Bemoneyaware writes about money topics in simple terms such as filing income tax forms, about EPF, PPF, Credit debt, loans, Investing in Mutual Funds, Stocks etc. We have answered questions on Quora(5.4M content views), have written articles for magazines like Femina, Outlook Money. We have done money workshops for corporates like Flipkart, colleges like Amity Management College (Bangalore), and schools like NPS(HSR), Primus in Bangalore. We are not from a financial background so we write in a simple language, with pictures, videos. Thanks to our readers Our blog is among the top 10 personal finance blogs of India. We have also written a book for young adults or teens which is available on Amazon, workbook on teaching kids about money, and income tax.

Table of Contents

What you will find at Bemoneyaware.com

Test your financial knowledge

Our education system focuses on academics and professional courses, we get the job and work hard and get caught in the race – buy a car, get married, buy a house, go on foreign vacations, have kids, send them to a good school, get them married and then maybe retire peacefully. But Cost to Company(CTC), Emergency Funds, Insurance, Inflation, Loans & EMI, Credit Card, Fixed Deposits, Stocks, Mutual Funds, PPF, EPF, Return on Investment, sounds like Latin and Greek. How well do you understand these money concepts?

Some of the questions are

Who will have more money at 58 years? Alicia invests Rs 5,000/year beginning at age 18. At age 28, she stops.(Total 50,000) or Boman invests Rs 5,000/year starting at age of 28 and invests for 30 years(Total 150,000) or Chitra invests Rs 5,000 per year starting at age 18 and invests for 30 years. (Total 200,000)

If a person’s CTC(Cost to Company) is 12 lakhs annually, How much salary will be credited to his bank account monthly? Less than 1 lakh, More than 1 lakh, or 1 lakh

Try it here

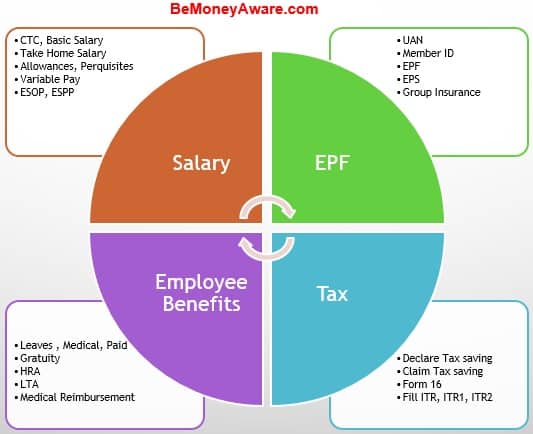

What should you know as an employee?

Companies on-campus talk about what is called cost to company (CTC), that is, the money they will spend on you. An employee needs to understand many things which are shown in the image below, the list of article you can find here

- Salary:

- What is CTC(cost to company), Net Salary, Gross Salary?

- Benefits and Allowances:

- What are the various allowances, like HRA, LTA, Transport Allowance, Medical Reimbursement? Variable payouts such as performance bonus, variable pay, and gratuity.

- How to claim the allowances

- What are the contributions towards long-term and retirement benefits such as Provident fund, superannuation fund, and, Gratuity?

- Stock Options: ESPPs, ESOPs, or, Employee Stock Options are the other incentives offered. Here, the company provides you with an option to purchase some company’s stock at a fixed price (also called exercise price) on a future date.

- Tax: And then there is Form 16, Form 12BB and you have to pay tax, even though your company has deducted TDS?

Basics of Income Tax

Albert Einstein, the great physicist said: “The hardest thing in the world to understand is the income tax.”

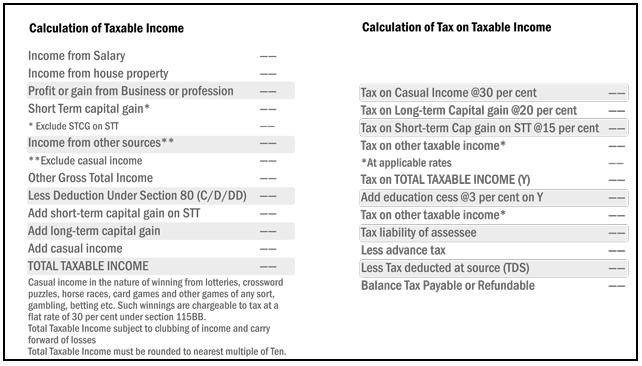

Well, it is not that difficult! If you want to understand what is Income, Income Tax slabs, Types of Income, the tax on different types of Income when it is taxed, dates and year related to Income Tax, tax cut i.e TDS, how to see TDS, how and when to pay advance tax, how to pay tax due then go through our list of articles at Understand Income Tax: What is Income Tax, TDS, Form 16, Challan 280

How to file Income Tax Return (ITR)

Today, it takes more brains and effort to make out the income-tax form than it does to make the income.

Income tax filing and processing comprises of following stages. Our list of the article, How to file ITR Income Tax Return, Process, Income Tax Notices, covers the list of articles on filing ITR, EVerifying and what notices you can get Income Tax for FY 2019-20 or AY 2020-21

-

- Compute income (5 types: Income from Salary, Income from owning a house, Income from selling capital (Mutual Funds Stocks, Property/House, Gold), Income from Business/Profession, Income from other sources(Interest on Saving bank account, Interest on FD)

- Check Exempt Income if any (PPF interest, EPF withdrawal after 5 years, Life Insurance payment)

- Deduct valid deductions (under Chapter VI-A) 80C,80D etc.

- Claim TDS already deducted(Check Form 26AS)

- Determine tax payable. Your net tax due should be 0.

- Pay the Self Assessment tax using Challan 280 if any and update ITR.

- Submit ITR.

- E-verify ITR / Sending ITR-V

- Wait for ITR to be Processed: Either ITR will be Processed / or you would get Notice

- Get refund (if due)

- How to reply to Notice if any.

Investing

There are various kinds of investment products such as Real Estate, Equity, Mutual Funds, Fixed Deposits, Post Office etc. One should invest in different types of investment products based on one’s financial goals, as each investment product has different features in terms of liquidity, time period, is associated with different types of risk gives, different types of returns. A portfolio must have an ideal mix of financial products. This lists articles about all Investing options to investors in India. The image below compares various investment classes in terms of Risks, Tenure, Liquidy, Returns and Taxation.

All About Investing in India:PPF,Fixed Deposits, Mutual Funds, NPS, Stocks

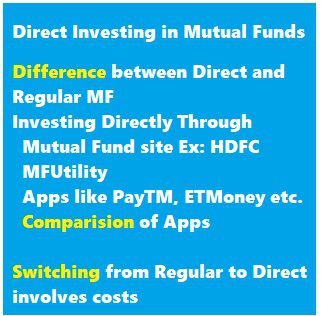

Direct Investing in Mutual Funds

Direct Investing in Mutual funds is becoming popular due to many Apps being available. Know more about Direct Investing here.

PaperWork, Will, Nomination

Most of us assume that our family will get access to our investments, bank accounts when we are no more but the law doesn’t recognize things this way. It needs valid papers in the form of Survivorship mandate, Nominations, Will. What are the type of records to keep, what to keep, why and for how long? List of articles related to paper-work can be found here.

If there are no nominees then banks, Mutual funds, PPF account, Demat accounts, Insurance Policies require lots of additional documents such as a will, legal heir certificate, no-objection certificate from other legal heirs etc.

Note though a nominee is an important person, he or she has no rights over the money or assets unless that is specified under the will. (except for shares)

Maintain a Money Book

- It should be a one-stop for all your financial information. Your insurance,(life, health, motor), your bank details(Accounts, Lockers, Demat Account, Credit Card), Your Loans(Home loan, Auto loan), your investments(FD, Mutual Funds, PPF, EPF, Others..) It would help you to stay organised as it will have all your information in one place

- It would be your legacy book: So your family don’t have to go through the inconvenience of searching for documents and whom to contact,

Debt: Credit Card and Loans

Urban Indian seems to be living a life of debt – Education loan, auto loan, multiple credit cards, a home loan. The word credit, loans, EMI is integrated with his life. Credit Information Report and Credit score play a critical part in the loan granting process these days. Based on your credit history, a bank will decide whether to give you a loan or how much interest to charge you on the loan

List of articles on Credit Card, Loans and Credit Report.

Women, Life, and Money

Principles of personal finance management are gender-neutral but a woman faces situations in life that men don’t such as relocation due to marriage, career disruption on childbirth, re-entry into corporate rat race or a complete career switch to achieve work-life balance. List of articles at All About Women: Life, Money

- Money resolutions for Women: Our article in Femina

- After Marriage: Parents and Finance

- Inheritance rights of Women in India: Hindu, Muslim, Christians

- Maternity Leave :Duration, Wages,Maternity Benefit Act

- StreeDhan : What is it? Why should one know about StreeDhan?

BigBoss, Salary of PM, MLA etc

Have you wondered how much does President of India earn? What are the savings of PM Narendra Modi? How much Money do Big Boss 13 contestants earn? How did Amitabh Bachchan rise for bankruptcy? Money is linked with what we see, we read, people, celebrities. This page is a compilation of the list of articles related to what we see in daily life here , links of few articles given below

- Bigg Boss 13: How much contestants earn, Prize Money, Salman Khan

- Amitabh Bachchan – from bankruptcy to crorepati

- Salary and perks of Indian MP, MLA and Prime Minister

- President of India and Rashtrapati Bhavan

- PM Narendra Modi Investments, Asset

Daily Life

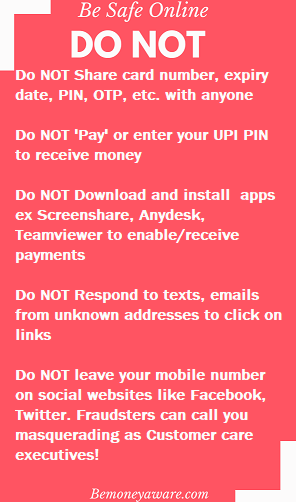

- Online Frauds : UPI Scam, AnyDesk, Matrimonial Site, Lottery, Fake Job Offer etc

- New Traffic Fines in India, Documents to carry, DigiLocker

- Reliance Jio Fiber Plans, Free TV Offer, Comparison with Competition

- When you lose your Credit Card,PAN,DL

- Fastag : What is Fastag, How to apply, Toll Charges

Thanks for sharing Article. Please visit https://stockoption.co.in

– Amazing, Thanks for sharing Article. Please Click Online stock trading

Student loans taken from platforms like financepeer is considered good because Financepeer helps parents/students to pay their education fees in monthly installments that too at zero interest and zero cost.

I appreciate blog posts such as this one. I will surely follow a few of them. Keep writing such detailed blogs. Those are some excellent summary.good Share

TODAY NIFTY 12100 PUT GIVEN @ 72 AND BOOKED PROFIT @ 82 ( TOTAL INVESTMENT OF THIS CALL WAS 5400

AND PROFIT GIVEN ON THIS CALL WAS 750 RS )

FOR SUCH LIVE CALL WHATSUP ME ON 8109060248

SURE SHOT TRADING TIPS

Excellent summery !

Thanks for sharing such a useful information.