Debt is a fact of most people lives whether Americans or Indians and paying off that debt can take years, some may never even become debt free. The reason why so many fail reducing paying off Debt or reducing debt is most likely because they are making mistakes in trying to reduce the debt or Paying off your debts. Let’s look at the 5 mistakes one is making while trying to reduce debt and then look at how you can pay Pay off your debts.

Table of Contents

Not Sticking to Your Plan

Changing habits, you have instilled in yourself for years are not going to be easy to break. The unfortunate fact is that living above your means is what got you in the debt. If you are serious about becoming debt free, then you must lessen the amount of frivolous spending you have daily.

This does not mean that you must live a miserable life until you are debt free, you must find a good mix. Simple things like your morning coffee from a drive thru- you could invest a bit into a coffee maker and then make your coffee at home. Perhaps one day a week you treat yourself to your favorite coffee treat but it is no longer a daily occurrence.

More impactful spending habits like frequent eating out and shopping with credit cards need to stop immediately and not start up again- ever. You are not paying off your debt, so you can get into debt again so make your plan a lifelong change. An easy way to keep track of your spending and keep your pay off plan on track is to utilize a debt payoff planner app, website or journal.

Moving Debt Around

There are many tricks consumers attempt to avoid paying their debts on time. Moving your debt from place to place can help you avoid a few fees short term, but long term it isn’t going to make paying off your debt any faster. Say you pay off all past medical bills on a credit card. Well, your spending on your credit card will surely surpass the recommended 30% or less of your limit- that will put a mark on your credit score.

Another option people will recommend consolidating your debts into one personal loan. This means you would calculate all your accumulated debt and then take out a loan in that amount. You would then pay off your debts with the loan, then pay off the loan. While this can put all your debts in one place and seem easier to pay off it may not be the best option for you if you cannot pay off your debts in the next few years.

There are no shortcuts to being debt free with a great credit score! Pay off your debts as the money comes in hand. Taking out more lines of credit does nothing more than instigating the behavior that causes the debt.

Not Automating Payments

Setting up auto-pay takes only a few minutes and could save you more money! This is one of the simplest tricks in the book, yet still so many ignore it. Automated payments make sure that your bill is run through every month without you needed to log into your account and pay or mail payment. This will keep you on track with your payment plan as well as on time with your payments, even if you happen to forget.

For many utilities, a late payment means a late fee on top of the money you already owe. Avoid burying yourself more in debt with fees and sign up for automatic payments today. You may even find that your utility company or bank offers a discount or perk for setting this feature up.

Missing Debts to Need Paid

Imagine being out of debt and ready to buy a home only to get your application denied on the spot because you have a large debt that was sent to collections- and you didn’t even know about it! An easy way to find out all your reported debts is to acquire a copy of your credit report. This report contains debts owed, debts paid, revolving credit accounts (credit cards) and more if they apply to you (mortgage, car payments).

You should contact every debt agency on the credit report to be sure that the debt is, in fact, honest and discuss a means to pay it off. You can receive a credit report once yearly for free so be sure to check it every year to be sure you have paid off all debts, and have no fraudulent debts being charged to your name.

Trying to Pay off Multiple Debts at Once

Consumers with multiple sources of debt – credit cards, mortgage, student loans, etc. – often try and address each one every month. While a monthly minimum payment is better than no payment at all, there may be a better way to go about it. Go back to your budget and create a surplus that goes directly at the credit card with the highest interest rate. When that’s paid off, go after the card with the next highest interest rate and keep going until all credit card debt is eliminated. Continue paying your other debts at their minimum payment option to avoid late fees but making large digs at these debts will end up reducing your monthly payments.

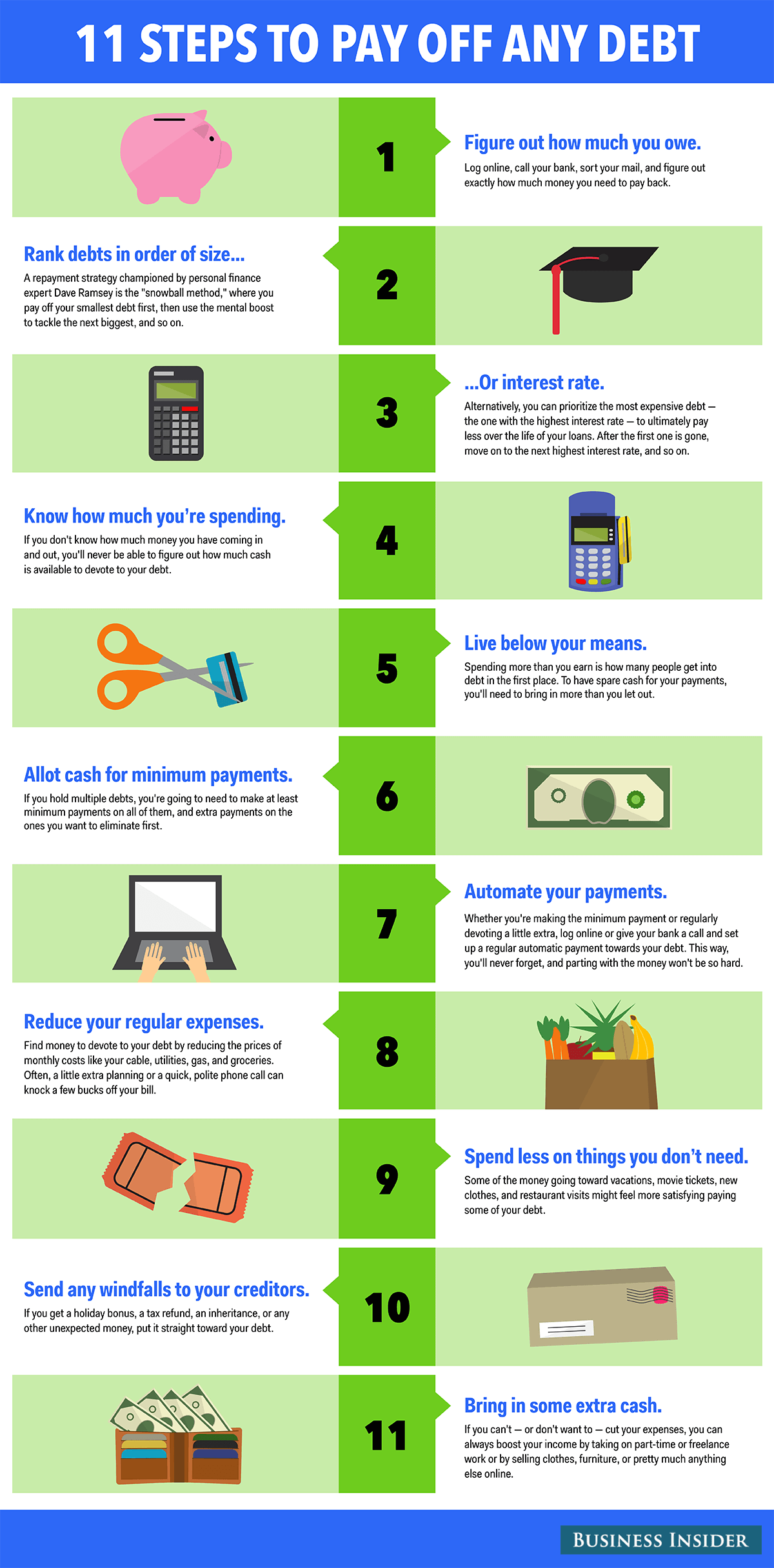

Infographic on 11 Steps to Pay off Your Debts

The infographic from Business Insider explains the 11 Steps to Pay Off Any Debt

Conclusion

Working towards becoming debt free is a challenging undertaking. Especially if you have thousands of dollars of debt to work through, it can take years. Which is why it’s hard to stick through the process. Now that you’re aware of some mistakes to avoid, you can make your debt journey easier and potentially problem free.

How did you reduce your Debt? Which techniques did you follow or which steps did you take? If you have any helpful tips and advice for people who are in the process of paying off debts, leave a comment and share your experience in the section below.

Nice article, most of the people failed to stick with plan. To success in your financial life you need to first create a plan & Stick with it.