TDS or Tax Deducted at Source, is one of the modes of collection of taxes, by which a certain percentage is deducted at the time of payments and deducted amount is remitted to the Government account. Till 31st Oct 2012 Tax Information Network (TIN) by NSDL was used to collect information about Tax Deducted at Source (TDS) on behalf of Income Tax Department (ITD). Now Income Tax Department (ITD), has started a new initiative TRACES or TDS Reconciliation Analysis and Correction Enabling System. The new portal has been created to enhance swift interaction between the deductor, deductee, income-tax department and CPC. It enables viewing of challan status, downloading of NSDL Conso File, Justification Report and Form 16 / 16A as well as viewing of annual tax credit statements (Form 26AS). This article will cover overview of TDS, TIN NSDL, TRACES

Table of Contents

Overview of TDS, Form 26AS

TDS or Tax Deducted at Source, is one of the modes of collection of taxes, by which a certain percentage is deducted at the time of payments of various kind such as salary, commission, rent, interest on dividends etc and deducted amount is remitted to the Government account. This withheld amount can be adjusted against tax due. The person/organization deducting the tax is called as Deductor while the person from whom the tax is deducted is called Deductee. Deductor is also termed as Employer and Deductee is termed as an Employee in cases where the payments are Salaries.Every person responsible for making payment of nature covered by TDS provisions of Income Tax Act shall be responsible to deduct tax. Our article Information about TDS deducted is made available to the PAN Holder via Form 26AS. Income Tax Department’s initiative to receive information and maintain records of tax paid through banks through online upload of challan details is termed as OLTAS (Online Tax Accounting System). Basics of Tax Deducted at Source or TDS covers TDS in detail.

Form 26AS

Income Tax Department facilitates a PAN holder to view its Tax Credit Statement (Form 26AS) online. Form 26AS contains

- Details of tax deducted on behalf of the taxpayer by deductors ,Part A & A1 of Form 26AS.

- Details of tax collected on behalf of the taxpayer by collectors. Part B of Form 26AS

- Advance tax/self assessment tax/regular assessment tax, etc. deposited by the taxpayers (PAN holders), Part C of Form 26AS

- Details of paid refund received during the financial year, Part D of Form 26AS

- Details of the High value Transactions in respect of shares, mutual fund etc. Also called as Details of AIR((Annual Information Return) transactions,Part E of Form 26AS.

The Tax Credit Statement (Form 26AS) are generated wherein valid PAN has been reported in the TDS statements.It is a form issued under Rule 31AB.

- From FY 2005-06 to 31st Oct 2012 one can view the Form through TIN-NSDL website.

- From AY 2009-10 one can also view the Form through TRACE website

About TIN NSDL

NSDL, the first and largest depository in India, established in August 1996 has established a national infrastructure of that handles most of the securities held and settled in dematerialised form in the Indian capital market

NSDL has established Tax Information Network (TIN) as a repository of tax related information on behalf of Income Tax Department (ITD). TIN system collects information about Tax Deducted at Source i.e. TDS from the tax deductors, the banks collecting the TDS on behalf of the Income Tax Department (ITD) and presents information to ITD and to the persons for whom the tax has been deducted. TIN is designed to make tax administration more effective, furnishing of returns convenient, reduce compliance cost and bring greater transparency. TIN system connects the nationwide users through its connected service centers called TIN Facilitation Centers (TIN FC) and web-based central system.Various functions of TIN are

- Receiving and storing of TDS returns in electronic format (e-TDS).

- Receiving and storing of Tax Payment information (OLTAS).

- Registration of e-Return Intermediaries.

- Processing of applications for issuance of Tax Deduction Account Numbers (TAN).

- Processing of applications for issuance of Permanent Account Number (PAN).

- Collection and processing of Annual Information Return (AIR) from specified persons for specified transactions on behalf of ITD.

- Assesses can view the details of taxes paid and TDS deducted for them (based on PAN) on the internet.

For more information please visit www.tin-nsdl.com, or NSDL’s What We Do / NSDL Projects / Tax Information Network.

In TIN NSDL , View of Form 26AS (tax credit details) :

- Is available from FY 2005-06 onwards.

- Details of Form 26AS is as per information processed upto October 31, 2012.

TRACES

TDS (Tax Deducted at Source) Centralized Processing Cell (CPC) or TDS CPC is an initiative undertaken by the Income Tax Department (ITD) to enable easy filing of TDS / TCS correction statements by deductors / collectors and related functionalities. TDS CPC endeavours to improve overall service levels for deductors and tax payers. It has set up a new portal(website) called as TRACES or TDS Reconciliation Analysis and Correction Enabling System. The new portal has been created to enhance swift interaction between the deductor, deductee, income-tax department and CPC. Deductors / collectors can file online correction statements after registering on TRACES. Tax Payers can also register to view and download Form 26AS. TDS CPC will facilitate timely filing and processing of statements and follow-up with deductors / collectors for rectification of defaults to enable correct reporting of TDS / TCS. It provides an interface to all stakeholders associated with TDS administration.The system has been designed to bring in transparency and efficiency to the taxation process. As explained earlier TDS related services for ITD was done by TIN-NSDL.

The following features are/ will be available to deductors and deductees

- Dashboard giving summary of Deductors account

- Online registration of TAN

- Online filing of TDS Statements

- Online corrections of TDS statements

- Default Resolution

- View Form 26AS

- Download Form 16/16A/Consolidated TDS File

- Grievance registration and resolution

Functionalities for Deductors through TRACES from TRACE webpage for Deductor is

- Registration on TRACES

- Add sub-users for a TAN

- View challan status

- Download NSDL Conso File

- Download Justification Report

- PAN Verification

- Download Form 16 / 16A

- Provide Feedback

- Download forms

- Manage Profile

- Download Consolidated TAN-PAN File

- Dashboard View

Not all of the above features have been activated so far.

Functionalities for Tax Payers through TRACES from Trace webpage for Tax Payers is

- Registration and Login

- View Form 26AS

- View and edit profile

- Provide Feedback

Registration at TRACES

- Users who have already registered at NSDL TIN site, need not register again on TRACES. Their registration details are migrated and they can login at TRACES with their NSDL-TIN login details

- Fresh registrations on NSDL site have been stopped

- New registrations can be done at TRACES site and for details you can find at FAQ .

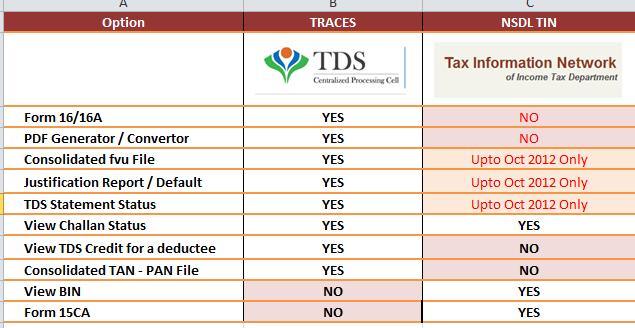

Comparison of TIN-NSDL and TRACE

The following table presents various services at both the sites (Ref: Fast Facts :: A Thomson Reuters Business TRACES : new TDS web interface from Income-tax Dept.)

Viewing Tax Credit : Form 26AS

Now Tax Credits Statement (Form 26AS) can be viewed/accessed through following ways :

1. View Tax Credit from incometaxindiaefiling.gov.in

Taxpayers who are registered at the portal incometaxindiaefiling.gov.in can view 26AS by clicking on ‘View Tax Credit Statement (From 26AS)’ in “My Account”. The facility is available free of cost. Earlier it used to TIN-NSDL website, now it takes to TRACE.

2. View Tax Credit (Form 26AS) from bank site through net banking facility

The facility is available to a PAN holder having net banking account with any of authorized banks. View of Tax Credit Statement (Form 26AS) is available only if the PAN is mapped to that particular account. The facility is available for free of cost.

The List of banks that were registered with NSDL for providing view of Tax Credit Statement (Form 26AS) are as below. View Tax Credit Statement from State Bank of India now takes to TRACE site. Earlier it was taking to TIN-NSDL site. That’s how I came to know but I am sure if other banks have done same. Does your bank View Tax -credit statement taking to TRACES website?

1. Allahabad Bank

2. Andhra Bank

3. Axis Bank Limited

4. Bank of Baroda

5. Bank of India

6. Bank of Maharashtra

7. Canara Bank

8. Central Bank of India

9. Citibank N.A.

10. City Union Bank Limited

11. Corporation Bank

12. Dena Bank

13. HDFC Bank Limited

14. ICICI Bank Limited

15. IDBI Bank Limited

16. Indian Overseas Bank

17. Indian Bank

18. Karnataka Bank Limited

20. Oriental Bank of Commerce

21. Punjab National Bank

22. State Bank of Bikaner & Jaipur

23. State Bank of Hyderabad

24. State Bank of India

25. State Bank of Mysore

26. State Bank of Patiala

27. State Bank of Travancore

28. Syndicate Bank

29. The Federal Bank Limited

30. The Karur Vysya Bank Limited

31. The Saraswat Co-operative Bank Limited

32. UCO Bank

33. Union Bank of India

34. United Bank of India

35. Vijaya Bank

3. Through TRACES website after registration. New registrations can be done at TRACES site and for details you can find at FAQ .

Related Articles:

Earlier their were problems with TRACES registration but now it seems to be ironing out. People are not happy with the change because of registration etc,infact wondering what was the need to move from TIN-NSDL. But now People have been able to generate requests and downloads. As TRACES needs to used by deductors and tax payers we will learn how to use and maybe come to like it like TIN-NSDL. What do you say? Does your bank View Tax -credit statement taking to TRACES website? Does your bank View Tax -credit statement taking to TRACES website? Please let us know we shall be obliged and update the article.

You can find all Government & Private Indian Banks all NEFT enable branches list with IFSC Code, Micr Code, Swift Code, Branch full address details, Bank Toll free No, Bank customer care no etc.