Tax slabs for various years from FY 1985-86(AY 1986-87) to FY 2019-20 (AY 2020-21) are given below :

Income tax slabs for FY 2019-20

For the Financial year 2018-19 or Assessment Year 2019-20

| TAX | MEN and WOMEN | SENIOR CITIZEN(Between 60 yrs to 80 yrs) | For Very Senior Citizens(Above 80 years) |

| Basic Exemption | 250000 | 300000 | 500000 |

| 5% tax | 250001 to 500000 | 300001 to 500000 | – |

| 20% tax | 500001 to 1000000 | 500001 to 1000000 | 500001 to 1000000 |

| 30% tax | above 1000000 | above 1000000 | above 1000000 |

| Surcharge | 10% of tax where total income exceeds Rs. 50 lakh

15% of tax where total income exceeds Rs. 1 crore |

||

| Education Cess | Health & Education cess: 4% of tax plus surcharge | ||

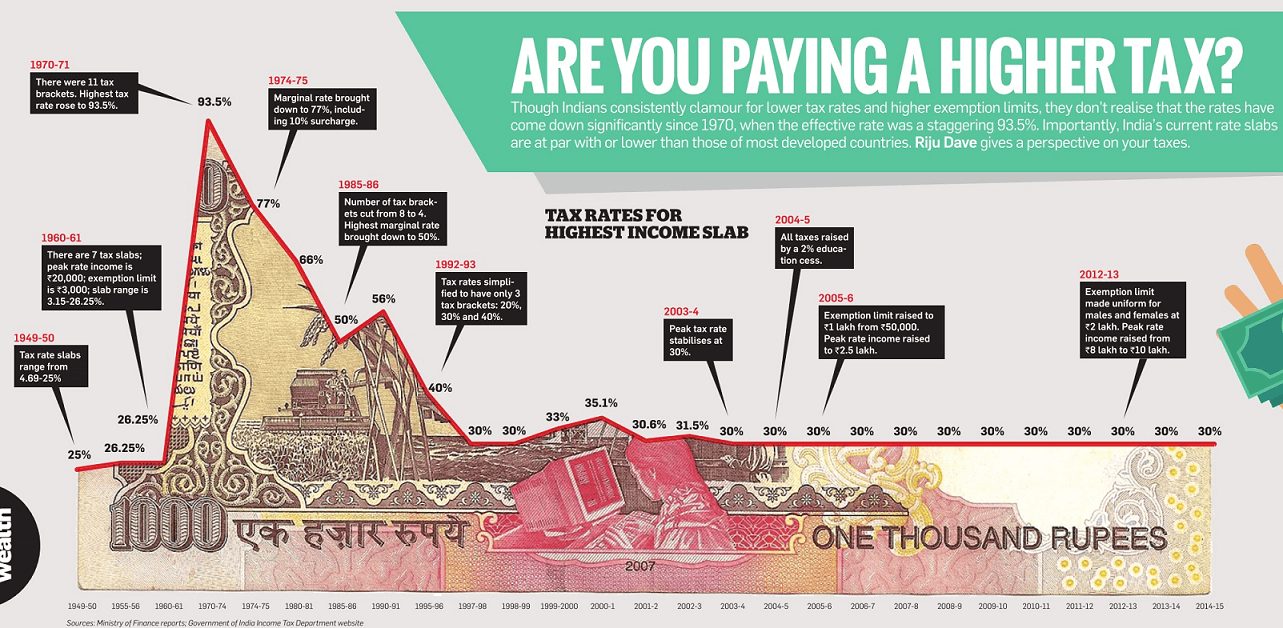

If interested in how Personal Tax rates have evolved in India you can read:

- MoneyControl:Evolution of Personal Taxation in India(till 2006-2007)

- India Today:A 50 year trend of Indian Personal Tax rates(Feb 2011)

- India Today:Income Tax since 1950’s (2009)

For Financial year 2015-16 or Assessment Year 2016-17

Returns to be filed by 31 Jul 2016.

| TAX | MEN and WOMEN | SENIOR CITIZEN(Between 60 yrs to 80 yrs) | For Very Senior Citizens(Above 80 years) |

| Basic Exemption | 250000 | 300000 | 500000 |

| 10% tax | 250001 to 500000 | 300001 to 500000 | – |

| 20% tax | 500001 to 1000000 | 500001 to 1000000 | 500001 to 1000000 |

| 30% tax | above 1000000 | above 1000000 | above 1000000 |

| Surcharge | 10% of the Income Tax, where total taxable income is more than Rs. 1 crore | ||

| Education Cess | 3% on Income-tax plus Surcharge. | ||

For Financial year 2014-15 or Assessment Year 2015-16

Returns to be filed by 7 Sep 2015.

| TAX | MEN and WOMEN | SENIOR CITIZEN(Between 60 yrs to 80 yrs) | For Very Senior Citizens(Above 80 years) |

| Basic Exemption | 250000 | 300000 | 500000 |

| 10% tax | 250001 to 500000 | 300001 to 500000 | – |

| 20% tax | 500001 to 1000000 | 500001 to 1000000 | 500001 to 1000000 |

| 30% tax | above 1000000 | above 1000000 | above 1000000 |

| Surcharge | 10% of the Income Tax, where total taxable income is more than Rs. 1 crore | ||

| Education Cess | 3% on Income-tax plus Surcharge. | ||

For Financial year 2013-14 or Assessment Year 2014-15

Returns to be filed by 31 Jul 2014.

| TAX | MEN and WOMEN | SENIOR CITIZEN(Between 60 yrs to 80 yrs) | For Very Senior Citizens(Above 80 years) |

| Basic Exemption | 200000 | 250000 | 500000 |

| 10% tax | 200001 to 500000 | 250001 to 500000 | – |

| 20% tax | 500001 to 1000000 | 500001 to 1000000 | 500001 to 1000000 |

| 30% tax | above 1000000 | above 1000000 | above 1000000 |

| Surcharge | 10% of the Income Tax, where total taxable income is more than Rs. 1 crore | ||

| Education Cess | 3% on Income-tax plus Surcharge. | ||

For Financial year 2012-13 or Assessment Year 2013-14

| TAX | MEN and WOMEN | SENIOR CITIZEN(Between 60 yrs to 80 yrs) | For Very Senior Citizens(Above 80 years) |

| Basic Exemption | 200000 | 250000 | 500000 |

| 10% tax | 200001 to 500000 | 250001 to 500000 | – |

| 20% tax | 500001 to 1000000 | 500001 to 1000000 | 500001 to 1000000 |

| 30% tax | above 1000000 | above 1000000 | above 1000000 |

| Surcharge | There is no surcharge in the case of every individual, Hindu undivided family, Association of persons and body of individuals | ||

| Education Cess | 3% on Income-tax plus Surcharge. | ||

For Financial year 2011-12 or Assessment Year 2012-13

| TAX | MEN | WOMEN | SENIOR CITIZEN(Between 60 yrs to 80 yrs) | For Very Senior Citizens(Above 80 years) |

| Basic Exemption | 180000 | 190000 | 250000 | 500000 |

| 10% tax | 180001 to 500000 | 190001 to 500000 | 250001 to 500000 | – |

| 20% tax | 500001 to 800000 | 500001 to 800000 | 500001 to 800000 | 500001 to 800000 |

| 30% tax | above 800000 | above 800000 | above 800000 | above 800000 |

| Surcharge | There is no surcharge in the case of every individual, Hindu undivided family, Association of persons and body of individuals | |||

| Education Cess | 3% on Income-tax plus Surcharge. | |||

For Financial year 2010-11 or Assessment Year 2011-12

| TAX | MEN | WOMEN | SENIOR CITIZEN |

| Basic Exemption | 160000 | 190000 | 240000 |

| 10% tax | 160001 to 500000 | 190001 to 500000 | 240001 to 500000 |

| 20% tax | 500001 to 800000 | 500001 to 800000 | 500001 to 800000 |

| 30% tax | above 800000 | above 800000 | above 800000 |

| Surcharge | There is no surcharge in the case of every individual, Hindu undivided family, Association of persons and body of individuals | ||

| Education Cess | 3% on Income-tax plus Surcharge. | ||

For Financial year 2009-10 or Assessment Year 2010-11

| TAX | MEN | WOMEN | SENIOR CITIZEN |

| Basic Exemption | 160000 | 190000 | 240000 |

| 10% tax | 160001 to 300000 | 190001 to 300000 | 240001 to 300000 |

| 20% tax | 300001 to 500000 | 300001 to 500000 | 300001 to 500000 |

| 30% tax | above 500000 | above 500000 | above 500000 |

| Surcharge | There is no surcharge in the case of every individual, Hindu undivided family, Association of persons and body of individuals. | ||

| Education Cess | 3% on Income-tax plus Surcharge. | ||

For Financial year 2008-09 or Assessment Year 2009-10

| TAX | MEN | WOMEN | SENIOR CITIZEN |

| Basic Exemption | 150000 | 180000 | 225000 |

| 10% tax | 150001 to 300000 | 180001 to 300000 | 225001 to 300000 |

| 20% tax | 300001 to 500000 | 300001 to 500000 | 300001 to 500000 |

| 30% tax | above 500000 | above 500000 | above 500000 |

| Surcharge for Taxable Income > 10,00,000 | 10% | 10% | 10% |

| Education Cess | 3% on Income-tax plus Surcharge. | ||

For Financial year 2007-08 or Assessment Year 2008-09

| TAX | MEN | WOMEN | SENIOR CITIZEN |

| Basic Exemption | 110000 | 145000 | 195000 |

| 10% tax | 110001 to 150000 | 145001 to 150000 | nil |

| 20% tax | 150001 to 250000 | 150001 to 250000 | 195001 to 250000 |

| 30% tax | above 250000 | above 250000 | above 250000 |

| Surcharge for Taxable Income > 10,00,000 | 10% | 10% | 10% |

| Education Cess | 3% on Income-tax plus Surcharge. | ||

For Financial year 2006-07 and 2005-06 or Assessment Year 2007-08 and 2006-2007

| TAX | MEN | WOMEN | SENIOR CITIZEN |

| Basic Exemption | 100000 | 135000 | 185000 |

| 10% tax | 100001 to 150000 | 135001 to 150000 | nil |

| 20% tax | 150001 to 250000 | 150001 to 250000 | 185001 to 250000 |

| 30% tax | above 250000 | above 250000 | above 250000 |

| Surcharge for Taxable Income > 10,00,000 | 10% | 10% | 10% |

| Education Cess | 2% on Income-tax plus Surcharge. | ||

For Financial year 2004-05 and 2003-04 or Assessment Year 2005-06 and 2004-2005

| TAX | MEN | WOMEN | SENIOR CITIZEN |

| Basic Exemption | 50000 | 50000 | 50000 |

| 10% tax | 50001 to 60000 | 50001 to 60000 | 50001 to 60000 |

| 20% tax | 60001 to 150000 | 60001 to 150000 | 60001 to 150000 |

| 30% tax | above 150000 | above 150000 | above 150000 |

| Surcharge for Taxable Income > 8,50,000 | 10% | 10% | 10% |

| Education Cess | 2% on Income-tax plus Surcharge. | ||

For Financial year 2002-03 or Assessment Year 2003-04

| TAX | MEN | WOMEN | SENIOR CITIZEN |

| Basic Exemption | 50000 | 50000 | 50000 |

| 10% tax | 50001 to 60000 | 50001 to 60000 | 50001 to 60000 |

| 20% tax | 60001 to 150000 | 60001 to 150000 | 60001 to 150000 |

| 30% tax | above 150000 | above 150000 | above 150000 |

| Surcharge for Taxable Income > 1,50,000 | 5% | 5% | 5% |

For Financial year 2001-02 or Assessment Year 2002-03

| TAX | MEN | WOMEN | SENIOR CITIZEN |

| Basic Exemption | 50000 | 50000 | 50000 |

| 10% tax | 50001 to 60000 | 50001 to 60000 | 50001 to 60000 |

| 20% tax | 60001 to 150000 | 60001 to 150000 | 60001 to 150000 |

| 30% tax | above 150000 | above 150000 | above 150000 |

| Surcharge for Taxable Income > 60,000 | 2% | 2% | 2% |

For Financial year 2000-01 or Assessment Year 2001-02

| TAX | MEN | WOMEN | SENIOR CITIZEN |

| Basic Exemption | 50000 | 50000 | 50000 |

| 10% tax | 50001 to 60000 | 50001 to 60000 | 50001 to 60000 |

| 20% tax | 60001 to 150000 | 60001 to 150000 | 60001 to 150000 |

| 30% tax | above 150000 | above 150000 | above 150000 |

| Surcharge for Taxable Income > 60,000 | 12% | 12% | 12% |

| Surcharge for Taxable Income > 150000 | 17% | 17% | 17% |

ASSESSMENT YEAR 2000-2001

ASSESSMENT YEAR 1991-1992

| Upto 22000 | Nil |

| 22000 to 30000 | 20% |

| 30000 to 50000 | 30% |

| 50000 to 100000 | 40% |

| 100000 and above | 50% |

| Surcharge | 12% if taxable income exceeds 75,000 |

ASSESSMENT YEAR 1990-91

| Upto 18000 | Nil |

| 18000 to 25000 | 25% |

| 25000 to 50000 | 30% |

| 50000 to 100000 | 40% |

| 100000 and above | 50% |

| Surcharge | 8% if taxable income exceeds 50,000 |

ASSESSMENT YEAR 1986-87 to 1989-1990

| Upto 18000 | Nil |

| 18000 to 25000 | 25% |

| 25000 to 50000 | 30% |

| 50000 to 100000 | 40% |

| 100000 and above | 50% |

| Surcharge | 5% if taxable income exceeds 50,000 |