Many people can’t wait to do this. As soon as they land that first steady job, they start spending money, spending and spending. Often, this is the first time in a young adult’s life that they’ve had full control over their money. After years or listening to parents not to spend on this or that. Now it’s their money and they can spend on anything that catches their eye – cool clothes to make them look hot, eating out,movies, entertainment, latest mobile and gizmos, motorbikes. Unless their parents have been very effective at conveying money ideas, these newly flush young adults make some awful spending decisions. Often I have come across the first time earners who have spent their salary in the first ten days, at times spending only to look cool. But what’s the price of cool? Let’s consider Shyam and Ram and how they spent their money on starting job.

Table of Contents

Shyam’s spending

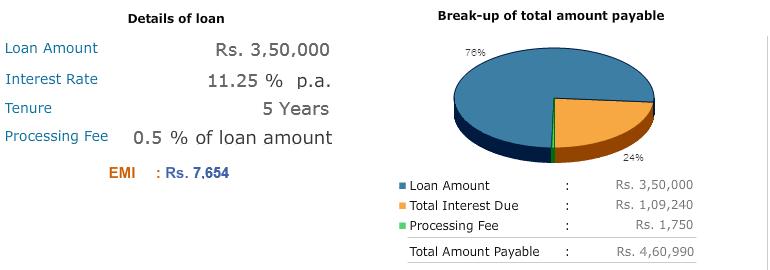

Shyam has got a job, he is living at home and saving money so that he can make down payment, say Rs 50,000 to buy a car. He takes a car loan for remaining amount , say 3,50,000 rupees. It is a five year loan at 11.25%. The EMI is only Rs 7,654. He cringes the first time he seals the envelope, kissing Rs 7,654 goodbye, but he forgets all about that when he’s driving around in the Car and his friends are telling him what a cool car it is. His total cost of owning a car is given in the picture below:

A few months later, there are scratches on the door and stains on the carpet and nobody is oohing and aahing when his car pulls into the parking lot. It’s just another car by now, but Shyam is stuck with the payments. At the end of five years, he’s sick of the car, which lost its cool a long time ago. He’s finally paid off the car loan, which cost him an extra Rs 1,09,240 in interest charges, so between the loan and the original purchase price, Shyam has invested Rs 4,60,990(four lakh sixty thousand nine hundred and ninety only) in his car, not including taxes and fees, insurance premiums, gas, oil, and maintenance. At this point, the car has dents and stains and the engine sounds a bit rough. If he sold the thing he could get maybe 75,000 for it. So what he’s got to show for his Rs 4,60,990 investment is a 4,00,000 car that he doesn’t even like anymore?

Ram’s Spending

Ram is friend of Shyam and he also works with Shyam and lives with his parents. He also saved but to buy a motor-bike. Since Ram paid cash, he didn’t have EMI payments. So instead of sending money to the finance company, he invested 4000 Rs a month in recurring deposits and Rs 3000 in mutual fund , say HDFC Top 200. His savings are as shown in picture below:

Calculations done using Bemoneyaware:Recurring Deposit Calculator and MoneyControl:SIP Calculator

Five years later, when Shyam was mailing out his last car payment, Ram has an asset of nearly Rs 5,27,699.11. He also has the motorbike, which gets him back and forth OK, and he never worries about the dents and stains because he never thought of his bike as an investment. It’s only transportation.

Best Time to Start Investing

The best time to start investing is when you’re young. The more time you have to let your investments grow, the bigger the fortune you’ll end up with.When you’re twenty or thirty, it’s hard to imagine the day will come when you’ll turn sixty-five, but if you get in the habit of saving and investing, by then your money will have been working in your favor for fifty years. Fifty years of putting money away will produce astonishing results, even if you only put away a small amount at a time.

Investing is difficult but learning about it can be an enriching experience, in more ways than one. It can put you on the road to prosperity for the rest of your life, yet most people don’t begin to think about investing until they reach middle age.

We are not saying don’t spend, please do so but apply some thought to your purchases. Carefully research any purchase over one fourth(1/4th) or half (1/2) of your income to make sure

- You actually need it: honestly evaluate the question “what do you need?” versus “what do you want?”

- That it meets your requirements,

- That you’re getting the best price on it.

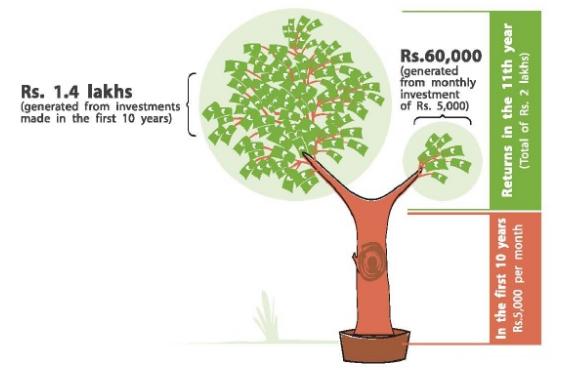

JagoInvestor:First 5 yrs of your earning life – Does it matter ? talks about how important are the first 5 years of earning life. In his book, Jago Investor, there is a chapter where he explain how your first 5 yrs investments, out of a 30 yrs period makes the 50% final corpus and rest another 25 yrs makes another 50% corpus. That means the initial 16% tenure makes 50% corpus and later 84% tenure builds rest 50% corpus – (read sample pages) “Early investing is very much like growing a tree…if you can take good care of it at the start, it will take care of itself later”

Investing is a very personal plan

Sadly we do not allow people to drive a vehicle without taking a license test but allow them to enter complex financial world without much financial education

Their are plethora of investment options and the marketeers may confuse you, the best way is to sit and work out a plan (with or without help of financial adviser.). You should be financially prepared not only for life’s predictable big events like your wedding, buying a house, educating your children, but also for your retirement years and sudden and unexpected bad news such as losing job or cost cutting etc.

Investing is not a process of getting hold of an investment agent, filling up an application form and signing a cheque, there is more to it. We explained in Why Is Investing Confusing?An infographic Investing is confusing because it is a very large subject, With many different people having as many different opinions – some suggesting real estate, some stocks, some mutual funds, some fixed deposits. In What is Investing? we explain that Investing is a plan not a product or a procedure. Before investing in any product think of Think about Liquidity,Safety,Returns,Risk,Tax. Our article Beginner to Investing talks about knowing yourself, knowing the world of investments and Beginner to Investing – Approaches, Plan, Psychology talks about various approaches like asset allocation, diversification.

In life we make the mistakes first and then it’s up to us to find the lesson, if we ever find it. Similar is world of investments, before we find the investing plan or product we shall make some mistakes. TFLguide:Club Mahindra Membership is my biggest Financial Mistake is about Hemant Beniwal, a financial planner, talking about why he bought Club Mahindra Membership. Reason of talking about mistakes is not to scare you but give you a realistic picture that all of us have made mistakes, financial mistakes even the legendary investor Warren Buffet. Just like a baby learning to walk needs to crawl and will fall before taking the steps it would take time and mistakes to get hang of investing. Bemoneyaware: Oops I did it! talks about how learning from mistakes.

[poll id=”19″]

Note: This article is based on the chapter Invest Now: What are you waiting for from book)( on GoogleBooks) ‘Learn to Earn‘ by Peter Lynch & John Rothchild.

What did you spend your first salary on? Did you buy something to just appear cool, what have been your investment mistakes? What do you find difficult about investing?

very interesting topic.

Thanks glad you liked it binod

Dear Sir,

i am earning from last two years & I have saved 60% of my salary but not in a proper way. 40% of my saving is in FD & 40% is in bank saving A/c & 20% is for health insurance.

Kindly guide me what to do.

Deepak congratulations on saving money – i’s a rarity to hear about saving from people who have been working for only 2 years. In last two years FD’s have given good returns – much better than equities though they are not tax efficient. It is difficult to suggest what should be appropriate investment plan for you as investment plan is very personal and depends on your aims, goals, risk profile, responsibilities . We are also not qualified (have only engineering degree) to answer it. We can suggest some of our articles on investing.

What is Investing?

Beginner to Investing

As we are not taught about money matters in school and colleges most of us have to start from scratch. Pick up good books on personal finance, learn about different kind of financial products, know your risk profile, goals. You can also take help of financial adviser to help you get started.

Hi Deepak

I agree with the author that it is rare to see young people saving money. But the trend is changing, as demonstrated by people like you.

To know more about investing, portfolio and ultimately to achieve financial freedom, stay in touch with my blog

http://ratrace2freedom.blogspot.in/

My upcoming book next month should be an eye opener for any one who wants to move “From Rat Race to Financial Freedom”

Congarts on your book. From Rat Race to Financial Freedom It seems interesting . I am not sure if people are saving more these days!