A person is bound to spend more money on medical as and when he grows old. To secure himself from the inflation and to protect against unseen outlays a person insures himself with a health insurance. What if the insurance cover is not sufficed for the cost actually incurred? Will you be okay settling the balance from your pocket? This article covers What is Top up Health Insurance Plan? How does Top Up health insurance plan work? What is Super Top up Health Insurance Plan? Buying a Top up health insurance plan or a Super top up plan.

Table of Contents

Top Up Health Insurance Plan

Many believe that their medical needs will be taken care of by the employers but have you ever wondered what if the coverage offered is not able to meet all your medical costs? The present cover is comfortably high and I am healthy enough, or I can handle medical costs if anything happens. Your present cover may be sufficient to pay for small illnesses, but there is always a chance it would fall short in case of a bigger medical emergency. And not to forget that the employer’s health cover ceases to exist once you leave or retire. Many go for health insurance plans. But a bigger health cover, may not fit into everybody’s scheme of things. This is where Top Up Health Insurance Plan come in. They not only cost less but provide high coverage too.

Would you go on a long trip without a spare tyre or stepney . Until Thomas Morris Davies came up with the revolutionary idea of a keeping a spare tyre in the car in 1904, people back then dreaded punctured tyres. Health top up plan is like the stepney of a car. Once you exhaust the sum assured of your health insurance, the stepney or top up health insurance can be used for overhead. Top-up Health Insurance plans are good supplement to your primary health cover as they provide the benefit of higher insurance coverage at a marginally higher cost.

What is a Top Up Health Insurance Plan?

To claim Top up health Insurance plan 2 conditions need to be fulfilled. The amount can be claimed only after the threshold limit of the plan is reached. For example if you take a Top up Plan of Rs 10 lakh but with threshold limit of Rs 3 lakh then

- To claim Top up Insurance you must have a minimum bill of Rs. 3 Lakh. A top-up policy does not cover expenses up to threshold limit. In case, one did not have a base policy, one would have to bear the R3 lakh bill and top-up policy will cover amount beyond that.

- The threshold amount needs to be realized in every single bill and not on the total number of bills.

Example of Having Only Top Up Health Insurance Plan

Let us take an example to understand health top up plan. Mr. Saini has opted only for a health top up plan as has no other basic health insurance plan. The top up plan is of sum assured Rs. 10 lakh with a threshold limit of Rs. 3 Lakh. Below are 3 different scenarios where Mr. Saini has been admitted.

Scenario 1: Bill amount is Rs 2 lakh.

The top up plan is of sum assured Rs. 10 lakh with a threshold limit of Rs. 3 Lakh. Because health top up plan is not a regular health insurance plan. The minimum claim needs to meet threshold amount. As 2 lakh< 3 lakh, no claim can be made. So Rs. 2 lakh will be paid from Mr. Saini’s pocket.

Scenario 2: Bill amount is Rs 6 lakh

The top up plan is of sum assured Rs. 10 lakh with a threshold limit of Rs. 3 Lakh. Amount that is over and above the threshold limit but below the sum assured of 10 lakh so bill of 6 lakh can be claimed.

Scenario 3: Bill amount is Rs 15 lakh

The top up plan is of sum assured Rs. 10 lakh with a threshold limit of Rs. 3 Lakh. Amount of 15 lakh is over and above the threshold limit but the sum assured is10 lakh so bill of 10 lakh can be claimed. Balance of Rs. 5 Lakhs will be paid from Mr. Saini’s pocket.

Scenario 4: 2 Bills in a year of Rs 2 lakh each.

Let us take a scenario 4 where Mr. Saini is admitted in the hospital and has 2 bills of Rs.2 Lakhs each. Single bill is not fulfilling the condition of achieving the threshold limit. Therefore, he will have to settle the bill either from his routine health insurance or will have to pay from his pocket.

Example of Having Top Up Health Insurance Plan with a regular Health Insurance Plan

If Mr. Saini had a Health insurance plan of 3 lakh in addition to the top up plan for sum assured of Rs. 10 lakh with a deductible limit of Rs 3 lakh.

Scenario 1: Bill amount is Rs 2 lakh.

The top up plan is of sum assured Rs. 10 lakh with a threshold limit of Rs. 3 Lakh. Because health top up plan is not a regular health insurance plan. The minimum claim needs to meet threshold amount. As 2 lakh< 3 lakh, no claim can be made from Top up. But Rs. 2 Lakh can be claimed from regular health insurance while zero can be claimed from the health top up plan.

Scenario 2: Bill amount is Rs 6 lakh

Firstly, the health insurance is upto 3 lakhs so Rs. 3 Lakh can be claimed. Balance amount of 3 lakh(6 lakh – 3 lakh) is equal to threshold limit. . So balance 3 Lakh can be claimed by the health top up plan.

Scenario 3: Bill amount is Rs 15 lakh

Again the health insurance will be exhausted upto its sum assured and then the health top up plan will kick in. So initially Rs. 3 Lakh will be claimed from basic health insurance followed with 10 Lakh that can be claimed from the top up and balance Rs.2 lakh will be paid by Mr. Saini personally.

Super Top Up Health Insurance Plan

Super top up cover is another variation of the top up plan. In Super top-up health insurance plan, threshold limit applies to total expenses incurred during the policy period. For instance, if a policyholder with threshold limit of R3 lakh and a top-up cover of Rs 10 lakh is hospitalised twice, with bills amounting to Rs 2 lakh for the first time and Rs 2.5 lakh for the second, the super top-up policy will get triggered during second hospitalisation as the total expenses (Rs 4.5 lakh) crosses the threshold (Rs 3 lakh). When the threshold limit to claim the top up is crossed but not in a single bill, this is where super top up plan marks its importance.

Now let us compare top up and super top up plan with Mr. Saini as an example. Note: All the scenarios are for 1 year.

| Cases | Top up cover | Super top up cover |

| Policies Mr. Saini has | Policy A: A regular health insurance sum assured Rs. 5 Lakhs.

Policy B: A top up health cover of Rs .10 lakh sum assured with Rs. 3 Lakh deductible. |

Policy A: A regular health insurance sum assured Rs. 5 Lakhs.

Policy B: A top up health cover of Rs .10 lakh sum assured with Rs. 3 Lakh deductible. |

| Mr. Saini makes a claim of Rs. 2 Lakh. | Policy A insurer will pay the entire sum of Rs. 2 Lakh.

Policy doesn’t kick in as the threshold limit is not reached. |

Policy A insurer will pay the entire sum of Rs. 2 Lakh.

Policy doesn’t kick in as the threshold limit is not reached. |

| Mr. Saini makes a claim of Rs. 4 Lakh in the same policy year | Policy A insurer will pay a sum of Rs. 3 Lakh after which it will be exhausted as the sum assured of Rs. 5 lakh will be reached with this claim.

Balance Rs. 1 Lakh will be paid by Mr. Saini from his pocket being the basic limit not reached to claim top up cover. |

Policy A insurer will pay a sum of Rs. 3 Lakh after which it will be exhausted as the sum assured of Rs. 5 lakh will be reached with this claim.

Balance Rs. 1 Lakh will be taken care by Super top up cover as the threshold limit for the year exceed Rs. 5 Lakhs. ( 2+4 = 6 Lakhs) |

| Mr. Saini makes another claim of Rs. 3 Lakh in the same policy year. | Policy A will not pay anything as it is exhausted.

So the entire bill of Rs. 3 Lakhs will be burdened on Mr. Saini being the basic limit of Rs. 5 lakh is not reached to claim top up cover.

|

Policy A will not pay anything as it is exhausted.

Policy B will pay the entire amount of Rs. 3 Lakh as the aggregate threshold has crossed the benchmark in the previous bill itself. (2+4+3= 9 Lakhs) |

| Mr. Saini makes another claim of Rs. 6 Lakh in the same policy year. | Policy A will not pay anything as it is exhausted.

Policy B will now kick in as the single bill amount has crossed the deductible limit of Rs. 5 Lakh. Policy B will pay Rs. 1 Lakh as claim. ( 6- 5 = 1 Lakh)

Mr. Saini can claim in the remaining time of the year if each bill exceeds Rs. 5 Lakh. |

Policy A will not pay anything as it is exhausted.

Policy B will pay the entire amount of Rs. 6 Lakh as the aggregate threshold has crossed the benchmark in the previous bill itself. (2+4+3+6= 15 Lakhs)

If Mr. Saini gets admitted again in the same year he will not be able to claim anything from Policy B as he has already exhausted the sum assured with 3 claims.

(1+3+6 = 10 Lakhs) |

Benefits of Top up Health Insurance Plan

- If you wish to extend your existing heath cover, the cost incurred is more than that for a top-up cover. The premium paid for top up plans is cheaper as compared to the regular health insurance.

- It is not mandatory to have an existing regular or group mediclaim to buy a top up or a super top up plan.

- The basic health insurance and top-up cover can be so two different companies. So you can choose the ones with least premiums and more sum assured/ less threshold limit to reap the best of savings.

- Top ups are available for individuals or with family floater cover. Family floater cover is where the bills of every family member can be considered for threshold limit. Single premium needs to be paid for all the members. Limited companies offer family floater cover.

- Top up plans offer tax benefit under 80D

- No higher premium if you claim policy in a particular year.

- Covers most of the expenses like ambulance, Pre and post hospitalization expenses etc. There is also a waiver for pre-existing ailments.

- Most of the Top-up / Super Top plans work on reimbursement basis. They will pay the claim amount after the insurer gets the details of all the medical bills, to assess whether the policyholder has paid the deductible limit by himself or through any existing health insurance policy.

Choosing Top up Health Insurance Plan

Top-up plans intend to act as supplementary policies providing dual benefits of low cost and higher sum insured. These are a boon for those about to enter the senior citizen category, when the probability of falling ill is high and medical expenses are bound to increase. Those who are covered under employer’s health insurance policy can also buy a top-up plan for higher protection. A top-up policy is suitable for anyone looking to buy a higher health cover.

The higher the deductible, the cheaper will be the plan. But top-up health plans are meant to bridge the gap between existing policies and actual costs. The idea is not to duplicate but buy extra cover at a reasonable cost. So, exclusions such as day care and dental treatment will not make a big difference as they will be taken care of by your base health policy. It is advisable to go through the policy wordings of any health insurance plan. Understand the important points like the duration for pre-existing diseases, scope of cover, if day-care procedures are covered, cover for pre & post-hospitalization expenses etc..

When to choose Top Up Health Insurance Plan?

- Top up plans should complement your existing health insurance. It should not be a substitute to your health insurance as the threshold limit needs to be crossed to benefit from the top up health insurance.

- If you have innumerable hereditary ailments prevailing in the family, you are at a risk . So a super top up plan will benefit you to shield against foreseen medical burden.

Higher the deductible, lower would be the corresponding premiums. However, you cannot choose a random figure as deductible limit. This amount should not be more than what you (or your basic health policy) can comfortably pay in case of an emergency.

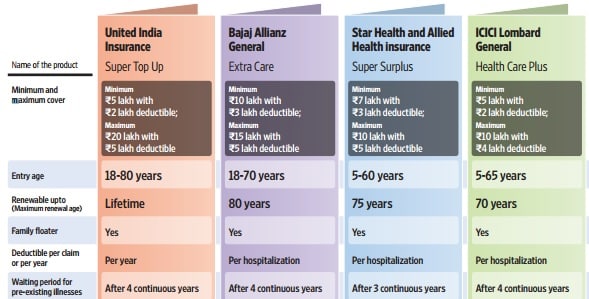

Companies offering top up health cover in India:

- Star Health’s Top up Plan – Star Health Super Surplus Insurance Policy, comes with a cover ranging between Rs 7 lakh and Rs 10 lakh, with the deductible starting at Rs 3 lakhs.

- United India’s Top up Plan – Top up Medicare,This plan can be used to protect both an individual and his/her family, coming with a floater option and offering cashless treatment across multiple locations in India.

- Apollo Munich Optima Plus Top up Plan, This plan covers multiple scenarios, offering cashless benefits and an option to convert the scheme into a zero deduction health insurance policy upon retirement.

- ICICI Lombard Top up Plan – Health Care Plus Insurance Plan. This policy offers flexible sum assured and deductibles to suit the financial requirements of different individuals, covering multiple scenarios.

- New India Assurance’s – Top Up Mediclaim Policy

- Religare Enhance, This custom designed scheme comes without any sub limits, ensuring that the entire family is protected, with the option to choose a cover between Rs 1 lakh and Rs 30 lakh, depending on their requirement.

- Bharti AXA

Companies offering super top up cover in India:

- Apollo Munich Optima Super Top Up

- United India Super Top up plan

- L & T Super Top up Plan – Medisure Super Top Plan

- Max Bupa Super Top up plan – Heartbeat High Deductible Plan (under Silver Plan)

- HDFC Ergo Health Suraksha Top up Plus, This plan comes with a family floater option, with deductible starting from Rs 1 lakh and sum assured ranging between Rs 2 lakh and Rs 10 lakh.

- Bharti AXA

- Cigna TTK Super Top Plan – ProHealth Plus Plan (Under ‘Protect’ & ‘Plus’ Plans)

Related Articles:

- Invest in a reliable Health Insurance Plan Early

- Why don’t we buy Health Insurance Plans?

- Basics of Insurance

- Insurance: Types of Term Plan

- Insurance at every lifestage

Remember to always compare the premiums and see the perks offered while choosing a top up plan in accordance to your base cover. While some people dodge health without buying insurance, some rely on employer’s group mediclaim and some invest wisely to cover entire medical and surgical overhead from insurance itself where top ups come to rescue! Have you invested in any of the top up plans? If yes which one

Top up and super top up are effective health insurance policy that offers extra coverage at a low premium. You must buy a top up or super top up plan; it will surely give you needful medical coverage n case of need. You must buy the same with the help of the Turtlemint health insurance portal.

Very Informative and helpful.

From all the insurance options available in the market, I recommend IFFCO Tokio health insurance policy as it covers all risks that might be happened. Make sure you compare prices and insurance quotes before making a decision.

Thank You. Hopefully it helps.

Thanks for this, very informative and helpful. I had a query, I have a mediclaim policy for 1 lakh(1.4 incl bonus) from National Insurance, Also covered by employer for 2 lakhs.

National Insurance does not provide top-up facility.

If I have to take a top-up policy of say Rs. 5 lakh, how it would work.

How much would be the approx. premium.

Thanks,

Rakesh