There are changes associated with Mutual Funds In 2018 some due to SEBI and some due to Income tax Department, such as Long Term Capital Gain Tax (LTCG) on Equity oriented Mutual Funds, New Classification of Mutual Funds, Change in Name of Mutual Funds, The New Index TIR. This article gives an Overview of Changes in Mutual Funds in 2018 and then discusses each of the change in detail.

Table of Contents

Changes in Mutual Funds in 2018

The Securities and Exchange Board of India’s (Sebi’s) has asked Mutual Fund companies to make changes in Name , characteristics of the scheme, benchmark, Disclosure of Total Expense Ratio. The Budget introduced tax on Long-term Capital gains(LTCG) on Equity oriented mutual funds and Dividend distribution tax on Equity mutual funds. An overview of these changes is given below.

Change in Name or Type of Mutual Funds: In October 2017 SEBI asked the mutual funds to make their mutual fund schemes more standardised in terms of category, characteristics and names of Mutual Fund Schemes. The names should also communicate the purpose of the scheme. SEBI circular numbers are SEBI/HO/IMD/DF3/CIR/P/2017/114 dated October 06, 2017 and SEBI circular SEBI/HO/IMD/DF3/CIR/P/2017/126 dated December 04, 2017.

The Mutual Fund schemes will be classified into five broad categories -Equity, Debt, Hybrid, solution-oriented and other Schemes. Only one scheme per category will be permitted.

- Equity schemes will be further classified into 10 subcategories: Multi cap, large cap, large & midcap, midcap, small cap, dividend yield, value, contra, focused, sectoral/thematic, ELSS (Equity Linked Savings Scheme)

- Debt schemes will be classified into 16 subcategories: Overnight, liquid, ultra-short duration, low duration, money market, short duration, medium duration, medium to long duration, long duration, dynamic bond, corporate bond, credit risk fund, banking and PSU, gilt, gilt fund with 10-year constant duration, floater

- Hybrid will be into 6 subcategories: conservative hybrid, balanced hybrid, aggressive hybrid, dynamic asset allocation/balanced advantage, multi-asset allocation, arbitrage, equity savings

- 2 in solution-oriented schemes : the goal of retirement and children benefit

- 2 in other schemes – Index fund, ETF (Exchange Traded Fund), FoF (Fund of Fund—overseas/domestic)

Example Parag Parikh Long Term Value Fund has been renamed as Parag Parikh Long Term Equity Fund while Mirae Asset India Opportunities Fund Mirae Asset India Equity Fund.

The biggest advantage of this classification is that it will make mutual fund schemes comparable. Right now it’s a bit difficult as each fund has its own definition of large-cap, mid and small cap stocks.

There won’t be duplication of schemes as it is happening right now where a fund house has two or more schemes in a category with similar strategy.

Benchmarking of Scheme’s performance to Total Return Index In accordance with SEBI circular no. SEBI/HO/IMD/DF3/CIR/P/2018/04 dated 4 Jan 2018, effective from February 01, 2018, the performance of all the Mutual fund schemes have to benchmark to the Total Return Index(TRI) of respective benchmark Index, as against the Price Return Index(PRI) of the respective benchmark index. Investors in equity shares get returns from two sources: appreciation in the traded price of share and dividends received. Fund NAVs factor in the capital appreciation and dividend received from underlying investments.

- TRI captures both the price movements and the dividend payouts of its constituent stocks.

- The TRI helps in giving the right picture of the real measures of what the fund has earned over and above—or below— of what was expected.

- The typical dividend yield on benchmarks is around 1.5% per annum, which means that the fund will have to work harder to beat the extra 150 basis points per annum.

Disclosure of Total Expense Ratio (TER) The TER is an annual charge deducted from the NAV daily. The impact will be felt more on the debt side where competition to attract large institutional money is fierce

- TER includes fund management charges, marketing and distribution costs, and registrar and transfer (R&T) expenses, among others. So far, expenses were being charged at the whims of the fund house.

- I order to bring uniformity in the disclosure of actual TER charged to mutual fund schemes and to enable the investor to make an informed decision, SEBI through its circular no. SEBI/HO/IMD/DF2/CIR/P/2018/18 dated February 05, 2018 has issued guidelines for changes in TER and disclosure.

- Therefore fund houses need to disclose the total expense ratio (TER) of their schemes daily on their website. Investors need to be informed via email or SMS at least three working days before any changes are affected.

Introduction of tax on Long-term Capital gains(LTCG) on Equity oriented mutual funds: 10% plus cess will be charged on LTCG arising from the sale of equity oriented mutual funds. However, LTCG up to RS. 1 Lakh will be exempt from Tax per fiscal.

Dividend distribution tax on Equity mutual funds: Tax@10% will be levied on the dividends distributed In case of equity mutual funds. However, this dividend will remain tax-free in the hands of investors. The tax will be deducted by the fund houses before distribution of dividend.

The T15(Top 15) and B15 (Beyond top 15) are slated to be replaced by T30 and B30: SEBI has revised the definition of top cities for the purpose of mutual funds’ total expense ratios.

- SEBI has removed the additional total expense ratio (TER) of 30 bps on incremental flows from so- called B 15. Instead, the regulator said the extra expense will now be allowed from flows coming from B30.

- Some of the cities which will lose incentives – Raipur, Bhopal, Ranchi, Varanasi, Jamshedpur, Cochin,Nashik, Rajkot, Patna,Ludhiana, Guwahati, Coimbatore, Indore, Panji and Bhubaneswar

Change in Mutual Fund name & its types

The Securities and Exchange Board of India (Sebi) has asked fund houses to classify their schemes into clearly defined categories. For long, there were no clear guidelines to categorise mutual funds. Fund houses even launched multiple schemes under each category, making scheme selection a confusing exercise for investors. To introduce clarity, Sebi has now asked fund houses to have just one scheme per category, with the exception of index funds, fund of funds and sector or thematic schemes. Mutual funds which have multiple products in a category will have to merge, wind up, or change the fundamental attributes of their products.

The Mutual Fund schemes will be classified into five broad categories -Equity, Debt, Hybrid, solution-oriented and other Schemes. Only one scheme per category will be permitted.

- Equity schemes will be further classified into 10 subcategories: Multi cap, large cap, large & midcap, midcap, small cap, dividend yield, value, contra, focused, sectoral/thematic, ELSS (Equity Linked Savings Scheme)

- So far the fund houses were arbitrarily defining large caps, mid caps, and small caps, among other schemes. Standard definition of caps.

- The stocks of the top 100 companies by market value will be classified as large-caps.

- Those of companies ranked between 101 and 250 will be termed mid-caps, and

- stocks of firms beyond the top 250 by market cap will be categorised as small-caps

- Debt schemes will be classified into 16 subcategories: Overnight, liquid, ultra-short duration, low duration, money market, short duration, medium duration, medium to long duration, long duration, dynamic bond, corporate bond, credit risk fund, banking and PSU, gilt, gilt fund with 10-year constant duration, floater

- Hybrid will be into 6 subcategories: conservative hybrid, balanced hybrid, aggressive hybrid, dynamic asset allocation/balanced advantage, multi-asset allocation, arbitrage, equity savings

- 2 in solution-oriented schemes : the goal of retirement and children benefit

- 2 in other schemes – Index fund, ETF (Exchange Traded Fund), FoF (Fund of Fund—overseas/domestic)

Now that scheme labelling is clearly linked to a fund’s strategy, the investor will clearly know what he is getting into. The fund category will define the scheme, and not its name Fund houses will also not be allowed to name schemes in a way that only highlights the return aspect of the schemes— credit opportunities, high yield, income advantage, etc.

With strict classification of schemes, fund houses may not be able to alter the investing style or focus of their schemes, as they did earlier. For instance, mid-cap funds stray into the large-cap territory or across market caps, in response to market conditions, which dramatically alters their risk profile. Now, funds will be forced to maintain their investing focus.Any drastic change in style will constitute a change in the fundamental attributes of the scheme, which would have to be communicated to the investors. For investors, this means they won’t have to worry about their chosen schemes altering mandates to something which doesn’t suit their needs or risk profile.

The distinct categorisation of schemes will also enable a better comparison of funds within the same category. While the earlier largecap funds category had schemes with pure large-cap focus as well those with a sizeable mid-cap exposure, now such distinctly varied schemes won’t be clubbed together

So far the fund houses were arbitrarily defining large caps, mid caps, and small caps, among other schemes. The new norms will bring uniformity in the operations of all mutual funds. Thus, comparing the performance of two schemes within the same subcategory will reflect an accurate picture of competence, in the future.

Going by the Securities Exchange Board of India circular, schemes benchmarked to midcap indices should have 65 % of their assets in mid-caps. But from a total Asset Under Management of Rs 7,17bn in 27 funds, only one fund had 65 % allocation to mid-caps. As per a CLSA report, Rs 19,300 crore of purchasing in mid caps would be needed to reach the 65 % lower limit.

In the case of large cap funds with an AUM of Rs 1,46,000 crore, most of them have already reached the 80 % minimum investment condition. About Rs 3,500 crore of additional purchasing would be required to make all of them compliant.

Small cap funds with Asset Under Management of Rs 27,200 crore will need to incur Rs 1,800 to meet the 65 % threshold. Eventually, the additional purchasing would be a function of how the Asset Management Companies reclassify the schemes, or effect mergers of various funds in order to comply with the market regulator regulation.

When there is a change in the fundamental attribute of the scheme, the investors are given exit option without any exit load. This exit option is not at all compulsory and should be availed if and only if there is a mismatch between your expectations and the offering. However, the capital gains will be payable in case of redemption in bond funds. Though the exits in current financial year from equity funds will lead to no tax on long term capital gains, the same will attract 10% tax after April 1, in case the gains exceed Rs 1 lakh.

Some of the changes announced so far.

| Parag Parikh Long Term Value Fund | Parag Parikh Long Term Equity Fund |

| Mirae Asset India Opportunities Fund | Mirae Asset India Equity Fund |

| DSP Blackrock Focus 25 Fund | DSP Blackrock Focus Fund |

| DSP Blackrock Micro Ca Fund | DSP Blackrock Small Cap Fund |

| DSP Black Small and Mid Cap Fund | DSP Blackrock Mid Cap Fund |

| DSP Blackrock Income Opportunities Fund | DSP Blackrock Credit Risk Fund |

| DSP Blackrock MIP Fund | DSP Blackrock 75/25 Fund |

| Reliance Monthly Income Plan | Reliance Regular Income Plan |

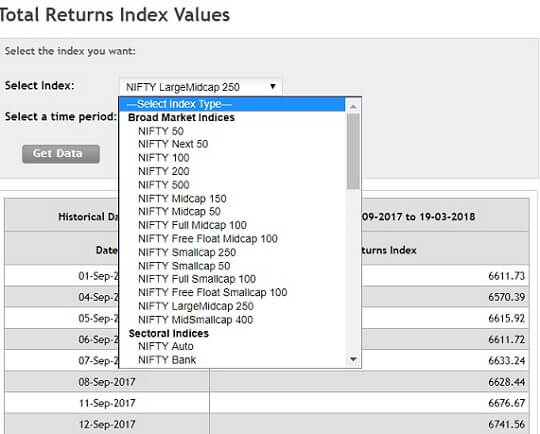

Benchmarking of Scheme’s performance to Total Return Index

Mutual Funds are required to disclose the name(s) of benchmark index/indices with which the AMC and trustees would compare the performance of the scheme in scheme related documents.

A benchmark is a standard against which the performance of a mutual fund can be measured. Since 2012, SEBI made it mandatory for fund houses to declare a benchmark index. This benchmark is independent and is based on the objectives of your fund. Most large-cap oriented equity funds benchmark themselves against the Sensex or the Nifty. Other benchmarks are CNX Midcap, CNX Smallcap, S&P BSE 200, etc. Hence, an investor in an equity mutual fund benchmarked against the CNX Midcap should compare should compare his returns accordingly.

If the scheme of the mutual fund that you have invested in delivers higher returns than the benchmark, it is said to have outperformed and vice-versa. On the other hand, if the benchmark index falls over a period of time and during the same time, your fund’s NAV falls lesser (in percentage terms), your fund can still be said to have outperformed the benchmark

It is a global benchmark, Most of the asset managers in the United States and Europe use Total Returns (TR) indices as benchmarks to measure the performances of their funds.

- At present, most of the mutual fund schemes(other than debt schemes) are benchmarked to the Price Return variant of an Index (PRI). PRI only captures the difference in prices of the index constituents or capital gains of the index constituents.

- On the other hand, Total Return variant of an Index (TRI)takes into account all dividends/ interest payments that are generated from the basket of constituents that make up the index in addition to the capital gains.Hence, TRI is more appropriate as a benchmark to compare the performance of mutual fund scheme

- For example, if a scheme was benchmarked against Nifty 50 earlier, it will be benchmarked against the Nifty 50 TRI. Some fund houses were already using the TRI. For example, Quantum, Edelweiss and DSP BlackRock. TRI is only a better and transparent way of showcasing how the schemes have done.

- Typically, the dividend in an index is around 1.5 per cent annually. Since the current indices are exclusive of the dividends, it understates the returns of the indices by about 1.5 percent annually. With TRI coming in, the returns of the index will go up by 1-1.5 percent yearly by default. Let us say that there was a particular scheme which claimed to beat the benchmark by 2.5 per cent in a year. That outperformance will now come down to one percent.

- Further, SEBI said that mutual funds need to use “a composite CAGR (compound annual growth rate) figure of the performance of the PRI benchmark (till the date from which TRI is available) and the TRI (subsequently) to compare the performance of their scheme in case TRI is not available for that particular period.

- The new norms are applicable to all schemes of mutual funds with effect from February 1, 2018.

- Given below shows the two variants of NIFTY50 index – TRI and PRI. The values for the 2 variants diverge due to reinvestment of cash dividends. As on 31st October, 2017, the NIFTY50 TRI returned 14.10% per annum against 12.52% per annum of NIFTY50 PRI (since 30th June, 1999) – a healthy difference of ~158 bps per annum.

You can find information of Nifty Indicies at NSE website for historical returns here

The Total Expense Ratio

Mutual funds are professionally managed investment vehicles which help investors to grow their money by investing in financial assets such as equities, bonds, gold and other assets. Mutual funds typically incur two types of expenses.

- There are non-recurring expenses during the launch of a fund, which in India, are usually borne by the fund house and not charged to investors

- There are recurring expenses such as the management fee, distributors’ commission, registrar’s fee, trustee fee and marketing expenses. Mutual fund companies charge a cost to their investors for managing their schemes. This cost is called the Total Expense Ratio, which is expressed as a percentage of assets managed.

In India, the maximum TER that a fund can charge its investors is prescribed by SEBI.

- Equity-oriented funds are allowed to charge a TER of 2.5 per cent.

- TER of debt is at 2.25 per cent

- TER of index funds is 1.5 per cent, respectively.

SEBI guidelines further set sub-limits for TER based on the size of the assets managed.

- For equity schemes, fund houses can charge 2.5 per cent for the first ₹100 crore, 2.25 per cent for ₹100 crore to ₹400 crore, 2 per cent on the next ₹400 crore to ₹700 crore and 1.75 per cent on any sums above ₹700 crore.

- For debt schemes, the limits are 25 basis points lower in each slabs.

- An additional 30 basis points can be charged by the mutual fund if 30 per cent or more of their inflows are received from beyond the top 15 cities.

- Funds can also charge for the service tax on their management fee. Hence, an equity fund with a corpus up to ₹100 crore may end up charging upto 3.3 per cent.

SEBI has taken various measures to rationalise the expense ratio of mutual funds. In 2012, it made it mandatory for mutual funds to launch ‘Direct’ options in all their scheme.

Why should you worry about TER, Your returns from a mutual fund depend on the growth in its Net Asset Value (NAV). This NAV is calculated after reducing the TER from the latest value of the scheme’s portfolio. Hence higher the TER, the lower the money you take home as a fund investor.

Take the case of two identical index funds tracking the Nifty50, one with a 1 per cent TER and another with 0.5 per cent. Had you invested ₹1 lakh in each fund 15 years before, the first investment would now be worth ₹8.95 lakh, while the second one would amount to ₹10 lakh. Though both funds own the same stocks, the 50 basis point difference in the expense ratio lowered your kitty by over ₹1 lakh.

Many fund houses, especially those that handle significant institutional money, dabble in what industry players call NAV management, adjusting expenses against returns made on a particular day. The aim is twofold: Maximise returns and shore up assets in the process.

This is how the expense play usually works. Suppose 8-10 basis points (bps) is the cost of running a liquid fund. The fund house may reduce this to anywhere between zero bps and 3 bps on days when the scheme performance is dismal. This is done to prop up returns. On days when the performance is good, the expense is raised to recover the cost. The ‘low expense’ carrot is also dangled to attract large corporate houses.

Expenses for other debt categories swing wildly as well. For instance, short-term funds may charge anywhere between 30 bps and 100 bps, depending on the returns matrix. Income funds typically charge 75-150 bps but on days when returns are poor, fees can go as low as 40-50 bps.

The Securities and Exchange Board of India’s (Sebi’s) has asked their fund houses to disclose the total expense ratio (TER) of their schemes daily. Investors need to be informed via email or SMS at least three working days before any changes are effected.

So far, expenses were being charged at the whims of the fund houses. Investors can now get the actual returns rather than the accountants’ returns artificially added to the NAV

Long Term Capital Gain on Equity Mutual Funds

Till now, investors, who invested in equity mutual funds and sold them after holding them for more than a year, paid zero tax. From 1 Apr 2018 a 10 per cent LTCG tax will be on gains made above Rs 1 lakh per annum.

The grandfathering clause is the exemption granted to existing investors for gains made by them before the new tax law came into force. The government has done this to ensure that investors who have committed money keeping in mind the easier tax regime are protected. As per the new laws, the government has said that gains made in equity-oriented mutual fund schemes till January 31, will be grandfathered or exempted. There will be no LTCG tax on notional profits on mutual funds till then.

For long-term capital gains made from sale of funds upto March 31, 2018, there is not tax. However, any sale made after April 1, 2018 will be liable to the new LTCG tax. One needs to segregate this LT capital gain into two parts:

- a) Part I – is LTCG made upto Jan 31, 2018. This will be the NAV of the mutual fund on Jan 31, 2018, minus the cost of acquiring the units;

- b) Part II – is LTCG made after Jan 31, 2018. This will be sale price NAV minus NAV of the scheme as on January 31, 2018.

- As per the tax law, Part I will be exempt. It is the Part II, which will be assessed as LTCG for Tax.

Dividend distribution tax on Equity mutual funds

Till 31 Mar 2018, there is no dividend distribution tax or DDT on equity-oriented mutual fund schemes. The mutual fund schemes which invest at least 65 per cent of their assets in equities were out of the DDT ambit till now. However, debt mutual funds pay dividend distribution tax of 28.84 per cent (25 per cent tax + 12 per cent surcharge + 3 per cent cess ) .

From 1 Apr 2018, mutual fund houses will have to pay a Dividend Distribution Tax of 10 per cent on dividends declared under equity schemes. Sure, DDT is paid by the mutual funds and not by investors. However, investors would be impacted as the company pays the tax out of the declared profits and it will debt the dividends to that extent

Related Articles:

All About Mutual Funds : Basics, Choosing, Paperwork, Direct Investing

- Get started with Mutual Fund investing: KYC, Platform

- How to Choose Mutual Fund

- Investing in Equities: Stocks vs Mutual Funds

- How to link Aadhaar to Mutual Funds Investments

Brilliant. I couldn’t find acomprehensive write-up such as this.

Thanks for kind words.

If possible, please share about it with friends/family/colleagues

Sir is there is a deadline set by SEBI to implement all these changes by all AMC’s?

No.

You can check out the SEBI circulars at SEBI website and Circulars