If you apply for EPF withdrawal and your bank details(name, account number or IFSC code) are not correct then though your EPF withdrawal will be settled money will not be credited in your account. In such a case you need to submit a reauthorization letter to the Regional EPFO office.

I have submitted my PF withdrawal form to delhi office(Nehru place) in july. I have recd no intimation nor the PF amount till date. 2)I have recently changed my Bank account too. I have closed the one which i have given for PF withdrawal. Plz help me resolve both my issues. (Src: citehr)

I resigned from my previous job last year. About 2 months ago, I submitted my PF withdrawal forms at the PF office in Bangalore. Yesterday I got my PF money, but I noticed that its lesser than what I had estimated, After some rough calculations, I found out that the Pension fund money has not been credited. I checked the photocopies of the forms again, and to my horror, I found that the bank account number in the pension form (Form 10C) had missed a digit, and thus invalid. (Src: Alok at Bemoneyaware)

Table of Contents

Procedure to withdraw from EPF account

Let's recap the procedure to withdraw from EPF. Quoting from our article Withdrawal or Transfer of Employee Provident Fund Employee can withdraw from EPF by filling Form 19(pdf) which is available with the HR department of his ex-employer or can download it from EPFI webpage of download forms. One can withdraw only after a waiting period of two months after resigning. The rules are that an employee should not be in employment for two months after resigning if he has to withdraw his P.F amount. Form is submitted to the regional provident fund Commissioner office after which the employee receives his amount along with interest within a period of 90 days. While submitting the EPF/EPS withdrawal form along with the bank details one needs to submit a cancelled cheque with the form. EPF office tries to do appropriate checking. Quoting from their circular by EPFO office (pdf format) It is also reiterated that considering large volumes, bank may not be in a position to check member name and account number which increases likelihood of wrong payments. Considering same, it is mandatory that three level check of comparing member name and account number from passbook copy/cancelled cheque should be done meticulously. As per EPF:FAQ webpage there are two modes of payment. Quoting from there:20) What is the mode of payment of Provident Fund and Employees' Deposit Linked Insurance dues?

Provident Fund & Employees' Deposit Linked Insurance dues is paid by money order/ by deposit in payees' bank a/c/ through employer/ by depositing the cheque in payees' name or part of amount in annuity scheme in any nationalised bank. Payment by money order is allowed where the amount is not more than Rs. 2000/-.

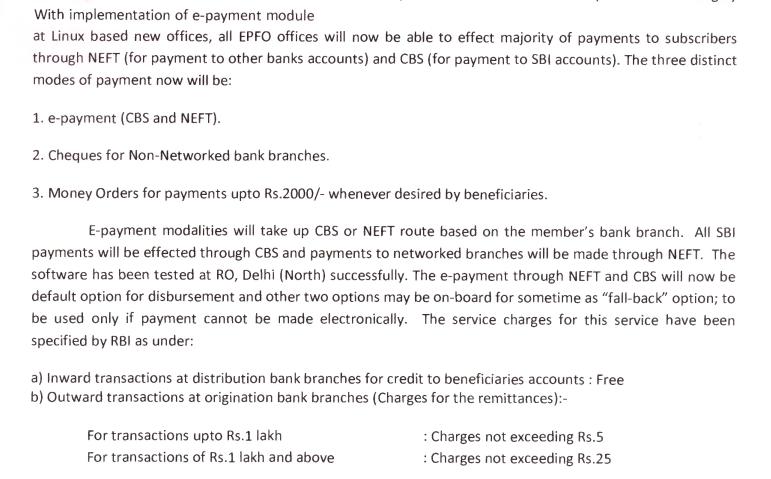

Cheque issued is of State Bank Of India. In 2010 as per the circular by EPFO office(pdf format) EPFO is moving towards three modes of payment of EPF refund as shown in picture below (picture is from the circular): But what does EPFO do if bank account is closed and cheque is returned. Quoting from EPF:FAQ webpage22) In case of returning of cheque what is the procedure to be followed?

Generally the cheques are returned by the bankers when the a/c number is furnished incorrect or a/c has been closed. On receipt of the cheque from the bankers the Provident Fund office will write to the member & employer about the fact & request them to intimate the bank, a/c number & detailed address. In case, the member comes to know about returning of the cheque before this, he can write to the Provident Fund office through his former employer regarding his present address & bank a/c number.

What if the bank account is closed/or bank details don't match due to name mismatch or number of digits after you get the refund cheque? In such case does one need to re submit the withdrawal application again. In such a case one does not need to submit the form again. No one does not need to refill and resubmit the form. One just needs to fill the reauthorization form.PF Reauthorization Form

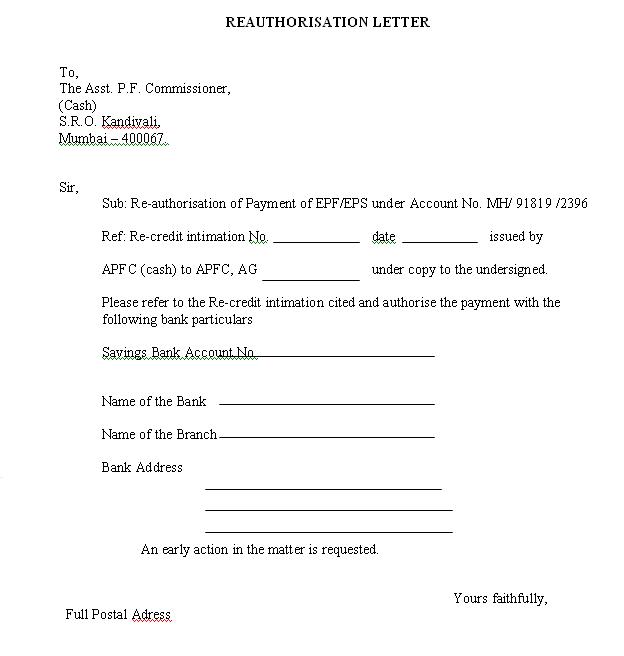

Sample PF Re authorization Form is shown in image below. It is for Mumbai. We found it on googling from CitehrRef: Re-Credit intimation No. ________ date ________ issued by APFC (Cash) to APFC, AG ______ under copy to the undersigned.

The form is pretty straight forward for the bangalore PF office. I never had to fill the details you have mentioned. (maybe they have different forms?) You have to fill up the PF account number that is already known. And of course the correct name, bank address and account number with the seal and signature of the employer who attests to verify your signature in this form which is mandatory. The official there told me that they will fill up the rest of the columns.

- Correct name,

- Bank address and

- Account number

- The seal and signature of the employer who attests to verify your signature in this form which is mandatory.

- Basics of Employee Provident Fund: EPF, EPS, EDLIS

- Withdrawal or Transfer of Employee Provident Fund

- Salary, Net Salary, Gross Salary, Cost to Company: What is the difference

- Cheque: What is cheque,Parts of cheque,Kinds of cheque,Money order,ECS,EFT, NEFT, RTGS

- Understanding Employee Pension Scheme or EPS

What happens to EPF withdrawal when bank details are incorrect?

What if the bank account is closed/or bank details don’t match due to name mismatch or number of digits or incorrect IFSC code? Once NEFT fails then EPF amount will be credited back to the EPFO bank account within 4-6 days.

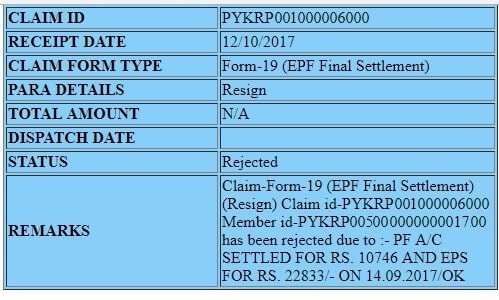

In such case does one need to reapply for the EPF withdrawal? No, one does not need to reapply for EPF Withdrawal. If you reapply your claim will get rejected as shown in the message below.

Reauthorization Form of EPFO

The solution is to submit the reauthorization letter to the Regional EPFO office offline with correct bank details and cancelled cheque leaf. After submitting EPF re-authorization letter, it takes 10-15 days to credit your EPF amount to the correct bank account.

The details required in reauthorization form are as follows:

- Correct name,

- Bank address and

- Account number

- The seal and signature of the employer/Authorized Official who attests to verify your signature.

The text of the form is given below. We have got this from CiteHr here,from post on 18 May 2018. To get details about your Regional EPFO please scroll down and read the section Regional EPFO office.

RE ISSUE PROFORMA

To, Regional Provident Fund Commissioner,

Employees Provident Fund Organization,

<Region of EPFO>

Subject: Request for re-authorization of returned Cheque/NEFT in r/0 of

Shri/Smt./Kum_____________

Bearing P.F.No. _______________

NEFT/Cheque No. ___________________Date___________ Amount________

NEFT/Cheque No. ___________________Date___________ Amount________.

Sir/Madam,

The Cheque/Neff payment towards the settlement of my Provident Fund/Family Pension Fund amount has not been credited to my SB A/c due to incorrect details.

Kindly re-issue the amount. My Bank details are as under-

1. Saving Bank A/c No. _____________________________

2. Name of the Bank _____________________________

3. Branch _____________________________

4. Full Address of Bank _____________________________

Residential Address _____________________________

____________________________________________

Yours Faithfully,

(Signature of the Member)

Enclosed: Cancelled Cheque.

I hereby identify & Certify that the applicant has signed/thumb impressed before me.

Signature Of Employer/Authorized Official with office seal

Get Details of Your Regional EPFO office

You can also visit the regional EPFO office and try to get information. Please take all the documents like Payslip, Letter from the employer, Identity proof like Aadhaar etc to the Regional EPFO office.

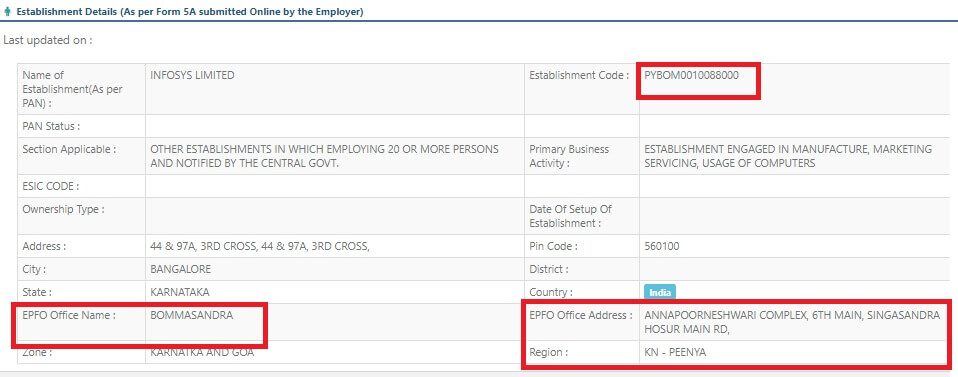

Our article How to find your employer’s EPFO office and EPFO office Phone Numbers explains it in detail.

-

- Go to http://www.epfindia.gov.in/

- Click on Our Services->Employers

- Click on Establishment Search. You can enter Establishment code/ name of the office

- Enter Captcha

- Click on Search

- After selecting your company/employer Click View Details on the company

- Scroll down to find Establishment Details which gives the name of Regional EPFO office and address.

- You can then go to EPF website and click on Contact Us to find the contact details of your regional EPFO. You need to search for Zonal office and then the Regional office name given as EPFO office name as shown below.

We are grateful to Anil for sharing his experience. If you know about it or have some experience to share regarding Reauthorization or EPFO refund please update in the comments section.

hi sir my pf balance shows 0 balance but the amount is settled and returned it’s been more than a week still it’s not updated in my pf passbook but I submitted reauthorization form will I get the amount or will it be rejected since pf passbook is not updated?

After how many days it takes for settled and returned amount to reflect in passbook

In re authorisation for there is given an option to fill pf number in that place I have given UAN Number by mistake and did not mention pf account Number anywhere in the form … Will it be a problem? Will my form be processed further?

Depends on the PF officer.

Can you submit the form again?

Hi sir, there is lot of confusion about bank account number, should be 11 digit or more. Some members have posted that there claim rejected because the account no is more than 11 digit and some got rejected due less than 11. If my cheque leaf has 11 digit account number then I should write same number, right? Otherwise they will reject because number does not match with cheque.

If SBI account then add even 0’s before the account number

Dear Sir

I have a PF account associated with your PF office Muzaffarpur, Bihar (UAN-100799386997). This month (Sept 2020), the first week, I applied for PF advance as I was affected by Covid 19 but unfortunately the SBI account Number – 20059260972, which was linked to my PF account was closed by the bank due to KYC issue. I was not aware of this , I came to know about this only on 12-09-2020 , when I checked in to my internet banking . Immediately I sent an email to the Regional PF official email id requesting to reject my request for PF advance. But on 14-09-2020, when I, tracked my claim it showed that the claim is settled.

Sir, I had talked to the bank they said that since the account is closed it will return back to PF account.

Sir, I have send several emails to the PF office but no response.

As on date, my PF passbook is showing as amount withdrawn. Kindly help me Sir.

Exactly the same problem for me too. please let me know if you find the solution

Call me 9765678111

Will assist you thank you

I have applied for PF withdrawal on OUTBREAK OF PANDEMIC (COVID-19).

My Claim is settled but amount is not credited. When i raised complaint in Grievance Management System

i got response

“Amt returned back from Bank to this office till date. Please submit Re-issue form along with cancelled cheque, copy of Pan, Aadhar through the employer for re-credited the same.”

So my concern is,

When i send re-authorization letter to EPFO office, Can i mention different bank account details(not linked to my UAN)?

Is it compulsory to mention only Linked bank account details?

Yes, one should use linked bank account details.

Exactly the same problem. Please let me know if you find the solution.

Call me 9765678111

Will assist you thank you

Hi,

I got a confirmation from PF office through my HR team that the NEFT was returned to PF office because the leading zero’s in my account number was auto-truncated. They have asked me to apply for re-issue form. Can you please let me know if the Re-issue form can be done online?

Because my HR department is not working from office due to COVID and it is not possible for them to provide attestation on physical Reissue form. Can you please suggest an alternative in this case?

Thanks,

Chiranthan

Try submitting the form at EPFO complaint site with all documents(reissue form, bank cheque book) as explained in the article

How to register EPF complaint at EPF Grievance

Should I use 11 digit bank account no or 17 digit six 0 front

All 17 digits. Don’t ignore 0.

Usually, SBI Account holders have this problem.

Is your account in SBI?

Hi Sir,

I have kyc of my 17 digit SBI account (started with zeros)with my UAN but in my cheque and passbook have 11 digit account number. My claims got rejected yesterday Your Claim [ Claim Id – xxxxxxx ] has been rejected due to : 1) BANK ACCOUNT NO. IS NOT VALID MORE THAN 11 DIGIT 2) INCOMPLETE BANK DETAILS

andYour Claim [ Claim Id – xxxxxx ] has been rejected due to : 1) PL UPDATED KYC OF 11 DIGIT BANK ACCOUNT NO. 2) INCOMPLETE BANK DETAILS.

Please guide me about this

You need to give 17 digits of bank account number in UAN.

Please add the Bank details with all 17 digits bank account number in KYC section.

Get it approved by your employer.

Then reapply

Call me 9765678111

Will assist you thank you

I have applied PF advance on 02 nd April on 07th April it’s showing claim is settled but returned.Though I have checked that my bank name,account number,IFSC code is correct.Please suggest the way forward.

Raise complaint at epf grievance site as explained in the article HHow to register EPF complaint at EPF Grievance website online

Anyone is there plz tell me how many days will take to credit the PF Amount after giving Reauthorisation form .

I have applied PF BUT MY REQUEST GOT REJECTED DUE TO BELOW 2 REASONS. PLEASE,anybody help me regarding this. 1) BANK MUNCH STATE BANK OF INDIA PL NEW BANK ACCONT 2) INCOMPLETE BANK DETAILS

Sir

My PF claim form has also been rejected .

They are providing the reason that bank pass book not available with claim form and incomplete bank details

But I provided everything.

I’m currently working in the institution but my bank account is not a salary account is it has created a problem..please provide me a solution…

Hi Sir,

I raised PF claim and it got rejected due to following reason. Anybody please let me know what should I do to get the claim approved.

Reason for rejection:

1) REQUESTED TO UPLOAD SCHEDULED COMMERCIAL BANK IN KYC DETAILS AND FORWARD CLAIM 2) INCOMPLETE BANK DETAILS

Your bank details are incomplete.

Please add bank details and get it approved by employer

Dear sir,

pf reauthorization form submitted before 19 days but status showing under process. what can i do ?

Regards,

Siddharth Ghadge.

From where you checked the status of re-authorisation from, as few days back i have couriered my documents to mumbai of office as i am residing in gurgaon, please suggest.

Sir my pf is setteld but bank account no is incorrect and bank account is closed.

Sir refund payment prosses.

hi, My pf amount transfer was initiated to to my inactive saving account of katak bank and now i dont know what will happen. no satisfactory reply is been given by bank.

Dear Sir,

I have submitted for Claim and the claim was settled. later I found my account number had one missing number but the last 4 digits were correct and verified.

In such a case will I receive the claim in my account or will it be transferred back to my EPF account.

Thanx a lot in advance for your valuable advice

It will be transferred back to your pf account, i faced the same problem. You just need to give reauthorization form with full bank details, account number and get it attested by your employer or (prev employer) and submit it to pf office

I have submitted reauthorization form with emplyoer attestation on 27th August. But i am not getting any reply to my emails and grievances. How long does it take after this form is submitted. Please let me know. Shall i raise a RTI request?

Did you get the PF or is it still pending?

Normally how many days will take to release the PF amount after giving the Reauthorisation form in PF Office

There is no fixed deadline, depends on Regional EPFO office.

Some approve it in a few days and some almost take a month

I am to facing the same problem my last 5digits of acct no is crrt but I missed a 0 in the beginning so will my of amount be claimed or not. If not claimed then how to resolve this issue currently my claim status is settled

I have claimed form 31 but it got rejected. the reason they stated was :

Claim-Form-31 (EPF Advance)(Construction of House) Claim id-DSNHP190550081796 Member id-DSNHP15481740000000362 has been rejected due to :- YOU HAVE SUBMITTED ONLINE CLAIM FORM BUT PDF NOT OPENED IN OUR SYSTEM/SUBJECT TO 100% CHECKED BY DA.

I don’t know what that means. My account no and Aadhar are correct and linked in UAN portal, Kindly Advice ????

ADD CORRECT FILE FORMAT IN EXCEL OR JPG

Resubmit claim, this is technical error in PF website.

first I applied claim thourgh online giving MY sbi account number prefixing six zero and claim got rejected as required only 11 degits of account number.

second time now submitted claim online by removing Six Zeros prefixed in front of my account number and claim status shows neft made on 03.06.2019 but 5 days over not credited

please advice i can get credit or not

jesuraj

Hi Jesuraj

I’m facing the same problem

Can you please share your mobile number so that I can call you. Or you can call me on 9954791159

Hi Surjya, did you get pf advance amount with 11 digit SBI account number? Or they ask for 17 digits?

Hi Jesuraj, did you get the NEFT credited? I have mentioned my SBI 11 digit account number and pf advance claim is in process, so wanted to check if they accepted your 11 digit account number second time?

Hi Jesuraj, did you get the NEFT credited? I have mentioned my SBI 11 digit account number and pf advance claim is in process, so wanted to check if they accepted your 11 digit account number second time?

I applied for EPF withdrawal but now I found that my account name in the Bank does not contain middle name whereas in PF account my name contains the middle name also. Will missing of middle name in Bank account reject the PF amount OR the missing of middle does not make any difference.

What is the name mentioned in the Bank details for EPF?

Please log in to UAN member portal and check KYC

Hi,

I have a similar problem, and thanks to your advise i am ready to fill a re-issue form. I am stuck in a situation now where i need your help. My PF account is with Thane Regional Office and i reside in Hyderabad. Do i need to go to Thane for submitting this ? or can i submit the re-issue form in Hyderabad Regional office ?

Thanks in advance.

Manindra

Dear Sir,

I am check the your pf advance details you will check your bank details are one digit missing 1st are resubmitted your correct bank details after are re clime of your advance amount.

so you changed your bank details before applying for EPF advance amount.

Were your new bank details approved by the employer?

While claiming you have to enter the last 4 digits of your bank account, was it verified.

If yes, claim money would come to your bank account.

Hi,

I have a similar problem, and thanks to your advise i am ready to fill a re-issue form. I am stuck in a situation now where i need your help. My PF account is with Thane Regional Office and i reside in Hyderabad. Do i need to go to Thane for submitting this ? or can i submit the re-issue form in Hyderabad Regional office ?

Thanks in advnavce.

Manindra

I have claimed form 31 but it got rejected. the reason they stated is :

Claim-Form-31 (EPF Advance)(Non Receipt of Wages (>2 months)) Claim id-WBCAL190150002539 Member id-WBCAL00619570000000074 has been rejected due to :- ENTER 11 DIGIT BANK A/C NO./YEAH

I don’t know what that means. My account no is correct, I gave this format 000000XXXXXXX3684. Should i have to remove the 5 ZEROs before my account no? Please help.

I have the same issue with PF withdrawal.

Could you help with solution

Please call us on 9582003311

Claim-Form-31 (EPF Advance)(Non Receipt of Wages (>2 months)) Claim id-WBCAL190150002539 Member id-WBCAL00619570000000074 has been rejected due to :- ENTER 11 DIGIT BANK A/C NO./YEAH

I don’t know what that means. My account no is correct, I gave this format 000000XXXXXXX3684. Should i have to remove the 5 ZEROs before my account no? Please help.

please guide what is the correct way & solution.

I have PF claimed through portal on 04.01.2019 till this is showing Under Process.

At the same time we check the our IFSC code wrong in the portal and we correct the same in the portal on 14.01.2019. Today we check the status and found settled but we are not received the amount. Please advice.

My UAN no. 100953650985

Online Claim Tracking ID. 10095365098506001

Regards

Surajit Banerjee

have you received or not because I have an same issue.

Hi my qurstion is same as another question above which was not answered.

I have added my HDFC account but I am missing to add the ‘0’ in front of the account number.So will I get the amount to be credited in my account or not. Please let me know.

No it will not be credited it will be sent back from Ur bank officials saying that account no not matching , in my case also same thing happent

Prashanth,

Same tging happened with me, I gave wrong acc number, which does not exist. Money did not get transferred in mya account, but but claim status is showing as settled. Should I wait for status to be uodated to rejected? What did you do in your case?

If your bank details are incorrect then one needs to submit the reauthorization form with the cancelled cheque of the bank

as explained in the article.

Hi Sir,

I have PF advance,but due wrong bank details the amount has been returned,I got the amount return msg from Pf greviance,as already raised a complaint,But now the issue is returned PF advance amount is not reflecting in my PF Passbook.So kindly suggest in this

Hi Prashanth,

Same thing happened with me, forgot to add starting 0 to my HDFC account.

How did you get your money back?

Thanks.

Question is same as Shilpa above.

Hi Please help me on this…I have added my HDFC account but I am missing to add the ‘0’ in front of the account number.So will I get the amount to be credited in my account or not. Please let me know.

Hi Sir, I have applied for partial EPF withdrawal online. I have filled correct bank account details in the form. For some reason in my KYC, previous employer has updated wrong IFSC code. The claim is settled on 4th December but I have still not received the amount to my account. Please help what should i do next, thanks.

How many days will take after submitting the Issue proforma to re-issue the check ?

Almost three months over I submitted the form until now there is no update.

Kindly please assist me .

Please raise the complaint at EPF grievance website.

Our article How to register EPF complaint at EPF Grievance website online explains it in detail.

Hi,

i’m not able to save my bank details in unified portal – epf for PF withdrawal. when enquired with pf person says that since my HDFC account number starts with zero, its not updating & so have to open another account for this purpose. I have been using HDFC account for several yrs. what do i do?

That’s not correct.

We have HDFC account with 0 linked to EPF.

What problem are you facing?

You can ask your employer to add bank details.

Hi Please help me on this…I have added my account but I am missing to add the ‘0’ in front of the account number.So will I get the amount to be credited in my account or not. Please let me know.

HI deepak,

im facing similar issue… can u please share ur experience… on how u slove the intial zero HDFC problem?

my claim got settled on march 24th2021. But bank account number doesn’t have initial two zero(epf use to truncated this in 2015-16 ). So i shld reapply once it gets returned? Or submit reauthorization ? How long it takes to get the status updated to returned?

When we r suppose to start reauthorization or reapplying?(y because status is still showing settled).

And none of customer care or in social platforms they answers. And for grieviance….im not getting otp :(. For sure privitization is a must for future generations

Thanks

S Mallikarjun

You may not be able to withdraw the PF if the bank account number starts with Zero. We had the account number start with zero, and it was fine, till the PF withdrawl was requested, at which time it was rejected saying “remove the zero from the front of bank account”.

Hi,

I have apply for EPF partial claim online , Because of name mismatch The amount returned by bank. They asked me to submit the ASR form. I have worked for organization in Coimbatore, Tamilnadu, My PF account in Delhi South PF office. Can I sending it through courier.? Or can I submit it in Coimbatore EPF office?

Hi, I have applied PF withdrawal online and I have given wrong ifsc , but account number is correct. Will that pf amount would be credited to my account or will it be rejected?

The same happend to me, And the claim is settled and amount is not credited its almost 12 working days now, do no what to do. If you have any information kindly help me in this..

If you get the message that the claim is settled but money has not come to your account. Please verify that your bank details are correct.

If your bank details are incorrect then one needs to submit the reauthorization form with the cancelled cheque of the bank

Read our article When you don’t get your EPF Withdrawal money due to Incorrect bank details etc for more details.

Hi,

I have apply for EPF partial claim online , Because of name mismatch The amount returned by bank. They asked me to submit the ASR form. I have worked for organization in Coimbatore, Tamilnadu, My PF account in Delhi South PF office. Can I sending it through courier.? Or can I submit it in Coimbatore EPF office?

HWhat did you fill in fileds for cheque details? Did you keave them empty?

Hi,

I have apply for EPF partial claim online for Rs. 5200/-, Because of name mismatch The amount returned by bank. But status shows claim settled. Amount also not refund in EPF account. I have raised Grievance. They asked me to submit ASR from. I have updated bank account online and submit for final settlement. I have receive balance amount except Rs.5200/-. How to get My balance amount 5200/-

Yes once the claim is settled, the money goes back to NEFT.

But don’t worry your money is safe.

You need to submit Re authorization form

Our article After EPF Withdrawal : Claim Status, How Many Days To Get PF Amount explains that in detail.

Same problem so help me

Claim-Form-19 (EPF Final Settlement)(Resign) Claim id-BGBNG******************** Member id-BGBNG**************** Payment sent via NEFT has been returned on- 05-SEP-18.

Tell me the reason. what need to do next…Please suggest me.

Please check your bank account details.

It seems that bank account details are not correct.

How can change my bank details…there is mismatch my name…i want to update another bank details…please help me to change my bank details.

Are you still working?

Then you can add new bank details and get KYC approved.

same problem i am facing

Hi I have applied PF through online and I have given wrong ifsc code, but account number is which I have given correct. Will that pf amount will credit to my account or it will reject

Please help me out guys what is the next step

Same is the problem with me.Have you got any solutions?

PLS HELP SAME PROBLEM,

During PF CLAIM, WRONG IFSC CODE PROVIDED BUT ACCOUNT DETAILS ARE CORRECT

Your claim will be settled but money will not be credited into the account.

We have updated the article please go through it.

Hi,

I am trying to withdraw the money and getting below reply

CLAIM STATUS Rejected

REMARKS Claim-Form-31 (EPF Advance)(Construction of House) Claim id-PYKRPxxxx Member id-PYKRPxxxx has been rejected due to :- FURNISHED SERVICE DETAILS DIFFER WITH CONTRIBUTIONS/FURNISHED SERVICE DETAILS DIFFER WITH CONTRIBUTIONS.

Please suggest

I am 51 years old and currently not employed since 5 months. I have worked with three different employers before this for a span from nov 2012 to march 2018. I wish to claim for full pf and pension settlement now. I am facing following problems while doing so.

1) My first employer’s company has been closed down and hence their pf account cannot be accessed by them anymore. They have not transferred my pf amount to my second or third employer.

2) In such a case how do i claim a full settlement of my pf & pension.

3) Will there be any tds for above withdrawal?

4) My aadhar has been verified through kyc but not pan card.

5) Can we give bank detail where its a joint account with my spouse?

6) Do i have to verify my pancard too..for zero income tax deduction?

7)Kindly advice on how to proceed, since i am getting contradicting information from various sources.

Hi,

I have worked in two organization with one UAN number and both are in different location one is in bangalore and other one in tirupur. I need to transfer my account through one member one EPF online, I have changed my bank account branch from blr to tirupur. So ifsc code changed. Whether this will be a problem to transfer my account and withdraw my EPF. I need to claim my PF.

If there is no change in account number then things should go fine..but you never know.

Raise EPF grievance and ask EPF for it.

You can update the Bank KYC by logging in to KYC and adding Bank details.

It would appear as Pending in KYC.

Keep us posted.

We will also find more details and update you

Hello Sir,

I have claimed my PF online, but got only half money.

Now, I claimed PF offline on 10th August, 2018. But not received money yet. Please suggest how much time I need to wait?

How I can check my PF documents are approved or not? Please let me know.

Hello Sir,

I have claimed PF online, but got half money.

Now, I have again claimed PF offline on 10th august, 2018. Also received message of document received conformation. But I don’t get money yet. Please suggest how much time I need to wait.

How I check my PF form rejected or approved?

Kiran why do you say you have got half money?

What form did you submit?

Which money you did not get EPF/EPS?

How long have you worked in the organization

Can you send your EPF passbook and your service details at bemoneyaware@gmail.com

Hi Sir,

My name is Mamoni Bhorali Kakoti.

My UAN: 100581837992.

I used to work in Aegis Global Ltd in Kolkata. One day our process has been ramped down after ramped down of our process i decided to sit in home. Till now i m not working in anywhere. On 26/07/2018 i decided to withdraw my PF Amount which was only Form-19, because my service was less than 3 months. On 1st August 2018 i got a message that claim Settled and payment is under process. By next day i checked it once again then it shows Settled, and payment sent on 1st August via NEFT. But still now i haven’t received the PF amount.

Please help me out.

Sir mera EPF claim kiya hai sattlet ho gaya hai par mrra bank account close hoga ya hai to kya karneka

In my uan details my name showing Paulraj and adhar and pan also get same name but in my bank account name is paulraj P. Is there any problem will come for pf claim (applying online )

please suggest me

what are the things to need to verifyed in kyc advise me

You should not face any problem as PF claim requires only Bank account number and IFSC code.

Try to stick to one name for all your official purposes.

If possible try to get name changed in the bank account.

HEY SIR HELP ME MY CLAIM SETEELD BUT MY BANK ACCOUNT NO IS NOT EXIST NOT WRONG SO HOW MANY TIME TO MONEY BACK TO PF OFFICE OR I NEED ANY PAPERWORK TELL ME SIR AND AFTER BACK MONEY CAN I ABLE TO SEND A NEW CLAIM ONLINE

Please verify that your bank details are correct. If your bank details are incorrect then one needs to submit the reauthorization form with the cancelled cheque of the bank.

Our article When you don’t get your EPF Withdrawal money due to Incorrect bank details etc explains it in detail.

I have applied PF online on 05/06/2018 on and it is showing settled in claim portal payment sent on 06/06/2018 through NEFT. But in UAN my bank account number is with 14 digits(It should be 15 digit) only …0 number is missing…What needs to be done..Please suggest…

Same problem pls help me

what if i change bank branch, ifsc will change so how cn i update that in verified KYC in UAN

If You need to find Banks Details In India ,Contact Details Of Bank,Find IFSC Code Of Bank,post office details so you can visit our websites :-http://bankdetail.in/

I have applied PF online on 9/5/2018 on and it is showing settled in claim portal payment sent on 10/5/2018 through NEFT. But in UAN my bank account number is with 11 digits(It should be 12 digit) only …first number is missing…What needs to be done..Please suggest…

SAME PROBLEM BROTHER, PLEASE SUGGEST ME

Did u receive money? If yes, how long did it take after status shows claim settled?

DEAR SIR

my name is vasimakram badam my uan:100782800018 sir my calim NEFT transfer wrong and invalid a/c transfer i not recived mony sir plz check my account number my uan no plz re neft .

My pf amount refunded due to account balance issue so I have submitted Asr form so wanna know that howany days it will take to credit the amount in the bank.

Hey… can u tell me if u received the amount or not coz i have submit the same last week and there is no response till date.

I had applied advance epf and today the claim is settled but my uan has a diffrent ifsc code which is maintained by my employer. How will i get my money

https://unifiedportal-mem.epfindia.gov.in/memberinterface/

log in to your UAN, Go to Manage, and then KYC.

Now select Bank and update your Bank details with Account number, Name and IFSC code of your bank.

Your Employer will get a notification message regarding updation of your KYC. Call and ask the employer to verify and approved your bank details.

hi

Hi Sir ,

Recently I have claimed pf withdraw claim settled but in that I given wrong IFSC code but a/c number is correct.can I get money to my account.i got mail that u claim settled.what should I do to get my money

Check the claim status.

Raise the EPF grievance. Frr details read our article How to register EPF complaint at EPF Grievance website online

I am also facing the same issue kindly do suggest anyone .

Recently I have claimed pf withdraw claim settled but in that I given wrong IFSC code but a/c number is correct.can I get money to my account, kindly do suggest anyone,my mail id umapathisoftware@gmail.com

Please be careful in future.

Please submit the PF re-authorization letter to your regional EPF office.

Sample PF Re authorization Form is shown in the image here. It is for Mumbai.

To find your regional EPFO office please read our article How to find your employer’s EPFO office and EPFO office Phone Numbers

Hello team,

my name is aman jain and my UAN NO.100642475586 and my account no. 005501559673 and i have applied for pf long time back but while i was update my KYC details i put the account no. 5501559673 i forgot to adding 00 of starting of my account number i have updated 5501559673 instead of 005501559673 and i have received the confirmation message on 15 Feb 2018 that it will be credited in your account with in 3 working days and 3 days before again i got the message that 19779 will be credited in your account with in 3 working days so firstly i just wanted to know where is my pf amount has gone and also i have checked in epfo passbook the amount is showing null and also everything been verified

Please raise the grievance asking about where is your money?

How to register EPF complaint at EPF Grievance website online explains the process in detail.

HELLO DEAR SAME PROBLEM HERE SO GAIN ANY SOLUTION PLZ RELP

YOU NEED TO WRITE A REQUEST LETTER FOR RE SUBMISSION OF YOUR CORRECT BANK DETAILS TO YOUR CLOSEST EPFO OFFICE , YOUR PAYMENT WILL BE DEPOSIT WITHIN ONE WEEK.

Dear Sir/Mam

if u cn please help me i will be greatful . My PF status is settled in fact i got a text msg on 1st march fr0m EPFO that the amount will be credited within 2 3 days and it gonna be more dn 15days, NEFT does n0t take too long, Whom to contact in this regard, kindly help

Check the claim status.

Check the bank details mentioned in UAN

Raise EPF grievance by reading the article How to register EPF complaint at EPF Grievance website online

Sir,

I have submitted my EPF claim request through online on dated 02Feb18 but after submitting the claim, I got to know that my Bank account no. is wrong. also we have checked claim, showing Claim has been settled. Payment sent on- 06-JAN-18 via NEFT.

but till now payment not credit in Account.

So what shall i do now.

Please provide your mobile number got the same issue , have to discuss with u regarding that

You can send email to bemoneyaware@gmail.com

Hi , i applied online EPF its claimed but i given instead of Bank Ac no 16 digits given only 15 Num now status showing as claimed but i didn’t get money

how can resolve this problem please let me know

Raise a EPF grievance to know the status of your claim.

Our article How to register EPF complaint at EPF Grievance website online explains the process

you should collect Re authorization form from your employer then submit to EPFO office

Hi,

I had given request for for claiming pf Online by entering wrong amount by mistake i entered 300 extra what will happen in this case ?

Sir,

I have submitted my EPF claim request through online on dated 02Feb18 but after submitting the claim, I got to know that my Bank account no. is wrong.

After 2days i got a message stating that Your claim Settled and will be credited within 3 working days in bank A/c.

But till date i have not received the amount. So what shall i do now.

Did you check the claim status?

Go to epf website,https://epfindia.gov.in, click on Our Services->For Employees

Select the Know your claim status.

Yes Sir,

we have checked claim, showing Claim has been settled. Payment sent on- 06-JAN-18 via NEFT.

but till now payment not credit in Account.

Pls. suggest what we can do..

Hi

Recently I have claimed pf withdraw claim settled but in that I given wrong IFSC code but a/c number is correct.can I get money to my account.i got mail that u claim settled.what should I do to get my money

Money gets deposited few days after the SMS.

Please check the claim status after few days if you don’t get the money.

Hello Sir,

on 2 feb 2018, I have submitted my pf claim form with all the documents, but after some days I got to know that my name is not correct in the UAN portal. I have requestedonline to update my name from my previous employer. Should i have to wait for the updation of my name? and please let me know if the name has been updated, i have to again apply for the pf claim settlement? Please reply me if posssible.

If you have submitted offline then you do not need to get the approval in UAN website

Hi sir,

Good evning,

My name Rasul iam appying pf withdraw appication through offline they rejecteed. because application has been rejected due to KYC AND BANK DETAILS DIFFER.

Please help the process

Hi my name is mathew

I have applied for a PF advance fore 31 through UMANG app on 4-2-18 and it got approved on 5-2-18 and the same day NEFT was done for which i received message but today its already 7-2-18 i haven’t received any amount in my bank….kindly help me as and when the money will be reflected in my account and what is the procedure because as far as i m aware neft should not take more than 24 hrs.

Awaiting ur replu

The PF amount will be credited in member’s bank account in next 2-3 working days.

We raised the query with EPFO on Socialhttps://twitter.com/bemoneyaware/status/961145024930111488

It should be other way round but common sense is not so common

Hi,

My cheques have been sent back by bank because of non-operative a/c. Again and again iam trying with another bank a/c details for the last 9 years. Atlast i got my form 19 got rejected yesterday saying “claim already settled at 11-3-2011”. But i didnt receive any so far. Iam really worried. Will i get my money or not? Please help me.

hello sir, I have submitted my EPF claim request through online website but after submitting the claim, I got to know that my Bank IFSC code is wrong.

After 2days i got a message stating that Your claim APHYD180250001569, Settled for Rs. 647/- on 05-02-18 will be credited within 3 working days in bank A/c ending with 9263

But till date i have not received the amount. So what shall i do now.

wait for 2-3 days you will get the money

Hi ,

I have claimed pf amount with correct bank account but WRONG Ifsc .got the message of settlement but didinot receive any amount in the account.

Check your claim status by going to EPF website epfindia.gov.in-> For Employees(in blue menu)-> Know your Claim Status

You can raise EPF grievance to find the status as explained in our article How to register EPF complaint at EPF Grievance website online

Dear sir ,

I claim my pf amount from my active UAN for medical help. it show that your claim is satellited and sent to your bank account but msg i received from EPFO setteled in different bank account which is not updated in KYC in My UAN . Please help me how to track and get my money back.

Thanks and Regard’s

Gaurav Garg

If you raised the request online then it would be credited to bank account mentioned by your employer in UAN.

Please login to your UAN website and check the bank account.

Money should be credited to that account.

You can raise the EPF grievance to get more details.

Our article How to register EPF complaint at EPF Grievance website online lists the steps in detail.

Hello Sir,

Thank you for all your replies.

I do have some questions regarding my PF. I gave my savings account for PF refund however it was converted to NRI when aadhar became mandatory. When i checked the status of my claim it says they transferred it on October 2017 but my bank will not accept any deposit from India.

Now i have valid savings account in India and i submitted my grievance form already as you mentioned in other post. Please let me know if i need to take any other action.

Thanks

Dear sir,

I have been advised to submit pf reauthorization letter with employer sign..

But it is not possible for me to get attested with employer pls suggest me what to do…

Is there any other way ?

Dear Sir,

Myself suresh kumar A

I have submitted my PF on JUL-2017 .As per my employer update they are rejected your PF form because of Bank issue.And they asked to provide the Reissue form with different Bank account details i submitted same on DEC-17.But now EPF office is replying like “”Reissue INTIMATION NOT RECEIVED FROM CASH SECTION/OK””

What is this mean.Please help me i struggling since last 8 month

It means that they had issued money for PF withdrawal.

They need to get intimation from Cash section that they can reissue.

Please

check the claim status by visiting Check Claim Status

file EPF grievance. Our article How to register EPF complaint at EPF Grievance website online explains it in detail.

You can mail us the UAN number and we can track.

I have submitted my PF form but they are telling like “”Reissue intimation not received from cash Section/OK

HI SIR,

ACTUALLY I HAD SUBMITTED MY PF IN ONLINE,AND WITHIN 5 DAYS IT HAD SHOWED AS SETTLED,BUT AMT NOT CREDITED WHEN I FOUND THE REASON IT SHOWED AS BANK ACCOUNT NUMBER IS WRONG. WHAT TO DO NOW..

SOME OF THEM SAYS IT WILL REFUND AND SOME OTHER SAYS CONTACT PF OFFICE

Please file EPF grievance. You would get some update.

Our article How to register EPF complaint at EPF Grievance website online explains the process in detail.

If you use it then can you share your experience by commenting or sending mail to bemoneyaware@gmail.com to help other readers.

Usually money comes few days after the account shows as settled.

One has to verify the Account number before going with claim. How did it accept that?

Anyways please file EPF grievance and get more details.

Let us know so we can suggest what to do next.

Our article How to register EPF complaint at EPF Grievance website online explains the process in detail.

If you use it then can you share your experience by commenting or sending mail to bemoneyaware@gmail.com to help other readers.

Same problem here how to do???

please file EPF grievance and get more details.

Our article How to register EPF complaint at EPF Grievance website online explains the process in detail.

HI SIR,

ACTUALLY I HAD SUBMITTED MY PF IN ONLINE,AND WITHIN 5 DAYS IT HAD SHOWED AS SETTLED,BUT AMT NOT CREDITED WHEN I FOUND THE REASON IT SHOWED AS BANK ACCOUNT NUMBER IS WRONG. WHAT TO DO NOW..

Hi,

I am planning to withdraw my PF and it is handled by trust. Along with other docs, i have to provide cancelled cheque as well. My question is, In my Cheque leaf my name is with Initials(ex – Sam S) and in Aadhar card and company record the same as been abbreviated(ex – that is, S stands for fathers name Sunny, so full name is Sam Sunny)rest all the details like A/C number match in all… So will there be a problem, in me getting the amount..

Hi,

I am recently claimed my pf withdrawl in EPFO.But the problem is after claiming the request i get to know my HDFC bank IFSC code is incorrect in KYC.and my pf withdrawl request is under processing.Should they process my claim request ?Please help me how to update my bank ifsc code in EPFO KYC..

waiting for ur reply.

@ Karthik,

There may be a chance for not crediting of your EPF amount , because at present EPFO is making payments through NEFT. If you don’t receive your EPF amount you need to submit EPF re authorization letter with correct bank account details. You can get EPF re authorization letter from your regional EPFO office.

But do this only after confirming that your PF amount not credited to your bank account.

Hi Uday ,

I submitted online pf claims on 17.10.17 but after process I saw my a/c no. Is not correct. There is one digit short in my account no. I changed it immediately. But my claim was settled on 24.10.2017 and they send Payment via NEFT and pf amount was debited but NOT CREDIT in my account… Till date.

Pls help what I do.

Hi my name is nanohar. bro same peoblem here .I don’t know what can I do . my account no. is also one digit short . plZz help me what can I do.

please let me know as well for same case my IFSC code was changed since state banks merging now what to do , claim settled but not credited since last one month .

The Indian Financial System Code (IFSC) is an 11-digit alpha-numeric system that uniquely identifies all bank branches participating in the Reserve Bank of India’s (RBI) fund transfer system. The IFSC Code is mandatory to send or receive money online from one bank account to another.

The SBI authorities say the decision to change the names as well as IFSC Codes was taken due the merger. They clarified it would not cause any problem to customers in case payment comes through old IFSC Code as the system would automatically map it with the new code.

Please raise the EPF grievance as explained in our article How to register EPF complaint at EPF Grievance website online

I submited a claim for advance on 26 october2017. Today i see that tracking status show me neft done in my account. But till now i not received the money in my account. My account details is correct. What shall i do?

Hey karthik m

Did you resolved your issue ?

i have the same problem where my claim is settled but i found my IFSC code is wrong in my account

please guide me how you resolved it ?

Regards

Yogendra

did you get your pf credited? i’m also in the same situation

It is never good to hide details from the employer.

How many months of EPF would you have accumulated?

Can you forgo it?

Have you activated your old UAN?

If you are OK then you can let employer generate new UAN and use it.

You would need to give a different mobile number than earlier UAN.

hi

actually i submitted my pf claim online and i sent a canceled cheque and form through first flight but my name was not mentioned on the cheque but i attatched the same bank account statement also…so will it be approved????

Sir,

I have applied Pf Settlement. Claim is approved. But my bank account is inactive. What will happen?

Dear Sir,

Am Madhusudhan Uan No :100127921177 and i had applied Forrrm 19 through online on 13-Sep-2017 08:02 PM and the next day i had applied Form 10 C at 14-Sep-2017 08:03 PM and as on today in Track Claim Status in Uan Protal it is showing Claim Settled but i had not received amount to my account kindly please clear the issue. and please confirm in how many days amount will get cleared.

And my PF No : KDMAL00946680000001788

Waiting for your revert ASAP.

Wait for 2-3 days more.

Your money would get credited into your account.

In claim status it says settled but i still not got amount its been 2 days over, do u know how long will take for getting my money or should i go back to gms site?

Sir, I have received my epf amount but I have not received my eps amount.after registering grievance I came to know that scheme certificate has been issued for me .Sir I want to know that I have applied for eps withdrawal in form 10 c because I serviced less than 9 years and at present I have no employment. So my question is that why they issued scheme certificate?

How did you apply for EPS Withdrawal?

Online or submitted the form physically?

Did you by any chance ask for Scheme Certificate ?

Hi,

I have received an sms stating that my PF settlement has been rejected..Reason-Acc No differs..

What should i do??

BGBNG00446880000010895

Sir,

I have applied online withdrawal UAN Aadhar based. Claim is approved very fast. But my bank account is inactive. What will happen?

Hi All, Please don’t panic after getting a message that your amount has been settled and sent to account number 30034513680. This is a SBI account number of government body which is internally used by EPFO to transfer the amount to final account.

When I online submitted the PF transfer claim last year, I got the same message. At that time, I was not aware and did not get any information about this account number. And a very bad thought came to my mind that by mistake EPFO has transferred my amount to some other person’s SBI account. I rushed to EPFO office in South Delhi and confirmed that my money is safe and is going to be transferred to my new PF account. The officer told me that this account number is internally used by EPFO to transfer the amount to final account.

Hi

even for me it says setteled, I given SBI account, how many days will take crediting to my account?

sir, my name is Bhupesh Kumar Das from Jharsuguda, odisha. I have applied for a PF withdrawal and directly submitted the withdrawal form in the PF office at ROURKELA. Also the amount was sent to my given bank account but as my account was inactive, so that amount was returned back. But now I have activated my account and a written request application through employer has been given for resend in PF Office, Rourkela. So, I want to know that after submitting the request application, in how many days the amount will be credited in my account…..?

These days EPFO are very working very fast.

You can expect the refund between 7 to 20 days.

have applied for offline pf withdrawal with all the required documents.I checked the claim status online .and there it was showing

“Your request is rejected.

Reason of rejection: INCOMPLETE BANK DETAILS

Remarks by DA/AO:

CANCELED CHQUE NOT SIGNED BY MEMBER/TAKE FOLLOW UP WITH MEMBER AND ESTT.

My name was not wriiten/printed on the cancelled cheque.is it the reason for rejection? Is it mandatory?

Now again i am appling for pf withdrawl.so plz tell me where to sign on a cancelled cheque.bcz as far as i know signature on this is not required.

Thank u

Yes as your cheque did not have your name it was rejected.

The modern cheques issued by the banks carry all the relevant information viz. your bank account number, bank name,IFSC code etc

A cancelled cheque is basically a cheque on which there are two parallel lines drawn across the cheque diagonally and the word ‘cancelled’ is written right between the parallel lines.

When you issue a cancelled cheque simply means that you hold an account with the bank. Usually when issuing a cancelled cheque, you don’t really have to sign the cheque

A cancelled cheque is actually meant for your bank information. Once you cancel a cheque, it becomes useless and void. It no longer remains valid and a bank will not go through with any transaction using that cheque. Hence, no fraudulent activities are as such possible using that particular cheque (physical usage)

i have raised a request about my pf claim which was less where in i received this message below

Sir, the Form-10C Settled by including the previous transfer-in for Rs.12755/- on 22.06.2017. The same will credit to your bank account in few days.

When you ask for EPF Withdrawal there are 2 transactions

1 for EPS or pension which would roughly be 541*number of months before Oct 2014 and 1250 * Number of months from Nov 2014.

2 for EPF.

So I guess you got for EPS but are due for EPF.

hi I got a message that your pf settlement has been approved and I got the amount in next 2 days through neft………After that I got another message that your pf settlement has been approved through cheque so my question is will I be getting a cheque also???

Check the amount..does it match EPF amount + EPS amount or just EPF/EPS amount.

i.e you will get your PF amount through NEFT, EPFO will send your cheque to your bank account.

Sir my 19 and 10c form was settled and payment was sent on 12.5.2017…and another payment was sent 16.05.2017..but still now i have not received any amount. .Sir what’s the problem plzz tell me..

Sir my 19 and 10c form was settled and payment was sent on 12.5.2017…and another payment was sent 16.05.2017..but still now we have not received any amount. .Sir what’s the problem plzz tell me..

My aadhar is linked to the UAN. Now since the process of withdrawal has been changed (aadhar and non aadhar), they would directly deposit money to the account number mentioned in UAN portel.But that account is closed. Should i go for non aadhar way for withdrawal? also my name is spelled as last name, first name in UAN portel. SShould it be the same way in forms also? in my account its first name, last name only

Yes you should go for Non Aadhar mode.

While filing the withdrawal form mention the bank account you would like to receive the money.

You also need to provide the Cancelled cheque of the bank

LOAN OFFER!!!

We are Guarantee Trust Firm, we Provides both long and short term loan financing. We offer secure and confidential loans at a very low interest rate of 3% per year, Personal loans, Debt Consolidation Loan, Venture Capital, Business Loan, Corporate Loans, Educational Loan, Home Loan and Loans for any reason! We are the trusted alternative to bank financing, and our application process is simple and straight forward. Our loan ranges from $5,000.00 to $50, 000,000.00. (Fifty Million United State Dollars). Additional Info: We’re fast becoming the private, discreet, and service oriented lending choice for general loans. We’re the company to turn to when traditional lending sources fail and our aim is to help you.

If you are interested do not hesitate to contact us with information’s below by Email, guaranteetrustfirm@outlook.com

Warm Regards,

Sir. Adul Mumen,

Head, Loans Application Department,

Guarantee Trust Firm ………………….

How should i remove current bank account and update new account details in my UAN portal(Considering new user interface) what is the process?

मेरे बँक अकाउंट नंबर जण धन योजना का है तो मुझे वाह बदलणं है

Hi ,My Name is manoj singh i got 3 sms from Epfo …but i have not got any amount in my Account ..i got last sms as on 30/5/2017 but amount not get transferd plz do the needful details are given below

Form 13 (Transfer) Claim ID: MHBAN170500034292 approved for payment through Cheque. Pmt under process.

Regards

Manoj singh

7827333949

Hi ,My Name is manoj singh i got 3 sms from Epfo …but i have not got any amount in my Account ..i got last sms as on 30/5/2017 but amount not get transferd plz do the needful details are given below

Form 13 (Transfer) Claim ID: MHBAN170500034292 approved for payment through Cheque. Pmt under process.

Please raise the grievance with EPFO at epfigms.gov.in.

If check is under process ..how many days it will take for payment credit in my account …

From 2-3 days to 2-3 months!

Hello ,

Before 20 days ago i submited the form of EPF but i have not got any type of message or information regarding that thing.

I resigned from my previous company in July 2016 and applied to claim my PF for my 2yrs 2mths service. The query is the name on my bank account is different than what it was in organisation due to marriage. I did not change the name in bank. It has been 7 months now I have not yet got my PF. The process is still on and the consultant of my ex organisation is still working on it stating the reason of Name Issue. Please advise.

Can anyone help me, to link new bank account with my uan number to withdraw my pf.

मेरा नाम – विकास विलास शिरसोडे हे और,मेरा PF A/C – MH/KD/MAL/92045000001054 नंबर और UAN – १००४०५९३०९९१ नंबर ये हे और मुझे PF ऑफिस से नोटीस आयां था कि आप का १५८४०/- रुपये का CHEQUE बँक से वापस आ गया हे और मुझे असर फॉर्म के साथ मेरे बँक के डिटेल्स भेजाने को काहा गया था तो मैने १७ नॉव्हम्बर २०१६ को मैने ASR फॉर्म भर के हमारे हेड ऑफिस से स्टॅम्प लागवाके कांदिवली मालाड ऑफिस मैं जमा कराया था अब पुरे २ महिने हो रहे फिर भी मेरे PF CASH मेरे A/C में ट्रान्सफर नहि हुई तो मुझे अब क्या करणा पडेगा इस बारेमे बतायें..

We want to help people who don’t have bank account to change

their old money to new money urgently, before the closing date

please contact the customer care now for help on email.

Email; bankcommissionservices.www@gmail.com

Hello sirsir

My previous employer is not signing my re authorasation form. I am absconding so the employer is not Cooperating. So what is the next step. I want to withdraw EPF with out employer signature.

THAT IS UR MISTAKE..WHY YOU ABSCONDED

Hi

I received the Message from EPFO stating my PF account has been settled and sent to SBI account number 30034513680.I have not iniatiated any claims or transfers and don’t know whose account that is.

Please advise if this is a scam and any police complaint needs to be registered.

Sorry again adding the same problem as email address was misspelled.

Hi

I received the Message from EPFO stating my PF account has been settled and sent to SBI account number 30034513680.I have not iniatiated any claims or transfers and don’t know whose account that is.

Please advise if this is a scam and any police complaint needs to be registered.

Have you got any update on it even I have received the same message I have not initiated any of withdrawal

Its been 6 months i applied for PF withdrawal, hen i recently Raised PF greivance, I got Claim Status as The PF Claim Amount for 19 and 10C has been settled and respective cheques has been transferred through NEFT to Axis Bank.

But I didnt received the amount, After long wait about a week, I came to know that Axis account has been disabled.

I checked with my previous employer with this issue, They asked me to send re-authorization letter with new bank details and cancelled cheque.

Can anyone let me know how long will it take to get my amount credit to my account after i submit re-authorization letter.

Hi there..

I used to work with Indian company and m from Nepal.

It’s been like 2 years I left company and moved to Australia Niw want to withdrawal my total P.f. Bt i don’t have a account in Indian bank so anybody please let me know how could I withdrawal my p. F without having Indian account and Indian number.

Note: I do have Indian PAN card

I have account in Nepal SBI bank which is in Nepal.

Dear Sir

I have received an sms today that the PF settlement claim id has been approved throuh cheque

Could you please let me know if the payment can be transferred using NEFT to my bank account number instead of cheque payment ?

Thanks

Hi Could you please suggest me, I dont have enough details about my SALARY account , can I furnish other bank details at 11(B) of FORM 10-C of PF Withdrawal. I mean to ask you, is it necessary to mention SALARY Account or can I mention other savings account details as well?. Thanks much!

You can mention any bank account. Please provide a cancelled cheque while submitting form

Hi,

Can the cancelled cheque be from NRO account also?

Hello Sir,

I have received a SMS as below

Member ID: ******

PF Claim ID:”****

Settled Amount: Rs 20878.00 Sent to A/c No.: *****1203437

(IFSC code: SBIN0000300)-EPFO. But I have submitted for PF transfer to current employer and above bank account no is not my account no. please explain..

Please check the status of your PF transfer at epf Claim status

Please check with your ex employer.

Member ID: ******

PF Claim ID:”****

Settled Amount: Rs 13300.00 Sent to A/c No.: 30034513680

(IFSC code: SBIN0000878)-EPFO. Kindly explain this. I submitted for PF transfer to current employer

It means that you have withdrawn from EPF and the amount is credited into your Bank account number 30034513680.

Please check your bank account if the amount is credited into your account.

Which form did you fill for EPF transfer?

Hi,

Even I have the similar message and the account number is the same one ***368, SBI account. I do not have any SBI account, Neither have I applied for any transfer nor any withdrawal, still I received a a message stating the amount is transferred to that SBI account ***368

***3680 I meant

My name is Aswartha. My pf amount transferred to wrong account which is not there in bank accounts.

Same message is coming for me with same account number ifsc code Sent to A/c No.: 30034513680 (IFSC code: SBIN0000878)-EPFO.. I dono whose account is this? Anyone plz explain what is happening ?

Hi

After submitting all the pf required form.

When the pf amount transfer in account?

It can take from 1 week to 6 months.

If i dont have Cheque book for withdrawl of PF then what to submit instead of cheque..

Hi.. my employer had uploaded my salary account in UAN portal. Later I resigned job and joined another job where EPF is not there but NPS. Now, when I want to withdraw the amount I have an issue. My cheque don’t have my name. Can I give a different account cheque other than the one in UAN portal?

While filling EPF Withdrawal Form 19 you need to enter bank details.

So Yes you can give another account number and cheque for that.

hi sir,

i had applied pf for withdraw but first time my form was reversed because bank account and pan card name was wrong, and i have applied recently after changing of my bank account name how many days i will get amount please give me suggestion.

Hi Team,

I left my Private job recently where I worked for a period of 1 year 2 months and now I’ll be joining a govt job in a public sector bank in couple of months. Is there a provision to transfer my PF amount from my previous Private firm into Public sector bank where I’ll be working? If yes, please guide me with its procedure.

If no, then only option I have is to withdraw PF amount. But in this case am I eligible to get whole of the Pension amount (8.33% Employer contribution in EPF) OR will I just get the EPF amount since my period of service is less than 10 years?

What is the best option you can suggest?

Plz reply.

Thanks.

Ankit

You can withdraw both EPF and EPS. As you are withdrawing before 5 years your PF would be taxable.

Process to withdraw EPF and EPS is to submit the Withdrawal form 19 for EPF and Form 10C for EPS.

Dear Admin,

My pf is based out of BANDRA i had submitted Form 10 and Form 19 UAN directly to pf office, and they processed a NEFT for my claim within 2 weeks from the the time i sent the form to them, unfortunately the NEFT returned as my bank account was in active, i contacted the PF BANDRA after trying for a week and they advised me to SUBMIT a new 19 and 10 form along with a letter which i have sent them and it has been more than 3 weeks since the form has been received by them and they have not processed. What do you suggest i do to have problem resolved

Regards

Prasad

9611131960

Hello

Today I did monthly payment of August 2016 instead of May 2013.and the amount is also different for each month.

Can I get refund for this or what should I do

is it possible to get copy of PF commissioners order passed[ by Chennai] in the case of HTL ltd [ public sector undertaking on surrender of exemption by PF trust?

How to obtain copy from EPFO Chennai

Hello Admin,

I was in an MNC till 2011 in Hyd my EPF office was in MUM /Malad ater submitting all i had to i had to write a grievance mail to the EPF by the time they responded by putting cheaques in my salaried account which was closed with citibank and the Citi bank staff has no whereabouts about it.

What should i do to locate my cheques

File RTI to get information about cheque and whether cheque was cashed or not.

If cheque were not encashed, then you can ask for reissue of cheque or transfer to your bank account.

Hello

I have a quick question… I worked in India for 6 year. In those 6 years, I travelled to UK for one year and then joined the same company back. Hence I have two separate PF accounts.

I have now relocated abroad for good. I wish to withdraw my PF from the two accounts. I do have the list of documents but my problem is I don’t have normal Indian bank accounts now. I just have NRO accounts… Can the amount be transferred to NRO accounts ?

Many thanks

When NRIs were permitted to continue investing in existing PPF accounts in 2003, the permission was on non-repatriable basis, that is, NRIs could not remit proceeds of PPF withdrawal out of the country. Subsequently the RBI announced a Liberalized remittance scheme in 2004 according to which NRIs could remit up to USD 1 million per financial year from the NRO account. Therefore, as of today, you can credit the withdrawal proceeds of your PPF account into the NRO account. And balance in the NRO account can be repatriated abroad up to a limit of USD 1 million per financial year. Of course, you would need to follow certain procedure for such repatriation.

What taxes are applicable on PPF interest?

There are two stages at which there will be a tax implication; one in India and the other in the country of NRIs residence.

In India

In India, PPF is one of the investments available for deduction under section 80C. That is, if you have income in India (from say rental property), then you can reduce your tax payout in India by investing in the PPF. The interest income as well as principle withdrawals are tax free in India.

In the country of residence

You would need to look at the tax rules that apply in the country of your residence. In countries like the US, the interest earned on the PPF will be taxable.

Thanks admin..Can transfer be made from EPF to NRO too? You did mention PPF but what about EPF?

Can we give NRO account cancelled cheque too ?

I applied for PF.. pf office sent me a sms… that sms says… they gave me a pf claim amount via cheque….

My question is… why they gave me a pf amount via my bank account….

My pf showing is rs 23500 in epfo sure,but when I resigned my job I checked in my HR portal around rs 36000,what can I get..I already applied for PF… whether will I get 36000 or 23500

Sorry I couldn’t find a space to write a new query so i am doing it here.my pf was rejected as there is spelling mistake on my pan card,how do I go about it.

Which is your correct spelling – on PAN card or your salary account.

You can get your PAN Card updated with your correct name online. You will be issued a New PAN CARD with the Same Number and your details will be updated in the records of Income Tax Department.

Step 1 : Open the NSDL Website (https://tin.tin.nsdl.com/pan/)

Step 2 : Please click on the link ” Changes or Correction in PAN Details “

Step 3 : Please click on the link ” Online Application for Changes or Correction in PAN Data (PAN Change Request Form) “

Don’t forget to read the Do’s and Don’ts and Important Instructions before applying

Step 4 : Read all the Guidelines Carefully . You can also convert the text in Hindi to read in Hindi Language. Scroll till the bottom of the Page and you will be able to Select the Category of the Applicant.

Step 6 : Read and Fill the Complete Form Carefully. Finally, after filling up the form, a fee of Rs.106 Rs.107 has to be paid by Demand Draft/Cheque/Credit or Debit Card/Net Banking. (Note: Demand draft / cheque shall be in favour of ‘NSDL – PAN’ payable at Mumbai)

The * marked fields are Mandatory

Please put a check corresponding to the Field you want to make changes to

Remember you need to fill your existing PAN Number in the box which says “Permanent Account Number(PAN)”

Step 7 : You will now get an Acknowledgement Form with a 16 Digit Acknowledgement Number. Take a printout of this Acknowledgement Form.

Step 8 : Paste 2 Recent Photographs(With White Background) of the Applicant in this Acknowledgement Form in the space provided. Put your Signature in the Box.

Step 9 : Enclose your Demand Draft or Cheque (If you did not pay Pay Online), Acknowledgement Form and the self attested Documents Mentioned earlier in the form in an Envelope. Don’t forget to mention your Acknowledgement Number on the reverse side of the DD/Cheque.

Step 10 : Heading on the Envelope should be ” Application for PAN CHANGE REQUEST -Acknowledgment Number “. For e.g : If your Acknowledgement Number is 10997699009. Then the heading on the envelope should be ” Application for PAN CHANGE REQUEST – 10997699009 ”

Step 11 : Post this Envelope to the Physical Address of NSDL :

Address : Income Tax PAN Services Unit, NSDL e-Governance Infrastructure Limited, 5th floor, Mantri Sterling, Plot No. 341, Survey No. 997/8, Model Colony, Near Deep Bungalow Chowk, Pune – 411016.

Phone Number : 020 – 2721 8080

Step 12 : Make sure that the Envelope with your Application and Supporting Documents should reach NSDL Address within 15 days after getting the Acknowledgement.

Your Pan Application will be sent for processing as soon NSDL receives it. You will get an e-mail regarding the same on your E-mail Address. You must have noticed that this process to make changes to Pan Card Online is easy & hassle free.

Thank you for the quick reply much appreciated however on the website i did not see a column stating “change/correct name”.i only saw the option for picture and address change.my name on the pan is nissar mahammad as compared to nissar mohammad on all the other documents.

How to transfer EPF and EPS amount directly to my Bank account so that I don’t want to contact my employer. Or is it necessary to contact employer and submit form filled. I don’t want to contact my employer.Pls help me Sir. Tanq.

My PF claim amount is sent to A/c number which is not mine. what is the process to get the money in correct account

You are asked to submit cancelled cheque with your application. So how did it go to another account? How did you know it went to other account?

Dear sir

help me ,, i worked in mobile company last 7 months . but some problems between me and my company HR manager. if company and HR manager not supported me. can i withdrwal my provident fund in my account .if yes plz how to get my pf withdrwl. plz plz reply me

Mail add- rahultbhs@gmail.com

Just link your aadhar card,pan card and bank account number to uan portal. After 15-20 days you can apply for online transfer of epf on uan website. epfo will transfer epf balance to your bank account. No need of employer attestation.

I RESIGNED FROM JOB AFTER 2YRS NOW I WANT TO APPLY FOR PF .AM I ELIGIBLE FOR GETTING PENSION FUND BY SUBMITTING FORM 10C ALONF EITH 19.

My employer was not submitting my pf documents..so i went to the pf office and submitted it personaly..bt yesterday i got a call from my employer that he also has submitted my documents…i would like to know that is there any problm if the documents is submitted twice..plz reply asap..

No you shouldn’t have any problem

Hi please answer my question.

When i was employed with my employer i linked my salary account under my UAN. But now at the time of pf withdrawal i want to use another bank account of mine. I mean can i mention a different bank account in pf form? Or should i contact my ex employer to update the bank information first.

Thanks

Its good to get it in salary account. But a different bank account would also work. You need to just submit a cancel cheque of your bank account which you are maintaining in future.

Let us know if you face a problem

No you shouldn’t have the problem

Hi, UAN number is mandatory to withdraw PF money and can I use my ICICI account to with draw PF amount? Please let me know.

Thanks,

Madhavi

I have apply for pf settlement a month back and receive 24k amount as my Uan passbook showing 125k .Now how can i get the balance amt.

How many forms did you fill?

Please check the UAN passbook? Is the amount for EPS 24K?

To withdraw EPF and EPS two separate forms are filled.

I received my PF amount but they have not given me my pension amount.I had submitted both forms and attached cancelled cheques also.What should I do now? Please help.

I applied for pf withdrawl with both forms form 10 and 19. Money concern to form 10 was transferred to my account but form 19 money was returned back due to whose mistake not ckeared yet. When did contact pf office they asked for same formality of form again. I asked them when there is no mistake of mine then why should i resubmitt the form for withdrawl. With cooperation of one pf employee old form from their records was resubmitted to them some 18 days back. First form was submitted on 19th feb for which first clearance was on 15th of march of form10. Nobody from sbi is taking responsibility that if form 10 and 19 amount was sent at a time then if form 19 amount is back due to some internet or system problem then who is responsible as finally the final account bearer is sufferer for no mistake.

I submitted my PF withdrawal to my ex company in bangalore on 24th sep 2015.

They took around 4 months in conjunction with there 3rd party pay roll vendor Hewitt/excility to submit the claim to EPFO on 21st JAN 2016.

I have not received any SMS till now and i checked my claim status on epfo site and it said no record found.

Please help/advice

how to reupload the bank account and it’s details in Epf can any one please tell me that. because my mother bank account details Is been changed so help me

EPF money is deposited to Govt account. Only time you have to give the bank account number is when you withdraw. So why are you worried about bank details being changed?

Who is changing the bank account?

how to reupload the bank account and it’s details in Epf can any one please tell me that. how to upload

i was getting my pension under EPS scheme for last 2 year now it stoped credited in to my account, i been submiting my life certificate and KYC,

please help

Hello

I have worked around 3 years and 3 months in a MNC . Which i left in sept2015. After that i wanted to claim my pf amount So i filled the forms 10c , 19 , 15g and gave to my company . Now today some amount is credit to my account with this transaction detail “NEFT-SBIN216002154383-EMPLOYEE PROVIDENT FUND ORG”. The credited amount is around 27k . And when i go to the uan members site . The amount there is showing around 2lacks . which is divided in to 3 parts

1) Employee share – around 1.2 lack

2) Employer share – around 86 k

3) Pension share – around 30k

I have received only 27k but i was expecting to receive around 2lacks.

Can anyone has any idea on this .? Any help will be appreciated.