The National Pension System (NPS) is is gaining popularity because of Tax benefits. It is also one of the most feasible and cheapest products in the market. This article talks about the features of NPS, changes in NPS in 2016 to make NPS attractive like more equity exposure ,about Bajpai committee which recommended the changes, why the changes were made.

Table of Contents

Changes in NPS

Despite of innumerable features, NPS has not performed well in the market. The total assets of all private NPS Tier 1 subscribers amount to less than Rs 5,000 crore. To lure subscribers for the scheme, the Pension Fund Regulator and Development Authority (PFRDA) has bought several improvements in the rules governing the scheme. Overview of the changes in NPS is given below. We shall discuss them in detail in article.

- Lower minimum investment of Rs 1,000

- 40% of corpus made tax free on maturity

- Early withdrawals allowed

- Deferring withdrawal till 70

- Two more options under Auto Choice option have been added with increased exposure to Equity. These are Aggressive Life Cycle Fund and Conservative Life Fund.

- A new asset class ‘A’ has been added for Alternative Investments for private sector subscribers.

- Deferring purchase of annuity

- Shift from Epf/Superannuation fund

The Bajpai committee, set up to review the investment pattern of the NPS, was of the view that investors should be able to put all their money in equities. The committee recommended a roadmap spanning 6 years, divided into three phases, to allow full equity exposure. It recommended allowing an increase in equity to 75% through the life-cycle fund in the first phase, then 75% allocation in the active choice and finally lifting the cap altogether. By introducing two life cycle funds, PFRDA has acted on the recommendations for the first phase:

Overview of National Pension Scheme

NPS is a government authenticated pension scheme where it is mandatory for government employees to subscribe while it is optional for other employees in the country. Our article Understanding National Pension Scheme – NPS covers NPS in detail. The highlights of the National Pension Scheme are:

- Choice: NPS gives diverse options to subscribers in terms of service providers, funds, investment options, pension fund managers, annuity service providers and annuity service plans. Subscribers even have an alternative to switch a service provider, fund, investment option or even a pension fund manager.

- Easy accessibility: On enrolling for the NPS scheme, online or offline, each subscriber gets a unique ID and password of NSDL system for accessing and viewing his NPS details online from the comfort of his home.

- Low cost of operations: Fund Management charges is only 0.01% of the investment amount which makes NPS one of the cheapest investment avenues. On an investment of Rs 1 lakh, the fund management fee is just Rs 10 a year, as compared to Rs 1,500-2,500 charged by a mutual fund or a Ulip.

- Tax perks: NPS Tier 1 is an investment product stacked with tax benefits. Note : There are no tax benefits in Tier 2.

- It not only enjoys tax deduction under Sec 80C but

- NPS also relieves tax payers with an exclusive window of Rs. 50,000 under Section 80CCD (1B)

- NPS tops up with an additional deduction to corporate employees who invest in the scheme under Sec 80CCD (2) Investment up to 10% of Salary (Basic + Dearness Allowance) is deductible from taxable income u/s 80CCD (2) of Income Tax Act, 1961 subject to 1.5 lakhs limit of section 80C

- Flexible Contribution Mechanism: Under NPS, a subscriber has the decision taking ability to choose and alter the amount and frequency of contribution towards the scheme.

- Regulated: NPS is prudently regulated by PFRDA. It propounds transparent investment norms followed with regular monitoring and performance review of fund managers by NPS Trust.

- Account portability: No matter the number of times a person changes his employer, his PRAN( NPS account) remains the same.

- Proficient Grievance Management mechanism: A subscriber has many arrays like the CRA/PFRDA website, call center, email and postal mail to submit his grievance.

Changes in NPS : Two new options under Auto Choice added

PFRDA in its circular dated November 4, 2016: Introduction of two New Life Cycle Funds (pdf), announced revised life cycle funds with two more options under Auto Choice option with increased exposure to equity . These funds are Aggressive Life Cycle Fund and Conservative Life Fund. These options are in addition to Existing life cycle fund which will be the default choice and known as Moderate life cycle fund or LC 50. Rationale of having higher equity exposure is that more investment in equity calls means higher returns. Equity fund in reality can yield more than NPS due to the power of compounding. Here small investments growing at a faster rate will compound and produce more income quickly as compared to large investments that grow slow.

- These options are limited only to non-government subscribers. Government employees or subscribers shall be denied the new options. For Government subscribers, the equity allocation is still capped at 15%.

- Active choice investors, who choose their own asset mix, cannot invest more than 50% in equities.

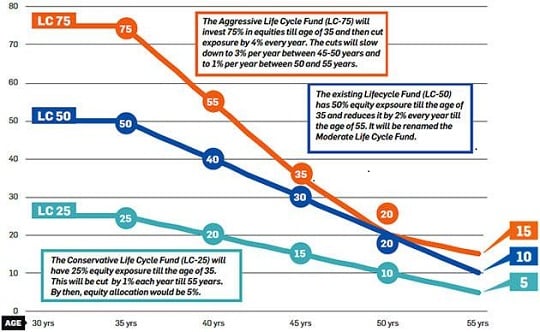

Aggressive Life Cycle Fund (LC 75)

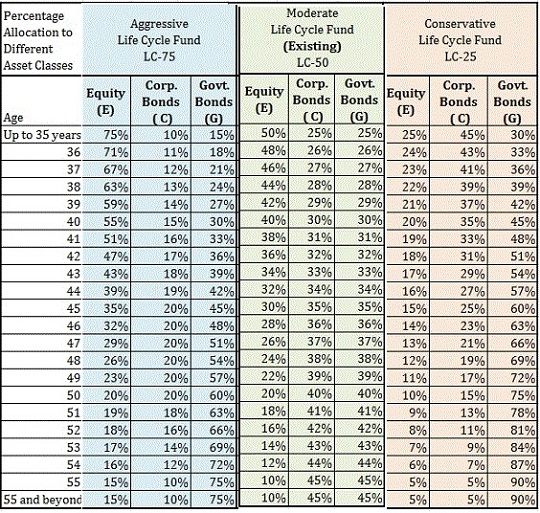

Aggressive life cycle fund modifies its exposure to equity as per the age and risk taking capacity of the subscriber. Under this fund, the exposure to equity (E) is 75% up to the age of 35 , reduces it by 4% every year till age of 55 and declines to 15% by the time a subscriber turns 55. Consequently, the allocation stays the same till the time a subscriber exits NPS. The Aggressive Life Cycle Fund is for Young investors and provides greater exposure to equity without the hassle of managing allocation themselves.

Conservative Life Cycle Fund (LC 25)

As the name suggest, Conservative life cycle fund is conserved or reserved for equity exposure. In this fund, the fund allocation to equity (E) is 25% upto the age of 35,reduces it by 1% every year till age of 55 and eventually goes down to 5% by the time a subscriber turns 55. Subsequently, the allocation stays the 5% till such time a subscriber is willing to exit NPS. A conservative life cycle fund is for subscribers who want to take lesser risk.

Moderate Life Cycle Fund (LC 50)

Existing Life Cycle Fund has been renamed as Moderate Life Cycle Fund. It has 50% equity exposure till the age of 35 and reduces it by 2% every year till age of 55 and eventually goes down to 10% by the time a subscriber turns 55 .

Following images shows investment in NPS in graphical and tabular form.

Image below shows Exposure to different asset classes in Aggressive Life Cycle Fund, Moderate Life Cycle Fund and Conservative Life Cycle Fund over a time period.

Changes in NPS: New Asset Class

PFRDA has added a new asset class ‘A’ for Alternative Investments for private sector subscribers. The subscribers are allowed to invest up to 5% of the corpus in asset A. This asset class is in addition to three existing asset classes i.e. Equity (E), Corporate Bonds (C) and Government Debt (G). Investment in Asset Class (A) consists of following, as announced in PFRDA circular dated November 4, 2016: Creation of a Seperate asset class,

- Commercial mortgage based securities or Residential mortgage based securities

- Units issued by Real Estate Investment Trusts regulated by SEBI

- Asset backed securities regulated SEBI

- Units issued by Infrastructure Investment Trusts regulated by SEBI

- Alternative Investment Funds (AIF Category I and II) registered with SEBI

Fund managers are also not happy as the ticket size of A class allowed by PFRDA is at least Rs 100 crore. Secondly A class funds are closed ended funds so there are issues of liquidity.

5% is too insignificant an exposure to make any material difference to overall portfolio returns. Secondly Asset Class A is difficult to understand , why would an investor want to look into it. The NPS was meant to be a simple investment product that serves the interests of the unseasoned, lay-investor. The addition of Asset Class A is an un-needed compilcation.

Changes in NPS : Deferring purchase of annuity

On retirement, NPS investors whether government employees or not have to reluctantly buy an annuity with 40% of the corpus. PFRDA after the change now allows investors to defer the purchase for up to three years. So now one can postpone buying annuity till the age of 63. An annuity is a retirement product that gives you pension for life. Annuities are of two types: deferred and immediate. A deferred annuity requires you to first build a corpus, and then use it to buy an annuity. The National Pension System (NPS) and pension plans offered by insurance companies come in this category as they first help you build a retirement corpus and then mandate that you annuitise a part of that corpus. An immediate annuity plan is purchased with a lumpsum. People who want to start their retirement payout opt for immediate annuity. It offers guaranteed income that starts almost immediately for either a limited period or till perpetuity. Deferred annuity helps people save for the future and the annuity starts after a certain date.

This is a good move. If the annuity rates are low, they can wait for some time for the rates to improve. But most experts think this extension should be longer. The older you are the higher is the annuity payout and some people may want to wait till 65 or even later. Also, many investors may not retire at 60-63

Changes in NPS : 40% of corpus made tax free on maturity

Budget declared in 2016- 2017 had made 40% of the NPS corpus tax-free on maturity. With this shift in decision, NPS has become a quasi EET instrument from an EET product where 60% of the total amount is taxable on maturity while 40% is tax free. With this variation, NPS has qualified to be a better pension plan as compared to the ones offered by insurance companies where the tax free withdrawal is capped at 33%. NPS still has to beat other products in the market like EPF, PPF and ELSS as they are fully non-taxable on withdrawal. However,pension is taxed as Income from Salary as per your income tax slab rate.

Changes in NPS : Deferring Withdrawal till 70

40% of the total sum invested in NPS has to be compulsorily invested in annuity but the balance 60% can be withdrawn. But as the fund management charges of NPS are negligible, a person need not withdraw 60% in one go. So NPS investors can now delay withdrawals till the age of 70. It also helps in reducing tax. An investor can withdraw some part in a specific financial year (one where his income is low) and reduce the overall tax liability. He can also split the withdrawal across different years (instead of lump sum withdrawal). Say you come under 20% tax bracket, You can reduce the tax liability on 20% taxable corpus by splitting them into 10 equal instalments of 2% each. Since each of these instalments (2% each) will be small, the tax hit will be very low.

Changes in NPS: Early withdrawals allowed

Realizing that urgent need of money can arise any time and easy liquidity is needed, NPS now allows its investors to withdraw up to 25% of their own contribution. Need for money can vary from children’s higher education or marriage, construction or purchase of first house, treatment of critical illness for self, spouse, children or parents. When a goal is as far away as retirement usually is, the tendency to make premature drawings is always imminent. The earlier on in the savings lifecycle these drawings are made, the more exponentially damaging their effect on your final corpus. As some people tend to spend when they are allowed, a good retirement product should enforce a lock on the saved amount till their retirement age. Allowing this ‘flexibility’ may be penny wise, pound foolish. I hope that most investors opt not to exercise this clause.

Changes in NPS: Lower minimum investment of Rs 1,000

The minimum investment into NPS has now been lowered to Rs. 1,000 per annum from Rs. 6,000 (Rs. 500 per month), opening gates for a wide range of subscribers. What if the entry level saver, comforted by this low threshold requirement, buries his head in the sand and just continues to save Rs. 1,000 per month for 20 years? Assuming a reasonable growth rate of 10% per annum, it would lead to the accumulation of a meagre Rs. 63,000 ,a very small amount! Forced to invest Rs. 6,000 per annum, it would have led to an accumulation of Rs. 3.82 Lakhs, which though small is better than 3.82 lakhs.

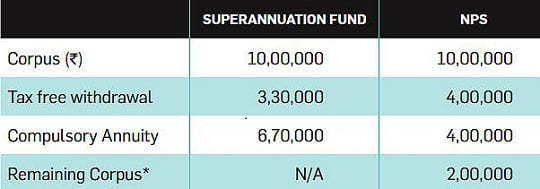

Changes in NPS: Shift from EPF/SUPERANNUTATION fund

The Government has also allowed investors covered by EPF and other superannuation funds to shift to the NPS. This is a one-time switch and you will get only one more chance to return to the EPF fold. Though shifting from EPF to NPS is not advisable, investors should shift from a superannuation fund to NPS

A superannuation fund is a retirement fund offered by your employer. The employer contributes 15% of your basic salary to this fund. It is not mandatory for you as an employee to contribute to the fund, but you may do so if you wish. Though the monthly amount may be a small one, it creates a corpus large enough to help sustain your needs after retirement. Employers generally take group superannuation policies with insurers such as LIC, which maintains both the group account and your individual account. The principal amount, interest and profits made through investments in funds (by the insurer) are deposited in your individual account. The rate of interest is usually similar to provident fund rates.

When you retire, you can withdraw 25% of this superannuation fund amount which is exempted from tax. The remaining 75% is invested in an annuity fund in your name, to ensure regular returns during your retirement period. You can choose to receive annuity returns either monthly, quarterly, half-yearly or annually. This amount that you get periodically, will be considered as an income and hence is taxable. If you change jobs and the next employer does not run a superannuation scheme, then you can either withdraw the whole amount or let the fund continue until your retirement.

Comparison of NPS returns with superannuation

- In a superannuation fund, you have to compulsorily buy an annuity with 67% of the corpus while it is only 40% in case of NPS.

- 33% of the accumulated amount is tax free in superannuation fund, it is 40% in NPS.

- While you have to pay 1.4% service tax while buying annuity using superannuation funds, you don’t pay any service tax for NPS funds.

- Superannuation funds allow annuity buying from the same insurance company, while you can buy from any company under NPS.

Comparison of NPS with superannuation

Why Changes in NPS : Bajpai Committe

The Pension Fund Regulatory and Development Authority (PFRDA) had set up the committee,headed by G.N. Bajpai, former chairman of stock market regulator Securities and Exchange Board of India (Sebi), on May 15, 2012 to resurrect the NPS which has failed to take off since its launch in May 2009. It has found only around 50,000 takers among a workforce of over 40 crore people without any pension plan. It submitted its report 10 May 2013 which you can read here

Again on September 10, 2014 the Committee was constituted by PFRDA to review Investment Guidelines for National Pension System (NPS) Schemes in Private Sector. The Committee was expected to examine the current investment guidelines with reference to global best practices. The Committee was also expected to examine and recommend measures for risk management, asset liability management, benchmarks for evaluation of schemes and principles for valuing portfolio etc. The report was submitted on 7th Apr 2015. You can read report of Bajpai committee here. Changes suggested by Bajpai committee in 3 phases are given in image below

[poll id=”100″]

Related Posts:

- Understanding National Pension Scheme – NPS

- eNPS : Open NPS account online, contribute to NPS online

- NPS Tax Benefits and sections 80CCD(1), 80CCD(2) and 80CCD(1B)

- Should you Invest in NPS the National Pension Scheme for additional 50,000 and save tax

Government is trying to make people invest in for NPS. Tax benefit of 50,000 has been a big incentive. These changes are aimed at making NPS attractive. Will people invest in NPS due to these changes is to be seen.