Where should I invest? Is the question that I am asked often. Equity market is volatile, debt funds have suffered, economy is slowing. We are living in what some have termed a VUCA World: Volatile, Uncertain, Complex and Ambiguous. Rapid globalisation and the resulting interdependence of financial markets, technology and economic systems have made this a more complex world to manage. As Warren Buffet says Of course, the immediate future is uncertain; It’s just that sometimes people focus on the myriad of uncertainties that always exist while at other times they ignore them So before we answer where to invest let us see what is state of Indian economy?

Table of Contents

USA, Strengthening of Dollar

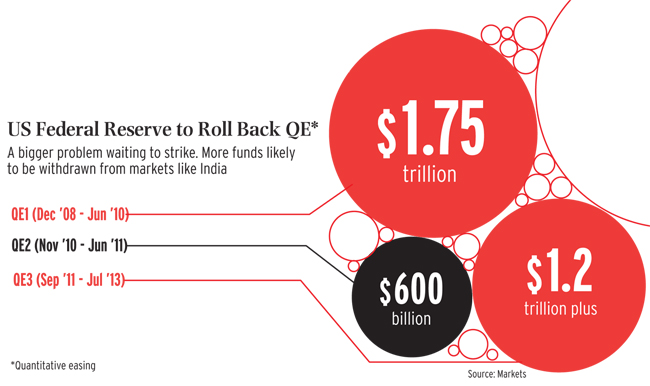

The slow but steady recovery in the US. In May 2013 the US central bank indicated it will stop its bond-buying programme,Quantitative Easing, with which it was infusing liquidity worth $85 billion into the US markets. The looming phase-out of the Fed’s cheap money policy is having a sobering effect. Investors are being lured back to advanced economies such as the US, where growth is recovering, while Asia’s prospects look less attractive as China shifts into a lower gear after years of torrid expansion. This had led to strengthening of US dollar and fall of other currencies like Indian Rupee. The pain is being felt most in India and Indonesia, where the investor exodus has sent currencies plummeting, threatening to fan inflation and widen current account deficits. Fall of Indian rupee means higher import bill, CAD deficit widening (discussed later)

Fall of Indian Rupee

The dollar has become expensive by nearly Rs 11 since May, making Indian rupee weaker.

Weaker Indian rupee means

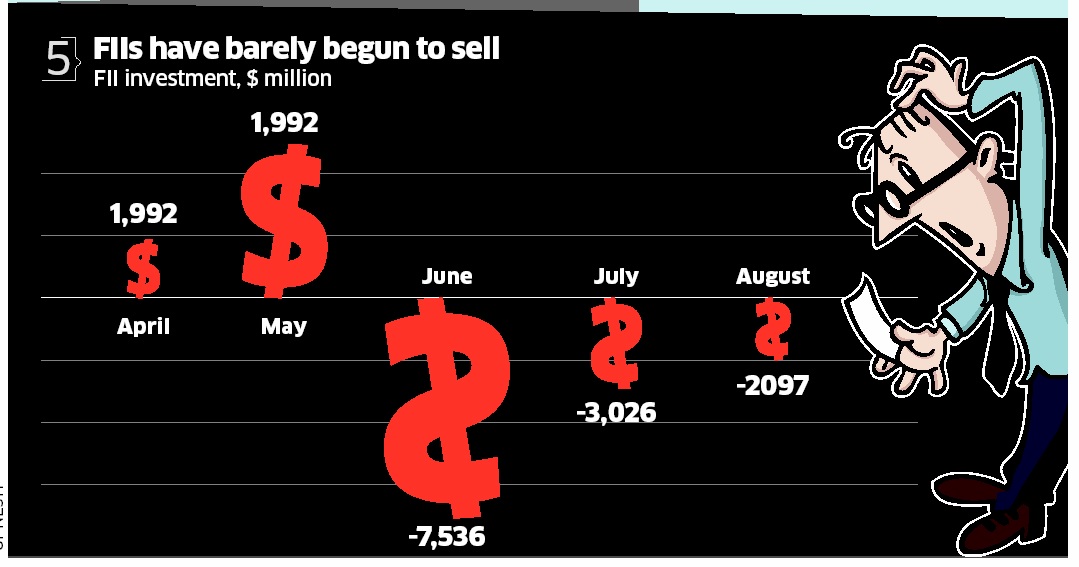

- Foreign institutional investors (FIIs) outflows : A sharp depreciation in the rupee has led to erosion of wealth for foreign investors. This is another reason why foreign institutional investors (FIIs) – who are one of the largest players in the Indian markets – have turned net sellers.

- Rising Import bill : Each rupee that the Indian currency depreciates on the US dollar, Rs10,000 crore gets added to the country’s import bill (about Rs6.7 trillion in 2012-13).We import gold, crude oil and recently coal and iron-ore.

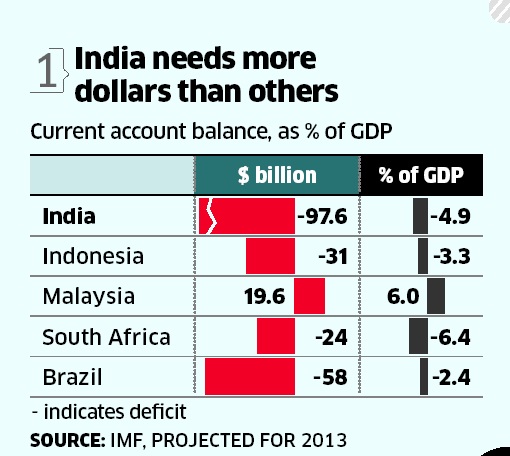

- Current account deficit (CAD) , the difference between exports and imports of goods, services and transfers. A higher deficit means a country is spending more than earning. India is a net importer,especially of oil and gold. CAD, at $88 billion was 4.7 per cent of GDP in 2012-13, nearly double the 2.5 per cent level that RBI thinks is sustainable. Its current account deficit has jumped drastically from 1.7% in 2007-08 to 4.8% of the Gross Domestic Product (GDP) in 2012-13. Finance Minister P. Chidambaram is confident he will keep CAD under $70 billion(3.7% of the GDP) this fiscal year but not all are convinced. To achieve this,it has imposed higher duties on gold imports.

- Indian Companies Borrowing: Indian businesses that took out foreign-currency loans with government encouragement are now suffering. Companies borrowed at low rates abroad and sometimes parked the cash in accounts back home to take advantage of the high interest rates set by the central bank to tackle inflation. Based on data with the Reserve Bank of India (RBI), about a quarter of the $300 billion in foreign debt owed by Indian corporations is short-term loans due to be repaid in a year,

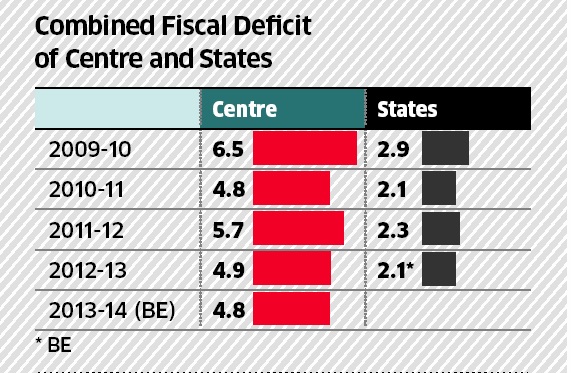

Fiscal Deficit

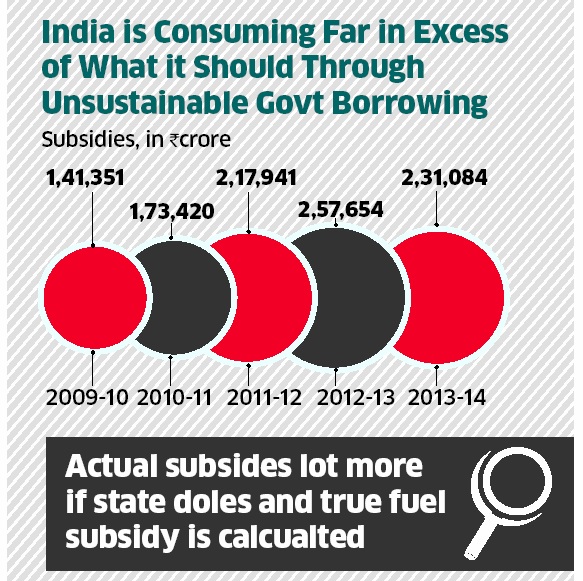

Fiscal deficit occurs when the government borrows more than it spends.India’s fiscal deficit had shot up over 5% levels. The government has pledged that it will bring it down to 4.8% this fiscal. To do so, it has cut expenditure. It has also steadily hiked fuel prices to bring down its subsidy bill. The government passed the Food Security Bill that promises 5 kg of rice, wheat and coarse cereals for everyone in a month at nominal prices. This has fuelled concerns about the government’s ability to meet its fiscal deficit target. The ambitious plan is expected to cost tax payers Rs 1,25,000 crore.

Slow Growth

India’s growth fell to 5% from 9% in 2010-11. The RBI expects the economy to grow at 5.5% in FY14, lower than its initial estimate of 6%. Poor economic growth in the manufacturing, agricultural and mining sector has dented investor sentiment and they have become wary of investing in India.

FDI inflows

Despite all the decisions to allow major reforms in India, the government has failed to tap major FDI inflow in the country. Instead, India has witnessed withdrawal of major projects by global giants like ArcelorMittal and Posco. Posco pulled out of its Rs 30,000 crore steel plant project in Karnataka followed by ArcelorMittal that scrapped its $12 billion (Rs 50,000 crore) steel plant project which it was planning to set up in Odisha. Inordinate delays, land acquisition problems, government clearance delays, lack of promptness have all contributed to the withdrawal of major companies. Last year Indian companies spent more overseas than Foreign Investors in India.

So..

- Consumer price inflation running in double digits for over a year. A direct casualty is crimped household consumption and savings. Even wholesale price inflation, indicative of the pace of price rise in the broader economy, which was on a downward spiral for some time, has started to inch up and is hurting business.

- With fuel prices set to rise soon, resultant inflation will again put pressure on interest rates.

- The recent monetary tightening is already having a spillover impact: Axis Bank, HDFC Bank and ICICI Bank have hiked lending rates.

- The banking sector, already under stress due to higher bad loans, is getting shocks from new industries as the effects of a decelerating economy spread. State Bank of India, the country’s largest lender, got a shock in the first quarter of 2013-14 from the rising slippages in the agricultural sector. There is another looming danger in infrastructure loans

P.M Manmohan Singh said that depreciation of the rupee and rise in dollar prices of petroleum products “will no doubt lead to some further upward pressure on prices”. I expect growth in the first quarter of 2013-14 to be relatively flat, but as the effects of the good monsoon kick in, I expect it to pick up. PM ‘s statement on Indian Economy from Zee News.

Options that will yield immediate benefits are limited. Some options are :

- Agriculture, despite its smaller contribution to the economy, which could stop the economy from stalling.

- Five states are going for election, and with a general election, election spending will provide a stimulus

Businesstoday An economy in tatters The economy is unlikely to shake off its sluggishness in the medium term, until 2015-16 or even later, according to some. Sonal Varma has a list of big ifs to see the needle will move on the economy. “If you start making the right moves, if there is change of guard and if there is a clear focus in reviving growth, it will take about 12 to 18 months for things to start turning,”

DNA Is Current Account Deficit really the culprit for India?

Related Articles :

Our economy is in tatters. Widening current account deficit, fiscal deficit and the slow growth need to be addressed. India needs to reduce its vulnerability. If there is some consolation India is not alone in the crisis. It would take time to recover, but how lon..g ..What do you feel about Indian Economy, how long will it to take to recover?