If mounting debt and unpaid EMIs are giving you sleepless nights,what can you do? The very concept of unsecured loans has found takers in many Indians, who, like their Western counterparts, are borrowing large sums of money to live in the present, paying little heed to the consequences of such a dangerous lifestyle. But if due to some reasons, if one is not able to make the repayment and debt piles up, you start getting overwhelmed by the debt , then one can go in for debt counselling. This article is about debt trap, how one can come out of it and credit counselling centres in India.

Table of Contents

Debt Trap

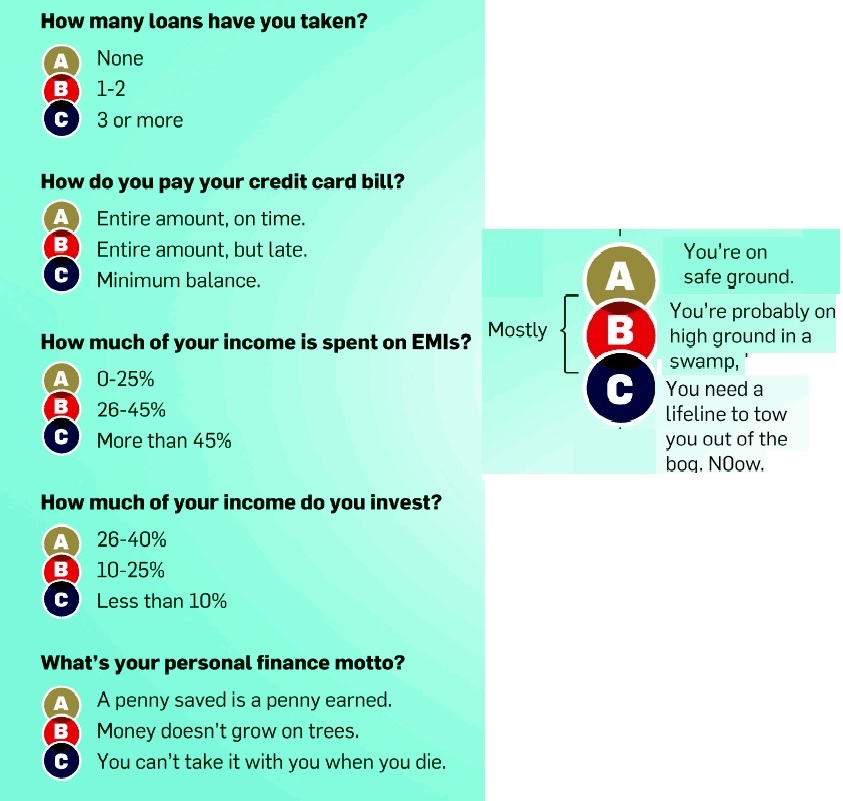

Gagan and his wife Nita were in the EMI trap,apart from their home loan, the couple were repaying a car loan and two personal loans. The situation turned from bad to worse when Gagan started using the plastic in his wallet not only for purchases but also to withdraw cash. With more debt and fatter credit card bills, the Mukherjees began digging a deeper pit for themselves every month. This isn’t an uncommon story. Economic Times Taming the debt monster talks about 34-year-old Phani Raj Jaligama, married to Srilata, who is also of the same age, whose Combined monthly income of Rs 1.23 lakh. Total outstanding amount on a home loan, a car loan and two personal loans at Rs 35.16 lakh. Credit card debt at a whopping Rs 3.5 lakh!

Indians have traditionally been debt averse, deeply conservative borrowers. With a strong cultural aversion to loans most people lived frugally all their lives until recently. Credit cards and loans flooded onto the markets giving way to way to a new generation of young India – willing to borrow to improve their life style and not reluctant to pledge future income flow for immediate gratification. So we now have Men and Women (Gen Y) Smart, Educated, digitally savvy, Socially networked and in debt. Our article Life of Debt – Responsibly talks about Kinds of Loans, Good and Bad Loan.

Repayment of Loan is Tracked

But Loan taken also has to be repaid. A clean borrowing record has become important, very important today. Banks Finance institutions provide information about the repayment details to Credit information organisations such as the Credit Information Bureau (Cibil) , Experian, Equifax . These credit information organizations track the credit history of an individual and pass it on to other banks who want to assess your credit worthiness. A credit card billed not settled, a dispute with the bank on loan, affects your credit score and may come to haunt you later . Lenders have become more vigilant and share information on delinquent borrowers. A poor Credit Report, Score can hinder your credit applications and result in a rejection. Our articles Understanding CIBIL CIR report, FAQ on CIBIL CIR Report and Score

Ways of coming out of debt

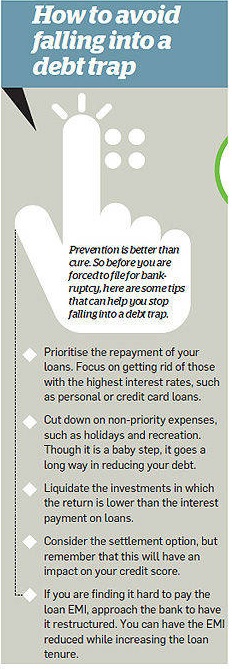

Till debt is manageable life is fine but what If your debt piles up, you start getting overwhelmed by the debt you have piled up, wondering how to get a grip on your finances. While there are many advisors and counsellors to advise individuals on financial planning, investments, insurance needs, wealth management etc. Ironically, not enough attention has been paid to the debt, lending and borrowing of these individuals. Don’t let it come to stage when you have to face harrassement and recovery agents Loan Recovery, Harassment : Pay up or Else

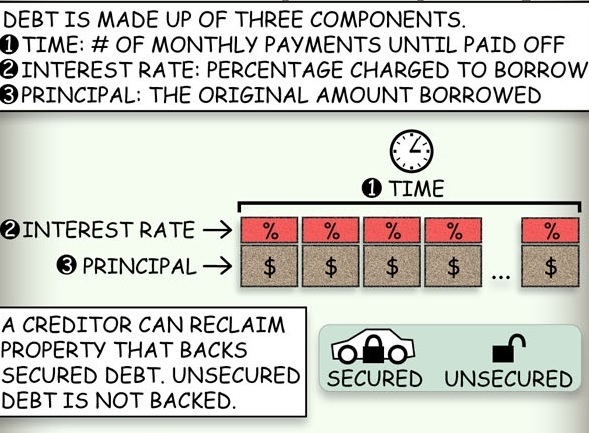

Paying off Loans : There are two strategies to choose which debt you want to destroy first.

- Avalanche: You start paying the debt with the highest interest rate. If the balance amount is too large, negotiate to lower the interest rate. In case the lender is unwilling to do so, shift to a bank that charges a lower rate. The small processing fee will be worth paying for the reduced interest rate.

- Snowball: You pay off the debt with the lower outstanding amount first. Crossing out a debt on your list will be a reward that will keep you motivated.

Settlement : Debt settlement is the process of offering a large, one-time payment toward an existing balance in return for the forgiveness of the remaining debt. For example, someone who owes Rs 40,000 on a credit card may approach their credit card company and offer a one-time payment of Rs 20,000. In return for this one-time payment, the credit card company agrees to forgive or erase the remaining Rs 20,000. Debt settlements will show up on your credit report and lower your credit score, hurting your ability to get affordable loans for the next few years.

Bankruptcy : By definition, a bankrupt or an insolvent person is the one who is unable to pay his debts. However, you can file an insolvency petition only if your liabilities exceed your assets, making it impossible for you to pay the debt. Hence, this option is not open to all the people who are in debt. If a petition is filed on flimsy grounds or you are unable to prove that you cannot pay the debt, your petition will be dismissed. Besides, you can file for bankruptcy if you have been arrested as per a court order or your property has been attached. You are eligible to file for insolvency even if you have not been arrested or the property has not been attached, but the debt amount should exceed 500. Economic Times When and how to file for bankruptcy? explains it in detail.

Credit Counselling

Till debt is manageable life is fine but what If your debt piles up, you start getting overwhelmed by the debt you have piled up, wondering how to get a grip on your finances. Yes there are debt counselling centres that too in India. Reserve Bank of India way back in 2008 talked about it in Financial Literacy and Credit Counselling Centres

Credit Counselling (known in the United Kingdom as debt counselling) can be defined as counselling that explores the possibility of repaying debts outside bankruptcy and educates the debtor about credit, budgeting, and financial management‘. It serves three purposes.

- First, it examines the ways to solve current financial problems.

- Second, by educating about the costs of misusing a credit, it improves financial management.

- Third, it encourages the distressed people to access the formal financial system.

Credit counselling often involves negotiating with creditors to establish a Debt Management Plan (DMP) for a consumer. A DMP may help the debtor repay his or her debt by working out a repayment plan with the creditor. DMPs, set up by credit counsellors, usually offer reduced payments, fees and interest rates to the client.

Debt Counselling Centres in India

There are several debt de-addiction centres across the country. While most of these debt counselling centres have been set up by banks and allied bodies, there are private ventures like the CredExpert, Debt Doctor,Credit Sudhar. Debt counselling centres require you to fill up a detailed form, which includes personal information, income details, expense break-up and existing assets. A debt counsellor is no different from a doctor. Give him the complete picture without hiding any information if you want him to diagnose the problem correctly and suggest a suitable remedy. These organisations help individuals work out strategies to repay their debts and advise them on avoiding such situations in the future. D

It is important you understand that the entire process is not a “quick fix” and requires discipline and perseverance

Be wary of conmen masquerading as credit counsellors. They will promise to get your dues settled for a small fee. However, they adopt unethical practices and you might end up with a poor credit report due to the settlement

Do not accept any non-written agreement and promises of credit counsellor.

Some of the Initiatives set up by bank are:

- Bank of India – ABHAY Credit Counselling Centre with centres in Mumbai, Wardha, Chennai, Gumla (Jharkhand)

- ICICI Bank – DISHA Trust with centres in Ahmedabad, Chennai,Delhi,Hyderabad,Jaipur,Kanpur,Kolkata,Ludhiana,Mumbai. It’s not just for ICICI Bank customers. Livemint Interview with S. Gopalakrishnan, senior counselor, Disha Financial Counselling

- Bank of Baroda – Grameen Paramarsh Kendras For the rural community, especially for the farmers

- Banking Codes and Standards Board of India (pdf)

The debt counsellors are usually retired or existing bank employees, who know the functioning of banks and can guide you towards a solution. These centres do not charge for the service. Housed in a residential complex at Dadar in Mumbai, the modest looking Abhay Counselling Centre gets roughly 4-5 cases every week.

Private Credit Counselling: They levy a fee for counselling. If the strategy involves negotiations with the lender,they charge a percentage of the amount it helps save. Some of the options are :

- Debt Doctor : Economic Times Debt Doctor guides borrowers on managing debt & renegotiations (2010). (We notices that news about Debt Doctor are for years upto 2011. Their blog link is for sale)

- Credit Sudhaar : Founded in 2010 by Arun Ramamurthy & Gaurav Wadhwani management graduates and banking professionals they offer Gold,Platinum and Titanium Plans. They have regular updates on their Facebook page. MoneyLife Credit Sudhaar asking Rs16,000 a year for restoring ‘credit’?, Are Credit Sudhaar and CIBIL taking borrowers for a ride? , Mixed opinion about services on Complaint Board

- Cred Expert : Founded by Satish Mehta ,who was also founding Managing Director of Credit Information Bureau (India) Limited (CIBIL), they provide credit and debt counselling to individuals and handhold them through their credit life cycle. Various products and services are offered by Credexpert, such as Credit Bureau Consultancy, Credit Aware and

- Credit Report Analysis : Credit Report Analysis gives an individual a detailed description and understanding of his credit report and credit score.

- CreditSolutions : They provide expert guidance and careful monitoring on matters relating to one’s credit information report and credit score Credexpert also provides an additional service where not only will it advise you, but also facilitate and actually execute this exercise for you by co-ordinating with different stakeholders such as your lenders and the credit bureaus.

Ref : Economic Times Seek professional help to get out of debt Economic Times 8 things you should keep in mind while handling different debts

Related Articles :

- Loan Recovery, Harassment : Pay up or Else

- Understanding Loans

- FAQ on CIBIL CIR Report and Score

- Credit Card Debt

- What’s The Price Of Cool?

We are likely to take on some kind of debt in our lifetimes. For some, it may be the only option to tide over a cash crunch, for others, a convenient way to leverage future cash flow or build an asset like a house. Take loan which is less than 50% of your salary and that too for building asset (Education, Home). Remember Jitni chadar ho utne hi pair failane chahiye . But if you find EMI’s unmanageable then tackle the EMI or Debt monster head on. And if you can’t do it alone take help. Debt management is still nascent in India but you have credit counselling centres in India. Have you fallen into debt trap? Have you used services of these debt counselling centres, If yes how has been your experience?

IS DISHA TRUST IS WORKING TILL PLEASE GIVE CONTACT NO OF MUMBAI OFFICE I AM IN CREDIT CARD DEBT OF 40 LAKHS . Please help me to settle this debt the debt is of HDFC bank and standard chartered bank

Mobile No. 9325606059

email id is dharmitali@yahoo.co.in

Dear Viewers,

We have released a guide on “Credit, Credit Bureaus and all that..”

The main purpose of this guide is to make all our viewers understand the basics as well as the nuances of credit bureau reports & scores.

Our proactive initiative to facilitate our viewers on the topics related to credit, credit bureau, implications of credit bureau decisions, and much more are covered in this guide.

Download your FREE credit guide copy now..!!

http://www.credexpert.in/eguide/

Warms Regards,

Credexpert

http://www.credexpert.in

Thanks for the book. I have downloaded it!

Dear Viewers,

We have released a guide on “Credit, Credit Bureaus and all that..”

The main purpose of this guide is to make all our viewers understand the basics as well as the nuances of credit bureau reports & scores.

Our proactive initiative to facilitate our viewers on the topics related to credit, credit bureau, implications of credit bureau decisions, and much more are covered in this guide.

Download your FREE credit guide copy now..!!

http://www.credexpert.in/eguide/

Warms Regards,

Credexpert

http://www.credexpert.in

Thanks for the book. I have downloaded it!

Very informative article !! Fortunately I don’t any loans, credit card etc. If in future I take loan or credit card I will make sure that I am not falling into debt trap. Thanks again for the timely article.

Precaution is better than cure. Be aware and have smooth financial journey

Dear Chetan,

It is good to know that you are for now debt free. But you wont be for long, because at any stage of your life the needs or the desire to posses an asset (house, car, etc) or fulfill your dream (holidays, etc.) will arise and you might have to take loan / credit card.

Before you take any kind of loan and / or credit card, you will have to look into various aspects of your financial life. There is something called as an individuals credit life cycle, where an individual should take precautions before availing the first credit, during the time of repayment and post repayment and maintaining the healthy credit life and thereon.

Click the link below, to understand more about your credit life cycle

http://www.credexpert.in/credit-life-cycle/

Warm Regards,

Credexpert

http://www.credexpert.in

Thanks for reference

Very informative article !! Fortunately I don’t any loans, credit card etc. If in future I take loan or credit card I will make sure that I am not falling into debt trap. Thanks again for the timely article.

Precaution is better than cure. Be aware and have smooth financial journey

Dear Chetan,

It is good to know that you are for now debt free. But you wont be for long, because at any stage of your life the needs or the desire to posses an asset (house, car, etc) or fulfill your dream (holidays, etc.) will arise and you might have to take loan / credit card.

Before you take any kind of loan and / or credit card, you will have to look into various aspects of your financial life. There is something called as an individuals credit life cycle, where an individual should take precautions before availing the first credit, during the time of repayment and post repayment and maintaining the healthy credit life and thereon.

Click the link below, to understand more about your credit life cycle

http://www.credexpert.in/credit-life-cycle/

Warm Regards,

Credexpert

http://www.credexpert.in

Thanks for reference

Hello,

My name is Damien Morgan. I am a Professional Financial Writer and I want to contribute an article for your blog “bemoneyaware . com” on Credit and Loans topic. I have contributed many financial articles for numerous reputed websites. My article will be more than 500 words, informative, unique and fully copyscape free along with current informations and also it will only publish on your blog.

I am pretty sure that you will gleefully accept my proposal to write an article for your website.

Hope you would like my proposal and will give me an opportunity.

May I send my Article?

Warm Regards,

Damien Morgan

Financial Content Developer & Writer

Skype Id :damien.morgan9

Thanks a lot Daniel. We appreciate you contacting us but as of now we do not need any guest posts.

If there is need we shall get back to you

Hello,

My name is Damien Morgan. I am a Professional Financial Writer and I want to contribute an article for your blog “bemoneyaware . com” on Credit and Loans topic. I have contributed many financial articles for numerous reputed websites. My article will be more than 500 words, informative, unique and fully copyscape free along with current informations and also it will only publish on your blog.

I am pretty sure that you will gleefully accept my proposal to write an article for your website.

Hope you would like my proposal and will give me an opportunity.

May I send my Article?

Warm Regards,

Damien Morgan

Financial Content Developer & Writer

Skype Id :damien.morgan9

Thanks a lot Daniel. We appreciate you contacting us but as of now we do not need any guest posts.

If there is need we shall get back to you