Credit card have made life for shoppers simpler. Carrying cash can be cumbersome and dangerous at times. These cards can be swiped at almost any establishment. You can also withdraw cash on your credit card but Credit cards aren’t free. As Spiderman said “With great power comes great responsibility” and these credit cards have various charges,fees associated with them and if not used judiciously can lead one to debt trap. Let’s become aware of terms, fees and charges related to credit card . In the article for example we have taken HDFC cards as they are most used card in India. The terms and conditions of HDFC cards can be seen here(pdf). You can also see the most important terms and conditions of State Bank of India (SBI) cards at their webpage :SBI:MITC

Terms related to credit cards

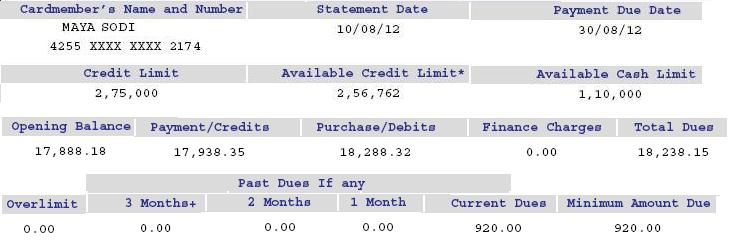

Part of sample credit card is shown below. The terms like Statement Date, Credit Limit etc are explained .

Credit Limit: Your credit limit is the maximum amount you can charge on the card. This includes purchases, balance transfers, cash advances, finance charges, and fees. Different cards have different credit limits. Credi card issuers determine the Cardmember’s Credit limit and cash withdrawal limit based on their internal criteria. Usually a platinium card will have more credit limit than the gold card. When you go over your credit limit, your creditor may charge a fee, an over-the-limit fee. For the credit card sample show the Credit limit is Rs 2,75,000.

Balance: The balance on your credit card at any given time is the total of your purchases, finance charges, and credit card fees. The higher your credit card balance, the lower the available credit you have to make additional purchases. For the credit card sample show the Balance/Total due is Rs 18,238.15. Available Credit limit becomes Credit Limit – Balance which in the above example is Rs 2,75,000 – 19,238.15 Rs or Rs 2,56,762

Billing Cycle and Grace Period: The billing cycle is the period of time between billings. At the end of the billing cycle, you are billed for all unpaid charges and fees made during the billing cycle. Your credit card payment is due 20-25 days after your billing cycle ends. The period of time between your billing cycle end date and your bill due date is known as your grace period. A billing cycle may start on the 1st day of the month and end on the 30th day of the month. Or it may go from the 15th of one month to the 15th of the next. Billing cycles are varying lengths, ranging from 25 to 45 days, depending on the credit card and the issuer. Remember If you carried a balance from the previous month, you do not have a grace period for your new purchases.

Suppose your billing cycle starts on 6th of every month and is of 30 days. The purchases made say from 6th of Mar to 5th of April are billed in bill on 6th April. You have say 25 days to pay your bill i.e you can pay your bill on 30th Apr. So Grace period is 25 days. This is shown in the picture below(Src:Jagoinvestor) So purchases made on 10th Mar have 50 days of interest free credit while purchase made on 3rd Apr has 27 days of interest free credit. Purchases made from 6th Apr to 5th May will be billed on the next bill i.e on 6th May.

Billing Cycle and Grace periodThe period of free of interest exists only if all previous dues are paid in full and there is no unpaid balance carried over from previous months

Statement Date is the date on which your statement is generated every month.

Payment Due Date is the last date by which the bank should receive clear funds post processing towards card payment,failing which, future transactions may not be honoured and late payment charges and charges on revolving credit plus service tax will be levied as applicable.

For the credit card sample show the Statement Date is 10/8/2012 while Payment date is 30/8/2012.

Annual percentage rate (APR): The annual percentage rate (APR) is the yearly interest rate applied to a balance carried beyond the grace period i.e it is the borrowing interest rate for when you don’t pay your bill or pay minimum amount. We shall how these are used later. Credit card companies usually advertise interest rates on a monthly basis (e.g. 2% per month). For example, a credit card company might charge 1% a month, but the APR is 1% x 12 months = 12%. Credit cards (also personal loans) are the most expensive loan that you can take with annual interest above 36% or 2% per month.

Incentives and Rewards:Some credit cards offer rewards and incentives for using their credit card. Rewards come in several different forms: cash back, points to redeem, and discounts.

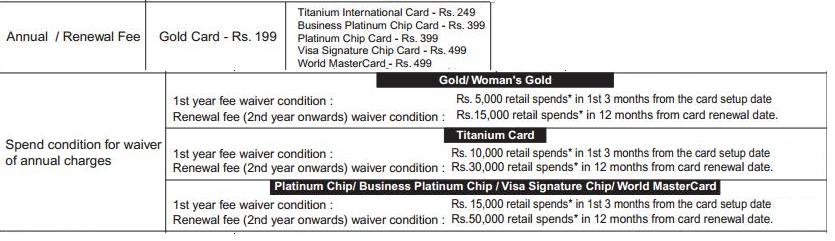

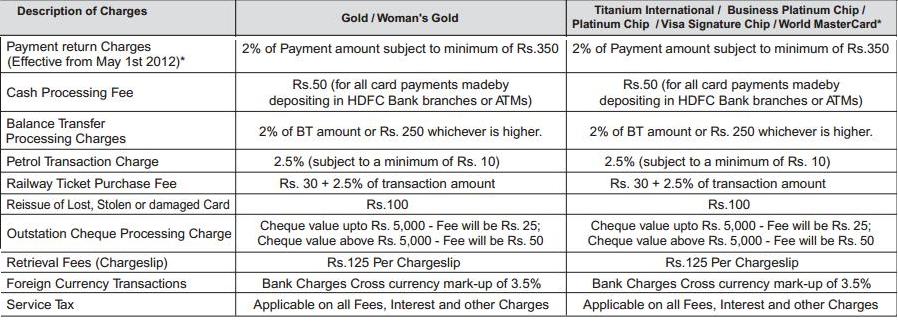

Types of cards:Titanium, Platinum, Gold, Silver or Classic/Executive are the different kind of cards offered by issuing banks. Other than color/name of the card charges, fees and levels of services offered are different. Generally more expensive the metal on which card is named(Platinum is more expensive than Gold which is more expensive than silver) more would be credit limit, annual charges, more offers, discount. These types of cards have the element of prestige and esteem associated with them.

Co-branded Credit Cards: CoBranded credit cards is partnership between the issuer, say HDFCBank, and a retail service-provider or a goods provider say Jet Airlines. Such cards have both the bank name and the store name on it.Every time HDFC Jet Privilege card is used, air miles accrue which can be redeemed for free flights, one is given automatic membership to the Jet Privileges scheme.. The tradeoff for all these free flights will be a hefty annual fe,e One needs to be a frequent flyer to get the card’s full value. Webpage HDFC:Jet Privilege card has details of the card. Are the co-branded cards worth it? Quoting from article Karvy:CobrandingThe answer boils down to cost. If the cost of owning a co-branded card is the same, or nearly so, as that of a normal `no-frills’ credit card then the former is worth it, as one gets that little extra for nothing. If the co branded entity has the rational appeal of saving money and the emotional appeal with the consumer of the lifestyle the retailer represents, then it could be a really strong value proposition.

Fees and Charges

Annual Fee: A yearly fee charged for the convience of having the credit card. You are charged once a year. Some credit cards waive the annual fee the in the first year. Some credit cards waive off the annual fees depending on the amount you spend. At times you can ask your credit card company to waive the fee.

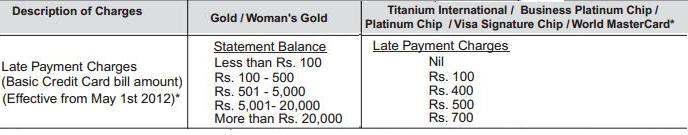

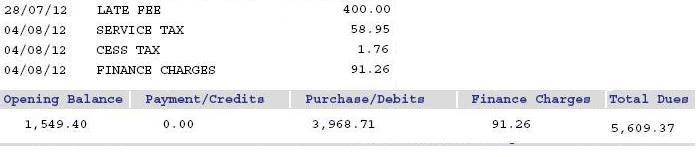

Late Fee: A charge for making less than the minimum payment or payment after the due date or both. Charged once each billing cycle you are late. To avoid it pay your bills on time. Late payment charges of HDFC credit card are shown below.

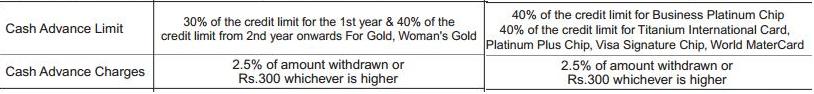

Cash Advance Fee: Credit cards provides a service/feature called Cash Advance which allows cardholders to withdraw cash through an ATM (at times in abroad also). The maximum limit to which one can withdraw is called as Cash Advance Limit which is expressed as percentage of cardmember’s Credit Limit. A fee (which bank says as nominal) is charged for making a cash advance called as the cash advance fee. Cash advance fee is 2.5% of the amount withdrawn or a minimum amount. Please note, other than the one-time cash advance fees one also has to pay service charge/finance charge from the date of withdrawal until the date of settlement. The finance charges are high, charged at the Annual percentage rate(APR) discussed earlier. How high if you are wondering, more than 2% per month or 24% per year depending on the issuing bank. Many people take cash advances from their credit cards and use them for any personal finance emergency without realizing the charges they have to pay. However, if some circumstances compel you to take cash advance, it will be better that you repay your entire outstanding amount with the very next monthly bill.

Quoting from cardbhai:How Big is “Cash Advances on Credit Cards” Market in India ?

Indians withdrew cash of Rs 12595.86 Mn [Rs 1259.58 Cr] using their Credit Cards from various bank ATMs in 2,190,662 number of transactions; Thus the Average Cash Withdrawal transaction at ATM was of Ticket Size Rs 5749.79 rounded of to Rs 5750. Indian Consumer Paid a whopping Rs 657.19 Mn / Rs 65.71 Cr as fees and Rs 377.87 Mn or Rs 37.78 Cr as Interest on the Cash Advance in FY 2011-12.

There are other fees also as shown in image below.

Over-the-limit Fee: Overlimit charges are applicable on total amount outstanding exceeding the Credit Limit. Say if credit Limit is Rs 50,000 and you spent 52,000 Rs then you would be charged for spending Rs 2,000 extra.

Cheque Bounce/Invalid Cheque Fee: Giving an invalid cheque or cheque being returned(bounced) from your bank. It is charged each time your cheque is returned by the bank.To avoid it Make sure you have funds available in your account when you write a cheque for payment

Ex: For SBI Gold Card Cheque Bounce/Invalid Cheque Fee is 2% of Cheque dishonor amount (Min Rs. 350, Max Rs. 500).

Foreign Transaction Fee: A fee charged on transactions made in a foreign currency. It is charged every time you make a foreign transaction.

Balance Transfer Fee: Balance transfer is a facility offered by all the credit card issuing companies to the cardholders which enables them to transfer the existing outstanding(balance) or debt of one credit card to another card. It is a way to induce potential customers to switch from one credit card to another. Generally low interest rates(at times zero interest rates) are available for balance transfer for introductory period only (say 3-6 months) and once it is over, interest rates returns to the normal rates. A fee charged when you transfer a balance from one credit card issuer to another is called Balance Transfer Fee. For a savvy consumer, a credit card balance transfer can be an excellent method of reducing debt. It leaves the person free to pay down the credit card balance incurring lower interest charges. When transferring to a new institution, there may be some fine print attached with hidden charges, such as transfer fees, annual fees, and joining fees. So please read fine print before going for Balance Transfer.

Finance Charge: When a person chooses not to pay his credit card balance in full(doesn’t pay or pays minimum) Finance charges are payable at the monthly percentage rate on all transactions from the date of transaction and on all cash advances taken by the Cardmember till they are paid back. Finance charges depends on your card’s APR, balance, and method of calculating finance charge. Pay your balance in full before the grace period expire. Paying minimum is what makes people go into debt trap. Sample of the bill which shows finances charges for missing out on credit-card payment with late fee is shown below. We shall look into finance charges in our next article.

Please remember that the fees may vary for each card member and from offer to offer. The same is communicated to the Cardmember at the time of applying for the credit card. The fees as applicable are billed to the card account and are also stated in the card statement of the month in which it is charged.

How to compare credit cards?

One can compare credit cards based on Card Type(MasterCard, Visa), Issuer(issuing banks ex:HDFC, SBI), Rewards (Cashback, travel), Interest Rate(low, min, max), annual fees etc. Some of the sites that help you in comparing the credit cards are: comparecards.in, apnapaisa.com:Compare credit cards, rupeetimes.com After shortlisting the cards please check the issuing bank website for latest details.

As Onemint:How to select a credit card in India? says “Paying interest on a credit card should really be the last thing you do, and is the worst kind of debt because it can easily snowball into a much larger number, and is generally spent on stuff that you can easily avoid. If one follows the policy of paying entire balance on credit card then Selection criteria can be: No Annual Fee, No Renewal Fee,Convenience to pay off your balance usually by linking card to bank, good reward points in the area where you spend the most.

Related Articles:

- How Credit/Debit card is Verified when it is Swiped?

- Rupay card: Difference from Visa, Master, One Nation One Card

- How India pays: Cash, Cheque,NEFT,Cards etc

- Compound interest: How it can be your friend or your enemy

- HOW TO WRITE A CHEQUE

- Choosing the best credit card: Annual Fee, Reward points,Cashback, APR

Nice information those who don’t know paymenting credit card bill.

Hi, i had got a car loan from Hdfc 5 months ago, after a week or so sales rep from Hdfc credit card called and asked if I would like to get a card, i agreed and I received a card in mail but i never signed any documents regarding credit card and now they are charging me a lot more interest than what i had expected..pls help.

Don’t focus on playing the blame game but take financial responsibility. Please try to understand why they are charging more interest.

Understand terms and conditions. Then decide if it makes sense to have the card. Else you can return it.

whoah this weblog is wonderful i love reading

your articles. Keep up the great work! You realize, a lot of individuals are searching around for this info, you could help

them greatly.

Thanks a lot for great comment.

Thanks. thats a lot of useful information about credit card usage. I have a problem. I transferred my Money from my Sweden account to my Indian credit card accound instead of transfering it to my Indian saving account. BAnk manager in credit card section asked me for all the receipts and documents. but still they are not convinced with the documents. The money is still staying as excess amount in my credit card. I could not able to transfer to my saving account.

How should I proceed now?

Good one….This article would actually be helpful for the less-aware folks..

Thanks a lot Soham. We try to write articles to make people aware as awareness empowers.