There are many ways of how to invest in a mutual fund. It can be done over the internet, the Online way of investing. In the online mode, one can either go via demat/exchange route or via mutual fund websites that deal directly with mutual fund companies. Paperwork maybe beone-time after which subsequent transactions can be made with a few mouse clicks. The other way of is paper-pen way where the investor will be required to fill up forms and write cheques for every investment, called the Offline way. Or You can contact a independent Financial advisor(IFA) who will come home, fill the form, complete the documentation and you just have to write cheques. Since 1 Janurary 2013 there is another way to invest in Mutual Funds called as the Direct Way of Investing. This article tries to explain the direct way of investing in Mutual Fund? What it is? How to invest directly, how to move from existing to direct plan.

Table of Contents

What is a Direct Plan?

Direct plans are when a person invests directly in a mutual fund company, without going through an advisor or an investment service. The direct plan has

- Separate Net Asset Value (NAV)

- Lower expense ratio ,

Mutual Funds have classified the existing plans as Regular plan and have created identical schemes and their related options under the Direct plan as well. When you invest in a mutual fund’s direct plan you deal with the Mutual Fund directly, while in a regular plan you invest through a distributor or advisor. All Plans offered currently under “Existing Plans” of the Schemes are also available for the “Direct Plan“. Thus, there shall be 2 plans available for each of the existing schemes

- Regular/Existing Plan

- Direct Plan

For example HDFC Top 200 Dividend and HDFC Top 200 Direct Dividend , Templeton India Short-term Income Ret and Templeton India Short-term Income Ret

Only the following three modes of investment will count as direct investments:

- Submitting your application at the fund house’s branch office

- Registering with the fund house’s own portal and investing through it

- Submitting your applications at registrars of fund houses such as CAMS and Karvy.

How different is direct plan from existing plan?

Though Direct and Existing Mutual Funds are different plans in terms of NAV and expense ratio they are similar in all other aspects.

- Scheme characteristics such as Investment Objective, Asset Allocation Pattern, Investment Strategy, risk factors, Fund Manager, facilities offered and terms and conditions including load structure will be the same.

- The portfolio(stocks in which mutual fund invests) will also be the same for both “Existing plan” and “Direct Plan”

- Taxation(short term, long term) remains the same for both plans.

Difference is the way in which you invest – directly or through a Mutual Fund distributor.

What is Net Asset Value (NAV) ?

The NAV or Net Asset Value per unit is the value of one unit in a fund. When you buy Mutual Fund units, you pay the current NAV per unit, plus any sales charge (also called a sales load). When you sell your units, the fund will pay you NAV less any other charges such as exit load.

Technically Net Asset Value is the market value of the assets of the scheme minus its liabilities. Mutual funds are a type of pooled trust fund that invest in other assets such as stocks and bonds. The value of a mutual fund’s underlying positions is added up by accounting firms based upon the closing price of the stock market and others, and used to determine the value of all the mutual fund’s holdings. Any debts or liabilities of the mutual fund, such as shorted stock, is deducted to calculate the net asset value, or NAV, as it is often called.

The per unit NAV is the net asset value of the scheme divided by the number of units outstanding on the Valuation Date. A fund’s NAV goes up or down daily as its holdings change in value. Please note that a high value of NAV per unit of the Fund does not reflect that the Fund is too expensive, and vice verse. Generally, a high NAV per unit shows the Fund has been set up long ago so its assets have experienced a high increase. WealthWisher How is Mutual Fund Net Asset Value (NAV) calculated explains in detail.

What is expense ratio ?

Quoting from valueresearchonline Learn Expense Ratio Like a doctor who charges you for his service, mutual funds too charge a fee for managing your money. This involves the fund management fee, agent commissions, registrar fees, and selling and promoting expenses. Funds’ NAVs are reported net of fees and expenses, therefore, it is necessary to know how much the fund is deducting. Expenses are charged at all times. Whether a fund generates positive or negative returns, expenses are always there.

Expense ratio states how much you pay a fund in percentage term every year to manage your money. For example, if you invest Rs 10,000 in a fund with an expense ratio of 1.5 per cent, then you are paying the fund Rs 150 to manage your money. In other words, if a fund earns 10 per cent and has a 1.5 per cent expense ratio, it would mean an 8.5 per cent return for an investor.

Expense ratio is disclosed every March and September and is expressed as a percentage of the fund’s average weekly net assets. Expense ratio can be found in the half-yearly reports of the AMC or mutual fund websites like valueresearchonline.com

Different funds have different expense ratios. But the Securities & Exchange Board of India(SEBI) has stipulated a limit that a fund can charge. Equity funds can charge a maximum of 2.5 per cent, whereas a debt fund can charge 2.25 per cent of the average weekly net assets. Livemint’s Will a hike in expense ratio matter to you? (Jul 2012) explains the expense ratio in detail.

There are other costs like when you invest (nominal fee, entry load), when you exit (exit load) for which you can read our article Investing in Mutual Funds for Beginner

What difference does expense ratio make?

Since expense is charged regularly (every year), a high expense ratio over the long-term may eat into your returns massively through power of compounding. For example, Rs 1 lakh over 10 years at the rate of 15 per cent will grow to Rs 4.05 lakh. But if we consider an expense ratio of 1.5 per cent, your actual total returns would be Rs 3.55 lakh, nearly 14% less than what would have been achieved without any expense charge.

Formula for calculating returns with and without expense ratio in the Mutual Fund is given below. x is return at no cost , c is expense ratio so return is x-c, then the asset value P(n) at the end of n years is (where P is the starting amount):

P1(n) = P * (1 + x) ^ n (without expense ratio)

P2(n) = P* (1 + x -c) ^ n (with expense ratio)

The wide divergence of returns between ‘good’ and ‘bad’ funds in India makes the expense ratio secondary. But if you find two similar funds, the expense ratio can be a differentiator.

Why is the expense ratio lower in Direct Plan?

The “Direct Plan” has a lower expense ratio as compared to existing plans in the same schemes, as there is no commission to be paid to the distributor under this plan.

Why is NAV different between Direct and Existing Plan?

As there is a difference in the expenses charged by the Direct and Existing Plans under every scheme, there will be a difference in the NAVs for both these Plans. As explained earlier the expense ratio is the total annual expenses charged to the scheme, which include the Asset Management fee, Marketing expenses, audit fee, custodian fee and so on. These expenses are divided by the number of units to get the expense to be deducted per unit. Let us take a simplistic example to illustrate this point. From SmartInvestor’s Lengthy process, but higher returns in direct MFs

| Direct | Regular | |

| Number of units | 10,00,000 | 10,00,000 |

| Current NAV | 20 | 20 |

| Value of assets | 2,00,00,000 | 2,00,00,000 |

| Expenses per annum | 2.00% | 2.50% |

| Total Expenses charged | 4,00,000 | 5,00,000 |

| Expenses per unit | 0.4 | 0.5 |

| NAV after expenses | 19.6 | 19.5 |

| Note – NAV is calculated daily after deducting the expenses applicable on a pro-rata basis not as shown above. The above is just to illustrate the principle as to why NAV in direct plan is higher than Regular plan. |

||

When were the “Direct Plans” launched?

The “Direct Plans” were launched with effect from January 1, 2013. All the mutual funds launched Direct Plans for their existing schemes and options (Dividend, Growth). The NAV of the direct plan was the same as that for the existing plan on December 31, 2012.

Which schemes are not eligible under the “Direct Plan”?

“Direct Plan” will not include :

- Plans under existing schemes which are discontinued for further subscriptions.

- Exchange Traded Funds

- Stock exchange platforms (BSE STaR or NSE MFSS) in which one buys mutual fund units in demat form.

- Online Platforms like icicidirect.com or fundsindia

As Quantum mutual fund does not use distributors to sell any of its schemes, its expense ratios already do not include any trail or distributor commissions. Therefore, all investments in the Quantum funds are Direct.

Should you go for the Direct Plan?

Though institutional clients may move quickly to direct plans, individual investors are expected to remain invested in regular plans as they need some handholding to choose the right product and handle transactions involving paperwork. A direct plan works for those who do not require any advice for investing and can track their investments on their own. Individual investors who are conversant with the range of mutual fund products and capable of choosing schemes, are technology savy and do not require servicing provided by the advisors, have the time to manage their portfolios over the long-term can go in for this option.

How can you invest in “Direct Plan”?

You will have to handle the documentation yourself. If you are investing in a fund house for the first time, you will have to download the application form from the AMC’s website, fill it up and submit it, along with the accompanying documents, to the fund house. Your subsequent purchases and redemptions can be done online. To help investors move to direct plan YourBse Direct investment through AMCs has provided links and tips on how to invest online for new and existing schemes. For Quantum Mutual fund New Scheme, Karvy Reliance Online, UTI new Purchase a new investor can buy a scheme it by just sending the forms by posts.

You need to be KYC (Know your customer) compliant. If you have been a laggard regarding your KYC formalities, you’ll have to visit the nearest branch office of the AMC since updating KYC information requires in-person verification. You can check you KYC status at CVL Inquiry on KYC

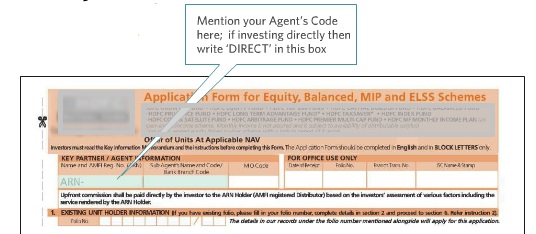

While Filling the Form : Some Investors subscribing under Direct Plan of any scheme will have to indicate

- The Scheme / Plan name in the application followed by “Direct Plan”. For example, HDFC Cash Management Fund – Treasury Advantage Plan – Direct Plan.

- Additionally, investors should mention “Direct” in the ARN column of the application form as shown below

If you don’t mention “Direct Plan” in the scheme name and also don’t mention broker code on the purchase request then still it will be considered as investment in Direct Plan of the scheme.

If the distributor code is mentioned in the application form, but “Direct Plan” is indicated in the scheme name then the distributor code will be ignored and the units for the investment will be allotted under Direct Plan.

Note: InvestorFirst How to fill the mutual fund form shows the entire process with images

Existing investments in Regular plan

For those investors who have already made investments in Mutual Fund directly or through an agent/distributor/Online platforms can move to direct plan. This section explains costs involved in shifting and how to shift?

Will the investment already made(lump sum or SIP) without distributor code in the existing/regular plan be converted into the direct plan automatically?

No. It will continue to remain in the existing/regular plan. Any such shift of units from one Mutual Fund Scheme to another scheme of the same fund family is called as switch in Mutual Funds language. It is like redeeming (selling) mutual funds unit in one scheme and buying new scheme. It may attract exit loads and capital gains tax That is the reason why fund houses have not shifted your existing units.

What costs does a switch in Mutual Fund involve?

Switching from one scheme or Mutual Fund to another in the same fund house involves :

- Exit Load : It varies from scheme to scheme. But in most cases, schemes generally charge 1% exit load for units that have not completed one year.

- Capital Gain Tax

- Equity Funds : You have to pay short-term capital gains tax (15.45%) on switched equity investments that have not completed one year. For equity investments that completed more than one year (if securities transaction tax(STT) paid ), you need not pay any capital gains tax.

- Non-Equity Funds: Ex: Debt, ETF, Gold Funds. If held for more than an year Long Term capital gains would be subject to tax at the lower of 10% of the capital gains computed without indexation of cost or 20% of the capital gains computed with indexation of cost. If held for less than an year short-term capital gains (STCG) would be chargeable to tax at the normal slab rates of tax applicable to you.

How to switch : You need to fill in a transaction slip, which you can download from Mutual Fund’s website or detach from the bottom of your account statement. The same can be submitted at any of their Official points of acceptance of transactions. Alternatively, if you have applied for a PIN and received the same, you can also switch through the ,online transacting facility offered by Mutual Funds.

Our calculator Capital Gain Calculator can be used for calculating capital gain tax.Please understand or consult professional tax advisor before initiating such requests.

What does a switch to Direct Plan attract exit loads?

It depends on which plan you switch from, into which plan and when. If you shift your investment made earlier through

- The direct mode to the new direct plan, then you don’t need to pay an exit load. Note that although exit loads have been waived for switches made from direct mode to direct plan, the exit load validity still remains on complete withdrawal (from the initial date of investment).

- If you had invested through a distributor before and would now like to switch to the direct plan, you will need to pay an exit load at the time of switch.

I have some investments made through some distributors in my folio. Can I convert those investments under direct plan?

Yes. You can submit a switch request for converting the same from existing/regular plan to direct plan.

For existing SIPS. You have to submit a written request , some days(around 15 days) prior to the next installment date. Intervening installments, if any, will continue to be processed under the “Existing Plan”.

References : For details on Direct Way of investing in Mutual Funds you can read HDFC AMC FAQ on Direct Plan, Canararobeco FAQ on direct plan (we are not affliated to HDFC AMC or Canara Robeco)

Related Articles :

- Investing in Mutual Funds for Beginner

- Not All Mutual Funds Do Well -the Laggards

- Returns of Stock Market, Gold, Real Estate,Fixed Deposit

- Basics of Capital Gain

How do you invest in Mutual Funds? Are you planning to invest directly? Have you made the switch to direct way of investing? How easy or difficult was it? Is direct way of investing worth it?

Great Post!!!!!!

Best Information shared by you.

to know more about the stock brokerage plans visit https://wisdomcapital.in

Very informative and insightful article. Thanks for sharing.

Thanks for throwing light on NAV and different investment plans. I am slowly turning into investments but am still in a very confused state. This article has been extremely helpful. Hope to read more similar and useful write ups.

The Q$A format makes this easier to understand.

Direct plans would definitely give higher returns in the long run than regular plans. This is truer about equity plans which have higher expense ratio. What I suggest is you should go for direct plan if you have at least basic level understanding about selecting funds and are willing to spend some time doing the initial requirements yourself.

Before switching existing investments try avoiding exit load and short term capital gain tax.We have written posts earlier this year on Direct Plan. Please do have a look at it

http://www.knowledge.fintotal.com/article/How-to-Switch-Your-Existing-Investment-to-Direct-Plan-in-Mutual-Funds/5824

http://www.knowledge.fintotal.com/article/Is-It-Best-to-Opt-for-Direct-Plan-in-Mutual-Funds/5825

Thanks Basith for link to your articles. As you mentioned one should go for Direct Investing if you have at least basic level understanding about selecting funds and are willing to spend some time doing the initial requirements yourself.

The Q$A format makes this easier to understand.

Direct plans would definitely give higher returns in the long run than regular plans. This is truer about equity plans which have higher expense ratio. What I suggest is you should go for direct plan if you have at least basic level understanding about selecting funds and are willing to spend some time doing the initial requirements yourself.

Before switching existing investments try avoiding exit load and short term capital gain tax.We have written posts earlier this year on Direct Plan. Please do have a look at it

http://www.knowledge.fintotal.com/article/How-to-Switch-Your-Existing-Investment-to-Direct-Plan-in-Mutual-Funds/5824

http://www.knowledge.fintotal.com/article/Is-It-Best-to-Opt-for-Direct-Plan-in-Mutual-Funds/5825

Thanks Basith for link to your articles. As you mentioned one should go for Direct Investing if you have at least basic level understanding about selecting funds and are willing to spend some time doing the initial requirements yourself.

Basically there should not be any discrimination like direct investors & regular investors.If it is there then there should be some criteria to identify such informed investors who are willing to invest directly.

Investing directly means we are assuming that he/she understands each & everything especially risk involved in the mutual funds….but this need to be endorsed by some criteria like having qualified for examination or similar thing…

Basically there should not be any discrimination like direct investors & regular investors.If it is there then there should be some criteria to identify such informed investors who are willing to invest directly.

Investing directly means we are assuming that he/she understands each & everything especially risk involved in the mutual funds….but this need to be endorsed by some criteria like having qualified for examination or similar thing…

Direct mutual funds is a wrong move & due to lack of interest / information retail investors are unlikely to gain from it.Most of the retail investors still invests only on Trial & Error basis….& Real beneficial category of direct investing is only institutional investor or HNI.

I think there is need of Exam for investor seeking to invest directly in mutual funds & qualified investors only need to allow to invest directly..and its there in few other countries where there is facility of direct investment plans.

You mean to say that people need help in selecting mutual fund. Have you experienced it? Why is it so?

Basically there should not be any discrimination like direct investors & regular investors.If it is there then there should be some criteria to identify such informed investors who are willing to invest directly.

Investing directly means we are assuming that he/she understands each & everything especially risk involved in the mutual funds….but this need to be endorsed by some criteria like having qualified for examination or similar thing.

(Reproduced above comment here as it went to wrong position)

Agree with you Paresh about Investing directly means we are assuming that he/she understands each & everything especially risk involved in the mutual funds.

It’s an initiative by SEBI to identify such informed investors who are willing to invest directly. No harm in trying, it might not work and fizzle out. Let it meet the test of time.

Do you know of people who moved to direct plan? Have you moved to direct plan?

I have seen investors switching in to direct mode but for having the necessary effect one need to be consistent in investing & need to have long term approach.

We have quantum schemes which are by default direct but its still give away for schemes of other mutual funds & they are in regular mode.

It’s a transition stage and I assume soon it would settle down, People at times become too focused on the small things that they miss the big picture.

Direct mutual funds is a wrong move & due to lack of interest / information retail investors are unlikely to gain from it.Most of the retail investors still invests only on Trial & Error basis….& Real beneficial category of direct investing is only institutional investor or HNI.

I think there is need of Exam for investor seeking to invest directly in mutual funds & qualified investors only need to allow to invest directly..and its there in few other countries where there is facility of direct investment plans.

You mean to say that people need help in selecting mutual fund. Have you experienced it? Why is it so?

Basically there should not be any discrimination like direct investors & regular investors.If it is there then there should be some criteria to identify such informed investors who are willing to invest directly.

Investing directly means we are assuming that he/she understands each & everything especially risk involved in the mutual funds….but this need to be endorsed by some criteria like having qualified for examination or similar thing.

(Reproduced above comment here as it went to wrong position)

Agree with you Paresh about Investing directly means we are assuming that he/she understands each & everything especially risk involved in the mutual funds.

It’s an initiative by SEBI to identify such informed investors who are willing to invest directly. No harm in trying, it might not work and fizzle out. Let it meet the test of time.

Do you know of people who moved to direct plan? Have you moved to direct plan?

I have seen investors switching in to direct mode but for having the necessary effect one need to be consistent in investing & need to have long term approach.

We have quantum schemes which are by default direct but its still give away for schemes of other mutual funds & they are in regular mode.

It’s a transition stage and I assume soon it would settle down, People at times become too focused on the small things that they miss the big picture.