This article explains what is Chit fund?How it works? Who invests in Chit fund? How popular it is in India? What are the benefits and disadvantages of investing in Chit funds? Why Saradha Chit fund in West Bengal is actually not a chit fund. How chit fund differs from Ponzi scheme.

Table of Contents

What is chit fund?

A chit fund is a savings cum borrowings scheme, wherein group of individuals contribute pre-determined amount for a pre-determined period. Every month until the end of the tenure collected money is loaned internally through bidding to a member who deserves. Kitty party, popular among Indian women, is also a variation of chit fund, which uses a raffle-like system to decide who gets the money each month

A Chit Fund can be either registered or unregistered.

- Registered Chit funds are organized by Chit Fund firms/companies and regulated by the Chit Fund Act.

- Unregistered Chit Funds are unorganized and run by friends, relatives or personal groups.

What are the terms associated with chit fund?

- Chit group : A Chit group refers to a specified number of members agreeing to subscribe a specified amount for a specified period. For example, 30 members, 40 months, Rs.500/- a month.

- Subscribers : People who invest in a chit group.

- Term Period : the duration of the chit.

- Monthly Subscription : The amount to be saved/paid every month by the Subscriber

- Chit Value : Amount collected from members in the group.

- Foreman : He is responsible for collecting the subscription amount from the subscribers, recording details of members and conducting the auctions. For these duties, he is paid a fee, (2.5% for Shririam chits, 5% for Margadarsi) of the amount collected. The Foreman’s fee is reduced from the amount paid to the subscriber who wins the bid.

- Chit agreement: It is a contract or agreement between the foreman and the individual subscribers to a chit group. Agreement includes rules, regulations and other details dealing with the procedure for the conduct of chits.

How does chit fund works?

Every month, one subscriber will get the collected amount based on a bidding system. Generally, those who are in need of money in a particular month participate in the bidding,

Bidding : Subscriber with the lowest bid (also called as highest discount) is allowed to take the amount. Usually there is a limit on maximum bidding amount. For chit funds like Shriram and Margadarsi it is 40 % of Chit value(sum of contributions of all the members). Once a subscriber wins the bit, he is not allowed to participate in the bidding again but he has to continue paying the monthly subscription amount.

If there are more than one participant for, then different chit fund follow different policies, in some the Successful Bidder will be determined by way of lottery. Where in, the tokens bearing the numbers allotted to the members is put into a box and one token is drawn by any of the member present in the auction and thus, the member whose number is mention on the drawn token will be declared as the Successful Bidder. In sum the bidders negotiate among themselves.

Foreman’s fee: The chit fund scheme is managed by one of the members/chit fund, who is known as the Foreman.The Foreman’s fee is reduced from the amount paid to the subscriber who wins the bid.

Payout: The amount left from the monthly collections is distributed equally among all the subscribers. This is adjusted in next month contribution.

Can you explain with an example?

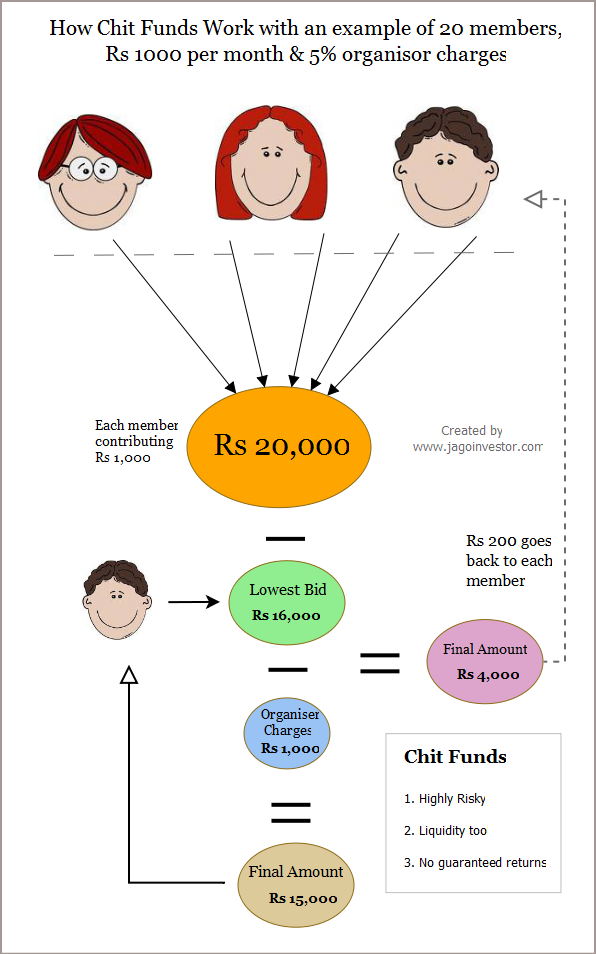

Let us take an example of a scheme of 20 members contributing Rs. 1000 each per month, for 20 months.The total amount collected per month,i.e chit value, would be Rs. 20,000 (20 * 1000). In the auction meeting, bidders can bid say upto 80% of this total amount i.e 16,000(80% of 20,000). Foreman’s fee is 1% of winning bid,

The successful bidder is one who gives the highest bid amount, not exceeding the maximum limit, within the specified auction time. Suppose there are bidding for Rs 14,000, Rs 15,000 and Rs 12,000. The winning bidder would be one with minimum bid ie of Rs 12,000. he would get this amount. Foreman will earn 120 (1% of 12,000) rest of the amount i.e. Rs. 8000 is divided among the 20 members. This discount of Rs. 400(i.e. 8000/20) is then returned back to each member. This is adjusted in next month contribution so the next month’s contribution would be Rs. 1000- Rs. 400 =Rs. 600

This process gets repeated for all months(20 month) till the end of the scheme, giving each member a chance of receiving the money. If in a particular month there are more than one person willing to take the sum, a lots is taken to declare the person who would get the sum. The process is shown in image below from jagoinvestor’s How Chit funds work

Who invests in chit funds?

Banks had restrictions on lending to the middle class and the government’s programmes were primarily addressing the poor and industries. The middle class needed money and chit funds emerged as an instrument that encouraged saving but also allowed borrowing, without interest. For example a tailor in Tamil Nadu needed Rs 6 0,000 in cash in less than three months,and his monthly salary was Rs 8,000. His application for a bank loan was rejected. He then participated in the Chit fund. Ref National’s How chit fund helps the improvished (2010)

IFMR research Chit Funds as an Innovative Access to Finance for Lowincome Households ( pdf ) of 2006 showed that on an average 50% of the chit fund members are below poverty line ( household consumption less than Rs 62.5 a day). Self employed and salaried employees formed a major part ( 78.9%) of the membership of chit fund schemes.

What are benefits of Investing in chit funds?

Benefits of chit funds are:

- Chit fund investments are not affected by any market fluctuations.

- It inculcates the habit of compulsory regular saving.

- It earns dividends every month. So the net effective rate of return proves to be pretty attractive.

- For any unexpected financial requirement, bidding for the lump sum amount, could prove to be a better option than going through the hassles of a loan.

What are disadvantages of investing in Chit funds?

- Returns are not guaranteed. It is not possible to calculate exact returns from a chit fund as this depends on the level of emergency of members for funds,bidding amount

- Liquidity: Once you begin investment in chit fund you need to continue it for full term.

How popular are chit funds in India?

Kerala State Financial Enterprises (KSFE), set up in 1969 and wholly controlled by the state government. Out of its aggregate business turnover of Rs 18,000 crore per year, around Rs 12,000 crore come from chittis (as they are known in Kerala) alone.With 460 branches in Kerala and 16 lakh subscribers, KSFE is perhaps the only profit-making chit business in the public sector

Hyderabad-based Margadarsi Chit fund, part of the Ramoji Rao group. It has a subscriber base of 4.5 lakhs, an annual turnover of Rs 7,500 crore, and operates in Tamil Nadu and Karnataka as well.

Shriram Chits was set up in 1974. Starting with a capital of Rs 10 lakh, the firm has grown to 900 branches and has a turnover of Rs 4,300 crore.

PROMINENT CHIT FUNDS IN SOUTH INDIA

- Balussery Benefit Chit Fund. Running since 1947

- Margadarsi Chit Fund. Running since 1962

- Kerala State Financial Enterprises. Running since 1969

- Shriram Chits. Running since 1974

- Kapil Chit Funds. Running since 1981

- Pooram Kuries. Running since 1995

The Institute for Financial Management and Research, IFMR has been carrying out extensive surveys on chit funds under the aegis of the Bill & Melinda Gates Foundation. It’s papers Chit Funds as an Innovative Access to Finance for Lowincome Households (pdf), Chit Funds – A Boon to the Small Enterprises (pdf)

Are chit funds only in India?

The chit funds are Indian equivalent to Rotating Savings and Credit Associations (ROSCA). Commonly called as Save and Borrow schemes.These are popular in many countries such as Cambodia, Korea and Indonesia. In some African countries, they are called merry-go-rounds. But India is widely thought to be the only country where large private companies also run formal chit funds.

Is chit fund a new concept?

No it has been around for many years. In ancient times, it was the village chieftain’s responsibility to collect grain from the villagers and store it for contingencies. The excess grain would be redistributed among the households on an annual or biannual basis. Should a family require financing for other expenses, he would release the grain depending on the capacity and capability of the borrower to repay the grain. In modern times, this system was altered and extended to money and brought under regulation by the Tamil Nadu Chit Fund Act (1962) followed by a central government Chit Fund Act (1982).

Are chit funds safe?

Are banks safe? As we said in Know Your Customer or KYC Recently there was a money laundering allegations against three top private sector banks(ICICI Bank, HDFC Bank,Axis Bank). Does that mean we should shut banks? Similarly One needs to exercise caution while choosing the chit fund.In a registered chit fund company, under legal binding, the activities are regulated and institutionalized by the Chit Fund Act. Easy prey are those who buy into the promise of others without checking the veracity.

But what about Saradha Chit Fund crisis in West Bengal?

Saradha chit fund crisis in West Bengal was actually not a chit fund. As Yahoo’s Disassociate Saradha from chit fund sector, says chit fund association says

“We have verified with the office of ‘Registrars of Chit Funds’ in Kolkata that Saradha is not registered. The company had varied business interests and what is quite glaring is that they did not float any chit fund company. Yet, their failure is attributed to chit funds,“

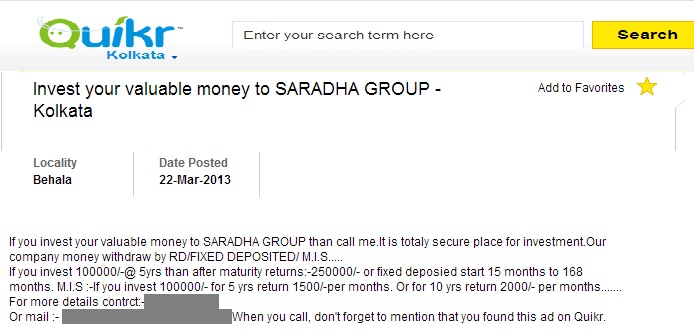

Examination of Saradha’s investment plans showed that the Saradha collected money ranging from 10,000 rupees to 100,000 rupees for periods ranging from between 15 months and 10 years. At the end of the investment tenure, investors were given the option of taking a piece of land or an apartment, or simply getting their money back, with an average return of 12% to 24%. It is not clear whether this was the promised annual return or total. More investors had opted for the cash repayment. Ref : FirstPost Another Sahara: How Saradha built a ‘brand’ and duped people, Wall Street Journal blog Small Investors Caught in Saradha Shutdown We found an Ad for investment in Saradha company on Quickr Kolkata dated 22 Mar 2013 shown below :

Infact Saradha was investigated by the Securities and Exchange Board of India (SEBI) and on Apr 23, 2013 order it asked Saradha Realty to refund all the money owed to investors within three months of the order. You can read SEBI’s order here (pdf) SEBI called Saradha as Collective Investment Scheme (CIS) which is defined as follows.

Any scheme or arrangement made or offered by any company under which the contributions, or payments made by the investors, are pooled and utilised with a view to receive profits, income, produce or property, and is managed on behalf of the investors is a CIS

For more information on CIS can read SEBI’s FAQ on Collective Investment Schemes and Economic Times Sebi cracks down on collective investment schemes operating in West Bengal

Investment in Saradha was actually a Ponzi scheme.

What is Ponzi scheme?

A Ponzi scheme is essentially a fraudulent investment scheme where money brought in by the newer investors is used to pay off older investors. This creates an impression of a successful investment scheme. Of course, as long as money entering the scheme is greater than the money leaving it, all is well. The moment the situation is reversed, the scheme collapses. The scheme gets its name from an Italian American called Charles Ponzi who in 1919 ran an investment scheme in Boston, which promised to double the investor’s investment in 90 days, later cut to 45 days. Example of Ponzi schemes in India are

- Emu scheme : In case of the emu Ponzi scheme an investor was supposed to rear emus and then sell their meat, oil, etc.

- Speak Asia : In order to become a member of Speak Asia one had to invest Rs 11,000 and subscribe to the electronic magazine issued by the company called Surveys Today. Member could participate in two online surveys every week and make Rs 500 per survey or Rs 1,000 per week. So an investment of Rs 11,000 ensured that Rs 52,000 was made through surveys, a return of 373%(100% 52,000 – 11,000/11,000) in one year.

- StockGuru It advised its clients to buy shares at a low price and sell them at a higher price.

Related articles:

We don’t recommend or suggest investing in Chit funds but we are also not against them. If you invest in a chit fund do appropriate checking on chit funds. Don’t get lured by quick get rich schemes, if someone promises you a return of 20% or so, control your greed. The safe way to double your money is to fold it over once and put it in your pocket.

Not bad.good job.

Sir, as said all chit funda are not bad. shriram, margardarsi, Balusarry are one of the dependable one. strangely i look from investment point-assuming I will take my money in the last instalment. I did once in shriram for 20 30 months. I reember I got 8 to 9 % which is very decent. lokk from another angle , the fixed deposit interest is almost same – but you cant deposit 500 or 1000 rs every month . secondly the monthly payable amount gets reduced slowly-thus reducing the pressure of onthly out go. that way this is very good saving & returns.ONE IMPORTANT . CHIT FUND OK NOT CHEAT FUND AS SAID. BALUSARRY IS MORE THAN A BANK IN FACT THEY WILL NOT EVEN ADMIT UNKNOWN PEOPLE bescuse of the problems. We should not forget also the foreman / company has to pay the members the balance money even if the member defaults/runs away.

Thanks for the post..

I was looking to do investment in Chit..

Thanks for the post..

I was looking to do investment in Chit..

Very informative and important post in the current scenario……….

http://debnature.blogspot.in

Thanks Debopam

Very informative and important post in the current scenario……….

http://debnature.blogspot.in

Thanks Debopam

nowadays chit finds become cheat funds. one clearly understand the working of chit funds reading your post.thanks for the info.

No Easwar all chit funds are not bad. Chit fund serve a purpose especially for those you have little or no access to banks.

Cheat funds come under the ponzi scheme. Anything promising returns of more that 15% one needs to be VERY VERY Careful

Foreman charge is very high, else this is not bad.

nowadays chit finds become cheat funds. one clearly understand the working of chit funds reading your post.thanks for the info.

No Easwar all chit funds are not bad. Chit fund serve a purpose especially for those you have little or no access to banks.

Cheat funds come under the ponzi scheme. Anything promising returns of more that 15% one needs to be VERY VERY Careful

Foreman charge is very high, else this is not bad.

thanks for sharing this useful information 🙂

InkMyTravel

Thanks for comment

thanks for sharing this useful information 🙂

InkMyTravel

Thanks for comment

thank you for answering the million dollar question i have had since decades.. about what exactly is a chit-fund .. or as the society cribs- the cheat fund !!

Thanks MySay. We try to make our readers aware..money aware!

thank you for answering the million dollar question i have had since decades.. about what exactly is a chit-fund .. or as the society cribs- the cheat fund !!

Thanks MySay. We try to make our readers aware..money aware!