Table of Contents

Overview of Will

- Will can be made at any point in the lifetime of a person.

- Will can be changed as many times as one wishes. However, only the last Will made before death is enforceable.

- In India registration of Wills is not compulsory.

- If you register, There is no stamp duty payable. It doesn’t have to be executed before a notary.

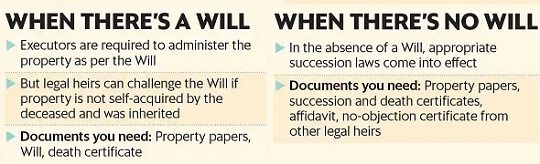

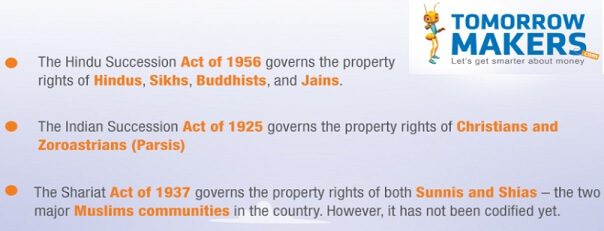

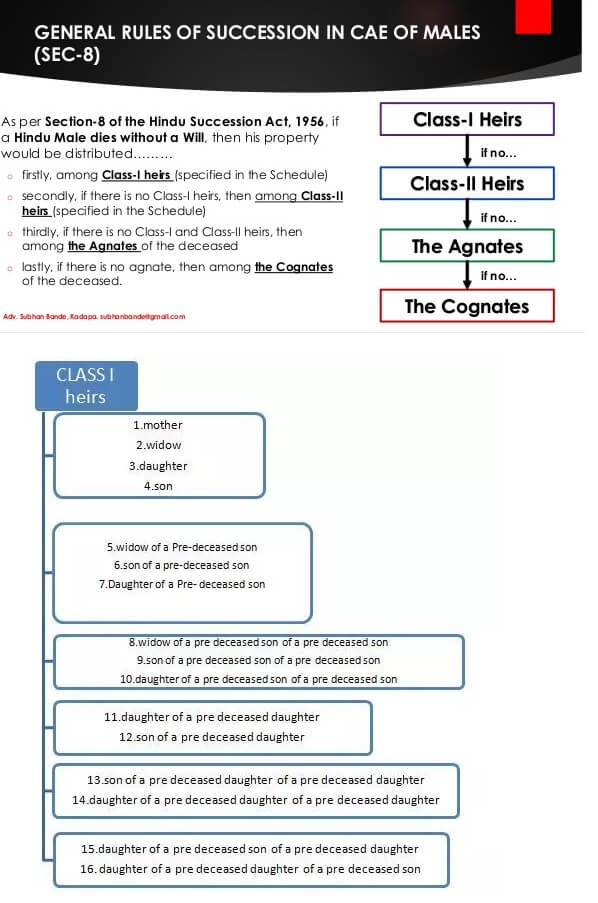

- If there is no will, different laws are applicable based on types of succession(will or no will) and religion(Hindu(includes Sikh, Jain, Buddhist), Muslim, Christian)

- There is no inheritance or gift tax if the property is inherited is acquired through a will.

- Once inherited, any source of income, such as rent or interest, is transferred to the new owner and he must pay tax on it. Inheriting a property is not enough, proper transfer of its title in your name is a must

What is Will, How does it differ from Nomination etc

Nomination or Will

When you nominate someone for your bank account, insurance policies, or shares held by you, it gives the bank/ insurer/company a convenient way to determine what to do with the balance in your account, the proceeds of your insurance policy and your shares upon your death. Remember nomination is introduced solely for the purpose of simplifying the procedure for settlement of claims of deceased depositors and nomination facility does not take away the rights of legal heirs on the estate of the deceased.

Will is not a substitute for nomination and neither is a nomination a substitute for making a Will. The ideal situation is where the name of the nominee and the beneficiary under the Will to whom you give the property as one and the same person.

Religion and Inheritance: If the Will is made or not made

However, such cases usually end up in court or are settled after acrimonious negotiations between the legal heirs. Remember Ambani brothers’ dispute. (to know more about the feud you can refer to Mukesh Ambani and Anil Ambani Feud, After the Split)

The financial institutions might ask for Succession Certificate or Letter of Administration, *covered in another post) which involves going to court time and money. This is why you should settle these issues during your lifetime. These words sum up very well: Where there is a will, there are relatives. Where there isn’t a will, there is chaos.

How to make a Will

- In order for a Will to be valid, it must be signed by the person making it (ie testator) in the presence of at least two Witnesses and the Witnesses must sign in the presence of the Testator.

- It is not necessary that the Witness should know the content of the Will since they are only testifying to the signature of the testator.

- Beneficiary(A person who benefits from Will) under a Will should not be a Witness. If a Beneficiary is also a Witness, he may not be entitled to that property under the Will. If you gift property to an attesting witness in the will, the document will remain valid, but the witness will not be able to inherit the property. For instance, if you want to leave a house to your daughter, she or her husband should not attest as witnesses. If they do so, your daughter will not inherit the house. The property will instead pass on to the residuary legatee

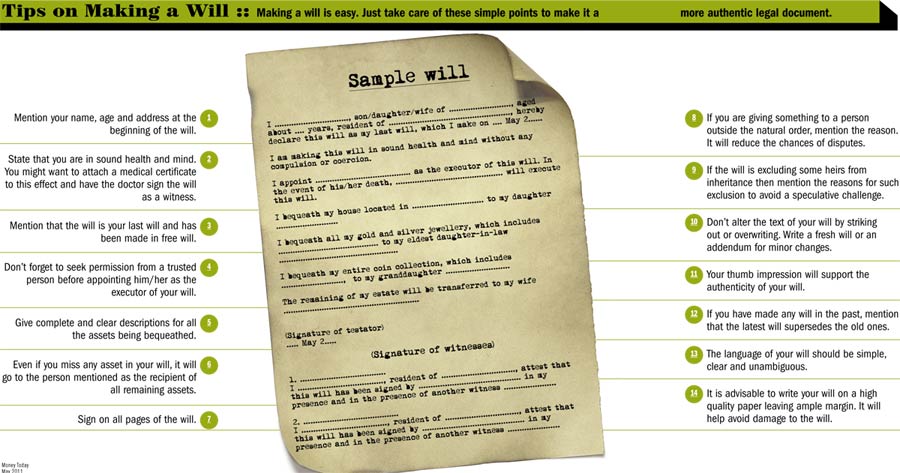

Format of Will

There is no prescribed format for a Will. The samples are shown below. Will should cover the following sections:

- Personal Details – You have to state your name, father’s name, residential address, Date of Birth etc.,

- Date of writing the will – It is very important to clearly mention the date of preparing your Will.

- Declare Soundness of Mind – You can mention that you are not under any influence and you are not forced to prepare this Will by any person.

- Provide Executor’s Details – Executor is the person who will implement/execute your Will. So mention his/her name, address, your relationship with him/her, age etc.,

- Details of Who gets what: List of all your assets and who gets what. Such as your land, house, gold, bank deposits, insurance, stocks, govt policies, mutual funds, lockers etc. Mention the name of beneficiary(ies) for each asset. Each asset has to be separately written along with the name of the beneficiary and his share allotted in that property.

- In case of beneficiaries their a) Names b) Age c) Name and address proof like Aadhar d) Your relationship with beneficiary etc. must be clearly mentioned.

- In case of Property the complete details of the property along with a stamped latest copy of ownership proof should be attached along with the Will.

- The full details and percentage of every property that you desire to give the particular beneficiary must be mentioned. Dates and amounts should always be mentioned in words.

- Signature – Your signature

- Signature of Witnesses – You have to get the Will attested by minimum two witnesses. Make sure that they mention their father’s names and addresses.

Sample Draft Will

Below is the sample Will format. Sample wills from different sources are given below. Click on the image to enlarge. As you can see there is not a standard form. One can also check out and download the various templates from vakilno1

I, Shri/Smt ………………….. son/daughter/wife of Shri …………….., resident of …………………., by religion………….., do hereby revoke all my previous Wills (or) Codicils and declare that this is my last Will, which I make on this …….(Date)………………… My Date of Birth is ………….

I declare that I am in good health and possess a sound mind. This Will is made by me without any persuasion or coercion and out of my own independent decision only.

I appoint Shri………………….. Son/daughter of ……………, resident of …………. to be the executor of this Will. In the event Shri…………… were to predecease me, then Shri……………., will be the executor of this Will.

I bequeath the following assets to my Wife Smt……………..

-

- My house located at………(address)………

- Bank balance of my savings account no…………………..with ……………(bank name & bank address)………

- My Bank fixed deposits in …….(bank name)…..bearing ……..(FD receipt nos)……..

- The proceeds of my Term insurance policy ….(Policy no)……, from…….(insurance company name)………

- The contents of bank locker no………, with bank…………, bank address……………

I bequeath the following assets to my son Shri……………

-

- Residential Plot no…….., located at…………….

- My car with registration no……….

- My mutual fund investments with folio numbers…………………..

- Any other asset not mentioned in this Will but of which I am the owner.

All the above assets are owned by me. No one else has rights on these properties.

Signature of Testator

Witnesses

We hereby attest that this Will has been signed by Shri………….as his last Will at ………(Place)……… in the joint presence of himself and us. The testator is in sound mind and made this Will without any coercion.

Signature of Witness (1) Signature of Witness (2)

Online WILL – Service Providers

Generally, lawyers charge atleast 4000 Rs for drafting a Will. You can now get will made online. Some of the service providers who are offering this service are. But one should be diligent before zeroing in on a service provider as they deal with your valuable personal data

- Willjini.com has tied up with many corporates like HDFC Securities, CDSL, Muthoot Finance etc

- LegalDesk.com

- Willstar.in

- Many banks such as ICICI Bank and Federal bank also offer Will services in collaboration with online legal advisors to their non-resident clients.

Some of these websites offer free templates while some offer legal advice to customise as per the needs of the client for a fee.

Should Will be registered?

In India, registration of Wills is not compulsory. A Will is not a compulsorily registerable document under section 17 of the Registration Act, 1908, (Act), and according to section 18 (e) it is the testator’s choice as to whether he wishes to register it.

A Will is a legal declaration of the intention of a person (testator) with respect to his property or estate, which he desires to take effect after his death. The following essentials of a Will must be kept in mind:

- (i) The Will must be executed by the testator, i.e., the person making the Will (or by some other person in the testator’s presence and under his directions; if it is not possible for the testator to affix his signature, he may also put his thumb impression);

- (ii) The signature should be placed in such as manner that it appears that it was intended to give effect to the Will

- (iii) The Will should be signed by the testator in the presence of two witnesses (other than the beneficiaries under a Will), and the witnesses must also attest (i.e., sign).

If you want to register will.

- There is no stamp duty payable.

- It doesn’t have to be executed before a notary public.

- But if one chooses to register a Will with the applicable registrar/sub-registrar of assurances, the registration provides evidence that the proper parties had appeared before the registering officer and the latter had attested the same after ascertaining their identity.

- Once a Will is registered, it is placed in the safe custody of the Registrar and cannot be tampered with, destroyed, mutilated or stolen. However, non-registration of a Will does not lead to any inference against its genuineness.

Important points about the Will: Registration, Executor,Residue claus

Registration of Wills is not compulsory in India but Will can be registered with the Sub-registrar of Assurances and then the registered will takes precedence over the unregistered will even though the same may have been drawn at a subsequent date and is stated to have revoked all previous wills. Because, a registered will can only be substituted by a registered will. For getting a will registered, you will have to visit the registrar’s office along with your witnesses. A will can also be registered by the executor or any beneficiary after the testator’s demise. There is no stamp duty for registration of a will.

The Will should provide for the appointment of Executor, though not mandatory. An Executor is a legal representative of the deceased person (who has made a Will) An Executor is the person who disposes of or oversees the settlement of the properties of the deceased person in accordance with the wishes of the deceased person as stated in the Will. You should appoint only a trusted person as the executor of your will after seeking his consent. If you do not seek his permission in advance, there might be no executor for your will if the person refuses to accept the responsibility after your demise. If there is no executor of a will, the court will appoint one. For more details about executor read FAQ at indianwillmaker.com

It is advisable to have a residue clause in the will to ensure disposal of all the investments which are not clearly mentioned or specifically included in the will.

Will can be made at any point in the lifetime of a person.

Will can be changed as many times as one wishes. There is no restriction in law as to how many times a Will can be made. However, only the last Will made before his death is enforceable.

If the person intends to make few changes in the Will, without changing the entire Will, he can do so by making a Codicil to the Will. The codicil can be executed in a similar way as the Will. The will or codicil can be altered or revoked at any time.

A person may dispose off any of his investments during one’s lifetime, even if they are mentioned in the Will. The WILL only applies to those assets, rights and interest which are owned at the time of death plus any future or contingent interests.

About Executors of Will

What can be willed

Property includes flats, jewellery, land, cars and cash actually, any right of a valuable nature. The succession of property is governed by complex laws of inheritance and religion as well as customs. The laws also differ for men and women.

A Hindu (which also includes Jains, Buddhists and Sikhs) man can write a will for any property earned and owned by him. For an inherited property, a Hindu man can only distribute his share in the property through a will.

Let’s assume that a person has Rs 1 lakh in cash earned by him and Rs 5 lakh inherited from his father. He is free to give only the Rs 1 lakh at his will. If he has four legal heirs, the Rs 5 lakh will have five claimants (one being the person himself). So his share in the inherited money is only Rs 1 lakh. He can give his share in the inherited asset to anyone he wants.

In contrast, a Hindu woman has absolute ownership of all earned as well as inherited property. She can write a will for her entire property.

Muslim law allows an individual with heirs to distribute only one-third of his wealth through a will. The rest two-thirds of the wealth is inherited according to the religious laws. The limitation does not apply if the heirs give their consent.

Both Indian and foreign assets can be passed on in a will. Inheritance of overseas assets is specifically permitted under the Foreign Exchange Management Act. However, you need to check the foreign exchange regulations in the overseas jurisdiction to confirm whether any specific approvals are required for the transfer

Writing a will is the first step in succession planning, but your effort could go to waste if there are discrepancies in the document.

Some technical terms related to Will

- Testate: When a person dies leaving a will, they are said to have died testate.

- Intestate succession: When a person dies without leaving a will , they are said to have died intestate.

- Testator is a person who makes a Will.

- Legatee/Beneficiary is a person who inherits the property under a Will.

- Codicil is an instrument made in relation to a Will, explaining, altering or adding to its dispositions and is deemed to be a part of the Will.

- Executor An executor is a person who is appointed by a testator to execute his Will. In other words, an executor is duty bound to distribute the assets of the testator as per the provisions of his Will. He is the legal representative of the deceased person (testator)

Is Will Sufficient?

Yes and No. It all depends on if the will is contested or not. Several films have had plots where the villain hatches a plan to misappropriate property through forged wills or by keeping the legal heirs in the dark. But such cases do happen in real life too. Remember Birla vs Lodha. In 2004Priyamvada Birla, chairperson of MP Birla group passed away at 76, leaving behind a Rs 5000 crore estate to her chartered accountant R S Lodha. Birla Dynasty erupted in indignation saying that they would not let an outsider cart away Birla assets.

For more details you can refer to:

Claiming Your Inheritance

Inheriting is not enough, example proper transfer of its title in case of property in your name is a must. You need to go through legal formalities to obtain ownership of a property.

- Paper Work A Necessary Headache which financial records to keep, for how long, especially for income tax purpose.

- Right paper-work for those you love -Part 1, we had talked about Survivorship Mandate and Nominations in detail

- Transfer Of Shares on Death Now Same as Physical Shares

Disclaimer: Please note while efforts have been made to provide correct information,We are not an expert in legal laws and it is advisable to visit a qualified lawyer for any truthful information on such laws before making any legal moves. We do not take any responsibility, if you read this post and act based on it. We also have no tie-up with any of the external websites mentioned in the post.

my grandmother made will, which is registered after her death before sub-registrar. while registering the will he gave remarks that signature are slghtly different in general power of attorney and will but there is no legal provision not to register it.

what is effect on will of above remarks?

We don’t think so. Once a will is registered it is legal and the entire purpose of registration is to

help the beneficiaries of the Will to obtain bequeathed properties with out hassles. Please update us on how things went.

please provide me your mobile no. i want to talk to you.

Thanks for asking.

I completely agree with what you have said.Will and nomination are extremely important.Moreover, I strongly feel that instead of having singe accounts and investments in single names in is preferable to have joint accounts and joint investments.

Thanks Sir. You are right first we should try for joints with either or survivor. Also have a nominee and a will.