Tax saving Fixed Deposit are special category of fixed deposits where the investor gets the benefit of a tax break when they invest a sum of money in the deposit. It is different from Fixed Deposits of 5 years. This article talks of Tax Saving Fixed Deposits. What are tax saving fixed deposits? Is interest on tax saving deposit taxable, TDS on tax saving deposit, Should you invest in Tax Saving Fixed Deposits?

Table of Contents

Tax Saving Fixed Deposits

What are Tax Saving Deposit Schemes?

Tax saving Deposit Schemes are special category of fixed deposits where the investor gets the benefit of a tax break when they invest a sum of money in the deposit. It is different from Fixed Deposits of 5 years. As it was announced in the budget of 2006, it is also called as Tax Saving Deposit scheme 2006 (Notification Number 203/2006 and SO1220 (E) dated 28/07/2006 ). Salient Feature of the scheme are given below. Interest Rates of Tax Saving FD is between 6% to 7.70% for General and 6.5% to 8.2% for Senior Citizens as on Jan 8 2017. Our article Best Tax Saving Fixed Deposit under section 80C discusses the Tax Saving Fixed Deposits with high interest rates and of popular banks.

- Fixed tenure without premature withdrawal. Since there is an underlying tax advantage under section 80C of Income Tax Act, there would be a minimum lock in period of 5 years on the FD under this scheme.

- Year is defined as a financial year , FY 2016-17 is Apr 1 2016- 31 Mar 2017 .

- Amount one can invest in Tax saving Fixed Deposit is limited to Rs. 100 minimum and one lakh and fifty thousand ( 1,50,000) maximum.

- One gets tax benefit on money put in Tax saving Fixed Deposit :

- Tax benefit is under section 80C.

- Maximum amount one can put in Tax saving Deposit scheme is Rs one lakh and fifty thousand ( 1,50,000).

- Investment is part of the Rs 150,000 exemption presently available in respect of life insurance premium, contribution to PF etc.

- You can claim the benefit only in the year in which you invest in Tax Saving Fixed Deposits.

- Bank will issue a Fixed Deposit Receipt that shall be the basis of claiming tax benefit.

- Term deposit under this scheme cannot be pledged to secure a loan.

- A person can invest in these FD’s through any public or private sector bank except for co-operative and rural banks. Investment in Post Office Time Deposit of 5 years also qualifies for deduction under section 80 (C) of the Income Tax Act, 1961. Post Office Fixed deposit can be transferred from one Post office to another.

- Premature withdrawal is not available.

- Two types of deposits are to be offered under the scheme,

- Interest is payable monthly or quarterly as per your convenience.

- Interest is compounded quarterly and reinvested with principal amount

- Interest is taxable.

- Tax is deducted at source (TDS), from the interest on Tax-Saver Fixed Deposit will be deducted according to Income Tax Regulations prevalent from time to time .

- TDS is deducted at the rate of 10% when interest for the financial year exceeds Rs 10,000 whether interest is paid or not. Even if one has invested for 5 years and interest for a year exceeds 10,000 though he has not actually got it TDS will be deducted.

- A consolidated TDS Certificate in Form 16A, for TDS deducted during a financial year, is issued in the month of April of the following financial year.

- If one is exempt from paying tax, one needs to present Form 15G or 15H when one opens a Fixed Deposit and subsequently at the beginning of the following financial year

- All individual depositors(resident Indians) and Hindu Undivided Family(HUF) who have a PAN number are eligible to open a fixed deposit account.

- Term deposit can be opened in following modes

- Single holder type deposits:

The single holder type deposit receipt shall be issued to an individual for himself or in the capacity of the Karta of the Hindu undivided family. - Joint holder type deposits:

The joint holder type deposit receipt may be issued jointly to two adults or jointly to an adult and a minor. But for FDs opened in joint mode, Benefit of deduction under 80C is available to first holder only.

- Single holder type deposits:

- Nomination facility is available for these FDs.

One can check out details of Tax saving Deposits schemes of various Banks :HDFC Tax Saving Fixed Deposits, SBI Tax Saving Scheme’s Axis Bank Tax Saver Fixed Deposit,

Calculating Tax Savings on Tax Saving Fixed Deposits

Let’s say Mr Malhotra invests Rs 1,00,000 in tax saving deposit scheme at the rate of 8% p.a. for five years. How much will he save by investing in Tax deposit scheme. Tax saving depends on the how much income you earn which income tax groups into slabs. For Financial Year 2016-17 (Assessment Year 2017-18) tax -slabs are as follows :

| TAX | MEN and WOMEN | SENIOR CITIZEN(Between 60 yrs to 80 yrs) | For Very Senior Citizens(Above 80 years) |

| No Tax (Basic Exemption) | 250000 | 300000 | 500000 |

| 10% tax | 250001 to 500000 | 300001 to 500000 | – |

| 20% tax | 500001 to 1000000 | 500001 to 1000000 | 500001 to 1000000 |

| 30% tax | above 1000000 | above 1000000 | above 1000000 |

| Surcharge | There is no surcharge in the case of every individual, Hindu undivided family, Association of persons and body of individuals | ||

| Education Cess | 3% on Income-tax plus Surcharge. | ||

Note: Education cess and Secondary and Higher Education Cess is on the tax and not on the income

If Mr Malhotra invests 1 lakh in Tax deposit scheme the benefits (including Education Cess) he gets is based on his income slab.

- If he is in 30% tax slab i.e his income is above 10 lakh rupees, He will get a benefit of Rs 30,900 at 30.90% . His effective investment is 69,100 (1 lakh – 30,900)

- If he is in 20% tax slab i.e his income is between 5 lakh- 10 lakh , he will get benefit is Rs 20,600 at 20.60%. His effective investment is 79,400 (1 lakh – 20,600)

- If he is in 10% tax slab i.e his income is between 2 lakh- 5 lakh , he will get benefit is Rs 10,300 at 20.30%. His effective investment is 89,700 (1 lakh – 10,300)

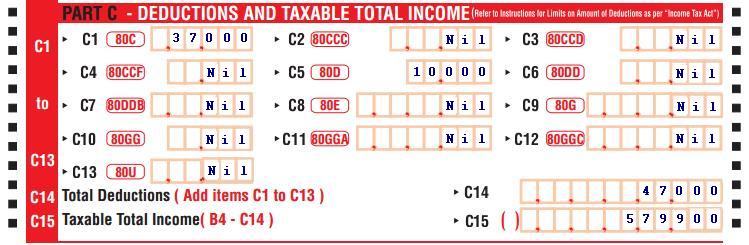

If invested in any tax saving , one needs to show in Income Tax Return (ITR) which has part asking for all deductions etc as shown from our article Filling ITR1 Form in image below

Showing Tax deductions for tax Saving Fixed Deposits

Tax Saving Fixed Deposit: Interest is Taxable

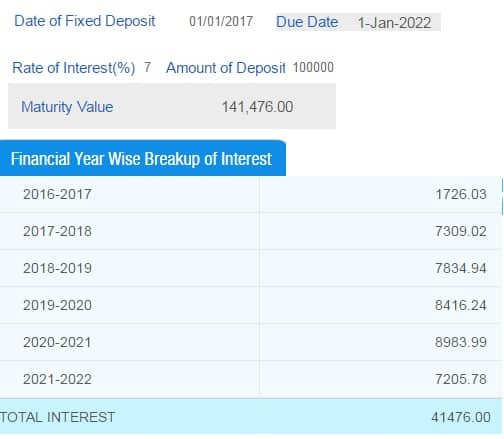

As this is Fixed Deposit tax saving is only for the principal amount that you invest, interest is taxable. On investment of 1 lakh one in 30% tax slab saves 30,900 , on investment of 10,000 one saves 3,090. But tax has to be paid on interest earned 5228. Check the advertisement of SBI Tax saving deposit scheme, it clearly mentions Pre Tax benefit., So tax to abi baki hai yaar(Tax needs to be paid). Interest earned in every year on Fixed Deposit of 1,00,000 at 7% for 5 years is shown in picture below

If interest for a year exceeds the limit (set at Rs 10,000 currently by Income Tax ) bank will deduct tax called as TDS(Tax deducted at Source) whether they pay you or not. If TDS in any year is cut it will come in Form 26AS, it is better to pay tax on interest earned every year. This way of accounting is called as Mercantile or Accrual method. But if interest in any year does not cross 10,000 Rs then bank will not deduct TDS hence one has an option to pay tax on interest earned at the end of 5 years. This way of accounting is called as Cash Method of Accounting. Our article Methods of accounting: Mercantile and Cash discusses it in detail.

If one includes tax on interest earned the yield would come down even more. Showing calculations for a person in 30% tax slab who invests 10,000 in Tax saving Fixed Deposit Scheme at 8.5% p.a for 5 years.

- Invested amount : Rs 10,000

- Tax saved : Rs 3,090 (30% tax slab)

- Maturity amount : Rs 15,228 .

- Effective investment (after tax saving) = Invested Amount – Tax Saved = 1000 – 3090 = 6910

- Total Benefit = Maturity amount – Effective investment (after tax saving) = 15,228 – 6910 = 8,318 for 5 years

- Interest earned is 5,228

- Tax on interest earned at 30.9% is 1615.452 or 1615.45 (rounded off to 2 decimal places)

- Effective Benefit = 8,318-1615.45 = 6702.55

- As investment is for 5 years so benefit per year 6702.55/5 = 1340.51

- Benefit on investment = (1340.51/10,000)*100 = 13.4051% = 13.41 % rounded off to two decimal places.

Considering post Tax, yield is still lower. Effective post-tax yield for PPF comes out to be above 16% as one saves tax during investing and interest earned is also tax free called as EEE.

Yield on Tax Saving Fixed Deposits

At times interest on tax saving deposits is expressed as yield. The standard way to express interest rates is with the annual interest rate. Interest rate is stated as a percentage usually at p.a.Yield is how much you actually profited from the investment. Yield is a term which can be interpreted in many different ways. As we saw in example of SBI and UCO ads the way of calculation of Yield is different and both correct! It like given two numbers say 2 & 6 and asked what would be the results, depending on mathematical operation used result can be 8(addition: 2+6), 4 (subtraction 6-2), 12(multiplication 6*2) and 3(division 6/3). A popular way of calculating what is called Effective Annual Yield, shown by the formula where r is rate of interest and m in compounding frequency.

CAGR on Tax Saving Fixed Deposits

Compounded Annual Growth Rate or CAGR is the actual indicator of return. This is the common practice used to analyze the return on any investment and it’s formula is :

CAGR=( End Value / Beginning Value)^ 1 / (Number of years – 1)

So if you plug in the values in CAGR calculator with

10,000 as Beginning Value and End Value as 15,228 and time period as 5 years is 8.775%

10,000 as Beginning Value and End Value as 15,228 and time period as 5 years is 17.121%

(it is taxable as per your income slab)

Should you invest in Tax Saving Fixed Deposits scheme?

Is Tax saving deposit right investment option for you? Consider Risk,Liquidity and Tax.

- Risk: It is safe (as backed by banks)

- Liquidity: there is a lock-in period of 5 years, Deposits cannot be withdrawn prematurely,Deposits cannot be pledged to secure loan or as security

- Tax : One saves tax on investing but interest earned on FD is taxable.

Table below shows the Features of Tax Saving Fixed Deposits

| Category | Product Features | Score |

| Flexibility of Investment | Money can be invested once in an FD.However, multiple FDs can be opened in a financial year.

No option to switch to equity or other security before maturity. |

2 |

| Liquidity | FDs can’t be broken before 5 years. | 1 |

| Volatility | Returns are fixed at the interest rate decided in the beginning. | 5 |

| Maturity Period | Tenure for these Fixed Deposits is five years. | 2 |

| Taxability | Investment is tax-free, but interest and maturity values are taxable. | 1 |

| Total | 11 |

The table below shows the comparison of various Tax Saving options in the different categories and overall. Our article Choosing Tax Saving options : 80C and Others discusses which Tax Saving Option to choose.

| Rank | Investment | Flexibility of Investment | Liquidity | Volatility | Maturity Period | Taxability | Total Score |

| 1 | ELSS | 3 | 3 | 1 | 5 | 5 | 17 |

| 2 | ULIP | 3 | 2 | 3 | 4 | 5 | 17 |

| 3 | Life Insurance | 2 | 2 | 5 | 2 | 5 | 16 |

| 4 | PPF | 3 | 2 | 4 | 1 | 5 | 15 |

| 5 | NSC | 4 | 3 | 5 | 2 | 1 | 15 |

| 6 | NPS | 4 | 1 | 2 | 2 | 4 | 13 |

| 7 | Tax Saving FDs | 2 | 1 | 5 | 2 | 1 | 11 |

But do you need to save the tax-doesn’t EPF, PPF , Life insurance premiums cover it? or Is this the right option for saving tax for you? Our article Choosing Tax Saving options : 80C and Others discusses it in detail.

I dugg som of you post ass I cerebrated they were invaluable handy.

Can the interest be deducted completely from tax saving fds on the premature withdrawal due to the demise of the investor.

Hi.

If i start FD with 1 lakh for 5 years period from now (2016), can i show this under 80c f for the remaing years.?

i understood that the interest is taxable however jus wanted to make sure whether i can include this 1 lakh for 5 years exemption.?

Hi,

How frequently do I have to pay for tax saving FD. Lets say that I want to deposit 1 lakh for a period of 5 years. Do I have to pay 1 lakh every year to gain tax benefit or pay just once and use the receipt for declaring in 80C. I am confused. Please clarify.

As mentioned in article, if you invest in Tax saving Fixed Deposit tax saving is only for the principal amount that you invest, interest earned in all years is taxable. On investment of 1 lakh one in 30% tax slab saves 30,900 , on investment of 10,000 one saves 3,090. But tax has to be paid on interest earned every year like any other Fixed Deposit.

Will it give tax benefit every year for five years?

No. Fixed Deposit tax saving is only for the principal amount that you invest, interest is taxable.

do i have to pay tax on accrued interest if it exceeds Rs 10,000 every year or will can i adjust that interest as reinvestment under Sec 80C and pay nothing on accrued interest income?

Please clarify

If possible, Can you show a CAGR also for this?

Good question. Added the information.

Can CAGR be calculated like this.

Assuming the same 30% tax.

Effective investment (after tax saving) = Invested Amount – Tax Saved = 10000 – 3090 = 6910 (Outflow)

Interest earned is 5,228

Tax on interest earned at 30.9% is 1615.452 or 1615.45

Inflow = Outflow +(Interest earned – Tax on interest) = 6910 + (5,228 -1615.45) = 10523

CAGR:

6,910 as Beginning Value and End Value as 10,523 and time period as 5 years is 8.78%

Will this be fine?

As it is maths you can use any combination. So calculations are fine.

But this takes into account tax on interest so to compare please use similar calculations in all your investments.

You should not end up comparing apples to oranges 🙂

If possible, Can you show a CAGR also for this?

Good question. Added the information.

Can CAGR be calculated like this.

Assuming the same 30% tax.

Effective investment (after tax saving) = Invested Amount – Tax Saved = 10000 – 3090 = 6910 (Outflow)

Interest earned is 5,228

Tax on interest earned at 30.9% is 1615.452 or 1615.45

Inflow = Outflow +(Interest earned – Tax on interest) = 6910 + (5,228 -1615.45) = 10523

CAGR:

6,910 as Beginning Value and End Value as 10,523 and time period as 5 years is 8.78%

Will this be fine?

As it is maths you can use any combination. So calculations are fine.

But this takes into account tax on interest so to compare please use similar calculations in all your investments.

You should not end up comparing apples to oranges 🙂

Thanks for the article. Can you please add this line also in this article.

“Effective investment (after tax saving) = Invested Amount – Tax Saved.”

Initially I was wondering what is this value 6910. then I saw the other link of yours for SBI and UCO. Then it cleared.

Thanks for differentiation for ROI with Annual Interest yield.

Thanks for pointing it out. Have added it!

Thanks for the article. Can you please add this line also in this article.

“Effective investment (after tax saving) = Invested Amount – Tax Saved.”

Initially I was wondering what is this value 6910. then I saw the other link of yours for SBI and UCO. Then it cleared.

Thanks for differentiation for ROI with Annual Interest yield.

Thanks for pointing it out. Have added it!

Hey nice explanation for things I find very difficult to understand.Thanks for sharing!

Thanks Swati for encouraging comments. It’s what keeps us going!

Hey nice explanation for things I find very difficult to understand.Thanks for sharing!

Thanks Swati for encouraging comments. It’s what keeps us going!

Very well put !

Thanks Paresh!

Very well put !

Thanks Paresh!

I guess if you are not into finance much and are looking for a safe investing option then going for fixed deposits is your best option.

Best is a very subjective. Are you not into finance or you are not interested in finding out more about finance. Choice is yours.

I don’t think FDs are the best option even for a non-interested finance guy, interest is taxable as per your income slab.

PPF, Debt funds are better options..but then..

I guess if you are not into finance much and are looking for a safe investing option then going for fixed deposits is your best option.

Best is a very subjective. Are you not into finance or you are not interested in finding out more about finance. Choice is yours.

I don’t think FDs are the best option even for a non-interested finance guy, interest is taxable as per your income slab.

PPF, Debt funds are better options..but then..