According to the Reserve Bank of India, transactions worth Rs. 546.35 billion were conducted through credit cards in December month, 2018. The usage of credit cards is rapidly increasing in India, thanks to interest-free credit provided that stay for up to 45 days.

Credit cards provide ease of doing transactions, and also offer discounts and cashback. However, using credit cards come with the risk of overspending as well. If you fall short of money, credit cards let you pay only the minimum amount due, which is much lesser than your total bill amount. However, paying only the minimum amount due on a regular basis can land you in a debt trap. Here’s all you need to know about the minimum payment on credit cards

Table of Contents

What is the minimum amount due?

It is the minimum amount that a credit card user is required to pay on or before the due payment date to maintain their card account. It is just a small portion of the total principal outstanding of each month.

Typically, the SBI Credit Card or any other credit card providers calculate the minimum amount due as 5% of the outstanding balance. However, it can increase if you have bought something on equated monthly instalment (EMI) through credit card, spent more than your credit limit, or have previous month’s dues, and so on.

Any unpaid minimum amount that is due from your previous bills will also be added to your current minimum due amount.

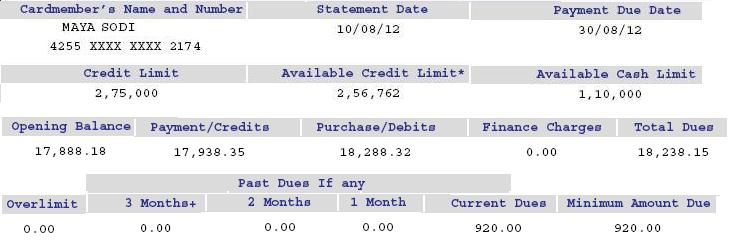

If you pay the minimum amount due, it can help you only to avoid paying late payment fee varying between Rs. 100 and Rs. 1,000, but interest on the outstanding amount will not be waived off. The image below shows the Minimum amount due

How do the credit card providers calculate minimum payments?

Most credit card companies let you pay the minimum amount due which is usually 5% of the outstanding balance as calculated on the statement date.

If you have converted any of your purchases to EMI, availed the EMI balance transfer option, or if there is any unpaid minimum amount from your previous credit card statement, the same will be added to your minimum amount due for the current month.

Let’s take an example to calculate the minimum amount due and make some assumptions for the same:

- The late payment fee is Rs. 500

- At the 5th of each month, the credit card statement is generated

- The rate of interest charged at 3% every month

- The payment is to be made on or before 26th of each month

Here’s how the minimum amount due will be calculated for the above parameters:

| Date | Transaction Details | Transaction Amount | Remarks |

| 15th July | Purchase | Rs. 10, 000 | Interest-free credit period |

| 5th August | Statement | Rs. 10, 000 | 26th August is the due date. Minimum amount due is Rs. 500 (5% of Rs. 10, 000) |

| 20th August | Payment | Rs. 500 | Payment of the minimum amount due |

| 25th August | Purchase | Rs. 15, 000 | No interest-free credit period |

| 5th September | Interest | Rs. 682 | On purchase |

| 5th September | Service tax | Rs. 95 | Service tax on interest |

| 5th September | Statement | Rs. 25, 278 | Minimum amount due is Rs. 1263.90 (i.e., 5% of Rs. 25, 278) |

| 26th September | Credit card user doesn’t make any payment. Hence, the late payment fee is applicable. | ||

| 30th September | Charges for late payment | Rs. 684 | Including service charges |

| 5th October | Interest charges | Rs. 778 | |

| 5th October | Service tax | Rs. 109 | Service tax applicable on interest |

| 5th October | Statement | Rs. 26, 848 | Minimum amount due is Rs. 2,542 including the previous due of Rs. 1, 263.9 |

What are the drawbacks of making the minimum payment?

If you fail to pay the minimum amount due you may have to pay an additional late payment fee, interest and other charges as levied by the card issuer. Your card may also be suspended by the issuer once the dues cross the permissible credit limit on your card.

Also, not paying the minimum amount due can drastically impact your credit score and creditworthiness, which can make it tough for you to avail a loan in the future.

Getting into the habit of paying only the minimum amount due can quickly multiply your total bill.

Most credit card issuers charge up to 3% as a monthly interest rate on the outstanding amount. However, the annual interest rate can be more than 40%.

The card issuer will keep levying interest on any outstanding amount left after you settle the minimum amount and you may take several months to settle the complete bill.

Paying only the minimum amount is fine once in a while for a genuine reason, but making it a practice is not advisable. Ideally, one should not consume more than 50% of their credit limit in a month.

Why should you pay the minimum amount due?

If you do not pay the minimum amount by the due date, the card issuer may charge a late fee and if the payment is late by a month, the issuer can also report the matter with the credit bureaus like CIBIL, which can hurt your credit score.

When you are stuck in a financial crisis and can’t afford to pay the complete due amount, then at least pay the minimum amount to maintain an on-time payment history on credit report.

What can be the reasons for increasing your minimum payment?

Below are the reasons why your minimum payment may increase from one month to the next:

- Late payment of the previous bill

- Balance has been increased

- You have crossed your credit limit

- Your interest rate on the card has been increased

- The credit card issuer has changed the percentage used for the calculation, due to company policy or because you are posing a bigger credit risk for the issuer.

Is paying the minimum amount due each month advisable?

Many people keep paying just the minimum amount due every month to keep their credit card active. However, doing this involves paying high-interest charges and you will lose the interest-free credit period.

Paying the less outstanding amount will make you pay more interest. Also, credit card debts are very expensive to clear off. You must always make payments in full. The facility of paying only the minimum amount due must be availed only during a financial contingency or cash flow crisis.

This 3 minutes video uses a jug(a pitcher) and a glass of water demonstrate the effects of minimum credit card payments. This video uses a simple analogy to describe how one is throwing away their money to the credit card companies

In conclusion, it is advisable to cut down on your expenses and reanalyse your budget if you constantly find yourself in a cash crunch situation.

How much of your credit card bill do you pay? Do you pay your Credit card bill in full or Do you pay only the minimum amount?