Tax free bonds are a rage in FY 2015-16. This article talks about How to buy Tax Free Bonds during the public issue and after the issue using online and offline i.e downloading the application form. How to apply using ASBA or Non ASBA mode? How to find the allotment status of Tax Free Bonds?

Table of Contents

How to Buy Tax Free Bonds

You have the choice of applying online or offline for tax-free bonds. You also have the option of holding the investment in physical or demat mode.

-

During the public issue of the bonds, or IPO you can invest in them by submitting a physical form furnishing the details as requested. Also, with brokerage companies, you can make an investment online and enjoy the ease of investing. In general allotment in these Tax Free bonds will happen on First come First Serve basis.

-

After the public issue you can buy these Bonds from Exchange: Post the public issue, these bonds are listed on NSE or BSE or both. You can invest in these bonds through your trading account the way you invest in shares.

Our article Tax Free Bonds of FY 2015-16 , AY 2016-17 covers the tax free Bonds issued in FY 2015-16 , AY 2016-17 in detail.

One should not invest in tax-free bonds just because the interest is tax-free. One must follow the primary rule of investing, product choice should be driven by one’s financial goals. Taxfree bonds would be attractive if one falls in the higher tax bracket, is looking for regular income and has no concerns on liquidity. Our article Investing:Think about Liquidity,Safety,Returns,Risk,Tax covers the topic in detail.

What is Public Issue of Bonds?

Lets try to understand the terms like Public Issue, Bonds and how does ASBA help an investor. For more information one can read SEBI document Frequently Asked Questions (FAQs) on Issues (pdf)

A bond is like a loan between an investor(lender) and a corporation(borrower). The investor agrees to give the corporation a specific amount of money for a specific period of time in exchange for periodic interest payments at designated intervals. When the loan reaches its maturity date, the investor’s loan is repaid. Bonds are issued by government agencies, credit institutions or commercial corporations in the primary markets. Companies can borrow from banks, but issuing bonds is often a more attractive proposition. The interest rate companies pay bond investors is often less than the interest rate they would be required to pay to obtain a bank loan.

Issues can be either Public, Rights of Preferential issues. A public issue is the offering of securities of a company or a similar corporation to the public for a certain period. After the period , the securities are listed on a stock exchange and one can buy from the Exchange. A Public issue can be either an IPO where a company offers its securities to the public for sale for the first time. A public issue can also be a follow on public offering (FPO) where an already listed company either makes a new share issue to the public or a fresh issue to existing shareholders.

In the Book Building issue, the price of each share/bond is not fixed at the outset. Instead, the offer document specifies a price range i.e. floor (lower) price and Cap (upper) price. The price of the issue is determined on the basis of the demand for the issue from prospective investors, at different price levels within the specified range.

In India, shares and securities are held electronically in a dematerialized (or Demat) account, instead of the investor taking physical possession of certificates. A Dematerialized account is opened by the investor while registering with an investment broker. Our article What is Demat Account : Brokerage,Charges,Comparison discusses it in detail.

Tranche: Bonds may be issued in Tranches or parts. Tranche means A part of an issue. A tranche refers to a single issue of a security released at different times. For example, a company may announce that is intends to issue Rs 5,000 crore bonds in two tranches of Rs 2500 crore. The word tranche is French for slice, section, series, or portion.

ASBA

ASBA or Application Supported by Blocked Amount refers to an application mechanism for subscribing to initial public offers (IPO). For detailed FAQ one can read NSE document on ASBA. (pdf)

- It is a facility provided by banks to investors in initial public offerings (IPOs), follow-on public offers (FPOs) and new fund offers (NFOs) of mutual funds.

- ASBA process facilitates retail individual investors bidding at a cut-off, with a single option, to apply through Self Certified Syndicate Banks (SCSBs), in which the investors have bank accounts. SCSBs would accept the applications, verify the application, block the fund to the extent of bid payment amount, upload the details in the web based bidding system of NSE, unblock once basis of allotment is finalized and transfer the amount for allotted shares to the issuer. SCSBs includes all major banks like Axis Bank, HDFC Bank, ICICI Bank, State Bank of India, Punjab National Bank, UCO Bank, IDBI Bank etc.

- The system, ensures that the applicant’s money remains in one’s bank account till the shares are allotted.

- The mechanism requires the applicant to give an authorisation to block application money in the bank account for subscribing to the IPO. The bank account is debited only after the basis of allotment is finalised, or the IPO is withdrawn or fails.

- In case of rights issue, the application money is debited after the receipt of instructions from the Registrars.

- It is not compulsory to submit bids through ASBA. You can choose to opt for the existing process of applying through cheques.

- The applicant need not worry about the refund in case he/she is not allotted any share. Moreover, since the money remains in the bank account, one does not lose out on the interest that can be earned during the period.

- Allotments to ASBA applicants are done only in demat form.

- It was introduced by SEBI for retail investors in 2008. from January 1, 2010, onwards it has been extended to corporate investors and HNIs as well

Find out about the Public Issue of the Bond

While you will get an overview of the public issue of the bond . For example for Upcoming issue of HUDCO Tax Free Bonds, you can overview of the Bond from Newspapers,financial blogs including ours at Tax Free Bonds of FY 2015-16 , AY 2016-17 .

Overview of HUDCO Tax Free Bond

- Offer Period: January 27 to February 10, 2016 (the offer can be pre-closed on full subscription)

- Annual Interest Rates for Retail Investors: 7.27% for 10 Years and 7.64% for 15 Years. The interest rates are 0.25% less for HNIs, QIBs and corporate subscribers.

- 40% of issue is reserved for Retail Investors i.e Rs. 684.60 crore

- Rating of the Issue – CARE and India Ratings have assigned AAA rating to the issue, thus suggesting that these bonds carry highest degree of safety regarding timely payment of financial obligations.

- Price of each bond: Rs 1,000

- Minimum Investment: 5 Bonds (Rs 5,000)

- Max Investment Limit for Retail Investor: Rs 10 Lakhs

- Can be applied both in Physical and Demat Form

- Allotment: First Come First Serve

- Listing: Bonds would be listed on BSE and will entail capital gains tax on exit through secondary market. The company will allot the bonds and get them listed within 12 working days from the closing date of the issue.

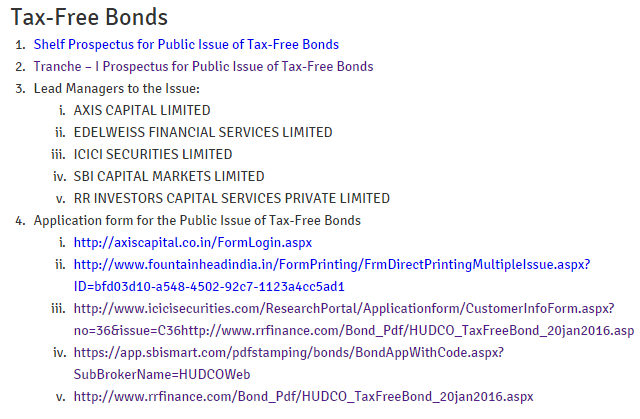

But’s it better to visit the HUDCO website and check out. For example details of HUDOC Tax free Bonds on HUDCO webpage are shown in image below. You can even download the application form. Read the prospectus , its not rocket science.

How to invest in Tax Free Bonds During Public Issue Online

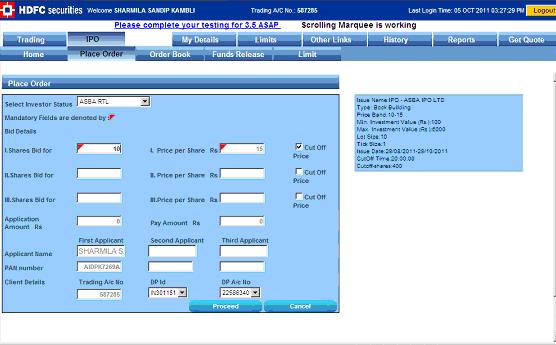

- Logon to the trading site Click IPO

- Step 2 :Click Place Order

- Step 3 : Choose the Tax-free bond from the drop- box you want to invest in .

- Step 4 :

- Select the various options that you want eg : ASBA- Retails , Retail ,HNI etc

- Click on Cut – Off

- Enter the number of shares in multiples of lot size you want to invest in

- Step 5 : You will get a message to confirm the Tax-free Bond order to proceed

- Step 6 : Read the disclaimer before clicking on “ I Agree ”

- Step 7 : You will get a message to hold funds for the required amount for Tax-free Bond investments.

- Step 8 : If the transaction is successful Click OK. Click Confirm to proceed with the Tax-free Bond order placement .

- Step 9 : Once you get this message you have successfully placed an order for the Tax-free Bond you wish to .

Entire process is explained in pictures at HDFC Securities webpage HOW TO PURCHASE TAX-FREE BOND ONLINE. One of the image is given below. You can also check out the Video of How apply for IPO on HDFC Securities webpage. Note: HDFC Securities is just used for example , process is similar in other trading sites.

How to invest in Tax Free Bonds During Public Issue Offline or through Physical Mode

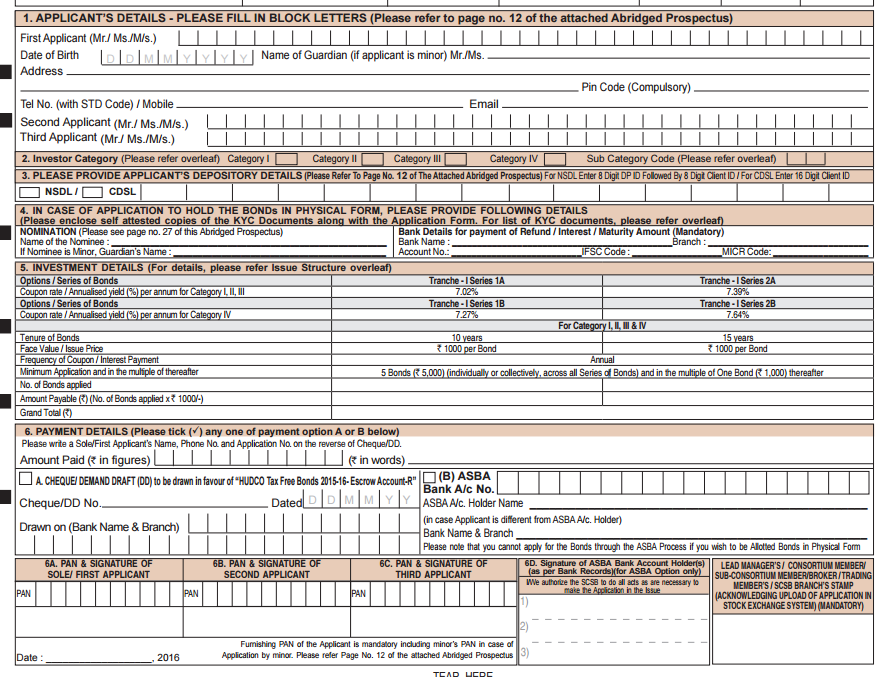

In case of a physical application or offline, you need to submit the bid/application details with the stock exchange. Application forms can also be downloaded from the stock exchange Web sites or other websites. The applicant has to fill in the details, based on whether customer has a demat account or not. If you need the bonds to be allotted in physical form, you can tick the relevant column when filling up the application. Submit the filled application. The application forms also carry a list of brokers/distributors and their branches across the country accepting the forms.

Filling/Bidding process for Physical application.

- Step 1 : Download form.

- Step 2 : Fill the details:

- Applicants details, PAN Details,

- Investor category: The investors are usually classified in the following four categories and each category has certain percentage of the issue size reserved during the allocation process:

- Category I – Qualified Institutional Bidders (QIBs)

- Category II – Non-Institutional Investors (NIIs)

- Category III – High Net Worth Individuals including HUFs

- c

- Want in Demat /Physical form. If in Demat then provide details of your demat account.

- Nomination

- Bank Details for payment of refund/interest/maturity

- investment detail: Type of bonds (10 years/15 years), Number of bonds

- Payment details:

- If Form in Non ASBA :Provide details of Cheque

- If Form is ASBA ,without cheque, ASBA account details.

- Step 3 : Submit the filled application.

Sample Form of HUDCO Tax free bonds issued in Jan 2016.(pdf) Excerpt from the form is given below. Click on image to enlarge.

After Applying for Tax Free Bonds : Allotment

After applying for Tax Free Bonds you would have to wait for allotment of the bonds. How many bonds get allocated depends on how many people have subscribed to the bonds in that category. For an individual one has to look at how many retail investor have subscribed. If demand is less or just equal to number of bonds then everyone will get what they have asked for.

In case of over-subscription, Allotments to the maximum extent possible, are made on a first-come first- serve basis and on a proportionate basis in each Portion. Proportion may ve determined based on the date of upload of each Application into the electronic system of the Stock Exchanges.

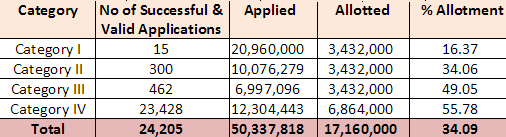

In FY 2015-16 Tax free bonds are very popular, so bonds are getting oversubscribed. For example Bollywood film star Akshay Kumar, 48, reportedly with earnings of Rs 128 crore this year, has been a regular and big investor in fixed income instruments. For example for IRDEA Bonds which were available for public issue between 8 Jan – 22 Jan 2016 the allotment was as shown in image below.

Tax Free Bond Allotment for 2015-16

| Issuer | Open Date | Close Date | Registrar | Link |

|---|---|---|---|---|

| IREDA | Allotment | |||

| NHAI | 17 Dec 2015 | 31 Dec 2015 | Karvy | Allotment |

| IRFC | 8 Dec 2015 | 10 Dec 2015 | Karvy | Allotment |

| REC | 27 Oct 2015 | 4 Nov 2015 | Karvy | Allotment |

| PFC | 5 Oct 2015 | 9 Oct 2015 | BigShare | Allotment |

| NTPC | 23 Sep 2015 | 30 Sep 2015 | Karvy | Allotment |

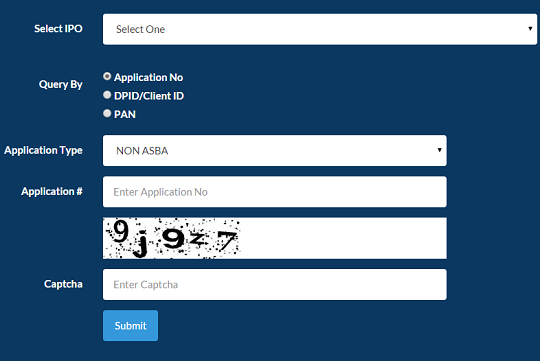

- Step 1: Visit the Registrar of the Bond. For example for NHAI, IRFC the Registrar is Karvy. So visit http://mis.karvycomputershare.com/ipo/

- Step 2: Select the company for which you had applied for

- Step 3: Fill in the required details like – your name, application number, DP id, Application Type etc.

Result of allotment will be displayed.

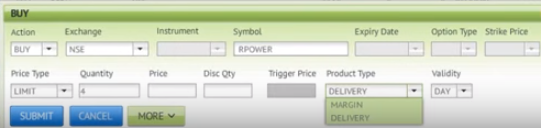

How to invest in Tax Free Bonds After Public Issue on Exchange

To buy the Tax free bonds after the public issue one needs to have a Demat account as its like buying a share. All of these bonds are listed on the stock exchanges such as the Bombay Stock Exchange or the National Stock Exchange. You can buy them in a similar way as you buy shares. For example, if you are buying online yourself, you can buy Hudco Tax free bonds, by simply typing HUDCO and the dropdown box would show the various tax free bonds from HUDCO. Alternatively, you can ask your broker to buy the same for you.You can check rates on the NSE website. For example, you can see the HUDCO rates here You can also type on the securities information to get details of the year of maturity, interest rate and most importantly interest payment date. Please remember that that tax free bonds do not have high liquidity. This means that you may not be able to buy in very large quantities. Be also careful of what price you buy. If the price is high the yields on your bonds would fall. You can see the Video of How to buy the Shares at HDFC Securities webpage.

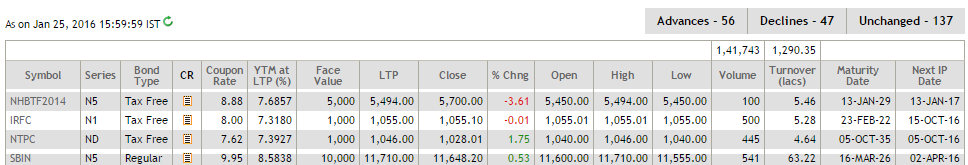

Picking up bonds in the secondary market is quite different from applying for one during the primary issue. When an issue opens in the primary market i.e public issue, the coupon rate on the bond is clearly stated, which is the annual rate of return. But in the secondary market, the coupon rate does not matter. This is because the bond in the secondary market may trade below or above its issue price. What matters is the yield-to-maturity. Yield-to-maturity (YTM) is the effective return you earn on a bond through interest and repayments by buying it at its current price. As bond prices fall, yields rise. There is an inverse relationship between the two. YTM is calculated by arriving at the discount rate, which equates the sum of all future cash flows from the bond (interest and principal) to the current price of the bond. This can be done with the help of a financial calculator or excel sheet. You can also check out the NSE/BSE website for details. The image below shows the information of bonds both tax free and Regular at NSE webpage (Click on image to enlarge)

Most of the tax-free bonds that were issued in the latter part of the 2014 fiscal are trading at a premium of about 3-7 per cent to their issue price. For example, the tax-free bonds issued by Power Finance Corporation (PFC). These bonds were issued in November 2013 with an 8.43 per cent coupon rate for 10 years at a face value of ₹1,000. They are now quoting at ₹1,054 on the BSE. The bond’s YTM works out to 7.7 per cent.

Please note any capital gain from sale in the secondary market is taxable. Short-term capital gains from sale of tax-free bonds on exchanges are taxed at the normal rate, while long-term capital gains are taxed at 10% without indexation and 20% with indexation, whichever is lower. By indexing, you adjust the purchasing price with annual inflation.

Related Posts:

- Tax Free Bonds of FY 2015-16 , AY 2016-17

- Understanding Tax Free Bonds

- Tax Free Bonds of FY 2011-12, FY 2012-13

- Tax free Bonds of FY 2013-14

- Fixed Deposits and Tax

One should not invest in tax-free bonds just because the interest is tax-free. One must follow the primary rule of investing— product choice should be driven by one’s financial goals. Taxfree bonds would be attractive if one falls in the higher tax bracket, is looking for regular income and has no concerns on liquidity.