One of the best ways to invest in mutual funds is through the Systematic Investment Plan (SIP) route. SIPs allow one to invest a small amount of money periodically into a selected mutual fund. What should you do or decide before Investing in Mutual Fund? Before investing in SIP? Can you stop SIP? What happens if you miss a SIP payment? Are there tax deductions available for investing in SIP?

Table of Contents

Before Starting Investing in Mutual Fund

Before you invest in Mutual you need to make few decisions whether you are investing one time or through SIP. These are shown in the image below.

Do KYC

Know your customer requirement or KYC is a must to invest in mutual funds whether you do lump sum or SIP. It is a one-time activity and you can invest and transact in any AMC once you are KYC complied. You will have to submit an identity proof, address proof and a photograph. You should also confirm your physical existence through an In-Person Verification or (IPV). You can also do eKYC. SEBI, the regulatory body, has provided guidance to restrict investments to Rs 50,000 per annum per Mutual Fund for OTP-based eKYC.

Decide Whether You Want To Invest Offline or Online

You can invest in SIP by submitting the physical application Form offline or online. In Offline mode, you just need to go to the concerned office once to submit the application. It allows auto-debit of money into your funds. So, there is no need for manual money transfer to your SIP account. Many investing platforms such as Geojit platform one provide features such as 100% Paperless, Instant KYC validation to make your investing simple.

Decide whether you want to go Direct or through Agent

A Direct plan is what you buy directly from the mutual fund company, whereas a Regular plan is what you buy through an advisor, broker or distributor (intermediary). Mutual fund distributors make annual commissions from your investments from the Mutual Fund Company or AMC. These distributors provide hand-holding for example why invest through Geojit?

Choosing Which Mutual Fund to Invest in SIP?

You have decided that you want to invest in SIP. The first question is SIP in which Mutual Fund? There are various mutual funds available in the market. To select the right Mutual Fund you need to have a financial plan which answers the following questions.

- Your risk profile

- Knows personal financial goals that you want to achieve through SIP investments. You can have many goals like your kid’s higher education and marriage, buying a new car, vacation, retirement etc. or you can have a particular goal for which you want to grow your wealth.

- Consider the fund’s performance

Decide the Amount, Frequency

You have to decide whether to invest in Lump Sum/ Systematic Investment Plan (SIP)/ Systematic Transfer Plan/Systematic Withdrawal Place.

Decide Growth/Dividend

When investing in mutual funds, there are three options that are available in which you could invest: growth, dividend and dividend reinvestment.

Investing in SIP

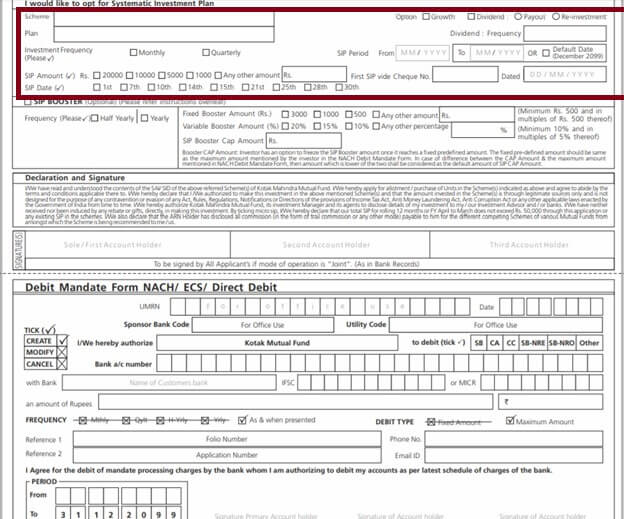

If you decide to invest in SIP you need to provide details shown in the image below. You need to set up the process, Once done investment happens automatically

- Decide your investment amount: 1000, 5000, 10,000, 20000 or any other amount

- Select your investment frequency: Monthly, Quarterly.

- SIP period: From to

- Set a Date:You can choose a date for monthly investment as per your convenience.Generally,the dates are 1,5,10,15,20,25 but these can vary based on different companies.You can select multiple dates for investing through SIP in different funds.

What is Tenure for SIP?

Most fund houses have a minimum SIP tenure of 6 months. This leads investors to believe that 6 months is the ideal time frame for investing via SIPs. But you can go for longer period by filling an appropriate period.

Is there a Lock in Period in SIP?

Most mutual funds do not have a lock-in period, you can withdraw your money any time. In fact, tax-saving mutual funds know as Equity-Linked Savings Schemes (ELSS), are the only (open-ended) mutual funds in India that have a lock-in period. The lock-in period for these funds is 3-years and it is 3 years for every SIP amount if you invest in ELSS through SIP.

What if I miss a month’s payment in SIP?

Nothing happens if you miss a month’s payment. There is no penalty levied by the mutual fund. But you may incur some bank charges for subsequent mandate failure (equivalent to cheque bounce). The coming month onwards you will get the normal trigger for your payment. You can always make an additional purchase for the lapsed amount later on.

Can one Renew the SIP?

At the end of the term, the investors have the option to renew the SIP to ensure continuity. The asset management company (AMC) usually sends a communication to the investor towards the end of the SIP term, asking for renewal along with SIP renewal form, which can be downloaded from the website.

The decision can be taken based on the performance of the investment and its suitability to the investor’s needs. The communication from the fund house may come with the

Can One claim Tax Deduction for investing in SIP?

Only investments in Equity Linked Savings Schemes (ELSS) or tax saving mutual fund schemes qualify for a tax deduction under Section 80C of the Income Tax Act. Investments in ELSS qualify for a tax deduction of up to Rs 1.5 lakh under Section 80C

How to cancel SIP

You can cancel a SIP anytime. Let’s say, for example, you invested some amount in SIP for a period of 24 months. After some time you realize you want to stop SIP, maybe you are unable to pay the amount or you don’t like the scheme.

You can stop your SIP anytime. You do not have to pay any penalty. Because SIPs are done voluntarily by customers and the Asset Management Companies (AMC) cannot charge you any penalty for the cancellation. The procedure and time have taken to cancel a SIP depend on the fund house.

Related Articles:

All About Mutual Funds : Basics, Choosing, Paperwork, Direct Investing

- Mutual Funds: Yehi Hai Right Choice

- Changes in Mutual funds in 2018

- Investing in Equities: Stocks vs Mutual Funds

Mention manual & automatic systematic investment, generally people think SIP means only automatic where AMC/agent co will pull money from your bank account. I have seen on SIP date the NAV value of the most of the time it will be high, so I generally invest manually (from MF Utils) when I get income.

That is a smart suggestion.

I have shared this on twitter here and facebook here