it is still extra money that you don’t have to spend by simply avoiding a delay.

Image credit: https://www.tomorrowmakers.com/

- Changes in health condition If you are thinking of delaying your decision to get a life cover; as your health is in an excellent condition right now; then now actually is the best time to apply for a life insurance policy. Most of us of course know the obvious that condition of health has an impact on getting cover and premium. At the event of being diagnosed with a serious health condition, your choice of delaying taking a term insurance can be a serious game changer. Besides the cost of paying expensive medical bills which otherwise could have been covered by a critical illness cover (which can be added to a term cover); a serious illness will not only make the cost of a life insurance prohibitive, but it can also force you to delay your application even further.

In a scenario where you had already gotten the cover in advance not only would the policy continue in the same way; but the premiums would also be the same.

- Dealing with unexpected situations Life is full of surprises some are good and then some are bad. Being human there are various situations that are beyond anyone’s control; such as meeting with a near fatal accident which affects your health majorly; or suddenly being diagnosed with a fatal illness; disability and so on. We all wish for the best and try to think positively always; and while we can’t protect ourselves emotionally and physically completely but at least we can have financial protection. Procrastinating can lead to a lot of changes in the life situation and to not get caught in huge expenses; it is ideal not to delay something as important as getting a life insurance policy.

- Changes in monetary situation Most life insurance companies will not issue a policy to someone who has filed bankruptcy or is out of a job. Along with bad financial situation most people are affected with deteriorating health conditions due to the stress that follows; which in itself can be an obstacle in getting a policy in the future.

- Cost to your family You don’t know what the future holds and that also includes life span. The ultimate reason for not delaying buying a life insurance is death itself. While you can’t protect your family against such an emotional loss; but the financial cost too can be very difficult to deal with for loved ones especially during such an emotionally low state; Hence, delaying life insurance becomes an even more disastrous a decision.

Eventually no matter how much you may not feel like applying for life insurance, do it for you and your loved ones future. The later you wait the more it will cost you and fundamentally time is of great essence when it comes to buying a life insurance policy.

You have brought up a very excellent details , thankyou for the post.

very informative

coming here after a very long time

Good to have you back Sujatha. How is life?