Do you have/want to have frequent fights with your spouse related to money for example because he or she is spending an inordinately large part of income on his or her parents? Times have changed we have nuclear families, women also working, higher cost of living, and parents asserting their financial independence. So after marriage, there is my money,your money and then your expenses, my expenses, ours expenses, my goals, our goals, my career, our career, our investments etc. A couple has to decide how will they handle finances (joint account, investments, running of house, goals of when to buy bike/car, house) etc. But one also has to talk about how they will support their parents. In India, traditionally a child is expected to take care of the parents in old age. This usually applies to sons and not to daughters. But things are changing – with girls getting educated and continuing to work after marriage, many times girls want to financially support their parents too as would a son. Preferably one should discuss these issues before marriage.

Table of Contents

Marriage and Need for Financial Discussion

In Earlier times life was simple, husband worked outside, wife took care of the house and kids.People lived in joint family where decision about money were taken by elders. Now the times have changed there are nuclear families, husband and wife both working often earning similar amount of money. So the question gets complicated as there is my money,your money and then your expenses, my expenses, ours expenses, our investments etc.

After you are married you become a family. You need to ensure that you have insurance, emergency corpus, a financial plan etc. for them first. You need to support your parents, but not at the cost of your family.

It is possible that all financial decisions are taken by both husband and wife after consulting each other. There could be a joint account from which all household expenses are paid for. But not every spend needs to get the spouse’s approval. Perhaps you can have a limit under which each partner gets to spend without having to inform the other. He/she could use it to gift something to the parents without having to make an equal gift to the in-laws. This financial space goes a long way in keeping peace in a marital relationship.

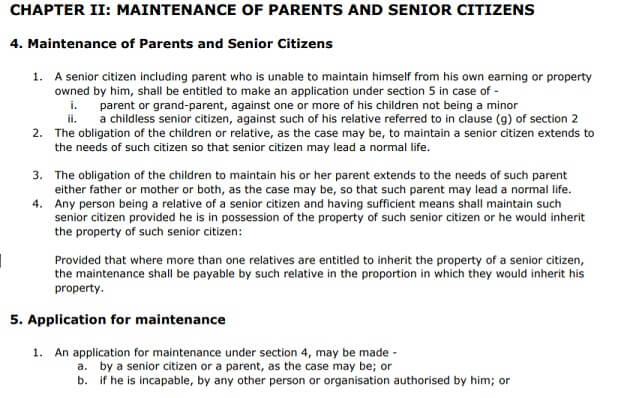

Maintenance and Welfare of Parents and Senior Citizens Act, 2007

If you think taking care of parents is a voluntary act, think again. Maintenance and Welfare of Parents and Senior Citizens Act, 2007 makes it mandatory for all adult children and heirs(grand daughter, grandson not minor) to provide maintenance or monthly allowance to senior citizens/parents. This means daughters, including married daughters, are equally liable for the well-being of her parents. Maintenance includes provision for food, clothing, residence, medical attendance and treatment. This Act also provides simple, speedy and inexpensive mechanism for the protection of life and property of the older persons.

The first case under the act was filed in November 2011 by Siluvai (age 84) and his wife Arulammal (age 80) from Tuticorin in Tamil Naidu against their son and daughter-in-law for neglect, besides taking away their two homes and gold jewellery

Siluvai had made his living by through fishing and also trading fish and had some property in his name. Siluvai and his wife had two children, a son and a daughter. His only son is also in the same business. However, he allegedly Their only son transferred his father’s properties in his name and also took away about 200g jewellery that his mother owned.

Since then, the elderly couple had been finding it difficult to fend for after themselves, and their daughter Sahayam, took her parents with her. She was angry about the ill-treatment meted out to their parents. She filed a petition in the chief judicial magistrate’s court in Tuticorin, which in turn directed the Thenpagam police to register a case against Pombai Cruz Raj (47) and his wife Antony T Vanitha under the act.

The act can be found here or click on the image below to read full act.

If you want to contribute financially to parents after marriage

It is important that you talk to your fiance before the wedding about your plans to support your parents. If this is discussed later, it may lead to rifts in a marriage. So the earlier this discussion happens and both the parties are in consensus about the support, the better it would be for peace in the family.

It is still not a norm for a girl to take care of her ageing parents. Also, at the time of the wedding, they could be healthy and financially secure to not need the son/daughter to support them. But just like any other goal, you need to plan for long term. At some point the money may run out, the health could fail and the parents may need more than emotional support from the daughters.

If you have decided to help, be clear about whether it will be a regular contribution or only on special occasions and emergencies. You also need discuss the percentage of salary that you want to allocate. Do not lie to your spouse or give money on the sly. If your spouse expresses resentment or opposes the decision, try to compromise on the extent of financial support and allay the partner’s fears about it impacting your finances or goals

Set a budget to be spent on parents

After you are married you become a family. You need to ensure that you have insurance, emergency corpus, a financial plan etc. for them first. You need to support your parents, but not at the cost of your family.

It is also important to set expectations with parents about the support you will be able to provide. Emotional times require level headed thinking. Your spouse should not feel that you are choosing your parents over him/her.

One should decide the amount of money to be spent on parents. Couple needs to take care of both sets of parents and it is better to set aside a fixed amount to avoid fights over money issues. And doing it from earlier on just like saving for a home or kids college education avoids surprise spends when an aging parent needs emergency care.

Life has a way of surprising you. Whatever you may have discussed before wedding or as newly-weds, circumstances may change and in a decade or two, very different type of support could be required. One set of parents may require more support, one parent may pass away with the remaining one depending on you more. If and when these happen, it is again important to talk it out with your spouse regarding lifestyle changes required to make it happen. So if widowed mom/dad move in with you, ensure that your spouse is supportive of the decision.

Involve siblings

Your siblings have an equal responsibility towards your parents and it is good to discuss with them regarding the sharing of responsibilities, financial and physical. Most of the times, due to proximity, one child ends up taking the primary responsibility and the others are visitors who may not realise the burden borne by one child. It is better to have a tangible plan transparent to everyone, so that it does not lead to resentments in the future.

Managing Parents Finances

Parents Medical needs

Given the increasing health-care costs, rising medical inflation of 15-20% annually, and the likelihood of worsening health problems in old age. You need to ensure that parents are financially prepared for their medical needs.

Have a discussion with your parents about their existing medical conditions, the size of health insurance that they have, if any, and if they are maintaining a medical buffer or emergency corpus. Find out the expenditure they are likely to incur after retirement and the cover or corpus they should have handy. If they have prepared well for their retirement, and have sufficient insurance and accessible cash, find out the details of the TPA, insurance documents, and ways to access medical corpus.

If the parents’ financial condition does not allow them to secure their medical needs, buy a health cover for them. There are several plans for senior citizens in the market, which cover pre-existing diseases and specific ailments after the waiting period. You can also claim tax benefit of Rs 50,000 under Section 80D for the premium you pay for them if they are above 60 years.

If your employer provides a group health plan that has a provision of covering parents and in-laws, avail of the maximum limit available, even if there is a co-payment clause. This is because such plans are heavily subsidised and you could retain these for your parents.

If, for some reason, you and your parents are unable to buy an insurance plan, make sure you maintain a sufficient buffer for eventualities. If their financial condition doesn’t allow them to build such a corpus, you should keep a bigger emergency corpus, which includes a medical buffer, before you start investing for your goals

Financial advice to parents

This is another way to help parents. Most of the times, parents may not need actual financial support but would like help in planning their finances. You can help them consolidate or diversify as the need may be.

For your parents Capital protection is important and you can help them identify investments that can help them with a steady cash flow without withdrawing from the capital.

Joint account with parents

If it is more convenient or if you are in a different location, it would be wise to open a joint account with one of the parents and the other one can be a nominee. Transparency with spouse is important here so that the partner knows how much money is being shared with parents.

Caring for your parents and parents-in-laws is good for your family. You set a good example for your kids and show them what familial love is all about.