Critical illness tends to cause havoc on the health and wealth of a person suffering from it. Not only does it take a toll on the person diagnosed with a life-threatening disease but it also affects the income and stability of their loved ones. In order to cope with the financial burden and avail the best treatment, getting a health insurance for critical illness is a must. More than often, people tend to harbour misconceptions when it comes to getting critical illness insurance; they tend to believe the myths and confuse themselves even more about the coverage of the plan.

Critical Illness Insurance Myths Vs Facts

The following are some of the most common critical illness insurance myths which must be busted before opting for any critical illness health insurance.

-

- Critical Illness Insurance and Health Insurance are the same This is an incorrect statement which most people take to be true. A health insurance plan covers the basic expenses of hospitalization while a critical illness health insurance provides a lump sum amount when the insured is diagnosed with a life-threatening illness.

- Critical illness plan is not for young people: Age is not a decisive factor when it comes to critical illness. One cannot predict the exact age bracket when one is expected to get diagnosed with a life-threatening disease. Both young and old are exposed to the drastic effects of rapidly changing lifestyle, environmental conditions and anxiety; it is a smart decision to get a health insurance for critical illness cover from a young age.

- Critical illness insurance also covers disability: Critical illness health insurance covers life-threatening diseases and offers the insurer a lump sum amount at the time of the diagnosis. It is up to the insurer how they want to use the amount received. It is the sole purpose of disability coverage to offer compensation in case of disability.

- Critical illness plan covers any critical illness: Critical illness plan intends to cover only those diseases that are listed on the terms of critical illness health insurance plan. Be thorough while reading through the terms, conditions and coverage aspects before selecting any particular plan to ensure maximum coverage.

- A person is sure to claim the amount when diagnosed with a critical illness covered by a plan: The insurer’s claim can be rejected if their illness doesn’t fall under a predefined definition. One needs to be aware of every detail when it comes to such policies.

- A plan inclusive of cancer covers all types of cancer: More than often it is not true for all plans in all cases. There are different types of cancer that require a varying extent of insurance coverage with varying premium. Be clear about your queries from the beginning to avail the required help for the right problem.

- A person diagnosed with critical illness will be able to avail the claim immediately: The rapidity with which medical insurance plans for critical illness claim is settled depends mostly on the insurance provider. Find out more about the Claim Settlement Ratio before selecting a policy.

- People suffering from a medical condition can’t purchase critical illness insurance: Different plans come with different terms and requirements. While some may require a medical screening, others may not undergo any medical examination or monitoring. In case of an already existing medical condition, one may have to opt for a plan with a higher premium than a person who hasn’t been diagnosed with a critical illness.

- Critical illness insurance plans have very high insurance premium: While some Critical illness insurance plan may cost more than others, not all the plans come with at a high cost. There are various cost-effective plans that can be availed by those with a limited budget. Choose your plan wisely to ensure that you get the best of the cover at an affordable price.

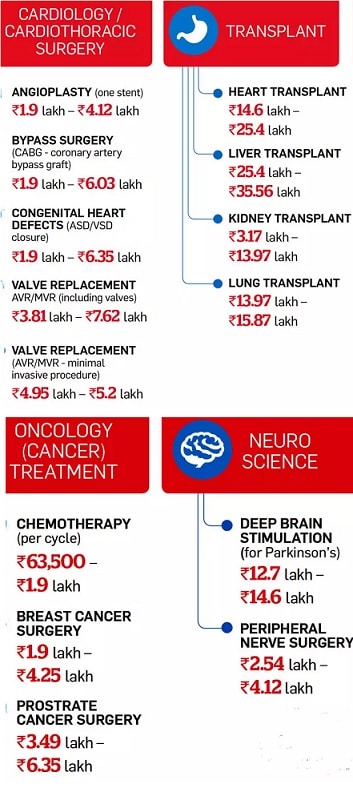

Average cost of treating various critical illnesses

The image given below shows how much you may have to shell out for these major medical problems. Add to it the loss of income that may ensue when you are out of action. Ref

Related Articles:

All About Insurance : Life Insurance, Health Insurance, Car Insurance, LIC

Before selecting critical illness health insurance plan make sure you clarify all your queries so that there is no scope for any misunderstanding at the time of need. Compare the objectives and terms of the best medical insurance plans for critical illness to find out which one is the most suitable for your requirements. Invest in a good plan for a secured future.

Dear sir,after purchasing a term plan in india If one moves to Abroad on a work visa,will She/he will be having the plan covered incase of any Accident/death happens? .what is the claim process?

Ramky

The term covers available in India pay a death benefit, irrespective of where you are.

Yes, term plans are very much valid, even if death happens outside India. The policyholder must have communicated this fact to the insurer. He should inform the insurance provider that he now lives outside India. Just like the change of coordinates like phone number, address or nominee, there is a provision in the policy service using which the policyholder has to state that he is going abroad. However, if he is migrating to a country that is considered as unsafe like Pakistan, Burma, Somalia etc, then the company will defer this facility. Otherwise, this cover is valid in other foreign countries like US or UK.

Keep in mind that you buy insurance for your dependants. So ensure that in case your dependants need to make a claim, they are able to interact with the insurer easily.

Ideally, if you are living abroad only for a short period of time and have family in India it makes sense to stick with your policy in India. But if you plan to relocate with your family for good then you should consider buying a fresh term plan abroad as term plans are much cheaper there

Dear Sir,

regarding the myth you mentioned, “Critical illness plan is not for young people” – Can any one change their policy to cover for critical illness later in life. The answer is no. So one should not think about their current age. They should think about the whole term they are insuring for. This is my point.

Well said

Critical illness covers cannot be renewed once a claim is made. Hence relapses pose a financial risk