It is said that 70% of lottery jackpot winners go broke within a few years. This proves that it isn’t the lack of money that is the problem. If you don’t have a system for properly managing the money you have, making more will only mean you will have more money to mismanage. Why people don’t like making the Budget? Why does the traditional approach to budgeting fail? Is there another method of budgeting?

As important as this is, many still don’t use a budgeting system for organizing their expenses. I remember reading an article on a survey taken a few years ago that concluded that only about 30% of people actually keep a budget.

I think a big part of the reason why many don’t bother keeping a budget is that they find it to be too limiting. They can’t ever truly stick to it because in the real world there are just too many unknowns and things that happen unexpectedly.

When many talk about “budgeting”, they are mainly referring to what is widely known as the Envelope system. This traditional approach to budgeting is nothing more than allocating your monthly income to different categories and sticking to the plan of what you will spend on each.

I like to think of this approach as present-based budgeting because you’re only ever looking at the current month. This is the approach taken by budgeting systems like Mint and YNAB.

What happens when something unexpected comes up and you end up having to “break” your plan and go over-budget? Not only does it make you feel like you have failed, but the system also does not tell you how going over budget in this current month will actually affect you months down the road.

What I want to know is what impact will what I spend now have on my money in for example, 6 months. What if I have to spend an extra $500 or Rs 10,000 this month on something I wasn’t planning to spend money on? Is my checking account going to have a negative balance at the current pace of my spending?

This other approach of forecasting your account’s cash flow is what I sometimes refer to as future-based budgeting. Rather than just creating a budget plan for the current month and hope you can stick to that plan, when you forecast your cash flow you are watching your future account balance and making sure it doesn’t go negative while paying your bills.

If you find the more traditional approach difficult to stick to, you may prefer the future-based approach of managing your expenses. For this, you have the option of using web-based services such as Kualto. Another option would be to create a spreadsheet that looks ahead at least 12 months and that calculates the beginning and ending balance of each future week so you can see how your spending today will affect that balance in the future.

Video on Why one hates Budgeting?

How to Budget?

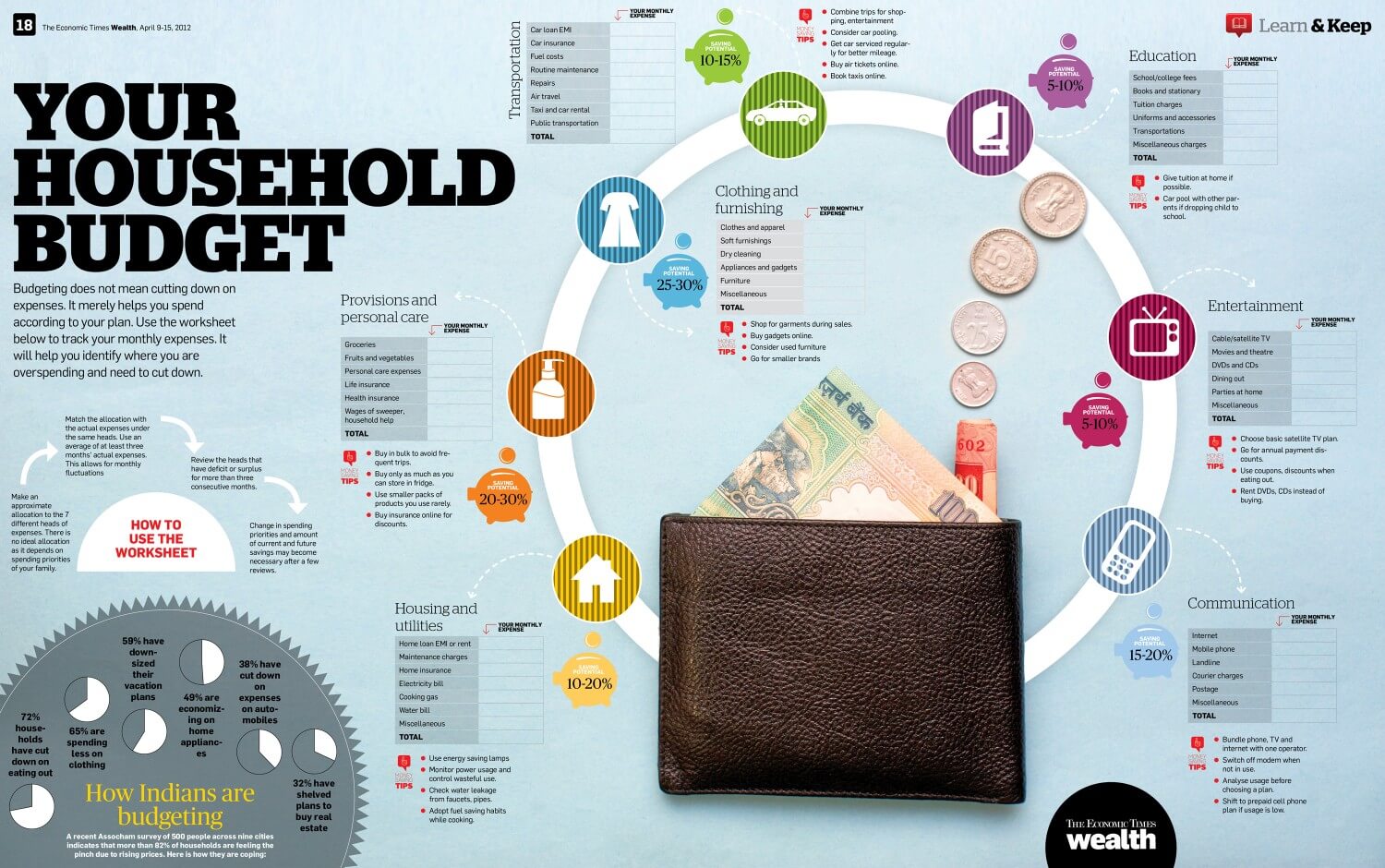

This infographic from ET Wealth gives a rough idea on How to make your household budget,

Related Articles:

- Money App to help you track your Spendings: ETMoney App, Qkly etc

- Learn Importance of Struggle: Gujarati billionaire Savji Dholakia to his son

Do you make a budget? If not why? Have you tried budgeting? Which approach did you use?

Mala maza uan number mahit nahi. Ani maza register mobile number chenge bandh zala ahe.tya mule mala uan mahit nahi. Pls mala mazya uan number chi mahiti kashi milel te sanga.

6376834266

UAN no Active

Dear sir/Madam

Wish to inform you that I had requested for withdrawal of my pf amount of UAN 100089524960 on 31st Oct 2018, till now I have not got settlement amount, the status for the same is showing as pending for approval.kindly look into it.

Sir,i have applied to claim of my pf amount of uan 100625158205 on dt 6.10.18 till date not recieved any information.