Most of us like investments which offers assured returns and have an exact date of maturity. Hence Fixed Deposits are very popular. But disadvantage of Fixed Deposits is that interest earned is taxable as per your income slab.We wish for having an investment option which has a maturity date, is tax efficient and returns are comparable to that of Fixed Deposits. Well Fixed Maturity Plans or FMPs from Mutual Funds Houses are just that. Fixed maturity plans (FMPs) are an alternative to bank and company fixed deposits (FDs) and open ended debt funds.

What are Fixed Maturity Plan?

Fixed maturity plans are closed-ended income schemes by Mutual Fund houses that invest in fixed income instruments or debt securities with maturity coinciding with the maturity of the scheme.

- The FMP invests in debt instruments such as treasury bills (T-bills) commercial papers (CPs), certificates of deposit (CDs), and government and corporate bonds with maturity coinciding with the maturity of the scheme.

- Close ended funds are open for subscription for a limited and you can only invest in them during that period, called as the New Fund Offer (NFO). It also means that you redeem(sell the units to the fund house) them only on maturity. These are listed on stock exchange and you can sell to others on exchanges.

- The minimum investment required under fixed maturity plans is typically Rs. 5,000.

For example, if a fund launches an FMP for 367 days between Nov 14- Nov 17, so if an investor can invest in this fund between Nov 14 – Nov 17. He will get his money back after 367 days. The Fund Manager of FMP will buy certificates of deposit (CDs) and commercial papers (CPs) that will mature after 367 days. Information about FMPs that are open are available in Scheme Offer or Information Document. To read a sample SID Of Reliance FMP click RelianceFixedHorizonFundXXVSeries1 (pdf format).

What is the time period or Tenure of FMP?

Fixed maturity plans come with different maturities: 1 month, 3 months, 6 months, 13 months , 3 years, 5 years. So you should choose one that matches your investment duration.

What are Dividend and Growth Option of FMP

- Growth : Under growth option, you will not receive any returns in the intermediate. You will return the lump sump on maturity. Returns earned are treated as capital gains (short-term or long-term depending on tenure of investment).

- Dividend option: It is a dividend Payout option. Under this the profits of mutual funds are distributed amongst the investors at various intervals . If you opt for the dividend scheme, remember that practically the entire return on investment is by way of dividends. In such a case, the Mutual Fund would pay Dividend Distribution Tax (DDT) at 28.325% of the dividend declared and the dividend received by you would be tax-exempt. At the time of redemption, if the amount realized is higher than the cost, the same would be liable to tax as long-term or short-term capital gains as in growth option.

Taxation of Fixed Maturity Plan

Fixed Maturity Plans are treated like Debt Mutual Funds, tax implication depends on the investment option (dividend or growth) and holding period of FMP.

- Dividend : Dividends in FMPs are tax free in hands of investors. However, mutual funds companies have to pay a dividend distribution tax of 28.325% before distributing it to investors.

- Growth : in the growth option returns earned are treated as capital gains ,short-term or long-term depending on tenure of investment.

- Short term gains are when FMP is redeemed within an year. The short term gains are taxed as per the tax slab.

- Long term gains are when FMPs are redeemed after an year. They are taxed at 10% without indexation or 20% with indexation. The indexation benefit inflates the cost of purchase lowering long term gains tax liability hence due to indexation benefit, fixed maturity plans end up becoming more tax efficient than a bank fixed deposit, particularly for investors who are in the 20 per cent or 30 per cent tax slabs.

Example of Indexation benefit and why FMP is better than Fixed Deposit

Indexation benefits are only available for long-term capital gains taxation, which is if you hold on to your investments for more than a year.

Investing in FMP : If you are in highest tax bracket of 30.9% and you invest Rs 10 lakh in a one-year FMP, and assume the FMP gives a return of 9% Rs. 90,000.

- With indexation : The tax liability without indexation would be Rs. 9,270. Hence the total amount received (net of tax) would be Rs. 10.8 lakh. The post tax return for investment period of 12 months would be 8.07% per annum.

- With Indexation : Assume you avail indexation benefit which is 7% rate of inflation index. The applicable tax rate for the highest tax bracket is 20.6% (20% tax + 3% education cess). The tax liability with indexation would be Rs. 4,120. Therefore the total amount received (net of tax) would be Rs. 10.85 lakh. The post tax return for investment period of 12 months comes to 8.59% per annum.

Investing in Fixed Deposit : On the other hand, a bank FD doesn’t offer indexation benefit. If FD offers an interest rate of 9% pa. Your tax liability would be Rs 27,810. The total amount received (net of tax) would be Rs. 10.62 lakh and the post-tax return for the investment period of 12 months is 6.22% pa.

It is because of the indexation benefits that FMPs score over Fixed Deposits. But fixed deposits score over FMPs on liquidity. Though FMPs are listed on stock exchanges you may never get to exit at fair value on stock exchanges due to poor liquidity

Our article Cost Inflation Index,Indexation and Long Term Capital Gains explains more about long term capital gains and Inflation index of various years.

Double Indexation Benefit

For example if you invest Rs 1 lakh in a 14-month FMP , in the month of Feb. This means that your FMP will mature in Aug 2015. Although the FMP’s tenor is just 20 months, it covers two financial years, one ending 31 March 2014 and the other ending 31 March 2015. Due to rising inflation, the government allows you to inflate your cost price once a year, every year. Since your FMP covers two financial years’ closing dates, you get to inflate your cost price of the FMP, twice. Such Indexation benefit which spans over two financial years is called as Double Indexation Benefit. Usually double-indexation FMPs come out in February and March every year.

What are returns from the FMP?

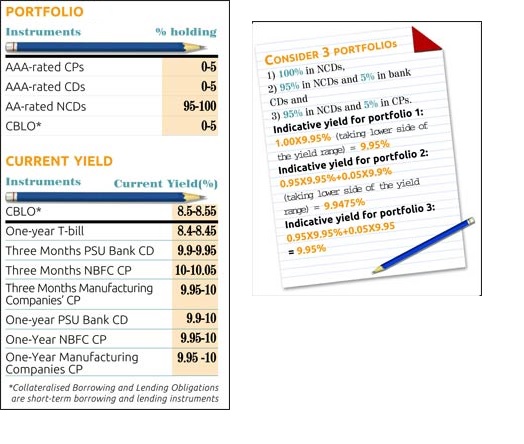

Mutual funds houses are not allowed to declare the returns or yield of the FMPs due to restriction by SEBI. But investors can make a rough estimate of the return as the scheme offer document(SID) mentions the instruments in which it plans to invest and in what proportion. The offer document also gives the average yields on different instruments in the current environment. So investors can estimate the yield on the fixed maturity plan by subtracting the expense charged by the scheme. Note as this is indicative yield on maturity, there is a possibility of the actual returns deviating from the returns indicated at the time of investing. The deviation might not be significant at the end, but it would still be imprudent to consider FMPs. To know the exact yield, you can check with distributors or agents selling these products.

Example of how to calculate indicative yield

For example a three-month FMP scheme invests 95-100 per cent money in CPs with A1+ or equivalent rating with yield of 11.45-11.55 per cent. CPs are issued by companies to raise money for the short term (less than a year). Assuming the fund manager keeps 5 per cent funds as cash and invests the rest 95 per cent in CPs, which are offering 11.45 per cent, the likely annual return will be 10.88 per cent (11.45 X 0.95).

Fund houses charge a fee to cover expenses. The maximum they can charge in a year is 2.25 per cent of the fund’s average net asset value. However, they rarely charge so much. To determine this, you can check the fee being charged on existing FMPs of the fund house. If it is not available, use the average expense ratio of existing FMPs, which at present is 0.4 per cent. If we deduct this (0.4%) from the return figure of 10.88 per cent, the likely annual return from the FMP, if held till maturity, will be close to 10.5 per cent. Therefore, the three-month FMP will pay 2.625 per cent (10.5/4).

Another Example of calculation of indicative yield is given below from Business Today Evaluating Returns

Who should invest in FMP

FMPs are ideal if you believe you do not need the money for a fixed term and actually have a goal for that investment at the end of the tenure. For instance, if you have plan to buy a car a year down the line and wish to save some money for down payment, a 1-year FMP can be a good option.

FMPs can be good options in a rising interest rate cycle when compared with open-ended debt funds. In rising interest rate cycle FMPs will lock into reasonably high rates but open-ended debt funds may see a temporary fall in their price as yields climb up. Another advantage for FMPs is that they have lower expense ratios when compared with openended debt funds. This is because in FMP the fund manager invests once while in regular debt mutual fund schemes the fund manager often has to churn the portfolio

Invest in FMP : If you are willing to lock money for the said period of the FMP. If you are looking at diversifying your investments across a portfolio of fixed income securities ,If you want to take advantage of the tax benefit of FMPs.

How to invest in FMPs?

You can invest just like Mutual funds through online platforms or by filling in the form. FMPs are open for short period only and are not often advertised so to find information about them use following sites from our article Finding Info on NFOs of FMP,MFs,FD and Saving Interest Rates

- Value Research Online: Fixed Maturity Plans of Offer : On One page we get information about different FMP’s categorized on the basis of the tenure. We also come to know about opening, closing date, of the FMP and also maturity date . Clicking on the scheme name gives details about the scheme.

- Money Control: New Fund Offers:Debts also provides information on Scheme Name, Fund Class(FMP, Short Term),Open Date,Close Date. MoneyControl:Debt Funds give information open for FMP New Fund Offers. You can also download the form from the link but note it would have distributor code/ARN filled up as ARN-11770.

- FundsIndia investor receives weekly mails/updates. Or You can also check available FMPs at FundsIndia webpage of NFOs

Related Articles :

- Bemoneyaware.com:Cost Inflation Index lists Cost Inflation Index from Financial Year 1981-82 to Financial Year 2013-14

- Finding Info on NFOs of FMP,MFs,FD and Saving Interest Rates

[poll id=”50″]

Do you invest in FMPs? Why or why not? Or you believe in investing in Equities?

Thanks in support of spending the calculate to discuss this, I stroke glaringly about it and adore rendition more resting on this topic.

Thanks in support of spending the calculate to discuss this, I stroke glaringly about it and adore rendition more resting on this topic.