For an Employee whose employer is making EPFO Contribution Universal Account number or UAN number is allotted. This article answers FAQ on UAN answering frequently asked questions like What is UAN number, What is Member Id and how does it differ from UAN number, What is registration of UAN number, How is UAN number allotted, What happens to UAN number when one changes job, Change of Job and UAN number, Request for this Member ID is already under process, What if two UAN numbers were allotted to someone, Mismatch in UAN and Member ID.

Table of Contents

What is UAN number?

UAN is Universal Account Number. The UAN is a 12-digit number allotted to an employee who is contributing to EPF. The universal number is a big step towards shifting the EPF services to the online platform and making it more user-friendly. Please note that The universal account number remains same through the lifetime of an employee. It does not change with the change in jobs.

What is the importance of UAN number?

Once you have the UAN number and you register it then you can check many details . Benefit Of Registration of UAN at UAN Member e-Sewa Portal are as follows:

- You can download the updated EPF passbook. The passbook will tell you the EPF balance broken into Employee Contribution(EE) and Employer Contribution (ER). Also deduction fro Employee Pension Scheme (EPS). Sample passbook is shown below.

- You can link your previous PF accounts (before Oct 2014) which are not linked to UAN number.

- You can upload KYC data.

- You can change mobile no and email address.

- In Future You can apply for the online PF transfer through UAN itself. Currently it’s a separate process done through Online Transfer Claim Portal (OTCP). Going forward plans are that when employee changes job and new Member ID is allotted then transfer of old Member Ids would be done automatically.

What is Member ID?

Employer submits the EPF(Employee Provident Fund) money to the EPFO (Employee Provident Fund Office) on behalf of the employee. This includes both the employee contribution, employer contribution, Employee Pension scheme. Member Id or Member Identification Numbers or PF account number is the number given by EPFO to allow the employer to submit EPF money of employee. It’s like Employer opens an EPF account for its employee and contributes to that account every month. Member ID is the account number of employee in the EPFO. When the employee changes the job then the new employer will open a new account number for it’s employee in EPFO. So a new Member ID will be allotted to employee. Member ID is same as PF number earlier. So you would have as many Member ID’s as the number of employers contributing on your behalf to EPFO.

Member ID or PF Account Number is in the format given below. PF Account Number may not have Extension code. Ex: For someone who works in Bangalore the code can be BG/BNG/012345//789.

EPFO Office Code/Establishment Code(Max. 7 Digits)/Extension(Max. 3 digits)/Account Number (Max 7 digit)

How does Member ID differ from UAN number?

An employee will have one UAN or Universal Account number, which as the name implies will remain the same. It will maintain all your Member Ids. It’s like you can have multiple Saving Bank account but all these are tied to your one Permanent Account Number or PAN. So when you change your job and the new employer, if contributing to EPF, gives you a new Member ID. This new Member ID has to be linked to your UAN number.

- If the employee does not have a UAN number, probably because it’s his first job or he was working before Jan 2014 when UAN number process started. Then employer will request the EPFO to generate the UAN number for its employee along with Member ID.

- For an employee who already has a UAN number the employer will submit the request to EPFO to generate new Member ID for the employee and link it to the UAN number of the employee by filling Form 11.

Video on Difference between UAN and Member Id

In EPF what is the Difference between UAN and Member Id or Provident Fund Account number

How is UAN number allotted?

- The EPFO will allot employers the universal numbers of all employees for which employer makes EPF contribution.

- If the employee does not have a UAN number, probably because it’s his first job or he was working before Jan 2014 before UAN number process started. Then employer will request the EPFO to generate the UAN number for its employee along with Member ID.

- For an employee who already has a UAN number, the employer will submit the request to EPFO to generate new Member ID for the employee and link it to the UAN number of the employee by submitting Form 11 filled by the new employee.

- The employer would then give the number to its employees, who need to provide their KYC (know-your-customer) details to the employer.

- The KYC details of employees would then be updated online on the EPFO website by the employer.

- An employee can also upload the scanned copy of the KYC document through the EPFO website once you are done with the UAN-based registration. However, your employer has to digitally verify your KYC details.

Every UAN will be linked to one or more Member Ids up to maximum of 10. It would help to track the EPF contribution throughout the entire career.

How to check the status of UAN Number Online

Visit EPFO Portal UAN website and check the Check UAN Status

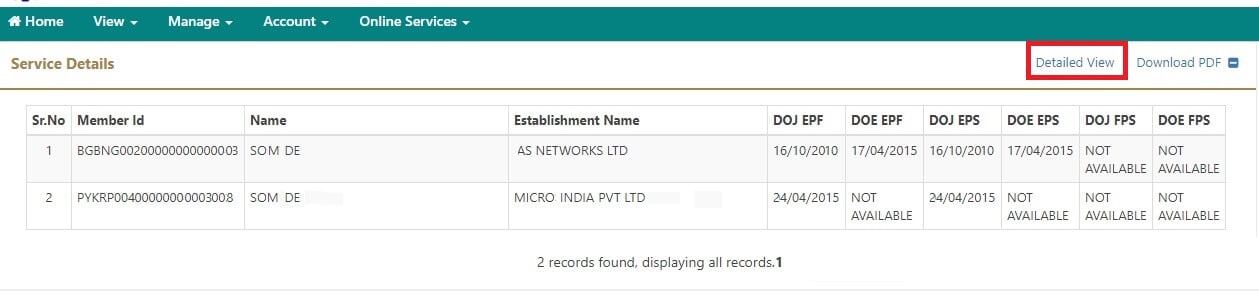

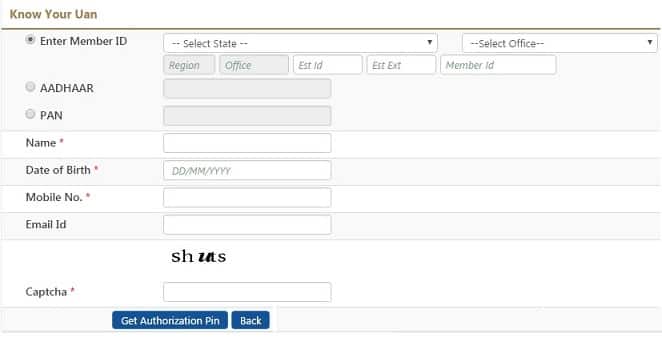

You can use the link Know your UAN status to verify whether UAN is allotted to you or not. Old Image

On Checking status, I get Request for this Member ID is already under process. What does it mean?

When one checks the UAN status one might see a message similar to Request for UAN for this Member Id ABC is already under process.(through ECR) since last 45 days.

This means that the UAN process for Member ID is processing and your UAN number will soon be generated. How soon, is anyone’s guess, It can take around 2 months, but With EPFO embracing technology it would become faster as time progresses.

What is registration of UAN number?

To see the details Once you receive the Universal account number or UAN from your employer, you have to log on to the official website http://uanmembers.epfoservices.in. Click on Activate UAN Based Registration and enter your UAN, mobile number and member ID. Once you are registered you can download your UAN card, EPF passbook, link earlier PF Member Ids etc. Our article UAN or Universal Account Number and Registration of UAN explains the process in detail.

On trying to Activate UAN I get message Mismatch in UAN and Member ID? What does it mean?

When one tries to activate the UAN one might see message similar to Mismatch in UAN and Member ID .

It means that the Member Id being used for Activation of UAN number and Member ID associated with UAN number does not match. It may be due to incorrect filling of Member Id. Member ID or PF Account Number is in the format given below.

EPFO Office Code/Establishment Code(Max. 7 Digits)/Extension(Max. 3 digits)/Account Number (Max 7 digit)

Some tips while entering Member Id

- Please select checkbox near I have Read and Understood the Instructions. (marked in Red colour in image below) to see the form

- By Selecting State and Office EPFO Office Code automatically gets filled. In case your office has multiple branches Your state may not be where you work but where your main office is situated. For example for a company with head office in Noida and branches in Pune & Bangalore. The EPF for all employees might be done at one place where the first office is situated, Noida in our example. Then even for employees in Pune and Bangalore the State to be selected is Uttar Pradesh and Office Noida.

- If your PF number does not have Extension Code leave it blank.

What about KYC and UAN?

KYC is an acronym for Know your Customer or Know your client. It refers to due diligence activities that financial institutions and other regulated companies (LPG,telephone) must perform to ascertain relevant information from their clients for the purpose of doing business with them. Our article Know Your Customer or KYC talks about KYC in detal.

The basic purpose of KYC is to verify that you are what you are claiming to be. So your UAN number also needs KYC. KYC status is reflected in UAN card. There are two ways that KYC for UAN can be done

- Your employer asks you for KYC document and uploads it on your behalf.

- You upload scanned copy of KYC documents and employer approves it. It can be done by going to the Profile menu and selecting Update KYC Information in the Member Portal. The uploaded KYC document by the member will be approved by employer till then status of KYC will be shown as Pending. Yu need to scan the KYC document first and save it as .jpg/.gif/.png/.pdf. The size of scanned document should not exceed 300kb. multiple KYC documents out of the 8 specified KYC documents can be uploaded.

Following documents can be used for KYC:

- National Population Register

- AADHAAR

- Permanent Account Number

- Bank Account Number

- Passport

- Driving License

- Election Card

- Ration Card

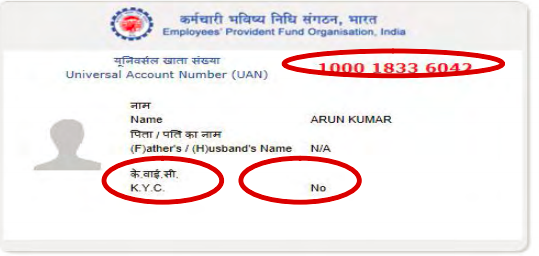

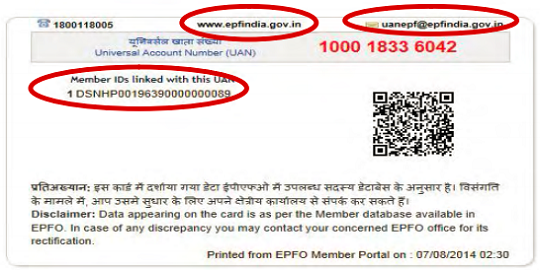

What is UAN Card?

UAN Card as the name implies shows the Universal Account Number and provides details related to UAN number. Its just like PAN card. Though it’s usage is still not clear.

- Front portion of the UAN Card displays : UAN, Name, Father’s/Husband’s Name, Member-ID, (as available in the EPFO member database) Photo and KYC. If KYC of this member is uploaded by the employer, it will reflect on the front side of the UAN card by displaying Yes in front of KYC else if will reflect No

- Back side of the UAN card displays latest five Member-IDs linked with this UAN alongwith helpdesk no. and email-id.

Change of Job and UAN number

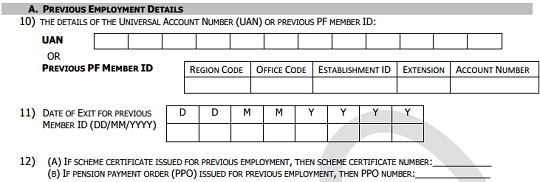

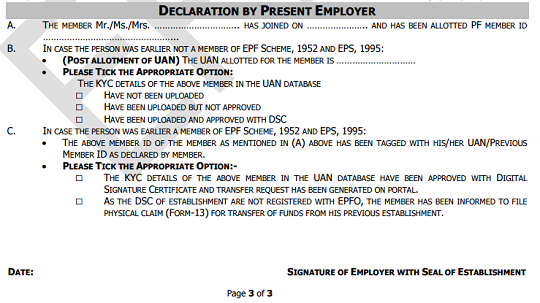

What to do when one changes job. If Universal Account Number (UAN) s already allotted then one is required to provide the same on joining new establishment to enable the employer to in-turn mark the new allotted Member Identification Number (Member Id) to the already allotted Universal Identification Number (UAN). This is done by Filling the epf-NewForm-11-with-instructions(epf) which replaces the old Form 11 and Form 13. The EPF circular of 2 Jan 2015 can be found here. Part of Form which refer to Previous Employment details and Declaration by previous employer are given below.

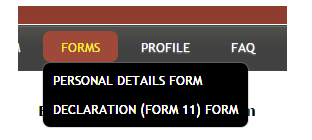

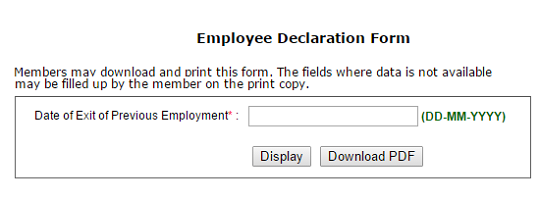

One can download the filled copy of Form 11 from UAN website after login by Selecting Forms->Declaration Form and filling Date of the exit of Previous Employment as shown in the image below.

What if two UAN numbers were allotted to someone?

Yes, there have been many cases when two UAN numbers were allotted to the same person. This was due to less awareness of the UAN number and during job change the new employer did not ask for UAN number or previous employer’s PF details. In such a case a person can have two UAN numbers associated in addition to two member IDs.

Now you can merge the different UAN numbers by logging in to UAN website and asking for the transfer of old UAN to new UAN. The process is similar to transferring a Member Id of the old employer to new employer.

Our article How to merge 2 UAN accounts explains it in detail.

To use the facility employee must have activated their UAN to which they want to transfer and should have linked their Aadhaar, PAN, bank account details with IFSC code and verified PAN and Aadhaar.

- Go to the EPFO UAN members’ portal and log in using your UAN and password. Use the UAN you want to transfer to.

- Verify that all your details are populated in the UAN portal. No missing or incorrect information.

- Verify that your KYC is approved.

- Please check that your Bank Account Number, IFSC code is correct.

- Click on Online Services->One Member One EPF (Transfer Request).

The following is still not in effect

From Sep 2016 The Employees’ Provident Fund Organisation (EPFO) has decided to deactivate all Universal Account Numbers (UANs) from which provident fund transfer has been effected to another PF account having different UAN. The earlier UAN would be simultaneously blocked for further use. The member would be informed of the deactivated status of his previous UAN by SMS to the registered mobile number. The member would be requested to activate the new UAN to get the updated status of his EPF account.

The member would be informed of the deactivated status of his previous UAN by SMS to the registered mobile number.

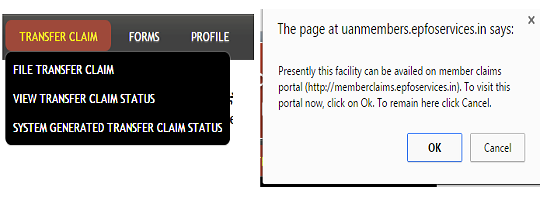

What is linking of Previous Member Id and UAN? Can one transfer claim through UAN?

one needs to transfer the earlier account . You can do so from UAN portal itself but it takes you to http://memberclaims.epfoservices.in/. Process of transferring is explained in our article Transfer EPF account online : OTCP

Name or Father’s or Spouse Name name or Date of Birth is not correct in UAN

EPFO has made a provision for change the name of EPF members. Members who wish to get their name/Fathers name/Date of Birth to be changed in the EPF Database can apply for the same through their employer along with supporting documents. One can read EPF Circular for change in name and EPF Circular for change in birthday

Supporting Documents for change in Name/Father’s Name/Spouse Name may be one of following documents

1. PAN Card 2. Voter’s ID Card 3. Passport 4. Driving License 5. ESIC Identity Card 6. Aadhaar Card 7. Bank Passbook Copy/Post office Passbook 8. Ration Card 9. Any school or education related certificate 10.Certificates issued by the Registrar of Births and Deaths 11. Certificate based on the service records of the Central/State Government organisation 12. Copy of electricity/water/telephone bill in the name of claimant 13. Letter from recognised Public Authority or public servant verifying the identify and residence.

Supporting Documents for change in Birthday may be one of following documents

1.Birth certificate issued by the Registrar of Births and Deaths 2. Education certificate/School record/leaving certificate 3. Passport. 4. Any other reliable document issued by a government department; but NO affidavit or court order merely based on member’s declaration only. 5. Certificate based on the service records of the Central/State Government organisation

Related Articles:

- What are EPF,Pension and Insurance Changes from1 Sep 2014

- Basics of Employee Provident Fund: EPF, EPS, EDLIS

- Understanding Employee Pension Scheme or EPS

- Voluntary Provident Fund, Difference between EPF and PPF

- Tax on EPF withdrawal

- Transfer EPF account online : OTCP

- Articles related to Salaried on EPF, Variable Pay, ESOP,NPS, Income Tax, MBA, Changing jobs

I worked at a company from January 2017 to October 2017. I had not activated my UAN. Now I am going to join a new job in August 2021. Even my salary slip till September 2017 had no deductions for tax. Only my October 2017(last month) salary slip has any mention of PF deposit and tax deduction. Will i get a UAN from my new employer. On the Know your UAN portal of EPFO it shows “no data found” in accordance to my PAN number

Yes, your new employer should provide you UAN and a new Member Id.

How much PF deduction you had? Do you have any PF number?

Informative post. Thanks for sharing.

I have a query. My previous employer had a PF Trust. Hence even after the transfer of PF amount service history is not updated in the UAN portal. My total work experience is 6.5 years but since my previous employment is not updated in UAN , it displays a total of 3.5 years of work experience only. Now that I am not working anymore and want to withdraw my PF how can I avoid TDS as the UAN portal is updated with only 3.5 years of experience?

Even those who are contributing to EPF trust have been allotted UAN number.

How many UAN’s do you have?

Did you withdraw from your previous employer?

You can mail all details to our email id bemoneyaware@gmail.com

I resigned my last company but he didn’t put date of exit in my member I’d. What it will happen when I join to new company.

Please ask your employer to update date of exit.

There would be problems going forward as you will not be able to transfer or withdraw from your earlier EPF account

जो हमारा पीएफ में मोबाइल नंबर रजिस्टर्ड था वह नंबर खो जाने पर हम नंबर कैसे रजिस्टर रजिस्टर कर सकते हैं

If a person resigns from a job and opts for full and final settlement, what happens to the EPF Account and UAN in that case? Now that transfer of PF is not an option (owing to the fact that full and final settlement has been processed), should the old UAN be filled in forms like Form 11?

I have to fill Form 2 and Form 11 as part of my Onboarding Formalities. Doubt arises that I dont know if after opting for Full and Final from my previous employer my UAN and EPF Account are still valid or they get discontinued/closed/inactive? Form 11 requires me to fill in if I have been a part of EPF and EPS. The answer is Yes, I once was. But, then I resigned and took full settlement because I did not have my future employer details and didnt know ho to initiate a transfer without that.

So in the above case should I fill the previous UAN and previous PF Account Number in the form even if I have taken the entire amount?

Good question.

Congratulations on your new job.

It depends on what your Full and Final settlement involved withdrawing from EPF.

For many EPF withdrawal is not in Full and Final Settlement – which usually is Gratuity, Leaves, Payment etc

Did your old company had exempted trust or UAN?

Please check your UAN passbook to see if there is Withdrawal.

Please do give your UAN and PF to your new employer.

UAN is like PAN it maintains your employment history.

Waiting for your answers

I had worked in X company last 11 years & Joined a new company new Y company had generate a new member id with my X company UAN. I had left Y company after 18 days job and join X company but X company not put date of exit and contribute EPF in old ID . Please suggest me.

So you rejoined company X after few days.

Did company X mark your date of exit?

If yes, a new member id would be generated again by company X.

Please check with your employer

Hi there, I needed your help.

I have very little knowledge about claiming and other procedures. I had claimed for my PF amount earlier and I only received half the amount. When I checked my EPF Passbook I could see the pension amount and a small contribution towards EPF from my end was not given to me.

I have again applied for the amount. Now I have joined a new company. I shared them my UAN number. My employer says they are not able to create a PF ac for me!

Does this means that as my latest claim is pending, a new PF won’t be created??

Sir, my name is Mini. I have resigned from my job 1 yr ago and i have not with drawn my pf. because my previous employer had to remit pf dues for 2 yrs. as i am in need of intense money i thought of applying for pf, but now my uan details are not matching and my previous employer is not doing the necessary approval on my uan/kyc details. what should i do now. How can i withdraw my PF

Hi,

I was was working in x company with lesser salary then i joined a new company with salary hike in process i had shown my previous company salary greater then actual, can my current company trace it through my uan.

No they can only see where you have worked , not the salary details

Dear Sir,

Recently I changed my job, my current company is linked with my UAN but I see that there is another company is also linked with the same DOJ of my current company,I don’t know why and how, I have never worked in that company.

Could you please help me how can I remove that company history which is showing in my Service history.

Thanks in advance.

Hello Sir,

I worked in a company two years ago for an year. I have UAN and this September I joined a new company and pf credited to this account. But the thing is now I got better offer from some other company.

I’m not ready to show this one month’s experience. Please advice.

Hi, thanks for the informative article. I need one input. I put a online transfer request for transfer of claim from my previous org (exempted org., trust) to current org. (exempted org., trust). Previous org. transferred the funds to EPFO Commissioner account and released Annexure K . However in UAN portal the status for transaction is shown as “rejected by field office”. What recourse I have in this case when previous org. has done NEFT transfer to PF commissioner account already ?

Please check your passbook/EPF details of the exempted trust of the new organization,

is the amount from the earlier organization reflecting in your new passbook?

Do you have annexure K? Can you send it to bemoneyaware@gmail.com

As the transfer from Exempted organization to the exempted organization only EPS gets transferred to Regional EPFO.

And transfer request has to be approved by the earlier employer, not by field office hence the status shows as Rejected.

Just get in touch with your new employer and see that EPF amount is transferred to new organization.

Entered information does not match with any member.

Last week i process previous PF transfer in current employer account but still not transfer ,my friend also submitted that time his pf transfered but my pf still not transfer where is gap i cant understand,Pl Help for this issue.

EPF transfer depends on many factors

Did you and your friend transfer from the same old employer?

Whom did you submit your request to old employer/new employer

I am doing a state govt job now. i want to change my job. I have appeared in a exam on June 2018..I am expecting to come in the merit list . But I have given one wrong data during registration process that I am not an employee which is not true. Now the problem is that if they know about my present job definitely they will dismiss me as I input wrong data..I don’t want to be dismissed as I want to do that job. I have one UAN , EPF and a PAN linked with .May I be dismissed if I don’t provide the details of my job ,EPF,PAN, UAN ? Is there anything problem if I don’t give the details? Should I provide the details ? Should I have an affidavit that I input no when asked if I am an employee incoherently..may they be able to know about my job , pan, UAN, even if I don’t provide the details?

Please please your any answer regarding my comment will be highly appreciable …please clear the doubt?

Pls let me know what happened to your case as I am also experienced d same

hi i worked in x company and after 1 year i joined in y company and i withdrawn money from x company . now y company can see my x company details like company details. experience and contribution. ..?

Company Y can only see that you worked in Company X for this much time period.

Nothing more.

do they use these details for background verification and pf handled by finance team r8..?

They can..

It is not good to hide your old employer from new employer

i have settled x company amount .

does current company(Y) use this information for background verfication .

since i have not mentioned x company details in experience .

I moved from X company to Y in Sep-2013. I did not transfer my PF to the Y company. Now When I try to withdraw the PF of X company, its asking for the UAN number(which wasn’t there in the year 2013). I tried to enter my X company PF details to activate my UAN. But I’m getting the message “Entered information does not match with any member” . Pls help.

We would recommend that you transfer EPF from company X to company Y.

But if you want to withdraw as you don’t have UAN you would have to go to regional EPFO office and submit the physical form.

Our article EPF New Composite Claim Forms for Full and Partial Withdrawal Aadhar and Non Aadhar based explains it in detail.

Hello,

I am moved from X company to Y company. I have filled Form 11 in X company but within 1 month I switched to Y company. I don’t know about my previous UAN number. should I fill new form 11? Please suggest me I need urgent help.

Hello,

I have changed the job one to another. already activate UAN. while login it showing current employer. On service history it showing both employer. Both has same UAN number. now I need to claim pf amount from previous employer. please advise

or else please advise how to transfer pf amount from previous to present employer with same UAN .

Please check both your passbook.

If there is transfer out from old employer passbook

and

transfer into the new employer passbook then

it is automatically transferred.

Else you would have to initiate the transfer.

Before transfer, you should be able to withdraw from the old employer PF which we don’t recommend.

EPF money is for retirement

and EPF withdrawal before 5 years is taxable.

Please check Our article How to Transfer EPF Online on changing jobs for more details on the Passbook images and process of transfer.

Dear Sir i want to know about my pf. My pf showing is exampted and i am not able to withdraw my previous employer amount kindly guide me how can i resolve this issue and should i create new UAN with new employer?

As your EPF is exempted you can only get it from your employer.

You can create new UAN but then you would have to merge with earlier UAN to get pension

Hello Sir,

I have two UAN number, my previous PF amount transferred from X company to Y company.

Y company generated new UAN number, but my employment history is not updated with new UAN number. how to update the same. As my PF transferred , but my EPS is not transferred as per new EPFO annexure-K.

Please let me know

a) How do i transfer my employment history from old UAN to new UAN

B) How do i transfer EPS ,as EPF already transferred.

C) How do i update Marital status in new UAN.

B)EPS/Pension does not get transferred as explained in the article What happens to EPS when you transfer your old EPF to new employer

C) Submit request to employer.

A) The View->Service details on new UAN should show it.

Can you send snapshot of your UAN->View Service History and Passbook to bemoneyaware@gmail.com

HI,

i have left company X and Joined Y, now first of all i have initiated the Transfer request but the Employer X is unable to process the request, can i withdraw the PF amount by submitting hard copy document to the PF office.

Thanks in Advance

If company X is not exempted organization then you can submit the request to current employer.

Dear sir,

Need the information on if i have existing PF Account with private company and switching over to government job, can i carry on with same PF account number.

Govt job usually offer NPS and not EPF these days.

In the budget of 2015-16, the government had announced that they will allow funds to be transferred from Employee Provident Fund EPF to NPS or National Pension Scheme.

On 06 March 2017, Government not only announced the guideline for transfer of PF to NPS but also they clarified that the amount transfer will be tax-free.

According to the rules, the subscriber looking to transfer funds from EPF to NPS must have an active NPS Tier-I account, which can be opened either through the employer where NPS is implemented or online through eNPS on the NPS Trust website.

The amount transferred from a recognised Provident Fund or superannuation fund to NPS would not be treated as income of the current year and hence, would not be taxable.

Further, the transferred recognised Provident Fund/Superannuation Fund will not be treated as contribution of the current year by employee/employer and accordingly the subscriber would not make Income Tax claim of contribution for this transferred amount.

The subscriber, either a government or private sector employee, must approach the concerned PF office where their money resides, through her or his employer and request to transfer their savings to an NPS account.

Should you Transfer EPF TO NPS

Well, as said the PF is a debt product hence falls under your debt portfolio. Out of 3 funds, NPS has 2 funds which are pure debt funds. Government employees have just one choice of a balanced fund. Transfer is a change in your asset allocation. Are you ready to take on some equity exposure? It really depends on your Risk-Tolerance.

NPS has some flexibility especially in the Auto-Life Cycle option, where equity portion minimizes on every birthday and goes zero at the time of retirement. Also features like opening Tier 2 account, commuting 60% at during withdrawal, switching the fund managers are good options as they offer choices to the investor. These are not available with EPF.

But, NPS withdrawals are still taxable. Although it has the option to commute 60% but it is taxable which is not in the case of EPF.

Also in the case of EPF, you can withdraw the amount after 2 months of leaving service. NPS has no such facility.

EPF is also coming with a housing payment scheme where you can pay your house purchase through EPF. NPS has not such facility.

So there are pros and cons. You need to see what works best for you.

Hello sir,

I have a question. Please advice me that what was the criteria to remove new pf account number? Because I was resigned on 31 March 2017 but the same employer created a new pf account number on 1st April 2017 by mistake which was recently shown into my PF data. So, just because of this pf authorities was rejected my claim? I don’t understand what should I do next?

Thanks for such wonderful info. I have a small query.

Initially I worked for an IT company X from 2007 to 2010. Later I joined another IT company Y from 2010 to 2013. After that I left India and currently working abroad.

UAN was introduced in Jan 2014. Since I left my job in India in 2013 there was no way my UAN was generated. My questions is, how can I generate my UAN now? How can I withdraw my PF from both the companies?

Your response will be highly appreciated. Thanking you in anticipation.

You would have to go the offline route.

Did you transfer your PF account from company X to company Y?

If not you would have 2 make 2 withdrawal requests one for each of EPF office.

Hi,

I am working for 2 diffent companies because I want to be in best one. It has been 1.5 months both companies have created Epf account linked to my same UAN no.

I am planning to leave one company. I wanted to know will my both company will come to know about each other.

Can 2 company deposit pf amount for same month but in different epf account.

Was working with a company for a brief period of 9 months. While joining the company I provided my old UAN number but instead the company issued a new UAN number. Is there any way to retrieve the new UAN which was issued by the company as because HR is not providing the same. My details being the same,can I retrieve my UAN and PF details …plz suggest

Hi

Can i withdraw PF from Previous employer if my new employer PF accounts linked with my UAN i had given UAN to present employer while i joined, but HR stated only new PF accounts will be linked not the money of previous employer will be added unless u give transfer request

EPFO is working on the automatic transfer of EPF accounts.

As it is not transferred you can withdraw it. but you would lose the benefit of compouding.

Dear Sir ,

I have left x company and joined Y company . And provided the same uan no to the present company . It is almost 6 months now . Will the prev company pf will audtomatically transferred in the new one ??? pls confirm .

I have also initiated to to manual transfer but I am Not able to transfer pf amount from previous account to present one .

The message error is showing :::

Details of previous account are different than present account. Hence Claim request can not be processessed ).

What should I do as all KYC are updated as per Previous one .

Pls suggest.

EPFO had said that auto transfer of PF account would be done automatically but we are still waiting for confirmation.

Did you follow the steps mentioned in the article Auto Transfer Of EPF: Check Out How This New EPFO Facility Works

You can verify how many member ids are linked to your UAN by visiting EPF site and clicking on check Claim Status as explained in our article. How to check Member Ids or PF accounts linked to UAN

You can send the UAN and picture of the View->service History to our email id bemoneyaware@gmail.com so that we can dig further.

Hi Sir,

I have resigned from my X company in Nov’17 & joined another Y company in the same month. For the UAN associated with X company, I have raised ‘Change request’ against my full name & Aadhaar no. as I want to transfer my PF to new company. The change request is now pending at Vashi office to get approved since 10 days. I need that changes to be reflected for PF transfer purpose. Also, due to this my KYC is also not getting approved by my previous employer.

So, my question is that how long it will take the field office to approve the requested changes so that I can initiate for transfer of PF from X to Y. I am unabe to receive any feedback of my mails from field office & they don’t receive any calls.

You can file an EPF Grievance. Our article How to register EPF complaint at EPF Grievance website online discusses it in detail.

I have recently joined as a Management Trainee in BEML Ltd. through GATE. It’s only been 6 months. I got the interview call from HPCL. BEML has the policy of not issuing NOC in the training period. But HPCL asked for the NOC if you’re already employed in a PSU. So in order to attend the interview I said I am unemployed to HPCL. I got selected in HPCL. Now while resigning from BEMLthey are not accepting the resignation stating that you have to mandatorily serve for 3 months notice period without fail during training. No other alternative of paying the bond amount in lieu of notice period. So I left BEML giving an application that I won’t be able to serve for 3 months, kindly consider it as a special case and relieve me and I am ready to pay whatever the bond amount is. No further communication from BEML. But HPCL is asking for the reliving letter from previous employer which I won’t be able to produce so I will say that I was unemployed. But PF account is created in BEML and UAN number is now connected to AADHAR number. HPCL has asked to create UAN through AADHAR. So when I am trying to do so it is showing AADHAR is already linked to the UAN no. So I have to provide the same UAN no to HPCL as new one can’t be created. So can HPCL see the details of previous employer through UAN. What shall I fill in the form 11 (new)? What should I do?

Hi Aman,

I am in the similar situation as you. It will be great if you could tell me, how you handled the situation. Thanks a lot!

hi anuj..

i am also in similar situation..plz help

Hi guys..

M also in similar situation…plz help.

Me in similar situation , can anyone help me on high priority??

Hi aman i am in same sitiuation.what u do???

I was worked in an MNC in 2012 and the employer created an PF a/c and it was not linked with UAN. Resigned on 2013 and now the current employer planning to use the same PF a/c. How can i link the PF a/c with newly created UAN. I have only the old PF a/c no and newly created UAN.

Your old account details would be merged with the new one.

If you check your View->Service History what does it show? Only the recent Date of Joining.

You can raise EPF grievance and get a ledger account details which shows that old account was merged with the new one.

Our article How to register EPF complaint at EPF Grievance website online explains it in detail.

Dear Sir,

I have an active UAN account number which was allotted while am working with my current company (i am working here for 7+ years). Also, i was working in another company previously for 3.5 years and transferred the PF amount to current PF account. Now my total tenure of PF is 10+ years so planning to withdraw partially for housing loan repayment.

But now in UAN portal my DOJ is showing current company’s date of join which is not allowing for withdrawing my PF using UAN portal’s claim.

Please guide me in correcting the data so that i can withdraw the amount online.

Thanks in Advance.

Can you send the following to our email id bemoneyaware@gmail.com

1. snapshot of the View->Service History after logging in to UAN website? Is it similar to the image shown below

2. How do you know that your account was transferred? Any proof (UAN passbook showing the transfer)

Typically when you work in multiple companies and transfer the amount to one UAN then your service history should be as follows

Hi are you telling that you can work in two companies at the same time if the clause allows ? And have pf from both?

@Mohan, I have a similar issue, how did you resolve it?

hi , i left the job in aug 2016 , and later due to some health issues, i havent joined any firm so far. i am unable to update kyc details in epfo site (how to update aadhar card ). let me know how to update it please.

Sad to hear about your health. Take care.

What issues are you facing while updating your Aadaar details?

Did you try eKYC Portal of EPF Link UAN with Aadhaar without Employer

Dear Sir,

I left my previous company in March 2017 where I had my UAN no.My new company created another UAN for me.I got the PF amount transferred to PF account in second company and this company is exempted from EPFO.They have a trust .Now both of my UAN are active,I am not able to link Aaadhar and PAN with second UAN no.How to do it,please advice.

What error are you getting on trying to link?

Have you activated your UAN?

As per EPFO’s notification issued on 21st September 2016, EPF should automatically deactivate the old UAN. Notification given below.

You can send mail to uanepf@epfindia.gov.in by mentioning, both – your current UAN and your previous UAN(s).

Raise Epf grivenace at http://www.epfigms.gov.in/

Wait for a week and then raise it on social media channels of EPF.

Do keep us updated.

You are advised to apply for EPF transfer from previous EPF account to the new EPF account (which you have already done).

The EPFO’s system would then automatically identify such cases (on periodic basis) where the PF transfer has been effected from one EPF account to another, and have two different UANs attached to these EPF accounts of the same EPF member (employee).

All such identified UANs (old UANs), from which PF transfer has been effected to PF account having different UANs (new UANs), would be deactivated. So, the old UAN numbers will cease to exist and are blocked for further use. (This procedure of merging duplicate UANs will be carried out by EPFO on periodic basis and can also be performed even when no requests have been received from its members.)

Your previous member ID (old EPF account) would henceforth be linked to your new UAN.

You will be informed of the deactivated status of your previous UAN by SMS to the registered mobile number. You would be requested to activate the new UAN (if not done) to get the updated status of your EPF account.

Sometimes, there are chances that you may have to receive some PF arrears from your employer, in such cases, since the system knows the new UAN against the deactivated UAN, the system would automatically populate the new UAN in the ECR (on punching of previous UAN or member ID by the employer) and the statutory contribution by the employer against the arrears can be remitted against new UAN only.

Dear Sir,

I’m unable to activate UAN. when i try and submit it says

“Entered information does not match with any member”

my adhar number aleady linked with EPF account.

hi,

i have declared my old PF number to my UAN no. but cannot see its member passbook.

Does this process takes time?

Moreover, can i wan to withdraw all the money in both of my PF accounts. How can i do it? Can i withdraw pension contribution as well?

I joined company A 10 days before. IAM getting better opportunity for company B in another 10 days. I have provided my UAN number to company A. If I abscond company A in 20 days without getting salary will my epf account gets created for company A. How many days it takes new employer to create epf account.will they create my epf account if I absconding company?

I would not recommend you to abscond.

It is better to tell the company for its a small world, socially connected and if caught later it might not look good.

Coming to your question.

Your employer can now instantly create your new Member ID and associate it with your UAN account.

But they usually do at the end of the month when the salary is credited.

Employer has to create the epf account and then credit the amount. So if the employee does not show up the salary would not be credited and then the EPF would also not be deducted.

Hi sir i have resigned from my previous employer on April 2017 and joined new employer.But both Pf accounts are got linked to my UAN Number. Now i want to withdrraw my previous employer PF amount due to some emergencies.Is it possible.I submitted Claim but it is showing process. Is there any limitation to withdraw previous employer PF ?

Please reply.

Can you send snapshot/picture of what it is showing?

Once the account is transferred you cannot withdraw, but you can do EPF partial withdrawal.

We have explained the process in our article How to do Full or Partial EPF Withdrawal Online

Can you help with the process and to know who exactly should be working on resolving the problem alike ( EPFO or previous employer).

Problem: Due to the carelessness of someone old as well as the new company, unfortunately, someone have two UN number. Now the person is willing to transfer his old EPF balance to a new employer. Here the problem comes that old employer was having his own trust before but coincidently at the same time employee left old company changes it to govt trust there onwards. And when this transfer happened between govt and old company UAN also got launched ..though the employee got the UAN number from the old company…but when he activated and went into his OLD company created UAN account there is no joining date and leaving date.

Now the transfer of EPF balance is not happening and neither govt EPFO responding nor old company taking responsibility.

What should someone do in that case?

It would be difficult but not impossible.

If you have all papers i.e your old company PF number and UAN you can approach your Regional EPFO .

You can also raise the grievance at http://epfigms.gov.in/

Then you ask the question or status update on twitter.com/socialepfo or facebook/socialepfo

Dear Sir/Madam,

I have left a Company on 30 jan-2017 and joined Govt. job on 01 jan-2017, I didn’t tell my company that I have joined govt. job so the date of joining in govt. and date of leaving in company are overlapsed. My questions are:-

1. What will happen with my PF and UAN of company and the new NPS maybe (not yet issued) from my new govt. job.

2. Is there any conflict in overlapsed of date of leaving and joining for UAN and NPS.

3. If Q1 and Q2 solved, can I withdraw my PF from my UAN.

Thanks

Hi I would like to know is there any chance for previous employer to know the details of new employer through UAN.

worked in a company for 4 months then i left job by breaking bond. i have pf account & UAN from that company. since was placed in MNC now i got Doj. They r asking for reliving letter which i dnt have .UAN is the only means from that they will get to know that i have worked in some company. so on the doj shall i give them UAN details or should i keep quite so that they will create new UAN?? While creating new UAN through PAN card will it shows that i already have UAN? PLease Reply and help me as my doj is near

Hi

Could you please let me know what happened further in your situation? Was a 2nd UAN created or did it show the first existed?

hello sir I have left the job in one year MNC company but I have not inform to old organization I left that Job but actually uan number is generate ….my problem I have join any organization but uan number will be generateold or new sir pls kindly help me

This is my Third company . In first two companies I don’t have UAN and only PF accounts there . Third company generated UAN based on Form11 ( i given old two pf accounts+Current PF) . In EFPO site showing Third company PF number(current) & Second company PF number. It is not showing First company PF number. How to add First company to current UAN.

Can I add in EFPO site or I need to approach current employer. I suspect current employer not linked my first PF number to UAN?

Hi,

When I try to link my previous employer PF account to my UAN in the portal which is in the format as shown below. I get the error message as “Name against member ID entered by you does not match. Kindly contact to concerned EPFO office.”

PF No : TH/THA/EXEM/43345/54596 (TH-THA-0043345-000-0054596)

I can see currently see two member IDs in my account.

1 PUPUN003146300E0055629

2 THTHA00426550000042634 ( my EPS account as per my previous company pay slip)

Thanks in advance.

Br,

Naveen

I have not disclosed my UAN to my present Employer. A new PF member ID is generated for me but still UAN is not generated for this member ID. I joined new company in September month. When I checked UAN status for the member ID in UAN portal, I found “your UAN is not available”. Can anyone please tell what does it mean and How long it takes to generate UAN to PF member IDs.

HI, MY NEW EMPLOYER HAS GENERATED A NEW UAN AND I WANT TO RESGITSER THE SAME MOBILE NUMBER WHICH WAS REGISTERED TO PREVIOUS ONE BUT ITS NOT ALLOWING ME TO DO SO. PLEASE SUGGEST WHAT CAN BE DONE IN THIS CASE

See if the following work (and let us know if it works)

Change mobile number registered with old UAN by logging in to UAN and Profile–>Change Mobile number.

Then try to register the mobile number with new UAN

My employer told me that they linked my new pf account to my UAN.

So How can i check the same as I need to apply for the pf transfer.

I have previous company UAN and current company also generated New UAN, I required to transfer one UAN money to another UAN…kindly help…

You can transfer PF account from old UAN to new UAN. Once the transfer has happened old UAN will become useless and it would be deactivate.

Remember UAN is tied to mobile number(for OTP) so use another mobile number for new UAN

Our article When you have 2 UAN Numbers What to do? talks about it in detail.

Hi, I have UAN number. My Previous company PF details were linked through UAN. After I exit from the company I have withdrawn the PF amount.

Now I joined in a new company and got the NEW PF number.

But when login into UAN portal, still old company PF number and details are showing.

How do I link the NEW Company PF number to my UAN.

Do I need to initiate the transfer even I withdrawn the old company PF amount?

Kindly suggest

Hi,

An year ago I switched my job, so I initiated the PF transfer from online and the past employer approved it as well. The problem is the UAN & past PF ac. has the incorrect DOB, I should have requested the past employer to do the DOB correction first & then start the transfer.

The transfer status shows successfully credited to the current employer in PF website, but the current employer says they can not link the PF account because the DOB in my past PF acc & UAN is wrong.

Later I generated the DOB correction request form & submitted to past employer, but the PF officials says we can not do the correction since the past PF is already transferred and so it is equivalent to closed.

Both the past employer & PF official says can not do the correction but the current employer keep on asking me what to to. Kindly advice.

If I ask current employer to generate new UAN, will I get the past PF acc balance? Or if I go to the current PF acc office, they can help me anything?

Thanks

Hi sir,

Currently I am working in Samsung c&t,recently my present employer asked me UAN number ,I gave him.he kept a request for linking my present id to UAN.In form 11 I gave wrong date of leaving previous organization because I had only 9 month of experience in previous organization.At time of joining company asked me one year experience to get a job so I gave instead of march 2014 to june 2014.Now my current employer requires approval from previous organization inorder to link my present pf id to UAN.I kept 3 more months fake Payslips and reliving letter by editing from friend.How to get out of this situation.Can I say to my present Hr that don’t know about my date of leaving details because I break the bond of 2 years so that’s why they are not approved.so can I say to them I need new UAN.Is there any problem for my current job

Don’t dig deep into lies.

Ask your HR to generate a new UAN.

You can then transfer from old PF account to new one.

Buthe already taken UAN number and filled the form 11 and send to previous organization for approval.Definitely previous organization wont accept because of not matching date of leaving.So if my hr asked me what can I say regarding this?

My current hr will be know exact date of leaving if they didn’t approve the transfer. If my hr ask regarding mismatching of date of leaving what can I say? how to say him to generate new UAN

Hi, I have UAN number. My Previous company PF details were linked through UAN. After I exit from the company I have withdrawn the PF amount.

Now I joined in a new company and got the NEW PF number.

But when login into UAN portal, still old company PF number and details are showing.

How do I link the NEW Company PF number to my UAN.

Do I need to initiate the transfer even I withdrawn the old company PF amount?

Kindly suggest

I have not shown my past experience where i worked for 4 months. Hence have not given any PF no. And UAN no. Was under process when checked on epf website.

Will a new UAN no. Be easily generated in my new company or will there be any issue with UAN generation as PAN no. And Aadhar card or mobile no. is same as given to previous employer….please advice on the same. Or can i deactivate previous UAN if already generated. Will the new company catch in background verification

Hi,

Please advice how many months it takes for the UAN to get generated. It has been more then 3 months and this is my first company. When i track its status, it says, UAN generation s under processing (through ecr).

Kindly advice usual ETA for UAN no. In the first job.

i have two member ids in my UAN member portal already.

now i dont have any jobs.

how could i widraw my PF NOW?

KINDLY SUGGEST….

Is it poosible by the new employer to know pf contibution by old employer using uan no..let me know please

sir I have join a new company and at the time of joining I has submitted wrong date of relieving from previous employer and the same has been furnished by me on form 11

kindly suggest me the implication of furnishing the wrong date of releiving on pf amt

Hi,

Please refer to your Current HR department because whenever you request your current employer to link your previous EPF to current account , then you have to submit the previous details.

Then current employer accepts your request and forwards the same to EPF department. This option we have is that before CUrrent employer accepts, he can delete the request from your side. Then agan you can submit the fresh details.

I have active uan no sir…. Can now possible my and my father epf account name change… Because its is incorrect.

Not sure, but maybe this one could help (a bit): http://www.repairsurge.amazon-certified.com

Hi,

I have withdrawn my PF and Pension from my previous company. Previous company verified KYC (my PAN)against my old UAN. My new company created another UAN. Present company saying no problem of using my new UAN, as I have already withdrawn PF and Pension from previous company. Is there any problem in future if I continue with my new UAN. Please suggest.

No there would be no problem

Sir, I have the adhaar card linked to my UAN portal showing status approved by my previous employer. Currently my later employer approved my pan card and bank account uploaded on UAN portal. Is it mandatory to upload the adhaar card again?. I want to apply for the withdrawal of my pf directly from epf department without employer concerned or employer signature? Kindly suggest.

Hi Team..My KYC details are pending to be approved by my previous employer (UAN generated by prev employer). I do not expect that they will be going to approve it soon or ever though i am following up with them. can you please tell if my current employer can approve it or please suggest all the alternatives to get this done. Due to this i am not able to get the UAN linked to my current PF account.

Hi,

There is mismatch in date of exit from my previous company due to which my my company is not able to map the new pf number. Wanted to know the process to get it changed.

Contact your previous company

I had been working with Accenture Services pvt. ltd for the last 5 years. Recently I shifted to a new company. As suggested by then HR, I have initiated the PF withdrawal after 2 months. In my previous company there is a separate trust which takes care of PF related issues. They have rejected my form 19 application multiple times stating signature is not there etc. 2 Months back I re-submitted the docs took scanned images and sent them and informed via mail by attaching the same. They came back after 2 days of submission and told me that they are waiting for ACCENTURE AUTHORIZED SIGNATURE and till now, I am getting the same response from them. I am fed up with all these excuses and want to raise a complaint against them to PF office. Could you please help me how to proceed with this?

how to identify if a specific account is associated with a specified UAN

Sir, I have 2 pf accounts linked with my UAN both are from my previous companies one is based at mumbai and other at bangalore. I have left job since Feb 2016 and I had applied for withdrawal of my pf through UAN with the new prescribed forms directly to pf offices. Though I got my pf money from the bangalore office, the mumbai office has returned my form saying I have 2 accounts linked with my UAN. kindly suggest a way by which I can withdraw my pf balance from mumbai vashi pf office

Decide which UAN you want to keep. In such a case, you are suggested to immediately report the matter through email to uanepf@epfindia.gov.in by mentioning your current and previous UANs.

Transfer account to the selected UAN.

Once transferred withdraw.

Is every new epfo number displayed on back side of UAN,

for eg-if a person changes to a third job, then will there be 3 accounts numbers on back of UAN card

hello sir ,

sir recently my friend have got a gov. job. Before getting this job he was an employee of another gov. department in the same state. but he didnot show about his previous gov. job.He has given resignation .he is going to join his new job .But the problem is that in gov job one person can hold only one NPS account. but he din’t show his previous job means he should not have nps a/c,but he has .both are contradictory.so what he should do…

Hi sir,

I have given trnsfer of EPF through UAN portal from previous to current employment(trough current employer),but my DOB is incorrect in previous employment,however i have given Revised form 5 to the EPFO,My EPF transfer got approved by current employer,however in my EPF portal, it says-Approved by current employer and pending with previous employer,is that previous employeer need to approve?

if not able to tranfer my EPF,could i able to withdraw through current employer.Pls advice

Sir,I was working in a private firm and have a UAN no,now I am going to join a govt job.As I don’t want to disclose my previous job details,is it compulsory to disclose my UAN no or I can start from a fresh?? Plz help me.

In Government job you will be contributing to NPS, so you do not need to disclose your PF details.

You can withdraw your PF from earlier job.

Though it is not good to hide details from employer.

I was joining a X company in Nov 2015 and from that months to till Apr 2016 my salary slip show my previous UAN which I submitted at the time of joining…. But from may and June 2016 suddenly my UAN no. Changed when I ask employer for the same…. They say activate new UAN no. this is submitted in EPFO office…. They activated my new UAN no. With another mobile no. Now what can I do..? When I know two UAN is illegal… Pls suggest the way forward….. Thanks in advance…

also not getting any response .. saale dheethe ho gae h .. UAN dene me bhi 2 months laga diye the .. itane gusse k baad bhi polite request mails kar pana bhut mushkil ho gaya h ..

My previous employer is not approving KYC .. dropped many emails but the status is still pending. What to do 🙁

Hi..!! I resigned from company X and joined company Y, but company Y had no PF. Now I have joined company Z and they have issued a new member id. Now –

1. There is no Date of Exit from company x on my profile of UAN

2. Company Z has not linked my new member id with my UAN.

3. They have not asked for Form 11 and it has been 6 months

Please advice.

Can anyone please help me to get UAN no, when i’m trying to get UAN by keeping my details the an Error like “Your date of birth and name didn’t matched” even if i gave correct DOB and im having some confusion on entering my name,what should i enter only first name or first name + surname .

Name and DOB should be as per the PF number. Please contact your employer to know what DOB and Name they have submitted to EPFO.

sir i have working with 2 company (Night Shit and morning Shift )? its will be possiable a runnig 2 PF A/c Of one person

I worked for company X and they generated my UAN , I withdraw my PF and while joining company Y , I gave the previous UAN but they didnt register this member id with my UAN. my questions are – 1. If someone withdraws the pf then what happens to the UAN number.?

2. what shd i do with the pf amount from company Y?? as i have joined company z.

Think of UAN as PAN and company like bank saving account.

Just because you close the bank saving account your PAN does not become useless. It is still there to be used next time.

UAN number is for you to be throughout your working life for EPF .

If someone withdraws PF the Member ID stops existing but UAN number does not.

We would suggest transfer the PF amount from company Y to company Z. It will help you to build your retirement corpus.

I have a UAN allotted in my pervious organization. I have changed job and in the present organization while linking new EPF account with my existing UAN the DOB is not matching. The present employer is now asking for the date of birth used while generating the UAN as it’s not matching according to my correct DOB. The previous emplyoer is saying they used correct DOB only based on my document but in reality it looks like they didn’t. Now the EPF linking process with my UAN is stuck in this. Does anyone know any solution or process to know the DOB that was used to generate the UAN ? Kindly reply if you have read this and know any solution. Thanks for your time.

Process is to get the DOB corrected by asking your previous employer to re submit the DOB.

You can also try UAN HelpDesk. Our article UAN Problems, Password,Mobile Number,Incorrect Details and Help Desk explains it in detail.

Hi, I was working in company X and that is acquired by company Y, so my PF account got transferred to company Y and my current UAN is linked with the current member ID. Now I have changed my job to company Z.

In my UAN and PF account, my Name and Birth date are incorrect. So I have given the name correction form to my previous employer (Y) while leaving the company.

In new company Z, I didn’t give my UAN and previous PF account number yet. As there is already problem in Name in my UAN, I want to withdraw the balance of my previous account (please don’t tell me PF amount is for retirement etc..) and open new UAN number with correct name in new organization.

Please suggest how I can withdraw my previous balance

Request for UAN for this Member Id is already under process.(through ECR)

Hi, I have worked for a company since 2011. i’ve resigned in Sept’2015. i have applied for PF claim. But Once again i’ve got a better offer in the same company(Previous Employer) and am about to join there. will they generate a new UAN or can i use the same old UAN for my New EPF Account? Pls Advice….

I have withdrawn amount when i have exit from the previous organization and have given the old UAN to the new organization.

they created new UAN in the new organization stating if amount is withdrawn the new member id cant be added to the OLD UAN.Is it true?

UAN is to track your EPF contribution so if you have withdrawan both EPF,EPS then old EPF will not ad any value. Its better to get a new EPF account.

Hi,

I joined one organization in 2009 and left that in 2015 and joined new organization. However I ma still waiting for my UAN from my first employer. Please help me how I can get the UAN as no one is responding to my mails/calls with regards to UAN from my first employer.

Also can 2nd employer can generate UAN?

Please help.

Thanks in advance!!

any luck?

I forgot my Epf login password and I also lost my old mobile number..Please help with this…how I can update my mobile no?

Hi,

Till Now I have worked for 4 companies. I started with Company A in the year 2007 and i served till 2011. I got a PF account which is not individual account number instead company trust PF account number. In 2011 I joined company B and serve till 2014 and got new PF account number(with UAN number which i dint Know). Then I joined Company C and currently am working with company D. In total i have 9 years of experience.

For more information I have withdraw Company A and B PF.

My question is I want to transfer my Company C PF to Company D. But as per the UAN generation site. Both Comapny C and company D has initiated seperate request to generate UAN number where I already have one from Company B.

Will i get 3 UAN numbers ?

Can i proceed with transfer of my PF from Com C to D ?

Will i be eligible for pension after one year (As i have already withdraw com A and B PF) ?

Please guide me.

I have two separate Employee Provident fund account numbers from the previous two employers.

I am going to join new company. Is it possible to merge the two previous provident fund accounts to the new provident fund account number?

My previous employer has applied for my UAN Number and it has been over 6 months that i left the orgazination and i still see the same message when i check the status for UAN generation, i.e.,

Request for UAN for this Member Id is already under process.(through ECR)

I have tried contacting my previous employer regarding this and i am not getting any reply.

How can i take this forward?

UAN for our employee I am waiting since 1 year and is still showing member id is already under process (through ecr)

I changed job and while transfer claim i came to know that my previous employer has given wrong name ie for first name they provided my lastname and vice versa.

Now i want to correct my name, but my previous employer’s pf department is not responding to my request to correct the name.

Is there any alternative to change the name either it can be done through new employer or could you suggest any other process that my previous employer is bound to address the issue.

My previous company generate uan no,but now i m going to join govt. Job.is it effect on my service?

Congrats on your Government job. In Govt one has to contribute to NPS. So your EPF cannot be transferred.

My form no 13 form has been processed and approved by the govt to. But the problem is that they had not transferred employer share towards pension fund in my new present employer account.

We had asked about EPS transfer and no EPS transfer and the response we got the same day after submitting our request was as follows

Dear Member, Your UAN Helpdesk Reference ID 15088888 has been closed with closing Remarks

“WHILE TRANSFERRING PF FROM ONE ESTABLISHMENT TO ANOTHER, THE SERVICE DETAILS INFORMATION (VIZ LENGTH OF SERVICE, NON-CONTRIBUTORY PERIOD, LAST WAGES DRAWN ETC) ARE FURNISHED TO THE RECEIVING PF OFFICE IN ANNEXURE-K WHICH WILL BE USED TO CALCULATE PENSION BENEFITS. AMOUNT IN PENSION FUND IS NOT REQ”.

I am not yet clarified, can you please elaborate the same in detail.

It means that EPFO has made a note of your length of service. There would be no other documentation/verification for transfer of EPS.

When you retire and apply to EPS for pension it would consider number of years you contributed in EPS in all your jobs.

But if I wish to withdraw the pf after leaving the job , will I get the whole amount of EPS amount that was not showing in my portal.

I have wrongly added my previous employer (company) as my current employer and my current employer (company) as my previous employer in UAN Member e-SEWA. Please let me know how can I change/amend the same because otherwise I won’t be able to transfer claim from one account to the other account. Please let me know the way forward.

Moreover my father name is wrongly spelled . Can it be rectified? Please let me know the way forward

Mr. Saurabh, there is no option available for this. The only solution with you is to inform you present employer and request them to reject your form and after that you have fill the form again new particulars and submit the same to the department.

My new employer has instead of transferring my pf account has created a new UAN . I had worked for 8 years with my previous employer with PF for 8 years. Now since the new employer has created a new UAN , will I be eligible for the pension after completing 2 years with my present employer.Or will my 8 years service will be a waste

Purpose of UAN was to track EPF & EPS across multiple jobs. So your 8 years of service will not be wasted.

You need to transfer your old PF account to new UAN.

you immediately report the matter either to your employer or through email to uanepf@epfindia.gov.in by mentioning your current and previous UANs. After due verification the previous UAN allotted to you will be blocked and Current UAN will be active. Later you will be required to submit your Claim to get transfer of service and fund to new UAN. How much time this would take we don’t know. If you can share your experiences with us it would be beneficial to others.

Hi Pradeep, In such a case, you are suggested to immediately report the matter either to your employer or through email to uanepf@epfindia.gov.in by mentioning your current and previous UANs. After due verification the previous UAN allotted to you will be blocked and Current UAN will be active. Later you will be required to submit your Claim to get transfer of service and fund to new UAN. How much time this would take we couldn’t find out.

If I change my company and my PF gets transferred to new Account, then what about pension part

Your service period is recorded. So you would not lose out pension for years worked in earlier company. This is what EPFO office says

“WHILE TRANSFERRING PF FROM ONE ESTABLISHMENT TO ANOTHER, THE SERVICE DETAILS INFORMATION (VIZ LENGTH OF SERVICE, NON-CONTRIBUTORY PERIOD, LAST WAGES DRAWN ETC) ARE FURNISHED TO THE RECEIVING PF OFFICE IN ANNEXURE-K WHICH WILL BE USED TO CALCULATE PENSION BENEFITS. AMOUNT IN PENSION FUND IS NOT REQ”.

I am having One UAN with two Menber ID linked in it.

Should I transfer the amount appearing in Old Member ID in the new one?

If not transferred should I get interest benefit for both the linked member ID?

Please suggest.

Yes Sir , you should transfer your old Member Id to New Member Id.

Yes you would get interest benefit for both the account, but separately.

You would miss out on interest on cumulative amount.

i am getting the below message from last 6 months

Request for UAN for this Member Id TBTAM00300270000039370 is already under process.(through ECR)

please review solve the issue and do the needful.

I am trying to add Previous Member ID but its showing the message like “Name against member ID entered by you does not match. Kindly contact to concerned EPFO office.”

Previous employer has put my name as per the PAN card as Rohit Vyavhare but it have the spell mistake. My correct name is Rohit Vyawahare.

So can you please tell me how I can link that PF Member ID.

My new compny generate new UAN no. I am also transfer my pf balance to new pf a/c.no. i have got sms for the same (your setteled ammount rs.12345 sent to A/c no. Xyz ifsc code xyz).i have informed to my new compny but they do not reply me so sir pls suggest me what can i do for the same i have both uan no. Where i can see my pf balance amt….

So you have withdrawn from your earlier EPF account. Did you withdraw your EPS too?

Send mail to uanepf@epfindia.gov.in mentioning your current and previous UANs and keep a copy in your records.

Hi, I am working in a company for last 1 year 7 months, They deducted my Pf amount but not given any pf number or any UAN number. What Should I do. Now I want move to another comapny is this create any problems or how to get

Your employer should give you PF account number . Please ask your finance department for it.

I iam working in the company where i got my uan no. After resignation i apply for withdral request and joined new company they aske me abt uan no i tell him previous one so it will effect my withdrawl form?

Currently no.

Theoretically one is not allowed to withdraw from EPF only if one is unemployed for 2 months

Why are you not getting your earlier EPF account transferred? EPF is for purpose of retirement and if you withdraw before 5 years you lose out on tax if withdrawal is before 5 years and lose out on compounding too!

my new compny generate new UAN No. i have two UAN no what can i do pls. suggest

Did you fill Form 11 on joining?

only one UAN is valid for one member id. In your case, you have to ask employer to link old UAN to the present member id and to surrender the duplicate UAN got issued from EPFO in your Company. You can apply for transfer of PF Accumulations on the basis of old UAN.

I am trying to create UAN number but its still showing

Request for UAN for this Member Id KRKCH00150760000062368 is already under process.(through ECR)

Then your employer has already kicked off the process of generating UAN number for you. Please wait for some more time to get your UAN.

Declaration of New employment or previous employment(FORM 11) is pending with employer.

I RECENTLY LOST MY SIM CARD WHICH WAS REGISTER IN PF ACCOUNT..NOW MY PRESENT MOBILE NUMBER IS 9535511517..HOW I CAN CHANGE THE MOBILE NUMBER IN UAN PORTABLE.

You can update the new mobile number in UAN if you have registered your UAN number and you can login to UAN portal http://uanmembers.epfoservices.in/. Select Profile->Edit Mobile Number and enter new mobile number. OTP will be sent to new mobile number.

Let us know if it worked for you.

Request for UAN for this I AM PAWAR SAKHARAM BALIRAM Member Id PUPUN03092060000000006 is already under process.(through ECR)

I had put a request for PF transfer from my old organization.

My current employer had created a new PF account and put a request for a new UAN number generation, 3 months ago.

But till now UAN number has not been created for my PF number.

When I check the status it is giving me the message: “Request for UAN for this Member Id xxxxxxxxxxxxxxxxx is already under process.(through ECR)”.

Please help me out.

Hi sir,

While checking the status of my UAN number it is show the below message “Request for UAN for this Member Id MPIND00198280000000095 is already under process.(through ECR)”. I am getting this message for last 6 months.

Could you please guide me how to get my UAN number ? . Also, in that case to whom i need to send mail to check and get the UAN number.

Thanks a lot.

I am trying to create UAN number since from morning but its still showing

“”Request for UAN for this Member Id BGBNG00441080000000035 is already under process.(through ECR)””.

kindly suggest to create the same.

Typically UAN number are created after information is submitted by Employer to EPFO.

The message Request for UAN for this Member Id BGBNG00441080000000035 is already under process.(through ECR) means that your employer has already submitted UAN request for you.

Hi sir,

While checking the status of my UAN number it is show the below message “Request for UAN for this Member Id PYBOM00xxxxx0000xxxxxx is already under process.(through ECR)”. I am getting this message for last 6 months.

Could you please guide me how to get my UAN number ? . Also, in that case to whom i need to send mail to check and get the UAN number.

Thanks a lot.

Best regards,

Purna

You can try UAN Helpdesk . Our article UAN Problems, Password,Mobile Number,Incorrect Details and Help Desk talks about the process in detail

This is what i expected from you …. keep it up

very worst information

I have worked with an organization for almost 3 years with “X” company. Now my “X” company open my PF account and give me UAN account number. After that I have joined a new company “Y”. “Y” company create new PF account with same UAN number. In “Y”, I have just worked for 3 months. Now I have joined new company “Z”. “Z” create new PF account with same UAN. But when “Z” try to attach my account they have error like “Birthdate mismatch”. Now I logged in with UAN site here I found my Name and birth date is not correct. So what I have to do for correct information. And one more thing that it is possible to withdraw PF amount of my previous company individually ?

Thnaks & Best regards

Uan member resitration request

An employee having 2 PF account number from different companies. Actually he is working as Field Associate in 1st Company, it’s timing 8.00 am to 5.00 pm and Cashier in 2nd Company, it’s timing 11.00 pm to 6.00 am. He gets salary from 1st company is Rs.8000/- and 2nd Company is Rs.12000/-

Both the employer has deduct PF from his salary.plse

Please let me know if both the accounts would be valid in this case

An employee having 2 PF account number from different companies. Actually he is working as Field Associate in 1st Company, it’s timing 8.00 am to 5.00 pm and Cashier in 2nd Company, it’s timing 11.00 pm to 6.00 am. He gets salary from 1st company is Rs.8000/- and 2nd Company is Rs.12000/-

Both the employer has deduct PF from his salary.plse

Please let me know if both the accounts would be valid in this case

An employee having 2 PF account number from different companies. Actually he is working as Field Associate in 1st Company, it’s timing 8.00 am to 5.00 pm and Cashier in 2nd Company, it’s timing 11.00 pm to 6.00 am. He gets salary from 1st company is Rs.8000/- and 2nd Company is Rs.12000/-

Both the employer has deduct PF from his salary.

Please let me know if both the accounts would be valid in this case

An employee having 2 PF account number from different companies. Actually he is working as Field Associate in 1st Company, it’s timing 8.00 am to 5.00 pm and Cashier in 2nd Company, it’s timing 11.00 pm to 6.00 am. He gets salary from 1st company is Rs.8000/- and 2nd Company is Rs.12000/-

Both the employer has deduct PF from his salary.

Please let me know if both the accounts would be valid in this case

sir i have joined to another company but my p.f was not transfer and iam filling the una no. so they can create error the DOB. was not match to previous member id.

sir i have joined to another company but my p.f was not transfer and iam filling the una no. so they can create error the DOB. was not match to previous member id.

Same problem is being faced by me for the past 1 year, did you get this issue sorted out, if so how?

Hai,

I am kbkumar from Hyderabad I have UAN number. I am working with 2 companies Day & Night. I would like to know that Can 2 PF amount’s can be credited into 1 UAN PF account as I have submitted my same PF number to another Employer. Please advise me.

Thank You

Hai,

I am kbkumar from Hyderabad I have UAN number. I am working with 2 companies Day & Night. I would like to know that Can 2 PF amount’s can be credited into 1 UAN PF account as I have submitted my same PF number to another Employer. Please advise me.

Thank You

Dear Sir

I have worked with an Organization for 3 months Feb-May 2014 and they have provided me Member ID.

Due to some reason, I have left the job(due to some reason) and get my entire PF debited from my earlier PF Account.