On 10th February 2016, the Ministry of Labour and Employment, Government of India, changed norms on withdrawal of provident fund (PF). Now, you would NOT be able to withdraw your full EPF corpus in any circumstance before the retirement! Lets look at changes in the rules for EPF announced and see how it affects the employees.

Government on 19 Apr 2016 has withdrawn the controversial provident fund (PF) withdrawal norms that had restricted complete withdrawal from PF account before the retirement age of 58 years, bowing to pressure from trade unions. This is the second major stepback by the government on provident fund in less than two months and comes close on the heels of it withdrawing the budget announcement of imposing tax on withdrawal from Employee Provident Fund (EPF) account. EPF Circular for this.

Government on 18 Apr 2016 has deferred the rule till Jul 31 2016. Facing protests in several parts of the country, the government kept in abeyance for three more months the proposed move to bar withdrawal of employers’ contribution to the provident fund corpus until an employee attains the age of 58. The proposal to amend the scheme to allow all accumulations on different grounds like purchase of house, serious illness, marriage and professional education of children, has been sent for vetting by the Law Ministry.

EPFO on 1 Apr 2016 has deferred till April 30 implementation of new norms that restrict 100 per cent withdrawal of provident fund by members after unemployment of more than two months, among others. All these new provisions related to PF withdrawal would be applicable from May 1, 2016.

EPFO on 29-Mar-2016 decided to provide interest on inoperative accounts from April 1, a move which will benefit over nine crore such account holders having total deposits of over Rs. 32,000 crore. Interest on deposits in inoperative accounts will be credited from April 1. Inoperative accounts are accounts wherein the contribution has not been received for 36 months. Retirement fund body EPFO had stopped payment of interest to such accounts from April 1, 2011

Overview of EPF

Employee Provident Fund (EPF) is one of the main platforms of savings in India for nearly all people working in Private sector Organizations. A provident fund is created with a purpose of providing financial security and stability to elderly people. Generally one contributes in these funds when one starts as employee, the contributions are made on a regular basis (monthly in most cases). It’s purpose is to help employees save a fraction of their salary every month, to be used in an event that the employee is temporarily or no longer fit to work or at retirement. The amount is deposited at the Employee Provident Fund Organization (EPFO). The investments made by a number of people / employees are pooled together and invested by a trust. EPF covers following three schemes. Our article Basics of Employee Provident Fund: EPF, EPS, EDLIS covers it in detail.

- Employees’ Provident Fund Scheme, (EPS)1952

- Employees’ Pension Scheme, 1995 (replacing the Employees’ Family Pension Scheme, 1971)(EPS). Our article Understanding Employee Pension Scheme or EPS covers it in detail.

- Employees’ Deposit Linked Insurance Scheme,(EDILS) 1976. Our article EDLI, Employee Deposit Linked Insurance Scheme covers it in detail.

Table below gives the rates of contribution of EPF, EPS, EDLI, Admin charges in India on the Basic Salary.

| Scheme Name | Employee contribution | Employer contribution |

| Employee provident fund | 12% | 3.67% |

| Employees’ Pension scheme | 0 | 8.33% |

| Employees Deposit linked insurance | 0 | 0.5%(capped at a maximum of Rs 15,000) |

| EPF Administrative charges | 0 | 0.85% (From Jan 2015) |

| PF Admin account | 1.1% | |

| EDLIS Administrative charges | 0 | 0.01% |

For example if your basic pay is Rs 20000, the breakup of EPF contribution is as follows. There are 3 ways as mentioned in our article,Basics of Employee Provident Fund: EPF, EPS, EDLIS, but most common one is given below.

- Employees Share (12%) in EPF i.e. 12% of 20000 = Rs 2,400

- Employer’s Share in EPS: Minimum of ( 8.33% of 20000 or Rs 1250) = Rs 1250

- Employer’s Share in EPF: 2400-Minimum of ( 8.33% of 20000 or Rs 1250) = Rs 1250=1150

- Employer’s Share in EDLIS (0.5%) i.e. 0.5% of 20000 = INR 100

- Employer’s Administration Charges (.85%) i.e. 1.11% of 20000 = Rs 170.

Other features of EPF are

- Compound interest as declared by Central Govt. is paid on the amount standing to the credit of an employee as on 1st April every year.

- Interest is earned on the Contribution made by Employee and Employer in EPF.

- Employer contribution to EPS does not earn interest.

- The employer contribution is exempt from tax and employee’s contribution is taxable but eligible for deduction under section 80C of Income tax Act.

- You can check your EPF balance through various ways. Our article How to get information about EPF balance : Annual Statement, SMS, E-Passbook explains the various methods of getting EPF balance in detail.

Changes in the EPF Withdrawal Rules from Feb 2016

The Employees Provident Fund has become the retirement saving in the true sense. the labour ministry has issued a gazette notification about the changes in EPF act, on 10-Feb-2016

- Retirement age has been increased from the current 55 years to 58 years.

- You can withdraw 90% of EPF balance once you reach the age of 57 years.

You cannot withdraw Employer contribution to EPF before 58 years.- EPF membership does not end with leaving the job.

Government is planning to start online facility for EPF withdrawal in Aug 2016.

Lets go through these changes in detail.

Retirement age increased from the current 55 years to 58 years.

Earlier the retirement age for EPF was 55 years. From 10 Feb 2016 it is increased to 58 years. In today’s scenario retirement age is 58 years across all organisation so this change is keeping in step with times.

You can withdraw 90% of EPF balance once you reach the age of 57 years.

Now, the subscribers will not be able to claim withdrawal of their provident fund after attaining age of 54 years. They would have to wait till attaining the age 57 years. Earlier the retirement age of EPF was 55 years. So one was allowed to withdraw 90% of his EPF balance one year prior to retirement i.e at the age of 54 years. Due to increase in age of retirement, it now changed to 57 years. But the change is that now under this facility, the subscriber would be able to withdraw 100% of his contribution and interest earned on it unlike 90% of the total accumulations earlier

Now you Cannot withdraw Employer part of EPF before 58 years This has been withdrawn

From 10 Feb 2016 You cannot withdraw the EPF contribution by the employer before the retirement.The employer’s portion can be withdrawn after attaining the retirement age (58 years). Remember the withdrawals from the EPF within five years of joining are still taxable. The problem that the EPF would face is whether it would pay interest on Employer share which one is not allowed to withdraw. The inoperative account rule of EPF says that an EPF account would not earn interest if there is no contribution for 3 years. Now onwards, there would be several EPF account without contribution as people would not be able to withdraw their full EPF corpus. Will such account would not give any interest after 3 years? The rule says

“A member who ceases to be in employment and continues to not be employed with a covered establishment for at least two months, may be permitted to withdraw only his own share of contribution, including interest earned thereon. The requirement of ‘two months’ period referred above shall not apply in case of female members resigning from the service for the purpose of getting married or on account of pregnancy/ childbirth.”

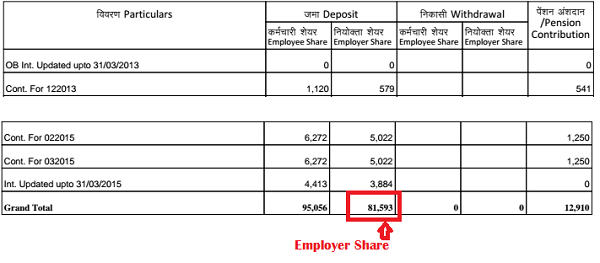

Image below shows the sample UAN passbook with no contribution from Apr 2015. So if this person withdraws EPF , before 1 Apr 2016(interest will get added on 1st Apr 2016. After 1st Apr interest for 2016 would also be added.) he would be able to withdraw only 95,056 and not Employer share of Rs 81,593.

EPF membership does not end with leaving the job

From 10 Feb 2016 You cannot withdraw the EPF contribution by the employer before the retirement.The employer’s portion can be withdrawn after attaining the retirement age (58 years). Since you can’t withdraw the 100% of the PF balance, your epf account is not closed.

Online Withdrawal of EPF may start from August 2016

Retirement fund body EPFO may launch an online facility to withdraw provident fund by August 2016. This move will reduce paperwork and provide hassle-free service to its subscribers. As per senior official al EPFO “We have already digitised our records and processes using Oracle operating system. EPFO will soon buy blade servers for setting up three Central Data Centres at Gurgaon, Dwarka (Delhi) and Secunderabad. All the three centres will be connected to 123 offices of the Employees’ Provident Fund Organisation (EPFO),” he said. “The process of procuring servers would be completed by May while the testing would start in June to gauge the response of the system in place. After intensive testing and trials in June and July, we are planning to launch the online PF withdrawal facility in August this year,” the official said.

Once this is operational, subscribers can apply online for PF withdrawal, which will be transferred directly to their bank accounts. At present, subscribers who wish to settle their accounts with the EPFO are required to apply manually. For settling online claims, the subscribers would have to activate their Universal (portable PF) Account Numbers which are seeded with KYC details including bank accounts, Aadhaar number and permanent account number. Ref PF May Be Withdrawn Online From August, Says EPFO Official

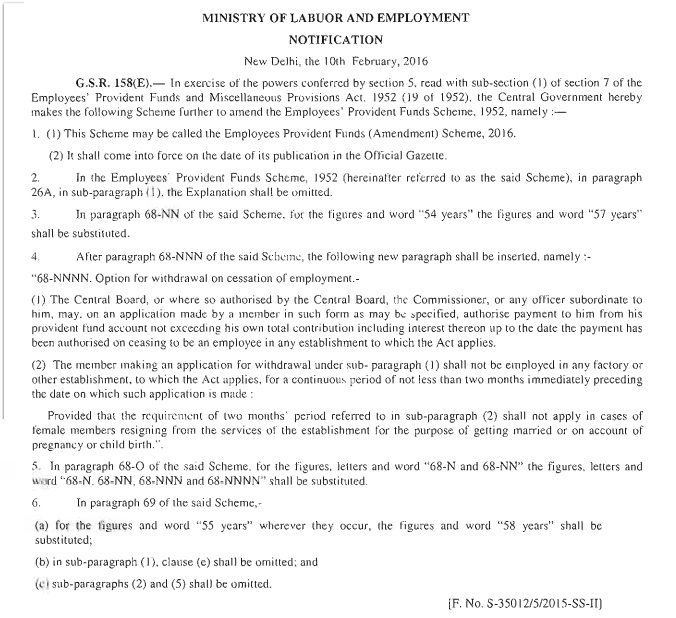

Government’s Notice regarding Changes in EPF Withdrawal from 10 Feb 2016

The Notification no. G.S.R. 158(E), dated February 10, 2016 [F.No. S-35012/5/2015-SS-II] which changes the rules for EPF withdrawal are shown in image below. All EPF circulars are at http://www.epfindia.com/site_en/circulars.php?id=sm7_officeUse. Interested readers can read PricewaterhouseCoopers article on it.(pdf) or click here.

Summary

The new rules have made the EPF withdrawal difficult. Purpose of EPF is your retirement . Many withdrew their EPF before retirement unable to gain from the power of compounding and defeating the purpose of EPF. These new rules FORCE you to accumulate atleast your Employer’s contributions till you attain the retirement age. Note that the withdrawals from the EPF within five years of joining are still taxable.

The problem is the EPF would face is inoperative account rule of EPF says that an EPF account would not earn interest if there is no contribution for 3 years. Now onwards, there would be several EPF account without contribution as people would not be able to withdraw their full EPF corpus. Will such account earn any interest after 3 years?

Change.org has petition Allow withdrawal of entire Employee Provident Fund (EPF) balance not just employee share. Please sign it if you want roll back on EPF withdrawal of Employer share.

Related Posts:

- Basics of Employee Provident Fund: EPF, EPS, EDLIS

- EPF Partial Withdrawal or Advance

- Forms to avoid TDS,15G, 15H, and EPF Withdrawal Forms Form 19, Form 20,Form 10C,Form 10D,Form 51F

- Withdrawal or Transfer of Employee Provident Fund

- Understanding Employee Pension Scheme or EPS

- EDLI, Employee Deposit Linked Insurance Scheme

- UAN or Universal Account Number and Registration of UAN

What do you think of the changes in EPF Withdrawal? Did you withdrew you EPF or had plans to do so?Did you transfer your EPF on changing jobs? Do you think its step in right direction of making EPF true to its purpose of saving for retirement? It is a victory for common people of India. Thanks to all those who signed the petition and contributed in making the Government withdraw it’s notification. We are thankful to the Garment workers in Banaglore who stage protested which led to creating more pressure on Govt. to roll back the new EPF rules immediately.

Hi,

Greetings for the day !

I have left one organization, where I was working as confirmed full time employee, during October 2016. That organization has a private PF trust. Due to certain reasons my Provident Fund transfer request was not sent to previous employer by my new employer. However, old organization has agreed to transfer PF balance in January 2018, however they are crediting only 90 days interest from October 2016 although the entire PF balance was with them for the entire tenor. Please advise if there is any government direction on this and can I claim the interest for entire period from October 2016 to January 2018 from my previous organization. Please guide how to get the interest amount.

Thanks in advance for your help.

Regards

UAN NO. (AS SHOWN IN SALARY SLIP: 100109511534

ACCOUNT NO. AS SHOWN IN SALARY SLIP: GN/GGN/33542/346

ACCOUNT NO. AS SHOWN IN FORM NO.32 DT.18/07/2012

BETSY ANTHONY

1. PL ACTIVATE THE ACCOUNT

2. FURNISH THE BALANCE OF EMPLOYEE AND ENPLOYER SUBSCRIPTION AS ON 30 SEPT 2017. REGARDS

Hello Betsy,

You would have to activate your UAN. It is easy. Process is explained in our article UAN or Universal Account Number and Registration of UAN

Once you receive the Universal account number or UAN from your employer, you have to go to the official website UAN

Click on Activate UAN.

Enter the details given below and Click on Get Authorisation PIN

Once a member has activated his UAN based registration, h

Hi, I have EE: 375000 and ER:320000, Pension contribution as 47947. I have lost my job 3 months back and haven’t got any yet. I have applied for withdrawal. How much I can’t get as the amount I get, if I submitted F15G and PAN

Change your Old India 500 and 1000 Rupees Note to U.S Dollar,with-out Paying any Tax Contact Number today for more Details.+917829609573 or email thompsonowen91@gmail.com

Is there any age restriction to claim EDLI if a person dies while in duty at the age of 59 years and 2 months?

sir,

i got job co-operative sector previously worked as a private employee can i transfer my pf amount to current employer,having UAN also

I urge to Govt of India to increase pension amount of the employees working in private sectors who have completed 58 years as the pension amount which is based on formula fixed by the Govt long back is not sufficient to survive in old age and may be implemented ethically considering the price dialation/inflation. The system of withdrawal of funds should also be liberal in near future. Please look into the matter and request to the Present Govt of India

yeh niyam 31.7.2016 ko samapt ho r ha he. yeh sarkar ka kahna hai,parantu yeh niyam hamesha ke liye khatm ho ja na chaiye,yeh tab ho ga jesa ki pichli bar sab logon ne saath diya tha.

sir,

i got job co-operative sector previously worked as a private employee can i transfer my pf amount to current employer,having UAN also

I feel, actually the govt has been thinking as a well wisher for the employees,by not allowing them to withdraw a part of the EPF until retirement ,as the main purpose of EPF is to help employees after their retirement.But of course we are unable to wait till then and try our best to acquire the whole lot.

BUT if we think with coolness yes the govt’s proposal has a purpose!

I feel, actually the govt has been thinking as a well wisher for the employees,by not allowing them to withdraw a part of the EPF until retirement ,as the main purpose of EPF is to help employees after their retirement.But of course we are unable to wait till then and try our best to acquire the whole lot.

BUT if we think with coolness yes the govt’s proposal has a purpose!

PF is not Govt property employee & employer contribute their share in PF fund govt manage PF fund means govt is run saving scheme when employee left job or retired from job to get PF it must be his fundamental right & no one can stop him to get his money.

Santosh Raut

PF is not Govt property employee & employer contribute their share in PF fund govt manage PF fund means govt is run saving scheme when employee left job or retired from job to get PF it must be his fundamental right & no one can stop him to get his money.

Santosh Raut

HEY MODI U R A BIG CHEATER,BETTER TO CANCEL THIS G.O….

HEY MODI U R A BIG CHEATER,BETTER TO CANCEL THIS G.O….

this is bad decision against all middle level .

don’t vote BJP

this is not government money this is workers money.

immediately change to old system.

tHIS IS NOT FAIR AND A BAD DECISION. THIS IS WORKERS MONEY NOT FOR GOVERNMENT. PLEASE IN OLD ONE.

this is bad decision against all middle level .

don’t vote BJP

this is not government money this is workers money.

immediately change to old system.

tHIS IS NOT FAIR AND A BAD DECISION. THIS IS WORKERS MONEY NOT FOR GOVERNMENT. PLEASE IN OLD ONE.

Please tell us about today’s latest announcement from Govt on EPF withdrawal. Whether the new withdrawal rule, declared on feb 10, has been deferred to 1st august?

Yes!. Please read more here: http://bemoneyaware.com/changes-in-epf-withdrawal-rules-from-10-feb-2016/

EPF facility provided by the Central Govt.so the Govt should consider the appropriate amountof pension on retirement of the employees suitable to afford the old age expenses looking into the consideration of inflation/price dialiation which are prevailed day to day.

Please tell us about today’s latest announcement from Govt on EPF withdrawal. Whether the new withdrawal rule, declared on feb 10, has been deferred to 1st august?

Yes!. Please read more here: http://bemoneyaware.com/changes-in-epf-withdrawal-rules-from-10-feb-2016/

Hey I want clarification, I left my job on 22/01/2016 and last week I have submit my pf form to Pf Office, is I will be eligible for full contribution ( Like My Contribution Employer Contribution Interest)

sarkar ke pass ham private sector ke logon ke do anshdan hain.1.employer share 3.67% aur8.33% pension fund.Jisko govt ne bandhak rakha hai aur 58 saal bad degi. pension fund 8.33 ke badle 1000 to 2000 monthly pension milegi eske liye bhi kai chakkar p.f.office ke katne parenge.sarkar ko chahiye ki pension ke badle hame doguna hissa de aur employer share ka bhi do guna de, jesa ki 1952 ka niyam bana hai.pension sirf 10 saal ki seva walon ko hi milega per yeh ham mein se kam hi log kante hain.58 saal mein 1000 pension se kiya gujara hoga,isse bhi achha to tab hota jab sarkar apne pass se 58 saal tak ka anshdan swayam de, tab ham mazdoor log yeh samjhenge ki modi ji achhey din la rahe hain. sirf sarkar ki yojna apne karmchariyon ke liye hai.private ko koi nahin poochhta.sarkar ko ham middle class mazdooro ki bhi guaranty leni hogi jesa ki epf per naya niyam bana diya hai.is niyam ko zaldi hiwapas le lena chahiye,yeh tab hoga jab pure india ke mazdoor ekjut honge.

kripya mere is comment ka jababb dein.

Hey I want clarification, I left my job on 22/01/2016 and last week I have submit my pf form to Pf Office, is I will be eligible for full contribution ( Like My Contribution Employer Contribution Interest)

sarkar ke pass ham private sector ke logon ke do anshdan hain.1.employer share 3.67% aur8.33% pension fund.Jisko govt ne bandhak rakha hai aur 58 saal bad degi. pension fund 8.33 ke badle 1000 to 2000 monthly pension milegi eske liye bhi kai chakkar p.f.office ke katne parenge.sarkar ko chahiye ki pension ke badle hame doguna hissa de aur employer share ka bhi do guna de, jesa ki 1952 ka niyam bana hai.pension sirf 10 saal ki seva walon ko hi milega per yeh ham mein se kam hi log kante hain.58 saal mein 1000 pension se kiya gujara hoga,isse bhi achha to tab hota jab sarkar apne pass se 58 saal tak ka anshdan swayam de, tab ham mazdoor log yeh samjhenge ki modi ji achhey din la rahe hain. sirf sarkar ki yojna apne karmchariyon ke liye hai.private ko koi nahin poochhta.sarkar ko ham middle class mazdooro ki bhi guaranty leni hogi jesa ki epf per naya niyam bana diya hai.is niyam ko zaldi hiwapas le lena chahiye,yeh tab hoga jab pure india ke mazdoor ekjut honge.

kripya mere is comment ka jababb dein.

sahi bola aapne sarkar ko purana pf rules chalana chahiye. govt employees hi ye naye rules ko apna sakte. kam salary aur private emplayees ko ye rules sahi nahi hi

Its very bad rule for poor employees jiski pf account me total hi 2 se 3 lakh ruppees hoge go kya 58 ki age tk wait krega …middle class family me log apne apni jarurte jarurte hi isse puri krte h bjaye kisi se loan lene k poor employee yh sochta h ki kisi bimari me ya beti ki shadi me uski mhnt ki kmayi kam aajaygi but ab kya log yh soche ki 58 ki age k bad hi bimari aaye or betiyo ki shadi PR vo logo se loan mangta fire..pls govt should change this stupid rules

Aapne bilkool sahi bola. Aur sab log jinka EPF hai aapki peeda ko samajhte hain. Kal(18/Apr/2016) Bangalore mein Garmet workers ne EPF withdrawal rule ke khilaaf protest kiya. Govt ne abhi 1st May 2016 tak pura EPF withdrawal allow kiya hain. Aage dekhte hain kya hota hai?

Its very bad ,,,,,

Public ko aisa math karna,Kya central gov’t KO our kytha hona hai money public say………..

Its very bad rule for poor employees jiski pf account me total hi 2 se 3 lakh ruppees hoge go kya 58 ki age tk wait krega …middle class family me log apne apni jarurte jarurte hi isse puri krte h bjaye kisi se loan lene k poor employee yh sochta h ki kisi bimari me ya beti ki shadi me uski mhnt ki kmayi kam aajaygi but ab kya log yh soche ki 58 ki age k bad hi bimari aaye or betiyo ki shadi PR vo logo se loan mangta fire..pls govt should change this stupid rules

Aapne bilkool sahi bola. Aur sab log jinka EPF hai aapki peeda ko samajhte hain. Kal(18/Apr/2016) Bangalore mein Garmet workers ne EPF withdrawal rule ke khilaaf protest kiya. Govt ne abhi 1st May 2016 tak pura EPF withdrawal allow kiya hain. Aage dekhte hain kya hota hai?

Its very bad ,,,,,

Public ko aisa math karna,Kya central gov’t KO our kytha hona hai money public say………..

its a very bad news of young poor workers .i think very bad desig. of govt.india .but govt. is govt. what can do a poor men in India .i ask

a quation of govt India take a guaranteed job in private sector 58 years

realy good thinking after retaire ment solution in private sector but whoose take a waranty of job 1 year in private sector .its very bad desig.

of ministry of labour .poor men is India all type war in India .

its a very bad news of young poor workers .i think very bad desig. of govt.india .but govt. is govt. what can do a poor men in India .i ask

a quation of govt India take a guaranteed job in private sector 58 years

realy good thinking after retaire ment solution in private sector but whoose take a waranty of job 1 year in private sector .its very bad desig.

of ministry of labour .poor men is India all type war in India .

This is a big torture…rule should be changed..people have their plans after qutiing job.

The employee have to get entire pf settlement when quiting job…

Its very bad rule for poor employees jiski pf account me total hi 2 se 3 lakh ruppees hoge go kya 58 ki age tk wait krega …middle class family me log apne apni jarurte jarurte hi isse puri krte h bjaye kisi se loan lene k poor employee yh sochta h ki kisi bimari me ya beti ki shadi me uski mhnt ki kmayi kam aajaygi but ab kya log yh soche ki 58 ki age k bad hi bimari aaye or betiyo ki shadi PR vo logo se loan mangta fire..pls govt should change this stupid rules

Dear all,

I have 7 years service in a EPF A/C from year Oct,2000 to March,2007 and at that time I withdraw my all EPF

(employee + Employer Part both).After that I opened a new pf a/c and Contributed for 8 years starting from

April ,2007 to Sep, 2016 . Now Is I am eligible for PENSION FUND ? As I have Overall 15 years of service but divided

into 2 pf a/c’s .If anyone knows then please reply me at rahulkhullar@live.in

Regards

Rahul Khullar

This is a big torture…rule should be changed..people have their plans after qutiing job.

The employee have to get entire pf settlement when quiting job…

Its very bad rule for poor employees jiski pf account me total hi 2 se 3 lakh ruppees hoge go kya 58 ki age tk wait krega …middle class family me log apne apni jarurte jarurte hi isse puri krte h bjaye kisi se loan lene k poor employee yh sochta h ki kisi bimari me ya beti ki shadi me uski mhnt ki kmayi kam aajaygi but ab kya log yh soche ki 58 ki age k bad hi bimari aaye or betiyo ki shadi PR vo logo se loan mangta fire..pls govt should change this stupid rules

Dear all,

I have 7 years service in a EPF A/C from year Oct,2000 to March,2007 and at that time I withdraw my all EPF

(employee + Employer Part both).After that I opened a new pf a/c and Contributed for 8 years starting from

April ,2007 to Sep, 2016 . Now Is I am eligible for PENSION FUND ? As I have Overall 15 years of service but divided

into 2 pf a/c’s .If anyone knows then please reply me at rahulkhullar@live.in

Regards

Rahul Khullar

what’s conditions if pf member has no more after 40 or 45 for complete pf withdrawal.

what’s conditions if pf member has no more after 40 or 45 for complete pf withdrawal.

its a very bad news of young poor workers .i think very bad desig. of govt.india .but govt. is govt. what can do a poor men in India .i ask

a quation of govt India take a guaranteed job in private sector 58 years

realy good thinking after retaire ment solution in private sector but whoose take a waranty of job 1 year in private sector .its very bad desig.

of ministry of labour .poor men is India all type war in India .

its a very bad news of young poor workers .i think very bad desig. of govt.india .but govt. is govt. what can do a poor men in India .i ask

a quation of govt India take a guaranteed job in private sector 58 years

realy good thinking after retaire ment solution in private sector but whoose take a waranty of job 1 year in private sector .its very bad desig.

of ministry of labour .poor men is India all type war in India .

Hi,

I want following clarification, if some one can help me it will be very beneficial?

Right Now i am working a company, where my basic salary is @40,000 INR. Earlier when i joined this organisation, i was having my basic is 6200 INR. Accordingly i have to compulsorily join the EPF Scheme.

Now as my present Basic is more than 15000 INR, i asked my employer out out from EPF Scheme! and My employer replied me that it is not possible the same as the PF account already in force.

Please guide me in this?

Hi,

I want following clarification, if some one can help me it will be very beneficial?

Right Now i am working a company, where my basic salary is @40,000 INR. Earlier when i joined this organisation, i was having my basic is 6200 INR. Accordingly i have to compulsorily join the EPF Scheme.

Now as my present Basic is more than 15000 INR, i asked my employer out out from EPF Scheme! and My employer replied me that it is not possible the same as the PF account already in force.

Please guide me in this?

All commentators are requested to go on Link change.orgepf and sign that petition so that government will roll back the same EPF withdrawal rule. and also suggest more and more peoples for doing the same.

Yes. Please spread the word.

Yes. ! It’s true , I am with u , we should spread this to all so that we can fight jointly for our rights.

All commentators are requested to go on Link change.orgepf and sign that petition so that government will roll back the same EPF withdrawal rule. and also suggest more and more peoples for doing the same.

Yes. Please spread the word.

Yes. ! It’s true , I am with u , we should spread this to all so that we can fight jointly for our rights.

Hello,

I was resigned my job since 1st January 2016. But till to date by PF form not forwarded to the PF department by the employer. As per new rule what amount will withdraw.

Govt only locked middle class employees amount for investment?

Please ask your employer to send the EPF form ASAP as till 1 May 2016 one will get both employee and employer contribution.

Hello,

I was resigned my job since 1st January 2016. But till to date by PF form not forwarded to the PF department by the employer. As per new rule what amount will withdraw.

Govt only locked middle class employees amount for investment?

Please ask your employer to send the EPF form ASAP as till 1 May 2016 one will get both employee and employer contribution.

Only the middle class is sucked dry from all sides. These are the people who contribute by paying tax and still the government want to squeeze them further. Please note once middle class revolts it would shake up the whole system. You are also losing on your vote bank in a big way. Let us know what the Govt. benefits by holding back the PF amount.

If you want to improve on your GDP, think of taxing the agriculture income and track all the black money transaction, not by killing the duck which lays the golden eggs…..Very disturbing and bad policies where a person cant live in peace.

Only the middle class is sucked dry from all sides. These are the people who contribute by paying tax and still the government want to squeeze them further. Please note once middle class revolts it would shake up the whole system. You are also losing on your vote bank in a big way. Let us know what the Govt. benefits by holding back the PF amount.

If you want to improve on your GDP, think of taxing the agriculture income and track all the black money transaction, not by killing the duck which lays the golden eggs…..Very disturbing and bad policies where a person cant live in peace.

This IDEA is ABSOLUTELY “RUBBISH” – UNABLE to recover Black Money from dubious businessmen this GOVT. of INDIA is poking the back of modest working class of the country.

Adamant in investing in Stock Market & thereafter making Losses the middle class will never ever support this.

This IDEA is ABSOLUTELY “RUBBISH” – UNABLE to recover Black Money from dubious businessmen this GOVT. of INDIA is poking the back of modest working class of the country.

Adamant in investing in Stock Market & thereafter making Losses the middle class will never ever support this.

Its not fair. its the only back up or support for a person who has lost his job and willing to withdraw his money. suppose today a person aged 45 having 10 lacs in PF has lost his job wants to start his own business will have to wait for next 13 years for employers contribution…….

a person also may face any sudden medical emergency.

Its totally a mess done by this govt…..

above decision should be reversed immediately.

Suppose an employee at 40yrs lost his job and withdrew employee contribution (assuming the above rule in force) and waits till he is 58yrs and by that time some other useless government comes to power and moves the age limit to 75yrs as all the funds were used to give loans to people like Vijay Malya and there are no funds to refund at the age of 58 years for this employee. This would still be more worse and all such tricks are to loot the middle class people. There is no guarantee of these TUGLAK kind of rulers as when they will change what. The person who actually got this idea to impose restriction on PF withdrawal should be sentenced to the maximum punishment as he/she created chaos and confusion and causing lot of mental torture in the minds of people.

Lost faith in this government, jitna jaldi ho sake BJP ko government se hatana hai.

We are in supporting Your decision since all the people in India are not with permanent jobs and it is not sure that next month we will be getting salary and once we lost our job it is very hard to get the next job till we get next job at least with our PF amount we can start a new business and settle in life if this Government do’s this injustice by not allowing our PF with draw completely all the Indian employees will join together to abolish this rule.

Its not fair. its the only back up or support for a person who has lost his job and willing to withdraw his money. suppose today a person aged 45 having 10 lacs in PF has lost his job wants to start his own business will have to wait for next 13 years for employers contribution…….

a person also may face any sudden medical emergency.

Its totally a mess done by this govt…..

above decision should be reversed immediately.

Suppose an employee at 40yrs lost his job and withdrew employee contribution (assuming the above rule in force) and waits till he is 58yrs and by that time some other useless government comes to power and moves the age limit to 75yrs as all the funds were used to give loans to people like Vijay Malya and there are no funds to refund at the age of 58 years for this employee. This would still be more worse and all such tricks are to loot the middle class people. There is no guarantee of these TUGLAK kind of rulers as when they will change what. The person who actually got this idea to impose restriction on PF withdrawal should be sentenced to the maximum punishment as he/she created chaos and confusion and causing lot of mental torture in the minds of people.

Lost faith in this government, jitna jaldi ho sake BJP ko government se hatana hai.

We are in supporting Your decision since all the people in India are not with permanent jobs and it is not sure that next month we will be getting salary and once we lost our job it is very hard to get the next job till we get next job at least with our PF amount we can start a new business and settle in life if this Government do’s this injustice by not allowing our PF with draw completely all the Indian employees will join together to abolish this rule.

Bloody Hell … Modi Is Junk PM .. Why the hell PF need to be there with Government.Its our money we have right to with draw when ever we want.

Bloody Hell … Modi Is Junk PM .. Why the hell PF need to be there with Government.Its our money we have right to with draw when ever we want.

AGLA RULE THAK H GAREB K PAYSA 4 ,5 SAL M WITHDWARAL KARNE DO UP KA SARKAR NAHIE CHAL PAYAGA

AGLA RULE THAK H GAREB K PAYSA 4 ,5 SAL M WITHDWARAL KARNE DO UP KA SARKAR NAHIE CHAL PAYAGA

I am not satisfied with this rule hame bhi agle sarkar ke bareme sochna padega. hame aase aache din nahi chahe ye. pl garibon par raham karo aur agle budget me ye rules nikal do. Saisa nahi yiha to hame dusre sarkar ke bareme sochna padega.

I am not satisfied with this rule hame bhi agle sarkar ke bareme sochna padega. hame aase aache din nahi chahe ye. pl garibon par raham karo aur agle budget me ye rules nikal do. Saisa nahi yiha to hame dusre sarkar ke bareme sochna padega.

This is a bad and wrong decision by this govt. This is a cheating and taking our money to govt. and govt is not clear about the benefit and refunds at the time of retirement age. Why people are not against this so vigourous?? we need to fight against..the robbing of our money.

we need to neglect this govt and fully defeat and fight strongly against this decision..

This is a bad and wrong decision by this govt. This is a cheating and taking our money to govt. and govt is not clear about the benefit and refunds at the time of retirement age. Why people are not against this so vigourous?? we need to fight against..the robbing of our money.

we need to neglect this govt and fully defeat and fight strongly against this decision..

This is totally bad decision

This is totally bad decision

This is totally bad decision. Those r loss job & not got any job what can they do. Before this decision I am a big supporter of modi & bjp then after in future I will be not again vote bjp they loss faith

बहुत ही घटिया निर्णय लिया है हम जैसे प्राइवेट लोगौ का कुछ भी नहीं सोचा आज मेरे पास जॉब नहीं है और दो दिन पहले resign दिया है dear मोदी जी हमारे बारे में कुछ सोचिये roll back कीजिए

This is totally bad decision. Those r loss job & not got any job what can they do. Before this decision I am a big supporter of modi & bjp then after in future I will be not again vote bjp they loss faith

बहुत ही घटिया निर्णय लिया है हम जैसे प्राइवेट लोगौ का कुछ भी नहीं सोचा आज मेरे पास जॉब नहीं है और दो दिन पहले resign दिया है dear मोदी जी हमारे बारे में कुछ सोचिये roll back कीजिए

HELLO

RESPECTED MODI JI AND JETTLY JI HUME AAP KI SARKAR PAR ITANA BELIEVE THA KI ACHE DIN DEKHNE KO MILENGE PAR AAP KI SARKAR NE TO LABOUR CLASS KO BHI NAHI CHHODA AAP AISA MAT KARO LABOUR KA EPF TO KAM SE KAM TIME PAR WITHDRAWAL KARNE DO ,AAP SE ANURODH HAI KI IS POLICY KO 55 TO 58 HATWA DO JAISA PEHLE THA AAP CHALNE DO ITNI BADI PUNISHMENT MAT DO ,PLEASE NEW RULE MAT BANAO,PURANA RULE HI SABSE BEHTAR ,SABSE ACHHA DIN KEHNA CHAHUNGA KI 1)APNE ONLINE WITHDRAWEL FACILITY CHALU KARNEWALE,2)CLOSE EPF KHATE KO INTERST CHALU KARBAYE BAHU BAHUT DHANYABAD ,BUT OLD IS GOLD THANKS MODI JI

it is the good comment,previous rule is better i.e.55 yrs.

kiya sarkar 58 saal ki ummar main 5000 rupya pension degi yaa hamare pension fund ka bhgtan double karegi.Hamara epf abhi to sarkar ke hi pass hai aur phir na jane kab degi,tab tak to kitne hi log is duniya mein nahi rahenge.

i really fed up ur new rule.ya its really true.v r respecting too much MODIJI.old rule was good.plz change the new rule modiji.

v all believe u sir.

HELLO

RESPECTED MODI JI AND JETTLY JI HUME AAP KI SARKAR PAR ITANA BELIEVE THA KI ACHE DIN DEKHNE KO MILENGE PAR AAP KI SARKAR NE TO LABOUR CLASS KO BHI NAHI CHHODA AAP AISA MAT KARO LABOUR KA EPF TO KAM SE KAM TIME PAR WITHDRAWAL KARNE DO ,AAP SE ANURODH HAI KI IS POLICY KO 55 TO 58 HATWA DO JAISA PEHLE THA AAP CHALNE DO ITNI BADI PUNISHMENT MAT DO ,PLEASE NEW RULE MAT BANAO,PURANA RULE HI SABSE BEHTAR ,SABSE ACHHA DIN KEHNA CHAHUNGA KI 1)APNE ONLINE WITHDRAWEL FACILITY CHALU KARNEWALE,2)CLOSE EPF KHATE KO INTERST CHALU KARBAYE BAHU BAHUT DHANYABAD ,BUT OLD IS GOLD THANKS MODI JI

it is the good comment,previous rule is better i.e.55 yrs.

kiya sarkar 58 saal ki ummar main 5000 rupya pension degi yaa hamare pension fund ka bhgtan double karegi.Hamara epf abhi to sarkar ke hi pass hai aur phir na jane kab degi,tab tak to kitne hi log is duniya mein nahi rahenge.

i really fed up ur new rule.ya its really true.v r respecting too much MODIJI.old rule was good.plz change the new rule modiji.

v all believe u sir.

Bloody shit policy!!! Really unjustice with middle class people. Employee can withdraw PF only in case of emergency and bloody shit govt will hold our money till 59 years of age. Death keeps no Calender. Who knows when to die.

Only way to fight against this policy is to change this Govt and hope next Govt will do justice for middle class people.

Bloody shit policy!!! Really unjustice with middle class people. Employee can withdraw PF only in case of emergency and bloody shit govt will hold our money till 59 years of age. Death keeps no Calender. Who knows when to die.

Only way to fight against this policy is to change this Govt and hope next Govt will do justice for middle class people.

Now you all go and hold Modiji Lund .. these people only do the politics on cast .. they dont know how to rule..i know every one comes for rule they will corrupt ,it is ok if they corrupt..but please we want peace and hard earned money

Yes, you’re right!

Now you all go and hold Modiji Lund .. these people only do the politics on cast .. they dont know how to rule..i know every one comes for rule they will corrupt ,it is ok if they corrupt..but please we want peace and hard earned money

Yes, you’re right!

This decision is not acceptable at all. The middle class people are expecting this money for his /her daugher’s marriage and higher studies. But blocking this amount may create lot of problem to them. Government started giving interest, but what is the right to block the hard earned money. This policy may remove immediately, which will create lot of problem for middle class people ( less income people. Government has no right to block this money.

This decision is not acceptable at all. The middle class people are expecting this money for his /her daugher’s marriage and higher studies. But blocking this amount may create lot of problem to them. Government started giving interest, but what is the right to block the hard earned money. This policy may remove immediately, which will create lot of problem for middle class people ( less income people. Government has no right to block this money.

The new EPF withdrawal changes is completely against employees interest. Why should the epfo hold our money. we should get it completely while resignation and we will invest it in anywhere we would like.

The new EPF withdrawal changes is completely against employees interest. Why should the epfo hold our money. we should get it completely while resignation and we will invest it in anywhere we would like.

This is not fair with poor middle class which wants to make small business with EPF

This is not fair with poor middle class which wants to make small business with EPF

Dear modi ji,we had lot of expectations from you but you hurt the lot middle class whichever belongs to private. This rules totally against us.so that is not good for your govt in 2019. Think again and ache din kab aayenge

Dear modi ji,we had lot of expectations from you but you hurt the lot middle class whichever belongs to private. This rules totally against us.so that is not good for your govt in 2019. Think again and ache din kab aayenge

Mine is a PF trust and they say they have not yet received go ahead from EPF office for processing. What should I do ?

Mine is a PF trust and they say they have not yet received go ahead from EPF office for processing. What should I do ?

Dear Mr. Modi and Jaitley,

The new rule implimented by your new govt for epfo is totally not acceptable by us. This is totally in favor of the govt servants and not for private sectors. If we are not able to use our epfo money when needed, then what’s the use of that money. If you withdraw this new rule, your govt will surely win the next election, else you will not. Most of the voting candidate are from the private sectors only. Please help the middle class people.

Perheps that day is not far,when government will issue the new rules to bankers for obtaining the epf amount which to be decided for withdrawing by members on or before 30th April 2016. It is amened order inplace of 10.2.16.

DEAR MODI JI AND JETTLY JI HUME AAP KI SARKAR PAR ITANA BELIEVE THA KI ACHE DIN DEKHNE KO MILENGE PAR AAP KI SARKAR NE TO LABOUR CLASS KO BHI NAHI CHODA AAP AISA MAT KARO LABOUR KA EPF TO KAM SE KAM TIME PAR WITHDRAWAL HONE DO KYUN GARIBO KA AATA GILA KAR RAHE HON AAP SE ANURODH HAI KI IS POLYCY KO 55 TO 58 HATWA DO JAISA PEHLE THA AAP CHALNE DO ITNI BADI PUNISHMENT MAT DO AGAR 2019 TAK AAP KI SARKAR KO CHALANA HAI TO NAHI TO RESULT BAHUT BHARI RAHEGA 2019 KA TARGET SIR G

Dear Mr. Modi and Jaitley,

The new rule implimented by your new govt for epfo is totally not acceptable by us. This is totally in favor of the govt servants and not for private sectors. If we are not able to use our epfo money when needed, then what’s the use of that money. If you withdraw this new rule, your govt will surely win the next election, else you will not. Most of the voting candidate are from the private sectors only. Please help the middle class people.

Perheps that day is not far,when government will issue the new rules to bankers for obtaining the epf amount which to be decided for withdrawing by members on or before 30th April 2016. It is amened order inplace of 10.2.16.

DEAR MODI JI AND JETTLY JI HUME AAP KI SARKAR PAR ITANA BELIEVE THA KI ACHE DIN DEKHNE KO MILENGE PAR AAP KI SARKAR NE TO LABOUR CLASS KO BHI NAHI CHODA AAP AISA MAT KARO LABOUR KA EPF TO KAM SE KAM TIME PAR WITHDRAWAL HONE DO KYUN GARIBO KA AATA GILA KAR RAHE HON AAP SE ANURODH HAI KI IS POLYCY KO 55 TO 58 HATWA DO JAISA PEHLE THA AAP CHALNE DO ITNI BADI PUNISHMENT MAT DO AGAR 2019 TAK AAP KI SARKAR KO CHALANA HAI TO NAHI TO RESULT BAHUT BHARI RAHEGA 2019 KA TARGET SIR G

I am not satisfied with this rule

I am not satisfied with this rule

i was planning to close my private loan which iam paying high interest now the plan is totally collapsed

i was planning to close my private loan which iam paying high interest now the plan is totally collapsed

This rule not ok for low class people.

In 40 year my son go to college for study, I close the epf account get the pf money then pay the college fee,

this rule not useful for above subject,

pls change the rules.

Dear Govt.:

The government is playing with salaried class. EPF is our hard earned money. Government has not given it to us. We must be allowed to use it any how. They cannot put age restrictions for withdrawal.

What is more distressing that it is applicable with retrospective effect and that is really bad. We planned our EPF according to existing rules, now suddenly government cannot unilaterally change rules with retrospective effect. That is cheating. What guarantee next year they will not again change rules arbitrarily. We have lost all faith in this government.

don’d do any thing.no need age limited withdrawal

This rule not ok for low class people.

In 40 year my son go to college for study, I close the epf account get the pf money then pay the college fee,

this rule not useful for above subject,

pls change the rules.

Dear Govt.:

The government is playing with salaried class. EPF is our hard earned money. Government has not given it to us. We must be allowed to use it any how. They cannot put age restrictions for withdrawal.

What is more distressing that it is applicable with retrospective effect and that is really bad. We planned our EPF according to existing rules, now suddenly government cannot unilaterally change rules with retrospective effect. That is cheating. What guarantee next year they will not again change rules arbitrarily. We have lost all faith in this government.

don’d do any thing.no need age limited withdrawal

This is not fair ,for those person ,who are not interested to service,so want to left own job and after then they want to start own busyness. So government sould back this rule immediately,so that any one can choice to do own business by helping own 100% withdraw EPF money .

We request to modi sarkar ,please back this rule.

Second We have question ,that this rule will be allowed all previous EPF saving or will be allowed further those EPF saving ,which would be saved after 1 April 2016 ??? please clarify this.

This rule is totally wrong and should be roll back by govt immediately.Previous rule was correct i.e.55 yrs instead of 58 yrs.Such type of rules are only applicable to govt employee and not a private sector.Govt takes full guarranty of his emlopyee s and not takes any guarranty for private worker.In my

opinion it is wrong policy to private sector. It should be applicable after september 2015 new joining where in after retirement good pension will be receive to worker and presently Rs 1000 pension is zeero.please clearify.

This is not fair ,for those person ,who are not interested to service,so want to left own job and after then they want to start own busyness. So government sould back this rule immediately,so that any one can choice to do own business by helping own 100% withdraw EPF money .

We request to modi sarkar ,please back this rule.

Second We have question ,that this rule will be allowed all previous EPF saving or will be allowed further those EPF saving ,which would be saved after 1 April 2016 ??? please clarify this.

This rule is totally wrong and should be roll back by govt immediately.Previous rule was correct i.e.55 yrs instead of 58 yrs.Such type of rules are only applicable to govt employee and not a private sector.Govt takes full guarranty of his emlopyee s and not takes any guarranty for private worker.In my

opinion it is wrong policy to private sector. It should be applicable after september 2015 new joining where in after retirement good pension will be receive to worker and presently Rs 1000 pension is zeero.please clearify.

i m not satishfied this rules

i m not satishfied this rules

Good News – Recent update 1st April 2016 rule is effective 1st May 2016. and all claims till 30 April will be processed as per previous provisions.

http://www.epfindia.com/site_en/circulars.php?id=sm7_officeUse

Good News – Recent update 1st April 2016 rule is effective 1st May 2016. and all claims till 30 April will be processed as per previous provisions.

http://www.epfindia.com/site_en/circulars.php?id=sm7_officeUse

Mai modi sarkar se ak hi sawal karunga ki, kya modi sarkar bharat ke karodo employes ka 58years tak jinda rahne ka garenty le sakta hai ,

Agar yo likhit rupse garenty de sakta hai to….

ITS OK…..PLEASE THINK ONCE MODI SARKAR…

Good News – Recent update rule is effective 1st May 2016. and all claims till 30 April will be processed as per previous provisions.

Hi AB,

I have a question for you, I have two EPF accounts which are inoperative since 2012, as I left my job and since then I m doing my own business. so no EPF Since late 2012. Can I withdraw my EPF money now.

if yes, kindly suggest the steps.

YES

check for new form where you get withdrawal without employers consent.

This is not fair ,for those person ,who are not interested to service,so want to left own job and after then they want to start own busyness. So government sould back this rule immediately,so that any one can choice to do own business by helping own 100% withdraw EPF money .

We request to modi sarkar ,please back this rule.

Second We have question ,that this rule will be allowed all previous EPF saving or will be allowed further those EPF saving ,which would be saved after 1 April 2016 ??? please clarify this.

good

this rule is notok

Mai modi sarkar se ak hi sawal karunga ki, kya modi sarkar bharat ke karodo employes ka 58years tak jinda rahne ka garenty le sakta hai ,

Agar yo likhit rupse garenty de sakta hai to….

ITS OK…..PLEASE THINK ONCE MODI SARKAR…

Good News – Recent update rule is effective 1st May 2016. and all claims till 30 April will be processed as per previous provisions.

Hi AB,

I have a question for you, I have two EPF accounts which are inoperative since 2012, as I left my job and since then I m doing my own business. so no EPF Since late 2012. Can I withdraw my EPF money now.

if yes, kindly suggest the steps.

YES

check for new form where you get withdrawal without employers consent.

This is not fair ,for those person ,who are not interested to service,so want to left own job and after then they want to start own busyness. So government sould back this rule immediately,so that any one can choice to do own business by helping own 100% withdraw EPF money .

We request to modi sarkar ,please back this rule.

Second We have question ,that this rule will be allowed all previous EPF saving or will be allowed further those EPF saving ,which would be saved after 1 April 2016 ??? please clarify this.

good

this rule is notok

Modi ji pls we trust you, please do favour to middle class family,

Modi ji pls we trust you, please do favour to middle class family,

Modi sir pls we trust you, please do favour to middle class family, help me

Modi sir pls we trust you, please do favour to middle class family, help me

This is the achhha din???? we dont want the 15 lakhs of indian money looted by the richest from india,,,,,,,,, we want our hard earned money (PF Amount) ,,,,,,You forced us to kill ourselves modiji,,,,,,,,,,,,,,,This is the pathetic situation ,No words to express.

This is the achhha din???? we dont want the 15 lakhs of indian money looted by the richest from india,,,,,,,,, we want our hard earned money (PF Amount) ,,,,,,You forced us to kill ourselves modiji,,,,,,,,,,,,,,,This is the pathetic situation ,No words to express.

Its not done its totally unfair to common people. I think this is wrong and the Govt should not implement this.

Its not done its totally unfair to common people. I think this is wrong and the Govt should not implement this.

I am also interested to know, as I am currently in USA and left the Job from USA in Oct 2015. But I was lazy to apply for withdrawal. If in case I can withdraw PF being I am in USA working in USA not in India at all then I would apply my case for withdrawal.

Second thing which is not clear if I do not withdraw PF amount will it earn interest after 3 years. Is there any way I can contribute to my EPF account myself to keep the account active?

Govt has not taken back the the ruling that one withdraw Employer part of EPF before 58 years.

But on 29 Mar 2016 they announced that from 1 Apr 2016 there will be no inoperative account so the employer contribution to EPF will continue earning interest

Currently there is no way to withdraw online. In Aug Online withdrawal facility is expected. So you can wait till then.

I am also interested to know, as I am currently in USA and left the Job from USA in Oct 2015. But I was lazy to apply for withdrawal. If in case I can withdraw PF being I am in USA working in USA not in India at all then I would apply my case for withdrawal.

Second thing which is not clear if I do not withdraw PF amount will it earn interest after 3 years. Is there any way I can contribute to my EPF account myself to keep the account active?

Govt has not taken back the the ruling that one withdraw Employer part of EPF before 58 years.

But on 29 Mar 2016 they announced that from 1 Apr 2016 there will be no inoperative account so the employer contribution to EPF will continue earning interest

Currently there is no way to withdraw online. In Aug Online withdrawal facility is expected. So you can wait till then.

Modi ji, you should think on yourself please allow full EPF withdrawl contribution

Modi ji, you should think on yourself please allow full EPF withdrawl contribution

sirji, i am an outsourcing employee in HOD my agency(worked 3years) has been changed because it resulted a fraud agency and i had been changed to another agency, and i had to withdraw my full epf amount from the fraud agency and after withdrawl of amount i have given the same epf number to the new agency. sirji due to withdrawl of amount i have lost my seniority for that 3year in the fraud agency. pls suggest me ????? regarding my epf and seniority and continuity of my job

sirji, i am an outsourcing employee in HOD my agency(worked 3years) has been changed because it resulted a fraud agency and i had been changed to another agency, and i had to withdraw my full epf amount from the fraud agency and after withdrawl of amount i have given the same epf number to the new agency. sirji due to withdrawl of amount i have lost my seniority for that 3year in the fraud agency. pls suggest me ????? regarding my epf and seniority and continuity of my job

Modi sarkar ne hum logo ko gale me rassi bandh kar bayapari ke hath me de diya hai. iske birodh me majdoor sangho ko awaaz uthani chahiye .

Modi sarkar ne hum logo ko gale me rassi bandh kar bayapari ke hath me de diya hai. iske birodh me majdoor sangho ko awaaz uthani chahiye .

its another blunder of this government, Comgress need to take up this issue in parliament for protest..This is our hard money and how can this governemnt impose this kind of rules…gov rolled back decision on tax on PF withdrwal, so that this amount can be utilize by government …..This need to to protest >>>>

its another blunder of this government, Comgress need to take up this issue in parliament for protest..This is our hard money and how can this governemnt impose this kind of rules…gov rolled back decision on tax on PF withdrwal, so that this amount can be utilize by government …..This need to to protest >>>>

Modi ji pls we trust you, please do favour to middle class family,

Modi ji pls we trust you, please do favour to middle class family,

Govt is killing common people, Congress is better than BJP, This govt completely worst,i supported this govt but now its my mistake

Govt is killing common people, Congress is better than BJP, This govt completely worst,i supported this govt but now its my mistake

We can not withdraw employers contribution. This contribution is for our hard work. This is really pathetic that we can’t withdraw our hard earned money. If any person left job and start own business why should not get total pf. In spite of having own money go for a loan to start business.

Already we can not withdraw amount transferred to pension fund for having pf account more than 10 years. If by mistake nomination is not registered family member will not get this money.

How can they deny it?

We can not withdraw employers contribution. This contribution is for our hard work. This is really pathetic that we can’t withdraw our hard earned money. If any person left job and start own business why should not get total pf. In spite of having own money go for a loan to start business.

Already we can not withdraw amount transferred to pension fund for having pf account more than 10 years. If by mistake nomination is not registered family member will not get this money.

How can they deny it?

The decision by the Govt./EPFO is unfair for a common man.

So, please roll back the decision and save private employees, so that the public can increase their faith on present govt.

The decision by the Govt./EPFO is unfair for a common man.

So, please roll back the decision and save private employees, so that the public can increase their faith on present govt.

Looks like there is big short in EPF account. That’s why they are not giving our money including employers money. Its not government prerogative to hold our retirement money and give us back later. Please watch Movie “Tabarana Kathe” in youtube.

Looks like there is big short in EPF account. That’s why they are not giving our money including employers money. Its not government prerogative to hold our retirement money and give us back later. Please watch Movie “Tabarana Kathe” in youtube.

Every Common people will only claim if they are in top most arjunt,if govt make this kind of rules the following will occur..

1.No NEW EPF members will join 2.Common People for emergency borrow with money lenders & move into risk 3.Only in average 5% of people will be benefitted & 100 % Govt can use the UnClaimed Amount 6.Unclaimed Amount Will be increase when compare to Past YEARS…

PLEASE GET BACK OF THE GO TO AVOID MANY DEATH OF COMMON PEOPLE WITHOUT MONEY.PLEASE ALL OPPOSITE THE RULES OF EPFO

its WRONG FOR PRIVATE EMPLOYEES

Surely, the new rule is to be roll back.

This rule should be take back… It’s unfair… Govt killing common people

totally wrong with private worker because private job change many time so how to claim full money every time

How many votes are required to reverse the rule ?

As per petition it says 2500 ?

Sir,

it is harassing to private employees. If any body lost his/ her job, If he/she decide to start a business then with out the PF fund how can it be possible. How can he manage his family? He has to give study to their children, marriage etc And wait for upto 58 years ? the new rule is equal to the killing a common man and his family.

Govt.want to collect to much more amt.from epf,this notification are ont favour any employees.

Every Common people will only claim if they are in top most arjunt,if govt make this kind of rules the following will occur..

1.No NEW EPF members will join 2.Common People for emergency borrow with money lenders & move into risk 3.Only in average 5% of people will be benefitted & 100 % Govt can use the UnClaimed Amount 6.Unclaimed Amount Will be increase when compare to Past YEARS…

PLEASE GET BACK OF THE GO TO AVOID MANY DEATH OF COMMON PEOPLE WITHOUT MONEY.PLEASE ALL OPPOSITE THE RULES OF EPFO

its WRONG FOR PRIVATE EMPLOYEES

Surely, the new rule is to be roll back.

This rule should be take back… It’s unfair… Govt killing common people

totally wrong with private worker because private job change many time so how to claim full money every time

How many votes are required to reverse the rule ?

As per petition it says 2500 ?

Sir,

it is harassing to private employees. If any body lost his/ her job, If he/she decide to start a business then with out the PF fund how can it be possible. How can he manage his family? He has to give study to their children, marriage etc And wait for upto 58 years ? the new rule is equal to the killing a common man and his family.

Govt.want to collect to much more amt.from epf,this notification are ont favour any employees.

This is unfair decision because if any body serve only 2 year in one organization and leave it doing something like business or own agricultural work . What is meaning of waiting to 58 year.

Govt. should think and withdraw.

This is unfair decision because if any body serve only 2 year in one organization and leave it doing something like business or own agricultural work . What is meaning of waiting to 58 year.

Govt. should think and withdraw.

Dear Sir/madam,

It is the wrong policy of government for locking the employer contribution up to 58 yrs,which is far from away the life of all epf member and it should be roll back.secondly the epf pension is very small ie Rs 1000 to maximum Rs 2200

instead of govt employee.Presently govt employee pension is Rs 8000 minimum and Rs 2000 pension of private employee is zeero as per the market cost. In my openion govt give final amount to worker and give stop the nothing

such zeero pension.

Thanks for your suggesion and assure that you will mail us all the present status of this rule and help all of members who are very sad from new epf withdrawl rule.please also tell us for the interest paying by govt in both employee and employers share upto 58 yrs, when govt is used worker amount for country work,then can also give the higher rate of interest hence no profit to all in this rule.

B.D.KUKRETI

Dear Sir/madam,

It is the wrong policy of government for locking the employer contribution up to 58 yrs,which is far from away the life of all epf member and it should be roll back.secondly the epf pension is very small ie Rs 1000 to maximum Rs 2200

instead of govt employee.Presently govt employee pension is Rs 8000 minimum and Rs 2000 pension of private employee is zeero as per the market cost. In my openion govt give final amount to worker and give stop the nothing

such zeero pension.

Thanks for your suggesion and assure that you will mail us all the present status of this rule and help all of members who are very sad from new epf withdrawl rule.please also tell us for the interest paying by govt in both employee and employers share upto 58 yrs, when govt is used worker amount for country work,then can also give the higher rate of interest hence no profit to all in this rule.

B.D.KUKRETI

This is the kacche din BJP is offering to common people. we can’t decide on our own hard earned money and never if we would be alive for 58yrs to utilise our own hard earned money, If government wants to improve the market conditions let them harass the people with black money. Let they tackle them instead of hitting the salaried class people who are the genuine tax payers.

This is my money then why i am wait till 58 year for withdraw,pls let me know if goverment wans make india they should return back black money

anather thing Modi goverment will prommised after BJP Govt every persons ate getting 15 lacs,i think our pf cash they provide each account and after 58 age return back

This is the kacche din BJP is offering to common people. we can’t decide on our own hard earned money and never if we would be alive for 58yrs to utilise our own hard earned money, If government wants to improve the market conditions let them harass the people with black money. Let they tackle them instead of hitting the salaried class people who are the genuine tax payers.

This is my money then why i am wait till 58 year for withdraw,pls let me know if goverment wans make india they should return back black money

anather thing Modi goverment will prommised after BJP Govt every persons ate getting 15 lacs,i think our pf cash they provide each account and after 58 age return back

Surely the new rule is to be roll back.

Surely the new rule is to be roll back.

Surely, the new rule is to be roll back.

We have to make rally against it

Surely, the new rule is to be roll back.

We have to make rally against it

Sir,

it is harassing to private employees. If any body lost his/ her job, If he/she decide to start a business then with out the PF fund how can it be possible. How can he manage his family? He has to give study to their children, marriage etc And wait for upto 58 years ? the new rule is equal to the killing a common man and his family.

Sir,

it is harassing to private employees. If any body lost his/ her job, If he/she decide to start a business then with out the PF fund how can it be possible. How can he manage his family? He has to give study to their children, marriage etc And wait for upto 58 years ? the new rule is equal to the killing a common man and his family.

Dear Sir/Madam,

I have left the service in nov.2013 and thought that i will withdraw our full and final amount aftger 3 years, because govt is giving the interest up to three years. at present aftger budget govt has changed the rule for completing 58 years. my age 58 yrs will be held as on 3.nov.2018 as two yrs is balance.my question is that can i get the interest upto 58 yrs in both EE AND ER amount,so that i can withdraw my final payment in 58 yrs after 3.11.2018 onwards.

kindly give the urgent reply in my mail id also ie bdkukreti123@gmail.com

I AM THE MEMBER OF EPF SINCE LAST 36 YRS.

thankis and kind regards.

B.D.KUKRETI

Dear Sir/Madam,

I have left the service in nov.2013 and thought that i will withdraw our full and final amount aftger 3 years, because govt is giving the interest up to three years. at present aftger budget govt has changed the rule for completing 58 years. my age 58 yrs will be held as on 3.nov.2018 as two yrs is balance.my question is that can i get the interest upto 58 yrs in both EE AND ER amount,so that i can withdraw my final payment in 58 yrs after 3.11.2018 onwards.

kindly give the urgent reply in my mail id also ie bdkukreti123@gmail.com

I AM THE MEMBER OF EPF SINCE LAST 36 YRS.

thankis and kind regards.

B.D.KUKRETI

New EPF rules for inoperative account is not suitable.This is suicide step for government itself.

New EPF rules for inoperative account is not suitable.This is suicide step for government itself.

its a faltu ideaa of govt. I have 200000 rupees in my epf account but my boss srinibas panigrahy didnt sign in my epf form tats why I can’t with draw my epf balance. but govt gv rule only 50 percentage can be with drawn by me. chi

its a faltu ideaa of govt. I have 200000 rupees in my epf account but my boss srinibas panigrahy didnt sign in my epf form tats why I can’t with draw my epf balance. but govt gv rule only 50 percentage can be with drawn by me. chi

These PF changes need to be withdrawn as this is not favorable to employees

These PF changes need to be withdrawn as this is not favorable to employees

I was working in an MNC company and left the organization in July 2016 and joined to an Government sector in July 2016. I had submitted my PF forms for with drawal, but due to the miscommunication between the company my PF was hold due to some reasons, after several followups my PF was submitted on 8th March 2016, when i enquired about the status of my PF, the PRO confirmed that due to the recent changes PF will not be processed. Can you help me when this can be sorted out.

Wait for few days. Due to budget proposal for EPF EPFO seems to have stopped processing the returns.

I was working in an MNC company and left the organization in July 2016 and joined to an Government sector in July 2016. I had submitted my PF forms for with drawal, but due to the miscommunication between the company my PF was hold due to some reasons, after several followups my PF was submitted on 8th March 2016, when i enquired about the status of my PF, the PRO confirmed that due to the recent changes PF will not be processed. Can you help me when this can be sorted out.

Wait for few days. Due to budget proposal for EPF EPFO seems to have stopped processing the returns.

Hi everyone My Name is Taiyuv Khan

I have resigned from my job in Dec 2015. please let me know that am i eligible for Withdrawal my full PF amount?

please reply.

Have not got a job ? If you are not working for 2 months after resignation you can apply for PF withdrawal.

Currently as per rule change in EPF you will not get your employer share.

If you have worked for less than 5 years PF withdrawal will be taxable.

So if you can wait do wait for a month or so – a) The financial year will change so your income would go down and hence tax on EPF withdrawal ,if worked for less than 5 years, will be minimised.

b) Employer share issue might get reversed.

c) From Aug there might be online withdrawal process.

What about Pension withdrawal ?

Please advise.

Hi everyone My Name is Taiyuv Khan

I have resigned from my job in Dec 2015. please let me know that am i eligible for Withdrawal my full PF amount?

please reply.

Have not got a job ? If you are not working for 2 months after resignation you can apply for PF withdrawal.

Currently as per rule change in EPF you will not get your employer share.

If you have worked for less than 5 years PF withdrawal will be taxable.

So if you can wait do wait for a month or so – a) The financial year will change so your income would go down and hence tax on EPF withdrawal ,if worked for less than 5 years, will be minimised.

b) Employer share issue might get reversed.

c) From Aug there might be online withdrawal process.

What about Pension withdrawal ?

Please advise.

This is really pathetic that we can’t withdraw our hard earned money i.e. employer contribution at will. All they want is to work for them till 58 years and pay the whatever taxes they force upon us.

I was having this plan of starting my own business after 4-5 years with the help of my PF money and other savings, was not expecting that would be screwed this way. The present government decisions have been really heavy on the common people, not expecting acche din this way.

This is really pathetic that we can’t withdraw our hard earned money i.e. employer contribution at will. All they want is to work for them till 58 years and pay the whatever taxes they force upon us.

I was having this plan of starting my own business after 4-5 years with the help of my PF money and other savings, was not expecting that would be screwed this way. The present government decisions have been really heavy on the common people, not expecting acche din this way.

Respected Sir/Madam

This is my pf A/c no. JHRAN00117380000000468 but i m unable to withdraw my pf, when i have to go Ranchi PF office some officers Mr. R R sahay (0651-2360874, 2360039) had said to me you can’t withdrawal your PF balance amount before 58 year, as per new Changes in EPF Withdrawal Rules from 10 Feb 2016

So i’m requesting you kindly suggest me how can i withdrawal my pf amount… Because next month 28/04/2016 is my sister marriage ceremony….

please sir…… please…..

AMIT KUMAR VISHWAKARMA

UAN 100080630861

You cannot withdraw employer Share of EPF. You can withdraw the remaining amount. Please tell Mr Sahay. You can printout of the EPFO circular and show it to him.

Sir, can you provide me new circular pdf link.?

This is not right disicion pls provide poor peopleb asap full amount claim.

Sir now will get full amount including employer contribution. The rule has been withdrawn

sir i am resign on 01.01.2016 , now apply epf refund application. my question is am eligible to claim the epf amount..

thank you sir

T.Senthil

pondicherry

Respected Sir/Madam

This is my pf A/c no. JHRAN00117380000000468 but i m unable to withdraw my pf, when i have to go Ranchi PF office some officers Mr. R R sahay (0651-2360874, 2360039) had said to me you can’t withdrawal your PF balance amount before 58 year, as per new Changes in EPF Withdrawal Rules from 10 Feb 2016

So i’m requesting you kindly suggest me how can i withdrawal my pf amount… Because next month 28/04/2016 is my sister marriage ceremony….

please sir…… please…..

AMIT KUMAR VISHWAKARMA

UAN 100080630861

You cannot withdraw employer Share of EPF. You can withdraw the remaining amount. Please tell Mr Sahay. You can printout of the EPFO circular and show it to him.

Sir, can you provide me new circular pdf link.?

This is not right disicion pls provide poor peopleb asap full amount claim.

Sir now will get full amount including employer contribution. The rule has been withdrawn

sir i am resign on 01.01.2016 , now apply epf refund application. my question is am eligible to claim the epf amount..

thank you sir

T.Senthil

pondicherry

respected all,

please provide me new pf withdrawal form without employer share & pension …..

because form 19, & form 10c not accepted by pf officer….

Please download the Forms from our article Forms to avoid TDS,15G, 15H, and EPF Withdrawal Forms Form 19, Form 20,Form 10C,Form 10D,Form 51F

Sir,

but form 19, & 10C, 15G not accepted by pf officer….

they said

pf withdrawal ka new form abhi nahi aaya hai…. jab naya form aayega to hi aap nikal payenge…

jisme aap sirf apna share nikal sakte hai…..

employer of pension ka paisa nahi nikal payenge…

respected all,

please provide me new pf withdrawal form without employer share & pension …..

because form 19, & form 10c not accepted by pf officer….

Please download the Forms from our article Forms to avoid TDS,15G, 15H, and EPF Withdrawal Forms Form 19, Form 20,Form 10C,Form 10D,Form 51F

Sir,

but form 19, & 10C, 15G not accepted by pf officer….

they said

pf withdrawal ka new form abhi nahi aaya hai…. jab naya form aayega to hi aap nikal payenge…

jisme aap sirf apna share nikal sakte hai…..

employer of pension ka paisa nahi nikal payenge…

How many votes are required to reverse the rule ?

As per petition it says 2500 ?

How many votes are required to reverse the rule ?

As per petition it says 2500 ?

Pls tell me

Pls tell me

I resigned november month 2015. If any possibility to get full amount… pls reply

Pls anybody tell me the possibility….

I resigned november month 2015. If any possibility to get full amount… pls reply

Pls anybody tell me the possibility….

Hello,

It doesn’t talk about who has immigrated outside India permanently. I left job in Dec 2015 and moved to Canada permanently. I am about to apply for withdrawal. Now what changes for me?

Thanks and regards,

Kanchan Dutta

From what we understand it applies to those also who are leaving India permanently. You would do our readers a favor if you could update us on whether you get full amount or not.

Thanks for the prompt response.

I’ll definitely let you know. But keeping fingers crossed, I think that the immigrants have been spared.

I have 93 page EPF scheme document with me.

They have modified paragraph 69, but left paragraph 69(1)(c) untouched. This paragraph and only this paragraph talks about immigrants.

I’m saying this based on the circular you shared above, point no. 6.

As per the circular you shared, they have changed the following paragraphs

– 26A subparagraph 1

– 68-NN

– 68-NNN

– 68-O

– Added a new paragraph 68-NNNN

– Modified 55 years to 58 in paragraph 69

– Omitted paragraph 69(1)(e)

– Omitted 69(2) and (5)

So they left 69(1)(c) untouched, paragraph related to migration.

But then the government offices are full of incompetent people.

Let me know your opinion.

I am also interested to know, as I am currently in USA and left the Job from USA in Oct 2015. But I was lazy to apply for withdrawal. If in case I can withdraw PF being I am USA working in USA not in India at all then I would apply my case for withdrawal.

Second thing which is not clear if I do not withdraw PF amount will it earn interest after 3 years. Is there any way I can contribute to my EPF account myself to keep the account active?

Tej,

I’m not sure whether you are aware of this or not. Make sure that your EPF forms are “accepted” with date stamp at RPFO, before 30-April-2016.

Due to complications in implementing the new withdrawal rules, these have been postponed to be effective from 01-May-2016.

So if you can, make sure that your RPFO receives all the “relevant” and “correct” documents before 30-April-2016.

Also note that my documents were accepted and stamped on 16-March-2016, but the acknowledgement was dated 18-March-2016. So you need to keep margin for at least 3-4 working days.

Hope this helps.

Hello,

I received the full EPF and pension amount with interest, within less than 30 days.

I resigned in December-2015 end and the documents were accepted at RPFO on 18-march-2016.