Income Tax Department has section AL from AY 2-16-17 called Asset and Liability ,Schedule AL ,in ITRs which is applicable in cases where the total income exceeds Rs 50 lakhs. This article talks about Schedule AL or Asset and Liability In ITR.

Table of Contents

Schedule AL, Asset and Liability Section in ITR

From AY 2016-17 or FY 2015-16, Any individual or Hindu undivided family (HUF) with total income of more than Rs.50 lakh in a year has to adhere to the new disclosure clause. The income tax department wants to keep a tab on the income and assets of those with income above 50 lakhs. It is to check whether the assets that the assessee owns are in line with the income of the assessee or are disproportionate to the income. So Schedule AL was introduced From AY 2016-17 or FY 2015-16. For an individual ,Schedule AL, is in the forms such as ITR2 ,ITR3 and ITR4.

‘Tax evasion a way of life’: Only 76 lakh Indians showed income of over Rs 5 lakh, said Our Finance Minister Arun Jaitely in 2018.

Before AY 2016-17 Schedule AL was already in ITR3 and ITR4, used for business income, so most of these assets, investments were shown as business assets or investments in Financial Statements of a taxpayer. But now, even the salaried person has to declare it if his total income exceeds Rs. 50 lakhs during financial year.

What is Schedule AL, Asset and Liability in ITR?

According to the new norms, under Schedule AL, an assessee has to disclose the value of assets and liabilities that he owned as on 31 March 2019, while filing ITR for assessment year 2019-20. The information that needs to be disclosed is similar to what one had to disclose earlier while filing wealth tax returns.

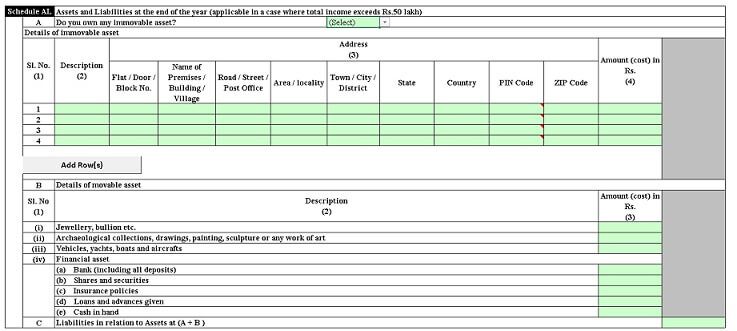

Individuals and entities coming under this income bracket will also have to mention the total cost of such assets. So, while immovable assets like land and building have to be furnished under the new ITR regime, movable assets like cash in hand, jewellery, bullion, vehicles, yachts, boats and aircraft will also have to be disclosed .One also has to describe their “Liability in relation” to these high value items. The schedule AL, for ITR1, ITR2,ITR2A is shown in image below

Total income of 50 lakh is with or without deductions?

Income is not the Gross Total Income but income arrived by deducting the tax saving deductions. If total income of taxpayer coming exactly Rs. 50 lakhs, then Schedule AL is not applicable.

For example during F.Y. 2015-16, Gross Total Income of Mr. Sharma is Rs. 52 lakh. He has done tax saving under section 80C of 1.5 lakh(EPF,PPF, life insurance premium ) and contributed Rs. 50,000 to National Pension Scheme(NPS). then as Total income of Mr Sharma is 50 lakh(52-2), it does not exceed 50 lakh so Mr. Sharma does not have fill Schedule AL.

How many of income tax payers earn above 50 lakh?

According to the Income Tax Department, only 1.5 lakhs ultra-rich individuals whose total income would be above Rs. 50 lakhs are required to fill this schedule in ITR Form and hence 99.5% of taxpayers are not affected by this requirement.

What details are required to be disclosed in schedule AL?

Persons who are required to fill this schedule will have to report the following details. The assets does not include personal accessories i.e. wearing apparel, furniture held for personal use by the taxpayer or dependent any family member.

- Immovable Property- Cost of Land and Building owned.

- Movable Property- Cash in hand, cost of Jewellery, bullion, aircraft, vehicles, yachts, boats.

- Liability (loans) in relations to the above-mentioned assets, investments.

How to declare the Cost of various assets for Schedule AL or Asset and Liability in ITR?

You are required to fill the total amount of COST of the assets. But if such assets were acquired by way of gift, will or inheritance, then Cost will be the Cost incurred by previous owner and any improvement cost is any.

Note that you have to fill the total cost. For example if you own land, You have to fill in total cost of all the lands (in the form of plots, agricultural land etc.) owned by you. or fill in total amount of Fixed Deposits, Recurring Deposits and Saving/Current Account Balances with all Banks.

According to the disclosure rules one has to declare only the cost of the assets have to be disclosed and not the market value . This means that if you owned, say, a house on 31 March 2019, which you had bought in 2010 for Rs.50 lakh, then you need to write Rs.50 lakh under the immovable assets column, irrespective of what the market value of the house was as the last day of March 2019.

Cost of Property, Gold

However, in many cases,one may not know the cost of the asset, for example, an inherited ancestral property, or jewellery or gold received as gifts.

- For an ancestral property bought before 2001, one can take the fair market value in 2001 as cost.

- For a property bought after 2001, one has to know the cost paid by the previous owner to acquire it,

- In some cases, if cost of purchase is not assessable, one can also put the current insured value as the cost

- One option is to get the property/asset valued by a valuer. Though obtaining a valuation report would add to the annual compliance burden but you need it anyway when you sell the asset.

Cost of Mutual Funds in Schedule AL

You can either get the consolidated statement from R&T agents like CAMS, Karvy or NSDL CAS. Yes, it is painful but take it as the opportunity to see how your investments.are, doing.

Cost of Shares in Schedule AL

For this, you have to get statement from the broker and get the COST of all the shares.

Cost in Banks in Schedule AL

Bank balance as on 31 Mar 2019 and all Fixed Deposits and Recurring Deposits.

Liability in Schedule AL, Asset and Liability in ITR

One also has to fill in the amount of loans/liabilities borrowed to purchase the Assets. Make a list of all your loans.

- Car/Vehicle Loan

- Personal Loan

- Home loan

- etc

Related Articles:

- List of Articles to Understand Income Tax, How to Fill ITR,Income Tax Notice…

- Income Tax for AY 2016-17 or FY 2015-16

- Mistakes while Filing ITR and CheckList before submitting ITR

- How To Fill Salary Details in ITR2, ITR1

- Self Assessment Tax, Pay Tax using Challan 280, Updating ITR

Despite the problems expected, many believe the step is in line with the government’s objective to curb black money and tax evasion. Do you think so such declaration will help?

1. For property bought by parents on my name, what should be cost of property.

2. For mutual funds: Should I write purchase cost in current FY or including all previous FY

3. For ULIPS: Premium paid only during this FY or all premiums paid till 31st March or sum assured for all policies.

Hi,

Your explanations have been very useful.

One question, Cost of shares to be reported in Schedule “AL” should be taken from the price as on January 31, 2018 or the price originally paid at the time of purchase?

Please help.

Thanks in advance.

Grandfathering is for Indian stocks not outside

My income is Rs.53,00,000/- in FY 2018-19 and My Capital Rs.1,50,00,000/- Creditors Rs.4,00,00,000/- Loan Rs.75,00,000/- Other Liabilities Rs.25,00,000/- and Immovable Assets Rs.3,00,00,000/- Debtors Rs.2,50,00,000/- Investment Rs.40,00,000/- Stock Rs.42,00,000/- Bank Balance Rs.10,00,000/- and Cash Rs.800,000/- so what is the amount entry in Schedule AL Liabilities in Relating to Assets ,(A+B)

Do I need to declare Provident Fund (with EPFO) in AL? Under which column?

Similarly, do I need to declare interest by EPFO under Exempt Income? EPFO still hasn’t given interest for last FY, what to do?

No, you don’t have to declare Providend Fund details in ITR either in AL or Exempt Income.

You can claim Employee contribution in EPFO under 80C

Though my presumptive income is not more than 2 lakhs, but I have assets like property, land , shares for more than 90 lakhs, I want to show in itr4. Can I do it?

If the scheduled are not applicable,as I have no Capital gain.I have to keep that one blank or delet it.If to delet, how ?

if you are using ITR Excel utility then

go to Home and

Under Select Applicable sheets make the column you don’t need to N as shown in the image below.

I have a tenant who has not paid rent for last 18 months even though he is supposed to. What rent income should I show in House Property?

Been through your responses regarding AL. Helped a lot.

Just to clarify once before filing:

1) Cost of all SIPs invested by me since past 10years should be declared.

2) Will PAN based report include investments by insurance policies?

3) Policy premium paid for FY2016-17 should be declared. Not sum of all premiums since the policy was purchased

Thanks in advance for last minute advice.

If your salary is above 50 lacs then you have to declare as on 31 Mar 2017 your assets

-For Mutual Funds your net cost of purchase in Mutual Funds which have not been redeemed.

-2 Will PAN based report include investments by insurance policies?

Not sure.

3- For policies which are active as on 31 Mar 2017 either declare SUM Assured or the premium paid

I used to own a vacant house and used to show the notional rent every year. Later, I dismantled the house. Now, it is only a plot there. Do I need to declare it if my income is much below 50 lacs?

There is no income to show from land.

A house property means either a building or a land attached to the building. This does not include vacant land or a plot of land – any income from such a land is taxable under the head Income from Other Sources. House Property could be your home, an office, a shop, a building or some land attached to the building say a car parking. The property in consideration must fall in the definition of a House Property.

Thank you. Actually, my question was about declaring the plot as an asset. Do I have to declare the plot anywhere in the tax return as my asset? I believe it is required to be declared as an asset only if my income is over 50 lacs.

If your income is less than 50 lacs then you don’t have to fill AL (assets and Liabilities section)

If you have vacant plot which is not earning any rent/money need not be shown under any income head.

Rent from all other property which is not building or lands appurtenant there to, can not be taxed under the head income from house property. This means vacant plot which is not appurtenant to building will not be taxable under the head income from house property

Hi I have a piece of land which is purchased from a builder and since last 6 years I am awaiting possession. Shall I declare it under Asset or not.

Bank details in schedule AL I have to mention balance as on 31st march 2017 for each bank account or only amount credited during 16-17 financial year.

i have self occupied house for which the loan was closed on 2012. cost of asset should include principal, interest, registration of land and anything else?. How to calculate the Liabilities, is the balance/outstanding loan as on 31st Mar 2017, in this case there is no outstanding as the loan was closed already. For car, i have loan from 2013, for liabilities should i only show the outstanding as on 31st Mar 2017 or the whole interest i paid from 2013 to 2017. How to calculate the cost of the asset = on road price + interest to be paid for 5 year loan?

Only the cost of the assets has to be disclosed and not their market value as on 31 March 2017. This means that if you owned, say, a house on 31 March 2017, which you had bought in 2010 for Rs.75 lakh, then you need to write Rs.75 lakh as the value of the immovable asset, irrespective of what the market value of the house was on the last day of March 2017.

Under financial assets bank details do I need to mention the balance as on 31st march 2017 as per bank statement for the bank accounts I hold.

I am a salaried person falling over 50 Lacs bracket. I have two questions to ask:

1- I have earned interest from saving accounts which i am declaring now in my ITR. I have form 16 and form 26AS which shows the TDS deposited by my employer and the Bank. While filling the ITR i see that my i am asked to pay ~35k more than what i had already paid, this includes the interest IT department is charging me for not paying this extra money. My question is how i should have avoided this interest charges?

2- My another question is my regarding the Schedule AL, I have a self occupant house joined owned with my wife. Should i be declaring the money mentioned during the registry and not the current market value which is much higher now in the black market? Should i be declaring the jewelry that wife and my mother have? I personally do not have any jewelry its with my wife or my mother only.

Thanks in advance for your help and for this great article

-Deepak

for point 1. You should self assess the tax every quarter the Quarter in which you earn the Interest you should pay self asses tax to avoid the interest .

Point 2. Mention the price at which you purchased the house either you need to mention or your wife in case both fall in 50 lack above you can have same share which both can mention.

In case your wife and mother are individual tax payers and they have acquired the same from their income then you need not to mention

Thanks, for the input! I see in this forum that last year (Ref July 29 2016), for the same query, the feedback was to provide property information.

Also, another query – for all the information that need to be provided in terms of FDs, MFs is it as on 31st March?

Regards,

-Sam

You have to provide the cost of the asset/purchase price.

Thanks, for the input! I am still confused, wondering on the point of PAN number, it being linked with the FDs, MFs, Shares, if I still need to list it in the AL. Also, since all these are online transactions over several years, I am wondering how I can now track the cost I paid at that time. How do I handle this?

-Sam.

Yes, it is painful.

It is difficult but not impossible. It would also help you to know how much you have and where it is, how the returns have been.

For Mutual Funds, if you have given EMAIL ID while filing information

You can get Purchase cost from Transaction statements sent by Mutual Funds.

You can try https://www.camsonline.com/InvestorServices/COL_ISAccountStatementCKF.aspx to get all information.

For FDs the principal is mentioned in the FD certificate.

Hi, I need help wrt filling the ITR2 – I am salaried, I have one apartment that is rented and one that is vacant (I stay with my parents). I have FDs, MFs, Shares. My income, including salary, interest from FDs and rent, is now more than 50Ls. Pls help me in terms

– Should I declare both the apartments (I am already declaring the rental income) or only 1, i.e., the vacant one.

– Should I declare the FDs – I have declared the interest and also paid tax

– Shares, MFs – It is linked with PAN, should I declare it?

Regards,

-Sam.

Sadly yes if your income is above 50 lakhs you would have to provide these details.

I am a salaried employee with income more than 50lac no other source of income.

Have 2 flats one self occupied and other vacant. Both co-owned with my wife (house wife).

No other source of income

Which ITR form I should use.

ITR2. As ITR1 is only for income from 1 house property

1. I have purchased a flat in 2012, and it is registered as a joint owner in me and my wife. Do I need to declare only 50% of this asset in my Schedule AL? Please note that my wife is house wife and she did not have any source of income that time, so her part of 50% was borne by me as gift to her. Please advice, whether I need to declare asset only for my part OR complete 100%?

2. Also what value should be declared for vehicles for example vehicle was purchased in 2005 at 4lac should i show 4 lac as vehicle value or depriciated value as per insrance idv

3. Do we need to mention amount in bank as of 31 march 2017 under Financial Assets Section–> banks

4. Under Insurance policies should we declare sum assured or premium paid in FY

1. Tax laws do distinguish between joint ownership where the name of the joint owner is merely for the sake of convenience, and beneficial joint ownership, where each joint owner has contributed towards the cost of the house.

Joint ownership for the sake of convenience is certainly not regarded as an ownership for the purpose of tax laws. So best declare it as 100% unless you can show that your wife purchased part of it.

2. Cost value. have added instructions from the ITR in the article.

3. Yes do mention amount in bank as on 31 Mar 2017.

4. Enter the total amount of Insurance Premiums paid by you for insurance policies that did not mature on 31st March {Financial Year end}.

Is Investment in PPF opened in icici bank to be shown in Schedule AL under assets. If yes, under which category. Further is accrued interest on it to be shown under exempted income.

In AL , shares need to be disclosed at cost or market price ?

Shares need to be disclosed at Cost price.

From ITR2 instructions

The amount in respect of assets to be reported will be:-

(a) the cost price of such asset to the assessee; or

(b) where wealth-tax return was filed by the assessee and the asset was forming part of the wealth-tax return, the

value of such asset as per the latest wealth-tax return in which it was disclosed as increased by the cost of

improvement incurred after such date, if any.

(vi) In case the asset became the property of the assessee under a gift, will or any mode specified in section 49(1) and

not covered by (v) above:-

(a) the cost of such asset to be reported will be the cost for which the previous owner of the asset acquired it, as

increased by the cost of any improvement of the asset incurred by the previous owner or the assessee, as the

case may be; or.

(b) in case where the cost at which the asset was acquired by the previous owner is not ascertainable and no

wealth-tax return was filed in respect of such asset, the value may be estimated at the circle rate or bullion

rate, as the case may be, on the date of acquisition by the assessee as increased by cost of improvement, if any,

or 31st day of March, 2017:

Previous owner shall have the meaning as provided in Explanation to section 4

Sir,

I am a resident Indian needing to submit AL sch as per my income slab. My query is regarding a residential flat for which I have paid an advance (by cheque) to the builder but have not got possession or registration done. The building is still under construction.

My question is

1. Should i show the flat as a residential property

2. If not, how do i show the advance paid to the builder

Thanks in advance for the response.

I have the same question. But no CA seems to know the answer.

I read some articles where a CA mentioned that an under construction property does not need to be declared as an asset, in his opinion.

However, my concern is that as a buyer, I am required to deduct 1% of every payment/installment paid to the builder and pay that amount to Government. I have done that for all the payments, and it shows in my form 26AS too (as a deductor of the tax). So the government already has a record of my property. So, probably we should declare it under assets, and loan taken (if any) be declared under liabilities.

No harm in declaring the asset and Home loan under liabilities.

If everything is in white and there is no extra tax liability then one can declare.

Thank you for your reply.

The under construction flat and home loan, both are jointly shared by me and my spouse (both on paper and in real). In this case, should I declare the cost of the asset in full or declare only 50% (because I am a co-owner). Same question for loan amount to be declared under liability, as both of us are co-borrowers of home loan.

At the time of retirement my friend ( Central Govt. employee) will get more than Rs.50 lakhs as retirement benefits which includes GPF, Gratuity, Commutation money, Lrave encashment, Gr. Insurance etc.

Does he need to declare this amount in AL of ITR 2 ?

If my salary and my commission is about 40 lakhs, and my share of profit in a partnership firm is about 25 lakhs (exempted income for me), then do I need to fill this schedule AL ?

While filing Income tax return for AY 2016-17, I was not aware of section AL which needs to be filled for declaration of Assets. If my income is more than 50 lakhs.

Can I declare this in AY2017-18 Return ? or do I need to rectify the return AY2016-17 ?

Also does the residential Flat cost to be declared under immovable asset – building ?

Please Guide. Thanks for your support.

Is your return processed?

Can I show a plot of land whose selling is development based and only 50% of amount is paid.this plot is only transfered in my favor but not registered still.

I am a retired USA citizen of Indian origin, now an ordinary resident of India for 20 years.

I have bank accounts and MF investments in USA. How do I declare that? Do I add those amounts to reportable amounts under different heads for India held assets?

Thank you if you clarify this point.

Yes, if you are a resident of India you need to declare your foreign assets in India.

It should be filed under foreign asset section.

As explained in http://bemoneyaware.com/are-espp-esop-in-mnc-to-be-filed-in-itr-as-foreign-assets/

Assets and Liabilities part is for income above 50 lakhs

For the purpose of Total income should I include Bank interest from FDs? With this if my income is more than 50 Lac do I need to declare assets and Jewellery of my wife?

No. Income tax department has information about your FDs .

It is looking for your land/buildings/ etc.

As per Income tax you and your wife are two distinct individuals.

Lets try to ans it this way. God forbid, If your wife leaves you today who would get jewellery and her assets.

If its you then declare it else No.

Thank you so much for the reply.

However I wanted to know whether a Salaried individual should include other income (generally FD/Bank interest) to find whether he/she is above or below 50 Lac bracket (since other income also is a part of Total income for salaried individuals).

Kindly inform. A list of type of incomes and deductions for the purpose of calculating 50 Lac category will help many tax payee in borderline income and they can plan to be below 50 lac bracket knowing the rule.

If I am filing ITR2, where can I show the followings-

Advance paid for purchase of flat

Loan given to someone

Deposit with Land lord etc?

Thanks for the Help

I have purchased a flat in 2007, and it is registered as a joint owner in me and my wife. Do I need to declare only 50% of this asset in my Schedule AL? Please note that my wife is house wife and she did not have any source of income that time, so her part of 50% was borne by me as gift to her. Please advice, whether I need to declare asset only for my part OR complete 100%?

If the car was purchased in 2006 for 8 lakhs, is that the price we need to declare ?

I am a US citizen working in India for past 6 years. Do I need to declare by US assets also on schedule AL?

Thanks in advance!

As a citizen of the US or a green card holder living outside the US, you are treated at par with a ‘US resident’ for tax purposes. So you must pay taxes on your global income in the US. At the same time, if you have lived in India for more than 182 days in a financial year, you are treated as a resident of India. As per the Indian income tax act, a resident of India must pay taxes in India on his global income.

A US citizen or green card holder living in India will have to declare his global income in his US tax return as well as his India return. The DTAA will only help in ensuring that a particular income is not taxed twice.

According to Article 4 of the DTAA between India and the US, if a person qualifies as a resident of both countries at the same time, then he shall be treated as a resident of the country where he either has a permanent home or has closer economic ties. As this can be confusing, do seek a professional advisor to help you out.

Please read Economic Times article How US citizens and Green Card holders living in India can file tax for more details

What is meant with Cash in hand in ITR2? Do i need to disclose the bank account details, Shares and Mutual funds?

As per what I have been suggested by a CA is that Cash in hand mean “Hard Cash” not FD etc.

What is the applicability of Schedule AL of ITR2 to NRI whose NRI income is greater than Rs50 Lakhs?

For Non Residents details of assets located in India have to be mentioned.

Dear,

Nice article.

I wanted to know whether liability needs to be shown even if repaid or position as on 31st March of respective year needs to be disclosed ?

Thanks.

No you have to mention assets as on 31 Mar 2016. If you sold an asset say land or jewellery then you have capital gains/loss but not asset

I am a salaried person earning 55lacs and as I am entering the details in the schedule AL the software (spectrum ) is not accepting some details –

1. Loans and advances

2. Shares and securities and

3. Cash and Bank Balances

Therefore I am not able to generate the xml as it is showing error that you have entered these details.

Other income entered are of House Property and Other Sources

Please reply for the same.

The assets to be reported will include land, building (immovable assets) and cash in hand, jewellery, bullion, vehicles, yachts, boats, aircraft etc

Shares and securities, bank accounts Income tax department can track through your PAN

Hi,

i had just purchase a flat in 2015 and units of which alloted to me but possession is still awaited so it is required to disclose that unit of asset if my income exceeds Rs 50 lakhs.

If it’s in your name then its an asset and you should declare it.

Hi

I had purchased an under construction property for 47 lakhs in Aug 2010 from builder. At this time, circle rate was similar to cost of property. I have got the possession now in 2016 and registry is supposed to happen in few months from now at rate of 90 Lakhs. The registry is happening at such a high price due to continuous revision of circle rates in NCR.

Am I liable for any tax because of this ?

Also, in the asset liability section for individuals with income more than 50 lakhs, should I report the cost of this asset as 47 lakhs or 90 lakhs.

In the

Thanks!

The cost of the property in your case is the cost you have paid to the builder! So you have declare as 47 lacs plus registration cost if any. However, the registration fees will be collected on the present guidance value at the time of registration.