Employee Provident Fund (EPF) is one of the main platforms of compulsory savings in India for nearly all people working in Government, Public or Private sector Organizations. This calculator is used to calculate the total amount accumulated in EPF based on 12% Employee contribution and 3.67% employer contribution to EPF. It is based on the following assumptions:

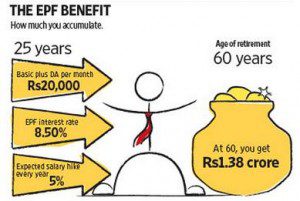

An employee starts with a basic salary of Rs. 20,000 at 25 years and works till 60 years. Every year, on average, he gets a 5% increment. He contributes 12% of his basic salary towards PF which is matched equally by one’s company, (EPF contribution is 3.67%, EPS 8.67%). Over the course of 35 years of his working life, his total contribution is Rs. 26.01 Lakhs. Of course, his company makes a contribution of Rs. 7.955 Lakhs, a total contribution of Rs 33.967 lakh. And this amount grows into – Rs. 1.38 Crores at the time of his retirement!

EPF Calculator

It uses Method I, the most common method to calculate EPF. To know more about EPF, different methods in which EPF can be calculated you may read our Basics of Employee Provident Fund: EPF, EPS, EDLIS

It uses Zoho Sheet which is like Excel. It may take a little time to load so be a little patient. You can play around with the numbers just like in excel using Options on the top-right corner of the sheet.

EPF Withdrawal amount

People usually wonder how much would they get from EPF.EPFO has been using technology to turn into a more professional and nimble organisation. It has made several other investor-friendly changes in the past. Now you can check your EPF balance through SMS, see your passbook. It has introduced online facility for transferring the balance to a new account. Going forward, all members will have a Universal Account Number(UAN) which will be portable across employers and cities. UANs have already been allotted to 4.17 crore active contributors to the EPF.

You can check your EPF balance in various ways. Our article How to get information about EPF balance : Annual Statement, SMS, E-Passbook explains the various methods of getting EPF balance in detail. We shall look in detail the SMS option

- EPF balance by SMS : From July 2011 one can check the EPF Account balance online.

- Go to www.epfindia.com/MembBal.html. Select EPFO Office

- Enter PF Account Number which is in the format : EPFO Office Code/Establishment Code(Max. 7 Digits)/Extension(Max. 3 digits)/Account Number (Max 7 digit) (PF Account Number may not have Extension code, in that case leave it blank).

- Enter your Mobile and Name, Accept Terms and condition and Submit.

- You will get SMS alert from EPFO : EE amount : Rs XXXXX and ER amount Rs:XXXXX as on <Today’s Date>(Account updated upto Date).

When you get information from EPFO the information is in terms of EE , ER and EPS.

The SMS is kind of coded so let’s try to decode it. The SMS says:

EPF Balance in A/C No. BG\BNG\0045123\000\000134 is EE Amt: Rs. 67009, ER Amt: Rs. 47000 as on 27-08-14 (Accounts updated upto 31-03-2014)-EPFO.

So what is EE and ER? Decoding the EPF balance SMS from EPFO:

- A/C No: This is your EPF account number. You EPF account number have your area code, company or establishment code and your account number.

- EE Amt: Employee Contribution i.e. your total contribution in the EPF account. The sum total of PF amount deducted monthly from your salary.

- ER Amt: Employer Contribution i.e your company contribution. The sum total of PF amount monthly contributed into your EPF account by your employer.

- As on [Date]: The date till which your monthly contribution has been updated in your EPF account. In the example above, contributions in EPF upto 27-08-14 are shown

- Accounts updated upto [Date]: This tells you till when the accounts were updated. Usually accounts are updated at the end of financial year when the interest till this date has been added into your EPF account. From the example above, it tells that interest till 31st March 2014 has been added into your EPF account. It does not show current balance of PF Account as on the day you asked for information.

You can see that EE(Employee Contribution) is more than ER(Employer Contribution). Because Employer’s contribution is split into two halves , the Pension fund(EPS) and Provident Fund(PF). SMS does not show the information about the Pension fund but the EPF passbook does.

You would get both EE which Employee’s contribution and ER which is the employer’s contribution.

If you have contributed for 5 years in EPF then there is no tax deduction but for less than 5 years TDS is deducted. Our article SMS What is EE, ER? How much on Withdrawal from EPF? explains it in detail.

- Basics of Employee Provident Fund: EPF, EPS, EDLIS

- Understanding Employee Pension Scheme or EPS

- Voluntary Provident Fund, Difference between EPF and PPF

- Tax on EPF withdrawal

- Transfer EPF account online : OTCP

- UAN or Universal Account Number and Registration of UAN

Hope you find it helpful! Please let us know whether you liked it or not by leaving a comment.