Banks’ savings accounts and fixed deposits (FDs) have been traditional favourites with Indians, even though they offer low interest (~6.50%[1]), because of capital protection[2]. Off late, more rewarding alternatives are available in the fixed income market; one such product is debt mutual funds or Debt Funds.

Debt funds invest in securities such as government bonds, non-convertible debentures and bonds, commercial papers (CPs), certificates of deposit (CDs) and money market instruments. All these instruments generate fixed interest and provide reasonable capital safety.

Table of Contents

Debt funds versus Fixed Deposits

The following table highlights the difference between debt funds and FDs.

| Particulars | Debt fund | FD |

| Definition | Collects money from investors and puts it in various fixed income securities such as government and corporate bonds, and money market instruments. | A financial instrument provided by banks wherein money can be invested for a fixed period, earning a fixed rate of interest. |

| Risk/return | Risk-return potential is high, as they are market-linked and not guaranteed. | Low risk and returns guaranteed (unless the bank defaults). |

| Withdrawal | No premature withdrawal. However, exit loads are applicable if money is withdrawn before the minimum period (except in the case of liquid funds). | The penalty is imposed for premature withdrawal. |

| Taxation | If holding period is less than or equal to three years, STCG is taxed at marginal income tax rate, while for a holding period more than three years, LTCG is taxed at 20% with indexation. | Interest on FDs is taxed as per the applicable tax slab of the investor. |

| Suitability | For investors who want to earn decent and stable returns, with exposure to comparatively lower risk than equities or other high-risk asset classes. | For investors with low-risk appetite and who want regular and guaranteed income to meet day-to-day expenses. |

Source: CRISIL Research

[1] Interest rate on the SBI term deposit rate of 2 years to less than 3 years

[2] Deposits in the bank up to Rs 1 lakh is insured by the Deposit Insurance and Credit Guarantee Corporation (DICGC).

Meet Short-term goals with Debt funds

Debt funds are broadly classified on the basis of tenure – short-tenured (liquid, ultra short-term debt and short-term debt funds) and long-tenured (income and gilt funds). Being market-linked products, these funds have the ability to generate higher returns than traditional debt instruments. However, short-term funds offer reasonable safety and liquidity compared with long-term funds, as they are less sensitive to interest rate risk. And this also makes them a good choice for short-term goals like payment of the children’s tuition fees, building an emergency fund, painting of house etc.

Investors can choose the following debt funds based on their risk-return profile:

SBI Mutual Funds offers the aforementioned fund variants. To know more log on to https://www.sbimf.com/en-us/debt-schemes |

Why consider short-tenured Debt funds?

Stable performance

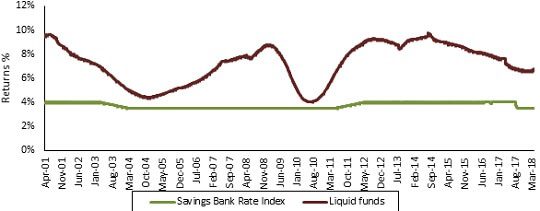

Historical data suggests short-tenured funds have delivered stable returns across periods. Liquid funds – an alternative to savings accounts – have outperformed the latter with considerable margin as seen in the next chart.

Liquid funds versus savings deposits

Source: CRISIL Research

Notes:

Liquid funds represented by CRISIL – AMFI Liquid Fund Performance Index

Average one-year daily rolling returns of CRISIL-AMFI Liquid Fund Index since its inception in April 2000 until March 2018

Savings bank rate index is created from the average rate of return provided by top three banks (by total deposits) – public and private

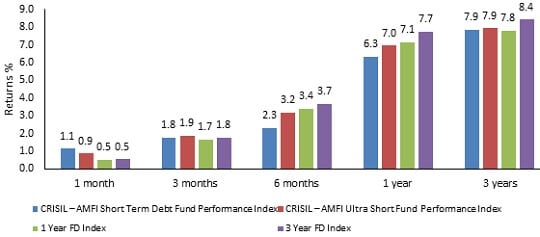

Point-to-point returns of Debt funds vis-à-vis FDs

Similarly, the performance of ultra-short-term and short-term debt funds has been at par with or higher than that of bank deposits.

Source: CRISIL Research

Note:

Mutual funds’ returns are represented by CRISIL-AMFI Mutual Fund Performance Index

Point-to-point returns (%) for the period ended March 28, 2018 are considered

FD rates of top three (by total deposits) public and private sector banks are use

Calendar year performance of Debt funds vis-à-vis FDs

Analysis of the calendar year performance shows that shorter maturity debt funds have given better returns than FDs in six of the 10 calendar years analysed.

| Calendar Year | Types of debt funds | |||

| 2008 | Short-term debt fund 9.05% |

Ultra short-term debt fund 9.04% |

Liquid fund 8.77% |

1-year FD 7.60% |

| 2009 | 1-year FD 7.75% |

Short-term debt fund 6.75% |

Ultra short-term debt fund 5.55% |

Liquid Fund 5.04% |

| 2010 | 1-year FD 6.51% |

Ultra short-term debt fund 5.32% |

Liquid fund 5.01% |

Short-term debt fund 4.91% |

| 2011 | Short-term debt fund 8.84% |

Ultra short-term debt fund 8.74% |

Liquid fund 8.45% |

1-year FD 7.66% |

| 2012 | Short-term debt fund 9.97% |

Ultra short-term debt fund 9.26% |

Liquid fund 9.22% |

1-year FD 9.12% |

| 2013 | Liquid Fund 9.23% |

Ultra short-term debt fund 9.20% |

1-year FD 9.07% |

Short-term debt fund 7.65% |

| 2014 | Short-term debt fund 10.90% |

Ultra short-term debt fund 9.17% |

Liquid fund 9.03% |

1-year FD 9.03% |

| 2015 | 1-year FD 8.83% |

Ultra short-term debt fund 8.51% |

Liquid fund 8.33% |

Short-term debt fund 8.13% |

| 2016 | Short-term debt fund 10.08% |

Ultra short-term debt fund 8.70% |

1-year FD 7.95% |

Liquid Fund 7.61% |

| 2017 | 1-year FD 7.25% |

Ultra short-term debt fund 6.81% |

Liquid fund 6.57% |

Short-term debt fund 5.92% |

Source: CRISIL Research

Note: Mutual funds’ returns are represented by CRISIL-AMFI Mutual Fund Performance Index

Annual returns for key indices ranked in order of performance (2008 – 2017)

One-year FD index returns are a simple average of FD rates of SBI and ICICI Bank for respective maturity until December 31, 2011. Starting January 1, 2012 FD rates of top three (by total deposits) public and private sector banks are used.

Liquidity – Investors can easily liquidate their money from debt funds. Most liquid funds, for instance, do not have an exit load, so there is no penalty for exiting early as is the case with FDs. In case of other debt funds, investors can freely redeem the units after completing a pre-determined period (usually 1 year but depends on the Mutual Fund Company).

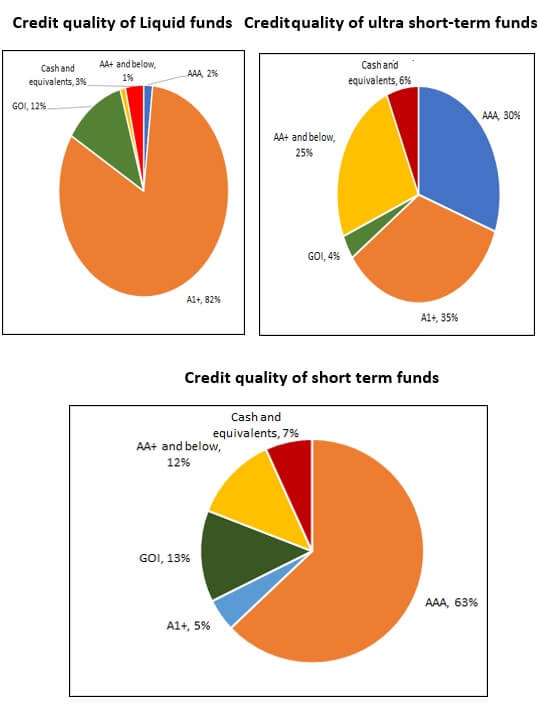

Safety – Unlike traditional avenues, shorter duration funds may not give guaranteed returns. However, these funds tend to reduce the risk by investing in superior credit quality papers. An one-year portfolio analysis of the CRISIL ranked funds showed that liquid funds, ultra short-term funds and short term funds have invested on an average 99%, 75% and 88% of total assets respectively in high credit quality debt instruments which includes AAA and A1+ rated papers, government securities and cash equivalents.

Source: CRISIL Research

Note: CRISIL ranked liquid funds (as of December 2017 ranking) used for analysis

Credit quality breakup data is one-year average as of March 2018

Summing up

Short-tenured debt funds are a good option for conservative investors, as they have the potential to generate good returns. However, these funds are exposed to interest, credit and liquidity risks to some extent. Investors can allocate a portion of their portfolio to these funds and capitalise on professional management and the ability to get better returns. Before choosing the right fund, do conduct due diligence and invest as per your risk profile.

Disclaimer – CRISIL Research, a division of CRISIL Limited (CRISIL) has taken due care and caution in preparing this Report based on the information obtained by CRISIL from sources which it considers reliable (Data). However, CRISIL does not guarantee the accuracy, adequacy or completeness of the Data / Report and is not responsible for any errors or omissions or for the results obtained from the use of Data / Report. This Report is not a recommendation to invest/disinvest in any entity covered in the Report and no part of this report should be construed as an investment advice. CRISIL especially states that it has no financial liability whatsoever to the subscribers/ users/ transmitters/ distributors of this Report. CRISIL Research operates independently of, and does not have access to information obtained by CRISIL’s Ratings Division / CRISIL Risk and Infrastructure Solutions Limited (CRIS), which may, in their regular operations, obtain information of a confidential nature. The views expressed in this Report are that of CRISIL Research and not of CRISIL’s Ratings Division / CRIS. No part of this Report may be published/reproduced in any form without CRISIL’s prior written approval.