Money makes the world go round. As a subject, Money is never taught in school or college.Words like basis point, inflation, CTC, 80C, 80CCF, Tax free bonds, Tax, Indexation, FMP, Mutual Funds, Fixed Deposits, ETF, Stocks,Capital gain sound like Greek and Latin. We don’t allow people to drive without taking a driving test yet we allow them to enter complex financial world without financial education. Once the realization dawns that we need to learn about finances we don’t have much clue or help or guidance, unlike school where we have a curriculum and know that we know to begin from (ABC, DoReMe). Personal finance books help to fill the void.

In our earlier post Personal Finance Books For Adults And Young Adults we covered personal finance websites, personal finance books with focus on “for the Indians, by the Indians, of the Indians“. Jagoinvestor :16 Personal Finance Principles Every Investor Should Know(earlier called Change your relationship with money), written by Jagoinvestor’s Manish Chauhan is the new book available for personal finance readers. It is based on the principle of personal finance.This article is about the book.

Table of Contents

About Jagoinvestor

Jagoinvestor.com is one of most widely read personal finance website in India(more than 18,000 readers). Since 2008 it is on a mission to demystify the world of Financial confusions. Manish Chauhan is Founder and Chief Blogger of Jagoinvestor. He is MCA by education, worked in Yahoo-Bangalore, but is now a financial coach based in Pune. His specific area of interest is teaching people how to simplify and strengthen their financial lives.

The Book

The book has 173 pages divided into 7 chapters. In words of author Manish Chauhan “The book is not about financial products and how they work. NO! You can get it anywhere. I have talked about very important and things. which really matter. It works on your thinking level and makes you think in a more quality way rather than just increasing your knowledge. I have tried my best to keep the language simple along with numerous examples and images/tables to convey the concept. I have written this book considering myself as the reader.” Let’s find out more about the book.

Chapter 1: Burning the jungle

This chapter is about the secret of wealth creation Start investing early. It answers “How much can saving a few thousands per month impact goals which require lakhs and crores“.“Early investing is very much like growing a tree…if you can take good care of it at the start, it will take care of itself later” . Instead of formulas which scare there are investment tables(one time investment, monthly investment) as a ready reckoner. These help you to find easily for how much you can generate by investing some amount for several years at different rates of return : 6%, 8%, 10%, 12% and 15%. Ex: 1000 Rs month saved for 20 years at 6% (Rs 2,40,000)return would Rs 4,64,351.

Advantages of early investing are explained with graphs and images. Even if you cut your contribution at the end of the tenure, it won’t affect the final corpus drastically.For example if you invest Rs 5,000 per month for 30 years at 12% interest (compounded monthly) you can generate Rs 1.76 crore. But if you only contribute for 20 years at end of 30 years you will still have Rs 1.65 crore! This is because of magic called compounding as you have put in enough effort in the start(taken care of money sapling) and given sufficient time to your investment(money tree) to grow. As investments made in early years form the main chunk of the final amount. And for those who haven’t started early book urges them not to loose time and provides ways to start NOW!

Our view: It explains one of the most important concept in wealth creation – Start investing early. Beautifully explained with tables and graphs.

Chapter 2: Have you protected your garden?

This chapter is about facing the unpleasant situation, what would happen to the family in case of untimely demise of it’s bread earner. It can happen to anyone, including us. God forbid if it happens have we taken enough protection or Life insurance. Just like buying a helmet while driving a two wheeler costs money and is inconvenient to wear but necessary so is Life insurance. It is an uncomfortable conversation and book shares an incident of asking a husband and wife to “Write down answers to tough questions” such as “I estimate that the monthly expense of my family will be ____ for the next _____ years. In case I am not around, this is where they will get income from “. The questions made husband and wife feel like Kumkaran coming out of sleep after decades(Kumkaran was brother of Ravan in Ramayana who used to sleep for six months at a stretch).

Book also helps you to find the right Insurance amount by providing tables such as how long the money will last under different scenarios, for example Insurance amount of 5 lakh can last for 4.3 years for a family with monthly expenses of Rs 10,000 or 10 months for a family with monthly expenses of Rs 50,000. After providing general and practical information about Life Insurance or Term Insurance, it answers the BIG mind blocking question Term insurance does not return the money.

Our view:It explains the need for term insurance, one of the most basic yet ignored! The tough questions scare you but makes one realize why she should not focus on not getting our money back in we live, it is a small price to pay for peace of mind. Calculating adequate term insurance amount through how much would money last is simple yet effective.

Chapter 3: Get Set Goal

This chapter focuses on getting the financial life in order by moving from “It happens” to Setting Goals. Just like shopping in a super market without a list makes us miss some things or we tend to buy items not really required, at times even overshoot our budget, so financial life without a plan makes us buy products which make headlines or to save tax etc. At-times before investing we do not even consider how long we plan to invest!(insurance schemes!). The book outlines the 180 degree change in the approach(the approach explained on Page 61 is paisa vasool- value for money). Setting the goals and it’s priority is the first step of the approach as the book says “Unless you know which port you are sailing to, no wind is favourable“. Linking the investment with goals in life keeps us more focused and breaking down into small promises makes them easier to achieve. Just like losing 25 kgs in a 1 year can be broken down into walk for 20 mins, 1 less pizza a month, exercise on Wed and Sat for an hour, similarly getting Rs 30 lakh in 20 years can be broken down to keeping aside Rs 100 per day or Rs 3000 a month, a small but achievable.

Our view: Most of personal finance book talk about goals but what sets this book apart is the change in approach required. As mentioned above the 180 degree change in the approach is an important paradigm shift. It is like putting horse in front of the cart rather than the other way round and if done would put our financial life on a fast track!

Chapter 4: Bursting your myths about money

This chapter focuses on bursting two popular beliefs or mis- conceptions “Equity is Risky” and “Debt is Safe”. The book provides lot of tables, graphs to prove that equity is risky in the short run but quite safe in the long run. For ex: Table about returns generated for different time frames with 30 year data from the year 1980 to 2010! , table and graph about best and worst return for different holding periods of 1 year, 2 years, 3 years. 5 years, 7 years, 10 years and 15 years. The book consider debt is not safe as it does not have strength to fight inflation which over long run erodes the purchasing power. Just like we eat balanced food our financial life should not be focused on one type of financial product, we need to strike a balance between debt and equity based on our comfort level and our stage of life called as asset allocation. This chapter outlines portfolio for different stages of life and also focuses on how to keep the portfolio balanced by rebalancing as per asset allocation plan.

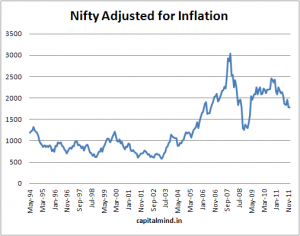

Our view:This chapter we found stresses a lot on proving why equity is not risky in the long term and not much on the risk profile of the person. There are all kind of investors – Conservative, Moderate, Aggressive irrespective of the ages (a 30 year old not investing in equity while a retired person investing in equity) which may be due to the past experiences and finding what kind of risk one is comfortable is missing from the book. DO NOT Blindly follow the typical portfolio suggested for different stages of life which stresses towards equity. Find your risk profile or as the book says comfort level first. Statistics can be made to prove anything or Torture numbers, and they’ll confess to anything(Gregg Easterbrook). For example we are told Invest in equity for double digit returns! Capitialmind’s article on Dec 9 2011, showed that In the 17 year period that the Nifty has existed, the return, net of inflation, is 55%. The long term return of the Nifty, net of inflation, is 2.6%. Ref:Nifty Adjusted For Inflation Returns Just 2.6%.

“Statistics are like a bikini. What they reveal is suggestive, but what they conceal is vital.” or “Do not put your faith in what statistics say until you have carefully considered what they do not say.” We have stressed it in our earlier article Fact or opinion:Do Due Diligence .

Note: This is not to say that don’ invest in equity or ignore the data. Data is absolutely correct and we totally believe in it. We personally have invested in stock markets and mutual funds. But do it after doing your homework- understanding the risks, market situation and the work,knowledge required to follow it. Statistics quotes on QuoteGarden, book Damned Lies and Statistics

Chapter 5: Change your relationship with money.

This chapter focuses on the passion and commitment required to build wealth. There are rare cases of having awesome financial life by chance,(winning lottery, getting BIG inheritance which sooner or later are spent. When Sushil Kumar won KBC his relatives left their job to enjoy Sushil’s wealth). The proven way of changing the financial life is to have a “Want to” attitude, commitment to find what you need,making correct choices, and USING IT! As book says “The fault is not in the stars…but the choices you make“. It also talks about Is paying for advice an expense or investment. We should be careful of free advice as it may turn out to be expensive in the long run. Focus on value and not the fee.

Chapter 6: Simplifying your financial life.

This chapter focuses on how information overload, complexity, takes away our focus and how we can simplify our financial life. – Use of technology and automation, Choosing less instead of more and Documentation management. Table about how much exposure a person can get by investing in 2,5, and 10 mutual funds (pg 134) is an eyeopener: if one invests in 2 mutual funds then one is exposed to 74 stocks out which 49 stocks or 85% are large cap. But if one invests in 10 funds then one is exposed to 131 stocks out of which 60 stocks or 80% are large cap. Simple portfolio (pg 136) is one of the greatest take-away from the book. Documentation management or organizing our financial documents is very important and the Master document is great starting point. The Commitments that we must keep in the financial life is awesome. If we follow them our financial life and hence our life would become much smoother!.

Our view:This chapter is the highlight of the book. Don’t abuse diversification. If we can de-clutter and organize our financial life make our financial life simple then our life would be great. Documentation management or paper work is a topic very close to our heart. And we were very happy to read about in the book. One thing which I did personally did after reading the chapter was consolidatedmy dates for the bill and decided to pay all my bills only twice in the month instead of on-demand.(I don’t do ECS but pay bills through netbanking as I want to fully understand why I am paying the amount, it forces me to go through my bills) Just doing it made me feel less stressed!

Chapter 7: 10 things to do to make your financial life awesome.

As the name suggests this chapter is about 10 commandments that we should incorporate in our financial life.

- Don’t invest just to save tax

- Start living with just 90% of your salary

- Control excessive leverage and careless spending

- Invest in great things other than financial instruments

- Become the CEO of your financial life and deliver performance

- Don’t fall prey to instant gratification in your financial life

- Teach your spouse & Kids about money

- Focus on action, don’t let little things get in the way

- Redefine “budgeting” as “priority spending”

- Look at the value or real return of a product.

Our view: This chapter is about the simple, basic things something like common-sense(which we all know how common it is!). Each of these is a gem. A paisa-vasool chapter!

Note: We believe in teaching kids about money-building the foundation. If you want to teach kids about basics of money: banks, Credit card you can download our FREE ebook or the appropriate chapters from our website

Overall

The book stays true to it’s vision. It is not about the financial products but about financial principles.As the book says Financial products will change, Personal finance tools will change, Financial planning models will change, Strategies RARELY change and Principles NEVER change. The language is simple supported with great quotes, tables, charts, graphs etc. Every chapter ends with Flashback learning which recapitulates the essence of the chapter and 2 Hour Action plan to make one apply the concepts learnt. At Rs 499 it might seem a tad bit expensive. But if order at flipkart or crossword you get it discount. Publisher Network 18(The CNBC people) prints usually hardcover copy. I wish they would take out a cheaper paperback version. But the quality of book is awesome and illustrations mind-blowing . Infact my seven year old son liked them so much that he went through the book asking me to explain them.

There are some errors in book: Ex on Page 6: It says Rs 3400 investment required per month to generate 5 crores in 35 years, assuming a 12 % return. At 12% return it would come out to be Rs 2.20 crore. Only If the returns are 15 % then one can get over 5.05 crore. For calculations check out investmentyogi SIP calculator(Enter 1 for initial amount ) . But well chand mein bhi daag hota hai(even moon has a spot)

A book is the most effective weapon against intolerance and ignorance and as Christopher Morley said “When you sell a man a book you don’t sell him just 12 ounces of paper and ink and glue – you sell him a whole new life”. The worth of a book is to be measured by what you can carry away from it and consolidating my bills to twice a month made this book an instant paisa-vasool for me. If you can learn even one thing from the book(and there are many gems in the book) it would be worth it! And for the readers of the book there is also a free gift kit (mentioned on Pages 132, 140)

If you are wondering, If I follow jagoinvestor should I read the book or wouldn’t following jagoinvestor be sufficient? We would still recommend you to read the book. If you are a follower of jagoinvestor you are familiar with how Manish makes every concept simple enough for readers. Yes some parts of the book have been covered in various articles at jagoinvestor such as:Creating Wealth for Long Term through Equity, 4 Charts which will change your perception about Equity, Why people dont like Term Insurance and why they are wrong. In the book Manish has added more graphs, tables and illustrations which explains the concept beautifully. In writing an article one is constrained by length of article, lack of good illustrations among other things and printout of the article is a poor substitute of the book! But Please note it is aimed for concepts of personal finance and not about any product!

First chapter online: Now you can read first chapter of the book here or here (pdf)

Disclaimer: Other than following jagoinvestor.com we are not related or affiliated to jagoinvestor ,Manish Chauhan, moneysights or CNBC 18. We bought the book from flipkart and have tried to share our views. This is for informational purpose only.

More reviews and ratings about the book at flipkart.com , About the book at jagoinvestor.com

Did you find the review helpful? Did we miss out anything? Did you read the book? What was your Wow moments from the book? We would love to hear your views.

I will tell you the secret to getting rich on Wall Street. You try to be greedy when others are fearful. And you try to be fearful when others are greedy. –Warren Buffett

Another Book Book on Investment Planning ” Investment Planning : Turn Your Money into Wealth” written by Ankit Gala & Khushboo Gala. Published by Buzzingstock Publishing House. A Must Read book for all investors

The review is really done in detail and it really will help many people to go for their own copy.

Thanks Nandish. The more people read the book and then apply the learnings from the book would smoothen their financial life. The book rocks!

Thanks for the detailed review 🙂 … and your views after each chapter is really appreciated 🙂

Manish

Thanks for commenting. We feel honored, we have been following your blog for a lon..g time. Thanks this review gave us an opportunity to not only read but also understand the concept which are basic and one needs to revise them again and again!

Excellent review. Waiting for my copy,btw.

Thanks. Let us know once you read it. We can then share notes!

Justgrowmymoney

When did you order it , how many days are passed ? Flipkart , generally ships in 1-2 days !

Manish

I ordered it from flipkart and it was delivered in one and half day. I stay in Bangalore.

Hi

I am a regular reader of jagoinvestor. Very good review. I have even presented this book for many of my friends. Very good book Manish !!! hats off!!!

Thanks Vignesh. Yes jagoinvestor is great personal finance website and his book rocks. Your friends are indeed very lucky to have a friend like you.

very comprehensive book review this one

Thanks Sujatha. Let me know if you buy the book!