For AY 2017-18 or FY 2016-17 many are receiving Income Tax Notice which says Communication u/s 143(1)(a) for PAN such as given below. Please do not panic. You have 30 days to responsd.

Table of Contents

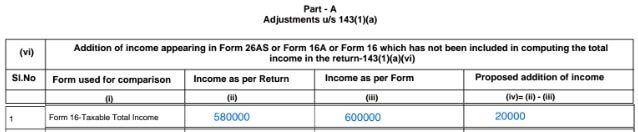

Notice under section 143(1)A

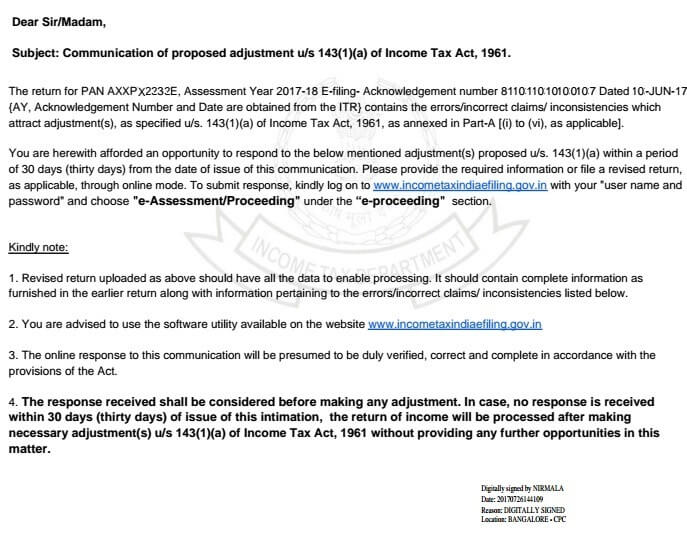

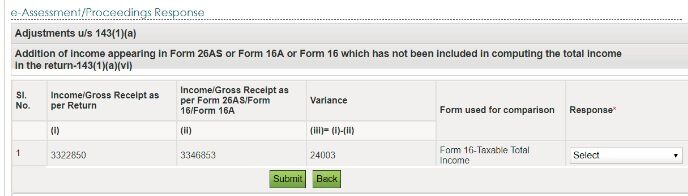

Notice u/s 143(1A) is sent If there are any mismatches, such as you have not included in your return all the income as reported in your 26AS, then these computer-assisted notices will be sent seeking necessary clarification. You will need to respond to this notice within 30 days by logging onto the income tax portal and uploading the proof needed to correct the mismatch. Notice Variance due to Income From Other sources

In June/Jul 2017 CPC sent such notice by mistake and they then sent revised communication soon. if notice is genuine then you have to go for eAssessment/Proceedings as explained in our article.

Our article, income tax notice for Inconsistency in Salary Income and Form 26AS explains Income Tax Notice for Inconsistency in Salary Income and Form 26AS explains

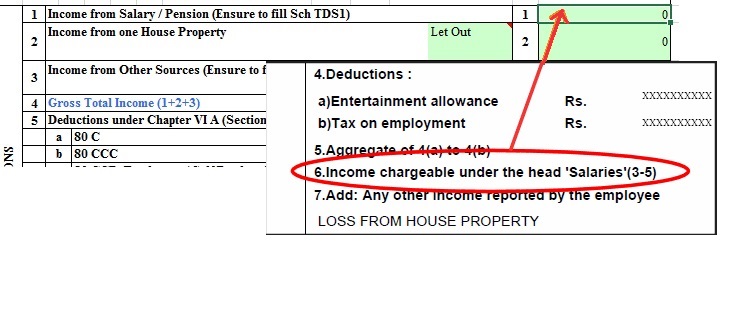

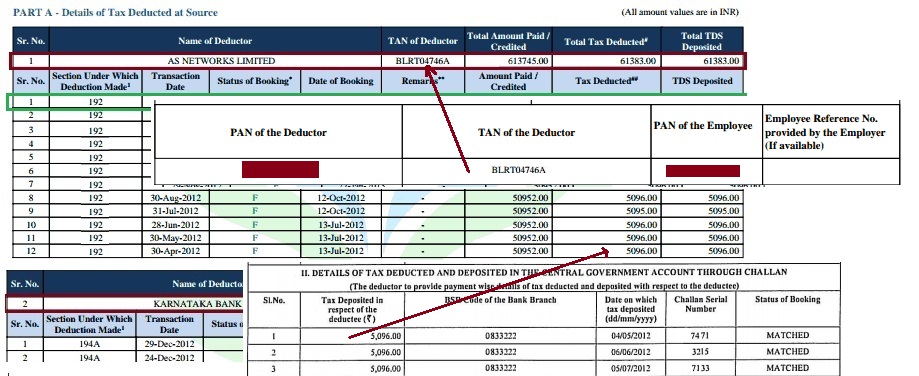

For Income Tax Department their source of your salary income is Total amount Paid/credited in Form 26AS. Quick e-File ITR option on incometaxindiaefiling.gov.in of ITR1 picks this amount in”Income under Salary” column.

- It is not INCOME CHARGEABLE UNDER THE HEAD “SALARIES” (3-5) from Form 16

- It is not “Income under the Head “Salaries” of the Employee(other than from perquisites) Form 12BA

So if you look at Form 26AS and Part A which shows the TDS details your Income from Salary should match the amount mentioned in the Total amount paid/credited,

If your Income under Head Salaries in ITR does not match Total Amount Paid/Credited in Form 26AS you would get this notice. Income from Salary is filled in two places in ITR or Income Tax Return, one in Income from Salary and other TDS details.

You have to Disagree to the notice and revise the ITR. Income from Salary is filled in two places in ITR or Income Tax Return, one in Income from Salary and TDS details.

ITR1 is simple, You need to enter the value of Total tax credited from Form 26AS in Income from Salary and fill the TDS details as per Form 26AS as shown in the image here

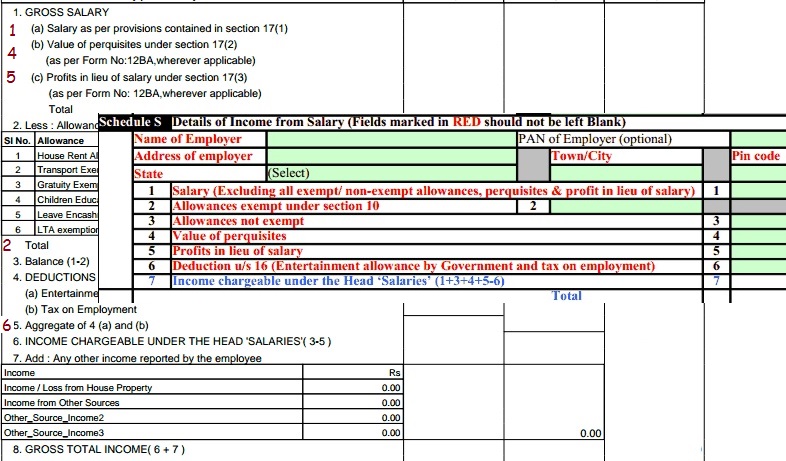

ITR2 needs a break up of the income in Schedule S. If you don’t have any prerequisites then just deduct the professional tax from the Income as shown in the image here.

If you have prerequisites then you need to open Form 12BA and see the value of income from Salaries other than perquisites. Add 2400 to it. You need to show your perquisites and other allowances to as shown in the image here.

Income tax notice under 143(1)(a) due to variance in income and file revised return

If you have got Income Tax Notice for Variance as per Form26AS due to Fixed Deposit Interest. Income from Fixed Deposit is the interest income and comes under Income from other sources.

Our article How to agree to income tax notice under 143(1)(a) due to variance in income and file revised return gives the steps to revise the return. It also shows how to file Revised Return to Income Tax Notice for Variance as per Form26AS due to Fixed Deposit Interest.

- Banks deduct TDS on interest only if the interest amount for an FD is greater than Rs.10,000 per year. The rate of TDS deducted by banks is 10% on interest income, provided your PAN number is available with the bank. If the bank doesn’t have your PAN in its records, TDS is deducted at 20% on interest income.

- If you submit the Form 15G/Form 15H to the bank declaring that since your taxable income for the year will be below the minimum tax slab, the bank shouldn’t deduct TDS on your FD Interest.

- The interest that is earned on fixed deposits is taxable in the hands of the depositor as per the income slab so a person who earns income between 2 lakh to 5 lakh pays only 10% tax on it while the person who earns above 10 lakh pays 30% tax. Individuals in higher tax brackets like 20% or 30% need to pay Self-Assessment Tax over and above the TDS deducted on their interest income

- The Form 26AS includes a record of all the interest earned on your Fixed Deposits including TDS payments and also when no TDS is deducted.

In such case Notice is genuine and you need to show the Income as income from other sources,

- Calculate your new tax liability by adding the income which appears as variance.

- Pay the self-assessment tax using Challan 280 online or offline. Please use the correct Assessment year. Please save the paid Challan receipt.

- File Revised return by logging on to the income tax website. Click on My Account->eFiled Returns. You can choose Quick Efile

- Show the

- New income

- TDS deducted which was not mentioned earlier

- New tax paid

- Everify the return or post ITR-V

143(1)a Notice in Jul -Aug 2017 due to Variance

In Jul-Aug 2017 such notices were sent when one had claimed investments under Section 80C or HRA that were not mentioned in their Form 16. Income Tax dept sent the revised communication.

Communication of proposed adjustment u/s 143(1)Update 23 Sep 2017: Income tax response submitted for 143(1)a are being processed. Reader Bimal informed that

My return was processed on 18/09/17. cpc has accepted my response against 143(1)a. Considering the reply positively

- Please do not panic

- Please verify your notice.

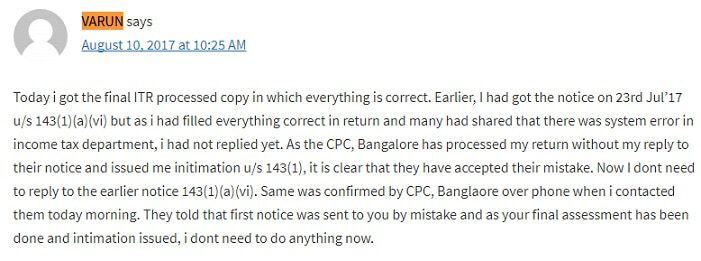

- CPC has told that ignore the notice, They would be resending the notice. On 10 Aug 2017 Varun said that his return was processed. Comment from him is shown below.

- As you have 30 days hopefully you will get another mail from CPC with revised communication.

- If you do not reply within 30 days the link may get disabled and there is no way to reply using Eproceedings. You would get another email from Income tax asking to pay tax. Our article If you did not respond to Communication of proposed adjustment u/s 143(1)(a) discusses it in detail. Many readers have said that for them after limit of 30 days the eProceedings link got opened again.

- For many eProceedings Link is not enabled. So please wait for 2-3 days after the notice is received.

- You can disagree to addition and attach proof .

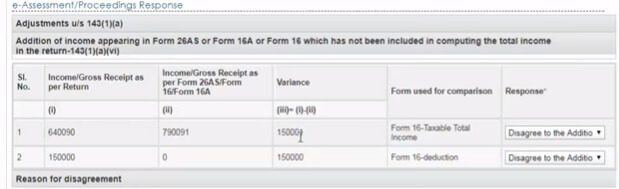

- There is bug in calculations shows in eProceedings. Variance (column 3) is sign independent. It’s i-ii and 1,50,000-0 and 0-150000 both show up as positive.

- Head of Income/Schedule under which reported in the return is only taking numerical values.

- Comment from Varun

Communication of proposed adjustment u/s 143(1)(a) notice from Income Tax department

Communication of proposed adjustment u/s 143(1)(a) of Income Tax Act, 1961.

Following cases have been reported

- Those who have claimed investments under Section 80C or HRA that are not mentioned in their Form 16.

- Those who have also had savings bank account interest or income from fixed deposits or house property that’s not included in the Form 16

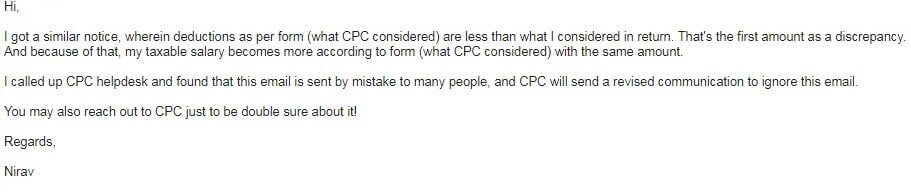

Please do not panic. Many contacted CPC. One of our readers, Nirav, wrote following.

CPC Contact Number for Refund /Refund re-issue Rectification Notification & Processing is 1800-425- 2229 or 1800-103-4455(Toll free)

Taxpayers can contact CPC from 8:00am to 8:00pm from Monday to Friday.

How to respond to the Notice of Communication of proposed adjustment u/s 143(1)(a)?

Please verify your notice. As you have 30 days hopefully you will get another mail from CPC with revised communication.

For many eProceedings Link is not enabled. So please wait.

If the notice is genuine then you have to e-Assessment/Proceedings

- Gather all your supporting documents (rent receipts, life insurance statement, home loan interest certificate etc).

- Visit the ‘e-Filing’ Portal https://incometaxindiaefiling.gov.in/

- Enter the valid ‘User ID*’, ‘Password*’ and ‘Date of Birth/Incorporation*’ at e-Filing portal. Click ‘Login’

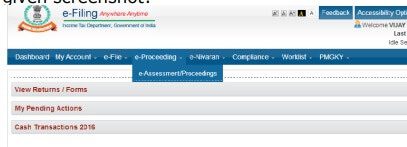

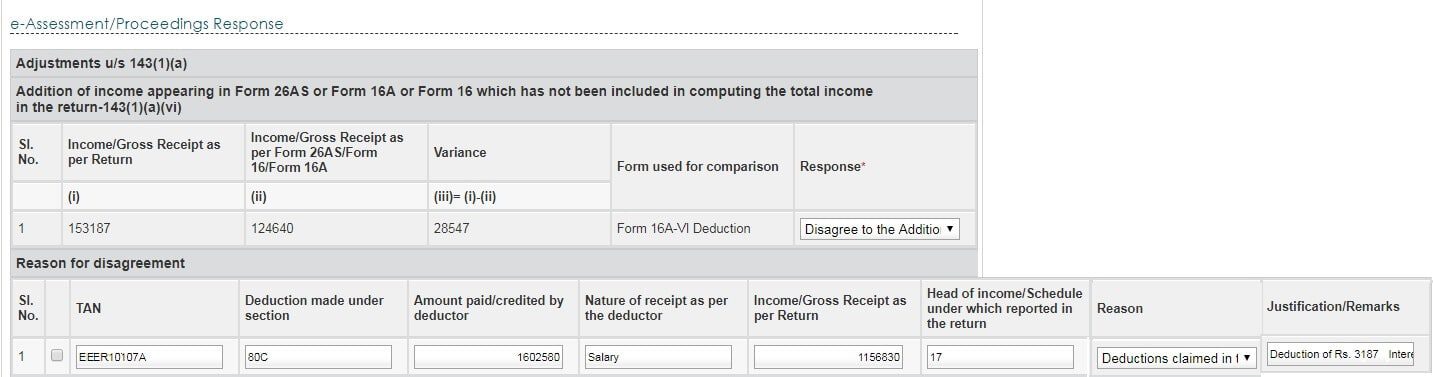

- Navigate to the ‘e-Proceeding’ tab -> Click ‘e-Assessment/Proceedings’ as shown in the image below.

- Click on the proceeding name to view the proceeding details. By clicking the ‘Reference ID’, additional details will be displayed.

- On clicking submit button You will see a list of all mismatches same as the ones you’ve received in the email

- Click on the dropdown under Response

- Agree to addition: If you have forgotten to include income from fixed deposits etc that are mentioned in your Form 26AS, select this option.

- Disagree to addition: If you have added deductions in your tax return directly and have necessary proofs for it, then select this option.

Note: In many cases we have come across the calculations are faulty. An example of it is given below. Column 3, Variance, does not take – sign. Actual difference should be 1

Error in variance shown in e-Proceedings

| 640090 | 790091 | -150001 |

| 150000 | 0 | 150000 |

| Total | -1 |

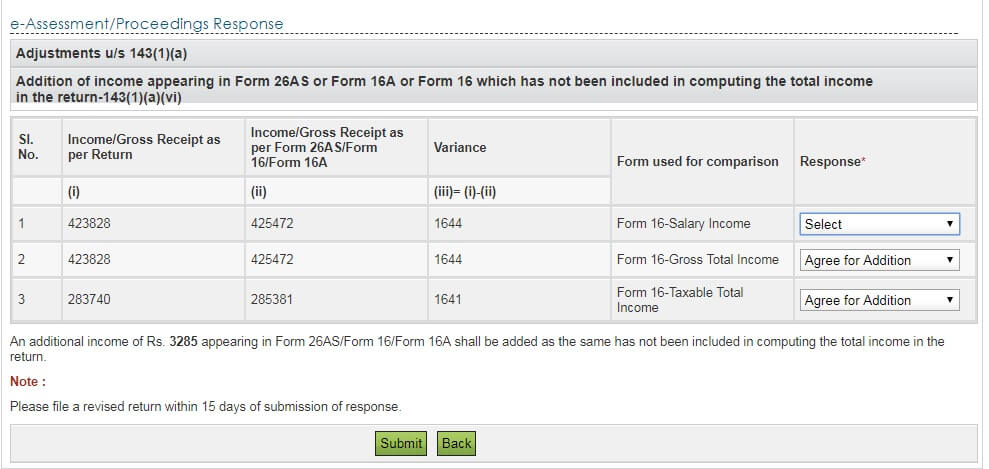

Or in the following case where the person has claimed less income in ITR than what is in Form 16 and Income Tax Department will still be adding the income.

- Total salary in return is 423828.

- While Form 16 says 425472

- Form 16 Salary Income and Form 16 Gross Total Income is repeated. So either Form 16 Taxable Income should be taken.

- Difference i-ii=423828-425472= –1644 and not 1644.

Eproceedings 143 error

In ITR you file Income as per your Form 16. Following image shows break up in ITR1. Image below shows value you add in ITR2. Our article How To Fill Salary Details in ITR2, ITR1 discusses it in detail.

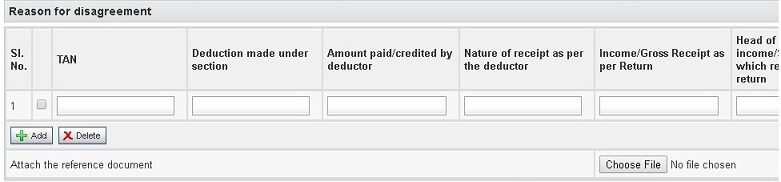

How to disagree to Addition in eProceedings

When you disagree, you’ll see a section open up where you have to fill in details and select from a list of reasons. You’ll also need to attach supporting documents before you submit your response. Once you disagree your original ITR is considered as good. These rows of information are asked just in case the officer wants to verify if the reason to disagree was sufficient.

Disclaimer: I am not a tax expert. This is to best to my understanding after talking to few tax experts. You might want to consult a qualified tax consultant or CA for your specific case!

Sample of Disagree to addition filled is shown below. Click on image to enlarge. Each field is explained below

TAN : Enter Details as per Form 16/Form 16A/Form 26AS based on the request. Enter the TAN of the employer (available in the Form 16 or Form 26AS) for salary income

If you have income from interest etc, put TAN of bank/company (available in Form 16A or Form 26AS)

Deduction made under section

- for investment in PPF, Tax Saving Fixed Deposit, etc : Mention 80C

- For NPS : Based on your Investment, 80CCD(1), 80CCD(2) or 80CCD(1B)

- For taking deduction upto Rs 10,000 on interest from savings account :80TTA

- For HRA 10(13A)

- For medical insurance 80D

Amount paid/credited by deductor:

Put Total amount paid/credited – you’ll get this from Form 26AS (shown above) for salaried interest income, etc. For salaried it should match the amount Gross Salary (1d) in Form 16.

Nature of receipt as per the deductor

Enter Type of Income any of five types of income defined by income Tax – Salary (For Pension also put salary income), Business, Capital Gains, income from house and other income which is income from Other sources and includes interest income.

Income/Gross Receipts as per the return

Enter the amount you have entered in your return.

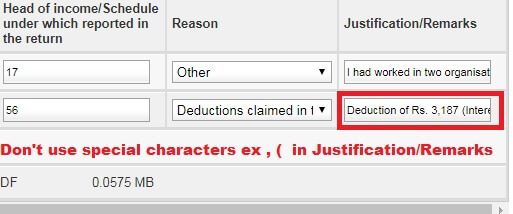

Head of Income/Schedule under which reported in the return

Note : Head of Income/Schedule under which reported in the return IS ACCEPTING ONLY NUMERIC VALUE and you cannot leave this field blank!

A reader said that Now it is not compulsory to enter numeric only in Head of income field.

If it accepts numeric values a CA has suggested following. There are sections of Income Tax which correspond to the Types of Income. With no clarification from Income Tax Department.

- Salary/Pension: 17

- Capital Gains: 54

- House Property: 24

- Business/Profession: 28

- Other Income (includes interest): 56

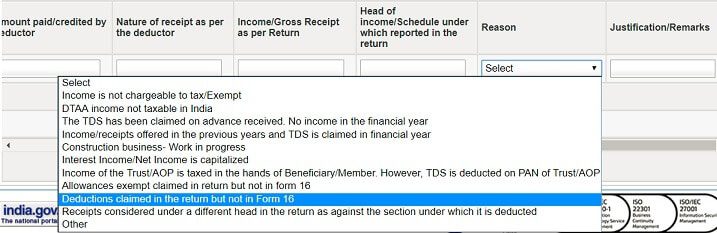

Reason

There are 10 reasons to choose from as shown below:

- For HRA, select the reason Allowance exempt claimed in return but not in Form 16

- For all Section 80 deductions, select Deductions claimed in the return but not in Form 16

e-assessment proceedings disagree to the addition

Once you’ve submitted, you will see an acknowledgement screen.

Justification/Remarks

Say why your Allowance or deduction was not in Form 16. It could be “employer did not consider this deduction” or “investment was made after proof submission to employer” etc.

Please do not use special characters in Justification/Remarks as shown in image below. Do not use special characters (Example :~,@,#,$,%,^,&,*.(,),”) and Double Spaces. You would get Invalid characters in input message.

For all deductions under chapter VIA (includes 80C, 80D, 80E, NPS related etc) which you claimed but were not part of Form 16 select “Deductions claimed in the return but not in Form 16”

In case everything was present in your Form 16 but still you got notice select “Others” and mention that the deduction already present in Form 16. Also attach the Form 16.

Savings Bank Interest does fall under TDS. For claiming 80TTA benefit in responding 143(1)a please use your employer TAN.

Same for PPF interest. One does not have TAN of Post office or saving bank account. So use TAN of uour employer

Attach relevant documents.

- For 80C investments you can attach the investment proof ex enteries in ppf passbook

- For HRA you can submit rent receipt, etc.

- For 80TTA which shows the interest from bank. (If you have many banks, add it in one document)

- For PPF attach the passbook enteries

Section 143(1) Acknowledgement

After all the process is complete you get an acknowledgement

Video on eProceedings

As usual Amlan has been quick to come up with Video on HOW TO REPLY TO COMMUNICATION OF PROPOSED ADJUSTMENT u/s 143(1)a and E ASSESSMENT PROCEEDING?

Disclaimer: I am not a tax expert. This is to best to my understanding after talking to few tax experts. You might want to consult a qualified tax consultant or CA for your specific case!

Related Articles:

i recieved intimation under 143(1) (a) and i was unable to respond within 30 days and now i see that there is a action to add authorised representative? what does this mean> what should i be doing?

What did the notice say? You can mail the notice at bemoneyaware@gmail.com

The response received shall be considered before making any adjustment. In case, no response is received within 30 days (thirty days) of the issue of this intimation, the return of income will be processed after making necessary adjustment(s) u/s 143(1)(a) of Income Tax Act, 1961 without providing any further opportunities in this matter.

Sadly there is no way to reply after 30 days. The link for e-proceedings gets closed.

We expect that You should get another email/notice from Income Tax Department asking you to pay extra tax for which demand was raised. You can expect Notice under Section 143(1) /Section 139(9). If you get Demand Notice earlier Income Tax Department allowed one to pay the outstanding tax if you agree or you can reject the Outstanding demand. We are not sure if this option would be available.

If you have missed the communications because your Mobile or Email Id was not set up then either check the status regularly by logging to Income Tax website, going to My Account >> e-Filed Returns/Form . Or setup Mobile and Email id for receiving SMS and emails from Income Tax.

I got a notice under section 143 1 section 154 now under e procedings for demand at 2010_11 and 2012_13 due to wrong uploads by employers how to procc6 further

Contact your employer and see if he can upload the correct data.

(Save the documentation)

Do you have Form 16?

You can reject the demand saying that you filed ITR as per Form 16.

And you have asked your employer to correct the data. Upload the documentation

I have received 143 with an additional refund than what I have claimed just 3Rs difference between.

Do I need to submit revised tax return? Or return will be processed if I agree to the notice.

I received intimation under 143(1) (a) stating that the net long term capital gains reported in my ITR is wrong, and they have added the ltcg from debt with the full sale value consideration from equity, without considering the cost of acquisition or net long term capital loss from equity reported in my statement. I have disagreed and requested them to subtract the, cost of acquisition reported in the statement. Is my reply ok, and will they reply? Please advise.

I have received 143 with an additional refund than what I have claimed just 3Rs difference to value. If I agree to notice then do I need to submit revised tax? Or just agreeing to notice will suffice to process refund

Hi,

I have submitted ITR for assessment year 2018-2018, ITR has been processed and got mail and message stating that there is refund value confirmation on 12-07-2018, however when I rechecked (vi) Income chargeable under the Head ‘Salaries’ (i+ii+iii+iv-v) value has updated after deducting HRA as per Form16, mistakenly again shown in 80GG-Rent Paid. Please note that I didn’t got refund amount,

Can you please explain the below doubts.

1)Ca n I get refund?

2)Do I need to re submit the ITR after refund or they will hold my refund and adjust it?

3) Is there any chances of getting notifications on this erroe.

If the ITR is processed then let it be.

You shouldn’t get the notice after processing but just in case you do, cross the bridge when you come to it.

I have to respond as ‘Disagree’ to CPC communication, as the variance is due to the allowances exempt u/s 10 which I’ve not explicity mentioned while filing ITR, but are available in my Form 16. I just used the figure from “Income chargeable under the head salaries” section and filed returns. So how do I attach Form 16 in my response because I didn’t see any option/way to do any attachment?

If you have a similar case best option is to Agree to the notice and revise the ITR. Please go through our article Income Tax Notice for Inconsistency in Salary Income and Form 26AS for more details on understanding the problem and how to revise the return.

Ok.. Thank you for the suggestion.

-In the suggested link article it says” For example: If a Return of Income for the Financial Year 2015-16 or Assessment Year 2016-17 is filed by the assessee on 28th July 2016 (before the due date of filing of Income Tax Return i.e.5 th Aug 2016), and he later discovers some mistake, he can file a Revised Return of Income Tax anytime up to 31st March 2017 or before the completion of Assessment whichever is earlier.”

-My case is for FY 2016-17, (FILED ORIGINAL ITR-2 on 28 July, 2017 before due date) , in this case can the revised return can be filed on May 31st 2018.

I received mismatch notice on April-7, 2018. Please suggest.

You have received IT mismatch notice and you agree with it hence you have to revise your ITR within 30 days of receiving the notice under section 139(5)

Hi,

I have got the same notice and need to respond in next 5 days for mismatch due to considering salary post Medical and Transport deductions – basically only considering “Income under the head Salaries”. What is the reason selected in the reject options as I do not see any matching reasons under us 10. Can we use “others” as the option?

Also 2nd query. Can we reject without really filing the revised ITR since we have received the notice post 31st March in May?

Thanks

You cannot reject the notice. You have to agree or partially agree or disagree

The Income Tax Notice, a notification from IT department is regarding inconsistency between salary income and Form 26AS in ITR. The breakup of salary in ITR2 is not shown properly. You can disagree and give the reason as missing HRA /Professional Tax. We would recommend agreeing as the problem is that salary details have not been filled properly. Adding the missing details does not incur any tax liability. You have to file the revised return only.

I have to respond as ‘Disagree’ to CPC communication, as the variance is due to the allowances exempt u/s 10 which I’ve not explicitly mentioned while filing ITR, but are available in my Form 16. I just used the figure from “Income chargeable under the head salaries” section while filing returns. So how do I attach Form 16 in my response because I don’t see an option/way to do any attachment?

I have to respond to CPC intimation 143(1) a.

I have to disagree and file my reason under section 10(11) for PF amount deposited by employer.

I have the proofs as well, but for this option there is no ways to attach the proof document.

Should I just submit the reason with the difference amount

Please let me know how to attach proof.

If you withdraw from EPF before completing 5 years of continuous service, TDS will be deducted. In calculating 5 years of service, your tenure with previous employer is also included. If you transfer your EPF balance from old employer to new employer and your total employment is 5 years or more, no TDS is deducted. Do remember that you must calculate exact 5 years, there is no grace if you are short by a few days.

ow TDS is deducted and which components are taxed.

Your EPF payout has 4 components.

Your contribution/employee’s contribution

Interest on your/employee’s contribution

Employers contribution

Interest on employer’s contribution

Your contribution/Employee’s contribution – This is the amount contributed by you to your EPF. This portion of your withdrawal is not taxable. However, if you have claimed deduction under section 80C on your contribution in earlier years, you may have to pay additional tax as if 80C was not claimed by you for those years.

Interest on your/employee’s contribution – This portion is taxed as income from other sources.

Employer’s contribution and interest on employer’s contribution – Employer’s contribution and interest on it is fully taxable. It is taxed under the head salary in your tax return. When TDS is deducted on it, you are likely to see an entry under salary TDS in your Form 26AS for it.

You can claim relief under section 89(1) on these balances

Hi, request your attention here.

I received an intimation today from the Income tax department reason being “Income appearing in Form 26AS which has not been included in computing the total income in the Income Tax Return – uls 143(1)(a)(vi)”

It is nothing but the FD interest income i received in the last financial year. What should I do now? Should I agree or disagree? In case I agree, is it correct that I have to file revised return? But if in case I disagree which appropriate section should I fill and where can I provide the total TDS details (Tax deducted on total return earned out of FD) or attach any proof to justify the same?

If you have not shown the FD interest in your ITR and it is coming up in Form 26AS then you have to agree.

Our article How to agree to income tax notice under 143(1)(a) due to variance in income and file revised return explains it in detail.

Hi ,

I received a similar email from CPC . It says I have not declared SB account interest income as ‘Others’ in F16 compared to 26AS. I have mentioned the same in TDS2 )(income from other than Salary). Do I need to mention in ‘Others’ section as well and submit a revised return again ?

Interest earned on Saving Account is considered as Income from other Sources. This needs to be declared in your income tax returns.

No TDS is deducted from the interest on Saving Bank Account so it does not show up in Form 26AS.

You can claim deduction up to Rs. 10,000 to an Individual / HUF from Gross Total Income towards Interest on saving bank Account under 80TTA.

You can check our article Interest on Saving Bank Account : Tax, 80TTA,ITR for more details.

You can send the notice and your ITR to our email id bemoneyaware@gmail.com for us to check it.

Hi,request your suggestion.I have read the respective info on your website but not exact one.

Issue :

I got an intimation about mismatch in income from per 26AS.It is nothing but the FD interest income i received.I declared the tax deducted on that FD,however not added the interest income to total income.It is true.

When i agree the same ….

a- Should i file the return again ?

b- If i file return ? Will it be a late filing ? I filed in last july on which i received an intimation now? If i file revised return..when will i get the refund ?

c-I heard that,If i do not respond, They will refund the amount after adjusting the same. Infact,here total income differs but not my refund.

Thank you in anticipation.

After receiving notice under 143(1)(a) due to variance in income as a mismatch with 26as, If I need to pay additional tax by filing revised return – then under which section the revised returned will be filed ? Also Do i need to pay interest under section 234(A) on the additional tax that need to be paid (considering the original return was filed timely )?

Today I recd a notice highlighting difference in income in return, against Form 26AS, which is now ‘variance’. This is nothing but FD interest in bank accounts. I had included all details in ITR1 TDS sheet, but not in ‘income from other sources’ field in main ITR sheet. Do I need to refile the ITR? Please help. Thanks for your response.

Even i got the same email today. Im not sure what to do.

Interest in Fixed Deposit is taxed as per your income slab.

If interest is more than Rs 10,000 in a financial year then TDS is deducted at the rate of 10% and if PAN is associated with FD it appears in your Form 26AS.

In your case, as TDS was deducted Govt knows that there is FD income.

As you have not declared the total interest in your ITR it finds the variance and has sent you the notice.

If your income is more than 5 lakh a year you need to pay more tax.

Our article Fixed Deposit , Interest , TDS, Tax,Income Tax Return, Refund covers it in detail.

If you can send the notice and Form 26AS at bemoneyaware@gmail.com we can tell verify it for you.

Interest in Fixed Deposit is taxed as per your income slab.

If interest is more than Rs 10,000 in a financial year then TDS is deducted at the rate of 10% and if PAN is associated with FD it appears in your Form 26AS.

In your case, as TDS was deducted Govt knows that there is FD income.

As you have not declared the total interest in your ITR it finds the variance and has sent you the notice.

If your income is more than 5 lakh a year you need to pay more tax.

Our article Fixed Deposit , Interest , TDS, Tax,Income Tax Return, Refund covers it in detail.

If you can send the notice and Form 26AS at bemoneyaware@gmail.com we can tell verify it for you.

Hi,

I have submitted the response towards us 143(1) intimation in Oct17. I am suppose to get the tax returns but still its showing Proceeding status as open. anyone knows how much time it takes to process and get the refund and any way to contact to check the status on refund

did you get a response, I submitted around same time no response yet, the proceeding is closed though.

I have submitted with disagree where I have not claimed for rental part in my original filing and while I received the 143 notice and I disagreed and claimed do I get refund I have not done anything other than submitting the notice. Any action required from me…Please suggest and also submitted proofs

When you disagreed did you submit proofs?

No nothing has to be done other than disagreeing. Yes you will get refunds

Hello,

I received communication for proposed adjustment u/s 143(1)(a) and responded appropriately around end of July 2017. However I’m yet to receive any response till date (29th September). I’m due to receive significant refund from income tax and is waiting patiently regrading the same. Should I wait little before contacting IT department? Kindly advise.

Regards,

Ranjeeta

This time processing is slower than usual.you can contact CPC for your status.

After submitting the response? Did anyone else Return processed and refund received? Mine still pending.

Bemoneyaware – please suggest if nnything to be done?

Yes after submitting the response the return have slowly started processed. Refund cases are slow.

No you don’t need to do anything.

I got an intimation notice 143(1)(a) on 26th July. I have filed revised return on 3rd August, after paying necessary demanded due tax mentioned in that notice 143(1)(a). I also received intimation 143(1) recently for my revised return processed and showing zero demand.

But surprisingly, till now i have a pending same intimation notice 143(1)(a) displaying in my IT login profile under e-assessment/processing menu.

can any body suggest, how should I respond this notice, as i can not be now ‘agreed’ for the demand as already paid due tax amount and filed revised return. Also that revised return is processed successfully with zero demand. I don’t see any suitable listed reasons as per my case to submit response. should I respond this notice or leave it for CTC to withdraw this notice.

Ok as e proceedings is a new thing no one knows how to proceed.

One problem in replying to the notice is that If you reply to intimation then you might have to file the revised return within 15 days.

Or as notice is wrt to demand raised on 26 Jul you can agree to it and later if approached say that you have filed the revised return.

Or you can let the proceedings link remain as such what matters is that you don’t own any tax.

I also have received 143(1) and submitted the response successfully as well.

But there is no update on the filled return. I was about to get some return from Income Tax dept and I have submitted the 143(1) response more than 40days ago. But have not got any process update from Income Tax not received the amount to be refunded.

Could anyone please guide me through on this?

Hi , myself shailesh responded to 143 communication almost 25 days back.Till when ITR will be processed.

Thanks

As the response to eProceedings has to be done manually it would take some time.

Will keep you updated.

I received a 143/1 intimation. I forgot to reply back within 30days. Is there some way I can do it now? It was basically a fixed deposit interest entry that I had missed to add in the filing of my returns. Can I e-file again?

No, sadly there is no way to reply after 30 days.

The link for e-proceedings get closed.

In your case, as the demand was justified you should get another notice from the income tax for payment of extra tax.

i also strucked similarly . send an email to bemoneyaware@gmail.com. lets see what will happen now. waiting for assistancce.

Sadly there is no way to reply after 30 days.

As per the income tax notice

The response received shall be considered before making any adjustment. In case, no response is received within 30 days (thirty days) of the issue of this intimation, the return of income will be processed after making necessary adjustment(s) u/s 143(1)(a) of Income Tax Act, 1961 without providing any further opportunities in this matter.

We expect that You should get another email/notice from Income Tax Department asking you to pay extra tax for which demand was raised. You can expect Notice under Section 143(1) /Section 139(9). If you get Demand Notice earlier Income Tax Department allowed one to pay the outstanding tax if you agree or you can reject the Outstanding demand. We are not sure if this option would be available.

Our article If you did not respond to Communication of proposed adjustment u/s 143(1)(a) discusses it in detail

Hi All,

Thank you for this post. Today( 24th of Aug) I have logged into income tax website to check my ITR status and to my surprise there is an Communication of proposed adjustment u/s 143(1)(a) on 23rd July. I couldn’t submit any response under e – Proceedings , looks like 30days time limit is over. What am i supposed do now? 🙁 , the notice says differnce in gross and taxble income with respect to Form 16 and Return.

Have already called CPC toll free no and was told someone will get back to me on this.

i am much worried about below point,

The response received shall be considered before making any adjustment. In case, no response is received

within 30 days (thirty days) of issue of this intimation, the return of income will be processed after making

necessary adjustment(s) u/s 143(1)(a) of Income Tax Act, 1961 without providing any further opportunities in this

matter.

Appreciate your help in this regard.

Oh..Did you not update your SMS and mobile number in income tax efiling for communication?

Is the eProceedings link still active? If yes try submitting the return?

Do you agree/disagree to the addition?

Hi,

I have received u/s 143(1)(a) notification.

I have filed a revised return because of a mistake in 80C seciton for which I received the above notification.

Since now I have filed a revised return and net amount payable is zero (TDS already deducted by employer), do I need to respond to the notification?

I had queries in few option and confused what to write in response of 143 (1)(a). I just send an email with screenshot and my queries to bemoneyaware@gmail.com. i got response with solution within 2 hrs. I never excepted response so fast.

This was really fast and these guys have been really helpful.

Thanks a lot guys!

Hi,

I got notice from CPC under “adjustment u/s 143(1)(a)”. I have Interest from Savings Account of Rs. 43,200/- from 3 banks & I made deductions of Rs 10,000/- under Section 80TTA while filing returns. These deduction is not visible in Form 16. I need clarification how should I file my response using “e-Assessment/Proceeding” under the “e-proceeding. I need to fill below section while filing my response in “e-proceeding” & need to know what should I fill in below field while responding in “e-proceeding”.

1. TAN : Do I have to give employer TAN here?

2. Deduction made under section : What should I write here (should I write Sec 80TTA)?

3. Amount paid/credited by deductor : What should I write here?

4. Nature of receipt as per the deductor : What should I write here?

5. Income/Gross Receipts as per return : What should I write here?

6. Head of Income/Schedule under which reported in return : What should I write here.

Thanks for Kind words.

is there any way to alter or re respond any reply u/s 143 notice.

i had mistakenly responded on half of notice, also not attached any proof.

I had a very small issue regarding 143 (1a) but could not find any proper solution on how to submit response. But this site came to my rescue.

I mailed my issue on bemoneyaware@gmail.com just last night along with screenshots and proper explanation and got a reply today morning.

This was really fast and these guys have been really helpful.

Thanks a lot guys!

Anyone tell,reply accepted by IT in respect to notice 143(1)a and processed return as it was submitted. Or Revised notice received from IT

My return was processed on 18/09/17.cpc has accepted my response against 143(1)a. Considering the reply positively

Thanks for the message. Appreciate it.

My return was processed on 18/09/17.cpc has accepted my reply against 143(1)a and also I received my refund.

Hello,

Is there anyone who has submitted a revised return which has been accepted & the demand has gone off?

Hi,

Kindly let me know whether I have the option of uploading multiple reference documents for the proof of e proceedings. Since I have 4 line items in the correction criteria. I have proofs for HRA ,80C,80D,80G sections.

I need to attach 4 reference documents . Please let me know if it is possible to attach 4 documents.

Thanks

Bhoopal S

Zip all documents and attach the zip.

Yes, select all and send to zip folder.

Can you please explain me if I disagree with the row, what should i write in the detail

1. Income from pension Rs. 452201

2. income from other sources Rs. 105776

Gross total income= Rs. 557977

Less Deduction(1,2&3 detail (-) 160000

Taxable Income Rs. 397980 ( round off)

U/s. 80C

1)125000 deposite in senior citizen tax saving scheme for 5 year( in Bank)

2)25000 paid to LIC for self and wife

U/s. 80TTA

3) 10,000 interest on Saving

Please tel me this points what should I write

1. TAN :

2. Deduction made under section :

3. Amount paid/credited by deductor : What should I write here?

4. Nature of receipt as per the deductor : What should I write here?

5. Income/Gross Receipts as per return : What should I write here?

6. Head of Income/Schedule under which reported in return : What should I write here.

7. Reason

Thanks

K Dey

Income as per Income as per Proposed addition of

Return Form income

1 Form 16A-VI Deduction 160000 0 160000

2 Form 16/16A-Taxable Total Income 397980 557977 159997

Addition of income appearing in Form 26AS or Form 16A or Form 16 which has not been included in computing the total

income in the return-143(1)(a)(vi)

hi,

I too have got a notice from IT department stating that the deductions shown in my Form 16, do not match with those entered in return. This is technically correct but I disagree with this, as I really have made investments under 80 C that don’t reflect in Form16.

Apart from this, there is one more row for mismatching taxable income, which is obviously a result of the above mismatch! (bizarre!!!) So if I correct one mismatch, the other should be gone!

Now, for FY 2016-17, I have 4 sources of income:

– Salary — TAN of my company

– FD interest from 2 TANs of Bank

– PF withdrawal — TAN of PF office reflecting in form26AS

I understand that I have to disagree under eAssessment, but do I need to add 4 rows – one for each TAN in my clarification in eAssessment? If yes, what should be the inputs? Kindly reply.

Thanks

Sunit

Can some one please reply to this? I have less than a week left to submit my answer to the IT department.

Really appreciate your assistance with this.

Sir, first of all appreciating the efforts taken by you. This blog is very much informative and helpful. After receiving the notice, I have inquired with two consultancy agents and 1 C.A. They are also not sure of how to fill in the details and it was yesterday I have gone through your article.

I have mailed you the matter to your mail address incorporating all the details.

Sir, kindly do look into the matter and guide me in doing the needful. Hope, you can reslove my issue.

I received the notice on 23.07.2017. I need to sent a reply before 21.08.2017 as the period of 30 days will be over by 21.08.2017.

Expecting your reply…

I submitted response for notice 143(1)a with investment documents. how many days for processing. In reply some column is confusing so as per my under standing i filled. if some mistake may be there. So IT will comunucate for it or not. Proofs of investments are correct. How can I know response from IT.

Hi,

I got notice from CPC under “adjustment u/s 143(1)(a)”. I made donation & I added it under sec 80G while filing returns. These donations are not visible in form16. I need clarification how should I file my response using “e-Assessment/Proceeding” under the “e-proceeding. I need to fill below section while filing my response in “e-proceeding” & need to know what should I fill in below field while responding in “e-proceeding”.

1. TAN : Do I have to give employer TAN here?

2. Deduction made under section : What should I write here (should I write Sec 80G)?

3. Amount paid/credited by deductor : What should I write here?

4. Nature of receipt as per the deductor : What should I write here?

5. Income/Gross Receipts as per return : What should I write here?

6. Head of Income/Schedule under which reported in return : What should I write here.

1. TAN : Do I have to give employer TAN here?

YES

2. Deduction made under section : What should I write here (should I write Sec 80G)?

YES

3. Amount paid/credited by deductor : What should I write here?

Amount you paid for 80G

4. Nature of receipt as per the deductor : What should I write here?

Donation or Deduction

5. Income/Gross Receipts as per return : What should I write here?

Your income that you filed in ITR

6. Head of Income/Schedule under which reported in return : What should I write here.

if it accepts Alphanumeric characters write Chapter VIA/VIA

or else if you are It affects your salaried income so write section pertaining to Income from Salary so 17

Please attach proof of donation

Hi,

I got notice from CPC under “adjustment u/s 143(1)(a)”. I have interest from savings account of Rs 43,520/- & I made deduction of Rs, 10,000/- under sec 80TTA while filing returns. These deduction is not visible in form 16. I need clarification how should I file my response using “e-Assessment/Proceeding” under the “e-proceeding. I need to fill below section while filing my response in “e-proceeding” & need to know what should I fill in below field while responding in “e-proceeding”.

1. TAN : Do I have to give employer TAN here?

2. Deduction made under section : What should I write here (should I write Sec 80TTA)?

3. Amount paid/credited by deductor : What should I write here?

4. Nature of receipt as per the deductor : What should I write here?

5. Income/Gross Receipts as per return : What should I write here?

6. Head of Income/Schedule under which reported in return : What should I write here.

It is important to reply if you have not got the revised Notice.

Technically as one has to report TAN the input should be from the deductor perspective.

People have replied using TAN of employer and Income from Other sources/salary

They were able to submit their disagreement.

Yet to get update on their submission.

Important is to attach the proof.

If you choose Nature of receipt as OTher income then Head of income should be 56

If you choose Nature of receipt as Salary then Head of income should be 19

Reason can be either of these.

Deductions claimed in the return but not in Form 16 or

Income is not chargeable to tax/exempt

1) TAN : Do I need to fill Employer’s Tan for savings account interest?

Yes

2) Deductions made under section: 80TTA

3) Amount paid by creditor : Do I need to enter my full salary paid or Rs. 779 which was the interest?

it can be 10000/

Technically from form 16/Form 26AS the amount you earned as salary

4) Nature of receipt:

Other Income/Salary

5) Income as per return :

what is mentioned in your ITR or notice or the row .

6) Head : 56 (as it is savings account interest)

or 17 as it is salary account)

56/17

7) Reason: Deductions claimed in the return but not in Form 16

Deductions claimed in the return but not in Form 16 or

Income is not chargeable to tax/exempt

For the proof document, you can download Interest certificate from your netbanking account.

Else just take images of your bank statements.

Make a zip file and submit the proof.

If excel does not work

Then modify the Justification/remarks to show Interest bank wise

and Make a zip of all the bank statements.

Note:

Do not use special characters (Example :~,@,#,$,%,^,&,*.(,),”) and Double Spaces. You would get Invalid characters in input message.

Guys,

E-mail your issue with snapshots to bemoneyaware@gmail.com.I have got my issue resolved and submitted successfully by sending snaps highlighting the issue to the said e-mail.The experts who are opering this site are quick to reply to any queries coming from anyone.At the end, Thanks bemoneyware for resolving my issue with this communication.

Thanks for kind words

Today i got the final ITR processed copy in which everything is correct. Earlier, I had got the notice on 23rd Jul’17 u/s 143(1)(a)(vi) but as i had filled everything correct in return and many had shared that there was system error in income tax department, i had not replied yet. As the CPC, Bangalore has processed my return without my reply to their notice and issued me initimation u/s 143(1), it is clear that they have accepted their mistake. Now I dont need to reply to the earlier notice 143(1)(a)(vi). Same was confirmed by CPC, Banglaore over phone when i contacted them today morning. They told that first notice was sent to you by mistake and as your final assessment has been done and intimation issued, i dont need to do anything now.

Thanks Varun for the details, I am in a similar situation, can you share the follow-up email that you received from IT department.

The email i got from income tax department was nothing but communication of “ITR processing completed”. It contains a pdf document issued u/s 143(1) which we get every year on final assessment. The amount filed and the amount computed by system are matching and there is neither any demand nor any refund. Earlier it was not updated online but today when i checked, it is updaed online and is showing as “ITR processing completed”.

I got the same notice. In my case i forgot to add income from a Form 16A for my SBI FD. They sent me the form late.

But I too am getting three rows. So only the first one is correct and other 2 are just repercussion of that form 16A.

So how to respond agree to one and disagree to another 2? Or any other way?

PLEASE HELP!

Yes that seems to the way.

Can you send snapshot of your eProceedings to bemoneyaware@gmail.com

Hi Shabbir,

Did you get this clarified on this part. I have the exact same 100% issue as you and trying to rectify it. Please help if you got an answer.

I am an pensioner and got notice for difference of Rs 153875(PPF 150000 and SB into 3875)wnich not reflect in Form 16 so please clarify the below mentioned point

Point to be clarified

1-what to be mentioned in colum Head of account /Nature of receipt for pensioner

2-Whether I can upload more then one documents for proof

3-What document to be uploaded for 80TTA proof

4-whether 80C and 80TTA will be mentioned in one line or separately by adding one more colum

Sorry sir that you had to go through this ordeal.

We’ll try to help.

1. Head of account/Nature of reciept Pension is same as Salary. Try Pension else salary.

2. Try uploading more than 1 proof. If it accepts well and good. Else zip it up and upload. (No format or size is specified)

3. For 80TTA upload passbook/bank statement

4. Technically should be shown as separate rows but then how to get TAN of bank is the question.

If Bank has deducted TDS, TAN of Bank will be available in form 26as

I have also received same Communication u/s 143(1)(a) from income tax department.

I have included below two deduction which is not mentioned in Form16

1. Stamp duty & registration

2. Home loan Interest

And also I have included FD interest income in my return filed and bank already deducted TDS.

Now, I want to say “Disagree to the addtion”, so for that I need to add two reasons for disagree using two TAN one is my company and another is bank.

And which amount I need to enter in “Income/Gross Receipts as per the return” column or I need to enter income after deduction above claimed amount or before claim.

How many rows do you have to disagree?

Can you send snapshort of the image to bemoneyaware@gmail.com

As per Form 16 issued by my employer:

INCOME CHARGEABLE UNDER THE HEAD “SALARIES” : 1,234,567

Deduction under 80C: 150,000

Total Taxable income: (1234567 – 150000) = 1,084,567

———————————————————

Now, I have income from interest on savings bank accounts: 12,000

Hence in ITR1, I filed as below:

Income from Salary: 1,234,567

Income from Other Sources: 12,000

Gross Total Income: (1,234,567 + 12,000) = 1,246,567

Deduction under 80C: 150,000

Deduction under 80TTA: 10,000

Total Deduction: 160,000

Taxable Total Income: (1,246,567 – 160,000) = 1,086,567

———————————————————

Now, I have received a communication with mismatch of 10,000 in my total taxable income (only one row).

Income as per Return: 1,086,567

Income as per Form: 1,096,567

Proposed addition of income: 10,000

———————————————————

I decided to disagree with following answers:

TAN: TAN of employer

Deduction made under section: 80TTA

Amount paid/credited by deductor: 12,000

Nature of receipt as per the deductor: Other Income

Income/Gross Receipt as per return: 2,000

Head of Income/Schedule under which reported in the return: Other Income

Reason: Deduction claimed in return but not in form 16

Remarks: Rs 10,000 deduction claimed under 80TTA.

Attachment: Manually created excel file with breakup of Rs 12,000 interest credited by date and bank account.

– Is it correct ?

Thanks.

Yes this is correct.

Check if Head of Income/Schedule is ACCEPTING ONLY NUMERIC VALUE and you cannot leave this field blank!

If yes then

change inst Other Income (includes interest) – 56

1-what to mentioned in head if account it onlyvaccept number

2-whether 80c and 80tta can be shown in one colum or separate column

3-can we upload more then one document for proof.

4- what document can be uploaded for interest proof 80tta

1. A reader said that Now it is not compulsory to enter numeric only in Head of income field. If it accepts numeric values a CA has suggested following. There are sections of Income Tax which corresponds to the Types of Income. With no clarification from Income Tax Department.

Salary/Pension – 17

Capital Gains – 54

House Property – 24

Business/Profession – 28

Other Income (includes interest) – 56

2. whether 80c and 80tta can be shown in one column or separate column

Depends on the income. If you can attach a picture or mail it bemoneyaware@gmail.com we can suggest better

3.can we upload more then one document for proof.

For different rows yes.

If for same row then you can make a zip file and attach it.

4- what document can be uploaded for interest proof 80tta

The bank statement showing the credit interest.

Hi All,

Is anybody able to submit the response with “Disagree to the addition”? As I am getting an error from server ” There is invalid characters in input” while submitting the response, so just wanted to confirm whether everyone is facing the same issue. Pls let me know.

Thanks All,

Manoj Nair

Try entering the numbers under Head of Income/Schedule. It is ACCEPTING ONLY NUMERIC VALUE and you cannot leave this field blank!

A reader said that Now it is not compulsory to enter numeric only in Head of income field.

If it accepts numeric values a CA has suggested following. There are sections of Income Tax which correspond to the Types of Income. With no clarification from Income Tax Department.

Salary/Pension – 17

Capital Gains – 54

House Property – 24

Business/Profession – 28

Other Income (includes interest) – 56

I am also getting the same message while submitting – “Invalid character(s) in input”

Please advise where is the issue. What to do ?

Try the following numbers based on Income Tax section

Salary/Pension – 17

Capital Gains – 54

House Property – 24

Business/Profession – 28

Other Income (includes interest) – 56

Hi Manoj,

I believe your issue is due to 1% TDS rounding off and the transaction amount added to your income during property purchase.

Could your please let me know the values for different fields while responding to e-proceeding response in disagreement.

Thanks,

Inder

Hello Inder,

Could you resolve the issue?

Thanks, Amlan – Finally I got your videos, was waiting for this to be released. Now I can file e-proceeding without panic.

Thanks sir, I got lots of information.

I have made two mistakes 1) I have not submitted all required documents for 80c to my employer and in ITR I have claimed all amount for 80c

2) there is also calculation mistake in 80c what I have submitted in ITR

I have got notice so what to do in such case? Should I have to submit the revised return and may I submit 80c proofs (which I have forgotten to submit earlier to my employer.) with revised return

My question is if I am submitting revised return in this case is it necessary to respond on eproceeding link.

Do you agree with the Calculation?

When you revise the return you will not be able to submit proof.

AMLAN DUTTA JI PLZ LOOK INTO THE MATTER FOR EXAMPLE WITH FIGURES ON WHAT TO REPLY WHEN WE DISAGREE UNDER 143 , I HAVE SEEN UR VIDEO BUT PLZ SHOW WITH EXAMPLE SO EVERYONE CAN UNDERSTAND.

Great information …Great Video & of course waiting for your book to be published.

Your video is really helpful. I am trying to upload the PDF documents as supporting. However it is not getting uploaded. I clicked on browse and then open document. Is there any other procedure/limitation?

Hello all,

I have received a similar notice due to the 1% TDS rounding off issue on amount paid to builder.Now the whole amount is coming up as an income in my name in section A2. Please keep us updated if any one finds a resolution to this. I have approached 2 CAs and both have the same opinion that it’s a system issue and nothing can be done by us.

Hi,

I got notice from CPC under “adjustment u/s 143(1)(a)”. I made donation & I added it under sec 80G while filing returns. These donations are not visible in form16. I need clarification how should I file my response using “e-Assessment/Proceeding” under the “e-proceeding. I need to fill below section while filing my response in “e-proceeding” & need to know what should I fill in below field while responding in “e-proceeding”.

1. TAN : Do I have to give employer TAN here?

2. Deduction made under section : What should I write here (should I write Sec 80G)?

3. Amount paid/credited by deductor : What should I write here?

4. Nature of receipt as per the deductor : What should I write here?

5. Income/Gross Receipts as per return : What should I write here?

6. Head of Income/Schedule under which reported in return : What should I write here.

BR,

NS

PLZ SHOW WHAT TO FILL IN HEAD OF INCOME SCHEDULE IN SUBMITTING RESPONSE AS IT DOES NOT TAKE ALPHABETS

PLZ EXPLAIN THAT PARTICULAR WITH EXAMPLE.

Plz reply urgently

Dear Inder ji,

I have received the same notice of 1% TDS payment to builder added in my Income.

I had same problem i got intimation u/s 143 1 a but in i had two employment this assessment year but CPC calculate one 80c deduction so now i got intimation but when i go to e processing that time i upload my form 16 both employment and submit it shows errors that add TAN but in my case no TDS for this year so what to do please reply..

PLZ SHOW WHAT TO FILL IN HEAD OF INCOME SCHEDULE IN SUBMITTING RESPONSE AS IT DOES NOT TAKE ALPHABETS

PLZ EXPLAIN THAT PARTICULAR WITH EXAMPLE.

By Mistake submitted saying I agree, How to revert now

Same here. How can we re submit the response

TAN is mandatory to disagree. How do I get the TAN for 80TTA deduction ? There is no TDS for interestin savings bank accounts.

I am a pensioner.I too have received this intimation.My investment in 80c and interest earned in saving bank account under sec 80 TTA is not being considered by the IT department. Do pensioners need to submit the investment proof to the bank? Both deductions not appearing in my Form-16, therefore I have received the notice u/s 143(1)(a). I contacted CPC help desk.They have told me not to respond to this mail as your return is taken up for reanalysis.shortly you will receive another mail till then wait . Meanwhile I could see the notice file is appearing under e proceeding section after 5 days..so far i have not received a revised communication from CPC.I am not able to understand what to do and how long to wait.please help.

Can I know what are all the proofs to be submitted in the following cases

1. Exempt under Section 80TTA (upto 10K) – Savings Bank Interest

2. Exempt under Section 10(34) – Dividend from Listed Companies

3. Exempt under Section 10(32) – Clubbed income of 2 minor children

Excellent video. Thank you so much!

My case: I opened PPF account in Mar’17 much after my employer asked for investment proof. Hence these PPF deduction under 80C do not reflect in my Form16. Now during efiling, I claimed benefit under 80C. Hence the 143(1)a notice is genuine in my case..Right?

Now I will be selecting “disagree to adjustment” and I will upload PPF account statement alongwith selecting “Deductions claimed in return but not shown in form16”. If you can explain what all I need to fill in other entry like TAN, etc in remaining column in this case, it will be very helpful to everyone.

Thanks very much

Raghav

Even I am in the same situation. I don’t have TAN. So should it be the TAN number of the employer as given in Form 16?

Hi,

Please let me know if you got any solution to your query.

I also received the same notice for my PPF account which I opened this Mar’2017. Now apart from TAN Number, Section to Claim and reason I am not pretty much sure what to fill in other columns.

Hello,

Like others, i too have received an email.

But there is nothing appearing in eProceedings section.

So should i wait for further communication , or atleast the link to appear?

Thanks

Rohit

Its Better to wait.

your blog to reply income tax notice u/s143(1) is worthy to be appreciated.WHAT PROOF IS TO BE SUBMITTED FOR REBATE U/S 80TTA

Wait for revised communication.

If you want to proceed , Entries in passbook/bank account statements showing the credit interest

1. “Head of Income/Schedule under which reported in the return”.

2. “Nature of receipt as per deductor”.

Please advsie what to fill in these columns.

I too got the same intimation. Contacted several time including this morning, as per CPC all pending cases are being taken into process again. So they told that we need not to reply.

Thanks for infor

For me too, I got a intimation regarding adjustment, I called CPC,BLR. They told me not to reply or rectify anything, rather we need to wait for few days. We will get a revised mail.

I got a response, not to respond, as this was intimated to almost everyone. They said that department is reviewing and wait for a communication.

Bottom-line: Nothing to be done at this point in time, until further communication. This was a generic response, and not specific to my case, so it applies to all.

Rahul would it be possible for you to share the response by sending mail/image to bemoneyaware@gmail.com.

It would help other readers

There’s a field which says “Head of Income/Schedule under which reported in the return”. In your tutorial video, you mentioned to enter as “Salary” but it expects only Numbers.

What should I enter ?

Bemoneyaware Team,

Can you please help on this regard? Not sure what to fill up in these two sections!!

1. “Head of Income/Schedule under which reported in the return”.

2. “Nature of receipt as per deductor”.

What should we enter in ” Nature of receipt as per deductor” ?

Is there a way to revert in case if I have mistakenly clicked on “I Agree” option ? 🙁

We are not sure as this is still new.

If you agree to an addition that means you have more income and tax liability has increased.

So you actually have to pay more tax and then update your ITR.

I think you can revise your return with old values and submit again.

Hi,

I too received the communication u/s 143(1)(a) after filing returns. The difference was due to saving account interest which did not show up in Form 16. However, in the e-assessment/proceedings, by mistake I agreed to addition instead of Disagreeing to addition.

Is there any way I can fix this?

Thanks

What needs to be in this case? I have same case, recd the notice today. Should I disagree? FD interest amt, which i showed while filing return, CPC is claiming as other income now.

Hi All,

I opened eNPS account in March’17 and it was opened after my company collected all tax saving details from employees. During return filing I claimed eNPS contribution as part of section 80CCD1B and I got above notice. When I am submitting the response , I don’t know what TAN is for eNPS and what all to fill in reason for disagreement section.

This is a wrong notice.

I would suggest you wait for revised notice.

Else can you mail the image of Eproceedings to bemoneyaware@gmail.com

I also received the same for exact reason that Ronak Patel mentioned. But have not received any revised notice. It’s already 15 days and not sure how to disagree and provide all the information

What should I write in nature of receipt

I also got same letter. But in my case I shown in returns in 80c which is not shown in form 16.

so the letter is correct right in my case ?

And do I need to upload all documents which I shown under my 80C ??

or only which are not shown in my form 10 (not submitted to my company) ??

And in portal we have only one file upload option ???

Have you made deductions under 80C.

If yes then the letter is not right

Vedio is very nice and gives lot of information for tax payers. Its really Gr8.

I have some problem to share regarding my IT returns.

By mistake(I forgot), I have not included FD interest income in my return filed.

Bank already dudected 10% but I fall in 30% income bracket and I am salaried employee.

Now I have got this notice(143(1)(a)). All the calculation are right in the notice sent by IT dept.

But If I say “agree to the addtion” in response in efiing website , addtional income adds up 3 times at bottom. example if I have bank interest income of 10K and if I agree to it(by selecting), then it adds up 3 times and becomes 30K addtional income as it has 3 rows. Where as it should have been showing only 10K as adtional income from Bank interest.

I am not sure why IT department has done this calculation mistake.( I say blunder).

Now I am not sure how to go farward. Should I wait for IT dept to correct it or should I proceed? Please advice.

Without going through all documents such as notice, details about Form 16 and ITR it would be difficult to say why 3 rows are appearing.

Do 3 rows say

Form 16 salary income

Form 16 total gross income

Form 16 taxable total income

Can you send notice/snapshot of the income tax website with 3 rows at bemoneyaware@gmail.com

I have sent just now.

Thanks for sending the image.

There is bug in the calculation.

As per this you have under reported your income in ITR while Form 16/Form 26AS shows more .

Is that so?

I would suggest wait for 2-3 days more for clarification.

Do you agree with the figures?

I too have the exact issue where my missing amount is showing 3x times. Do I need to wait or “Agree to response” and file revised IT return?

For me as well, amount is showing 3x times. Do we need to wait or file revised IT returns after “Agree to response”?

Me too facing same problem . Can u help me if i send an image to your email id ?

Will try to help.

You can send image at bemoneyaware@gmail.com

Hi, yes, I also got similar email.

Video to see is

Thanks Amlan

I got the same notice and I was told to wait for the next communication . My question is Can i file revised return?

Pls check in itr1 schedule what income you have filled . By default it takes the amount as shown in 26As where as it should be filled from form 16 I.e after subtracting all your deductions u/s 10 I.e HRA , travelling allowance children education etc you can revise

Can any one give the CPC helpline number. I received the Communication u/s 143(1)(a) from Income tax office, but whatever I filled in the return and Form 16 is correct.

18001034455

Please don’t panic.

Refund /Refund re-issue Rectification Notification & Processing 1800 425 2229

Taxpayers can contact CPC from 8:00am to 8:00pm from Monday to Friday.

I too recieved a intimation from IT dept u/s 143 (1)(a) –

In my case, the amount I had paid to the property builder was added to my income. Here’s the explanation –

I had deducted Rs 10731.3 as TDS (1% of transaction amount of Rs 1073130) while making payment to a property builder. I paid the same through HDFC net banking, however while making payment 10732 (rounded off to the next higher digit). Subsequently I downloaded the Form 16B which correctly showed the TDS amount of Rs 10731.3 and sent to the builder.

Now, in the Form 26AS, there are two transactions showing against the same Acknowledgement Number. One transaction showing transaction amount as 1073130.00 with TDS deposited as 10731.30. The second transaction is showing the

transaction amount as 1073130.00 with TDS deposited as 0.70 with both Deductee and Deductor as my name.

Therefore, in Section A2 (For seller of the property), there is a record showing my name as Deductor with my own PAN No. Similarly, there are two records in Section F, one showing Builder name as Deductee (with TDS as 10731.3) and another showing my name as Deductee (with TDS Rs 0.70)

Any idea on how should I go about correcting this ?

Thanks.

I faced the similar thing. I went to e-processing to submit response but could not do it as wrt Justification they are asking TAN number, which would not be available as there is no such transaction and I have not sold any house.

Guys have you found a solution to this one? According to me we did the right thing by paying the TDS. Why should the demand show up as income for us?

We need to wait for revised notice. Today I have talked to CPC,BLR. They told me to wait for some time and not to act anything now.

Hi Inder,

I am in the exact situation. Have you found a solution to this?

Really appreciate any help in this regard.

Wait for revised notice

Not yet able to resolve anything. I called up at the customer helpdesk and they told to wait for revised notice from their end. I have taken a ticket no as well for my future reference. Meanwhile I am also taking this up with the TDS dept as correction needs to be done at Form 26AS as the installments paid to the builder should not be reflected as our income in sec A2 of Form 26 AS. I have written an email to them and waiting for their response.

Anyone else able to resolve it. Let us share the exact steps here for all of us who have paid 1% TDS towards purchasing a property and the transaction amount is added to their income.

Will keep you all updated.

Thanks.

Dear Inderji,

Facing the same condition of 1% TDS amount paid to builder, total transaction amount added in the Income.

M.Mehta

Hello,

I have called up the TDS helpline and they confirmed me that Form 26AS is fine and this should be taken care by IT dept. I am presently waiting for a revised intimation from them. Btw, I checked that e-proceeding link has become active for me. I am not sure if I should respond to that or keep waiting.

Thanks,

Inder

Similar thing happened with me, did you get any further information from them?

I too got the intimation for the exact same situation.

Actually, they have credited back excess TDS amount on our name whatever we have deposited (in my case 0.50 paise). They have generated a TDS certificate on our name so that we claim the same while filing return. Because of that, it is started reflecting under part A2 of 26AS form. This is their process.

As per me it is an issue with their software. It is a logical issue as they can clearly identify by checking the Part F of 26AS form that it is not an income.

I tried to submit with option “disagree with adjustment” in e-proceeding section but it is always giving error “Invalid character(s) in input”.

Please help if anyone found the solution and able to submit.

Thanks

I also has similar issue. When i clicked on Reference ID under proceeding section it is giving error page. I called customer support. They are asking us to wait.

Now eproceeding link is active. Is anybody filed response for this TDS case. ?? Please share the details.

Rafi, many have started getting their ITR processed. If you think that notice is genuine then you can proceed with eProceedings.

Notice is not is not correct. I got notice for the money i paid to my builder.

I guess some more people got similar notice. I am finding it difficult reply on eproceeding section as it does not cover this case. Please help me if you have solution for this.

I have faced the same thing.I received the same notice, but there is no link in E proceeding. They told me to wait for the next communication. But my question is that can i file Revised return now ? before next communication?

Please Reply

I have also received such notice. Whereas I have filed the returns correctly, the notice has been sent to me by clubbing the Exempt Income (For Reporting purpose) too and thus the difference. Can you pls. help me to draft the reply for e assessment/proceeding.

Hi All, I called them up and i must say that their customer care center was very well equipped with a response.

My Query – I have received this email communication on 143 (1) (a) but the link is not yet active as i cannot see anything in the ‘e-proceeding’ section. What do i do next?

Their response – The CPC is in the process of sending across a revised communication to all who have received this email. Please don’t submit a response in the portal until you receive the second communication – for those who can see the response in the portal. The second communication is revised in its content and it is specific to each individual, so they will not be able to comment on what we might expect in the second communication – mostly it will be REVISED.

Hi,

I have taken a LIC policy in Mar17 and that have not been shown in Form16. I have filled the returns (2017-2018) including that policy under 80C and i supposed to get the refund of some amount. Now i got the intimation 143(1)(a) from income tax Dept. asking to respond on this. Can you please Help me out on this. Do we have any option in income tax portal to upload the proof of documents.

Regards,

N chakravarti

Just wait till the e-proceedings appears and then follow the steps given in the above website using reason “Deductions claimed in the return but not in Form 16”. Also attach the proof in the attachment section.

Most of the people who are salaried/Pensioners are getting intimation u/s 143(1)(a). IT department (e-filing) is pointing out additional income which is actually deductions under chapter VI-A in which deductions u/s 80C, 80D, 80TTA etc and IT department has considered it as “Zero” as per there record of form 16 / Form 16A . Which shows that C.A. of company / bank has not uploaded annexure-II along with quarterly return of Form 24 which includes such details of deductions which employee has reported to his/her company/bank who is responsible for issue of Form 16 bearing Part-A and Part-B. IT deptt is sending notices to such persons whose return is not exactly matching with Form16/16A. From A.Y. 2017-18 IT deptt is matching form 16, Form16A and 26AS and giving harassment to honest tax payer of the mistake done by chartered accountant. More over website does not show any demo/instructions how and what to fill in all columns. This link is not user friendly, which is very confusing even C.A. is unable to tell it. We got duly signed Form 16 along with Part-B ( From traces) which shows deductions under chapter VI-A, we don’t understand why CPC Bengaluru said that our return is not as per Forn 16 and they say this amount also to be included in taxable income.

Exactly! very well said. my father, a pensioner has also got a similar email and was in panic for a while. i hope they rectify this error and issue a apology to all the concerned tax payers asap.