Think of retirement and the need for financial security probably pops up foremost. With the need for financial security arises the need for guaranteed income. This is even more so after one retires when there is an uncertainty of how long one would live. The longer one survives, the longer is the uncertainty and higher is the need for guaranteed income. Getting the peace of mind associated with a guaranteed income becomes paramount.

To address the above need for guaranteed income post-retirement, the template financial solution that is widely prevalent today is as below:

| Investment Phase (while earning) | Income/Retirement Phase |

| Invest in a savings vehicle (E.g. NPS, PPF, Pension plans of life insurance companies, etc.)

|

Use the proceeds of the savings vehicle at the time plans of life insurance companies, etc.) of retirement to purchase an immediate annuity product at the then prevailing annuity rate. |

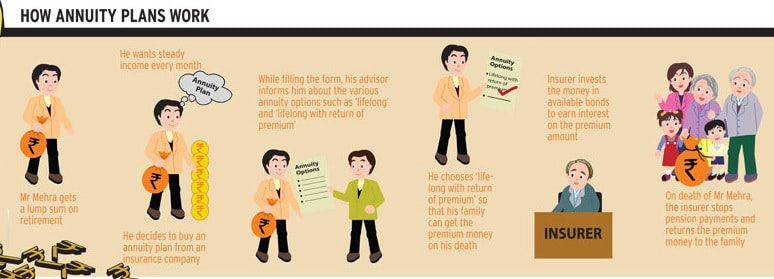

An annuity a contract between two parties called the insured and an insurance company. The insurance company agrees to pay the insured an agreed upon benefit either in the form of regular interval payments or in a lump sum

The Risk of getting the prevailing Annuity rate

One of the main drawbacks with the above solution is that while the person knows how much he/she is investing into the corpus every year, the income he/she would get post-retirement is unknown because the annuity to be purchased at the time of retirement is based on the 1/then prevailing annuity rate”.

This is a major risk to the retiring population. It is comparable to the risk of the value of investments falling just prior to one’s retirement date.

Let’s consider the following example:

A 55-year-old male customer plans to retire in 5 years and his current retirement corpus is Rs. 2 Cr. At age 60 he plans to purchase an immediate annuity product with the corpus built till that time (through any market linked investment vehicle) to get a lifetime guaranteed income.

| Scn. | Description | Effective return over the next 5 years | Annuity Rate at age 60 (5 years from now) | Corpus accumulated at age 60 (in Cr.) | Lifetime guaranteed income (in lac per annum) |

| 1 | High investment returns, High future annuity rates | 10.0% p.a. | 7.0% | 3.2 | 22.5 |

| 2 | Low investment returns, High future annuity rates | 5.0% p.a. | 7.0% | 2.6 | 17.9 |

| 3 | High investment returns, Low future annuity rates | 10.0% p.a. | 5.5% | 3.2 | 17.7 |

Compare the drop in the lifetime; comes in scenario 2 and 3 vis-a-vis scenario 1. The drop in income in scenario 3 (as compared to scenario 1), due to annuity rate falling by 1.5% is more than the drop in lifetime income scenario 2 where investment returns over the next 5 years fall by 5% p.a. Thus, future movement of interest rates, and hence annuity rates can impact customers nearing retirement significantly by reducing their guaranteed lifetime income.

The Solution: THEN Prevailing Rate vs. NOW Guaranteed Rate

Deferred Annuity products, which guarantee the annuity rate to be paid in future at the time of purchase, are a possible solution to the above problem. Such products take away interest rate risk from customers nearing retirement and help them lock-in to an annuity rate. Such products were prevalent pre-2000 when interest rates were high (10-year government security yields were > 10% and part of the retiring population had access to defined benefit pension plans from their employers.

However, now when interest rates are volatile and are hovering between 6-8% and most of the retiring population (including government and corporate employees) are outside a defined benefit pension regime, the role of deferred annuity products (where guarantee is provided at the time of purchase) has become increasingly important from a customer need viewpoint, especially for those who seek the comfort of a guarantee.

A person at 55 will never be happy to opt to Annuity scheme. A person at 18 starting NPS, will have 42 years of compounding. To reach a target corpus of more than 2 crores, is an easy task. Hence those at around 18 should be educated by the parents to go into NPS. The parents should subscribe for their child say, upto 24 years. Thereafter the matured child together with compound interest will play the powerful role.