Balance transfer in credit cards means that you transfer the amount you owe on one credit card to another card as typically the rate of interest offered by the new bank is lower than the interest you pay on your existing card for a limited period. This can help you save on interest costs and give you more time to pay your dues. What is balance transfer of credit cards? Is it a good idea to do a balance transfer on a credit card? Do balance transfers affect your credit score? How to do balance transfer of credit card?

Table of Contents

What is Balance Transfer of credit card?

The balance transfer is basically transferring your debt from one lender to another. Balance transfer in credit cards means that you transfer the amount you owe on one credit card to another card. Banks frequently give such offers to acquire clients.

There are some fees associated with the balance transfer of credit cards which are given below:

- The balance transfer fee is a one-time amount that’s charged to process each transfer.

- Fee for the new card.

- The balance transfer interest rate for a limited period. This period is called as the holiday period. The holiday period you get on your card is totally dependent on the card you choose. In some cases the holiday period can be as long as 90 days while in other cases it may be limited to 30-45 days.

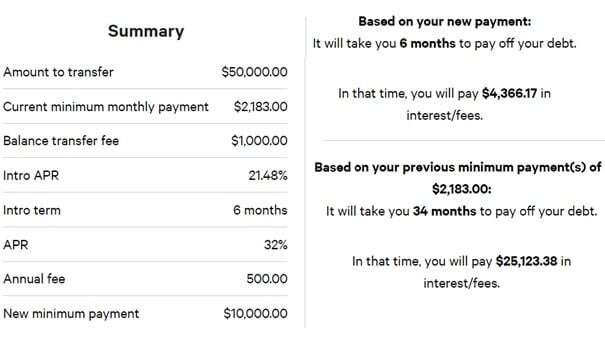

For example balance transfer to the Axis Bank credit card is shown below.

- You can make a minimum Credit Card balance transfer of Rs. 5,000.

- Repayments towards the balance transfer can be made in instalment periods of 3 months or 6 months. Online credit card Payment can be done using Internet banking of other banks or Axis Bank/Axis Mobile App/

- The tenure of 3 months does not attract any interest charges, but interest will be charged on the 6-month tenure if chosen.

As you know a credit card’s interest rate is the interest you pay for if you don’t pay your balance in full each month by the due date. The interest rates for credit cards are typically stated as a yearly rate. This is called the annual percentage rate (APR).

Suppose Reema had Credit Card A with an outstanding balance of Rs 50,000 at a rate of interest of 40.8% APR or 3.4% per month.

Now she has an offer to Balance Transfer to Card B with a promotional interest of 1.79% for 6 months with 2% as processing fee. She has to pay annual charge of Rs 500.

If she pays the full outstanding balance during the promotional period then Using Calculator she would have saved = 4,366.17-1000-500 = 2866.17.This can help her save on interest costs.

Restrictions on the New Card after the Balance Transfer: The Credit Limit, Fresh Purchase

The Credit limit of the card to which you have transferred the balance reduces the balance transfer amount. Say Reema’s credit limit on her new credit card is Rs. 1,00,000 and she have opted for a balance transfer of Rs. 50,000, then the credit limit on the new card will be reduced to Rs. 50,000

Any fresh purchases made on credit card after doing a balance transfer does not enjoy any interest-free period. Interest will be charged from the very day the purchase is made. So No fresh purchases should be made on a credit card till the entire amount is paid off.

Balance transfer or EMI option of Credit Card which is good?

Credit card companies also offer an option to convert the dues to easy EMIs. Then along with the minimum payment dues one also needs to pay the also the EMI, GST will be billed in the monthly statement starting from the immediate billing cycle date. You need to pay this new Minimum Amount Due to keep using your card and also have to pay Interest & other charges on the balance outstanding. For example, if you convert Amount of 50,000 to EMI for 9 months you would have to pay interest of 5,980 and for 36 months 1,808. The interest calculations at Rate of Interest @ 1.50% per month using the reducing balance method.

They are shown below(Monthly payment dues will include EMI and GST on the Interest amount of EMI)

| Loan Amount (Rs.) | 36 months | 24 months | 18 months | 12 months | 9 months |

| 50,000 | 1,808 | 2,496 | 3,190 | 4,584 | 5,980 |

| 1,00,000 | 3,615 | 4,992 | 6,381 | 9,168 | 11,961 |

| 2,00,000 | 7,230 | 9,985 | 12,761 | 18,336 | 23,922 |

| 3,00,000 | 10,846 | 14,977 | 19,142 | 27,504 | 35,883 |

| 4,00,000 | 14,461 | 19,970 | 25,522 | 36,672 | 47,844 |

| 5,00,000 | 18,076 | 24,962 | 31,903 | 45,840 | 59,805 |

Converting to EMIs sounds easy, but don’t ignore the high interest that is charged. Remember EMI/ balance transfer is only a temporary solution. Your dues still need to be paid by you, and even if your card is low interest, you are still paying some interest cost. So, a balance transfer can help you for some time but it is not a permanent solution to your dues.

Does A Balance Transfer Affect Your Credit Score?

The credit score is based on many parameters including payment history, credit utilization levels and percentage of unsecured loans. When you do a credit card balance transfer, debt is transferred from one bank to another bank, the overall limit does not increase. So a balance credit card transfer should not have any impact on the credit score.

Do your research and then approach the banks. For if you approach many banks for credit cards or personal loans, it will affect your credit scores.

Balance transfer process

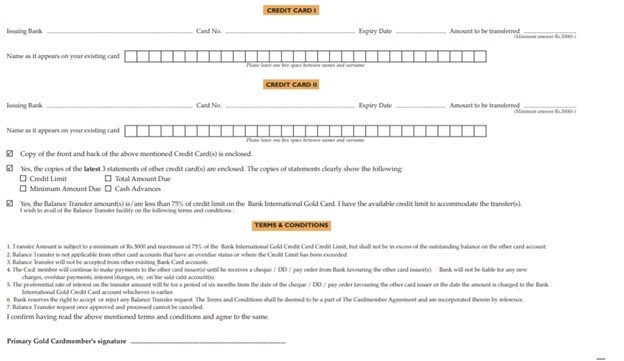

As a first step, you have to inform the credit card issuer that you want to avail the balance transfer facility. You will have to fill in balance transfer form. Then you have to fill in the details of your old credit card and also attach latest bill statement.

If approved after 7 to 10 working days, the credit issuer will do a NEFT transfer or send a Demand Draft (DD) to your residence in the name of the old credit card issuer. After that outstanding amount on your old credit card gets cleared. Now you have to pay the balance transferred amount to the new credit card issuer. Sample Balance transfer form is shown below

The key of the balance transfer appeal lies in the lower interest rate charged by the institution offering the scheme. Suppose, you are paying an interest of 2.95% per month on your existing credit card’s balance outstanding. If you decide to transfer this amount to another bank under a scheme that doesn’t levy any interest for, say, three months, your savings could be huge if you manage to clear the dues within this period. Remember that a balance transfer is only a temporary solution. Your dues still need to be paid by you, and even if your card is low interest, you are still paying some interest cost. So, a balance transfer can help you for some time but it is not a permanent solution to your dues.