Gone are the days of standing in queue for banking operations like depositing money,withdrawing money. After internet banking, mobile banking, e-wallets what next’s? Banking in now Social, says Kotak Bank. Is it the way to go forward? Will it work? Let’s try to find out.

Table of Contents

About Kotak Jifi Account

Kotak Jifi is the new-age account which changes the way we bank and socialize, bringing friends, family and the world of banking closer than ever! It harnesses the infinite power of the internet and lets every tech-savvy customer gain from transactions, referrals and social connections. There are two parts to Kotak Jifi account, one is a like any other bank account and other one which Kotak calls Social banking which uses Facebook and Twitter. Picture below captures the overview of Kotak Jifi account (Click on image to enlarge). To explore more about the Kotak bank Jifi account www.kotakjifi.com

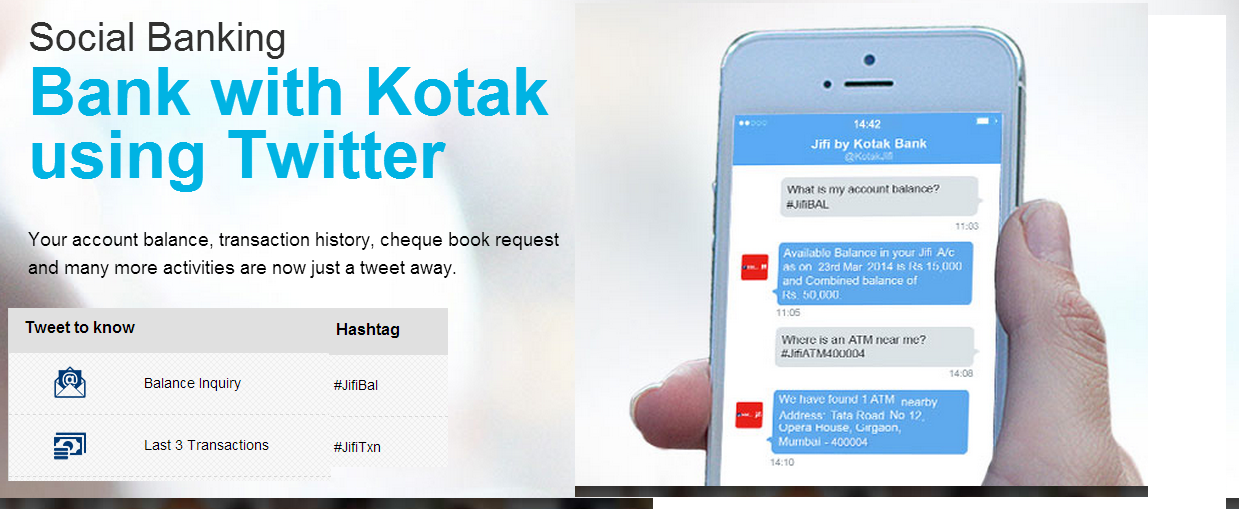

What is Social Banking?

You need to have a Facebook account to open Kotak Jifi account.

Social banking lets you enjoy instant updates of your bank account through your personalised Twitter handle. After activating your Jifi bank account, you need to connect your Twitter account through the Jifi dashboard. Once, your Twitter account is authenticated, you can tweet to get your bank account details from anywhere, anytime.

Overview of Banking in India

According to Census 2011, 59% of the 246.7 million households across India have access to banking services—54% of the 167.8 million rural households and 67% of the 78.9 million urban households. Prime Minister Narendra Modi is expected to announce the Sampoorn Vittiyea Samaveshan (comprehensive financial inclusion plan) on 15 August 2014 along with a roll-out road map. The financial inclusion plan will look to provide universal access to banking facilities with a basic bank account with an overdraft facility of Rs.5,000 and a RuPay-enabled debit and ATM card with an inbuilt accident insurance cover of Rs.1 lakh.

Banks offer many different channels to access their banking and other services. Our article How to Bank explains in detail

- A branch is location where a bank offers a wide array of face-to-face service to its customers

- ATM is a computerised telecommunications device that provides bank’s customers a method of financial transactions in a public space without the need for a human clerk or bank teller.

- Telephone banking is a service provided by banks which allows its customers to perform transactions over the telephone.

- Internet or Online banking is a term used for performing transactions, payments etc. over the Internet through a bank’s secure website

- Mobile banking is a method of using one’s mobile phone to conduct simple banking transactions by remotely linking into a banking network.

India is considered among the top economies in the world, with tremendous potential for its banking sector to flourish. The last decade witnessed a significant upsurge in transactions through ATMs, as well as internet and mobile banking. Over the last few years, the mobile and wireless market has been one of the fastest growing markets in the world and it is still growing at a rapid pace. Mobile phones have become an essential communication tool for almost every individual. With mobile phone penetration of over 80 per cent, India has a huge potential for mobile banking. But on the global landscape, mobile payments have a long way to go in India. According to the MasterCard Mobile Payments Readiness Index (MPRI), India ranked 21st among 34 countries with the score of 31.4 on a scale of 100. It relies on an analysis of 34 countries and their readiness to use three types of mobile payments: person to person, mobile e-commerce and mobile payments at the point of sale (POS).

Some interesting facts

- The first online banking service in United States was introduced, in October 1994 , developed by Stanford Federal Credit Union.

- In May 1995 : Wells Fargo – the first bank in the world to offer customer access to their accounts over the internet

- ICICI was the first bank to initiate the Internet banking revolution in India as early as 1997 under the brand name Infinity.

- Mobile payments were trialed in 1998 in Finland and Sweden where a mobile phone was used to pay for a Coca Cola vending machine and car parking. Commercial launches followed in 1999 in Norway. The first commercial payment system to mimic banks and credit cards was launched in the Philippines in 1999 simultaneously by mobile operators Globe and Smart.

What do we want from the bank?

Choosing a bank is one of the most important financial decisions. Core banking services, such as savings accounts, make up the central hub of personal finance, but most banks also provide a comprehensive array of additional services to complement them. By meeting the financial needs of their customers, banks are able to create lasting relationships with them that can offer cost savings and added convenience ( at times for banks). Most of the time for salaried employee employer decides the bank in which salary gets paid. At times one goes for a public sector bank due to address proof or having an alternative bank.

India has progressed a lot in terms of banking in last few years. And latest one is Mobile banking. Mobile banking services can be classified into :SMS Banking, Application (Software) oriented, Browser (Internet) based model and Mobile Apps. India has 55.48 crore mobile users as per one news report. Of this, only 2.3 crore (RBI data) or just 4.41 percent do any kind of mobile banking activities.”There is substantial potential for mobile based payments,” said Raghuram Rajan in his first speech after taking over as the Governor of the Reserve Bank of India. Why has mobile banking not picked up in India? True, there’s surely potential for mobile-based payments in India. But the question is how long will it take for us to fully use that potential? Is it not picking up because people don’t see the need or are scared of security?

What do I want from Bank in terms of banking services? (Let’s ignore the mutual fund ,insurance and Relationship managers). Bank is a place where I deposit money in my account and then spend money from. I hardly go to the bank, use ATM to withdraw my money for daily use,use ECS to set up my bill payments (electricity,mobile,broadband) netbanking to check status of my account, set alerts. Everytime there is a transaction I get an SMS and email alert(I have set it up using netbanking) which informs me of the balance also. I have not explored the Mobile Apps (just tried SMS banking).

Can Banking be social? We hardly discuss the money in general(unless you count how less we have or how fast it goes) and banks in specific (actually we do discuss but it is more to crib about something that did not go well. Like it’s so difficult to get a locker, or I had to go to bank because of signature mismatch ). Infact I don’t know the bank account of my best friends,my parents. (Sometimes a spouse has a bank account unknown to the other half also). I do realise that what social banking means? (Even before my teen age daughter tried to enlighten me”Mummy social banking means banking with Social media like Facebook and Twitter!” looking at me like I am an alien or why can’t I get the simple fact :-)). Banks are now going social(I mean using social media, they have facebook accounts, twitter accounts and I hear that you get response faster if you raise complaint on these accounts ).

In the article Banking and Social Media Communications: Boom or Bust? the research study asks if consumers really want to join the conversation with banks? Are they even listening? Has the financial industry’s rush to social media paid off? Or not? (It is about US banking but would results be different for Indian Banks?)

Researchers asked participants if they had used social media in any way to “talk” about their bank or credit union. Most of them (71%) had never used social media for this purpose. 29% say they’ve used social media to make a complaint or publicly comment on the service of their bank or credit union.

One in ten respondents say they have used social media to complain about their bank or credit union.

During one focus group session, participants scoffed at the notion of connecting with their financial institution through social channels, dismissing it as silly. The discussion question evoked a sarcastic response or two, but the group collectively saw no real need to answer a question they found funny. They didn’t take it seriously.

“I’ve honestly just never even thought about it,” said one participant. That sentiment seemed to reflect everyone’s position.

Every organization has to try giving new products (or updating the products) for their customers especially new customers. Kotak Bank has come out with the Social banking concept , Jifi account. The concept is interesting, will it work especially with the Gen Y who is so socially active is for us to see.

Related Articles :

- Dormant Bank Account

- Changing Jobs:Take Care Of Bank Account,Tax Liability

- Saving Bank Account:Do you know how interest is calculated and more

- Know Your Customer or KYC

- What is Auto Sweep Bank Account?

Do have a account with a private bank or public bank or both? How do you feel about their services? What do you want in banking? Have you tried mobile banking? What do you think about Social media and banking?

Great!!!! Quite interesting. Can you please write about Pockets by ICICI, an Social Banking Initiative on Facebook. Briefly picture out it salient feature to use.

Thank you in advance

Gowtam found a good review of ICICI bank Pockets on livemint

Using this app, an ICICI customer can send money to any of her Facebook friends even if she does not have the friend’s bank details. To transfer money, you either need a mobile number, an email ID or a Facebook account. Once you select an option, type the amount and name of the friend and submit. The receiver will get a coupon number and a password. You will also have to send a password, which the bank sends you. Using both the passwords along with her bank account number, your friend can get the money credited in her account. The money transfer system works on NEFT (National Electronic Funds Transfer) platform.

Is there something specific you are looking for Gowtham?

Thanks for your words!!!

Yep i am specifically looking for Split n Share feature in Pocket by ICICI.

And i also like to add,Please do write a Blog on it.

Gowtham let us do research and get back to you soon.

Hello Gowtham

Our article on Pockets Facebook App by ICICI Bank with information on Split n Share feature is at Pockets Facebook App by ICICI Bank, Social Banking

Did you find the article useful?

I liked Split n Share feature (and Pay a Friend) also.

If you use it do share your experience

Thanks for blogging. I do share my experience

Great!!!! Quite interesting. Can you please write about Pockets by ICICI, an Social Banking Initiative on Facebook. Briefly picture out it salient feature to use.

Thank you in advance

Gowtam found a good review of ICICI bank Pockets on livemint

Using this app, an ICICI customer can send money to any of her Facebook friends even if she does not have the friend’s bank details. To transfer money, you either need a mobile number, an email ID or a Facebook account. Once you select an option, type the amount and name of the friend and submit. The receiver will get a coupon number and a password. You will also have to send a password, which the bank sends you. Using both the passwords along with her bank account number, your friend can get the money credited in her account. The money transfer system works on NEFT (National Electronic Funds Transfer) platform.

Is there something specific you are looking for Gowtham?

Thanks for your words!!!

Yep i am specifically looking for Split n Share feature in Pocket by ICICI.

And i also like to add,Please do write a Blog on it.

Gowtham let us do research and get back to you soon.

Hello Gowtham

Our article on Pockets Facebook App by ICICI Bank with information on Split n Share feature is at Pockets Facebook App by ICICI Bank, Social Banking

Did you find the article useful?

I liked Split n Share feature (and Pay a Friend) also.

If you use it do share your experience

Thanks for blogging. I do share my experience