We all wish life was as easy as refilling your mobile balance. Once the balance is not sufficient we can easily recharge our phones with a topup. But when we have a long planned vacation or a dream wedding to execute we wish we had some TOPUP income. With Exide Life Income Advantage Plan we actually have a backup finance option, we have #incomekatopup! In this sponsored post we shall give overview of Exide Life Income Advantage Plan, who should buy it, why should one but Exide Life Income Advantage Plan.

Exide Life Income Advantage Plan

What is Exide Life Income Advantage Plan?

Exide Life Income Advantage Plan is a very efficient savings cum insurance plan which works to your benefit to provide regular income along with insurance cover.

Who should buy Exide Life Income Advantage Plan?

This is generally for individuals who have just started their career to secure for their retirement or to spend lavishly during their middle half. This adds as a top up for your current income. Also, this works as stable secondary income for individuals with non-fixed income like those working in business or freelancing where everything is non-reliable. Like in this video, Pooja’s scuba diving tour would have be canned if she wasn’t wise enough to invest for her future. We often Bank on the annual salary increment for our dreams might . And when that increment isn’t satisfactory, then we need #IncomeKaTopUp without being subjected to ups and downs of annual increments. Like Pooja we need to be wise enough to invest for our future with a steady additional income and secure for our retirement thus Income Advantage Policy can be a choice.

How does Exide Life Income Advantage Plan work?

- The policy terms are available for 3 durations: 16 years, 24years or 30 years.

- The policy holder pays premium for the first half of the policy period. A person will pay premium for 8years, 12 years or 15 years.

- The benefits for the premium paid can be reaped in the second half of the policy i.e from the 9th year, 13th year or 16th year depending on your policy term.The premium can be paid monthly or annually.

- During the benefit payout term, the advantage holder has two options:

- Pure Income Benefit: Where an individual receives guaranteed income + applicable bonus every year. OR

- Income with Maturity Benefit: Where an individual receives accrued bonus, if any on maturity of the policy while he receives annual guaranteed income during the benefit payout period/ Depending on the stage of life of the investor and foreseeing the income needs, you can pick the benefit that suits you the best.

- Table below shows the Pure Income Benefit

| Policy Term | Premium Payment Term | Benefit Payout Term | % of basic sum assured paid as annual income | Minimum Premium |

| 16 years | 8 years | From 9th year | 25% | Annual: Rs. 30000

Monthly: Rs. 2724 |

| 24 years | 12 years | From 13th year | 16.67% | Annual: Rs,18000 Monthly: Rs. 1635 |

| 30 years | 15 years | From 16th year. | 13.35% | Annual: Rs. 12000

Monthly: Rs. 1090 |

NOTE:

- In total, 200% of the basic sum assured will be received during the policy payout period till the end of the policy.

- Once you select the payout option you cannot change it during the policy term.

- There is no limit for maximum premium.

Reasons why you would want to Topup your Income

- Guaranteed Income Flexible Payout Based on the premium paid and policy term, you will get a fixed income annually during the benefit payout term along with non-assured bonuses. You also get an option to choose if you require annual benefits or benefits on maturity.

- Life Insurance Cover for full policy Term: Incase of demise of the policyholder, a lumpsum amount will be paid to this family. Insurance coverage will be during the entire policy term.

- Enhanced protection through nominal additional premium: With payment of nominal additional premium, a person can benefit from riders like accident cover and critical illness cover.

- Tax Benefits: Premium paid for the policy can be deducted for tax under Section 80C of the Income Tax Act,1961, the amount received annually or on maturity(depending on your choice) is deductible under Section 10(10D), premiums paid for availing rider benefits are also deductible under Section 80D.

- Discount on higher premiums: Higher premiums attract higher discounts upto 6% as compared to lesser ones.

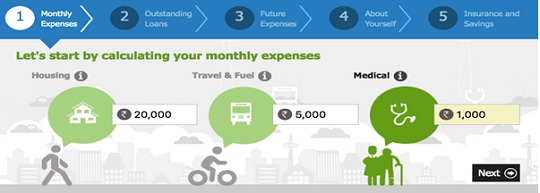

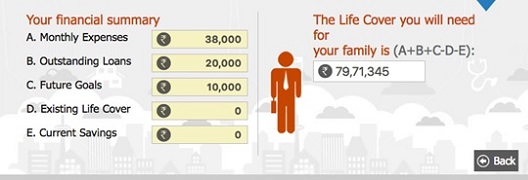

- Insurance Cover Calculator Tool: Exide has insurance cover calculator that gives you the amount you should as your future cover. The tool is user customized and gives results after assessing various expenses and factors of the policyholder’s lifestyle. This helps you to determine more or less accurate cover for your future. This is a vastly categorized tool wherein you have to enter your current personal details like housing, travel, medical, education, food & lifestyle expenses.

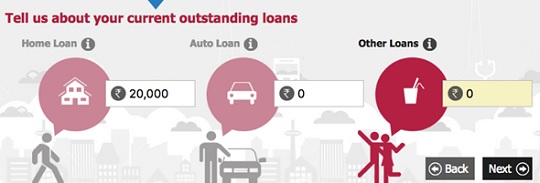

You also need to enter your current liabilities and loans along with savings and insurances if any to arrive at the cover you should require in the future.

The best fragment of the calculator is when it allows you to plan for your future expenses like marriage and child’s higher education.

Enter you current age and the age you wish to retire. A very accurate quotation for the cover will be generated.

Note: This is a very vague example and is for reference only. Individual cover will differ. We have entered a very high monthly expense with 0 savings and 0 invested in any insurance avenue. Also the age of retirement is early.

About Exide Life Insurance

Exide Life Insurance Company Limited, an established and profitable life insurance company, commenced operations in 2001-02 and is head quartered in Bengaluru. The company is 100% owned by Exide Industries Limited. Exide is India’s largest manufacturer of electric storage batteries and its biggest power-storage solutions provider with a market capitalization of over INR 11,600 crores*. The Exide Life Insurance Company serves over 15 lakh customers and manages assets of over Rs 9500 Crores. During the financial year 2015-16, the company achieved Total Premium Income of over Rs 2000 crores. The company is focused on providing long term protection and savings solution plans and has a strong traditional product portfolio with a consistent bonus track record. The company has ISO 9001:2008 quality certification for all Customer Service processes.

How to apply?

Go through the plan offered thoroughly and then decide whether you would like to avail of the Exide Life Income Advantage Plan. If you like it then all you need to do is visit ExideLife and enter you personal details and the policy will be available at your doorstep!

Note: This is a sponsored post

Do you have Income Ka Top Up? What do you do with your increments? Do you spend your increments to fulfill your dreams or do you invest it for future?