One may have been allotted multiple PAN Numbers. Those who have more than one PAN should immediately apply for surrender of additional PAN numbers allotted to them as having more than one PAN may make them liable to a penalty of Rs. 10,000. Income Tax Department in Feb 2017 has started deactivating PAN. So please surrender any additional PAN that you have. This article talks about Deactivation of PAN by Income Tax Department for more than one PAN, how to surrender or cancel PAN manually and through Online.

PAN is very important. Thinking of buying a car? Or taking a new phone connection? Making an investment? Well, there’s one detail you need to quote for all, and that’s your Permanent Account Number (PAN). Required for an ever-widening gamut of transactions, a PAN card is a must these days. Our article What is PAN Card? explains it in detail.

Table of Contents

Deactivation of PAN by Income Tax Department for more than one PAN

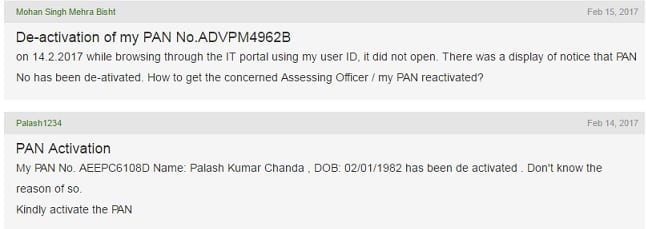

The income tax department in Feb 2017 has started de-activating PAN of income tax payers who were allotted more than one PAN in the past. Unfortunately, in many cases, the PAN which is deactivated is the PAN on which the assessees are filing their income tax returns as shown from the image below from Complaint Board website. You can get the deactivated PAN active again by writing to Jurisdictional Assessing Officer(explained below). It takes at least 10-15 days for the Income Tax Department for re-activating the PAN after submission of the letter to ITD.

How to get the PAN activated?

Once, the PAN is de-activated by the income tax department, the income tax e-filing login of the assessee also gets blocked and the PAN holder is not able to do anything on the Income Tax e-filing portal such as filing of Income Tax Returns, view intimations and respond electronically to various communications by the ITD. If your Permanent Account Number (PAN) is de-activated then you need to do the following:

- You need to write a letter to your jurisdictional AO in the Income Tax Department for activation of your PAN. Our article How to find Jurisdictional Assessing Officer : Income Tax explains how to find the Jurisdictional Assessing Officer in detail.

- Following documents need to be attached to the letter for activation of PAN:

- Indemnity Bond in favour of the Income Tax Department.

- The copy of PAN on which the PAN holder is regularly filing the Income Tax Return.

- The copy of last three years Income Tax Returns filed on the PAN de-activated.

Format of Indemnity Bond for reactivation of PAN

An indemnity bond or a surety bond protects the person or company holding the bond from financial loss.

Indemnity Bond – PAN

I, _____________________, R/o____________________, do hereby solemnly affirm and declare as under:

- My PAN is:

- I am regularly assessed in your ward/jurisdiction with PAN: ___________________.

- I have only one PAN i.e ________________ which is used for last many years for filing my income tax returns.

- I do not have any other PAN with me, if any allotted in your records, kindly deactivate the same.

- I undertake to indemnify the income Tax Department for any loss that may be caused in the future.

- Kindly activate my PAN: ___________________.

That the above statements are true to the best of my knowledge and belief.

(Deponent)

VERIFICATION

Verified at <place> on this ________________ day of <month>, 2017, that the contents of the above affidavit are true and correct to the best of my knowledge and belief. No part of it is false and nothing material has been concealed therefrom.

(Deponent)

Ques: I have received online intimation/mail regarding cash deposits during demonetization, how do I respond if my PAN is de-activated and I cannot login to the e-filing portal?

Ans: If you have received any intimation from the ITD for which an online response needs to be filed but your e-filing login is blocked then you need to approach your Jurisdictional AO for activation of your PAN ASAP as stated in the previous question.

As the re-activation of PAN by ITD takes some time, therefore you can respond to the intimation manually by filing a response/letter to the jurisdictional AO.Although, you might have filed the offline/manual response to the AO but you still need to ensure that you file the online response to the intimation as soon as your PAN is re-activated.

When does one end up with more than 1 PAN Number?

Keeping two PAN numbers is a punishable offense under Income Tax Act and you may be levied with a fine of up to Rs 10,000. One may end up with multiple PAN for many reasons. For example, one may have applied multiple times for allotment of PA . For example,

- I applied for a PAN CARD many days back. But I didn’t receive the card. So I applied for a new card. I got it in few days. After some days I received another card which I had applied earlier. What should I do?

- My PAN card got lost & I registered a FIR for that. After that I applied for another PAN card(fresh application) [One should have applied for issue of a new PAN card. Our article When you loose your wallet, Credit Card, PAN Card, Driving License covers it in ]

In example 1, there are two different things. A Permanent Account Number (PAN) and a PAN Card.

You have two PAN Cards.

- Check if both the cards have the same PAN Number. If the number is same, you are good. You don’t have to do anything. You can keep both the cards.

- If the PAN number in both the cards are different, then you will have to surrender one of the PAN Number as soon as possible.

Which PAN number to cancel?

Cancel the PAN which you do NOT use.

How to surrender or cancel PAN number if you have more than 1 PAN?

The application can be done either through NSDL portal or the UTI. There are many ways to surrender the duplicate PAN Number.

- Manually Submitting the Application for PAN to Jurisdictional Assessing officer.

- Submit Form 49A for change/Correction in the correction in PAN

- Online Application on NSDL and UTI

Fees to be paid while submitting the form for Request for New PAN Card or/and Changes or Correction in PAN data are

- If the communication address is within India, the fee for the processing of PAN application is 107 (93 +15% service tax).

- If communication Address is outside India, then the fee for the processing of PAN application is 994.00 [(Application fee 93.00 + Dispatch Charges 771.00) +15% service tax].

The PAN that you are using should be clearly mentioned or specified on top of the form.

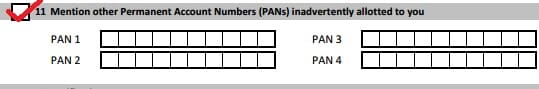

Mention other Permanent Account Numbers (PANs) inadvertently allotted to you should be mentioned in the appropriate section and the copy of corresponding PAN card(s) to be submitted for cancellation with the form.

Manually Submitting the Application to cancel PAN to Jurisdictional Assessing officer.

- Write a letter to the assessing officer under whose jurisdiction you have been filing your returns.

- The letter must contain details such as your name, contact details, details of the PAN Card to be retained, details of the duplicate PAN Card(s) which you need to surrender, etc.

- Keep the acknowledgment copy of the letter that you have filed with the I-T department, stating that you are surrendering your additional PAN. That is sufficient as proof of surrender and no additional confirmation from the I-T authorities is required.

Manually Submit Form 49A for change/Correction in the correction in PAN

Manually Fill the Form No. 49A for change/Correction in the correction in PAN and submit the same at your nearest UTI PAN centers or NSDL TIN Facilitation centers. Fill the section in the form(section 11) where you can fill the additional PAN number you want to cancel as shown in the image below. Tick the checkbox in the section(shown by red). Fill in details about additional PAN.

PAN correction form from NSDL to download the form for correction in PAN card.

OnlineApplication to surrender/cancel additional PAN on NSDL

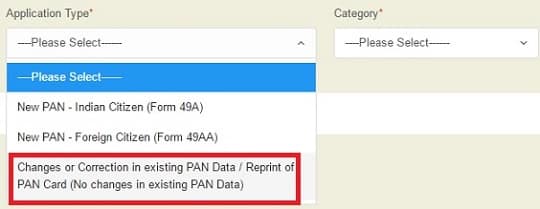

If you want to apply online by yourself, use this link to NSDL portal: https://www.onlineservices.nsdl.com/paam/endUserRegisterContact.html Choose the application type as the request for change/correction in the existing PAN card.

OnlineApplication to surrender/cancel additional PAN on UTI

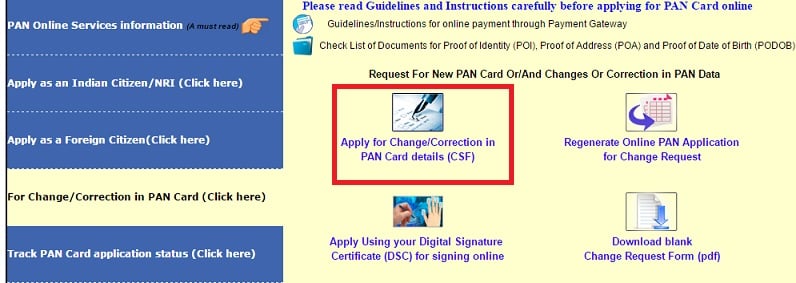

If you want to apply online by yourself, use this link to UTI portal: https://www.utiitsl.com/UTIITSL_SITE/site/pan/index.html Click on

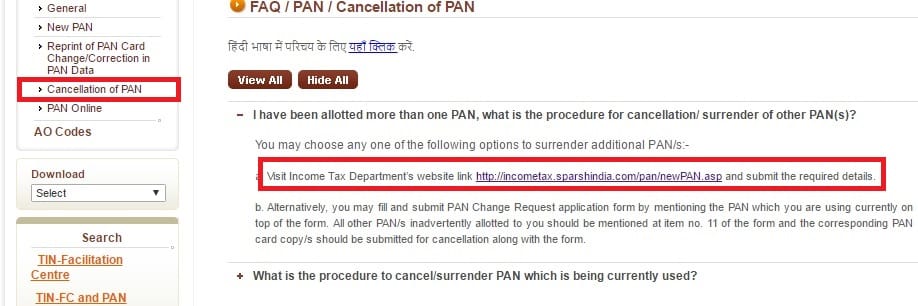

Site for Cancellation of PAN sparshIndia does not exist

TIN NSDL link for Cancellation of PAN or Googling shows the site http://incometax.sparshindia.com/pan/newPAN.asp But the site does not exist.

Related Articles:

- What is PAN Card?

- When you loose your wallet, Credit Card, PAN Card, Driving License

- How to find Jurisdictional Assessing Officer : Income Tax

CAN ANY ONE PROVIDE THE DUPLICATE PAN CARD SURRENDER FORMAT.WITH PROPER CAPTION OR FORMAT.

MAIL ME. haider.ali450@gmail.com

Is indemnity bond for reactivation of PAN card needs to be given on non judicial stamp paper

Dear team,

I just now that i am holding multiple PAN account while i was applying PF online occur ”error” please guide me to cancel old pan no. It might made through temporary sitting out side market earner I told them to reissue my PAN card due to misplace so he issued new one kindly advise..for future no problem to me.

IRFAN JINNAH

8898685003

It happens that one ends up having multiple PANs.

I hope you have not used the new PAN.

Currently, the online way to submit duplicate PAN is not working.

We have raised it on twitter account of Income Tax department. You can see the tweet here.

You can follow the reply or go the offline way

Multiple PANs in same name may creating issue in getting loan in future. Please get one cancelled immediately. Read the whole process to return dual pan: http://sagarsvt.blogspot.com/2018/09/how-to-surrender-duplicate-pan-card.html

What to do If My Accessing officer not Cancel My Another PAN from income tax Dept. Record Because without this Cancellation NSDL Unable to allot my original PAN. Anyone Have idea what to do???

Why cannot you use your earlier PAN?

What reason is Assessing officer giving you for not cancelling the PAN

I have surrendered one of the PAN Card alloted to me. How do i check if that has been deactivated or not?

can u provide format for indemnity bond for re activation of PAN?

kindly email it to thakurnishu39@gmail.com

Thanks in advance.

We agree with the points mentioned above. People easily apply for the second PAN card when their first one isn’t delivered to them. That’s however a bad practice because you could end up in jail for doing this.

can u provide format for indemnity bond for re activation of PAN?

kindly email it to catarunsethi@gmail.com

Thanks in advance.