You would have often seen people using cards in shops. They buy things, at the counter they give a card to shopkeeper who swipes the card on a machine, gives a receipt and people walk off with their things without paying any money seemingly. Let’s understand what happens when a credit card is swiped, how does the card is approved, who all are involved?

Let’s take the example of Mr Kumar using his credit card. Mr.Kumar wants to buy a Sony T.V with SBI credit card (a MasterCard affiliated). The shopkeeper at Sony Showroom swipes the SBI Master card on a machine provided by ICICI bank.

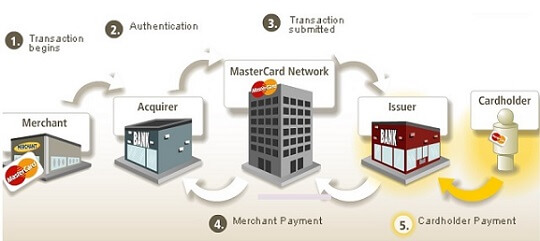

In the example Mr Kumar is called the cardholder, SBI bank is called the card issuer, a merchant is a shop or Sony Showroom, ICICI Bank is called the acquirer and MasterCard is the card association.

The video which shows how the credit card swipe works, click here.

1. When the merchant/shopkeeper at Sony World, swipes Mr Kumars SBI credit card on a machine provided by ICICI bank. The machine dials a stored telephone number via a modem to call to the acquirer bank, ICICI bank in our example, sending details of purchase such as Cardholder name, number, date of expiry of a card, amount of money that Mr Kumar has to pay and merchant id.

2. The acquirer, ICICI bank contacts SBI bank through MasterCard network. It asks for the validity of credit card and the credit limit. SBI Card approves or rejects the transaction. This step is shown as Step 1 in the picture below.

Steps of when credit card is swiped

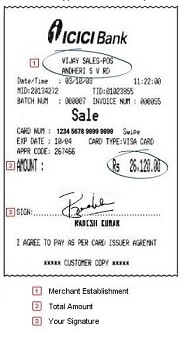

If SBI bank approves the transaction a credit card transaction receipt is printed by ICICI bank machine. Mr Kumar signs the receipt and gives it to a merchant. The merchant gives one copy of credit card receipt to Mr. Kumar and saves the signed receipt with him. A sample credit card receipt is shown below. Note: It is not for this example.

Receipt on swiping credit card

For using the swiping machine of ICICI bank, a merchant will have to pay ICICI bank Merchant Discount Fee.

3. When shopkeeper submits such receipts to ICICI bank, ICICI banks pay the amount due to merchant including the Rs 20,000 owed by Mr Kumar after deducting the Merchant Discount Fee. For example, if Merchant Discount Fee is 2% then ICICI bank will deduct 2% of Rs 20,000 = 400 Rs and give 19,600 Rs to a merchant. Therefore at some shops, the merchant asks the customer to pay extra(the merchant discount fee) if paying by credit card.

4. ICICI bank will send the transaction details to SBI bank through MasterCard interchange. SBI Bank will pay the amount to ICICI bank after deducting the Interchange transaction fee. Interchange transaction fee is a fee paid by an acquirer, ICICI bank in our example, to the issuer of the credit card, SBI Bank in our example. In our example let Interchange transaction fee be 1%. So SBI bank will deduct 1% of 20,000 = Rs 200 and pay Rs 19800 to ICICI Bank.

5. SBI bank will send the credit card statement to Mr Kumar. Mr Kumar will then repay Rs 20,000 to SBI bank.

When Mr Kumar used the credit card to pay, SBI bank earned Rs 200, ICICI bank paid Rs 19,600 to a merchant and got Rs 19,800 so it also earned Rs 200. Merchant had to pay Rs 400. Mr Kumar got the TV he wanted and paid Rs 20,000.

Video explaining What happens when a credit card is swiped

Why do people use credit cards

Why did merchant agree to use credit card machine for he needs to pay for it? People do not carry a large amount of money in their purse or wallet. So by agreeing to let the customer pay by credit card merchant is selling more than he otherwise would have. People can pay by cheque but the merchant is not sure if cheque would be honoured or not at the bank. What if the customer doesn’t have money in his bank account? By using credit card merchant is assured that once approval is done he will get his money. So the credit card is the secure way of getting money.

Customers like Mr Kumar use a credit card because it is so convenient. As the famous advertisement of MasterCard goes: “There are some things money can’t buy. For everything else, there’s MasterCard.”

The word credit comes from Latin, meaning “trust”. When you sell something to another person but give them time to pay, you trust them to pay you back.

Master Card, Visa Card

If one sees the cards, one would see logo Visa or MasterCard. These are card associations that work behind the scenes to facilitate the card transactions. Let’s know about them a little more about these card issuing companies

MasterCard Worldwide is a multinational corporation based in the United States. Throughout the world, its principal business is to process payments between the banks of merchants and the banks of purchasers that use its “MasterCard” brand debit and credit cards to make purchases. Master card advertisements are spun around the theme ” There are some things money can’t buy. For everything else, there is MasterCard“.

Visa Inc. commonly referred to as VISA (Visa International Service Association), is a multinational corporation based in the USA. The company operates the world’s largest retail electronic payment network, managing payments among financial institutions, merchants, consumers, businesses and government entities. For more information check out Visa website.

RuPay is India’s own card payment network just like Visa and Master Card and provides a low-cost alternative system for banks to provide card service.

As far as most people are concerned, there is no real difference between the two. Usually, Visa card number begins with 4 while of Master Card begins with 5. For more details on numbers on credit card checkout out section They are both very widely accepted in over one hundred and fifty countries and it is very rare to find a location that will accept one but not the other. However, neither Visa nor MasterCard actually issue any credit cards themselves. They are both simply methods of payment. They rely on banks in various countries to issue credit cards that utilise these payment methods. You can find more information about Payment networks in our article Rupay card: Difference from Visa, Master, One Nation One Card

Related Articles:

- How Credit Card Number is Verified Online Using CVV2

- Rupay card: Difference from Visa, Master, One Nation One Card

- How India pays: Cash, Cheque,NEFT,Cards etc

- Compound interest: How it can be your friend or your enemy

- HOW TO WRITE A CHEQUE

Купить аккаунт World of Tanks – Скачать Ворлд оф Танк с Официального сайта, Скачать Танки World of Tanks бесплатно

изрядный вебсайт

программа для удалённого контроля, контроль над пк, контроль за пк, администрирование пк, защита пк, remout controle pc, Удалённый Dowloader