Bharat 22 is an ETF that tracks the performance of 22 stocks the government plans to reduce its stake in. Additional Offering Period (AOP) or Second follow-on offer of Bharat 22 Exchange Traded Fund (B22ETF) opens on February 14, 2019. Since its launch in November 2017, the government has raised Rs 22,900 crore so far through B22ETF through two tranches.

Table of Contents

About Bharat 22 ETF Additional Offering

Bharat 22 ETF is managed by ICICI Prudential Mutual Fund, while Asia Index will be the index provider and the index is rebalanced annually. Bharat 22 exchange traded fund (ETF), new fund offer (NFO) opened for investors on 14 Nov 2017, while subscription for retail investors was from 15 November to 17 November. An upfront discount of 3% was offered to all category of investors.

Looking at the past performance, the discount offered and the valuation, we feel only long term investors can take a limited exposure to the ETF.

The Government of India has come out with an additional offering of its Bharat -22 Exchange Traded Fund (ETF) on February 14, 2019. Through this issue, the government is looking to mop up Rs. 3,500 crore.

- Demat account is mandatory to apply for this ETF

- The minimum investment amount is Rs 5,000 and there is no entry or exit load in the scheme.

- The expense ratio of BHARAT 22 ETF is up to 0.0095% p.a. of daily net assets of the scheme

- This time investors across all categories will get a 5 per cent discount on the additional offering Reference Market Price on government disinvestment shares. No discount will be offered on purchases from the open market.

- Taxation for this ETF will be like that of equity shares or equity mutual funds.

An investment in Bharat 22 ETF since its launch has posted a loss of 8.7 per cent. Over the past one year period, it has grossly underperformed Nifty. Bharat 22 ETF lost 9.66 per cent whereas Nifty gained 2.55 per cent. Though investors are offered a 5 per cent discount on the divested shares of the government through this offer, but returns are limited.

Applicants may submit the physical application at designated Investor Service Centres of ICICI Prudential Asset Management Company Limited or Computer Age Management Services Pvt. Ltd. (CAMS).

Additionally, the below mentioned online modes will be available:

i. ICICI Prudential AMC or ICICI Prudential Mutual Fund website

ii. IPRUTOUCH App

iii. NSE MFSS

iv. BIMF (BSE IBBS PLATFORM)

v. NMF II platform of NSE

vi. e-ETF under web-based NSE e-IPO platform

vii. MF Utility

viii. CAMSONLINE

Anchor investors are institutional investors who are offered shares in an IPO a day before the offer opens. They are supposed to ‘anchor’ the issue by agreeing to subscribe to shares at a fixed price so that other investors may know that there is demand for the shares offered. Each anchor investor has to put a minimum of ₹10 crore in the issue.

Difference between Mutual Funds, Index Fund and ETF

A stock exchange is an institution, organization, or association which hosts a market where stocks, bonds, options and futures, and commodities are traded. It would be too difficult to track every single security trading in a stock exchange. So a smaller sample of the market that is representative of the whole is taken. Just as the average marks in a class test tells you how the class has fared in the test, just as pollsters use political surveys to gauge the sentiment of the population the stock index tells you the general health of the stock market. Our article Stock Market Index: The Basics explains in detail What is index? How is it calculated?

- In India, Sensex is an index that captures the increase or decrease in prices of stocks of 30 companies that are traded on the BSE. The word Sensex comes from the sensitive index and was coined by Deepak Mohoni.

- Nifty is the Sensex’s counterpart on the NSE and comprises of 50 companies.

- S&P BSE 100. The S&P BSE 100 index, a rules-based, broad index, is designed to measure the performance of the top 100 large-cap companies in India that are listed at BSE Ltd. based on size and liquidity. The index is calculated in Indian Rupees. It’s Ticker: BSE100.

Mutual funds bundle together securities to offer investors diversified portfolios. Mutual Funds rely on a professional adviser to actively manage investments on behalf of others, at a fee. The hope is that active management can take advantages of trends in the market or informational discrepancies to “beat” the overall market return.

Index funds are mutual funds that are designed to track the performance of a particular index. Sensex is an index of 30 stocks and Nifty 50 is an index of 50 stocks. The index fund holds the securities in the same proportion as they occur in the actual index, and when the index decreases in value, the fund’s shares decrease as well, and vice versa. The only time an index buys or sells stock is when the index itself changes (either in weighting or in composition). Index funds have ticker symbols and are traded on all major exchanges.

Exchange-traded funds, or ETFs, are similar to mutual funds because both instruments bundle together securities to offer investors diversified portfolios. ETFs offer the convenience of stock along with the diversification of a mutual fund. ETFs are index funds and they track a particular index. ETFs are passive funds. It means that the proportion of the underlying assets remains the same. Therefore, the portfolio of the ETF remains the same, unlike a mutual fund that will be actively managed. Resultantly, ETFs have a low expense ratio.

- ETFs trade throughout the trading day, like stocks, while mutual funds trade only at the end of the day at the net asset value (NAV) price.

- Most ETFs track to a particular index and therefore have lower operating expenses than actively invested mutual funds.

- In addition, ETFs have no investment minimums or sales loads, unlike traditional mutual funds, which often have both. Most indexed mutual funds will not have sales loads.

Why Bharat-22?

To boost its disinvestment program,the government has set a target for disinvestment in 2017-18 at Rs 72,500 crore and so far approx Rs 9,300 crore has been realized through nine disinvestment transactions. BHARAT 22 will help the government in achieving its target.

The ETF mechanism has proven to be a smart, effective way for the government to help meet its disinvestment targets, a key factor to keep fiscal deficit under control. Earlier, when the government sold big stakes in individual PSUs, the stocks would invariably get beaten down in the run-up to the offer and also attract employee ire. The ETF route provides a neat workaround by letting the government reduce small stakes (2-3 per cent) in a big basket. Everyone’s happy, the state gets its money, investors get a piece of PSUs and employees are glad to stay under the PSU umbrella.

What is CPSE ETF?

The government has raised Rs 11,500 crore or so in three tranches through the CPSE ETF. The government had raised Rs 3,000 crore in March 2014 with the launch of its first Central Public Sector Enterprises (CPSE) ETF. an exchange traded fund of 10 PSUs. Subsequently, it raised Rs 8,500 crore through two follow-on offers of the CPSE ETF in FY 2017-18. Our article Reliance CPSE ETF : Central Public Sector Enterprises ETF disucssed the CPSE ETF in detail.

It comprised of 10 companies and their Weightings is shown in the table below.

CPSE is managed by Reliance Mutual Fund and its selling proposition was Invest in 10 Maharatnas & Navratnas at 5 per cent discount!

| Stocks | Sectory | Weighting |

| Oil & Natural Gas Corp Ltd | OIL | 24.51 |

| Indian Oil Corp Ltd | PETROLEUM PRODUCTS | 18.08 |

| Coal India Ltd | MINERALS/MINING | 20.68 |

| GAIL (India) Ltd | GAS | 11.25 |

| Rural Electrification Corp Ltd | FINANCE | 5.25 |

| Container Corporation of India Ltd | TRANSPORTATION | 5.08 |

| Bharat Electronics Ltd | INDUSTRIAL CAPITAL GOODS | 4.36 |

| Power Finance Corp Ltd | FINANCE | 5.62 |

| Oil India Ltd | OIL | 3.41 |

| Engineers India Ltd | CONSTRUCTION PROJECT | 2.28 |

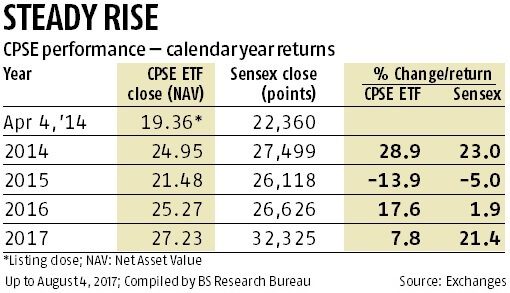

The performance of CPSE ETF over the years is shown in the image below. The retail investor’s experience with central public sector enterprises’ exchange-traded fund (CPSE-ETF) has been good. Except for a blip in the calendar year 2015, when the fund’s net asset value fell 14 per cent, returns in 2014 and 2016 were 29 per cent and 18 per cent, respectively substantially higher than the BSE Sensex’s returns of 23 per cent and 1.9 per cent for the corresponding periods.

About Bharat22 ETF

While CPSE ETF has only state-run companies as its constituents, Bharat-22 will give the government a shot at selling stakes in some of the private sector blue-chip companies as well, as it will include some holdings of SUUTI (Specified Undertaking of Unit Trust of India). SUUTI holds equity stakes in over 50 companies, including large holdings in L&T, ITC and Axis Bank, earlier held by the erstwhile Unit Trust of India before its breakup. SUUTI’s equity stakes in L&T, ITC and Axis Bank alone are valued at above Rs 50,000 crore.

ICICI Prudential AMC is the ETF manager for the fund and Asia Index Private Limited would be the index provider. The index will be balanced annually.

The ETF will have a diversified portfolio of companies from six sectors with a 20 per cent cap on each sector and a 15 per cent cap on each stock. Bharat-22 draws companies from six sectors, fast-moving consumer goods (FMCG), finance, energy, minerals, industrials, and utilities. Here is a list of stocks to be included in Bharat-22 with their weightings.

| S.No | Company | Sector | Ownership | Weight (%) |

| 1 | Larsen & Toubro | Industrials | SUUTI | 17.10% |

| 2 | ITC | FMCG | SUUTI | 15.20% |

| 3 | State Bank of India | Finance | Government | 8.60% |

| 4 | Power Grid Corporation of India | Utilities | Government | 7.90% |

| 5 | Axis Bank | Finance | SUUTI | 7.70% |

| 6 | NTPC | Utilities | Government | 6.70% |

| 7 | ONGC | Energy | Government | 5.30% |

| 8 | National Aluminium | Metals | Government | 4.40% |

| 9 | Indian Oil Corporation | Energy | Government | 4.40% |

| 10 | BPCL | Energy | Government | 4.40% |

| 11 | Gail India | Utilities | Government | 3.70% |

| 12 | Coal India | Energy | Government | 3.30% |

| 13 | Bharat Electronics | Industrials | Government | 3.30% |

| 14 | Engineers India | Industrials | Government | 1.50% |

| 15 | Bank of Baroda | Finance | Government | 1.40% |

| 16 | Rural Electrification Corporation | Finance | Government | 1.30% |

| 17 | NHPC | Utilities | Government | 1.20% |

| 18 | Power Finance Corporation | Finance | Government | 1.00% |

| 19 | NBCC (India) Ltd | Industrials | Government | 0.60% |

| 20 | NLC India | Utilities | Government | 0.30% |

| 21 | Indian Bank | Finance | Government | 0.20% |

| 22 | SJVN | Utilities | Government | 0.20% |

Sector wise distribution of Bharat-22 is shown in the image below

| Sector | Weightage | Num | Constituents |

| Industrials | 22.6% | 4 | L&T, Bharat Electronics, Engineers India, NBCC(India) |

| Finance | 20.3% | 6 | SBI, Axis Bank, Bank of Baroda, REC, Power Finance Corp, Indian Bank |

| Utilities | 20% | 6 | Power grid,NTPC,Gail(India),NHPC,SJVN,NLC India |

| Energy | 17.5% | 4 | ONGC, Indian Oil, Bharat Petroleum, Coal India |

| FMCG | 15.2% | 1 | ITC |

| Basic Materials | 4.4% | 1 | NALCO |

Should one invest in Bharat-22?

As in the past, the Government could throw in goodies such as discounts or bonus units to woo retail investor. Retail investors might expect to get some discount (may be 5%) as has been the case for CPSE ETF.

As the government is more focused on reforms, governance, and divestment, it is expected that Bharat 22 would give good returns to investors, who have a long-term investment horizon. Eventually, this fund would also represent the performance of India and the government’s agenda for the long term.

On the flip side, as the main reason for the attractiveness of PSUs in the recent years was a change in the government’s working pattern and policies towards the fiscal and monetary towards the fiscal and monetary performance. Any slight unenthusiastic changes in government policy may ruin the sentiment of the market participants and also the fate of the PSUs companies.

How to Subscribe to Bharat 22 ETF?

- You can subscribe in the same manner as you do for any IPO through ASBA. On listing, you can buy as you buy any other stock but you won’t get any discount after the listing.

- One must be KYC compliant in order to invest in this scheme.

- One must have a Demat account in order to invest in ETFs.

Related Articles:

- Reliance CPSE ETF : Central Public Sector Enterprises ETF

- Types of mutual funds: Are You Making Right Choices in SIPs

- Stock Market Index: The Basics

- Stock exchange : What is it, Who owns, controls it