The cut-off time determines at what Net Asset Value (NAV) you get to buy or sell units of your mutual fund scheme. There are different cut-off timings for liquid, debt and equity funds. This article explains What is Cut off time, What does cut off time depends on?

Table of Contents

What is Cut-off time? How is it related to NAV?

The cut-off time determines what Net Asset Value (NAV) you get to buy or sell units of your mutual fund scheme. It is the time before which you must invest to get a particular day’s net asset value (NAV). And if you invest after this, you get another day’s NAV.

NAV or the Net Asset Value of a mutual fund is the cost at which a single unit of the mutual fund can be bought/sold by an investor. The NAV of any mutual fund is calculated and revised at the close of every trading day. NAV is like MRP of a product(with no discount).

If a mutual fund has a NAV of Rs. 100, then an investor has to pay to Rs 100 to acquire one unit of that mutual fund. If an investor decides to invest Rs 5,000 in this mutual fund with NAV Rs 100, then that investor will be allotted 500(5000/10) units of the fund.

The image below shows the Folio statement of Investor who bought units of Axis Lon Term Equity Fund.

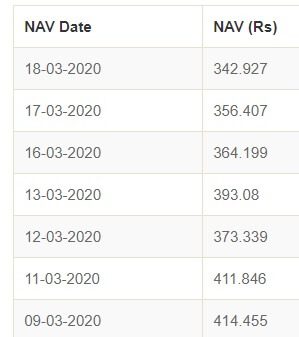

The image below shows the NAV of HDFC Top 100 Fund – Growth Option over few days.

For whom Cut Off time is important?

For individuals investing small amount with a long time-frame, one day’s movement makes little difference. But the cut-off time matters for individuals investing a large amount of money. One per cent difference on Rs 10,000 might not be that big, but on Rs 10 lakhs, it does make a lot of difference

What is Cut off Time?

Cutoff timing based on Types of Funds is given below. But this is if you go through the websites of a mutual fund house or CAMS or Karvy(RTA). An online distributor’s website or app or any other such online platform might close early (as early as an hour) compared to the regular cut-off time.

| Mutual Fund Scheme | Purchase Cut-off Time | If submitted by cut-off time | If submitted after cut off time |

| Liquid Fund | 1:30 pm | NAV of the preceding day | NAV of same day |

| Equity Funds (Investment amount<Rs. 2 lakh) | 3 pm | NAV of same day | NAV of next day |

| Debt Funds (Investment amount>Rs. 2 lakh) | 3 pm | NAV of same day | NAV of next day |

SEBI (The Securities and Exchange Board of India) has special guidance for processing transactions of more than Rs. 2 lakh((SEBI Circular No. CIR/IMD/DF/21/2012). The transfer of money to the AMC (Asset Management Company’s) bank account has to be completed by 3 PM for qualifying for the same day’s NAV.

The funds are remitted to the AMC’s bank account before 3 PM (on a best effort basis) to get the same day’s NAV. If the money reaches the AMC bank account later due to inter-bank transfer delays, the NAV of the next business day will be allotted.

Cut off Time from MF utility

Cut off time for switch and systematic transfer(STP)?

A systematic transfer is treated as a redemption from one scheme to another and fresh buying in another. So the amount of time taken to get money comes into play.

if you switch from a liquid fund on March 16, before 1.30 PM, you will be paid as per the NAV as of March 16. The amount so transferred to, say, an equity fund will be received by your new equity scheme on March 17 and the units will be allotted as per the NAV of March 17.

When a switch is made from a non-liquid fund (say an equity fund), the amount would be realised after three business days. If you switch out of an equity fund before the cut-off time (3 pm) on March 16, and the funds are received by the mutual fund on March 20, then the liquid fund’s units will be allotted as per the NAV of March 19.

Is there a workaround cut off time?

An ETF or exchange-traded fund works in real-time. For example, if you see Nifty down to attractive levels, you can buy units of a Nifty ETF on the stock exchange, provided there is enough liquidity. However, check the indicative NAV of the units on the website of the mutual funds. Trade only if you are sure that the value is closer to the NAV. Many times, the illiquidity in ETF units means that you often end up paying more than the NAV.

Related Articles:

All About Mutual Funds: Basics, Choosing, Paperwork, Direct Investing explains

- What are Index funds? What are ETFs? Do Index Funds Work?

- Index Funds in India: Compare with ETF, Active Funds, How to buy

Getting a particular day’s NAV can give short-lived satisfaction to an investor. However, when you are investing in an equity mutual fund for the long term, say for more than five years, an investment made a day or two later really does not impact the return much.