Sometimes for Income Tax related work we need to meet the Jurisdictional Assessing Officer or simply Assessing Officer. Assessing Officer is related to your PAN number. This article explains how to find the Jurisdictional Assessing Officer.

Table of Contents

Assessing Officer of Income Tax

An Assessing Officer going by name is a person who has assesses and technically he has jurisdiction(means: official power to make tax decisions and judgements for that assessee) to make assessment of an assessee, who is liable to tax under the Act. The designation may vary according to the volume of income or nature of trade as assigned by the Central Board of Direct Taxes(CBDT Board), the department which deals with income tax. He may be an Income-tax Officer, Assistant Commissioner, Deputy Commissioner, Joint Commissioner or an Additional Commissioner. To know more about Assessing Officer one can read incometaxindia.gov.in:Central Board of Direct Taxes

Why do we need Assessing Officer : The income-tax laws are complicated and taxpayers are flooded with instructions, guidance notes, and Circulars from the CBDT to enlighten them about the way laws are to be interpreted. However, the reality is that tax assessments involve both subjective and objective considerations, and that the Assessing Officer is a quasi-judicial statutory authority who has to safeguard the income department’s interests, and at the same time, display objectivity in assessments.

When does one need meet the assessing officer :

- When one has fillen Challan 280 wrong online. Our article How to Correct Challan 280 discusses it in detail.

- When one gets the notice from Income Tax Department ex for outstanding demand , for scrutiny or to follow up refund and enquire on the reasons for it not being processed. . Basically when you need a human to present your case.

However, if no action is taken by the assessing officer, the taxpayer can move up the hierarchy and write to the jurisdictional chief commissioner with copies of previous letter/s written to the assessing officer and with a copy of the tax return filed.

It is not necessary for you to personally meet the Assessing Officer. Your lawyer, Chartered Account (CA) can get details or submit the papers on your behalf. (Please correct me if your experience has been different)

Find your Jurisdictional Assessing Officer

Jurisdiction of the Assessing Officer is the geographical area for which Assessing Officer can assess requests. It is typically associated with the PAN or Permanent Account Number. Permanent Account Number (PAN), as the name suggests, is a permanent number and does not change during lifetime of PAN holder. Changing the address or city, though, may change the Assessing Officer. Such changes must, therefore, be intimated to nearest IT PAN Service Center or TIN Facilitation Center for required correction in PAN databases of the Income Tax department. These requests will have to be made in a form for Request For New PAN Card Or/ And Changes In PAN Data.

Steps to find your Jurisdictional Assessing Officer

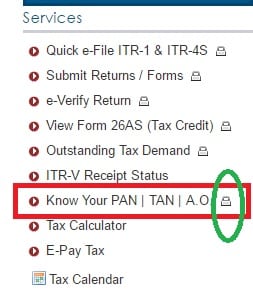

From 1 week of Feb 2017, Income Tax services to find PAN/TAN/Assessing officer all requires login. From 1 week of Feb 2017 to find your Assessing Officer you have to follow the steps given below.

- Login to your account on the income tax e-filing website, using your PAN and password

- In the Menu select Profile Settings.

- Click on PAN details. You will see jurisdiction info as shown in image below

From 1 week of Feb 2017, Income Tax services to find PAN/TAN/Assessing officer all requires login, as shown by lock in the image below.

Old Method of finding your Jurisdictional Assessing officer no longer works

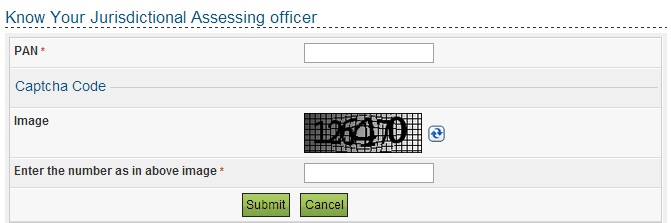

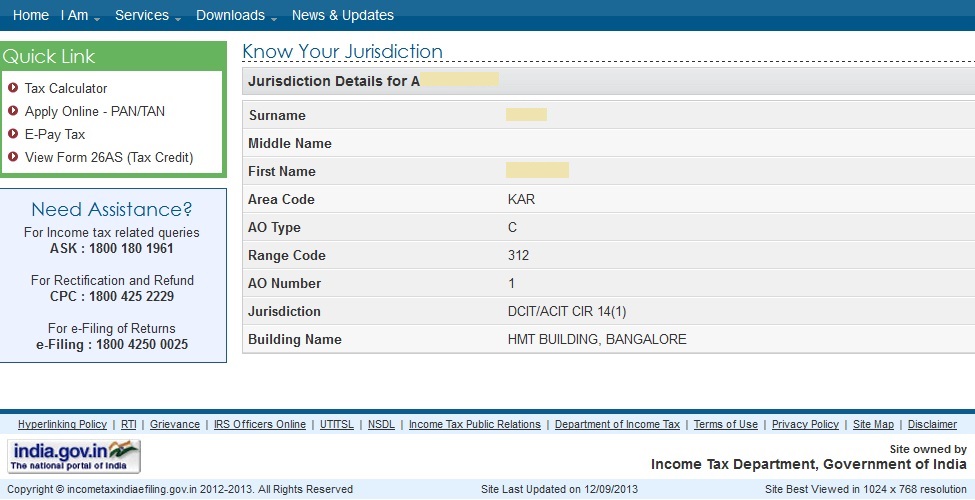

To know your Assessing Officer , (which is an optional field to fill in our ITR forms also) Go to incometaxindiaefiling.gov.in/e-Filing/Services/KnowYourJurisdictionLink.html and enter your PAN number and Captcha code (number in the image to prove you are a computer) as shown in the picture below (this (This has changed from beginning of Feb) . if you click on the link it will show following image

How to find Jurisdictional Assessing Officer for Income Tax

It will show you your Jurisdiction Details as shown in image below

-

Know your Jurisdiction

Find Address of the Building of Jurisdictional Assessing Officer

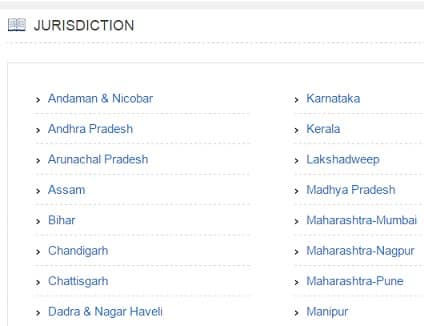

To find the address of the building mentioned go to website http://www.incometaxindia.gov.in/Pages/jurisdiction.aspx. You will see list of states shown in the image below

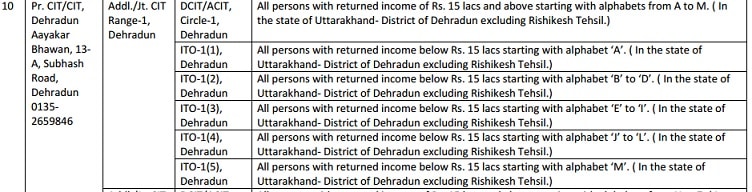

Click on the state and a document in pdf form will open which will show details as shown in the image below

Old method of finding address of Assessing Officer

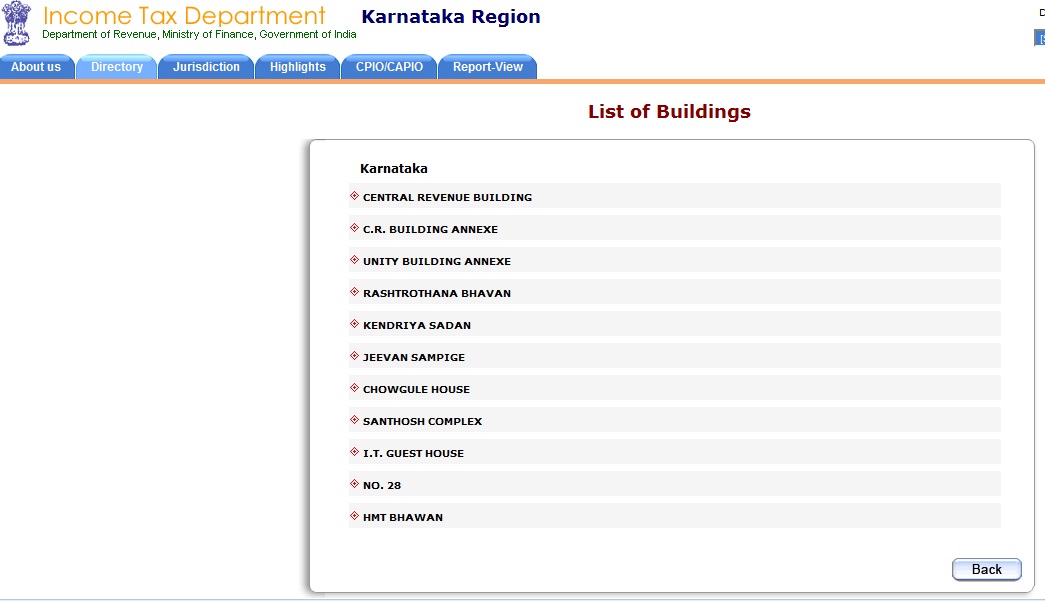

Select the state, it would show you list of income tax offices for example for Karnataka field offices are shown in image below

List of Field Offices in Karnataka

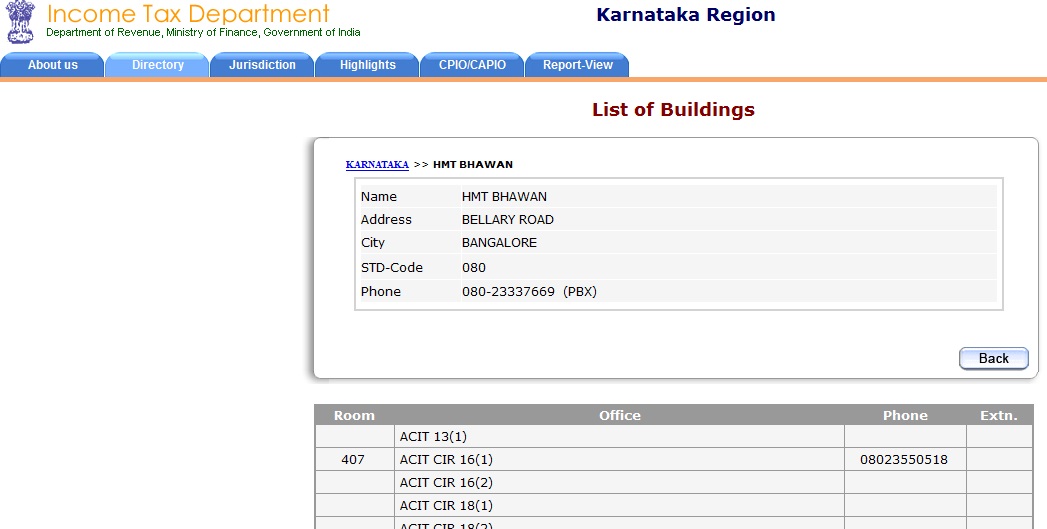

Select the Building name which was mentioned in your jurisdiction details , for example in my case it was HMT Bhawan. Find the room number and extension of Jurisdiction which in our example was DCIT/ACIT CIRCLE 14(1)

Address and Room of Assessing Office

Meeting the Jurisdictional Assessing Officer

Change of Assessing Officer and Jurisdiction for Income Tax

Typically processing of Income Tax Return is done by Central Processing Cell (CPC) Bangalore. But there are cases where you may need to contact your Assesing officer. Our article Change of Assessing Officer and Jurisdiction for Income Tax discusses it in detail, shows the format of application to submit.

- For Income Tax Refund

- In response to outstanding Tax Demand

- For Challan 280 Correction

- Notice for Processing of Income Tax Return to meet the Assessing Officer

It is common that people shift to new places for work or other reasons. Due to change in address there are many aspects that need to be updated and modified for filing of tax returns. Now say for example, you shifted to Bangalore from Mumbai due to your new job. Your old jurisdiction was Mumbai. However for future correspondence with the Income-tax department, you are required to change your jurisdiction as Bangalore. In such cases, the taxpayer is required to inform the existing jurisdictional Income-tax officer about such change by way of written application. Many times your Jurisdiction will be changed automatically.

Changing address details in PAN database does not automatically change your jurisdiction. You have to write to your current assessing officer regarding your change of place and request him to transfer your case records and jurisdiction to appropriate AO. Once both the officers are satisfied about proposed transfer, the old Assessing Officer will initiate transfer process and migrate your PAN to the new AO.

For any genuine reason like change of address, or ill-mannered assessing officer you can apply to the income tax authority for the change in assessing officer. Please note that

- Six (6) copies of Application should be filed with competent authority.

- Copy of application should be sent to concerned AO, CIT and Addl./Jt.CIT.

- As per section 127(4) of the Income Tax Act, 1961 income file can be transferred at any stage of proceedings even if Assessment is Pending.

- When a file is transferred then Demand or Refund of Tax can be collected/refunded by new assessing officer. Now a days Demand or Refund is processed by Central Processing Centre, Bangalore.

- After e-filing ITR: ITR-V,Receipt Status,Intimation u/s 143(1)

- Notice for Adjusting Refund Against Outstanding Tax Demand, Section 245

- Income Tax Notice :Sections,What to check,How to reply

- Understanding Income Tax Notice under section 143(1)

- How to Correct Challan 280

Did you need to meet Assessing Officer? For what, how was the experience, did your problem got solved. Please share your experiences and help in spreading awareness. Please comment, correct, add details , give feedback on the article, it means a lot to us. If you liked it please share it atleast one more person.

We are continually told the secret for you to get six pack abs is diet

and diet only. Some places the code might be situated are: for the

footer, the translucent looking bar on the bottom from the page; a typical and popular area for the optin form,

the page side bar; inside posts, with all the form being placed automatically

inside post; inside comments, a cheque box could be enabled to sign up easily

or perhaps the form may be integrated straight into the comment through the user.

The friary is introduced being a good counterpoint to Gaea’s quest with all the interactions relating to the monks

and Quantum in the guise as Leo towards the monks providing some strong repartee.

Jobs for Freshers, Experience Jobs, IT Jobs, Bank Jobs, Govt. Jobs

Fresher Jobs In Bangalore

thank you for their best information

sir i have filled my ITR after due date of AY 2015-16, individual ITR-I and my refund ITR paper has been transferred to AO for processing, so now what i should able to do?

hOW TO FIND TAX ASSESMENT OFFICER OF AN INSTITUTION WITH A tan NO. NOT pan cARD NO.?

Sir,

I work in Bangalore but my PAN Card address is in Pune, so my assessing officer is Pune.Is it necessary to change assessing officer to Bangalore. Can you let me know what difficulties I can face if i dont do the same? And how can I shift assessing officer to Bangalore? Is only chage in PAN correction address required?

Difficulty would arise in case when you get income tax scrutiny or are asked to meet Assessing officer. Our article Change of Assessing Officer and Jurisdiction for Income Tax discusses it in detail.

Typically processing of Income Tax Return is done by Central Processing Cell (CPC) Bangalore. But there are cases where you may need to contact your Assesing officer. Examples of Mail from Income Tax

For Income Tax Refund

In response to outstanding Tax Demand

For Challan 280 Correction

Notice for Processing of Income Tax Return to meet the Assessing Officer

It is common that people shift to new places for work or other reasons. Due to change in address there are many aspects that need to be updated and modified for filing of tax returns. Now say for example, you shifted to Bangalore from Mumbai due to your new job. Your old jurisdiction was Mumbai. However for future correspondence with the Income-tax department, you are required to change your jurisdiction as Bangalore. In such cases, the taxpayer is required to inform the existing jurisdictional Income-tax officer about such change by way of written application. Many times your Jurisdiction will be changed automatically.

For any genuine reason like change of address, or ill-mannered assessing officer you can apply to the income tax authority for the change in assessing officer. Please note that

Six (6) copies of Application should be filed with competent authority.

Copy of application should be sent to concerned AO, CIT and Addl./Jt.CIT.

As per section 127(4) of the Income Tax Act, 1961 income file can be transferred at any stage of proceedings even if Assessment is Pending.

When a file is transferred then Demand or Refund of Tax can be collected/refunded by new assessing officer. Now a days Demand or Refund is processed by Central Processing Centre, Bangalore.

Hi,

My question id regarding form 26QB incoorect date of deduction, for which I received a default notice for late deduction, this is for the purchase of a property I did in Noida in Aug 2014, I received the notice on 5 Feb 2016, I have corrected the date of payment and the date of deduction to be exactly matching by filing the correction online for form 26QB without digital signature, which is a genuine scenario, so my queries are below:

1) Do I need to meet the jurisdictional AO in person to represent the case or Should I hire a CA to represent my case.

2) I have purchased a property in Noida(U.P), and my PAN Details show the jurisdictional AO to be of Ward1(4),Mysore;Area Code: KAR;Building Name: Shilpashree Building, MYSORE,

but on the other hand in my correction request it reflect the AO Detail to be:

TDS Ward-3(3), Bangalore HMT Building, Bangalore.

Also, the default notice that is served to me is from the following address:

TDS CPC, Aaykar Bhawan, Sector – 3, Vaishali, Ghaziabad, U.P. – 201010

So, I wanted to know that should I sent the acknowledgement for correction along with the proof I had by post to the address from where the notice is served or the Bangalore address assigned to me in AO Detail which is Bangalore HMT building.

3) Also, please let me know that since the default notice has been served to me in feb 2016 and I have filed for the correction on 25 April 2016, so will there be any extra interest that I need to pay for this period of delay.

4) I did understand from the above posts that since the property lies in Noida,it comes under the AO jurisdiction of Vaishali, Ghaziabad, and since my PAN number lies in AO jurisdiction of KAR, and this is why they have assigned me the AO of Bangalore HMT building.

It will really be of great help if you please assist to me in the current situation.

Thanks

Mohit

Sir

I k srinivasrao worked in LSK projects Pvt ltd of 9 years in this view I am asked management for my form 16 for last 3 years. In this period my gross salary is 25000 per month

But now they told me your form 16 issued to you for 1000/month. What can I do how can approach pls feed back me sir

Dear Sir,

I applied for change in address in PAN card from Delhi to Bangalore & was

hoping that IT Department will also change my A.O. address from Delhi to Bangalore. But even after change in address they have not change A.O. details. Is this O.K.? My worry is that when I file my ITR this year from Bangalore, my A.O. will be from Delhi & this may cause problems for me if I have to visit A.O. due to some reason as visiting him/her in Delhi will be very inconvenient for me. Kindly suggest. Thanking you. Best regards, RAKESH

Dear Sir,

I do E-filing every year and same for 2014_15. But for this AY, my return keep showing transferred to AO and when I write mail to AO, there is no response to mails. Is there anyway to contact them over phone as I am NRI not able to meet them in person. Please advise.

Dear sir,

I do E-filling 2014-15 but my return keep showing transfer to AO .Please advie me what will I do.

Hi,

Nice article! I was googling too much for similar problems that I am facing now.

Actually, I have got a demand request by ITO Ward 1(1) AO in November 2011 via CPS intimation letter. At that time, I was in Delhi and therefore could not visit the AO in Bangalore. Accordingly, I sent a letter enclosing all relevant documents (form 16, ITRV etc.) to claim that the demand is not correct. I was quite sure about this as I found out that I have wrongly filed two ITRs for AY 2007-2008 and AY 2008-2009 for the Form 16 of 2007-2008 financial year. Means, I should have filed ITR only for AY 2008-2009. I believe the demand is raised for the wrong filing of ITR for 2007-2008. Whereas, for AY 2007-2008, I have filed against form 16 of financial year 2006-2007 using CA service. I had all the details and accordingly submitted it the AO via courier. I infect talked with her over phone and explained the situation. She said she will correct the matter.

However, yesterday I got an another CPC intimation letter for adjusting my refund for AY 2015-2016 against outstanding demand of Rs. 80000 for AY 2007-2008. Thus, I come to know that my previous case is not closed yet. I used e-filling website and send the response “Disagree with Demand” stating that my previous rectification request. However, I am not getting further response from the AO.

Meanwhile, I checked the current Jurisdiction office and found that it is changed from the previous one who has raised the outstanding demand. Earlier it was ITO Ward 1(1) and now it is ITO Ward 4(2)(4) Bangalore. I have got the current AO officer email id and send an email too claiming my previous request and providing all necessary documents. As usual, I am not getting any response and I am least hopeful that there will be any response. I am not sure how to take this matter forward as I cannot visit Bangalore now. Your idea or suggestion will be quite helpful.

Regards

Saumar

Sir ,

Please give some input on this

Sir,

My ITR status for the assessment year 2015-16 shows “ITR transferred out of CPC for jurisdictional Assessing Officer at income tax office for processing ” . My AO office is in chennai .And the date of transfer to AO is 23/9/2015. Still I didn’t get any updates from them . So what l have to do next? Do I want to meet my AO In-Person?or do I need to submit any documents to them?

Kindly reply,

Thanks.

I plan to move from Delhi to Bangalore. For change of address, I must fill form “Request For New PAN Card Or/ And Changes Or Correction in PAN Data” available on TIN-NSDL website. Will this automatically change AO code in PAN data applicable to my residence in Bangalore? If, not, how can request to change AO code in PAN card?

Go to NSDL site and change the address on PAN Card first.

Thereafter you apply to the assessing officer for transfer of your assessment records to the new A.O. having jurisdiction over your case. Copy of the letter must be send to the present CIT and would be CIT with supporting evidence of address proof. The jurisdiction will be changed.

Dear Sir, Thank you for very useful information provided by you in the article. But, I want to find contact details for CIRCLE 4(3)(1), BANGALORE & searched in PDF file at link http://www.incometaxindia.gov.in/Pages/jurisdiction.aspx for state Karnataka. The link does not provide details for the ward (CIRCLE 4(3)(1), BANGALORE). Is this the most recent link or some new link has been provided by Income Tax Department? If yes, kindly provide me. Thanking you. Best regards, RAKESH

Dear Sir,

In addition to my A.O. in Bangalore (CIRCLE 4(3)(1)), how can I find contact details (postal address) of A.O & CIT at Delhi to whom I must send application for transfer my assessment records to my A.O. in Bangalore? Thanking you. Best regards, RAKESH

If you check https://incometaxindiaefiling.gov.in/e-Filing/Services/KnowYourJurisdictionLink.html you get the name of building and email id too!

560076 ITO, WARD-4(3)(1) PRo CIT/CIT, CClT,

560034, & 560095 ITO, WARD-4(3)(2) DCIT/ACIT, S’LURU-4 S’LURU-1

560078 [Alphabets ‘A’ to ‘M’] ITO, WARD-4(3)(3) CIRCLE-4(3)(1) ADDL/JT. CIT,

560068, & 560102 ITO, WARD-4(3)(4) [with total income

RANGE-4(3) Rs. 20 Lakh &

560083,560099,560105,562107, ITO, WARD-4(3)(5)

Unity Building

Annexe, Mission

4(3), Bangalore Income-tax, Range-4,

Bangalore

Road, Bangalore

-560027

Ph :080-22221599

Thanks a lot Sir. Very useful information. Best regards, RAKESH

Dear Sir/Madam, I have a quick query.The change of address, for communication by I.T. department, can be done online by logging on to I.T. website then why is it necessary to make change in address in PAN data by filling the Request for change in PAN data form? I was hoping that A.O. details would be changed automatically on change in address in PAN data. Kindly comment. Thanking you. Best regards, RAKESH

If common sense was so common.

Logically when everything is centralised and digitalized u can expect that when u change address in income tax profile it should be automatically result into ur pan data base.

But; seems everything is not and 100% digitalization is on the way …right now u have to change address in pan by way of fresh application of change in pan data base.

It is there because; everyone can add whatever address they prefer in their login I’d and department is not going to check whether it is correct or not.

In addition to that they have single point mechanism where they can communicate with assessee as per address mentioned in pan application.So; in cases where u have left place and you are moving temporary u should not miss any communication by way of physical delivery of documents.(helpful In those cases where assessee don’t have knowledge of Email and all stuffs and especially in cases where you have been called for scrutiny and you are being served notice or any other stuffs.)

So; digitalization is on the way and you will be asked to produced documents online and same will result into change in pan database and will result into change in ward details automatically.

So right now..Have to apply for change in pan details physically and have to check ward details every time you apply for change.

Dear Sir/Madam,

Thanks for your very detailed reply.

In the last para, you have mentioned “So right now..Have to apply for change in pan details physically and have to check ward details every time you apply for change.” One quick question. I could not understand “and have to check ward details every time you apply for change.”. Kindly explain this part only & kindly do not get angry for

asking this. Best regards, RAKESH

It means which ward you want to change to when you apply for change.

Thanks for asking questions. We do not get angry infact we are happy that you have taken efforts to clarify your doubt.

Looking forward to mores question.

Dear Sir/Madam,

Thanks for your comment on my query.

I plan to apply for change in PAN in March. Will certainly contact you after I receive new PAN.

Best regards. RAKESH

Dear Sir,

As I mentioned in my last post dated 4 February 2016, next week (March end) I am going to visit TIN-FC to change address in PAN card. Kindly confirm that this should change my AO from Delhi to Bangalore (my PAN was made in Delhi & now I live in Bangalore). Thanking you. Best regards, RAKESH

Dear sir my name manjunath .My pan is BCEPM6162L sir i have Applied 2015-2016 assessment on December strat but still i didn’t get any information from this department but same time my friend also applied who is working with me in same company but he got everything but y is my status still pending sir and i chucked with my pan card number in online and i spoken with incometaxe department executive but in all way i had taken opinion as same like its processing from long time.plz come forward to help me what i can do

How fast the ITR will be processed depends on many factors source of income,tax which ITR one filed etc. You please wait for atleast a month. No need to panic.

Hi,

one my TDS in AY 2015-16 was put wrong AY as 2014-15. I saw it later and followed with deductor to get this corrected and all in vain. While filing AY2015-16 ITR, I was advised to use this as arrier. My ITR is processed now and CPC didn’t consider this amount and put a demand note. Thsi TDS amount is showing as unmatched fund in AY14-15.

Can you help next step how to fix this.

First you can reject the outstanding demand. Our article How to Pay or Reject Outstanding Income Tax Demand under Section 143(1) explains it in detail

My tax refund status for assessment year 2010-11 is showing like “Conduct to jurisdictional assessing officer”. E-filing Acknowledgement Number 190867050220211 dt 22-02-2011. I am staying DDN. So I cannot go personally to assessment office. you are request to my IT return for the year 2010-2011 to my account. Pl confirm my e mail ID is wasuraju@gmail.com

I am 63, voluntarily retired from pvt. service due to illhealth in Aug.2010, hence no regular income except bank interest & a meagre EPFO pension. I see an outstanding Tax Demand for AY 2010-11 for Rs. 40140 (Tax & computation sheet Rs. 47820). I had filed return then through a consultant at Bhiwadi (Alwar, Rajasthan). Now since 2010 I am at my native place Kolhapur (Maharashtra). When contacted he says that my TDS deducted by Post Office Rs. 28321, (cert. dtd. 28/08/2009) seems to be the reason, which was shown in the return, but PO might not have taken action at their end. Can it be so ? Under the circumstances what can be option for me ? I can’t visit ITO personally due to vast distance & my health limitations.

Will you pl. help me in the matter as to what should be done in the case.

Thanks & Regards

Ashok S Mahadik

Kolhapur

Earlier Post office used to deducted TDS only for Senior Citizen Scheme. So please check for which scheme is TDS deducted.

You can transfer your jurisdictional officer to place of your residence.

APPLICATION FOR TRANSFER OF AN INCOME TAX FILE To, The Chief Commissioner of Income Tax/ Commissioner of Income Tax City………………… State………………. Hon’ble Sir, Ref. : Shri…………… (Name of the Tax payer) PAN……… /GIRNo…………. A.Y…………… Sub: Transfer of file from………………….. to……………. I would like to inform you that I have permanently shifted from…………………. to…………….. My present address is as under:- (Name and address of the Tax payer) My present jurisdiction lies with the A.O. Circle /Ward………… /Range……….. Income Tax Department …………. (Place), which falls under the Commissioner of Income Tax………… Under the circumstances Your Honour is requested to kindly issue necessary orders for transfer of my assessment records from the present A.O. Circle/Ward ………… /Range…….. ..to the A.O. Circle/Ward…………….. /Range……… who is now having correct jurisdiction over my new address as stated above. An early action in the matter will be greatly appreciated as I have been filing my returns regularly and it would be proper if my past records were available with the current Assessing Officer. Yours sincerely. (Signature of the Tax payer) Copy also sent to:- 1. Commissioner of Income Tax (having jurisdiction over new address). 2. Addl. /Jt. CIT (Transferor/Transferee) Range……………….. & A.O. Circle/Ward…………………….. (Who is having the present jurisdiction). 4. A.O. Circle/Ward…………….. …… (to whom the file is Proposed to be transferred). (Signature of the Taxpayer) Old Address: New Address: Note: In case the file is to be transferred to a place within the same CIT Charge, the application should be addressed to the Commissioner of Income Tax under whose charge the file is existing.

MY TAX RETURN FOR AY 2013 -14 IS SHOWING THE BELOW STATUS,WHEN I GIVE MY ACK NUMBER. No such Address – Refund voucher cancelled. The instrument returned undelivered by the speed post as the address provided by the assessee is not complete/ non existent.

Please assist me.what should i do to get my refund.

You can ask for reissue of refund.

Procedure to apply for refund – reissue for refund related to AY 2009-10 and succeeding years

Logon on to https://incometaxindiaefiling.gov.in/ with your user ID and Password.

Go to MY Account →Refund Reissue Request

Please go through the article at income tax website for more details (pdf)

I have actually submitted the ITR V via tax consultancy manually, I hv ack no only. Googled and found that for manual stuffs I hv to contact AO . pls assist on tis.

I filed IT only this month for year 2012-2013 and sent to Bangalore IT dept address. I got a mail yesterday like this:

The Income Tax Department- Centralized Processing Centre (ITD-CPC), Bangalore is not in a position to proceed with the e-return filed by you,

details of which are indicated above. The return is transferred to Jurisdictional Assessing Officer (in AST) processing of which is to be done by the Jurisdictional Assessing Officer who may be contacted for further clarifications if any.

What does this exactly mean. Do I need to meet the local Jurisdictional Assessing Officer or will the contact me, in case of clarifications?

Thanks

Assessing Officer and their assistants have power to request for any assessee data for processing purpose for those assessee who come under their jurisdiction. Once the case being transfered to AO. You have to follow up with AO for Completion of Processing if there is Refund. Otherwise If there are no issues, you don’t have to worry about its processing return will be processed in due course.

1. I want to know jurisdictional ao code those who have no pan yet? 2. A person earns income one in island and overseas. Both the incomes are taxable. How he files his return of income – whether he has to file ITR seperately in two countries.

I want to know jurisdictional ao code those who have no pan yet? A person earns income one in island and overseas. Both the incomes are taxable. How he files his return of income – whether he has to file ITR seperately in two countries.

Hello Kirti,

My refund for FY 2009-10 is still pending. The ITR was filed manually in Delhi as I used to live in Delhi. Now, I have moved to Bangalore but I still file ITR with the help of my CA at Delhi with whom I am associated for over 20 years. He sent a letter to my AO at Delhi in November 2014 to send Intimation under 143(1) for the return but received no reply so far. Kindly suggest, is it advisable that I send reminder to AO (IT Department now makes E-mail of AO available under Jurisdiction details)? Do AO respond to such E-mails? Your reply will be very helpful for me. Thanks in advance.

Sir i am a salaried employee i have filed mi ITR for AY 12-13 in aug 2014 due to late receipt of my form 16. And after that i send signed copy of ITR V to cpc Bangalore they send my ITR TO AO in ward 13 pune jul 15. My AO is not processed the return till date, what can i do for the same… please help me

thanks

You would have to meet the AO along with all your relevant documents and get it processed.

Nice article Kirti.

I have few queries –

My jurisdiction is WARD 5(3)(4) Bangalore. I am unable to find mailing address of my AO. I have already sent an email with all the details but didn’t receive any reply from them. So I want to send them mail through courier/speed post.

In case of mailing all the documents how will I receive acknowledgement from them.

Thank you in advance.

Employees of private companies whose name begins with any of the letter of alphabet ‘N’ to ‘S’ fall in ITO, typically fall in WARD-5(3)(4) .

You would know the building and email id from incometaxindiaefiling.gov.in/e-Filing/Services/KnowYourJurisdictionLink.html

Then google the name of building for address.

For example FROM HMT building in Bangalore I got following details

+(91)-80-23550500, 23550501, 23550520 +(91)-80-23550551 No.57, 3rd & 4th Floor, HMT Bhavan, Bellary Road, Ganga Nagar Extension, Bangalore – 560032 (Map)

Send by registered post or speed so that you get confirmation.

Check out India posts article on tracking ,http://www.indiapost.gov.in/articleTracking.aspx

26AS has a wrong entry and i have informed the company about the same but now they are not responding to my mail. What should i do? Can i mail the person in my jurisdation?

Yes please do so.

Hello

I stay in Thane, Maharashtra for close to 30 years and has been paying Income Tax for many years. Till IT processing was centralized I used to file return at Thane office and deal with refund etc at Thane offices of IT. Since the time centralized processing started I see my ward office has been shown as Madurai. I have no connection with Madurai and wonder as to how I can correct this and get my ward office shifted to Thane as earlier.

Pls advice..

Thanks

Vijay

Sir please check the details on your PAN Card. The Ward office is typically associated with address mentioned in the PAN Card.

If that is so, You can update your PAN card details.

Thank You. Address at the time of application was a Thane address. Unfortunately PAN card (it is the old laminated one) doesnt show the address. I could see ward etc only on the Income Tax web site.

You can login in to your Income tax e filing website and check the address associated with the PAN by going to Profile Settings -> My Profile.

Another reason why your Ward number can be different from your home address is if you are salaried employee and your company address is not of Thane

Thank You. Just checked the site and it is the Thane address. Like I mentioned earlier I am salaried employee with a Thane address for the 30 years and my employers are/were all having Mumbai as their registered office address. Still wonder as to what prompted them to attach me to a ward office in Mudurai!!

I have worked for a company then I resigned from that company,now I want to withdrawl pf from my previous employer.But I have some doubts in filling form 15G,e.g. (7.assessed in which ward),(17.present ward),(10.AO code ),(21.Jurisdiction chief commissioner of income tax),(18.residential status)

Can anyone have idea about that.My AO code shows according to my PAN card is ITO jaisalmer but ward no. not showing.

You can get details about ITO from NSDL website

For ITO, JAISALMER from NSDL website https://tin.tin.nsdl.com/pan2/servlet/AOSearch?city=JAISALMER&display=N

Area Code AO Type Range Code AO Number

RJN W 560 4

BTW from 1 Oct 2015 the 15G/15H forms have changed.

You can download latest forms from Income tax website http://www.incometaxindia.gov.in/Pages/downloads/most-used-forms.aspx

I have an outstanding tax demand raised because of paying Tax for the wrong A.Y. I recently moved to Hyderabad from Bangalore. My A.O is in HMT Building Bangalore. I won’t be able to go to Bangalore for a few months because of my current client work. Can I write a mail to the A.O instead with all the details?

Is your change of place temporary?

If you would be in Hyderabad Do you want to change the assessing officer?

You can also contact a tax consultant and give him power of attorney to represent you in your case.

Hi- i filed return in oct 2014 for AY 2014-15 which was rejected subsequently due as defective u/s 139(9). I corrected the mistakes and filed return again as per the process stipulated (efile in response to notice under section 139(9)). I filed the ITR in april 2015 & the same got processed in april 2015.

Now in sep 2015, i got notice for the return filed in oct 2014 u/s 143(2) and it asks me to be present in front of assesment officer. Ques i have is:

1. is it for the defective return i filed in oct 2014 or for the correct return i filed subsequently in april 2015 (notice says return filed in oct 2014 but even the return i filed in april 2015 u/s 139(9) has oct 2014 as original return date )

2. I am in pune. assesment officer is in gurgaon. how to chnage the meeting location to pune?

3. what all documents assesment officer may ask?

thanks for your great help…

You have to correct PAN for your Address and then intimate to old AO via letter (letter should include request for transfer of case to new AO) duly acknowledged and old AO may ask for intimating such change to new AO, You have to intimate to new AO (along with letter already filed to OLD AO. This whole procedure will help you to transfer the case. 143(2), notice is being sent for Scrutiny Assessment which is sent within 6 months from end of financial year in which return is filled. It is initial procedure for Scrutiny assessment.

claim TDS,but Tds not shown in Form26a

I filed my income tax of 2015-16,my previous employer didn’t provide me form 16,so from salary slip information,I filled all details,but my problem is ,after submitting income tax,I checked form 26as,where i didn’t entry of my employer.I spoke and mailed to my previous employer.But no body is giving response to me.What to do,where i have to compliant.

your response will help me

I am a senior citizen. From my superannuation benefit I deposited some amount in Post Office Senior Citizen scheme. I am now getting interest and the same is used for my living expenses. Post office had deducted tax on my interest but had not filled the return with Income tax resulting tax credit is not visible on AS 26. on realizing that i won’t get tax refund on the tax deducted at the time of filling return I took up the matter with Post Office but the people there was not ready to understand as he was constantly telling that he has discharged his duty by providing me Form 16(manual). I tried to contact call centre and i got a response that I have to meet A.O. I am really not able to go to meet him personally as i am indisposed off. Kindly advise me what to do?

Friends please help me in my matter. I have seen outstanding tax demand of Rs 27560/- for assesment year of 2011 12. I am shocked after seen it. I am salaried person. The tax deducted for that period was Rs18187/- as per TDS. By mistake I have submit the status DEMAND IS CORRECT. My AO is Rajpura Punjab. Presently I am in Chennai. What did I do friends now. Please mail me on manavvarkhan@gmail.com.

Please.

Thanks in advance.

Please check that TDS shown in form 16 and shown in 26 AS is correct and tallies. If no, contract your DDO/disbursing Officer to upload the correct TDS in income tax site. secondly take a print out of return filed by you. check that TAN of your employer has been correctly mentioned.

Thanks For your input

Even my case is the same like yours. I am a salaried person. My form 16 and 26AS is corect and verified. But I have wrongly submitted the status demand is correct , I got intimation to pay demand. How to go about it ? Got any solution

I had deposited Rs.21880/ in PNB as Advance Tax for AY13-14. By mistake the bank reflected for 12-13 instead of 13-14.I was informed about it on 23.5.15. I submitted the rectification from the bank with all relevent proofs with the concerned AO ward II Pathankot. It seems no action is taken by them as my this year’s refund has been withheld stating that I have this outstanding demand. Now I am shocked to see that my AO is no Pathankot II bot is Ward 48 (2) Range Code 60 Delhi ..Who changed it, when changed or why changed no one knows, but my case remains pending and so is my request at Pathankot ward II.where I had been filing the mannual returns .Now I have been e filing for the last two years. Whom should I contact now ..I do not know. Kindly advice.

My Jurisdiction Details are as below:

Area code-WBG/AO type-W/ RangeCode- 120/AO no-1

Jurisdiction- WARD 56(1)Kolkata, Building name- Bamboo Villa

Sir,

I can not get back my Refund as there is some outstanding Tax demand.I agree to pay it back and propose for adjustment. I need e-mail id of officer concerned to put my case. Kindly help thro my mail also. Regards!-ARUN

Sir you have to first find why you have the outstanding demand. Settle it.

You need to contact address of your assessing officer.

Address of the assessing officer for your jurisdiction is 033-2284-3396

I was able to find the below information based on “Know Your Jurisdiction” but I’m unable to find the exact address for this Office to go and visit. Where can I find the address?

Ward/Circle/Range/ Commissioner – WARD 70(2), DELHI

Area Code -DEL

AO Type -W

Range Code -76

AO Number -2

Hi,

I got a Income tax demand from income tax office this year. On examining I got to know that in my self-assessment challan a wrong AY was selected due to which the tax amount is not considered.

Currently I am staying in Bangalore & my PAN card is issued from Mumbai.

Can anyone tells what to do now to correct the challan? Do I need to visit Mumbai for this?

Thnaks

Same issue here! My jurisdiction is in Delhi and I am here in bangalore. Please update if you find solution.

Hi,

I am not able to locate my Jurisdictional Assessing Officer- DEL/W/77/1.

Can someone help me locate.

Regds,

Prashant

Pathetic Income Tax Department. Pathetic babus.

What the shit is indian govt. I have changed my address but my assessing officer still remains the same…

Do I need to visit my old city for this?

I don’t know when the world is online, why this can’t be done online….?

Also my PAN has my old address.

Some ppl said, that I need to write to my assessing officer, can I write to him over email and where can I get his email address now?

Can someone please help me in this regard?

As per Income Tax Rules, you are liable for just filing of your ITR. Who will assess your return its a department internal matter. Now Ques arises that in which ward you will file your return. It will decide according to your residential address or your employer. In online filing its not mandatory to fill ward etc.

You can write to AO abt your change in address and transfer of file.

Hi, Kriti I am applying for PAN card and i here i cant find my jurisdiction under particular AO i live in small town named Bankhedi in Distict Hoshangabad this is under bhopal judrsdiction but i m not able to find under which AO’s Judrisdiction comes can u suggest something

thanks

Hello Eshu,

I tried to find AO code in the Excel file provided by TIN NSDL but couldn’t.

You may contact the local Income Tax office or call Aaykar Sampark Kendra on 0124-2438000 .

You can find out from your family/friends/neighbours who have PAN card.

Please do let us know how you found

thank you for your suggestion i will write to you as soon as i find.

What a pathetic, unprofessioinal agency this Income Tax Department is.

I had been to HMT Building, Bangalore. Currently, the officers have informed that the systems were done and it will be only available after June 1 st week. I had to put a day leave to find out this. For anyone, who is planning to go to HMT Building, You can check in this number 080-23550038 for Enquiry, Before Proceeding there.

Sad to hear that and thanks for Info.

I had been to HMT Building, Bangalore. Currently, the officers have informed that the systems were done and it will be only available after June 1 st week. I had to put a day leave to find out this. For anyone, who is planning to go to HMT Building, You can check in this number 080-23550038 for Enquiry, Before Proceeding there.

Sad to hear that and thanks for Info.

Hi Kirti,

I really liked this article as it explains everything so nicely. The only thing is that, I guess the incometax website has changed as I dont see the “List of Buildings” when I select Karnataka in the “Locate Field offices” on “www.incometaxindia.gov.in/home.asp” website.

I recently figured out that I have outstanding Tax Demand since 2010 (I never received any intimation from IT Dept). Since Until 2011, I used to file manual IT Returns through some CA, I cant request this Tax Intimation 143(1) online.

I used to be in bangalore at that time but no longer in bangalore. Could you please let me know if there is a way to handle this problem remotely ? May be through some CA (I dont have access to the CA who filed my Return that time)?

Any help/suggestions in this matter would be really helpful.

Thanks and Regards

-Ravi

Hi Kirti,

I really liked this article as it explains everything so nicely. The only thing is that, I guess the incometax website has changed as I dont see the “List of Buildings” when I select Karnataka in the “Locate Field offices” on “www.incometaxindia.gov.in/home.asp” website.

I recently figured out that I have outstanding Tax Demand since 2010 (I never received any intimation from IT Dept). Since Until 2011, I used to file manual IT Returns through some CA, I cant request this Tax Intimation 143(1) online.

I used to be in bangalore at that time but no longer in bangalore. Could you please let me know if there is a way to handle this problem remotely ? May be through some CA (I dont have access to the CA who filed my Return that time)?

Any help/suggestions in this matter would be really helpful.

Thanks and Regards

-Ravi

Good one Kirti. I like the way you articulated.

Coming from a fellow financial blogger it means a lot. Thanks Suresh for encouraging words.

Good one Kirti. I like the way you articulated.

Coming from a fellow financial blogger it means a lot. Thanks Suresh for encouraging words.

Most of the outstanding demand in case of salaried individuals is due to non deposit of TDS by employer.

Based on my experience I can say it is mostly due to Form 26AS not matching our TDS etc.

And also because somehow the online data does not reflect the submission(physical/online) esp during transition stage from paper to electornic

Most of the outstanding demand in case of salaried individuals is due to non deposit of TDS by employer.

Based on my experience I can say it is mostly due to Form 26AS not matching our TDS etc.

And also because somehow the online data does not reflect the submission(physical/online) esp during transition stage from paper to electornic

Outstanding demand is not always because non deposit of TDS. It is because TDS return not filed properly or PAN errors, or defective TDS challan.

@Ramesh :- Contact ur CA. As procedure is complicated.

@admin :-

You broke some cardinal rules of Department visits 😀

Rule 1 :- Never visit Assessing Officer directly.

Rule 2:- Let your CA visit Department.

they only deal usually with CAs.

I don’t agree with the statement Mr CA. The Assessing officer was handling the CA and ordinary people in same way (Go and talk to my income tax officer).

When I insisted on speaking to him, he was courteous though not of much help.

BTW I had gone with the CA,who handles our tax filing, as we did not want to be sure and don’t miss out anything.

@Ramesh :- Contact ur CA. As procedure is complicated.

@admin :-

You broke some cardinal rules of Department visits 😀

Rule 1 :- Never visit Assessing Officer directly.

Rule 2:- Let your CA visit Department.

they only deal usually with CAs.

I don’t agree with the statement Mr CA. The Assessing officer was handling the CA and ordinary people in same way (Go and talk to my income tax officer).

When I insisted on speaking to him, he was courteous though not of much help.

BTW I had gone with the CA,who handles our tax filing, as we did not want to be sure and don’t miss out anything.

They are all looking for bribe. Pathetic people, shame for human race on earth.

My tax refund status for assessment year 2009-10 is showing like “Unable to credit refund as the account number provided by you is incorrect”. To which address I need to send the actual details. I have sent multiple mails to tax dept. I haven’t got any response. I filed that return in Chennai, but now I am residing in Hyderabad. So I cannot go personally to assessment office.

So you advice is highly appreciated.

Thanks in advance.

were your returns filed electronically or physically?

Are the bank details correct?

If physically need to go to Assessing officer. It might be that your assessing officer is in Hyderabad only. Check that given the link provided. You don’t need to go yourself. Find a trusted CA who can go on your behalf.

If electronically – verify your bank details and then you can request for Refund after logging in to income tax e filing cite and selecting My Accounts and then Refund Reissue Request.

please keep us updated.

My tax refund status for assessment year 2009-10 is showing like “Unable to credit refund as the account number provided by you is incorrect”. To which address I need to send the actual details. I have sent multiple mails to tax dept. I haven’t got any response. I filed that return in Chennai, but now I am residing in Hyderabad. So I cannot go personally to assessment office.

So you advice is highly appreciated.

Thanks in advance.

were your returns filed electronically or physically?

Are the bank details correct?

If physically need to go to Assessing officer. It might be that your assessing officer is in Hyderabad only. Check that given the link provided. You don’t need to go yourself. Find a trusted CA who can go on your behalf.

If electronically – verify your bank details and then you can request for Refund after logging in to income tax e filing cite and selecting My Accounts and then Refund Reissue Request.

please keep us updated.

Helpful Information. Since I also have outstanding Tax Demand. Thanks for the information.

Thanks for encouraging words

Helpful Information. Since I also have outstanding Tax Demand. Thanks for the information.

Thanks for encouraging words