Tax Deducted at Source or TDS is one of the modes of collection of taxes from the people in India. This post is about What is TDS? Why TDS?TDS Rates Chart with various sections and Threshold limit, How TDS is deducted and how often? What is TAN? TDS Certificates – Form 16, Form 16A, Tax Credit Statement or Form 26AS.

Table of Contents

What is Tax Deducted at Source or TDS?

TDS is a certain percentage deducted at the time of payments of various kind such as salary, commission, rent, interest on dividends etc and deducted amount is remitted to the Government account. This withheld amount can be adjusted against tax due. The person/organization deducting the tax is called as Deductor while the person from whom the tax is deducted is called Deductee. Deductor is also termed as Employer and Deductee is termed as an Employee in cases where the payments are Salaries. It is governed under Indian Income Tax Act, 1961, by the Central Board for Direct Taxes (CBDT) and is part of the Department of Revenue managed by Indian Revenue Service (IRS), Ministry of Finance, Govt. of India

Why TDS?

The concept of TDS envisages the principle of pay as you earn. Tax must be deducted at the time of payment in cash or cheque or credit to the payee’s account.

Advantages of TDS

- It facilitates sharing of responsibility of tax collection between the Deductor and the tax administration.

- It ensures regular inflow of cash resources to the Government.

- It acts as a powerful instrument to prevent tax evasion as well as expands the tax net.

It is similar to concept of Withholding Tax in USA

Nature of Payments and TDS Rates

As mentioned earlier TDS is a certain percentage deducted at the time of payments of various kind such as salary, commission, rent, interest on dividends etc. The various payments for which TDS is deducted, Threshold limit (above which TDS is deducted), the rate at which it is deducted for Resident Individual or Hindu Undivided Family(HUF), Domestic Company or Firm with appropriate Income Tax Section Code and links to the Income Tax law from VakilNo1 website are given below.

TDS Rates Chart Assessment Year 2012-13 (Financial Year 2011-12 )

| Section Code | Nature of Payment | Threshold Limit | Individual or HUF | Company/Firm |

| 192 | Payment of salary to a resident/non-resident | Normal Income Tax Rates | ||

| 193 | Interest on securities | 10 | 10 | |

| 194 | Deemed dividends u/s 2(22)(e) | 10 | 10 | |

| 194A | Interest other than Interest on securities | 5000 | 10 | 10 |

| 194B | Lottery or crossword puzzle or card game or other game of any sort. | 10000 | 30 | 30 |

| 194BB | Horse races | 5000 | 30 | 30 |

| 194C | Contracts/sub-contracts | 30000 | 1 | 2 |

| 194D | Insurance Commission | 20000 | 10 | 10 |

| 194EE | Payment in respect of deposits under NSS | 2500 | 20 | – |

| 194F | Payment on account of repurchase of units of MF or UTI | 1000 | 20 | 10 |

| 194G | Commission on sale of lottery tickets | 1000 | 10 | 10 |

| 194H | Commission or brokerage | 5000 | 10 | 10 |

| 194-I | Rent of Plant and Machinery | 180000 | 2 | 2 |

| Rent of Land or Building or Furniture and Fitting | 180000 | 10 | 10 | |

| 194J | Fees for professional or technical services | 30000 | 10 | 10 |

| 194L | Payment of compensation to a resident on acquisition of certain immovable property | 100000 | 10 | 10 |

VakilNo1 webpage Income Tax Act, 1961 has information on IncomeTax Law and it’s various sections.

Income from Salaries: The income from salaries is required to be computed on estimated basis at the beginning of each financial year. Income Tax payable on the basis of such estimated salary income should be deducted at the rate applicable to the corresponding slab of income every month in equal instalments subject to adjustments depending upon tax saving investments made by the Deductee.

When an employee is working with more than one employer simultaneously or changes his job from one during the financial year, the employer will deduct tax on considering the aggregate salary from all sources and tax deducted thereon, if any. Be careful of not evading tax while changing jobs. For details you may read Changing Jobs:Take Care Of Bank Account,Tax Liability

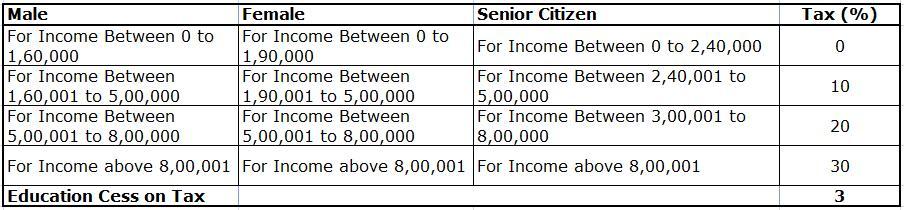

TDS Salary Rates for Assessment Year 2012-13

For tax rates over the years you can check our Income Tax rates Since Year AY 1992-1993

TDS Calculator for Financial Year 2011-2012 or Assessment Year 2012-2013 is available at Taxworry:TDS Calculator

When No Tax is deducted

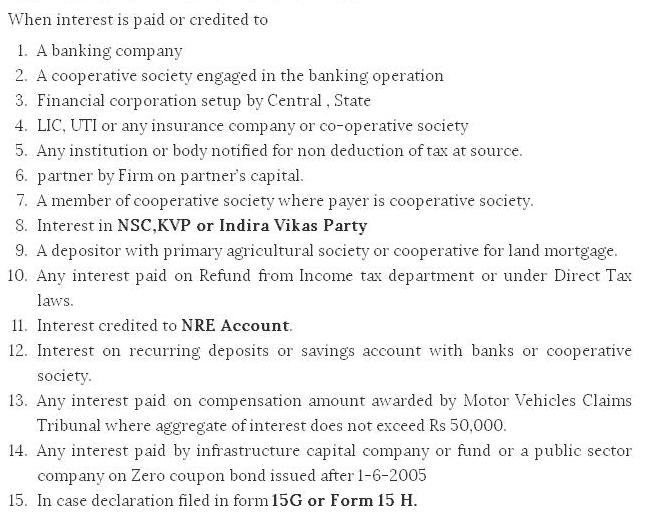

No Tax has to be deducted for the payment made to Government, RBI, Corporation whose income is exempt from tax or mutual fund specified under sec. 10(23D). Also in case where deductee produces a non deduction certificate or lower deduction certificate under section 197 of the Income Tax Act 1961. Quoting from Taxworry:All about TDS on interest income…No Tax is deducted

If Tax is not deducted at Source i.e TDS has not been cut at times it does not mean that one is not required to pay tax. For example in case of interest on recurring deposit or saving account with banks and society, TDS is not cut but one is required to pay interest on it.

Self declaration in Forms 15G and 15H can be filed by the deductee if his income doesn’t exceed the amount chargeable to tax. This self declaration can be filed for dividends, interest and mutual fund income only. In these cases no tax has to be deducted. However the tax deductor is required to furnish copies of this self declaration to the concerned CCIT or CIT as per the rules. Form 15G is for all taxpayers, while Form 15H is a special form for senior citizens. In either case, it can be filed only if their income falls below the taxable limit. Both forms incorporate a declaration that the declarant is not liable for tax. Important points to be considered with respect to these forms.

- Fresh forms are required to be filed each year. As incomes of investors may differ from year to year, the eligibility for furnishing the forms has to be ascertained every year.

- Secondly, for optimum benefit, these forms need to be furnished at the beginning of the fiscal such that the entire amount of interest escapes TDS. If the form is filed during the year, the tax already deducted cannot be adjusted against future tax deductions.

Ref:IncomeTaxGov.in:Exemptions, DNA:Who is eligible for filing forms 15G, 15H and how to save TDS

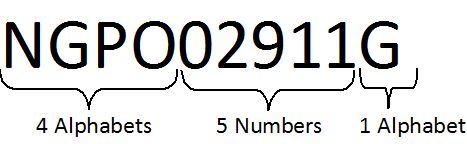

Tax Deduction and TAN

All those persons who are required to deduct tax at source or collect tax at source on behalf of Income Tax Department are required to obtain Tax Deduction and Collection Account Number or TAN as per the provisions of section 203A of the Income-tax Act. It is compulsory to quote TAN in TDS/TCS return (including any e-TDS/TCS return), any TDS/TCS payment challan and TDS/TCS certificates. Failure to apply for TAN or comply with any of the other provisions of the section attracts a penalty of Rs. 10,000/-.

TAN is a 10 digit alpha numeric number ex: BLRR02933A.

- The first three characters are an Income Tax Region Code ex: BLR stands for Bangalore

- Fourth digit is the first character of the deductor name ex: R may be Royal Travels.

- Remaining 5 characters form a unique combination.

- Last character is an alphabet

How to apply for TAN: An application for allotment of TAN is to be filed in Form 49B and submitted at any of the Tax Information Network Facilitation Centres(TIN FC). Tax Information Network (TIN) is an initiative by Income Tax Department of India (ITD) for the modernization of the current system for collection, processing, monitoring and accounting of direct taxes using information technology. TIN is a repository of nationwide Tax related information, and has been established by National Securities Depository Limited on behalf of ITD. The fee for processing TAN application is Rs.50/- + service tax (as applicable). To know more about TIN and NSDL and it’s services you may read more About us at tin-nsdl.com.

For more details on TAN one can read Incometaxindia.gov.in: Frequently Asked Questions and Answers (FAQs) on TAN. One can find information about Deductor or TAN from Incometaxindiaefiling.gov.in: Know Your TAN

How does Deductor pay TDS

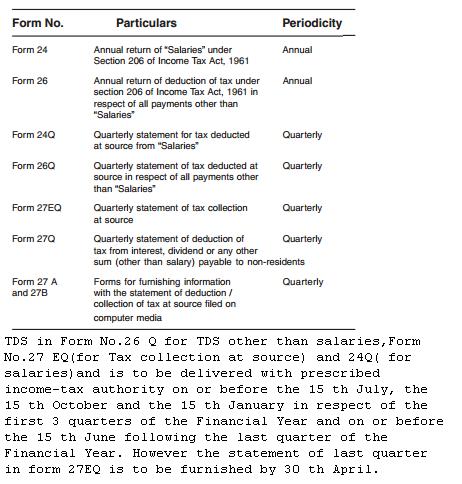

Every organization responsible for deducting tax is required to file quarterly statements of TDS for the quarters ending on 30 th June, 30 th September, 31 st December and 31 st March in each Financial Year The provisions of quarterly statements of TDS have been introduced in the statute vide section 200(3) w.e.f. 01/04/2005. The returns, forms and their periodicity is given below

TDS forms and periodicity

Note:All income tax related forms are available at incometaxindia.gov.in website.

e-TDS return is a TDS return prepared in form No.24Q, 26Q, 27EQ or 27Q in electronic media as per prescribed data structure. As per Section 206 of Income Tax Act all corporate and government Deductors are compulsorily required to file their TDS return on electronic media i.e. e-TDS. However for other Deductors, filing of e-TDS return is optional.

Flow of TDS Deduction is shown in figure below(Click on image to enlarge)

Credit of TDS

Under Section 199 of Income Tax Law 1961, when tax has been deducted at source from any payment of income receivable, credit will be given to the Deductee while calculating the net tax payable by him and the TDS will be treated as a payment of tax on his behalf to the Central Government by the payer or Deductor who has deducted the tax at source. Section 199 in detail at law.incometaxindia.gov.in:Section 199, Vakilno1.com: Section 199

TDS Certificates

A tax deductor is required to issue TDS certificate to the Deductee within specified timed under section 203 of the Income Tax Act. The Deductee should produce the details of this certificate to adjust the amount of TDS against the Tax payable him, during the regular assessment of income tax. Various Types of TDS certificates are as follows:

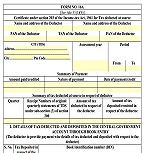

- Salaries – Form 16: In case of Salaries, the certificate should be issued in FORM 16 containing the Tax computation details and the Tax deducted & Paid details. This refers to the details submitted over Form 24Q.

- Non-salaries – Form 16A: In case of Non-Salaries, FORM 16A is issued containing the Tax deducted & Paid details. Separate certificates should be prepared for each Section(ex:194C, 194J). This refers to the details submitted over Form 26Q and 27Q.

Form 16 |

Form 16A |

|

|

TDS certificate in Form 16A should be generated and downloaded from the Tax Information Network (TIN) website for the TDS deduction made on or after 01st April, 2011. This is mainly for Companies including banking companies and co-operative societies engaged in banking business. For other deductors, it is optional to download Form 16A from TIN Web site. Such downloaded TDS certificate will have a unique TDS Certificate Number.This is to avoid the mismatch in e-TDS records and Form 16A.

Tax Credit Statement or Form 26AS

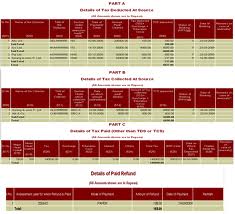

Deductee can know his TDS details through online Form 26AS. Those who wish to view their TDS details can register their names with PAN no in Income Tax website or view it directly if they have bank account with selected banks. This helps to eliminate the mismatch and the above changes also help to avoid the mismatch in form 26AS and in Form 16A.The Tax Credit Statement or Form 26AS is generated when valid PAN has been reported in the TDS statements.

Form 26AS contains

- Details of tax deducted on behalf of the taxpayer by deductors, Part A of Form 26AS

- Details of tax collected on behalf of the taxpayer by collectors, Part B of Form 26AS

- Advance tax/self assessment tax/regular assessment tax, etc. deposited by the taxpayer, Part C of Form 26AS

- Details of paid refund received during the financial year

- Details of the High value Transactions in respect of shares, mutual fund etc.

Sample Form 26AS is given below. Click on image to enlarge

Form 26 AS

incometaxindia.gov.in:26AS has indepth information of Form 26AS, how to view it ,List of banks registered with NSDL for providing view Form 26AS

Reference: incometaxindia.gov.i:Tax_deducted_Source_otherthansalaries_Vol1.pdf

We tried to explain What is TDS? Why TDS?TDS Rates Chart with various sections and Threshold limit, How TDS is deducted and how often? What is TAN? TDS Certificates – Form 16, Form 16A, Tax Credit Statement or Form 26AS. Hope it helped you. If you liked it or found any mistake please let us know.

Thank you.The article was very helpful.

Thank you. The comments are helpful

Sir,

If the deductor accepts form 15G from a customer even if the total interest income does not exceed 10000? what is to be done?

the word “Thank You” is not enough for your explanation but I cannot do more than this thank you so much sir ….

Thank You Sir for such a sweet comment. It means a lot to us!

We just need your Thank You,Best Wishes!

Above information helps me to grow knowledge. thanks to u

Above comments helps us to write more such article . Thanks to you

To,

The bemoneyaware team

Your article is very informative and simple to understand. It would be great of you can resolve me query which is;

What is the relevance of this act for FY 2015-16 and 2016-17… which parts of this scheme will be applicable and which forms and other documents would be used?

Can you expand on the question Anita, what are you looking for?

thank u so much very informative and very easy to understand while comparing to other sites.:)

Thanks for appreciating our efforts. Please spread the good word about our site.

it is very informative and reader friendly. Thanks for providing such information.

Hi Kirti, nice article. Can you please explain the concept of tax subsidies?

Thanks Vidya. Thanks for the request. While we welcome the idea of doing articles on readers choice, we currently do not have much information on the topic of tax subsidies. We shall do some research and then if we feel we can do justice to the topic we shall take it up.

If you have a specific questions, let us know please.

very informative

read in The Week that one of the allegations of malpractice against KingFisher was they did not deposit the TDS of their employees amounting to couple of a few thousand lakhs!!! can it happen so?

Thanks Sujatha. Yes you are right about Kingfisher they did not deposit TDS of the employees. How it happened..we shall try to find out and update.