The Income Tax Act, 1960 has provided Section 80C, 80CCD, 80CCC, 80CCCE benefit to save tax by investing upto 1.5 lakh in different options, each suited to a different need. In this article we shall cover the tax saving sections of Income Tax Act, discuss tax saving options under Section 80C, Section 80CCC, Section 80CCD, Section 80CCE, Other deductions available like Medical insurance (Section 80D), Education Loan (Section 80E), Interest on Housing Loan (Section 24), Disability and Disease (Section 80U). We compare the various options and also how ,since November 2011, Government has linked interest rates on small savings to market rates,pegged to the benchmark yield of government bonds.

Table of Contents

Comparing Tax saving Options

Various tax saving options under various sections given below. Tax planning should not be done in isolation. You must align the larger investment plan with tax saving instruments to maximise returns. should be done at the start of the financial year, it is still not too late.

Deductions under Chapter VI (sec 80C to 80U)

| SECTION | NATURE OF DEDUCTION | LIMIT OF DEDUCTION | Comments |

| 80C |

|

Rs. 1,50,000 | |

| 80CCD(1B) | NPS (National Pension Scheme) | Rs. 50,000 | |

| 80D | Payment towards Medical Insurance Premium | Rs. 25,000 for self,spouse and children if you/parents are below 60 & Rs.50,000 for Parents (above 60 years) | You and Your Parents: Both below 60 years of ageRs. 25,000Rs. 25,000 = MaxRs. 50,000

You: Below 60Your Parents: Above 60Rs. 25,000Rs. 50,000 = Max Rs. 75,000 You and Your Parents: Both above 60 years of ageRs. 50,000Rs. 50,000 = Max Rs. 1,00,000 |

| 80DD | Medical treatment for handicapped dependents | Max is Rs 75,000(1,25,000) for severe disability | |

| 80DDB | Medical for specified diseases | Max is Rs 40,000(1,00,000 for senior citizens) | |

| 80E | Education Loan Interest Repayment | No limit | |

| 80EE | Interest on loan taken for residential house property | Upto Rs 50,000 |

|

| 80G | Donation to approved fund and charities | ||

| 80GG | Rent deduction only if HRA not received | ||

| 80TTA | Saving interest | Max 10,000 Rs | |

| 80U | Deduction for permanent disability | ||

| 87A | Rebate of Rs.2000 for individual havin total income Upto Rs.500000 | Rs.2000 | |

| 80CCG | RGESS (Rajiv Gandhi Equity Saving Scheme) | Least of 50% of amount invested or Rs. 25,000 | Was claimed last in FY 2017-18

Introduced in Budget 2012

|

| 80QQB | Royalty |

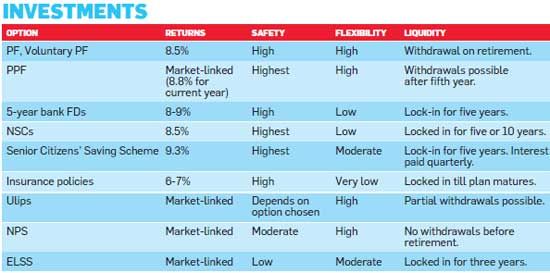

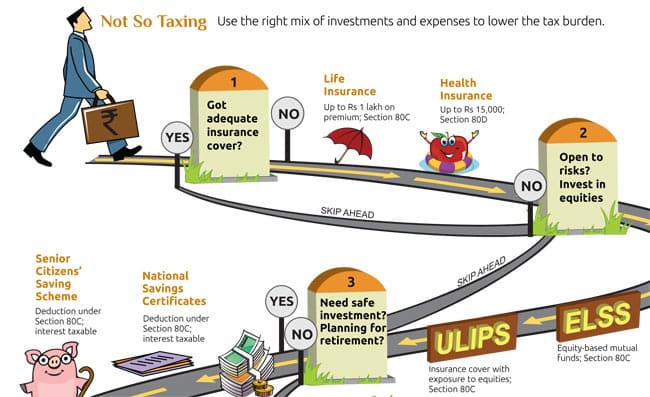

The image below shows common tax saving options in terms of returns, safety, flexibility, liquidity. Your choice of tax saving options should be defined by how soon you need the money, your expectations of returns and the risk you are willing to take. Our article Choosing Tax Saving options : 80C and Others covers how to choose tax saving options

Income Tax Act :Tax saving options

Levy of income tax in India is governed by Income Tax Act of 1961 which came into force on 1st Apr 1962. It has 298 Sections and XIV Schedules. These undergo change every year with additions and deletions brought about by the budget, presented by Finance Minister, which when passed by the Parliament becomes Finance Act. To encourage long term investments and savings, tax saving options are included in the Income Tax Act under sections 80C, 80CCC, 80CCD, 80CCE . These section states that qualifying investments, up to a maximum of Rs.1 Lakh, are deductible from your income.

- Section 80C: savings for deduction under income tax and their limits. 80C became effective w.e.f. 1st April, 2006 replacing Section 88.

- Section 80CCC: Deductions in respect of contribution to certain Pension Funds

- Section 80CCD: Deduction in respect of contribution to new pension scheme

- Section 80CCE: Limit of deduction under section. 80C, 80CCC and 80CCD

There are other tax saving options like:

- Medical Insurance and Health Checkups under Section 80D

- Interest on Housing Loan under Section 24

- Education Loan under Section 80E

- Disability and Disease under Section 80U

Tax saving expenses in 80C

Some expenses that qualify for deductions under section 80C.

Home Loan Principal Repayment: The Equated Monthly Installment (EMI) that you pay every month to repay your home loan consists of two components – Principal and Interest.The principal component of the EMI qualifies for deduction under Sec 80C. Even the interest component can save you significant income tax – but that would be under Section 24 of the Income Tax Act. Taxguru FAQ on Housing Loan and Income Tax Benefit covers it in detail.

Stamp Duty and Registration Charges for a home: The amount you pay as stamp duty when you buy a house, and the amount you pay for the registration of the documents of the house can be claimed as deduction under section 80C in the year of purchase of the house.

Children Education Expense : Tuition fees paid at the time of admission or otherwise to any school, college, university or other educational institution situated within India for the purpose of full time education can be claimed under 80C, for maximum of two children.Payment towards Development fees, Donation and payment of similar nature does not qualify for deduction u/s 80C. No deduction will be available for tuition fee paid for studies of self or for studies of spouse. More details at Simple Tax India TUITION FEES PAID FOR CHILDREN U/S 80C-FAQ

Tax saving investing options in 80C

The options saving under section 80C are as follows:

Employee Provident Fund(EPF) & Voluntary Provident Fund (VPF) :

Employee Provident Fund(EPF) is automatically deducted from salary. Both you and your employer contribute to it. Under the current norms, 12% of the employee’s salary is contributed towards EPF, which is exempt from income tax. While employer’s contribution is exempt from tax, your contribution (i.e., employee’s contribution) is counted towards section 80C investments. Any contribution over and above the 12% limit by the employee towards EPF is consider as voluntary provident fund (VPF) and the same is also exempt from tax, subject to the overall 80C limit per annum. EPF, falls under the EEE tax regime wherein the interest received (on retirement from service or withdrawal after 5 years of service) is tax-free in the hands of the investor. The interest payable on EPF is determined each year by the Employee Provident Fund Organisation (EPFO). Our article Basics of Employee Provident Fund: EPF, EPS, EDLIS covers EPF in detail.

Public Provident Fund (PPF)

PPF offers an interest rate of around 8% (8.8% for FY 2012-13) compounded annually and mandatory investment tenure of 15 years. Interest is calculated on the lowest balance between the close of the fifth day and the last day of every month. Only the amounts which are actually cleared on or before the 5th of the month are eligible for that month’s interest. Money cannot be withdrawn before the completion of 6 years. It falls under EEE (exempt-exempt-exempt) tax regime i.e not only the investor can enjoy deduction on the amount invested in this scheme but the interest received on maturity is also exempt from tax. The government of India decides the rate of interest for PPF account. The current interest rate effective from 1 April 2012 is 8.80% p.a(compounded annually). Our article Understanding Public Provident Fund, PPF covers PPF in detail.

National Savings Certificate (NSC)

NSC also offers a return of around 8% on half yearly compounding basis. Interest accrued on NSC is also eligible for Section 80 C benefit. Interest received on NSC, at the time of maturity, is taxable in the hands of the investor. Earlier only a 6 year National Savings Certificate was available for investors. Since 1 April 2012 two types of NSCs are on offer:

- NSC VIII Issue : 5 year instrument with current interest rate as 8.6% . Maturity value of Rs 100 shall be 152.35 after 5 years.

NSC IX Issue: 10 year instrument with current interest rate as 8.9%. Maturity value of Rs 100 shall be 234.35 after 5 years.

The government of India decides the rate of interest for new NSCs. For NSCs bought the interest rate remains constant for the entire tenure i.e Unlike many other instruments where a change in the interest rate is applicable to an existing investment(EPF, PPF) here the rate is locked in at the time of making of the investment. More details at IndiaPost National Savings Certificates and MoneyControl ‘s NSC

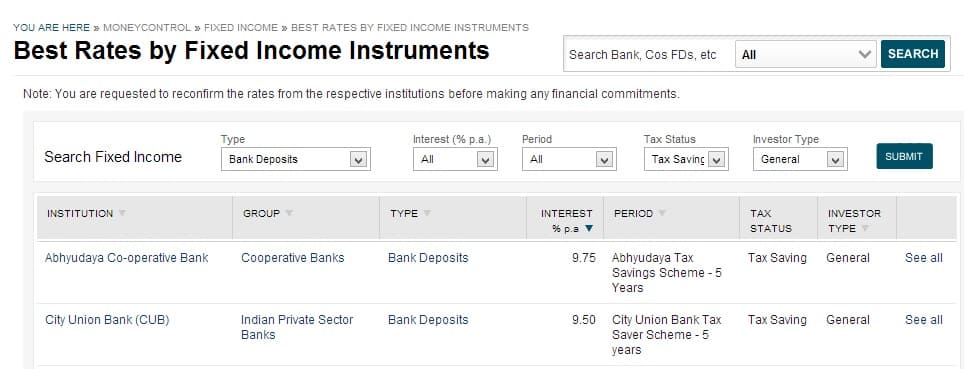

Tax saving Bank Fixed Deposits

These are like regular fixed deposits with interest being compounded quarterly but with a lock-in period of five years. Investment up to Rs 1 lakh in these special tax saving bank fixed deposits entails an investor tax deduction under Section 80C. Most public and private banks offer these tax saving FDs such HDFC Bank. The drawback is taxability of interest income upon maturity.It is important to note that there is no option for premature withdrawal even with penalty for tax savings FD and the interest is taxable. The rates you can find at moneycontrol Best Rates for Fixed Income by selecting Deposits as Bank Deposits and Tax Status as Tax Saving as shown in picture below.

Senior Citizens Saving Schemes (SCSS)

Indian citizens who have attained 60 years of age or those who have attained at least 55 years of age and have opted for voluntary retirement scheme are eligible to invest in senior citizens saving scheme. If offers interest rate of 9.3% a year, payable on quarterly basis. Maximum investment is upto 15 lakh. It has lock in of 5 years which can be extended by 3 years. While investment in this scheme is eligible for tax deduction under Section 80C, interest earned shall be taxable in the hands of the investor. Tax is deducted at Source (TDS) .The government of India decides the rate of interest for SCSS. Details at IndiaPost’s Senior Citizen Savings Scheme (SCSS) Account and RBI’s Senior Citizens Savings Scheme, 2004

Equity Linked Saving Schemes (ELSS)

These are Diversified Equity mutual Fund schemes, which invest in stock market, with lock in of 3 years. The returns are linked to the performance of equity markets, hence are volatile.If one invests in ELSS by means of SIP (Systematic Investment Plan)every monthly investment carries a lock in period of 3 years not the date of first investment. More details at ThinkRupee ELSS You can track performance of ELSS at MoneyControl Performance Tracker or Valueresearchonline’s ELSS Comparison.

Life Insurance Premium

Any amount that you pay towards life insurance premium for yourself, your spouse or your children can also be included in Section 80C deduction.If you are paying premium for more than one insurance policy, all the premiums can be included. The life insurance policy may be purchased either from LIC or from any other private player in the insurance industry. An insurance plan will be eligible for tax deduction and the income will be tax-free only if it covers the policyholder for 10 times the annual premium. Till 2011, policies were required to offer a cover of five times the annual premium for tax breaks. Please note that life insurance premium paid by you for your parents (father / mother / both) or your in-laws is not eligible for deduction under section 80C. Our article Life Insurance covers different kinds of Life Insurance policies.

Unit Linked Insurance Plans (Ulips)

Ulips, or market linked insurance schemes provide investors the benefit of both life cover and investment in equity and debt market. These are the insurance plans where a portion of premium is used for insurance, rest is invested in a mutual fund (equity ,debt) hence returns of these plans are market linked. These plans are complex & also expensive as they cover charges for insurance(mortality charges), fund management,Premium Allocation Charges. MoneyControl covers FAQ on ULIP’s HDFC ULIP covers it in detail along with comparison with Conventional Plans and Mutual Funds. MoneyControl ULIP shows NAV’s of ULIPs.

Tax Saving Options under Section 80CCC

Section 80CCC of Income Tax Act deals with the deductions and income in respect of contributions to certain Pension funds by an individual assessee Payment of premium for annuity plan of LIC or any other insurer. Deduction is available upto a maximum of Rs. 100,000. Please note that amounts received on surrender (whole/part) of annuity plan, amounts received as Pension is taxed as income. Note:The limit of deduction under Section 80CCC will be part of the overall limit prescribed under Section 80CCE.

Tax Saving Options Section 80CCD

The National Pension System (NPS) is a defined contribution based pension system launched by Government of India with effect from 1 January 2004. Section 80CCD of income tax act provides deduction under the section 80CCD(1) in respect of contribution made by the employee, and a deduction under the section 80CCD(2) in respect of contribution made by the employer to the New Pension System (NPS). Contribution made to the pension scheme under section 80CCD(2)(employer’s contribution) shall be excluded from the limit of one lakh rupees provided under section 80CCE. The Finance Act, 2011 amended section 36 so as to provide that any sum paid by the assessee as an employer by way of contribution towards a pension National Pension System(NPS) to the extent it does not exceed ten per cent of the salary of the employee, shall be allowed as deduction in computing the income under the head “Profits and gains of business or profession”. Details on TaxguruFAQ:80CCD Deduction for Contribution to New Pension Scheme , Wikipedia’s National Pension Scheme.

Tax Saving Options under Section 80CCE.

The aggregate amount of deductions under section 80C, section 80CCC and section 80CCD shall not, in any case, exceed Rs. 1,50,000.

Other Tax Saving Deductions

Medical Insurance and Health Checkups under Section 80D

- The investment in health or medical insurance of self or family members(spouse and dependent children) is exempted under Section 80D upto Rs. 20,000 for senior citizens and upto Rs. 15,000 for others, is available with effect from (w.e.f) Assessment Year 2009-10.

- From FY 2012-13 you can claim deduction upto Rs 5,000 spent on health checkup of self or family or parents.However, this Rs 5,000 is a part of the overall Rs 15,000((or 20,000 for senior citizen) deduction that you are entitled to under section 80D. So if you have spent say Rs 8,000 in medical check-up and Rs 11,000 as health insurance premiums, you can claim only up to Rs 5,000 of medical check-up bill and Rs 10,000 of health insurance premiums under section 80D.

- This relief is in addition to the maximum relief of Rs. 100,000 available for investments under section 80C, 80CCC and 80CCD.

- Medical insurance can be taken from the General Insurance Corporation of India or any other insurer pproved by the Insurance Regulatory and Development Authority.

Ref:Taxguru’s Section 80D Deduction – For health insurance premia paid, etc.

Interest on Housing Loan under Section 24

Deduction on accrued interest upto Rs. 1,50,000 per annum from the total income is available under Section 24 of the Income Tax Act. Taxguru FAQ on Housing Loan & Income tax benefit covers commonly asked questions related to Housing Loan.

Education Loan under Section 80E

The interest paid on education loan taken for higher education by a person for himself, his spouse or children is fully tax-deductible under section 80E. The main points of Education Loan are:

- Higher education has been defined to mean full-time studies for any graduate or post-graduate course in engineering, medicine, management or for post-graduate courses in applied sciences or pure sciences, including mathematics and statistics. Also, it has been specifically clarified that architecture will fall under the engineering category.

- The studies can be anywhere in the world and not necessarily in India.

- The education loan taken can cover not only tuition or college fees alone, but also other incidental expenses like hostel charges, book costs, etc.

- The deduction is available only for loan taken from financial institutes (ie, Indian banking companies and other notified institutes like HDFC) and approved charitable institutes. Thus loans from family, relatives and employers are not covered.

- However the deduction is available only for the first 8 years after the first deduction.

- Loans taken for siblings and other relatives do not qualify

Disability and Disease under Section 80U

You can claim deduction if you or any of your dependents suffer from a specified ailment or physical disability. The deduction is Rs 50,000 in normal disability case and Rs 1,00,000 in severe disability. Every individual claiming a deduction under this section shall furnish a copy of the certificate issued by the medical authority in the form and manner, as may be prescribed. These deductions under section 80U, 80DD and 80 DDB are not subject to actual expenses incurred. TaxWorry Deduction under section 80U in 6 steps.

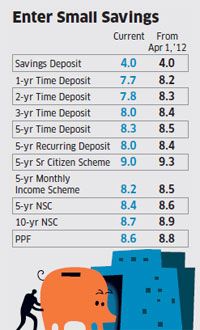

Interest Rate on Small Saving Schemes

Government has linked interest rates on small savings to market rates,pegged to the benchmark yield of government bonds, since November 2011 . The interest rate of small savings schemes is calculated on the basis of the average yield during the year. For instance, your PPF balance earns 25 basis points above the 10-year benchmark yield. Though the PPF rate changes every year, the SCSS and NSCs will have a uniform rate (fixed at time of buying) till maturity. Government notifies interest rates afresh at the beginning of every financial year. Rates for 2012 from ET Interest rates on small savings schemes like NSC, PPF hiked by up to 0.5%

On Returns on small saving scheme in future Quoting from Economic Times How to Save Tax in 2013 ( Jan 2012)

Bond yields have come down in the past one month and are likely to recede even further on expectations of a rate cut. This could translate into lower rates for small savings schemes, such as the PPF, NSC and the Senior Citizens’ Saving Scheme (SCSS). The consensus estimate by Bloomberg is that the 10-year bond yield will fall to around 7.95 per cent by March, and slip to 7.77 per cent by December 2013, before recovering to about 8.01 per cent in March 2014. dropping to 8.25 per cent, the PPF interest rate could be lower at 8.5 per cent in 2013-14. It could fall further in the following years.

Related Articles :

- Choosing Tax Saving options : 80C and Others

- Understanding Income Tax Slabs,Tax Slabs History

- Income Tax Overview

- Understanding Public Provident Fund, PPF

- Basics of Employee Provident Fund: EPF, EPS, EDLIS

[poll id=”37″]

Each tax-planning instrument has a different underlying objective, which needs to be understood by the taxpayer before making an investment, Choose an option that fits into your overall financial plan, not because it offers good returns or your neighbour or bank is selling it. Your choice should be defined by how soon you need the money, your expectations of returns and the risk you are willing to take.

I am government employees and my 10% contribution from salary is 53000. I have 1.5 Lacs saving under section 80C. Can I claim my 50000 out of 53000 above 1.5Lacs under 80ccd

yes you can claim it under 80CCD(1B)

As explained in the article NPS Tax Benefits and sections 80CCD(1), 80CCD(2) and 80CCD(1B)

If Employees have savings Rs. 1,50,000 under 80C excluding NPS Deductions, Then the Employee can show their NPS Deductions, under 80 CCD(1B), which is over the 1,50,000 Limit.

dear sir,

I m a seafarer, working on ship.

Initially I was in Indian company where my TDS was getting cut. and I used to file income tax returns. Now I m in foreign flag company ships which do not deduct tax and I am completing more than 183 days in a finantial year on ship , which makes me NRI.

So is it compulsory for me to file income tax returns?

Dear Sir,

My annual CTC including bonus is Rs. 2000000/- .I have following savings & queries

1) I have Rs. 81000/annum LIC – How much tax I am saving – In which slab this saving comes 5%, 10%, 20% or 30%

2) My PF deduction is Rs. 151000/annum – How much tax I am saving?In which slab this saving comes 5%, 10%, 20% or 30%

3) Housing loan interest Rs. 185000/- & priniciple Rs. 75000/- How much tax I am saving?In which slab this saving comes 5%, 10%, 20% or 30%

4) What more I can do save tax? Please mention how much tax I will save. Just saying this much money is tax exempted doesn’t give clear idea about tax saving

Thank you.

Regards,

Gajanan

My gross salary is 7lack . Saving under 80c is 1.5 lack how we can take other rebate through NPS

Do I get any benefits on LSCS, if I don’t have any other medical claims and I had paid for the surgery from my income.

hi

please suggest me investments for 80d apart from health insurance

It’s nearly impossible to find knowledgeable men and women on this topic, and you be understood as guess what happens you’re speaking about! Thanks

Sir, my current year (2016-17) total salary Rs.35000/- and i have not any investment. my taxable income Rs.70,000 in case i will paid paid tax amount Rs.7,000. So i will any other amount refundable?

Sir, my current year (2016-17) total salary Rs.3,50,000/- and i have not any investment. my taxable income Rs.70,000 in case i will paid paid tax amount Rs.7,000. So i will any other amount refundable?

Yes, you can refund the amount after you file the return with the income tax department.

Dont worry 🙂

Dear All,

My employer contributes to EPS-95, 1250 rupees per month totaling to 15000 per year. It is below 10% of my annual salary. Can I get exemption under 80CCD(2)? or only NPS contribution is exempted?

Under which section one can get tax benefit for employees contribution to Group Life Insurance Scheme provided by employer?

would like to know in detail about the investments other than 80C,rent,medical bills and 80D.

my age is 27

Sir my annual sellary rs 3,60000/ and my home loan EMI-9000 per month deducted my a/c .pls help me for income tax save section

You have income from Salary.

You have home loan EMI, are you living in the house or is house in construction stage?

Do you have any EPF,PPF contribution any LIC policy?

Hi Anil,

Interest towards Home loan is exempted upto INR 2L & upto 50,000 towards principal as part of 80C exemption in a financial year. According to your CTC you can evade the complete tax

Dear Sir,

I am working in Saudi Arabia and my monthly salary is Rs.52000 and I have two LIC policy Rs.24941 annual. Please help me how can I fill ITR by online.

As you are working in Saudi Arabia you would be considered NRI by India Income Tax laws.

Your income in Saudi Arabia is not taxable in India in view of the provisions of Section 5 of the Income Tax Act, 1961. Under Section 5, a non-resident is not liable to pay tax in India on his income earned and received outside of India.

Are your NRI?

Here’s how you can check your residential status for a financial year.

You’re considered a ‘resident’ in a financial year if you satisfy one of the conditions below:

You are in India for 182 days or more during that financial year

OR

You are in India for 60 days or more during that financial year AND you are in India for at least 365 days during the 4 years preceding that financial year.

An exception is made for Indian citizens working abroad and members of a crew of an Indian ship or a PIO visiting India, where 60 days is replaced with 182 days.

You are an NRI if you do not meet any of these conditions.

Salary received in India or salary for service provided in India, income from a house property situated in India, capital gains on transfer of asset situated in India, income from Fixed Deposits or interest on savings bank account are all examples of income earned or accrued in India.

These incomes are taxable for an NRI. Income which is earned outside India is not taxable in India. Interest earned on a NRE account and FCNR account is tax free. Interest on NRO account is taxable for an NRI.

ncome Tax Return must be filed by an NRI when their total income (before any deductions) is more than Rs 2,50,000 (for AY 2015-16 or FY 2014-15).

Income Tax Return must be compulsorily filed in the following cases:

NRI has short term or long term capital gains from any investments or assets (even when gains are less than Rs 2,50,000).

To get a tax refund

To carry forward losses so they can be adjusted later

A return need not be filed if income from short term or long term capital gains is the only income the NRI has and TDS has been deducted on it.

sir

namaste sir .i have undergone medical check up which costed me Rs.3500/- My husband was admitted to hospital and it costed to Rs. 32000/-I have not claimed any reimbursement.should i take any cetificate from a doctor or is it enough if i produce the bills to claim tax deduction ofRs.15000/-u/s 80D

Thanking you sir,

V.Grace

i am a ex-serviceman and invested my complete/total APPF (Army public provided fund )received after retirement in the bank (SBI)and bank is deducting the TDS on it.

kindly let me know whether the said fund is exempted from tax deduction or not. if not then what should Ido to avoid the tax deduction.

i m confused if the pf based components will be considered for nps exemption or only Basic+DA.

Which part of NPS and tax deduction 80C or 80CCD(1B) are you talking about?

While the employee contribution up to 10% of basic plus dearness allowance, or DA, is eligible for deduction under Section 80CCD within the Rs 1.5 lakh limit, the employer’s contribution up to 10% of basic plus DA is eligible for deduction under Section 80CCE over and above the Rs 1.5 lakh limit.

For FY 2015-16 (assessment year 2016-17)

A new section 80CCD(1B) has been introduced to provide for additional deduction for amount contributed to NPS of up to Rs 50,000.

Therefore for financial year 2015-16, Total Deduction under Section 80C, 80CCC, 80CCD(1) and 80 CCD(1B) cannot exceed Rs 2,00,000.

Hi Sir,

My CTC is 113000 where 79,298 bonus and 59,474 is PF, I joined this company in December 2015. I didn’t saved anywhere. I am new for tax, Could you please tell me where and how I have to invest to save tax.

Thanks in Advance.

Dear Kuldeep,

As you have joined in December and were not employed earlier. Your taxes for the year 2015 would be minimum.

In 2016 you would be assessed for the entire year.

For help contact us on support@taxache.com

Sir i am investing Rs.1000 per month in 5 yr post office recurring deposit scheme…Am I eligibile to claim the deduction of total amount invested in a financial year u/s 80C

No recurring deposit in Post office does not come under 80C. Infact interest earned on recurring deposit is taxable.

Hi,

I have joined work on 30 July 2015

Due to pay tax on 30 March 2016(I think- Correct me if I am wrong)

My monthly income is 70000

7000 (sometimes less) is cut from my salary as TDS

I have incurred some expenses on blood test and Ultrasound and medications for my wife amounting 5000

I am paying off my uncle & aunt 10000 per month for amount they gave me for my education…

I have paid my wife’s tution fees on 29 July 2015 amount 25000

How much of IT do I have to pay by march?

Are the above exempt?

Regards

Denver

Good you are thinking about saving tax now. You can go through our video Filing ITR : Video on which ITR to fill to get overview on type of income etc

You have income form salary

Are your medical bills upto 15,000 reimbursed by your office – this is tax free if reimbursed.

The amount you give to your uncle/aunt will not be considered for tax purpose.

You get no benefit for tuition fee (under section 80C) paid for your spouse only tuition fee paid for children is considered.

Tax deducted:

Your office is deducting tax or TDS based on how much you have claimed you are saving under section 80C.

Your EPF contribution etc are all part of saving under 80C which has limit of 1.5 lakh, which includes plethora of options like home loan principal, life insurance premium,

Other than income from salary do you have income from FD, selling of land/house etc. These income also need to be accounted for and then tax calculation done.

If you owe govt more than 10,000 Rs of tax in year then you need to pay advance tax. If not then balance you can pay while filing your ITR till Jul 2016.

Sir,

I am a salaried person working for an MNC and At present i am paying a tax of 6 to 7Lakh per annum. I do availof the home loan benefit of 2.5L and principal of 1.0. In addition to this med insurance and life insurance etc. Beyond this can i save?

Hi,

I have a gross salary of 348000. I am a newly joined employee so i have no idea about tax. I have to give tax declarations. I invest (1600+1600) every month into PF. Also I take food coupons of 1200 per month. I don’t have any Rental agreements or loans that i can claim deduction for. So how much amount would be taxable?.

Also, i invest in RDs in a private bank. Does RDs in a private bank like HDFC come under tax deduction(i mean the amount invested not interest)?

if so what is the min period and max amount that can be deposited in such RDs to obtain deduction?

Thank You,

in advancce

Good to know that you are making effort to learn.

If we take your gross salary for AY 2016-17 then it is between 2.5 lakh and 5 lakh so you come under 10% income tax slab.

Your tax due is 9800 Rs (10% of 3.48-2.5=98,000)

Your PF contribution is 1600 Rs month (the employee part) will be Rs 19200 which will be considered under 80C.

Tax is due only on Rs 26,000. You can pay tax on it Rs 2600 at 10% or avoid it by investing in a tax saving product such as ELSS fund, PPF.

Fixed Deposits and RDs don’t offer any tax deduction.

We have given the basics of income tax in our articles

Basics of Income Tax Return and

Income Tax For Beginner – Part II

And Income Tax Calculator

If you have more questions we will only be happy to answer them

Sir, In your reply to Preetham’s query (OCT’2015)you have calculated his annual PF as 72000.00 but as per his submission he is contributing 1600.00 per month only and this makes his annual PF contribution only 1600 x 12 = 19200.00

Am I right ?

Thanks for the question. Yes his annual PF is 1600 X 12=19200. Comment has been corrected.

Sir, under 80CCC is it Rs 2000 concession is there for whose income is less than Rs 5 lakhs? IF so please share..

Section 80CCC provides deduction to an Individual for any amount paid or deposited in any annuity plan of LIC or any other insurer for receiving pension from a fund referred to in Section 10(23AAB).

In case the annuity is surrendered before the date of its maturity, the surrender value is taxable in the year of receipt.

There is no special rebate or concession for those whose income is less than 5 lakh under section 80CCC.

The amount of tax rebate u/s 87A is restricted to maximum of Rs.2,000. In case the computed tax payable is less than Rs.2,000, say Rs.1,500 the tax rebate shall be limited to that lower amount.

Income Tax Rebate under Section 87A was introduced by P. Chidambaram while presenting Budget 2013

Let us assume that Your Gross Income is Rs.400000

All Deductions and Exemptions is Rs.100000 and Your Total Income after applying all eligible deductions is Rs.3,00,000.

Hence, Now the Net Taxable Income will become Rs.3,00,000.

Now, 10% Tax on Rs.1,00,000 (Rs.3,00,000 – Rs.2,00,000) will be Rs.10,000.

As the Taxable Income is Less than Rs.5,00,000, apply Tax Rebate u/s 87A upto a Max of Rs.2,000.

Hence Tax is Rs.10,000 – Rs.2,000 = Rs.8,000.

Add Education Cess, Higher and Secondary Education Cess 3% on Rs.8,000 and Pay the Tax

Husband took lic policy on wife’s name, paid the premium thru cheque. Can husband take tax rebate on his wife’s policy ?

Yes he can.

I had taken a lifetime Pension II Policy from ICICI Prudential in 2004 for ten years. After10 years on maturity the policy was surrendered.Kindly tell me what is the tax liability on the proceeds on maturity.

Sir My father’s yearly pension is Rs 320000/-(Approx) he is 67 years.

Now he take Loan of Rs 150000/- agnst his pension. Pls let me know how much he has to do invest u/s 80C

Iam 69 ,my pension for the year 2014-15 is 264000, and I get 160000 as interest on my FDR, and i have invested amount of 1 lakh in tax saving scheme, 25000 LIC premium of my grandson , 20000 school fees of my grand children ,in this case how much tax am i suppose to pay.

Sir My father’s yearly pension is Rs 480000/-(Approx) he is above 80.

Now he take Loan of Rs 150000/- agnst his pension. Pls let me know how much he has to do invest u/s 80C

As your father is above 80 basic exemption on his income is 5 lakh. As his pernsion is less than 5 lakh he does not need to invest to save

Sir, I need to know if you invest in Monthly Recurring Deposit for a period of 5 years in Postal Office will be considered for tax exemption.

Thanks in advance

No Sir, it will not be considered for tax deduction though no TDS will be deducted

Sir, with reference to Daljeet Singh ‘ s query related to TDS on recurring deposits …..TDS is being done from 1 June’2015

if interest accrued is more than 10000/- annually as per FA 2015 amendment in this regard. Please confirm….

Yes Sir TDS on RD will be deducted if interest accrued is more than 10,000 Rs annually. This rule has come into action from 1 June 2015

Dear Admin,

Thanks for providing a wonderful article for providing the basics needed for someone new to the indian taxation system.

I have few questions that I would like to get clarification from your team.

1) Will the ‘Taxable Income’ change depending upon the ‘Residential Status’? I have OCI (Overseas Citizen of India) card and been in India for 2 months and salary comes to Rs. 55,200 per month. I intend to stay in India for total of 1 year. Based on the tax slabs, what would be my total tax.

2) What other ‘minor’ tax saving options exist other than the 80C, 80D, 24, 80E and 80 U options?

Many Thanks

Thanks Devan for making our article wonderful. (Beauty lies in the eyes beholder :-))

Details of NRI are in our article Non Resident Indian – NRI Quoting from it

An Indian abroad , popularly known as an NRI – has two important definitions determining his residential status –

one coined under the Foreign Exchange Management Act (FEMA) 1999 – and the other coined under the Income Tax Act,1961

We shall focus on the NRI for Income Tax Act.

Non-Resident’s definition under the Income Tax Act, 1961 (IT Act) is tied to number of days of an individual’s stay in India during a particular financial year. A person is Non-Resident under IT Act if his stay in India does not exceed 181 days in a financial year( 1st April to 31st March of next year)

So your two months in India for FY 2012-13(AY 2013-14) you might be NRI but for FY 2013-14(AY 2014-15) you might be resident indian

2. For other tax saving options you can see our article Income Tax Overview

my salary is over 14lacs/annum however, this year I am unable to make required investments. I have paid close to INR 20,000 each in two health related policies and running short of time to cover my savings u/s 80c. I am liable to pay heavy tax this year but I still have time. Please help/advise what I can do by this weekend under 80c and 80d. One of option I’d exercise is invest 70-100,000 in PPF. Will that be sufficient?

Ricky How much more to save means knowing how much do have you saved already?

Total limit – Existing investments = Balance Limit.

Existing investments that one could have made are:

Tuition Fees for your school going children :

Contribution to EPF or VPF

Contribution to Insurance or Pension Plan

Principal portion of Equated Monthly Installment (EMI) of home loan

Stamp duty, registration charges if house bought in the financial year.

if you are a salaried employee you would most probably have EPF. Take out your pay-slip or contact your finance department and check how much has been deducted, The contribution to provident fund by employee is eligible for deduction under section 80C. Employer’s contribution is not taken for deduction purpose.

It is possible that your 1 lakh limit is exhausted. In such a case you need not save for tax anymore.

If you still have to invest remaining portion in PPF is an excellent choice but remember PPF is for 15 years.

Our article Choosing Tax Saving options : 80C and Others might help you in getting clear picture.

Waiting to hear from you!

contribution by employee u/s 80CCD(i) is a compulsory contribution in new pension scheme, hence it should be allowed as deduction irrespective of the limit of Rs. 100000 as it is in case of employers contribution. Non-deduction of employee share in NPS causes direct loss to the employee.

80C is so overloaded. Employer contribution is exempted to encourage NPS. But about employees no so benefit. You are right but then FM does not agree with you!

Sir, who will get exemption for the employer’s portion of NPS ? Is it employee or employer ? This is with reference to your reply to ROSHAN (28 FEB’2013). Please clarify.

Thank you for the reply

you are welcome! Don’t hesitate to ask questions!

Looking forward to more questions!

Hi sir

I am a A.C.M. Our annual salary is 6.5 lakhs.I have invest 1 lakhs against 80c and 15000/-against 80D.Now what i do for saving income tax in FY-2012-2013.

Thanks

P.MATHUR

You seem to have exhausted major options for saving tax. Why do you need to save more tax?

What are the savings that come under EEE model and EET model. Please give me a clear idea

Thanks

Bala Our article Taxation of investments : EEE, ETE, TEE.. , Three stages of investment and Tax covers it in detail. I would request you to go through them and come back with doubts/questions/comments. !

Thanks a lot…

You are welcome..

Sir, I need to know if you invest in Monthly Recurring Deposit for a period of 5 years in Postal Office will be considered for tax exemption.

Thanks in advance

Balaviswanathan The investment in Monthly Recurring Deposit for a period of 5 years in Postal Office does not qualify for tax exemption. TDS will not be deducted but interest is taxed as per the income slab.

For details you can read Finotax Postal Recurring Deposit Scheme

If you have more questions or doubts please ask

Hi Sir,

Thank you so much for writing an article about this. I have doubts regarding PF, I guess I can ask you here in this forum too.

I have a doubt, what happens to the pension amount if a person resign a job and joins other organisation , Will that be carried forward?

Thanks once again. Also what are the benefits in VPF? Will it be constantly deducted or can we vary the amount?

Yes Bala thanks for asking question on our blog. We have tried to answer your questions with references. If you have any more questions or doubt, please don’t hesitate to ask.

Employee Pension Scheme : Eps and EPF are not linked. You can get your EPS scheme transferred by getting Scheme Certificate.

You can withdraw the PF once you leave the organization after filling Form 19. In case of EPS, if the service period is less than 10 years, you’ve option to either withdraw your corpus or get it transferred by obtaining a ‘Scheme Certificate’. Once, the service period crosses 10 years, the withdrawal option ceases .For pension, withdarwal benefit, scheme certificate etc. application should be through ex-employer. For pension, Form 10D(pdf format) is to be used. For withdrawal benefit & scheme certificate fill Form 10 C More details at Withdrawal or Transfer of Employee Provident Fund, Understanding Employee Pension Scheme or EPS

VPF

Apart from contributing the normal 12% of his basic pay, employee may choose to put in contribute more than this, voluntarily he can do so at any rate he desires upto 100% of basic and D.A. The contribution will earn the same rate as normal EPF contribution. But the employer is not bound to contribute at the enhanced rate. Employer’s will contribute an amount matching only the 12%.

Typically one can start contributing to VPF any time, and can stop contributions at any time as well. One can also change the amount to contribute to VPF anytime. But usually the Finance/Payroll department in the company allows the change at the beginning of the financial year. Typically, the employee must give his option and amount of contribution in writing at the beginning of the financial year, i.e. in April. The amount of contribution can be reduced or increased within the permissible limit once a year, also in the month of April.

While one gets a good risk-free return, one should be prepared to have your money locked in, till the time of retirement/withdrawal. In case one makes a premature withdrawal, before five years of contin-uous service and contributions in EPF as discussed in , one will have to pay tax.

More details at Voluntary Provident Fund, Difference between EPF and PPF

Thanks for the reply, I am so happy that you have dedicated a blog for the money awareness, Please do keep the good work going

I have a small clarification. In my pf slip,the EPS column gets zeroed without carrying forward[PF gets carried forwarded],

My doubt here is can I withdraw the EPS every fiscal by submitting the Scheme certificate as mentioned by you in the earlier question or should I forgo my EPS. Please suggest.

Why should you forgo your EPS? It’s your hard-earned money and right.

EPS Scheme Certificate is made available when contribution to EPS stops. So once you get EPS Scheme Certificate your EPS account is closed so why would your need to submit every year Bala?

Some facts about EPS Scheme Certificates are: (ref)

This Certificate shows the service & family details of a member

This is issued if the member has not attained the age of 58 while leaving an establishment and he applies for this certificate

Member can surrender this certificate while joining another establishment and the service stated in the certificate is added with the service he is gaining from the new establishment.

After attaining the age of 50 or above, the member can apply for Pension by surrendering this scheme certificate (if total service is atleast 10 years)

Bala I am in same boat as you. I am from a non-financial background struggling to understand Money. Thanks for your wishes, if you readers support Insha-allah the blog will continue spreading awareness!

Thank you for the information.

I have another doubt. What happens to the pf account or amount when one goes to abroad for higher studies

And if he goes there for a job and he has been working there for 5 yrs

what happens to that amount. is it possible to maintain till few years and if he joins a company in India. Can he/she still quote the same pf account for transfer

Sorry to bother you with questions, I am having lots more doubts.

Thank you in advance

Bala no problems just shoot your questions we will try to answer them to the best of our ability

When no contribution is made to EPF account, it goes into inactive state,

For 3 years your balance in EPF will earn interest.

If an inactive EPF account wont be claimed 3 years then the amount gets transferred to an Unclaimed Deposit Account and stops earning interest

Then when you join back you can get your PF account can be transferred.

To withdraw money from Unclaimed Deposit Account, EPF department usually ask for an Affidavit cum Indemnity bond on Rs 100 Stamp paper along with with other documents for the withdrawal of funds.

good artcles.