Budget 2016 has proposed to make EPF withdrawal taxable unless 60% of it is used in buying annuity. This article talks about what is Annuity?How does Annuity work? Type of annuities?

What is an annuity?

An annuity is a pension product that provides periodic income. In return for a lump sum an annuity provider will give you an annual income for the rest of your life. Annuity insures against you living too long. Right now, only insurance companies offer annuity plans in India. One of the problems faced by those close to retirement is how to invest the lumpsum money to ensure a regular income after retirement.

Type of annuity plans

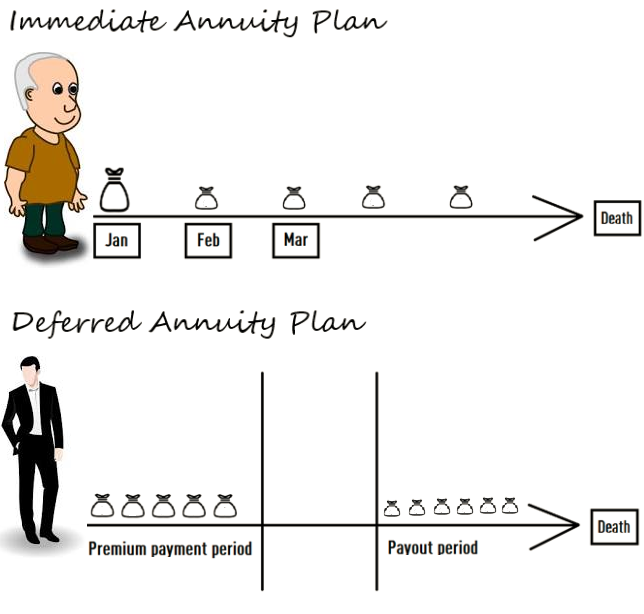

There are two ways in which the individual receives the annuity payout:

- Immediate annuity : he begins to receive payments soon after the initial investment. This is ideal for someone approaching retirement age.

- Deferred annuity: it accumulates money as opposed to paying out annuity regularly. Here the policyholder pays the premium(purchase price) for a particular tenure after which the policy matures with some added returns to the premium paid. Pension is paid as annuity after maturity till the death of the policyholder. if you are between age group 20 to 45, you can go for a deferred annuity because you have some time left to contribute towards the purchase price. Deferred annuity can be converted into immediate annuity based on the individual’s preference.

How Does An Immediate Annuity Plan Work?

- The individual begins by making a lumpsum investment in the annuity plan.

- The annuity then makes payments to the individual on a future date or series of dates. The income can be doled out monthly, quarterly, annually or even as a lump sum payment.

- The income payout is determined by a number of factors, including the tenure of the annuity.

- The individual can opt to receive the income payments for the rest of his life or for a fixed period of time.

- The income depends on whether he has opted for a guaranteed payout (fixed annuity) or a payout stream determined by the performance of the annuity’s underlying investments (variable annuity).

LIC Jeevan Akshay VI is a popular immediate Annuity plan which can be purchased by investing a Lump sum amount.

How Does A Deferred Annuity Plan Work?

- A deferred annuity plan you have to collect sufficient money (Build a corpus) called the accumulation phase to purchase an annuity plan.

- On maturity of the deferred annuity plan (vesting age/retirement age) you have the option of commutation (you take 1/3rd of the amount as a lump sum) and the remaining 2/3rd is invested in an annuity. You can also purchase an immediate annuity plan for the entire amount.

- Pension is paid to you after vesting age (retirement age) either monthly, half yearly or annually. This is the distribution phase.

LIC’s JEEVAN NIDHI is a with profits Deferred Annuity (Pension) plan. On survival of the policyholder beyond term of the policy the accumulated amount (i.e. Sum Assured + Guaranteed Additions + Bonuses) is used to generate a pension (annuity) for the policyholder. The plan also provides a risk cover during the deferment period. The USP of the plan being the pension can commence at 40 years. The premiums paid are exempt under Section 80CCC of Income Tax Act.

Image shows the Immediate Annuity Plan and Deferred Annuity Plan.

What Are Tax Implications Of Annuities?

- If you invest in a deferred annuity plan You get a deduction under Section 80C and Section 80 CCC combined up to Rs 1.5 Lakhs per year from your taxable salary on the payment made towards the annuity policy.

- The 1/3rd of the amount you get as a lump sum in a deferred annuity plan is tax free under Section 10(10A).

- The annuity amount (pension you receive) from your immediate or deferred annuity after vesting (retirement age) is added to your taxable salary and taxed as per the income tax slab you fall under.

Why is annuity important?

Retirement & Pension Plans provide you with financial security so that when your professional income starts to ebb, you can still live with pride without compromising on your living standards. Given the high cost of living and rising inflation, Retirement planning has become all the more important. People who retire such as Senior citizens need regular income as a replacement for salary.People who get a lump sum at retirement can put money in immediate annuity plans.

Are Annuities Good Retirement option?

People buy annuity due to guaranteed pension for life sales pitch ,but this option offers very low returns, is tax-inefficient and hampers liquidity by locking up their money forever. Senior citizen savings schemes, mutual fund dividend schemes and tax-free bonds are other investments you should look at along with annuity

Is buying annuity compulsory?

For many investors, buying an annuity is a compulsory evil. When they retire at 60, investors in the New Pension Scheme have to put at least 40% of their corpus in an annuity. Budget 2016 has proposed to make EPF withdrawal taxable unless 60% of it is used in buying annuity.

There is no exit option after buying annuity

Once you buy annuity it, there is no way out, it like one-way street. There is no provision for surrendering the policy. Even annuities that return the corpus, give it back to the heirs of the investor only after his death. So, investors need to be extra careful before they pour their lives’ savings into an annuity.

How is the annuity rate calculated?

The annuity rate you are offered – in other words, the amount of income a provider offers you – depends on a number of factors.

- The younger you are the less income you will receive.

- Men receive a better rate because they typically do not live as long as women.

- Health and lifestyle can affect your income: those with medical conditions or unhealthy lifestyles can get more income.

How often does one receive Annuity or What is Annuity Payout Frequency?

Annuity may be paid either at monthly, quarterly, half yearly or yearly intervals. You may opt any mode of payment of Annuity.

Types of annuities

Annuity is a fixed sum that you get every year to provide for pension. They are of various types but all of them come at a fixed rate from the beginning. The rate depends on factors such as type of annuity you buy, your age and the current economic scenario. But once decided, the rate is guaranteed for life. There are types of annuities –

Insurers offer various type of annuity products ranging from pension for life, pension to spouse on the death of the annuitant, inflation-indexed annuities

- Life annuity without return of purchase price: Under this option, the individual receives pension for as long as he lives. The pension ceases on occurrence of an eventuality and the insurance contract comes to an end.

- Life annuity with return of purchase price:the individual receives pension till he is alive. In the event of an eventuality, the purchase price of the annuity is paid out to his nominees/beneficiaries. Purchase price here means the maturity amount, which includes the basic sum assured plus the bonuses/additions, if any. Ex a 60-year-old man with a corpus of Rs.1 crore, without return of purchase price annuity would give annuities at a rate of 8.72% per annum for annual payouts, whereas return of purchase price will give 7.07%.

- Joint life survivor annuity. The individual receives a pension till he is alive. In case of an eventuality, his spouse receives the pension. Apart from the options mentioned above, some companies also offer both, ‘with’ and ‘without return of purchase price’. Under the ‘Joint life / last survivor annuity with return of purchase price’, in case of an eventuality to both the individual as well as his spouse, the purchase price of the annuity is ‘returned’ to the nominee.

- Inflation-indexed annuities: in which periodic payout increases at a certain rate of interest a year. So pay-out starts with a small amount at first and gradually inflates.

- Lifetime annuity guaranteed for a certain number of years: Under this option, the individual receives a pension for a certain number of years (as prescribed by the plan) irrespective of whether he is alive for the said period or not. A major positive of this option is that, if he survives the period, he continues to receive pension for the rest of his life. For example, if the individual has opted for ‘Lifetime annuity guaranteed for 15 years’, and he meets with an eventuality after only 3 years, then his nominees will keep receiving annuity for the remaining 12 years (i.e. 15 years less 3 years). After the said 15-year period, the annuity will cease and the pension plan will draw to a close.

Life annuity without return of purchase price offers the maximum payout. It makes sense for individuals who don’t have any dependants.

Why are returns offered by annuity are low?

A major problem with annuities from insurance companies is the measly returns they offer. At a time when banks are offering 9.5-10% on fixed deposits to senior citizens, annuities offer less than 8% . Annuity products are linked to the long-term rates and are, therefore, unable to match the high, short-term rates.

The other problem is the unavailability of long-term corporate bonds, which can generate better yields than those offered by the ultra-safe, but low-yield, government bonds. Though government bonds have tenures of up to 30 years, getting enough long-term gilts is not easy. This explains, but does not justify, the yields that are significantly lower than those offered by the 30-year government bonds.

Why are Annuities not popular?

Besides the low returns, there is abject lack of transparency in the annuity market. Insurance companies are cagey about divulging their annuity rates. Many don’t have this information on their own websites, let alone the possibility of a single window comparison of the rates across insurers.Unlike other financial products, in annuities investors have to consider the impact of the 3.09% service tax. So, if you were to invest Rs. 10 lakh in an annuity, Rs. 30,900 flows out as service tax.

Immediate Annuity Plans in India

Annuity rates calculated for age 60 and a purchase price of Rs 1,00,000 from some insurance providers are given below. The annuity mode chosen is Annual.

| RANK | COMPANY | PLAN NAME | ANNUITY RATE |

| 1 | Life Insurance Corporation of India | Jeevan Akshay VI | 9350 |

| 2 | SBI Life Insurance Co. Ltd. | SBI Life – Annuity Plus | 9201 |

| 3 | Edelweiss Tokio Life Insurance Co. Ltd | Edelweiss Tokio Life – Immediate Annuity Plan | 8170 |

| 4 | Future Generali India Life Insurance Co. Ltd. | FG Immediate Annuity plan | 8092 |

| 5 | Reliance Life Insurance Co. Ltd. | Reliance Immediate Annuity Plan | 7840 |

| 6 | Aviva Life Insurance Co. India Ltd. | Aviva Annuity Plus | 7816 |

| 7 | Star Union Dai-Ichi Life Insurance Co. Ltd. | SUD Life Immediate Annuity Plus | 7090 |

| 8 | IndiaFirst Life Insurance Co. Ltd | IndiaFirst Annuity Plan | 5166 |

| 9 | Birla Sun Life Insurance Co. Ltd. | BSLI Immediate Annuity Plan | Rate Not available |

| 10 | Bajaj Allianz Life Insurance Co. Ltd. | Bajaj Allianz Pension Guarantee | Rate Not available |

| 11 | HDFC Standard Life Insurance Co. Ltd. | HDFC Life New Immediate Annuity Plan | Rate Not available |

| 12 | ICICI Prudential Life Insurance Co. Ltd. | ICICI Pru Immediate Annuity | Rate Not available |

| 13 | Kotak Mahindra Old Mutual Life Insurance Ltd. | Kotak Lifetime Income Plan | Rate Not available |

| 14 | Shriram Life Insurance Co. Ltd. | Shriram Immediate Annuity Plan | Rate Not available |

| 15 | Exide Life Insurance Co. Ltd. | Exide Life Immediate Annuity | Life Annuity not available |