In Budget 2017,Finance Minister Arun Jaitely has proposed to change the base year to calculate the indexation benefit from 1981 to 2001 in the budget. The change in the base year is across all asset classes but the impact would differ across assets that enjoy indexation benefit on long-term capital gains—real estate, unlisted shares, gold and bond funds. This article talks about Fair Market Value of asset, What is Indexation, What is Base Year, Example of Impact of Change of Base Year on the calculation of Long Term Capital Gains.

Table of Contents

Overview of Change in Base Year and Capital Gain Calculations

Till now, capital gain was calculated with 1981 as the base year. This means that the purchase price of an asset bought before 1 April 1981 could be calculated on the basis of the fair market value of 1981.

Now on, the purchase price will be calculated based on the fair market value of 2001. Accordingly, capital gains on assets acquired before 1 April 2001 will also be calculated using fair market value as on 2001.

Gains from the sale of immovable property (land or building) after a holding period of 2 years will now qualify for long-term capital gains. Earlier this was three years.

Long Term capital gain tax would decrease if Fair Market Value of the property is more than indexed cost between 1995 and 1981. Long Term capital gain tax would increase if Fair Market Value of the property is less than indexed cost between 1995 and 1981.

Fair Market Value of Asset

Fair market value (FMV) is an estimate of the market value of an asset such as property or gold, based on what a knowledgeable, willing, and unpressured buyer would probably pay to a knowledgeable, willing, and unpressured seller in the market. Fair market value differs from the value that an individual may place on the same asset based on their own preferences and circumstances.An estimate of fair market value may be founded either on precedent or extrapolation or a formal valuation by certified Valuer.

From Income Tax Rules on Fair Mair Market Value for objects other than house/land/building valuation of jewellery,(i) the fair market value of jewellery shall be estimated to be the price which such jewellery would fetch if sold in the open market on the valuation date;

(i) the fair market value of jewellery shall be estimated to be the price which such jewellery would fetch if sold in the open market on the valuation date;

(ii) in case the jewellery is received by the way of purchase on the valuation date, from a registered dealer, the invoice value of the jewellery shall be the fair market value;

(iii) in case the jewellery is received by any other mode and the value of the jewellery exceeds rupees fifty thousand, then assessee may obtain the report of registered valuer in respect of the price it would fetch if sold in the open market on the valuation date;

The most common method to calculate the fair market value of a property is to figure out what similar properties were selling for at that time. This type of information can be ascertained from the registration offices. A little bit of home work would be required. Since no two properties would be exactly the same, some intelligent guesswork would be required. Property valuation is based not only on the property size but the location, improvements, amenities etc. So comparable method can be used as a guideline and then add or subtract accordingly. If this sounds complicated, then there is a simpler method. Use a valuer

Government Approved Valuer: There are government approved property valuers in most major cities. you can hire a valuer to ascertain the fair market price of the property and provide you with the documentation of their evaluation.

What is Indexation?

Indexation refers to the adjustment in the purchase price of an investment for the inflation rate during the period for which it was held. This inflated cost is considered as the purchase price while computing the gains arising from the sale of the asset from the taxation perspective.

This benefit is available after holding period of three years(changed for 2 years in Budget 2017) for property sale, and after three years in case of sale of unlisted shares, gold and debt funds. The Cost of Inflation Index notified by the Income-tax Department every year is used to compute this indexed cost of any asset.

For instance, assume you bought a property in June 2005 at a price of Rs 40 lakh and sold it for Rs 1 crore in December 2016. While your actual capital gains stand at Rs 60 lakh(1 crore 40 lakh), you can index the acquisition cost as per the rate of inflation during this time to arrive at the inflation adjusted capital gains.

- Considering that the CII for the year of purchase (2005-06) as notified by the tax authorities is 497 and that for the year of sale, 2016-17, stands at 1125.

- The indexed cost of the property comes to around Rs 90.54 lakh (Rs 40 lakh *1125/497).

- This translates into lower capital gains of roughly Rs 9.46 lakh on the sale. The investor will be taxed at 20% on Rs 9.46 lakh resulting in a liability of Rs 1.89 lakh.

- Without indexation benefit, the liability would be Rs 12 lakh (20% of Rs 60 lakh).

Base Year

Till now, capital gain was calculated with 1981 as the base year. This means that the purchase price of an asset bought before April 1, 1981 could be calculated on the basis of the fair market value of 1981. Now on, the purchase price will be calculated based on the fair market value of 2001. Accordingly, capital gains on assets acquired before 1 April, 2001 will also be calculated using fair market value as on 2001. This will accordingly change the computation of capital gains, but with results. Please note that investors have the option of considering either the fair market value or the cost of acquisition for computing capital gains. Choosing the higher value would result in the lower tax.

Fair market value of assets bought before 1st April 1981 was based on the valuation report of a registered valuer. There has been a considerable hardship in determining this fair value since it depends on a period which is more than three decades old. Therefore the government has decided to shift the base year to 2001. So if an asset bought before 2001 is sold in FY 2017-18 or later, its cost will be its FMV on 1st April 2001.

Those who are holding onto inherited shares or gold bought many years ago also get a free pass on tax on capital gains made till 1 April 2001. However, even though the capital gains liability till 1 April 2001 has been reduced to zero, the actual impact on those holding gold will be marginal at best. This is because gold prices mostly held steady until the turn of the century, with much of the gold price appreciation happening only after 2007-8.

Those holding unlisted shares, on which no securities transaction tax (STT) has been paid, are likely to benefit more due to a lower capital gains tax incidence. If the price of gold or shares went up between your date of acquisition and 1 April 2001, you can consider the fair market value as on 1 April 2001 as their purchase price to enjoy a lower tax burden. If not, you can consider their actual purchase price as cost of acquisition.

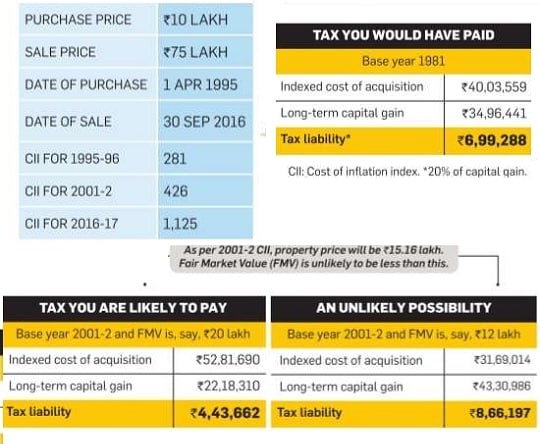

Mostly the property owners who would benefit from this revision in the base year. This is because the inflation rate in property market between 1981 and 2001 is not captured in the current index. For one, between 1981 and 2001, the index has jumped four times from 100 to 406 whereas property prices have surged 10 times in the same period. The shift in base year will help align the index with the actual rise in property rates, and help investors get the full benefit of indexation. The following image shows the different scenarios which is explained in detail in the example later in article.

Example of Impact of Change of Base Year on calculation of Long Term Capital Gains

For instance, assume you bought a property on Apr 1, 1995, at a price of Rs 10 lakh and sold it for Rs 75 lakh on 30 Sep 2016. CII of various years is :CII (1995-96): 281, CII (2001-02): 426, CII (2016-17): 1125

CURRENT SCENARIO with Base year as 1981

- Time between Purchase and Sale Price : 21 years 188 days and Gain Type: Long Term Capital Gain

- Difference between sale and purchase price: 7400000(74 lakhs)

- CII of the Purchase Year: 1995 month: Apr: 281

- CII of the Sale Year: 2016 month: Sep: 1125

- Purchase Indexed Cost:40,00,355.87(10,00,000 * 1125/281)

- Long Term Capital Gain (Difference between sale and indexed purchase price): 34,96,441 (75 lakhs – 40.00355 lakhs = 34.96 lakhs)

- Long Term Capital Gain Tax with indexation (at 20%): 699,288 (6.99 lakhs)

If we look at the CII of 1981 and 1995 the indexed property price in 1981 is 15,16,014.23(10,00,000 * 426/281) (15.16 lakhs)

- Indexed Cost of acquisition : 52,81,690(20,00,000 * 1125/426) (52.81 lakhs)

- Long Term Capital Gain: 2,218,310 (7500000 – 52,81,690) (22.18 lakhs)

- Long Term Capital Gain Tax with indexation (at 20%): 443,662 (4.43 lakhs) which is less by 255626 from capital gain calculated earlier 699,288

- So TAX LIABILITY has come down due to change in Base Year.

- Indexed Cost of acquisition : 31,69,014.085(12,00,000 * 1125/426) (31.69 lakhs)

- Long Term Capital Gain: 43,30,985.915 (7500000 – 31,69,014.085) (43.30 lakhs)

- Long Term Capital Gain Tax with indexation (at 20%): 8,66,197.183(8.66 lakhs) which is more by 1,66,909.183 from capital gain calculated before change in base year 699,288

- So TAX LIABILITY has gone up due to change in Base Year.

Sir/Madam,

A senior citizen aged 77 years sold her property which was purchased in 1985 and 1991 in 2018.

One cost 2,400/-in 1985 and sold for Rs 2,40,000/- and other cost 10,000 in 1991 sold in 2018 for 5,00,000/- what shall be capitl gain and tax to be paid .

From Where we can find the Circle rate of Greater Kailash 1 for 2001?

Kindly send me the link, please.

Thank you very much for your help and guidance.

Valuers registered under income tax are the professional valuer and their valuation is acceptable under the provisions of Income Tax Act.

As you have taken the help of authorised valuer of IT dept use the recommended values for calculating tax gain. If you take 1.98 lakhs tax would be more but if you take 26.77 lakh then tax would be less.The higher capital gain will mean more capital gains tax.

Dear Sir,

I purchased 1800 sq ft of land in urban area in January 2012 through registered sale deed. The registration value of the land was Rs 1.98 lakhs despite the fact that I paid Rs 19.80 lakhs. I completed construction of a two storied residential house over it in March 2013 with expenditure of Rs 62 lakhs. Now due to family problems I want to sell it. As I don’t have all the receipts in support of the expenditure I requested the authorised valuer of IT Department to make valuation of the property. He has reported that the total valuation of the property is Rs 60.17 lakhs as on March 2013 out of which Rs 26.77 lakhs is cost of the land due to its proximity to the National Highway and rest Rs 33.4 lakh is cost of the two storied house with boundary wall. Kindly enlighten if the value of land will be taken as Rs 1.98 lakhs or as Rs 26.77 lakhs while calculating the long term capital gain.

Kindly try to help’

Yours Sincerely

S Patel