At the time of investing in a mutual fund, it is mandatory to provide bank account details. If there is a change in the bank account details, it is essential for the investor to register it with the mutual fund to ensure that dividends and redemption proceeds are credited to the new operational account. Investors can change the details by submitting a change of bank mandate form, along with supporting documents, at the mutual fund office or investor service centre. This article explains on how to change the bank account details for mutual funds.

Table of Contents

What form needs to be submitted for change in bank account details in Mutual Fund?

Change of Bank Mandate Form of the mutual fund needs to be submitted at the mutual fund office or investor service centre. You can see the Change of Bank Mandate form of HDFC Mutual Fund(pdf), Franklin Tempelton (pdf)

Why would one change bank account details?

One might be closing the account or would like to have investments from one account only hence change the bank account.

Is process different for lump Sum investment or earlier investments through SIP or existing investments through SIP?

No process is similar though forms of exiting SIP and earlier investments may be different.

I want to redeem my mutual funds and bank has changed, then do I need to submit Change of Bank Mandate?

Any unregistered bank account or a new bank account mentioned by the Unit holder along with the redemption request may not be considered for payment of redemption/dividend proceeds.

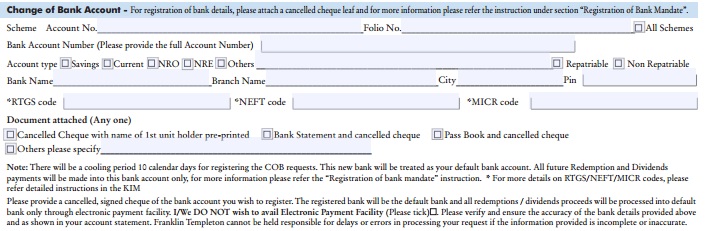

What information needs to be filled in the Change of Bank Mandate?

- Folio Number : Folio number is a unique number identifying your account with the mutual funds.

- Scheme Name and Plan : Name of the Scheme of Mutual Fund and Plan (Growth, Dividend) etc.

- Individual or All:Whether change of Bank Mandate is for a particular scheme in the Folio or all Scheme’s in the Folio.

- Signature: The form has to be signed by all the holders of the folio according to the mode of holding. If Single only First Account holder, if Joint then all the holders.

The change of bank mandate of Franklin Templeton is shown below. For others it is similar.

What is Folio Number ?

A folio number is a number given to a mutual fund investor by an asset management company.

- This number is unique for each fund house. So, when you invest for the first time in XYZ fund you would get a folio number that’s different from the folio number given to you when you invested in ABC fund.

- Like a bank account number, the folio number can be used as a way to uniquely identify fund investors and keep records of items such as how much money each investor has placed with the fund, their transaction history and contact details.

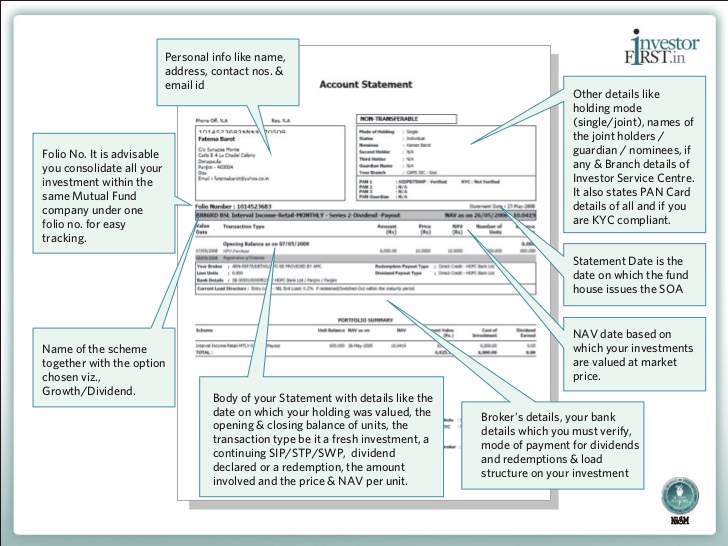

- This applies only to existing account holders If you are an existing investor in the fund , then you will find the folio number in the investment certificate or the statement from mutual fund as shown below. (Click on the image to enlarge)

- Most fund houses offer one folio number and several account numbers in the same folio for all investments made under the same unit-holder combination. This makes tracking all your investments with same fund house easier.

- You may not be able to have a single folio number for all mutual fund houses. But a folio number given by the respective fund house can be used for all the later investments in the same asset management company.

- A single folio number would ensure a single account, a single password for online and the convenience of checking the entire portfolio with a fund house, history of buying and selling on a single page.

- If a single folio number is quoted an investor would not have to go through the know-your-customer (KYC) norms every time an application is made. An allotment of a folio number means that the identity of this investor has been checked earlier and the KYC process would be less stringent the next time you invest with the same fund house.

Where does one need to submit Change of Bank Mandate Form?

In order to make any changes in bank details, you need to submit documents in physical form to nearest collection center ( mutual fund office) or registrar such as CAMS or KARVY.

What else has to be submitted along with Change of Bank Mandate Form?

Along with filled Change of Bank Mandate Form one needs to submit

- Cancelled original cheque leaf of the new bank account

- Cancelled original cheque leaf of old bank account(one that is currently registered and you want to change it) with the Mutual Fund

Cancelled cheque should have the account number and first unit holder name is printed on the face of the cheque. A cancelled cheque is held as proof of holding an account. The mutual fund people need to know your account number and MICR code.They need the cheque to be sure that they never go wrong about your Account.

What is cancelled cheque?

A cancelled cheque is nothing but a cheque bearing the account number and account holder name which has an inscription Cancelled across it as shown in image below.

What if one cannot provide cancelled cheque?

If name is not printed on the original cheque, the Unit holder may submit a letter from the bank on its letterhead certifying that the Unit holder maintains/maintained an account with the bank, the bank account information like bank account number, bank branch, account type, the MICR code of the branch & IFSC Code (where available).

In case of non-availability of any of these documents, a self attested copy of the bank pass book or a statement of bank account with current entries not older than 3 months having the name and address of the first unit holder and account number.

Note: The above documents shall be submitted in Original. If copies are furnished, the same must be submitted at the ISCs where they will be verified with the original documents to the satisfaction of the Fund. The originals documents will be returned across the counter to the Unit holder after due verification. In case the original of any document is not produced for verification, then the copies should be attested by the bank manager with his / her full signature, name, employee code, bank seal and contact number.

When should one submit the Change of Bank Mandate?

It is desirable to submit their requests for change in bank details at least 7-10 days(for SIP around 30 days),depending on mutual funds, prior to date of redemption or dividend payment, if any and ensure that the request for change in bank mandate has been processed before submitting the redemption request. If change in bank mandate has not been processed, payment will be made in the existing bank account registered in the folio.

Can request for change of bank mandate be rejected?

In the event of a request for change in bank account information being invalid / incomplete / not satisfactory in respect of signature mismatch/document insufficiency/ not meeting any requirements, the request for such change will not be processed. Redemptions / dividend payments, if any, will be processed and the last registered bank account information will be used for such payments to Unit holders.

Refrences: DNA Use a single folio number for MF investments. It helps, EconomicTimes How to change bank mandate in Mutual Fund

Related Articles:

- Direct Investing in Mutual Funds

- Not All Mutual Funds Do Well -the Laggards

- Investing in Mutual Funds for Beginner

- Number of Mutual Funds

This article discusses on how to change a bank mandate for mutual funds. Have you changed the bank account for Mutual Fund? How was the process?

Another useful information to keep in mind.

Another useful information to keep in mind.