Indians love gold. More than 18,000 tonnes of the metal is lying in Indian households. Now there are many ways to invest in Gold such as Gold Jewellery, Bars- Coins and Biscuits, Sovereign Gold Bonds, Gold ETFs, Gold Saving Funds, Gold Mining Funds, Gold Futures. In this article, we shall see different ways to invest in Gold and pros and cons of each of the way.

Table of Contents

Overview of ways to invest in Gold

An overview of ways to invest in Gold and pros and cons of different investment options in gold is shown in the picture above. Section How the different Investment options in Gold perform? covers how the investment of 1 lakh in different Gold investment options will change based on 4 different scenarios, if gold prices fall every year by 5%, if gold prices remain steady over 5 years, if gold prices rise every year by 5%, if gold prices rise every year by 10%. Gold Bond, Bullion, Gold ETF, Gold Bonds and Ornaments seem to be the choice.

- GOLD BONDS As you earn on an interest of 2.5%, this is the best form of gold to have in your portfolio. However. liquidity is not great. You also have to pay a brokerage of 0.5% if you buy the bonds from the secondary market.

- GOLD ETFs They are fairly liquid and thus suit investors who want to hold it for the short to medium term. However, be prepared for tower returns because of 1% expense ratio. You have to bear 0.5% brokerage while buying or selling.

- GOLD FUNDS Being open-ended funds, there is no issue with liquidity. However, these funds invest in gold ETFs and, therefore, the expense ratio is 1.5%, higher than that of gold ETFs.

- GOLD BULLION If you want gold in physical form, this is the vehicle to choose. However. jewellers charge a small 2% commission while buying or selling them.

- GOLD JEWELLERY Making and liquidation charges can be as low as 10% and 5%, respectively. if you opt for plain jewellery. Making charges (or intricate jewellery can be 20% and liquidation charges 10%.)

- Image Ref:outlook money

Gold Buying in India

The only thing that Indians probably love more than buying real estate is buying gold. In India Gold tends to show a seasonal pattern across the year, rising in spring, flattening in summer, and then rising again from September. Demand for gold tends to go up in the final quarter of the year in India due to Hindu festivals such as Diwali, Dusshera, Akshay Tritiyha the start of the wedding season when buying gold is considered auspicious.

India has been one of the largest gold consumers for over 2,000 years after China that continues to be the leading consumer.

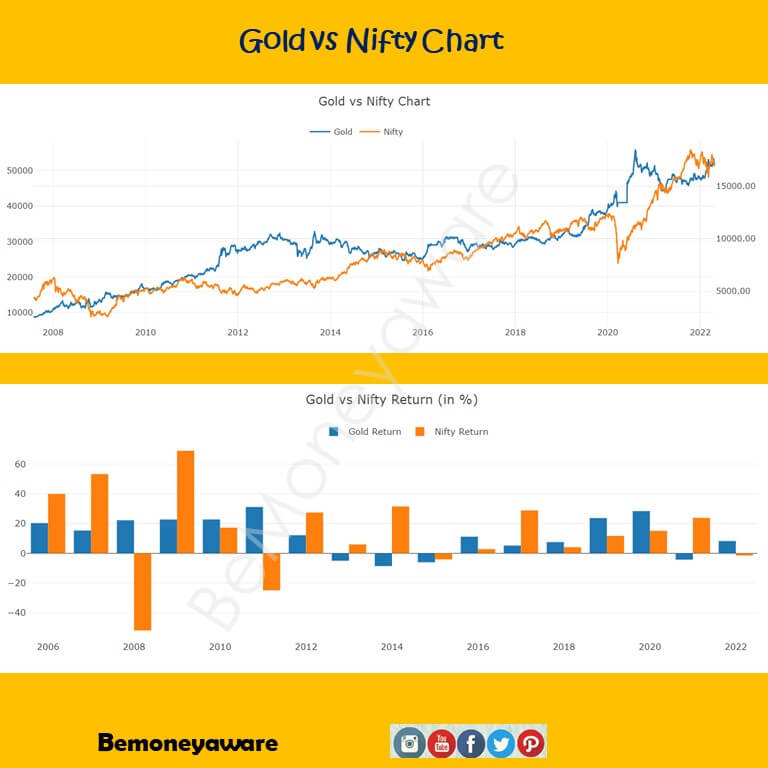

How gold price has changed over the years is shown in the image below. Detailed price here.

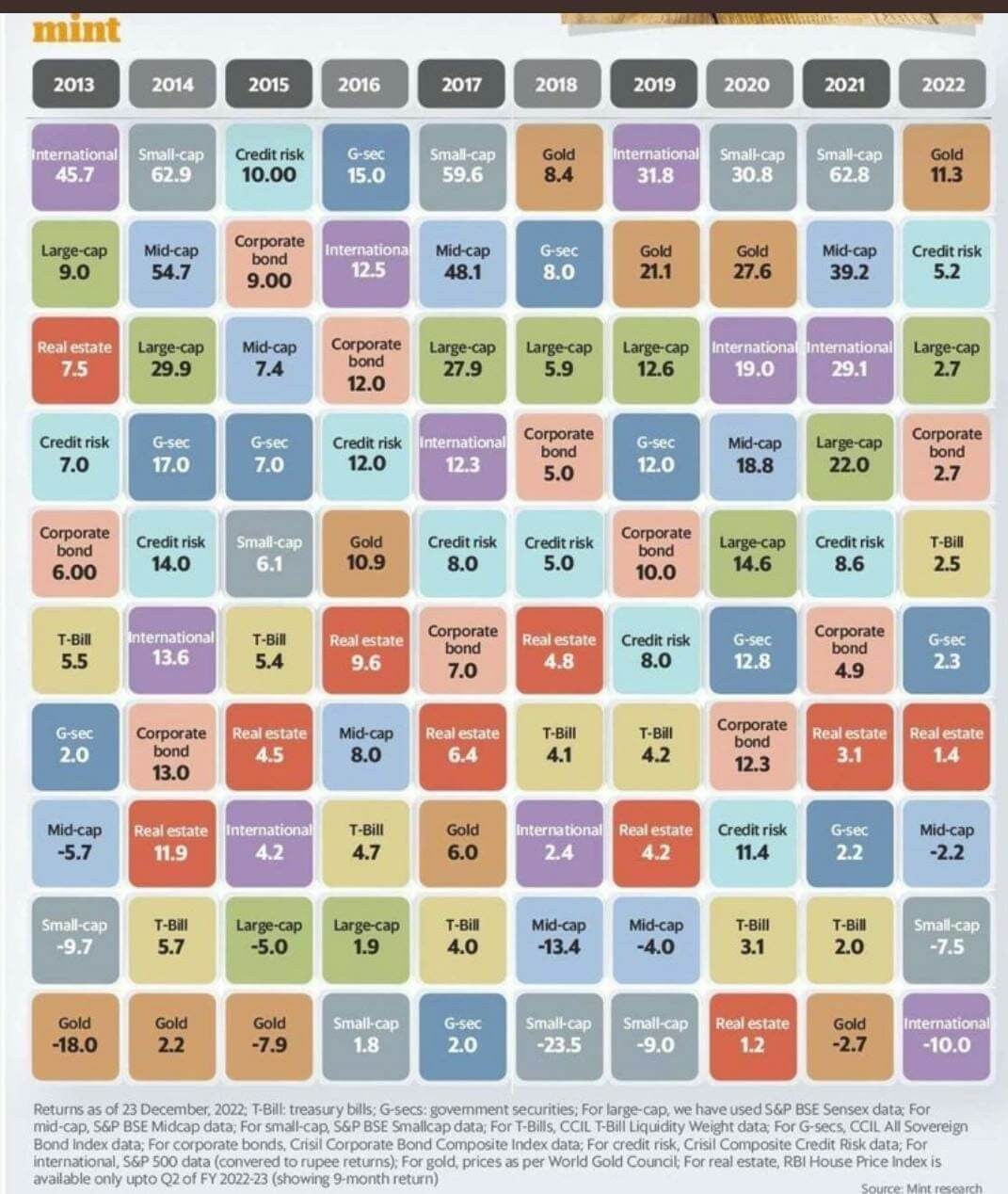

Returns on Gold from our article Returns of Stock Market, Gold, Real Estate,Fixed Deposit are shown in the image below

Things to take care of When you Invest in Gold Jewellery

This is the most common form in which gold is bought in India The biggest advantage of buying jewellery is that you can enjoy the gold you own even as it continues to gain in value. Disadvantages :

- Charges: Making charges.

- Purity: The purity of gold is another problem that one encounters in case of jewellery. Most of the time, it may not be of the level that is being claimed. Though this problem has receded due to the widespread use of ‘hallmarking’, it has not been resolved completely.

- Liquidity: Though most jewellers are ready to exchange the gold sold by them at market rate, very few are willing to pay in cash. Most of them deduct 5-10% of the value if you want hard cash. The deduction is higher if you try to sell gold that has been bought from some other jeweller. This is because he will questions the gold’s purity, claiming it to be suspect, and pay you less. you want to start using the ornaments immediately or give them as a gift.

- Tax : Two types of tax are levied on physical gold , wealth tax during the holding period and capital gain on selling.

Wealth Tax: Physical gold such as jewellery attracts wealth tax. One is liable to pay wealth tax at 1% in case the total taxable wealth exceeds 30 lakh. Wealth tax is charged for every assessment year on net wealth evaluated on 31st March of the financial year.Wealth tax is no longer leviable with effect from the assessment year 2016-17.- Capital Gain Tax: The tax treatment on selling physical gold is similar to that of any capital asset. If you invest in physical gold in the long-term, i.e., more than 3 years, then the tax deducted will be 20% of the gains with indexation. On the other hand, if you sell it before 3 years, the tax treatment will be according to the tax slab you fall in depending upon your income bracket. To find the capital gain tax you can use our Capital Gain Calculator.

Our articles Understanding Gold:Purity,Color,Hallmark and How Gold Ornament is Priced? talks about buying gold jewellery in detail.

Wealth Tax

Wealth tax was payable on the market value of the wealth determined on the last date of the accounting year, which is 31st March every year. Wealth tax is payable over and above the income tax on the income earned by you during the year, irrespective of whether that asset generates any income for you or not. Jewellery does not generate any income, but wealth tax is payable on it. Wealth Tax explains wealth tax in detail. Wealth tax is no longer leviable with effect from the assessment year 2016-17.

Invest in Gold Bars, Coins & Biscuits

Bars and coins are the next most common form of gold bought in India. You can purchase these from any jeweller or bullion trader. In the past few years, banks have started selling 24-carat gold biscuits. Unlike jewellery it cannot be worn. Some features of buying gold in form of buying gold bars, coins and biscuits are:

- Purity : Buying gold bars, coins and biscuits is buying gold in its purest form. Further, most of the gold biscuits and coins come in tamper-proof covers.

- Storage: You need to protect it by keeping it in a bank locker or a commercial vault. This however comes at a cost

- Charges : Though there should not be any making charge for gold bars and coins, they are usually sold at a price higher than the prevailing gold rate.

- Liquidity : While the banks will readily sell you the gold, they won’t buy it back due to RBI regulations. You need to approach a jeweller or bullion trader if you want to sell the gold back.

- Tax : As it is also physical gold the taxes are same as in case jewellery, wealth tax during the holding period and capital gain on selling.

When should one consider buying it: If you don‘t have any faith in paper gold and want to purchase only physical gold. But it’s best to go for bars and coins from a reputed jeweller, who will buy them back when you need the money.

Invest in Gold ETFs

Exchange Traded Funds (ETF) tracks the value of an index(ex: sensex, nifty junior index), commodity (ex:gold), or basket of assets in the same way as mutual funds does except, it trades like stocks on stock exchange. Infographic What is ETF explains the concept through image. Gold Exchange Traded Funds (ETF) are open-ended mutual fund schemes that invest in standard gold bullion of 0.995 purity. Gold ETFs are sold in units representing 1 gram of gold and are listed on the stock exchanges, where they are traded. These are passively managed funds, Net Asset Value (NAV) of the gold ETF changes according to the variation in gold prices. These are designed to provide returns that would closely track the returns from physical gold. Why closely because some of part of corpus is kept aside in cash or liquid funds to take care of redemption. These ETF’s are regulated by SEBI. To be able to invest in gold ETFs, you need a demat account and a trading account with a broker.

Pricing : Investors are assured of transparency in pricing as there are no making charges or premium involved and units are traded on the exchange. But as some of part of corpus is kept aside in cash or liquid funds Gold ETFs don’t mimic gold prices accurately.

Purity of Gold : These funds are required to hold equivalent quantity of standard gold bullion of 99.5% purity.

Charges : It involves demat account opening charges ( 500-750) and maintenance charges (up to 500 a year). There is also the fund management fee (or expense ratio, usually 1% per year), which gets deducted from the NAV of the fund and the brokerage for the transaction (0.25%-0.5%).

Liquidity: Investors can liquidate their holdings quickly at prevailing market prices.

Tax: Investors do not incur any wealth tax. As it is not an equity based mutual fund tax implications are same as the debt funds. If sold after one year long-term capital gains tax(LTCG) at 10% without indexation or 20% with indexation. If these gold fund of funds are sold within one year of investment then the gain would be added to the income and taxed according to your income slab. For Physical gold long term is considered only after three years of investing.

Investors should focus on gold ETFs, which boast good volumes on the exchanges. Also, avoid gold ETFs that hold large amounts in cash. NSEGold : Know All About Gold ETF (pdf) answers questions on Gold ETF.

Invest in Gold Savings Fund or Gold Fund of Funds

Gold Savings Fund are open ended schemes which invest in Gold ETF fund of same AMC i.e Birla SunLife Gold Fund will invest only in Birla SunLife Gold ETF, Reliance Gold Savings will invest only in Reliance Gold Savings ETF . As they invest in another mutual fund the Gold Savings Fund are also called Gold Fund of funds (FoF). These funds invest in gold ETFs so that you don’t need to have a demat account. Therefore, the NAV is indirectly linked to the price of the metal. To be fair, both gold ETFs and gold funds are mutual fund products — only the mode of purchase differs but subtle differences are as follows

Mode of Purchase : Gold ETFs can only be bought or sold through a platform of stock exchange and you cannot purchase these units directly from the mutual fund. However, with introduction of the facility of purchase of mutual funds units on the stock exchange platform, you can invest in the units of gold funds either through a mutual fund or a stock exchange.

Systematic Investment Plan (SIP) : Through Gold funds you can invest a fixed sum of money in units of gold fund sailing through the highs and lows of gold (also called rupee cost averaging)

Liquidity: Currently, there are around a dozen gold ETFs listed on the stock exchanges. But barring the gold ETF of Benchmark Fund(Gold BeES), and the gold ETF of Reliance, their traded volumes on the stock exchanges are not significant. This raises an issue of liquidity of the investment. In case you invest in gold through gold funds, you can surrender the units to the mutual fund at any time.This ensures that you are able to get your money back whenever you want.

Costs Involved: The tentative annual expenses of the gold mutual fund is projected to be around 1.5% of the asset under management, whereas it is around 1% in case of gold ETFs generally. On the face of it, the investment in gold ETFs looks comparatively cheaper than the gold fund, but In addition to the 1% cost of annual expenses of the mutual fund managing the gold ETF scheme, you have to pay brokerage every time you buy and sell the gold ETF. Moreover, there is an annual cost of maintaining the demat account.Though there is no entry load in case of gold fund (as of now), you need to take into account the exit load. FoFs usually charge a 1-2% exit load if the investment is redeemed within a year.

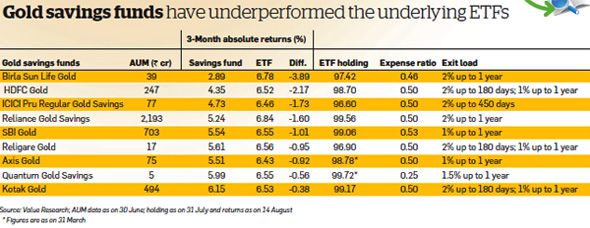

Information about Gold ETF and Gold FoFs can be found on valueresearchonline : Gold Funds. Quoting from EconomicTimes : Should you buy gold savings funds or restrict yourself to gold ETFs? (Auhg 2012) All gold savings funds have underperformed the ETFs in their portfolios in the past three months

Sovereign Gold Bonds

Sovereign gold bonds are government-backed securities denominated in grams of gold. Investors in sovereign gold bonds are assured of the market price of gold at the time of purchase and redemption. Our article Sovereign Gold Bonds :Should You Invest discusses it in detail.

- SGB is free from issues like making charges and purity in the case of gold in jewellery form.

- The SGB offers a superior alternative to holding gold in physical form. The risks and costs of storage are eliminated.

- The quantity of gold for which the investor pays is protected, since he receives the ongoing market price at the time of redemption/ premature redemption.

- The bonds are held in the books of the RBI or in demat form eliminating risk of loss of scrip etc.

- The return is 2.75% over the price of gold at the time of investment, leading to compounding benefits.

- You can gift the bonds to a relative or friend on some occasion.

- You can use these securities as collateral for loans. The loan-to-value (LTV) ratio will be set equal to ordinary gold loan mandated by the Reserve Bank from time to time.

Invest in E-gold

It is offered by the National Spot Exchange Limited (NSEL). NSEL It is national level, institutionalized, electronic, transparent spot market providing facilities for risk free and hassle free purchase and sell of various commodities across the country. It also provides an opportunity for small investors to invest in gold (also silver) in smaller denominations of 1 gram and multiple in demat form. It is similar in functionality to the cash segment in equities. The spot market or cash market is a public financial market, in which financial instruments or commodities are traded for immediate delivery. It contrasts with a futures market in which delivery is due at a later date. Stock exchange : What is it, Who owns, controls it explains basics of stocks and stock markets like NSE, BSE.

These units are traded on the NSEL exchange from 10 am till 11.30 pm on weekdays. The demat account is different from the demat account used for stocks/equities. One needs to set up a trading account with an authorised participant with NSEL such as Globe, Religare, Karvy, Goldmine, IL&FS, SMC, Geojit BNP Paribas, India Infoline, Aditya Birla etc. These are similar to gold ETFs in that each unit of e-gold is equivalent to 1 gram of physical gold and the e-gold units are fully backed by an equivalent quantity of gold kept with the custodian.E-gold units can be converted to physical gold, called as rematerialisation, which involves remat charges ( 200 per 10 gram of gold) and VAT . It’s features are:

Trading time:These units are traded on the NSEL exchange from 10 am till 11.30 pm on weekdays.

Pricing : Investors are assured of transparency in pricing as there are no making charges or premium involved and units are traded on the NSEL exchange.

Purity of Gold : These funds are required to hold equivalent quantity of standard gold bullion of 99.5% purity.

Charges : Account opening charges, annual maintenance charges of the demat account with NSEL. The transaction costs and brokerage involved in e-gold is lesser than that for gold ETFs.

Liquidity: Investors can liquidate their holdings quickly at prevailing market prices.

Remat:

Tax: Treated as physical gold so wealth tax and long term capital gain tax applies. As with physical gold, investors would be liable to pay wealth tax at 1% in case the total taxable wealth exceeds 30 lakh. The benefit of long-term capital gains tax is only available after three years, unlike gold ETFs and gold FoF, where the same is available after one year.

For more details one can read MoneyLife : E-gold: A new option , NSEL: FAQ on eSeries

When should one consider buying it: Go for e-gold if you are buying a large quantity of the metal. Small investors, who intend to buy 10-20 gm, will not benefit.

Gold ETF, Gold FoFs, E-Gold are example paper gold. They offer investors the benefits of security, convenience and liquidity.

Gold Mining Companies

If you are bullish on gold, why not invest in a gold mining company? Since there are no good gold mining companies listed in India, you will have to scout for those that are listed abroad. You could also invest in funds that invest in such companies. As of now, there are only two options—AIG World Gold Fund and DSP BlackRock World Gold Fund. Apart from gold, the DSP BlackRock World Gold Fund also has some exposure to silver, platinum and other metals, thereby providing diversification to some extent. These funds are different from other FoF schemes in that their underlying funds invest mainly in stocks of gold mining companies across the globe. By investing in the stocks of these companies, these schemes give investors the chance to participate in the rise in gold prices and the resulting profitability of gold mining companies.

Other benefits mentioned earlier for mutual funds (capital gains tax after a year, no wealth tax, etc) are applicable for these FoFs as well. The main disadvantage here is that gold prices and the stock prices of gold mining companies will not rise in tandem as equity prices are affected by several other factors as well. Also, keep in mind that these funds invest in international equities and, therefore, are affected by value of rupee.

Gold Futures

Investors with a higher risk appetite have another route to gain exposure to the yellow metal—gold futures. Multi Commodity Exchange (MCX) and the National Commodity Derivatives Exchange (NCDEX) allow investors to take trading positions in gold through a futures contract. A gold futures contract is an agreement to buy (or sell) a certain specified quantity of gold at a price determined today on a specified date in the future.

Bullion

While talking of gold we often come across word Bullion. Let’s find about it. Bullion is the generic word for gold and silver. Bullion refers to any precious metal in a form in which its primary value comes from the worth of the metal. Bullion coins may be produced by government mints. United States and Canada also give their coins a denomination in common amounts like, $5, $20 and $50 when minted. Usually, the gold, silver, platinum or palladium within each coin is worth far more than its face value. For example, a $50 gold coin would be worth far more than its face value because it usually contains 1 oz of gold. Bullion products manufactured by private mints and banks are not referred to as coins. Private mints and banks refer to their products as Trade Units, Rounds, bars or ingots.Examples of bullion coins , usually minted in platinum,gold,and silver include: U.S. Eagles, Canadian Maple Leafs, Chinese Pandas, South African Krugerrands

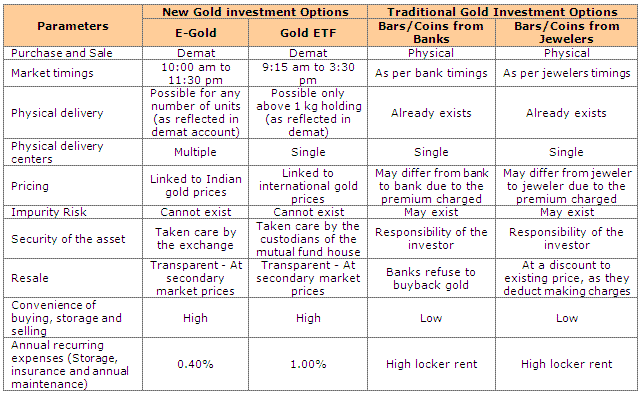

Detailed difference on popular ways of buying gold is shown in following figure (Ref: PersonalFn)

- Gold is a safe haven asset, which makes it an effective portfolio diversifier.

- It’s thus prudent to allocate 10-15 percent of your portfolio investments to gold; Please consult your financial advisor before taking any asset allocation related decisions.

Potential to earn higher returns should be evaluated in the context of Liquidity. - Easy availability is another important consideration. The investment instrument should be easily available so that investors are able to deploy their funds without any delay.

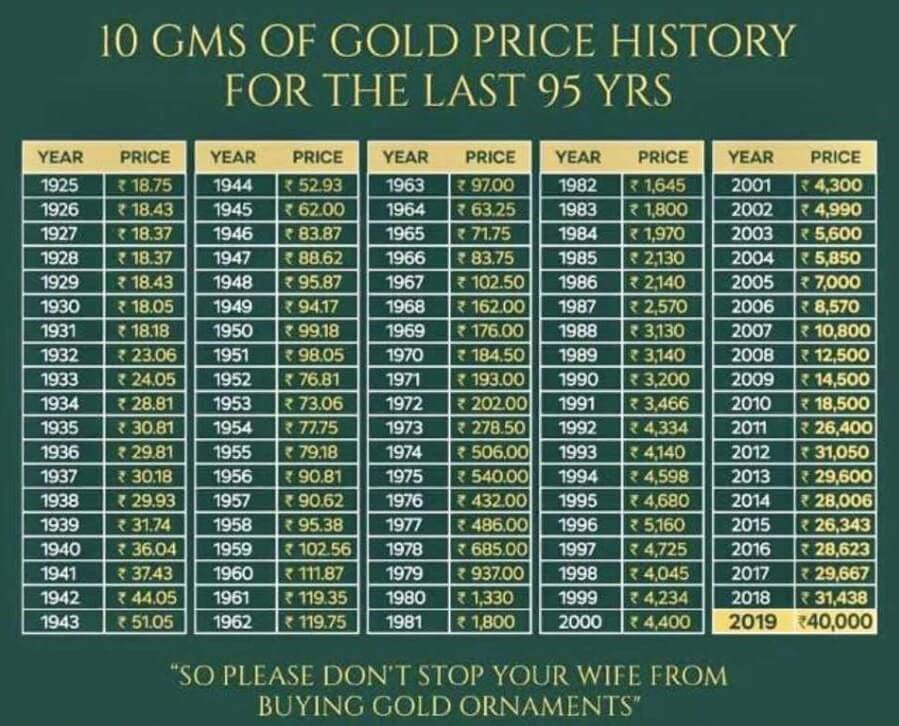

Price of Gold over the years

The image below shows the price of 10 gms of Gold in India

Comparison of Gold with Equity, Fixed Deposit

There are various kinds of investment products such as Real Estate, Equity, Mutual Funds, Gold, Fixed Deposits, Post Office etc. One Asset class does not perform well in every year. One should invest in different types of investment products based on one’s financial goals, as each investment product gives different types of returns, which is why a portfolio must have an ideal mix of financial products. The image below shows the return of various classes over the years from our article All About Investing in India: PPF, Fixed Deposits, Mutual Funds, NPS, Stocks

How will the different Investment options in Gold perform?

The following infographic from ET Wealth Apr 24 2017 shows how the investment of 1 lakh in different Gold investment options will change based on 4 different scenarios, if gold prices fall every year by 5%, if Gold prices remain steady over 5 years, if gold prices rise every year by 5%, if gold prices rise every year by 10%. Gold Bond, Bullion, Gold ETF, Gold Bonds and Ornaments seem to be the choice.

- Sovereign Gold bonds preferable as they are offered at discount, the government pays interest, can be held in demat and listing on stock exchange gives liquidity.

- Gold ETFs not so attractive after bonds.

- Before buying coins check best price option if you are buying from websites check who is selling jeweller or refinery. Preferably BIS certifies refinery or should be hallmarked. Or a jeweller who is selling coin online should be of repute. There are many jewelers who are known regionally only.

- Check gold purity with market price. For example 999.9 is highest purity, not even all jewelers will sell that. Standard 999 purity gold per 1 gram according to IBJA’s opening price today is Rs 2,922, standard gold 995 purity gold price is Rs 2,907. Even 22 carat or 916 purity gold which is used for jewellery making is Rs 2677 per gram. So check purity and match price and then see what is extra you are paying

Related Articles :

All About Investing in India: PPF, Fixed Deposits, Mutual Funds, NPS, Stocks

- Understanding Gold:Purity,Color,Hallmark

- Sovereign Gold Bonds :Should You Invest

- How Gold Ornament is Priced?

- Wealth Tax

- Capital Gain Calculator

- Stock exchange : What is it, Who owns, controls

Awesome content, do check out our page too!

I am amazed that the article was last updated in 2017 and covers a lot more then the scenario for Gold Investments which prevailed in 2012. Could the Admin also through some light on Online Platforms like PayTM, Google Pay etc. who are selling Digtial Gold v/s Platforms like CoinBazaar.in who are selling physical gold ? Also is it safe to buy Coins & Bars Online from such platforms ?

Hi, very informative article. Gold surely is a very great investment option. But I was wondering about more options where I could invest that would provide me higher interest rates. I just came to know about peer to peer lending as an emerging platform in India and wanted your views on that.

nice article, thanks

Can you please write something on Bullion India, a joint venture of Riddhi Sidhhi Bullion Refinery and others, for the sale of Gold coins and bars and Silver bars, in attractive sizes for investment.

Thanks

Thanks for suggestion Umesh. But we are not clear what exactly are you looking for about RSBL.

RiddiSiddhi Bullions Limited (RSBL) is a leading company in India established in 1994. It deals in bullion, specializing in bars and coins of various precious metals like Gold, Silver and Platinum. Their representative appears on ET Now to give outlook on gold. Link to their website is RSBL

Thanks for the reply

I am not looking for RSBL but Bullion India which is a joint venture of RSBL NCDEX Spot, Finkurve Financial Services Limited, is offering online sale of gold coins and bars and silver bars, in different sizes.

For details you can visit http://www.bullionindia.in/index.aspx

I want to know your opinion about the safety, and other aspect of this deal. Is it good to invest here.

Thanks

Sorry Umesh don’t have much information about it now. Shall try to find it.

Thanks

Will wait for your opinion.

Shall check it up , I think you can also ask shiv kukreja guest writer at onemint for his advice,

Sorry for delay in replying. Was not able to find information hence the delay. Found one on moneylife. Hope it helps!

Quoting from moneylife BullionIndia offers gold and silver trading with no demat and no brokerage: What is the catch?

BullionIndia.in claims to offer gold and silver trading at wholesale prices. Its features include no brokerage charges for buying and selling as well as no need for a demat account. It allows buying and selling in low denominations of 0.1 gm gold and 1 gm of silver. Physical delivery of your holdings is also a feature with payment of delivery charges. The new service gives you an option other than the existing ones of physical purchase, gold ETF (exchange-traded fund), e-gold/e-silver, gold fund-of-funds (FoF) and futures market.

Why go for Bullionindia?

• There is no storage fee; no account opening charges; and no brokerage

• There is no need for a demat account

• Allows buying and selling of low denomination of 0.1 gm gold and 1 gm of silver

• Physical delivery after payment of delivery charges. According to Mr Dwivedi, “In the second phase, BullionIndia will also offer delivery at specific jeweller shops.”

• The website claims to offer free insurance while storage and in-transit

Why not go for Bullionindia?

• There is no regulator. Website claims to be regulated in parts by various Acts including the FCRA, APMC, Companies Act, etc. This is the biggest negative

• The buy/sell quote may not be lowest in the market. It depends on market pricing, BullionIndia’s pricing as well as volumes in the business.

• The buy/sell will have spread of 50 paisa for 0.1 gm gold and 1 gm silver. It means that the selling price will also be at the ‘wholesale’ rate, which limits your profitability

• 1% of the customer profit will go towards VAT. While it may be for compliance with regulations, it works differently in other gold/silver holding options

Agreed Gold is an integral part of portfolio.maybe 10-15%. Read this article on why investing in Gold actually is bad for Indian economy

http://www.gold.fintotal.com/Investing-in-Gold-is-a-Bit-Anti-India/2579/1

Yes Basit, As you said :

80% of the gold we buy needs to be imported. According to an estimate, in the year 2011-12 India’s total gold import stood at 655 tonnes. It has increased customs duty on gold. RBI was even mulling banning sale of gold coins by banks to clamp down on imports. A country’s value of imports exceeds value of its exports there is a current account deficit. Widening deficit is a worry for governments. Numbers tell us that gold imports have played not a small role in widening India’s current account deficit in the recent past.

The situation worsens when rupee depreciates, sending its value south. Imports become more expensive for us and contribute to higher deficit. This is what we are witnessing at the moment. The government gets burdened with debt. We are collectively responsible for this.

These article is really worthful for us. The points are valuable treasure for my life. i will keep follow those ways when i invest in gold.

thanks for your valuable article

Thanks a lot Athiya.

Buying gold is a great and also risk-free way to invest your hard earned cash. You can purchase gold bars, gold coins as well as jewelries made from gold. Whichever item you would like to purchase, the most essential thing to do initially would be to perform research. Discover for yourself which form you would like to own and get the most out for your money. Hurry buy gold assets right now.

Agree with you but gold should be part of one’s investment plan and should not exceed 10-15% of total investment

Sorry,

I couldn’t find……..

a point, you missed in this article.

I have not read such an exhaustive article on gold investment, so far.

Umesh

Thanks a lot Umesh for you ‘Sorry’. We try to cover about topic but we have such great readers that they forgive us. Thanks again.

Really Good article

Nice piece of information in one Article.I liked it….. once i came to know about the Blog it has become my routine to visit the site ….Always good points and information This will help me in getting a licence for the financial transactions….

Thanks a lot Madhavan. Your words are very encouraging. Best of Luck for getting your license. Please let us know when you get it.