Employee Provident Fund is a retirement benefit applicable only to salaried employees of private organizations. Government Employees do not contribute to EPF but to NPS from 2004. It is a fund to which both the employee and employer contribute 12% of the basic salary each month. This page has articles and link to articles covering EPF, EPS in Detail. You will come to know What is EPF, What is EPS, What is EPF Private Trust, How much pension will one get under EPS, VPF,

When one says EPF it means

- Employee Provident Fund (EPF) : Employee’s contribution is matched by Employer’s contribution(till 12%). The employer contribution is exempt from tax and employee’s contribution is taxable but eligible for deduction under section 80C of Income tax Act. The EPF amount earns interest as declared by Government.

- Employees’ Pension Scheme (EPS) of 1995 offers pension on disablement, widow pension, and pension for nominees.

- Employees Deposit Linked Insurance Scheme (EDLIS) provides for a lump sum payment to the insured’s nominated beneficiary in the event of death due to natural causes, illness or accident, while in job.

UAN is Universal Account Number is a 12-digit number allotted to employee who is contributing to EPF. Universal number is a big step towards shifting the EPF services to online platform and making it more user-friendly. Please note that The universal account number remains same through the lifetime of an employee. It does not change with the change in jobs. Now one has UAN number and PF number also called as Member Id. Our article All About UAN or Universal Account Number of EPF discusses UAN in detail.

Table of Contents

All About EPF, EPS, EDLIS

This page has articles and link to articles covering EPF, EPS in Detail.

| Basics of EPF | While investing in EPF

EPF Forms |

Basics of Employee Provident Fund

Employee Provident Fund (EPF) is implemented by the Employees Provident Fund Organisation (EPFO) of India. It is one of the largest social security organisations in the world in terms of members and volume of financial transactions undertaken. An establishment with 20 or more workers working in any one of the 180+ industries ( given here) should register with EPFO. EPFO is a statutory body of the Indian Government under Labour and Employment Ministry

Table below gives the rates of contribution of EPF, EPS, EDLI, Admin charges in India. For more details about EPF you can read our article Basics of Employee Provident Fund: EPF, EPS, EDLIS which covers how the contributions are calculated based on basic salary and dearness allowance, what are the EPF interest rate, how much would one save in EPF, how would one know about the amount accumulated in PF.

| Scheme Name | Employee contribution | Employer contribution |

| Employee provident fund | 12% | 3.67% |

| Employees’ Pension scheme | 0 | 8.33% |

| Employees Deposit linked insurance | 0 | 0.5%(capped at a maximum of Rs 15,000) |

| EPF Administrative charges | 0 | 0.85% (From Jan 2015) |

| PF Admin account | 1.1% | |

| EDLIS Administrative charges | 0 | 0.01% |

Understanding EPS or Employee Pension Scheme

12% contribution from employee salary goes to EPF, but the 12% contribution of your employer contribution is distributed as 8.33% actually goes in EPS (subject to the maximum of Rs 541 and after Oct 2014 Rs 1250) and the rest goes into EPF. The amount of employe’s contribution that goes into EPF is considered as investments under section 80C. Our article Understanding Employee Pension Scheme or EPS discusses EPS in detail.

Employees Deposit Linked Insurance Scheme (EDLIS)

Under the EDLI scheme life insurance cover is provided to the PF members. The cost of the scheme is borne by the employer but as the amount of life coverage under this statutory scheme is very low, usually employers opt out of the EDLI scheme by going for group insurance scheme which usually provides higher coverage to employees without any increase in cost to the employer. Premium for the EDLI is entirely funded by the employer, which contributes 0.5% of monthly basic pay (capped at a maximum of Rs 15,000) as premium for life cover in case the organization does not have a group insurance scheme for its employees. Our article EDLI, Employee Deposit Linked Insurance Scheme discusses it in detail.

EPF Private Trust

The Government has permitted employers/companies to establish and manage their own private PF schemes, subject to certain conditions prescribed under the Employees Provident Funds and Miscellaneous Provisions Act, 1952 . These trusts are regulated by the Employees’ Provident Fund Organisation (EPFO). These private EPF trust are required to seek approval under the Income-tax Act, 1961 for employees to get tax benefits. There are over 3,000 private Provident Fund (PF) trusts,with an estimated corpus of Rs 1 lakh crores and a membership of 50 lakh employees, which are managing the accounts as well as retirement fund of their workers. Companies like TCS, Accenture have their Private PF Trust. Our article EPF Private Trust, the Exempted EPF Fund covers EPF Private Trusts in detail.

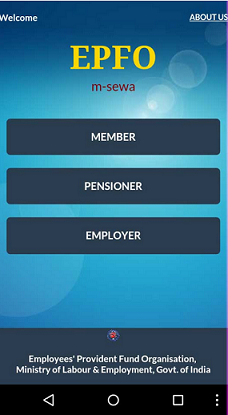

EPF Balance and EPFO Mobile App

If UAN registered then you can check EPF Balance by following methodsCheck EPF Balance by sending

- Check EPF Balance by sending SMS : If your UAN is registered then from the mobile send SMS EPFOHO UAN ENG to 7738 299 899. You have option to specify 9 other languages like HINDI,Gujrati etc,Check EPF balance with EPF mobile

- Check EPF balance with EPF mobile App : Download Mobile App m-epf from Google Play store. One can also view their monthly credits through the passbook as well view their details available with EPFO

- Get EPF Balance by Missed Call : If you have a valid UAN, your mobile number too will be registered with the EPF department. A missed call to 011 229 01 406, at no cost, will ensure that you receive an SMS that lists down your PF number, age and name as per the EPF record. This facility is available only to UAN members.

- EPF Passbook if UAN

Our article How to get information about EPF balance : Annual Statement, SMS, E-Passbook discusses it in detail

EPFO has been upgrading itself on technology front to access the EPF account access and transfer of EPF account. The new EPF Mobile App is another initiative to let people access there EPF details. Mobile Application can be used by employees, pensioners and employers. Our article EPFO Mobile App , SMS Service and Missed Call : Employee Provident Fund talks about EPFO Mobile App.

EPF Mobile App

How much pension will one get under EPS

For those who joined after 15 Nov 1995 the formula for calculation of Pension is simple. the formula of calculation of pension is given below. Our article How much EPS Pension will you get with EPS Pension Calculator explains it in detail with examples.

EPS Pension = Average Salary X Number of Years Service /70

- Lifelong pension is available to the member and upon his death members of the family are entitled for the pension.

- Pension is called Superannuation pension if one gets pension on retiring on attaining the age of 58 years

- An employee can start receiving the pension under EPS only after rendering a minimum service of 10 years and attaining the age of 58/50 years.

- One can apply for EPS Pension from a date immediately following the date of completion of 58 years of age notwithstanding that the person has retired or

ceased to be in the employment before that date. - Maximum Pension one can get is Rs 7,500 per month.

- Minimum Pension one can get is Rs 1,000 per month.

- Maximum service for the calculation of service is 35 years.

Voluntary Provident Fund

For employees who are covered under PF, besides their compulsory contribution to PF(Employee Provident Find or EPF), there is a provision for an additional or Voluntary contribution to EPF popularly called as Voluntary Provident Fund or VPF. Let’s find out more about what is VPF? How to contribute? Should one contribute? In EPF, an employee has to contribute 12% of his basic pay towards his provident fund account. An equal amount is contributed by his employer. Apart from contributing the normal 12% of his basic pay,

In EPF, an employee has to contribute 12% of his basic pay towards his provident fund account. An equal amount is contributed by his employer. Apart from contributing the normal 12% of his basic pay, employee may choose to put in contribute more than this, voluntarily he can do so at any rate he desires upto 100% of basic and D.A. The contribution will earn the same rate as normal EPF contribution. But the employer is not bound to contribute at the enhanced rate. Employer’s will contribute an amount matching only the 12%. Our article Voluntary Provident Fund, Difference between EPF and PPF covers Voluntary Provident Fund in Detail.

Withdrawal or Transfer of EPF

At the time of change of Job what happens to EPF? Legally it is mandatory to transfer EPF Account at the time of job change. But, people generally don’t do it; instead of transferring, they withdraw the amount. In case of EPS, if the service period is less than 10 years, you’ve option to either withdraw your corpus or get it transferred by obtaining a ‘Scheme Certificate’. Once, the service period crosses 10 years, the withdrawal option ceases. Our article Withdrawal or Transfer of Employee Provident Fund discusses it in detail.

If you withdraw before completing a period of 5 years, then your withdrawal is taxable. All your previous years income gets recomputed as if the fund was unrecognized from the very beginning (i.e., the tax benefits you received on your own contribution u/s 80C/88 in earlier years will get forfeited) and further the employer contribution and interest received will be added to your current income subject to relief under section 89.

Tax on Provident Fund withdrawal before 5 years from Jun 2015

- TDS to be deducted by at the rate of 10% from the withdrawn amount.

- TDS will not be deducted if the withdrawal is less than 50,000. (Before Apr 2016 the limit was Rs.30,000).

- Also, if the person gives declaration that he do not have any taxable income by filing Form 15G or Form 15 H, then also no Tax will be deducted.

- In case the PAN is not provided to the Provident Fund authorities than tax will be imposed at the maximum marginal rate which means tax rate applicable to highest slab tax payers, around 35 percent.

- Tax on Provident Fund withdrawal after 5 years of continuous service remains intact and no tax will be levied on the withdrawn amount.

Transfer of EPF Account

From 25 Jul, 2017 UAN interface replaces the OTCP facility launched in 2013 to transfer their PF.

On 20 Sep 2017, EPFO has introduced a new composite form called Form 11 that replaces Form 13 in all cases of auto transfer. At the time of joining a new employer, an employee can give details of their previous EPF account in new composite form (Form 11). Once the previous EPF account details are provided in Form 11, the funds will be automatically transferred by the EPFO to new EPF account.

Article How to Transfer EPF Online on changing jobs explains it in detail

- You can transfer EPF balance from your old EPF account to new EPF account.

- There is no time restriction to transfer the EPF balance but it is better you do fast before you get busy with responsibilities.

- With the transfer of EPF, the pension amount of employee pension scheme also gets transferred.

- To transfer the EPF from one account to another, the name, father’s name, date of birth, should be same in the both accounts.

- The authentication is necessary for EPF transfer.

Interest Rate on EPF

The EPF interest rate of India is decided by the central government with the consultation of Central Board of trustees. Compound interest as declared by Central Govt. is paid on the amount standing to the credit of an employee as on 1st April every year. Articles EPF Calculator-Method I:3.67% and EPF Calculator – Method II talk about differnet ways in which employer can calculate your EPF contribution. Interest Rate of EPF in last few years is given below.

| Financial Year | Interest Rate |

| 2012-13 | 8.5% |

| 2013-2014 | 8.75% |

| 2014-2015 | 8.75% |

| 2015-16 | 8.8% |

| 2016-17 | 8.65% |

How EPFO earns to pay Interest

The EPFO ‘declares’ the annual interest paid out to subscribers each year. In the last four years, the returns have been around 8.7 per cent a year. This interest is decided based on the surplus of its income over expenses. The fund earns income from the interest on government deposits, gilts, corporate bonds and the other securities it holds in its portfolio. It incurs costs on subscriber payouts and expenses. In 2015-16, EPFO invested 5% of its incremental corpus, or a little more than Rs.6,000 crore, in stocks. Our article How EPFO Manages Money, EPFO investment in Stock Market discusses how EPFO earns interest and investment of EPFO in stock market.

I applied for transfer of my Private Trust PF acocunt to the non-exempted one in Feb this year. In March, I got to know that the account transfer got completed but with amount 0.00 credited to my existing PF.

I enquired if there is an error to this, but the Provate trust-related organization said that there are two parts of trust account transfer: PF and Pension fund. So now my Pension Fund has been transferred and it would take some time for the PF funds to get transferred.

My question here is: Is there any annexure for knowing the PF balance (which would be non-zero ideally, unlike pension amount), so that I can forward the same across to PF department for quick processing during these covid times?

Also to add here, I raised a grievance on EPF portal for the same. They reverted with Annexure K which also mentions Pension amount as zero and does not provide any details on the PF amount.

My previous organisation is an exempted trust and I need to transfer the accumulated amount to my current employer who has maintained my pf account with epfo

I have submitted form 13 with all my details to my current employer and they have submitted it to my previous employer. Now what is the process that needs to be followed by my previous employer to transfer the amount to my current employer??

Please help.

As explained in our article about exempted organization

From Exempted to Unexempted (2a in image below) :

Apply Online at EPF website, submit the claim to old Employer(with trust).

You must collect/ensure that you get Annexure-K, Cheque in name of EPFO from old employer and submit to the new employer.

After some days, Check EPF passbook of the new employer.

You should see the amount transferred in, to passbook with the new employer.

Now you can track the UAN passbook of new member id for further EPF contributions.

My current employer PF is managed by private trust and due to some confusion during my joining they only opened PF account not the EPS. Although my last employer have both PF and EPS. When I asked my current employer to transfer the PF balance they told its not possible as last employer have both PF and EPS account. Pl guide.

That is strange.

A private trust needs to have both PF and EPS.

And transfer of funds from exempted trust is allowed.

You speak to your employer and get details.

Check with your colleagues too!

Any person 5 years serviced with epf account and left the job for 1 year ( not serviced in any company) and then again he worked for another 5 years with same epf account. shall the person is elegible for pension ?

Did that person withdraw Pension from his old EPF account or not?

If not then total years of contribution is more than 10 years hence he is eligible for the pension.

Hopefully, you have transferred old PF account to new?

If retirement is before Sep 2014 the average salary is last drawn 12 months average while it is 60 months average if the retirement is after Sep 2014

Sir,

I am Venkataramanappa working in a public sector company I have joined EPF during 1980 and completed 58 years w.e.f 20.7.2016, after completion of 58 years I have submitted Form 10D for grant of EPS pension. The EPFO has sanctioned Rs.2698/- EPS pension per month. According to EPS calculator I have to get Rs.3653/- pension according to their average salary of Rs.9617/-. In this regard I have written several letters to EPFO for rectifying my pension but they have not responded properly. Kindly anybody can advise me what further I can do.

Venkataramanappa

why max pension amount is rs 7500.

kindly explain

My EPF contribute Wef 05/08/1995 I am retired after 58years age on 30/09/2016 / 541rs contribute 30/09/2016&after1250tildate

My epf contribute Wef 05/08/1995I am retired after 58years age 30/09/2016 -541Rs contribute 30/09/2014& 1250Rs contribute 30/09/2016 how much pension should be there now

How to calculate PF on consolidated salary?? Suppose salary is 13000 p.m what amount will be deducted as pf???

chk epf

Dear Sir/Madam,

Very nice articile by you

I have on query that-

I have worked for one organization on 1-APR-08 TO 1-MAR-09 and, by form-13 asked for transfer of pf balance to current organization in year 2009.

> joined another organization(epf-2) on 02/03/09 till 18/09/13

THEY SETTLED pf only in 2016 after my request in JUNE-2016. and then i got the withdrawal in AUG-2016.

BUT THE CHEQUE WHICH I RECEIVED THEY HAVE ISSUED ME THE AMOUNT ACCORDING TO THE STATEMENT THEY MADE UPTO MAR-2014. i wish to know, i should receive interest for the period of APR-2014 TO APR-2016(2YEARS) OR NOT!

> Currtnely, i am working in same organization on different position with a different pf(epf-3) since 23/9/13

Kindly advice, if i can request them to give me the interest for 2 years as per epf rules!!

Thanks awaiting your advice

If an employee has left organization and presently not employed, but the Date of Exit (DoE) under EPF UAN Portal show blank, what’s it significance, how to change that without going to last employer

Very good article. Couple of queries –

How is EPS calculated? What is average salary here, is it annual basic?

EPS Pension = Average Salary X Number of Years Service /70

Also what is the criteria of 10 years?

Second point is if i retire at 50 years how can i get my EPF amount?

Thanks,

Rakesh